Posts tagged ‘Warren Buffett’

Monitoring the Tricks Hidden Up Corporate Sleeves

As Warren Buffett correctly states, “If you are in a poker game and after 20 minutes, you don’t know who the patsy is, then you are the patsy.” The same principle applies to investing and financial analysis. If you are unable to determine who is cooking (or warming) the books via deceptive practices, then you will be left holding a bag of losses as tears of regret pour down your face. The name of the stock investing game (not speculation game) is to accurately gauge the financial condition of a company and then to correctly forecast the trajectory of future earnings and cash flows.

Unfortunately for investors, many companies work quite diligently to obscure, hide, and distort the accuracy of their current financial condition. Without the ability of making a proper assessment of a company’s financials, an investor by definition will be unable to value stocks.

There are scores of accounting tricks that companies hide up their sleeves to mislead investors. Many people consider GAAP (Generally Accepted Accounting Principles) as the laws or rules governing financial reporting, but GAAP parameters actually provide companies with extensive latitude in the way accounting reports are implemented. Here are a few of the ways companies exercise their wiggle room in disclosing financial results:

Depreciation Schedules: Related to GAAP accounting, adjustments to longevity estimates by a company’s management team can tremendously impact a company’s reported earnings. For example, if a $10 million manufacturing plant is expected to last 10 years, then the depreciation expense should be $1 million per year ($10m ÷ 10 years). If for some reason the Chief Financial Officer (CFO) suddenly changes his/her mind and decides the building should last 40 years rather than 10 years, then the company’s annual expense would miraculously decrease -75% to $250,000. Voila, an instant $750,000 annual gain created out of thin air! Other depreciation tricks include the choice of accelerated or straight-line depreciation.

Capitalizing Expenses: If you were a management team member with a goal of maximizing current reported profitability, would you be excited to learn that you are not required to report expenses on your income statement? For many the answer is absolutely “yes”. A common example of this phenomenon occurs with companies in the software industry (or other companies with heavy research and development), where research expenses normally recognized on the income statement get converted instead to capitalized assets on the balance sheet. Eventually these capitalized assets get amortized (recognized as expenses) on the income statement. Proponents argue capitalizing expenses better matches future revenues to future expenses, but regardless, this scheme boosts current reported earnings, and delays expense recognition.

Stuffing the Channel: No, this is not a personal problem, but rather occurs when companies force their goods on a distributor or customer – even if the goods (or service) are not requested. This deceitful practice is performed to drive up short-term revenue, even if the reporting company receives no cash for the “stuffing”. Ballooning receivables and substandard cash flow generation can be a sign of this cunning, corporate custom.

Accounts Receivable/Loans: Ballooning receivables is a potential sign of juiced reported revenues and profits, but there are more nuanced ways of manipulating income. For instance, if management temporarily lowers warranty expenses and product return assumptions, short-term profits can be artificially boosted. In addition, when discussing financial figures for banks, loans can also be considered receivables. As we experienced in the last financial crisis, many banks under-provisioned for future bad loans (i.e. didn’t create enough cash reserves for misled/deadbeat borrowers), thereby overstating the true, underlying, fundamental earnings power of the banks.

Inventories: As it relates to inventories, GAAP accounting allows for FIFO (First-In, First-Out) or LIFO (Last-In, Last-Out) recognition of expenses. Depending on whether prices of inventories are rising or falling, the choice of accounting method could boost reported results.

Pension Assumptions: Most companies like their employees…but not the expenses they have to pay in order to keep them. Employee expenses can become excessively burdensome, especially for those companies offering their employees a defined benefit pension plan. GAAP rules mandate employers to contribute cash to the pension plan (i.e., retirement fund) if the returns earned on the assets (i.e., stocks & bonds) are below previous company assumptions. One temporary fix to an underfunded pension is for companies to assume higher plan returns in the future. For example, if companies raise their return assumptions on plan assets from 5% to a higher rate of 10%, then profits for the company are likely to rise, all else equal.

Non-GAAP (or Pro Forma): Why would companies report Non-GAAP numbers on their financial reports rather than GAAP earnings? The simple answer is that Non-GAAP numbers appear cosmetically higher than GAAP figures, and therefore preferred by companies for investor dissemination purposes.

Merger Magic: Typically when a merger or acquisition takes place, the acquiring company announces a bunch of one-time expenses that they want investors to ignore. Since there are so many moving pieces in a merger, that means there is also more opportunities to use smoke and mirrors. The recent $8.8 billion write-off of Hewlett-Packard’s (HPQ) acquisition of Autonomy is evidence of merger magic performed.

EBITDA (Earnings Before Interest Taxes Depreciation & Amortization): Skeptics, like myself, call this metric “earnings before all expenses.” Or as Charlie Munger says, Warren Buffett’s right-hand man, “Every time you see the word EBITDA, substitute it with the words ‘bulls*it earnings’!”

This is only a short-list of corporate accounting gimmicks used to distort financial results, so for the sake of your investment portfolio, please check for any potential tricks up a company’s sleeve before making an investment.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in HPQ/Autonomy, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Uncertainty: Love It or Hate It?

Uncertainty is like a fin you see cutting through the water – many people are uncertain whether the fin sticking out of the water is a great white shark or a dolphin? Uncertainty generates fear, and fear often produces paralysis. This financially unproductive phenomenon has also reared its ugly fin in the investment world, which has led to low-yield apathy, and desensitization to both interest rate and inflation risks.

The mass exodus out of stocks into bonds worked well for the very few that timed an early 2008 exit out of equities, but since early 2009, the performance of stocks has handily trounced bonds (the S&P has outperformed the bond market (BND) by almost 100% since the beginning of March 2009, if you exclude dividends and interest). While the cozy comfort of bonds has suited investors over the last five years, a rude awakening awaits the bond-heavy masses when the uncertain economic clouds surrounding us eventually lift.

The Certainty of Uncertainty

What do we know about uncertainty? Well for starters, we know that uncertainty cannot be avoided. Or as former Secretary of the Treasury Robert Rubin stated so aptly, “Nothing is certain – except uncertainty.”

Why in the world would one of the world’s richest and most successful investors like Warren Buffett embrace uncertainty by imploring investors to “buy fear, and sell greed?” How can Buffett’s statement be valid when the mantra we continually hear spewed over the airwaves is that “investors hate uncertainty and love clarity?” The short answer is that clarity is costly (i.e., investors are forced to pay a cherry price for certainty). Dean Witter, the founder of his namesake brokerage firm in 1924, addressed the issue of certainty in these shrewd comments he made some 78 years ago, right before the end of worst bear market in history:

“Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.”

Undoubtedly, some investors hate uncertainty, but I think there needs to be a distinction between good investors and bad investors. Don Hays, the strategist at Hays Advisory, straightforwardly notes, “Good investors love uncertainty.”

When everything is clear to everyone, including the novice investing cab driver and hairdresser, like in the late 1990s technology bubble, the actual risk is in fact far greater than the perceived risk. Or as Morgan Housel from Motley Fool sarcastically points out, “Someone remind me when economic uncertainty didn’t exist. 2000? 2007?”

What’s There to Worry About?

I’ve heard financial bears argue a lot of things, but I haven’t heard any make the case there is little uncertainty currently. I’ll let you be the judge by listing these following issues I read and listen to on a daily basis:

- Fiscal cliff induced recession risks

- Syria’s potential use of chemical weapons

- Iran’s destabilizing nuclear program

- North Korean missile tests by questionable new regime

- Potential Greek debt default and exit from the eurozone

- QE3 (Quantitative Easing) and looming inflation and asset bubble(s)

- Higher taxes

- Lower entitlements

- Fear of the collapse in the U.S. dollar’s value

- Rigged Wall Street game

- Excessive Dodd-Frank financial regulation

- Obamacare

- High Frequency Trading / Flash Crash

- Unsustainably growing healthcare costs

- Exploding college tuition rates

- Global warming and superstorms

- Etc.

- Etc.

- Etc.

I could go on for another page or two, but I think you get the gist. While I freely admit there is much less uncertainty than we experienced in the 2008-2009 timeframe, investors’ still remain very cautious. The trillions of dollars hemorrhaging out of stocks into bonds helps make my case fairly clear.

As investors plan for a future entitlement-light world, nobody can confidently count on Social Security and Medicare to help fund our umbrella-drink-filled vacations and senior tour golf outings. Today, the risk of parking your life savings in low-rate wealth destroying investment vehicles should be a major concern for all long-term investors. As I continually remind Investing Caffeine readers, bonds have a place in all portfolios, especially for income dependent retirees. However, any truly diversified portfolio will have exposure to equities, as long as the allocation in the investment plan meshes with the individual’s risk tolerance and liquidity needs.

Given all the uncertain floating fins lurking in the economic background, what would I tell investors to do with their hard-earned money? I simply defer to my pal (figuratively speaking), Warren Buffett, who recently said in a Charlie Rose interview, “Overwhelmingly, for people that can invest over time, equities are the best place to put their money.” For the vast majority of investors who should have an investment time horizon of more than 10 years, that is a question I can answer with certainty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including BND, but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Twinkie Investing – Sweet but Unhealthy

It’s a sad day indeed in our history when the architect of the Twinkies masterpiece cream-filled sponge cakes (Hostess Brands) has been forced to close operations and begin bankruptcy liquidation proceedings. Food snobs may question the nutritional value of the artery-clogging delights, but there is no mistaking the instant pleasure provided to millions of stomachs over the 80+ years of the Twinkies dynasty. Most consumers understand that a healthy version of an organic Twinkie will not be found on the shelves of a local Whole Foods Market (WFM) store anytime soon. The reason people choose to consume these 150-calorie packages of baker bliss is due to the short-term ingestion joy, not the vitamin content (see Nutritional Facts below). Most people agree the sugar high gained from devouring half a box of Twinkies outweighs the long-term nourishing benefits reaped by eating a steamed serving of alfalfa sprouts.

Much like dieting, investing involves the trade-offs between short-term impulses and long-term choices. Unfortunately, the majority of investors choose to react to and consume short-term news stories, very much like the impulse Twinkie gorging, rather than objectively deciphering durable trends that can lead to outsized gains. Day trading and speculating on the headline du jour are often more exciting than investing, but these emotional decisions usually end up being costlier to investors over the long-run. Politically, we face the same challenges as Washington weighs the simple, short-term decisions of kicking the fiscal debt and deficits down the road, versus facing the more demanding, long-term path of dealing with these challenges.

With controversial subjects like the fiscal cliff, entitlement reform, taxation, defense spending, and gay marriage blasting over our airwaves and blanketing newspapers, no wonder individuals are defaulting to reactionary moves. As you can see from the chart below, the desire for a knee jerk investment response has only increased over the last 70 years. The average holding period for equity mutual funds has gone from about 5 years (20% turnover) in the mid 1960s to significantly less than 1 year (> 100% turnover) in the recent decade. Advancements in technology have lowered the damaging costs of transacting, but the increased frequency, coupled with other costs (impact, spread, emotional, etc.), have been shown to be detrimental over time, according to John Bogle at the Vanguard Group.

During volatile periods, like this post-election period, it is always helpful to turn to the advice of sage investors, who have successfully managed through all types of unpredictable periods. Rather than listening to the talking heads on TV and radio, or reading the headline of the day, investors would be better served by following the advice of great long-term investors like these:

“In the short run the market is a voting machine. In the long run it’s a weighing machine.” -Benjamin Graham (Famed value investor)

“Excessive short-termism results in permanent destruction of wealth, or at least permanent transfer of wealth.” -Jack Gray (Grantham, Mayo, Van Otterloo)

“The stock market serves as a relocation center at which money is moved from the active to the patient.” – Warren Buffett (Berkshire Hathaway)

“It was never my thinking that made big money for me. It always was my sitting.” – Jesse Livermore (Famed trader)

“The farther you can lengthen your time horizon in the investment process, the better off you will be.”- David Nelson (Legg Mason)

“The growth stock theory of investing requires patience, but is less stressful than trading, generally has less risk, and reduces brokerage commissions and income taxes.” T. Rowe Price (Famed Growth Investor)

“Time arbitrage just means exploiting the fact that most investors…tend to have very short-term time horizons.” -Bill Miller (Famed value investor)

“Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.” -Don Hays (Hays Advisory – Investor/Strategist)

A legendary growth investor who had a major impact on how I shaped my investment philosophy is Peter Lynch. Mr. Lynch averaged a +29% return per year from 1977-1990. If you would have invested $10,000 in his Magellan fund on the first day he took the helm, you would have earned $280,000 by the day he retired 13 years later. Here’s what he has to say on the topic of long-term investing:

“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

“My best stocks performed in the 3rd year, 4th year, 5th year, not in the 3rd week or 4th week.”

“The key to making money in stocks is not to get scared out of them.”

“Worrying about the stock market 14 minutes per year is 12 minutes too many.”

It is important to remember that we have been through wars, assassinations, banking crises, currency crises, terrorist attacks, mad-cow disease, swine flu, recessions, and more. Through it all, our country and financial markets most have managed to survive in decent shape. Hostess and its iconic Twinkies brand may be gone for now, but removing these indulgent impulse items from your diet may be as beneficial as eliminating detrimental short-term investing urges.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in WFM, BRKA/B, LM, TROW or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sifting Through the Earnings Rubble

An earthquake of second quarter earnings results have rocked the markets (better than expected earnings but sluggish revenues), and now investors are left to sift through the rubble. With thousands of these earnings reports rolling in (and many more in the coming weeks), identifying the key investment trends across sectors, industries, and geographies can be a challenging responsibility. If this was an easy duty, I wouldn’t have a job! Fortunately, having a disciplined process to sort through the avalanche of quarterly results can assist you in discovering both potential threats and opportunities.

But first things first: You will need some type of reliable screening tool in order to filter find exceptional stocks. According to Reuters, there are currently more than 46,000 stocks in existence globally. Manually going through this universe one stock at a time is not physically or mentally feasible for any human to accomplish, over any reasonable amount of time. I use several paid-service screening tools, but there are plenty of adequate free services available online as well.

Investing with the 2-Sided Coin

As Warren Buffett says, “Value and growth are two sides of the same coin.” Having a disciplined screening process in place is the first step in finding those companies that reflect the optimal mix between growth and value. I am willing to pay an elevated price (i.e., higher P/E ratio) for a company with a superior growth profile, but I want a more attractive value (i.e., cheaper price) for slower growth companies. I am fairly agnostic between the mix of the growth/value weighting dynamics, as long as the risk-reward ratio is in my favor.

Since I firmly believe that stock prices follow the long-term trajectory of earnings and cash flows, I fully understand the outsized appreciation opportunities that can arise from the “earnings elite” – the cream of the crop companies that are able to sustain abnormally high earnings growth. Or put in baseball terms, you can realize plenty of singles and doubles by finding attractively priced growth companies, but as Hall of Fame manager Earl Weaver says, “You win many more games by hitting a three-run homer than you do with sacrifice bunts.” The same principles apply in stock picking. Legendary growth investor Peter Lynch (see also Inside the Brain of an Investing Genius) is famous for saying, “You don’t need a lot of good hits every day. All you need is two to three goods stocks a decade.”

Some past successful Sidoxia Capital Management examples that highlight the tradeoff between growth and value include Wal-Mart stores (WMT) and Amazon.com (AMZN). Significant returns can be achieved from slower, mature growth companies like Wal-Mart if purchased at the right prices, but multi-bagger home-run returns (i.e., more than doubling) require high octane growth from the likes of global internet platform companies. Multi-bagger returns from companies like Amazon, Apple Inc. (AAPL), and others are difficult to find and hold in a portfolio for years, but if you can find a few, these winners can cure a lot of your underperforming sins.

Defining Growth

Fancy software may allow you to isolate those companies registering superior growth in sales, earnings, and cash flows, but finding the fastest growing companies can be the most straightforward part. The analytical heavy-lifting goes into effect once an investor is forced to determine how sustainable that growth actually is, while simultaneously determining which valuation metrics are most appropriate in determining fair value. Some companies will experience short-term bursts of growth from a single large contract; from acquisitions; and/or from one-time asset sale gains. Generally speaking, this type of growth is less valuable than growth achieved by innovative products, service, and marketing.

The sustainability of growth will also be shaped by the type of industry a company operates in along with the level of financial leverage carried. For instance, in certain volatile, cyclical industries, sequential growth (e.g. the change in results over the last three months) is the more relevant metric. However for most companies that I screen, I am looking to spot the unique companies that are growing at the healthiest clip on a year-over-year basis. These recent three month results are weighed against the comparable numbers a year ago. This approach to analyzing growth removes seasonality from the equation and helps identify those unique companies capable of growing irrespective of economic cycles.

Given that we are a little more than half way through Q2 earnings results, there is still plenty of time to find those companies reporting upside fundamental earnings surprises, while also locating those quality companies unfairly punished for transitory events. Now’s the time to sift through the earnings rubble to find the remaining buried stock gems.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, AMZN, AAPL, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Munger: Buffett’s Wingman & the Art of Stock Picking

Simon had Garfunkel, Batman had Robin, Hall had Oates, Dr. Evil had Mini Me, Sonny had Cher, and Malone had Stockton. In the investing world, Buffett has Munger. Charlie Munger is one of the most successful and famous wingmen of all-time – evidenced by Berkshire Hathaway Corporation’s (BRKA/B) outperformance of the S&P 500 index by approximately +624% from 1977 – 2009, according to MarketWatch. Munger not only provides critical insights to his legendary billionaire boss, Warren Buffett, but he also is Chairman of Berkshire’s insurance subsidiary, Wesco Financial Corporation. The magic of this dynamic duo began when they met at a dinner party during 1959.

In an article he published in 2006, the magnificent Munger describes the “Art of Stock Picking” in a thorough review about the secrets of equity investing. We’ll now explore some of the 88-year-old’s sage advice and wisdom.

Model Building

Charlie Munger believes an individual needs a solid general education before becoming a successful investor, and in order to do that one needs to study and understand multiple “models.”

“You’ve got to have models in your head. And you’ve got to array your experience both vicarious and direct on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and in life. You’ve got to hang experience on a latticework of models in your head.”

Although Munger indicates there are 80 or 90 important models, the examples he provides include mathematics, accounting, biology, physiology, psychology, and microeconomics.

Advantages of Scale

Great businesses in many cases enjoy the benefits of scale, and Munger devotes a good amount of time to this subject. Scale advantages can be realized through advertising, information, psychological “social proofing,” and structural factors.

The newspaper industry is an example of a structural scale business in which a “winner takes all” phenomenon applies. Munger aptly points out, “There’s practically no city left in the U.S., aside from a few very big ones, where there’s more than one daily newspaper.”

General Electric Co. (GE) is another example of a company that uses scale to its advantage. Jack Welch, the former General Electric CEO, learned an early lesson. If the GE division is not large enough to be a leader in a particular industry, then they should exit. Or as Welch put it, “To hell with it. We’re either going to be # 1 or #2 in every field we’re in or we’re going to be out. I don’t care how many people I have to fire and what I have to sell. We’re going to be #I or #2 or out.”

Bigger Not Always Better

Scale comes with its advantages, but if not managed correctly, size can weigh on a company like an anchor. Munger highlights the tendency of large corporations to become “big, fat, dumb, unmotivated bureaucracies.” An implicit corruption also leads to “layers of management and associated costs that nobody needs. Then, while people are justifying all these layers, it takes forever to get anything done. They’re too slow to make decisions and nimbler people run circles around them.”

Becoming too large can also create group-think, or what Munger calls “Pavlovian Association.” Munger goes onto add, “If people tell you what you really don’t want to hear what’s unpleasant there’s an almost automatic reaction of antipathy…You can get severe malfunction in the high ranks of business. And of course, if you’re investing, it can make a lot of difference.”

Technology: Benefit or Burden?

Munger recognizes that technology lowers costs for companies, but the important question that many managers fail to ask themselves is whether the benefits from technology investments accrue to the company or to the customer? Munger summed it up here:

“There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.”

Buffett and Munger realized this lesson early on when productivity improvements gained from technology investments in the textile business all went to the buyers.

Surfing the Wave

When looking for good businesses, Munger and Buffett are looking to “surf” waves or trends that will generate healthy returns for an extended period of time. “When a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows,” states Munger. He notes that it’s the “early bird,” or company that identifies a big trend before others that enjoys the spoils. Examples Munger uses to illustrate this point are Microsoft Corp. (MSFT), Intel Corp. (INTC), and National Cash Register from the old days.

Large profits will be collected by those investors that can identify and surf those rare large waves. Unfortunately, taking advantage of these rare circumstances becomes tougher and tougher for larger investors like Berkshire. If you’re an elephant trying to surf a wave, you need to find larger and larger waves, and even then, due to your size, you will be unable to surf as long as small investors.

Circle of Competence

Circle of competence is not a new subject discussed by Buffett and Munger, but it is always worth reviewing. Here’s how Munger describes the concept:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

For Munger and Buffett, sticking to their circle of competence means staying away from high-technology companies, although more recently they have expanded this view to include International Business Machines (IBM), which they invested in late last year.

Market Efficiency or Lack Thereof

Munger acknowledges that financial markets are quite difficult to beat. Since the markets are “partly efficient and partly inefficient,” he believes there is a minority of individuals who can outperform the markets. To expand on this idea, he compares stock investing to the pari-mutuel system at the racetrack, which despite the odds stacked against the bettor (17% in fees going to the racetrack), there are a few individuals who can still make decent money.

The transactional costs are much lower for stocks, but success for an investor still requires discipline and patience. As Munger declares, “The way to win is to work, work, work, work and hope to have a few insights.”

Winning the Game – 10 Insights / 20 Punches

As the previous section implies, outperformance requires patience and a discriminating eye, which has allowed Berkshire to create the bulk of its wealth from a relatively small number of investment insights. Here’s Munger’s explanation on this matter:

“How many insights do you need? Well, I’d argue: that you don’t need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it….I don’t mean to say that [Warren] only had ten insights. I’m just saying, that most of the money came from ten insights.”

Chasing performance, trading too much, being too timid, and paying too high a price are not recipes for success. Independent thought accompanied with selective, bold decisions is the way to go. Munger’s solution to these problems is to provide investors with a Buffett 20-punch ticket:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches ‑ representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

The great thing about Munger and Buffett’s advice is that it is digestible by the masses. Like dieting, investing can be very simple to understand, but difficult to execute, and legends like these always remind us of the important investing basics. Even though Charlie Munger may be slowing down a tad at 88-years-old, Warren Buffett and investors everywhere are blessed to have this wingman around spreading his knowledge about investing and the art of stock picking.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in BRKA/B, GE, MSFT, INTC, National Cash Register, IBM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Boo! Will History Offer a Bearish Trick or BullishTreat?

October is not only a scary month for trick-or-treaters during Halloween, but October is also a scary month for investors.

Boo! Scared yet? Well if not, need I remind you of the market crashes of 1929 and 1987 also occurred during this ghoulish month? With a wall of worry and concerns galore overwhelming myopic traders, it’s no surprise nervous memories become shortened in anxious times like these.

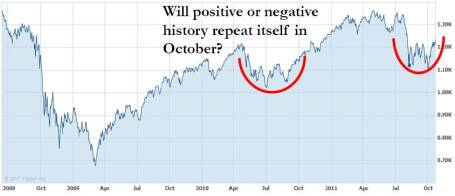

The financial crisis of 2008-2009 is seared into the minds of investors and every Greek debt negotiation creates fresh new Armageddon fears. But perhaps history will repeat itself in a shorter-term more positive way? Just last year, I wrote about the excessive pessimism (It’s All Greek to Me) in July 2010, when “de-risking” was the buzz word of the day and hedge funds were bailing in droves – right before the +30%+ QE2 (quantitative easing) melt-up. Despite a massive expansion in earnings growth over the last few years, the S&P 500 just touched 1074 a few weeks ago – putting the index at similar trading levels as in Fall 2009 (see chart below).

Will Europe crater the U.S. into an abyss, or will Bernanke need to pull a QE3 rabbit out of his hat? I’m not sure what’s going to happen, but I do know it’s better to follow the wisdom of Warren Buffett who says to “buy fear and sell greed.” If a 2% 10-Year Treasury, elevated VIX, and trillions in swollen cash reserves do not represent fear, then I may just need to pack my backs and head out to the Greek island of Santorini – that way I can at least enjoy my fear on a sunny beach.

Regardless of the Q4 outcome, I thought my friend Mark Twain could provide some insight about history’s role in financial markets. Here is an Investing Caffeine flashback from the fall of 2009 (History Never Repeats Itself, but it Often Rhymes) which also questioned the extremely negative sentiment at the time (S&P 500: 1069):

As Mark Twain said, “History never repeats itself, but it often rhymes.” There are many bear markets with which to compare the current financial crisis we are working through. By studying the past we can understand the repeated mistakes of others (caused by fear and greed), and avoid making similar emotional errors.

Do you want an example? Here you go:

Today there are thoughtful, experienced, respected economists, bankers, investors and businessmen who can give you well-reasoned, logical, documented arguments why this bear market is different; why this time the economic problems are different; why this time things are going to get worse — and hence, why this is not a good time to invest in common stocks, even though they may appear low.”

Although the quote above seems appropriate for 2009, it actually is reflective of the bearish mood felt in most bear markets. We have been through wars, assassinations, banking crises, currency crises, terrorist attacks, mad-cow disease, swine flu, and yes, even recessions. And through it all, most have managed to survive in decent shape. Let’s take a deeper look.

1973-1974 Case Study:

For those of you familiar with this period, recall the prevailing circumstances:

- Exiting Vietnam War

- Undergoing a recession

- 9% unemployment

- Arab Oil Embargo

- Watergate: Presidential resignation

- Collapse of the Nifty Fifty stocks

- Rising inflation

Not too rosy a scenario, yet here’s what happened:

S&P 500 Price (12/1974): 69

S&P 500 Price (8/2009): 1,021

That is a whopping +1,380% increase, excluding dividends.

What Investors Should Do:

- Avoid Knee-Jerk Reactions to Media Reports: Whether it’s radio, television, newspapers, or now blogs, the headlines should not emotionally control your investment decisions. Historically, media venues are lousy at identifying changes in price direction. Reporters are excellent at telling you what is happening or what just happened – not what is going to happen.

- Save and Invest: Regardless of the market direction, entitlements like Medicare and social security are under stress, and life expectancies are increasing (despite the sad state of our healthcare system), therefore investing is even more important today than ever.

- Create a Systematic, Disciplined Investment Plan: I recommend a plan that takes advantage of passive, low-cost, tax-efficient investment strategies (e.g. exchange-traded and index funds) across a diversified portfolio. Rather than capitulating in response to market volatility, have a systematic process that can rebalance periodically to take advantage of these circumstances.

For DIY-ers (Do-It-Yourselfers), I suggest opening a low-cost discount brokerage account and research firms like Vanguard Group, iShares, or Select Sector SPDRs. If you choose to outsource to a professional advisor, I recommend interviewing several fee-only* advisers – focusing on experience, investment philosophy, and potential compensation conflicts of interest.

If you believe, like some economists, CEOs, and investors, we have suffered through the worst of the current “Great Recession” and you are sitting on the sidelines, then it might make sense to heed the following advice: “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.” Dean Witter made those comments 77 years ago – a few weeks before the end of worst bear market in history. The market has bounced quite a bit since March of this year, but if history is on our side, there might be more room to go.

Portions of this article were originally published on September 16, 2009.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

*For disclosure purposes: Wade W. Slome, CFA, CFP is President & Founder of Sidoxia Capital Management, LLC, a fee-only investment adviser based in Newport Beach, California.

Shoot First and Ask Later?

The financial markets have been hit by a tsunami on the heels of idiotic debt negotiations, a head-scratching credit downgrade, and slowing economic data after a wallet-emptying spending binge by the government. These chain of events have forced many investors and speculators alike to shoot first, and ask questions later. Is this the right strategy? Well, if you think the world is going to end and we are in a global secular bear market stifled by a choking pile of sovereign debt, then the answer is a resounding “yes.” If however, you believe the blood curdling screams from an angered electorate will eventually influence existing or soon-to-be elected politicians in dealing with the obvious, then the answer is probably “no.”

Plug Your Ears

Anybody that says they confidently know what is really going to happen over the next six months is a moron. You can ask those same so-called talking head experts seen over the airwaves if they predicted the raging +35% upward surge last summer, right after the market tanked -17% on “double-dip” concerns and Fed Chairman Ben Bernanke gave his noted quantitative easing speech in Jackson Hole, Wyoming. I’m still flicking through the channels looking for the professionals who perfectly envisaged the panicked buying of the same downgraded Treasuries Standard and Poor’s pooped on. Oh sure, it makes perfect sense that trillions of dollars would flock to the warmth and coziness of sub-2% yielding debt in a country exploding with unsustainable obligations and deficits, fueled by a Congress that can barely blows its nose to a successful negotiation.

The moral of the story is that nobody knows the future with certainty – no matter how much CNBC producers would like you to believe the opposite is true. Some of the arguably smartest people in the world have single handedly triggered financial market implosions. Consider Robert Merton and Myron Scholes, both renowned Nobel Prize winners, who brought global financial markets to its knees in 1998 when Merton and Scholes’s firm (Long Term Capital Management) lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Or ask yourself how well Fed Chairmen Alan Greenspan and Ben Bernanke did in predicting the credit crisis and housing bubble.

If the strategist or trader du jour squawking on the boob-tube was really honest, he or she would steal the sage words of wisdom from the television series secret agent Angus MacGyver who articulated, “Only a fool is sure of anything, a wise man keeps on guessing.”

Listen to the “E”-Word

If you can’t trust all the squawkers, then whom can you trust (besides me of course…cough, cough)? The answer is no different than the person you would look for in other life-important decisions. If you needed a serious heart by-pass surgery, would you get advice from a nurse or medical professor, or would you listen more closely to the top cardiologist at the Mayo Clinic who performed over 2,000 successful surgeries? If you were looking for a pilot to fly your plane, would you prefer a 25-year-old flight attendant, or a 55-year old steely veteran who has 10 million miles of flight experience? OK, I think you get the point…legitimate experience with a track record is key.

Unfortunately, most of the slick, articulate people we see on television may look experienced and have some gray hair, but the only thing they are experienced at is giving opinions. As my great, great grandmother once told me, “Opinions are a dime a dozen, but experience is much more valuable” (embellished for dramatic effect). You are better off listening to experienced professionals like Warren Buffett (listen to his recent Charlie Rose interview), who have lived through dozens of crises and profited from them – Buffett becoming the richest person on the planet doesn’t just come from dumb luck.

If you are having trouble sleeping, you either are taking too much risk, or do not understand the nature of the risk you are taking (see Sleeping like a Baby). Things can always get worse, and the risk of a self-fulfilling further decline is a possibility (read about Soros and Reflexivity). If you are determined to make changes to your portfolio, use a scalpel, and not an axe. The recent extreme volatility makes times like these ideal for reviewing your financial position, goals, and risk tolerance. But before you shoot your portfolio first, and ask questions later, prevent a prison sentence of panic, or your financial situation may end up behind bars.

[tweetmeme source=”WadeSlome” only_single=false https://investingcaffeine.com/2011/08/20/shoot-first-and-ask-later/%5D

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MHP, CMCSA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

6 Traits of a Winning Aggressive Investor

“Winning” means different things to different people, including Charlie Sheen. As I have stated in the past, there is a diverse set of strategies to win in the investment business, much like there are numerous paths to enlightenment among the extensive choices of religions. Regardless of the differences, followers of a strategy or religion generally believe their principles will lead them to prosperity (financial and/or spiritual). One specific flavor of investment religion follows a path of aggression, which Douglas Bellemore describes in his book The Strategic Investor, published in 1963.

Modern finance and textbooks teach us the virtues and powers of diversification, but Bellemore has learned from the school of Warren Buffett, who stated, “Put all your eggs in one basket and then watch that basket very carefully.” Buffett also believes, “Diversification is protection against ignorance.” It’s no surprise that Buffett’s partner Charlie Munger also harbors some skepticism on the topic, “Wide diversification, which necessarily includes investment in mediocre businesses, only guarantees ordinary results.”

Bellemore’s Big 6

In his book, Bellemore builds upon this bold, concentrated strategy that he taught at New York University for four decades. He believed there are six basic traits necessary for a successful aggressive investor. Here is a synopsis of the characteristics:

1) Patience: Bellemore explains that success in the investment world does not come overnight, and much of the same thought processes necessary to prosper can be found in the in corporate management world.

“Success depends, in large measure, on the ability to select undervalued situations not presently recognized by the majority of investors and to wait for expected developments to provide capital gains which may only come after several years… Many of the personal qualities for successful business management are the same as those for an aggressive investor.”

2) Courage: When it comes to investments, hiding in a cave will not get you very far. On the topic of courage, Bellemore believed:

“The investor must have solid convictions and the courage and confidence emanating from them –that is, courage, at times, to ignore those who disagree…It is this willingness to differ and accept responsibility that distinguishes the top executive and the top investor.”

3) Intelligence: One need not be a genius to be a successful investor, according to Bellemore, but common sense is much more important:

“Many highly intelligent investors have had poor investment records because they lacked common sense, i.e., the down-to-earth, practical ability to evaluate a situation.”

4) Emotional Stability: Bellemore acknowledges the similarities of this trait to patience but emotional stability encompasses a broader context. Here he describes the necessary trait of emotional stability:

“It is needed to prevent the investor from being engulfed in waves of optimism and pessimism that periodically sweep over Wall Street. Moreover, it is required to separate the facts from the entangled web of human emotions.”

5) Hard Work: Ignorance is not an asset in the investment business, therefore in order to become a successful investor it requires hard work. Bellemore underscores the following:

“[An investor] must be knowledgeable about the company in which he considers making an investment, the industry, the position of the company in the industry, and the place and future of that industry in the economy as a whole.”

6) Willingness to Sacrifice Diversification: By definition, Bellemore asserts outsized gains cannot be achieved with diversification:

“Although wide diversification reduces risks by offsetting mediocre selections with good ones, it also reduces substantially the profit or capital gain potential of a portfolio.”

Bellemore acknowledges aggressive investing is not for everyone, and if the six tenets are not followed, the unqualified investor would be much better off by following a conservative, diversified investment approach. The cost of the conservative path, however, is the potential of winning outsized returns. If winning is a priority for you, and your goal is to achieve outperformance, then you and Charlie Sheen would be in agreement to follow Douglas Bellemore’s six traits of an aggressive investor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Buffett on Gold Fondling and Elephant Hunting

Warren Buffett is kind enough to occasionally grace investors with his perspectives on a wide range of subjects. In his recently released annual letter to shareholders he covered everything from housing and leverage to liquidity and his optimistic outlook on America (read full letter here). Taking advice from the planet’s third wealthiest person (see rankings) is not a bad idea – just like getting basketball pointers from Hall of Famer Michael Jordan or football tips from Pro Bowler Tom Brady isn’t a bad idea either.

Besides being charitable with billions of his dollars, the “Oracle of Omaha” was charitable with his time, spending three hours on the CNBC set (a period equal to $12 million in Charlie Sheen dollars) answering questions, all at the expense of his usual money-making practice of reading through company annual reports and 10Qs.

Buffett’s interviews are always good for a few quotable treasures and he didn’t disappoint this time either with some “gold fondling” and “elephant hunting” quotes.

Buffett on Gold & Commodities

Buffett doesn’t hold back on his disdain for “fixed-dollar investments” and isn’t shy about his feelings for commodities when he says:

“The problem with commodities is that you are betting on what someone else would pay for them in six months. The commodity itself isn’t going to do anything for you….it is an entirely different game to buy a lump of something and hope that somebody else pays you more for that lump two years from now than it is to buy something that you expect to produce income for you over time.”

Here he equates gold demand to fear demand:

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything.”

Buffett goes on to say this about the giant gold cube:

“I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side…Now for that same cube of gold, it would be worth at today’s market prices about $7 trillion dollars – that’s probably about a third of the value of all the stocks in the United States…For $7 trillion dollars…you could have all the farmland in the United States, you could have about seven Exxon Mobils (XOM), and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.”

Although not offered up in this particular interview, here is another classic quote by Buffett on gold:

“[Gold] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

For the most part I agree with Buffett on his gold commentary, but when he says commodities “don’t do anything for you,” I draw the line there. Many commodities, outside of gold, can do a lot for you. Steel is building skyscrapers, copper is wiring cities, uranium is fueling nuclear facilities, and corn is feeding the masses. Buffett believes in buying farms, but without the commodities harvested on that farm, the land would not be producing the income he so emphatically cherishes. Gold on the other hand, while providing some limited utility, has very few applications…other than looking shiny and pretty.

Buffett on Elephant Hunting

Another subject that Buffett addresses in his annual shareholder letter, and again in this interview, is his appetite to complete large “elephant” acquisitions. Since Berkshire Hathaway (BRKA/B) is so large now (total assets over $372 billion), it takes a sizeable elephant deal to be big enough to move the materiality needle for Berkshire.

“We’re looking for elephants. For one thing, there aren’t many elephants out there, and all the elephants don’t want to go in our zoo…It’s going to be rare that we are going find something selling in the tens of billions of dollars; where I understand the business; where the management wants to join up with Berkshire; where the price makes the deal feasible; but it will happen from time to time.”

Buffett’s target universe is actually fairly narrow, if you consider his estimate of about 50 targets that meet his true elephant definition. He has been quite open about the challenges of managing such a gigantic portfolio of assets. The ability to outperform the indexes becomes more difficult as the company swells because size becomes an impediment – “gravity always wins.”

With experience and age comes quote-ability, and Warren Buffett has no shortage in this skill department. The fact that Buffett’s investment track record is virtually untouchable is reason enough to hang upon his every word, but his uncanny aptitude to craft stories and analogies – such as gold fondling and elephant hunting – guarantees I will continue waiting with bated breath for his next sage nuggets of wisdom.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including commodities) and commodity related equities, but at the time of publishing SCM had no direct position in BRKA/B, XOM or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

![940614_83408820[1]](https://investingcaffeine.com/wp-content/uploads/2011/08/940614_834088201.jpg?w=455)