Posts tagged ‘warren buffet’

Dow Knocking on the Door of 40,000

The stock market rang the doorbell of the New Year with a bang during the 1st quarter. The S&P 500 index built on last year’s +24% gain with another +10% advance during the first three months of the year. And as a result of these increases, the Dow Jones Industrial Average index is knocking on the door of the 40,000 milestone – more specifically, the Dow closed the month at 39,807 (see chart below). To put his into context, when I was born more than 50 years ago, the Dow was valued at less than 1,000 – not a bad run. This is proof positive of what Einstein called the 8th Wonder of the World, “compounding”. At Sidoxia Capital Management, we view investing as a marathon, not a sprint. You cannot realize the benefits of compounding without having a long-term time horizon. The sooner you start saving and the more you save, the faster and larger your retirement nest egg will grow.

If you are one of the people who thinks the stock market is too high, then you should definitely ignore Warren Buffett, arguably the greatest investor of all-time. Buffett predicted the Dow will reach an astronomical level of one million (1,000,000) within the next 100 years. I’m not sure I will still be around to witness this momentous achievement, however, if history repeats itself, this targeted timeframe could prove conservative.

Despite the magnitude and duration of this bull market, there is still a lot of angst and anxiety over the upcoming election. Nevertheless, investors are choosing instead to focus on the strong fundamentals of the economy. Just this last week, we saw the broadest measurement of economic activity, GDP (Gross Domestic Product), get revised higher to +3.4% growth during the 4th quarter of 2023 (see chart below). On the jobs front, the unemployment picture remains healthy (3.9%), near a generational low.

Source: Trading Economics and Bureau of Economic Analysis

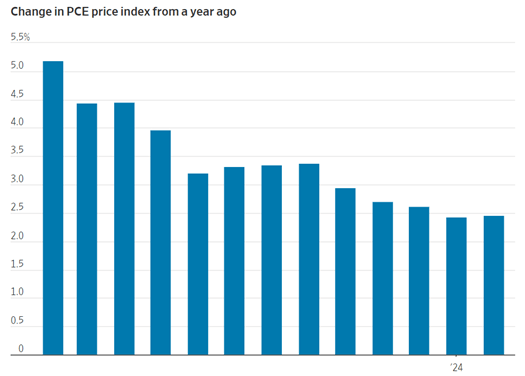

And when it comes to the all-important inflation data, the Federal Reserve’s preferred inflation measure, Core PCE index (Core Personal Consumption Expenditures), was also just released in-line with economists’ projections at 2.5% (see chart below), very near the Fed’s long-term 2.0% inflation target and well below the Core PCE’s recent peak near 6%.

Source: The Wall Street Journal and Commerce Department

This resilient economic data, when combined with the declining inflation figures, has resulted in the Federal Reserve sticking with its plan of cutting its Federal Funds interest rate target three times this year. If inflation reverses course or remains stubbornly high, then there is a higher likelihood that interest rate cuts will be delayed. On the flip side, if economic data slows significantly or the country goes into a recession, then the probability of sooner and/or more Fed interest-rate cuts will increase.

In other news, here are some of the other major financial headlines this month:

- Francis Scott Key Baltimore Bridge Collapse: Six people died when a large container ship crashed into the Francis Scott Key bridge in the Port of Baltimore. An estimated 50 million tons of goods valued at $80 billion flows through this port, making this one of the top 10 ports in the country. The auto and coal industry supply chains will be disproportionately affected, but the good news is much of these goods will be diverted to other larger ports (e.g., Port of New York and Port of New Jersey).

- DJT Debut: A lot of hype surrounded the trading debut of Trump Media & Technology Group, which began trading last week under the initials of our country’s former president, Donald J. Trump (Ticker: DJT). Despite only posting a few million in revenue and -$50 million in losses during the first nine months of 2023, the stock skyrocketed +65% in its first week of trading and attained a $9 billion valuation. Time will tell if Trump’s Truth Social media platform will gain traction and justify the stock’s price, or rather suffer the declining fate of other meme stocks like GameStop Corp. (GME) or AMC Entertainment Holdings (AMC).

- SBF Sentenced to 25 Years: The former CEO of cryptocurrency exchange company FTX, Sam Bankman-Fried (SBF), was sentenced to 25 years in prison due to his conviction on seven counts of fraud and what is believed to be $8 billion in stolen client funds. SBF didn’t help his own cause by perjuring himself, tampering with witnesses, and showing a lack of remorse, according to the judge.

We are only 25% of the way through the year, but the Dow is knocking on the 40,000-milestone door. The way things look now, investors are wiping their feet on the welcome doormat and ready to walk right in.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), and notes including AMC 2026, but at the time of publishing had no direct position in DJT, GME, AMC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Give Thanks and Feast on New Record

There were many things to be grateful over the Thanksgiving holiday, including personal finances for many. Stock market investors were especially thankful for the new record highs achieved in the S&P 500 index, which rose a heaping +3.4% last month, bringing 2019 stock market gains to a whopping +25.3%. Any concerns over politics, China trade, global monetary policy, Brexit negotiations, slowing economic growth, and other fears have been overshadowed by record corporate profits, generationally low interest rates, historically low unemployment rates, rising wages, strong consumer confidence, and hopes of an economic recovery abroad.

Despite the strong advances, concerns remain over a bubble or a stratospheric stock market. These worries of inflated gains seem overblown, if you consider stocks were down -6.2% in 2018. In other words, if you combine 2018-2019, so far, the two-year period averages an +8.4% annualized return – a more reasonable advance. One thing is for sure, this bull market, which started in early-2009, has been no turkey. Since the S&P 500 bottomed at 666 in March of 2009, the index finished the month at over 3,140 – almost a quintuple in value over a 10-year period (not too shabby).

I get the question a lot, “Wade, don’t you think the stock market is crazy now and it is going to crash soon? It’s gone up so much and is at a record high.” Just because the stock market hits a record level doesn’t mean it will stop going up. In fact, since 2013, the S&P 500 has hit 38 new, monthly record highs (see chart below). For each of these new records, I have listened to anxious investors brace themselves for another crash resembling the 2008 financial collapse. The only problem is the 100-year flood normally doesn’t come every 10 years, and as history often proves, record highs often beget future new record highs.

Be Careful to Whom You Listen

There are always varying opinions about the level and direction of future stock prices, but I always warn investors to be careful about following the judgments of television talking heads, especially when it comes to economists, strategists, and analysts, all of whom typically have very little experience in actually investing. These prognosticators typically are very articulate and persuasive but have little-to-no experience of really managing money. Traders generally fall into the useless camp as well because their opinions are moving at the speed of light based on the everchanging headlines du jour, thereby making this fickle advice worthless and ineffective. Instead, investors should pay attention to successful long-term investors who have proven the ability to make and preserve wealth through years of up-and-down markets. You don’t have to believe me, but when the most successful investor of all-time, Warren Buffett, says the stock market is “ridiculously cheap,” it probably makes sense to pay more attention to his words of wisdom versus the latest political headline or dangerous and speculative day trader advice to buy-buy-buy or sell-sell-sell!

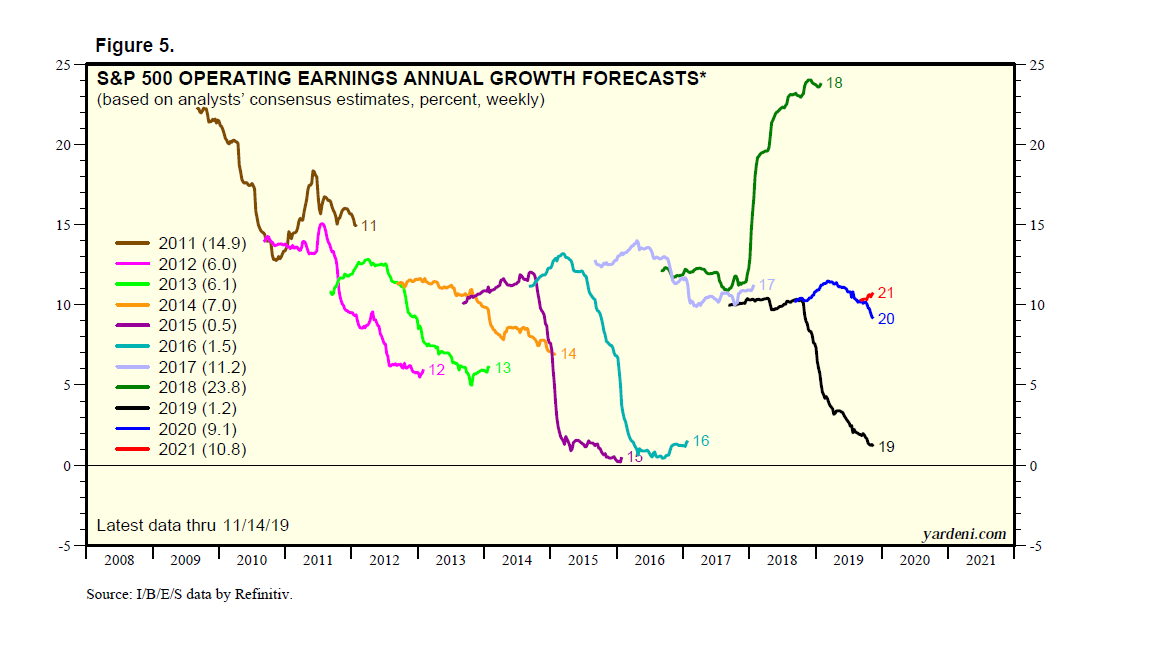

Although Warren Buffett freely provides his opinions, he openly admits he has no idea what direction stock prices will do in the short-run. So, if the greatest investor of all-time cannot predict short-term direction of stocks, then maybe you shouldn’t try to predict either? Case in point, corporate profits were up over 20% in 2018 (see chart below) and stock prices went down, while this year corporate profits have been essentially flat and stock prices have catapulted approximately +25%. This goes to show you that short-term stock movements can be incredibly difficult to predict. You will be much better off by focusing on making sound investments and following a suitable strategy based on your unique objectives and constraints.

Source: Dr. Ed’s Blog

You may have gotten some heartburn by feasting on too much turkey, mashed potatoes, stuffing, and gravy, however investors are feasting on new record stock market highs despite investor anxiety. When the anxiety eventually turns to euphoria and gluttony, from fear and skepticism, then that will be the time to reach for the Tums antacid.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.