Posts tagged ‘valuation’

Siegel & Co. See “Bubblicious” Bonds

Siegel compares 1999 stock prices with 2010 bonds

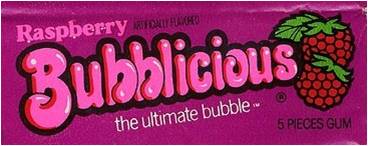

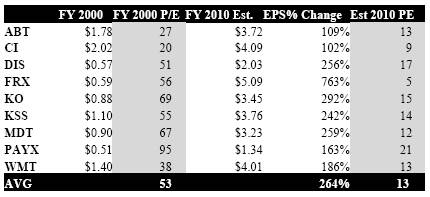

Unlike a lot of economists, Jeremy Siegel, Professor at the Wharton School of Business, is not bashful about making contrarian calls (see other Siegel article). Just days after the Nasdaq index peaked 10 years ago at a level above 5,000 (below 2,200 today), Siegel called the large capitalization technology market a “Sucker’s Bet” in a Wall Street Journal article dated March 14, 2000. Investors were smitten with large-cap technology stocks at the time, paying balloon-like P/E (Price-Earnings) ratios in excess of 100 times trailing earnings (see table above).

Bubblicious Boom

Today, Siegel has now switched his focus from overpriced tech-stock bubbles to “Bubblicious” bonds, which may burst at any moment. Bolstering his view of the current “Great American Bond Bubble” is the fact that average investors are wheelbarrowing money into bond funds. Siegel highlights recent Investment Company Institute data to make his point:

“From January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.”

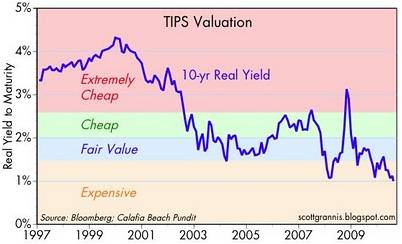

The professor goes on to make the stretch that some government bonds (i.e., 10-year Treasury Inflation-Protected Securities or TIPS) are priced so egregiously that the 1% TIPS yield (or 100 times the payout ratio) equates to the crazy tech stock valuations 10 years earlier. Conceptually the comparison of old stock and new bond bubbles may make some sense, but let’s not lose sight of the fact that tech stocks virtually had a 0% payout (no dividends). The risk of permanent investment loss is much lower with a bond as compared to a 100-plus multiple tech stock.

Making Rate History No Mystery

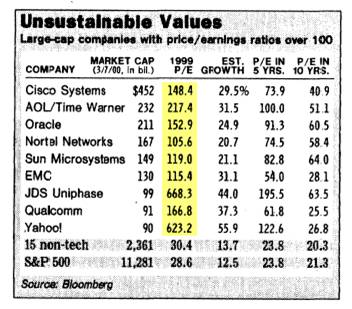

What makes Siegel so nervous about bonds? Well for one thing, take a look at what interest rates have done over the last 30 years, with the Federal Funds rate cresting over 20%+ in 1981 (View RED LINE & BLUE LINE or click to enlarge):

As I have commented before, there is only one real direction for interest rates to go, since we currently sit watching rates at a generational low. Rates have a minute amount of wiggle room, but Siegel rightfully understands there is very little wiggle room for rates to go lower. How bad could the pain be? Siegel outlines the following scenario:

“If over the next year, 10-year interest rates, which are now 2.8%, rise to 3.15%, bondholders will suffer a capital loss equal to the current yield. If rates rise to 4% as they did last spring, the capital loss will be more than three times the current yield.”

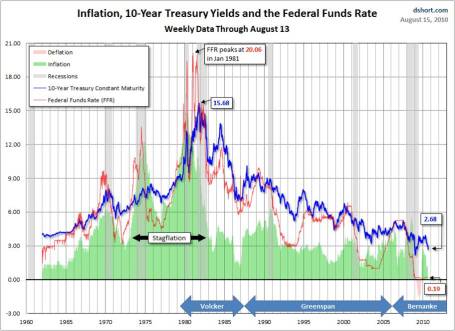

Siegel is not the only observer who sees relatively less value in bonds (especially government bonds) versus stocks. Scott Grannis, author of the Calafia Report artfully shows the comparisons of the 10-Year Treasury Note yield relative to the earnings yield on the S&P 500 index:

As you can see, rarely have there been periods over the last five decades where bonds were so poorly attractive relative to equities.

Grannis mirrors Siegel’s view on government bond prices through his chart on TIPS pricing:

Pricey Treasuries is not a new unearthed theme, however, Siegel and Grannis make compelling points to highlight bond risks. Certainly, the economy could soften further, and trying to time the bottom to a multi-decade bond bubble can be hazardous to your investing health. Having said that, effectively everyone should desire some exposure to fixed income securities, depending on their objectives and constraints (retirees obviously more). The key is managing duration and the risk of inflation in a prudent fashion. If you believe Siegel is correct about an impending bond bubble bursting, you may consider lightening your Treasury bond load. Otherwise, don’t be surprised if you do not collect on another “sucker’s bet.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP and other fixed income ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Marathon Investing: Genesis of Cheap Stocks

It was Mark Twain who famously stated, “The reports of my death have been greatly exaggerated.” So too has the death of equities been overstated. Long-term stock bulls don’t have a lot to point to since the market, as measured by the S&P 500 index, has done absolutely nothing over the last 12 years (see Lost Decade). Over the last 10 years, the market is actually down about -20% without dividends (and about flat if you account for reinvested dividends). So if equities belong at the morgue, why not just short the market, burn your dollars, and hang out in a cave with a pile of gold? Well, behind the scenes, and off the radar of nanosecond, high frequency, day-trading CNBC junkies, there has been a quiet but deliberate strengthening in the earnings foundation of the market. In the investing world it’s difficult to move forward through sand. Even without a sturdy running foundation, sprinters can race to the front of the pack, but those disciplined runners who systematically train for marathons are the ones who successfully make it to the finish line.

Prices Chopped in Half

What many pundits and media mavens fail to recognize is S&P corporate profits have virtually doubled since 1998 (a historically elevated base), despite market prices stuck in quicksand for a dozen years. What does this say about the valuation of the market when prices go nowhere and profits double? Simple math tells us that all stock market inventory is selling for -50% off (the market multiple has been chopped in half). That’s exactly what we have seen – the June 1998 market multiple (valuation) stood around 27x’s earnings and today’s 2010 earnings estimates imply a multiple of about 13.5 x’s projected profits. With the rear-view mirror assisting us, it’s easy to understand why pre-2000 (tech bubble) valuations were expensive. By coupling more reasonable valuations with a 10-Year Treasury Note trading at 3.19% and lofty bond prices, I would expect stocks to be poised for a much better decade of relative performance versus bonds. The case becomes even stronger if you believe 2011 S&P 500 estimates are achievable (12x’s earnings).

In order to make the decade long valuation contraction more apparent, I wanted include a random group of stocks (mixture of healthcare, media, retailer, consumer non-discretionary, and financial services) to liven up my argument:

What Next?

From a stock market standpoint, there are certainly plenty of believable “double dip” scenarios out there along with thoughtful observers who question the attainability of next year’s earnings forecasts. With that said, I do have problems with those bears like John Mauldin (read The Man Who Cries Wolf) who just last year pointed to a market trading at a “(negative) -467” P/E ratio, only to subsequently watch stocks advance some 80%+ over the following months.

Regardless of disparate economic views, I contend objective market observers (even bearish ones) have trouble indicating the market is ridiculously expensive with a straight face – based on current corporate profit expectations. At the end of the day, sustainable earnings and cash flow growth are what ultimately drive durable, long-term price appreciation. As Peter Lynch stated with technical precision, “People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

Running a marathon is always challenging, but with a sturdy foundation in which prices have been chopped in half (see also Market Dipstick article), reaching the goal and finish line for long-term investors will be much more achievable.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, WMT, and PAYX, but at the time of publishing SCM had no direct positions in ABT, CI, DIS, FRX, KO, KSS, MDT or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Measuring the Market with Valuation Dipstick

Investor opinions about the stock market’s value are all over the map.

Doomsayers think the market is valued at crazy levels, and believe that “buy-and-hold” investing is dead. Bears remind investors that stocks have led to nothing good except for a lost decade of performance (read article on Lost Decade). Many speculators on the other hand believe they have the ability to “time the markets” to take advantage of volatility in any market (see also Market Timing article). In trader land, overconfidence is never in short-supply. Certainly, if you are a trader at Goldman Sachs (GS) or UBS and you are trading with privileged client data, then taking advantage of volatility can be an extremely lucrative endeavor. However most day-traders, and average investors, are not honored with the same information. Rather, the public gets overwhelmed by online brokerage firms and their plethora of software bells and whistles – inadequate protection when investing among a den of wolves. Equipping speculators with day trading tools is a little like giving a 7-year old a squirt gun and shipping them off to Afghanistan to fight the Taliban – the odds are not in the kid’s favor.

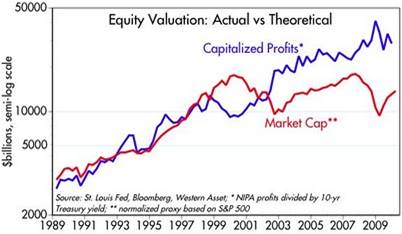

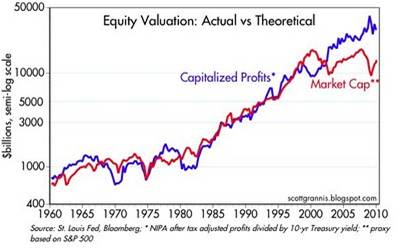

With so much uncertainty out in the marketplace, how do we know if the overall market is cheap or expensive? According to Scott Grannis, former Chief Economist at Western Asset Management and author of the Calafia Beach Pundit blog, the dipstick components necessary to measure the value of the market are corporate profits relative to the level of Gross Domestic Product (GDP) and the value (market cap) of the S&P 500 index. Grannis is a believer in the tenet that stock prices follow earnings, and as you can see from his charts below, earnings have grown much faster than stock prices over the last 10 years:

20 Year Chart

50 Year Chart

As you can see there is an extremely tight correlation on the 50-year chart until the last decade. What does the recent diverging trend mean? Here’s what Grannis has to say:

“Note that profits doubled from 1998 to 2009, yet the S&P 500 index today is still lower than it was at the end of 1998…equities continue to be extremely undervalued. Another way of looking at this is that the market is discounting current profits using an 8% 10-yr Treasury yield, or a 50% drop in corporate profits from here. Simply put, according to this model the market is priced to some very awful assumptions.”

How will this valuation gap be alleviated? Grannis correctly identifies two scenarios to achieve this end: 1) Rising treasury yields; and 2) Rising equity prices. His base case would be a move on the 10-year yield to 5.5%, and a move upwards in the S&P 500 index +50%.

Judging by Grannis’s dipstick measurement, there’s plenty of oil in the system to prevent the market engine from overheating just quite yet.

Read the Complete Scott Grannis Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GS, UBS, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Balance Sheet: The Foundation for Value

Let’s talk balance sheets… how exciting! Most people would rather hear nails scratching against a chalkboard or pour lemon juice on a fresh paper-cut, rather than slice and dice a balance sheet. However, the balance sheet plays a critical role in establishing the foundational value of a business. As part of my financial statement analysis series of articles, today we will explore the balance sheet in more detail.

It’s not just legendary value investors like Warren Buffett and Benjamin Graham who vitally rely on a page filled with assets and liabilities. Modern day masters like Bill Ackman (CEO of Pershing Square Capital Management LP – read more about Bill Ackman) and Eddie Lampert (CEO of Sears Holdings – SHLD) have in recent years relied crucially on the balance sheet, and specifically on real estate values, when it came to defining investments in Target Corporation (TGT) and Sears, respectively.

Balance Sheet Description

What is the balance sheet? For starters, it is one of the three major financial statements (in addition to the “Income Statement” and “Cash Flow Statement”), which provides a snapshot summary of a company’s assets, liabilities, and shareholders’ equity on a specific date. One of the main goals of the balance sheet is to provide an equity value of the corporation (also called “book value”).

Conceptually the balance sheet concept is no different than determining the value of your home. First, a homeowner must determine the price (asset value) of the house – usually as a function of the sales price (estimated or actual). Next, the mortgage value (debt) is subtracted from the home price to arrive at the value (equity) of the homeowner’s position. The same principle applies to valuing corporations, but as you can imagine, the complexity can increase dramatically once you account for the diverse and infinite number of potential assets and liabilities a company can hold.

Metrics

Many key financial analysis metrics are derived directly from the balance sheet, or as a result of using some of its components. Here are a few key examples:

- ROE (Return on Equity): Derived by dividing the income from the income statement by the average equity value on the balance sheet. This indicator measures the profitability of a business relative to shareholders’ investments. All else equal, a higher ROE is preferred.

- P/B (Price to Book): A ratio comparing the market capitalization (total market price of all shares outstanding) of a company to its book value (equity). All else equal, a lower P/B is preferred.

- Debt/Equity or Debt/Capitalization: These ratios explain the relation of debt to the capital structure, indicating the overall amount of financial leverage a company is assuming. All else equal, lower debt ratios are preferred, however some businesses and industries can afford higher levels of debt due to a company’s cash flow dynamics.

There are many different ratios to provide insight into a company, nonetheless, these indicators provide a flavor regarding a company’s financial positioning. In addition, these ratios serve a valuable purpose in comparing the financial status of one company relative to others (inside or outside a primary industry of operation).

Balance Sheet Shortcomings

The balance sheet is primarily built upon a historical cost basis due to defined accounting rules and guidelines, meaning the stated value of an asset or liability on a balance sheet is determined precisely when a transaction occurs in time. Over time, this accounting convention can serve to significantly understate or overstate the value of balance sheet items.

Here are a few examples of how balance sheet values can become distorted:

- Hidden Assets: Not all assets are visible on the balance sheet. Certain intangible assets have value, but cannot be touched and are not recognized by accounting rules on this particular financial statement. Examples include: human capital (employees), research & development, brands, trademarks, and patents. All these items can have substantial value, yet show up nowhere on the balance sheet.

- Lack of Comparability: Comparability of balance sheet data can become fuzzy when certain accounting rules and assumptions are exercised by one company and not another. For instance, if two different companies purchased the same property, plant, and equipment at the same time and price, the values on the balance sheets may vary significantly in the future due to the application of different depreciation schedules (e.g., 10 years versus 20 years). Share repurchase is another case in point that can alter the comparison of equity values – in some cases resulting in a negative equity value.

- Goodwill & Distorted M&A Values: Companies that are active with mergers and acquisitions are forced to reprice assets and liabilities upwards and downwards (inflation, or the lack thereof, can lead to large balance sheet adjustments). Goodwill (asset) is the excess value paid over fair market value in an acquisition. Goodwill can be quite substantial in certain transactions, especially when a high premium price is paid.

- Write-offs and Write-ups: In 2001, telecom component maker JDS Uniphase (JDSU) slashed the value of its goodwill by a massive $44.8 billion. This is an extreme illustration of how the accounting-based values on the financial statement can exhibit significant differences from a company’s market capitalization. Often, the market value (the cumulative value of all outstanding market-priced shares) is a better indicator of a company’s true value – conceptually considered the present value of all future cash flows.

Some balance sheets are built on shaky foundations. A risky, debt-laden balance sheet can resemble a shoddy home foundation built on sand, along an earthquake fault-line. In other words, a small shock can lead to financial collapse. In the credit-driven global bubble we are currently working through, many companies that were built on shaky foundations (i.e., a lot of debt) are struggling to survive. Survival may be dependent on a company restructuring, selling assets, paying down debt, merging, or other tactic with the aim of shoring up the balance sheet. Using the balance sheet value of a company in conjunction with the marketplace price of the same business can be a valuable approach in establishing a more reliable valuation. Before you make an investment or valuation conclusion about a company, do yourself a favor and dig into the balance sheet to verify the condition and soundness of a company’s financial foundation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in TGT, SHLD, or JDSU. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sports & Investing: Why Strong Earnings Can Hurt Stock Prices

There are many similarities between investing in stocks and handicapping in sports betting. For example, investors (bettors) have opposing views on whether a particular stock (team) will go up or down (win or lose), and determine if the valuation (point spread) is reflective of the proper equilibrium (supply & demand). And just like the stock market, virtually anybody off the street can place a sports bet – assuming one is of legal age and in a legal betting jurisdiction.

Right now investors are poring over data as part of the critical, quarterly earnings ritual. Thus far, roughly 20% of the companies in S&P 500 index have reported their results and 78% of those companies have beaten Wall Street expectations (CNBC). Unfortunately for the bulls, this trend has not been strong enough to push market prices higher in 2010.

So how and why can market prices go down on good news? There are many reasons that short-term price trends can diverge from short-run fundamentals. One major reason for the price-fundamental gap is the following factor: expectations. Just last week, the market had climbed over +70% in a ten month period, before issues surrounding the Massachusetts Senatorial election, President Obama’s banking reform proposals, and Federal Reserve Bank Chairman Ben Bernanke’s re-appointment surfaced. With such a large run-up in the equity markets come loftier expectations for both the economy and individual companies. So when corporate earnings unveiled from companies like Google (GOOG), J.P. Morgan (JPM), and Intel (INTC) outperform relative to forecasts, one explanation for an interim price correction is due to a significant group of investors not being surprised by the robust profit reports. In sports betting lingo, the sports team may have won the game this week, but they did not win by enough points (“cover the spread”).

Some other reasons stock prices move lower on good news:

- Market Direction: Regardless of the underlying trends, if the market is moving lower, in many instances the market dip can overwhelm any positive, stock- specific factors.

- Profit Taking: Many times investors holding a long position will have price targets or levels, if achieved, that will trigger selling whether positive elements are in place or not.

- Interest Rates: Certain valuation techniques (e.g. Discounted Cash Flow and Dividend Discount Model) integrate interest rates into the value calculation. Therefore, a climb in interest rates has the potential of lowering stock prices – even if the dynamics surrounding a particular security are excellent.

- Quality of Earnings: Sometimes producing winning results is not enough (see also Tricks of the Trade article). On occasion, items such as one-time gains, aggressive revenue recognition, and lower than average tax rates assist a company in getting over a profit hurdle. Investors value quality in addition to quantity.

- Outlook: Even if current period results may be strong, on some occasions a company’s outlook regarding future prospects may be worse than expected. A dark or worsening outlook can pressure security prices.

- Politics & Taxes: These factors may prove especially important to the market this year, since this is a mid-term election year. Political and tax policy changes today may have negative impacts on future profits, thereby impacting stock prices.

- Other Exogenous Items: Natural disasters and security attacks are examples of negative shocks that could damage price values, irrespective of fundamentals.

Certainly these previously mentioned issues do not cover the full gamut of explanations for temporary price-fundamental gaps. Moreover, many of these factors could be used in reverse to explain market price increases in the face of weaker than anticipated results.

For those individuals traveling to Las Vegas to place a wager on the NFL Super Bowl, betting on the hot team may not be enough. If expectations are not met and the hot team wins by less than the point spread, don’t be surprised to see a decline in the value of the bet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing had no direct positions in JPM and INTC. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Siegel Digs in Heels on Stocks

Jeremy Siegel, Wharton University Professor and author of Stocks for the Long Run, is defending his long-term thesis that stocks will outperform bonds over the long-run. Mr. Siegel in his latest Financial Times article vigorously defends his optimistic equity belief despite recent questions regarding the validity and accuracy of his long-term data (see my earlier article).

He acknowledges the -3.15% return of U.S. stock performance over the last decade (the fourth worst period since 1871), so what gives him confidence in stocks now? Let’s take a peek on why Siegel is digging in his heels:

Since 1871, the three worst ten-year returns for stocks have ended in the years 1974, 1920, and 1978. These were followed, respectively, by real, after-inflation stock returns of more than 8 per cent, 13 per cent, and 9 per cent over next ten years. In fact for the 13 ten-year periods of negative returns stocks have suffered since 1871, the next ten years gave investors real returns that averaged over 10 per cent per year. This return has far exceeded the average 6.66 per cent real return in all ten years periods, and is twice the return offered by long-term government bonds.

Siegel’s bullish stock stance has also been attacked by Robert Arnott, Chairman of Research Affiliates, when he noted a certain bond strategy bested stocks over the last 40 years. Here’s what Mr. Siegel has to say about stock versus bond performance:

Even with the recent bear market factored in, stocks have always done better than Treasury bonds over every 30-year period since 1871. And over 20-year periods, stocks bested Treasuries in all but about 5 per cent of the cases… In fact, with the recent stock market recovery and bond market decline, stock returns now handily outpace bond returns over the past 30 and 40 years.

If you’re 50, 60, or older, then Siegel’s time horizons may not fit into your plans. Nonetheless, in any game one chooses to play (including the game of money), I, like many, prefer to have the odds stacked in my favor.

In addressing the skeptics, such as Bill Gross who believes the U.S. is entering a “New Normal” phase of sluggish growth, Mr. Siegel notes this commentary even if true does not account for the faster pace of international growth – Siegel goes on to explain that the S&P 500 corporations garner almost 50% of revenues from these faster growing areas outside the U.S.

On the subject of valuation, Mr. Siegel highlights the market is trading at roughly 14x’s 2010 estimates, well below the 18-20x multiples usually associated with low-interest rate periods like these.

In periods of extreme volatility (upwards or downwards), the prevailing beliefs fight reversion to the mean arguments because trend followers believe “this time is different.” Just think of the cab drivers who were buying tech stocks in the late 1990s, or of the neighbor buying rental real estate in 2006. Bill Gross with his “New Normal” doesn’t buy the reversion argument either. Time will tell if we have entered a new challenging era like Mr. Gross sees? Regardless, Professor Siegel will be digging in his heels as he invests in stocks for the long run.

Read the Whole Financial Times Article Written by Professor Siegel

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Dry Powder Piled High

Money goes where it is treated best. Sometimes idle cash contributes to the inflation of speculative bubbles, while sometimes that same capital gets buried in a bunker out of fear. The mood-swing pendulum is constantly changing; however with the Federal Funds Rate at record lows, some of the bunker money is becoming impatient. With the S&P 500 up +60% since the March lows, investors are getting antsy to put some of the massive mounds of dry powder back to work – preferably in an investment vehicle returning more than 1%.

How much dry powder is sloshing around? A boatload. Bloomberg recently referenced data from ICI detailing money market accounts flush with a whopping $3.5 trillion. This elevated historical number comes despite a $439.5 million drop from the record highs experienced in January of this year.

From a broader perspective, if you include cash, money-market, and bank deposits, the nation’s cash hoard reached $9.55 trillion in September. What can $10 trillion dollars buy? According to Bloomberg, you could own the whole S&P 500 index, which registers in at a market capitalization price tag of about $9.39 trillion. The article further puts this measure in context:

“Since 1999, so-called money at zero maturity has on average accounted for 62 percent of the stock index’s worth. … Before the collapse of New York-based Lehman Brothers Holdings Inc. last year, the amount of cash never exceeded the value of U.S. equities.”

Cash levels remain high, but the 60% bounce from the March lows is slowly siphoning some money away. According to ICI data, $15.8 billion has been added to domestic-equity funds since March. Trigger shy fund managers, fearful of the macro-economic headlines, have been slow to put all their cash to work, as well. Jeffrey Saut, chief investment strategist at Raymond James & Associates adds “Many of the fund managers I talk to that have missed this rally or underplayed this rally are sitting with way too much cash.”

With so much cash on the sidelines, what do valuations look like since the March rebound?

“The index [S&P 500] trades for 2.18 times book value, or assets minus liabilities, 33 percent below its 15-year average, data compiled by Bloomberg show. The S&P 500 was never valued below 2 times net assets until the collapse of Lehman, data starting in 1994 show. The index fetches 1.15 times sales, 22 percent less than its average since 1993.”

On a trailing P/E basis (19x’s) the market is not cheap, but the Q4 earnings comparisons with last year are ridiculously easy and companies should be able to trip over expectations. The proof in the pudding comes in 2010 when growth in earnings is projected to come in at +34% (Source: Standard & Poor’s), which translates into a much more attractive multiple of 14 x’s earnings. Revenue growth is the missing ingredient that everyone is looking for – merely chopping an expense path to +34% earnings growth will be a challenging endeavor for corporate America.

Growth outside the U.S. has been the most dynamic and asset flows have followed. With some emerging markets up over +100% this year, the sustainability will ultimately depend on the shape of the global earnings recovery. At the end of the day, with piles of dry powder on the sidelines earning next to nothing, eventually that capital will operate as productive fuel to drive prices higher in the areas it is treated best.

Read the Complete Bloomberg Article Here.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Taking Facebook and Twitter Public

Valuing high growth companies is similar to answering a typical open-ended question posed to me during business school interviews: “Wade, how many ping pong balls can you fit in an empty 747 airplane?” Obviously, the estimation process is not an exact science, but rather an artistic exercise in which various techniques and strategies may be implemented to form a more educated guess. The same estimation principles apply to the tricky challenge of valuing high growth companies like Facebook and Twitter.

Cash is King

Where does one start? Conceptually, one method used to determine a company’s value is by taking the present value of all future cash flows. For growth companies, earnings and cash flows can vary dramatically and small changes in assumptions (i.e., revenue growth rates, profit margins, discount rates, taxes, etc.) can lead to drastically different valuations. As I have mentioned in the past, cash flow analysis is a great way to value companies across a broad array of industries – excluding financial companies (see previous article on cash flow investing).

Mature companies operating in stable industries may be piling up cash because of limited revenue growth opportunities. Such companies may choose to pay out dividends, buyback stock, or possibly make acquisitions of target competitors. However, for hyper-growth companies earlier in their business life-cycles, (e.g., Facebook and Twitter), discretionary cash flow may be directly reinvested back into the company, and/or allocated towards numerous growth projects. If these growth companies are not generating a lot of excess free cash flow (cash flow from operations minus capital expenditures), then how does one value such companies? Typically, under a traditional DCF (discounted cash flow model), modest early year cash flows are forecasted until more substantial cash flows are generated in the future, at which point all cash flows are discounted back to today. This process is philosophically pure, but very imprecise and subject to the manipulation and bias of many inputs.

To combat the multi-year wiggle room of a subjective DCF, I choose to calculate what I call “adjusted free cash flow” (cash flow from operations minus depreciation and amortization). The adjusted free cash flow approach provides a perspective on how much cash a growth company theoretically can generate if it decides to not pursue incremental growth projects in excess of maintenance capital expenditures. In other words, I use depreciation and amortization as a proxy for maintenance CAPEX. I believe cash flow figures are much more reliable in valuing growth companies because such cash-based metrics are less subject to manipulation compared to traditional measures like earnings per share (EPS) and net income from the income statement.

Rationalizing Ratios

Other valuation methods to consider for growth companies*:

- PE Ratio: The price-earnings ratio indicates how expensive a stock is by comparing its share price to the company’s earnings.

- PEG Ratio (PE-to-Growth): This metric compares the PE ratio to the earnings growth rate percentage. As a rule of thumb, PEG ratios less than one are considered attractive to some investors, regardless of the absolute PE level.

- Price-to-Sales: This ratio is less precise in my mind because companies can’t pay investors dividends, buy back stock, or make acquisitions with “sales” – discretionary capital comes from earnings and cash flows.

- Price-to-Book: Compares the market capitalization (price) of the company with the book value (or equity) component on the balance sheet.

- EV/EBITDA: Enterprise value (EV) is the total value of the market capitalization plus the value of the debt, divided by EBITDA (Earnings Before Interest Taxes Depreciation and Amortization). Some investors use EBITDA as an income-based surrogate of cash flow.

- FCF Yield: One of my personal favorites – you can think of this percentage as an inverted PE ratio that substitutes free cash flow for earnings. Rather than a yield on a bond, this ratio effectively provides investors with a discretionary cash yield on a stock.

*All The ratios above should be reviewed both on an absolute basis and relative basis in conjunction with comparable companies in an industry. Faster growing industries, in general, should carry higher ratio metrics.

Taking Facebook and Twitter Public

Before we can even take a stab at some of these growth company valuations, we need to look at the historical financial statements (income statement, balance sheet, and cash flow statement). In the case of Facebook and Twitter, since these companies are private, there are no publically available financial statements to peruse. Private investors are generally left in the dark, limited to public news related to what other early investors have paid for ownership stakes. For example, in July, a Russian internet company paid $100 million for a stake in Facebook, implying a $6.5 billion valuation for the total company. Twitter recently obtained a $100 million investment from T. Rowe Price and Insight Venture Partners thereby valuing the total company at $1 billion.

Valuing growth companies is quite different than assessing traditional value companies. Because of the earnings and cash flow volatility in growth companies, the short-term financial results can be distorted. I choose to find market leading franchises that can sustain above average growth for longer periods of time (i.e., companies with “long runways”). For a minority of companies that can grow earnings and cash flows sustainably at above-average rates, I will take advantage of the perception surrounding current short-term “expensive” metrics, because eventually growth will convert valuation perception to “cheap.” Google Inc. (GOOG) is a perfect example – what many investors thought was ridiculously expensive, at the $85 per share Initial Public Offering (IPO) price, ended up skyrocketing to over $700 per share and continues to trade near a very respectable level of $500 per share.

The IPO market is heating up and A123 Systems Inc (AONE) is a fresh example. Often these companies are volatile growth companies that require a deep dive into the financial statements. There is no silver bullet, so different valuation metrics and techniques need to be reviewed in order to come up with more reasonable valuation estimates. Valuation measuring is no cakewalk, but I’ll take this challenge over estimating the number of ping pong balls I can fit in an airplane, any day. Valuing growth companies just requires an understanding of how the essential earnings and cash flow metrics integrate with the fundamental dynamics surrounding a particular company and industry. Now that you have graduated with a degree in Growth Company Valuation 101, you are ready to open your boutique investment bank and advise Facebook and Twitter on their IPO price (the fees can be lucrative if you are not under TARP regulations).

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct long positions AONE, however some Sidoxia client accounts do hold GOOG securities at the time this article was published. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

How to Make Money in Stocks Using Cash Flows

There you are in front of your computer screen, and lo and behold you notice one of your top 10 positions is down -11% (let’s call it ticker: ABC). With sweaty palms and blood rushing from your head, you manage to click with trembling hands on the ticker symbol that will imminently deliver the dreadful news. A competitor (ticker: XYZ) just pre-announced negative quarterly earnings results, and an investment bank, Silverman Sax, has decided to downgrade ABC on fears of a negative spill-over effect. What do you do now? Sell immediately on the cockroach theory – seeing one piece of bad news may mean there are many more dreadful pieces of information lurking behind the scenes? Or, should you back up the truck to take advantage of a massive buying opportunity?

There you are in front of your computer screen, and lo and behold you notice one of your top 10 positions is down -11% (let’s call it ticker: ABC). With sweaty palms and blood rushing from your head, you manage to click with trembling hands on the ticker symbol that will imminently deliver the dreadful news. A competitor (ticker: XYZ) just pre-announced negative quarterly earnings results, and an investment bank, Silverman Sax, has decided to downgrade ABC on fears of a negative spill-over effect. What do you do now? Sell immediately on the cockroach theory – seeing one piece of bad news may mean there are many more dreadful pieces of information lurking behind the scenes? Or, should you back up the truck to take advantage of a massive buying opportunity?

Thank goodness to our good friend, cash flow, which can help supply answers to these crucial questions. Without an ability to value the shares of stock, any decision to buy or sell will be purely based on gut-based emotions. Many Wall Street analysts follow this lemming based analysis when whipping around their ratings (see The Yuppie Bounce & the Lemming Leap). As I talk about in my book, How I Managed $20,000,000,000.00 by Age 32, I strongly believe successful investing requires a healthy balance between the art and the science. Using instinct to tap into critical experience acknowledges the importance of the artistic aspects of investing. Unfortunately, I know few (actually zero) investors that have successfully invested over the long-run by solely relying on their gut.

A winning investment strategy, I argue, includes a systematic, disciplined approach with objective quantitative measures to help guide decision making. For me, the science I depend on includes a substantial reliance on cash flow analysis (See Cash Flow Components Here). What I also like to call this tool is my cash register. Any business you look at will have cash coming into the register, and cash going out of it. Based on the capital needs, cash availability, and growth projects, money will furthermore be flowing in and out of the cash register. By studying these cash flow components, we gain a much clearer lens into the vitality of a business and can quickly identify the choke points.

ACCOUNTING GAMES

The other financial statements definitely shed additional light on the fitness of a company as well, but the income statement, in particular, is subject to a lot more potential manipulation. Since the management teams have more discretion in how GAAP (Generally Accepted Accounting Principles) is applied to the income statement, multiple levers can be pulled by the executives to make results look shinier than reality. For example, simply extending the useful life of an asset (e.g., a factory, building, computer, etc.) will have no impact on a company’s cash flow, yet it will instantaneously and magically raise a companies’ earnings out of thin air…voila!

“Stuffing the channel” is another manipulation strategy that can accelerate revenue recognition for a company. For example, let’s assume Company X ships goods to a distributor, Company Y, for the exclusive purpose of recognizing sales. Company X wins because they just increased their sales, Company Y wins because they have more inventory on hand (even if there is no immediate plan for the distributor to pay for that inventory), and the investor gets “hoodwinked” because they are presented artificially inflated sales and income results.

JOINT STRATEGY

These are but just a few examples of why it’s important to use the cash flow statement in conjunction with the income statement to get a truer picture of a company’s valuation and “quality of earnings.” If you don’t believe me, then check out the work done by reputable academics (Konan Chan, Narasimhan Jegadeesh, Louis Chan, and Josef Lakonishok) that show negative differentials between accounting earnings and cash flow are significantly predictive of future stock price performance (Read more).

So the next time a holding craters (or sky-rockets), take an accounting on the state of the company’s cash flows before making any rash decisions to buy or sell. By doing a thorough cash flow analysis, you’ll be well on your way to racking up gains into your cash register.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.