Posts tagged ‘valuation’

Markets Race Out of 2012 Gate

Article includes excerpts from Sidoxia Capital Management’s 2/1/2012 newsletter. Subscribe on right side of page.

Equity markets largely remained caged in during 2011, but U.S. stocks came racing out of the gate at the beginning of 2012. The S&P 500 index rose +4.4% in January; the Dow Jones Industrials climbed +3.4%; and the NASDAQ index sprinted out to a +8.0% return. Broader concerns have not disappeared over a European financial meltdown, high U.S. unemployment, and large unsustainable debts and deficits, but several key factors are providing firmer footing for financial race horses in 2012:

• Record Corporate Profits: 2012 S&P operating profits were recently forecasted to reach a record level of $106, or +9% versus a year ago. Accelerating GDP (Gross Domestic Product Growth) to +2.8% in the fourth quarter also provided a tailwind to corporations.

• Mountains of Cash: Companies are sitting on record levels of cash. In late 2011, U.S. non-financial corporations were sitting on $1.73 trillion in cash, which was +50% higher as a percentage of assets relative to 2007 when the credit crunch began in earnest.

• Employment Trends Improving: It’s difficult to fall off the floor, but since the unemployment rate peaked at 10.2% in October 2009, the rate has slowly improved to 8.5% today. Data junkies need not fret – we have fresh new employment numbers to look at this Friday.

• Consumer Optimism on Rise: The University of Michigan’s consumer sentiment index showed optimism improved in January to the highest level in almost a year, increasing to 75.0 from 69.9 in December.

• Federal Reserve to the Rescue: Federal Reserve Chairman, Ben Bernanke, and the Fed recently announced the extension of their 0% interest rate policy, designed to assist economic expansion, through the end of 2014. In addition, Bernanke did not rule out further stimulative asset purchases (a.k.a., QE3 or quantitative easing) if necessary. If executed as planned, this dovish stance will extend for an unprecedented six year period (2008 -2014).

Europe on the Comeback Trail?

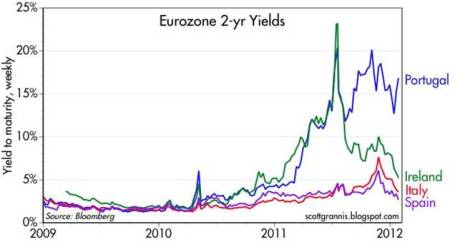

Europe is by no means out of the woods and tracking the day to day volatility of the happenings overseas can be a difficult chore. One fairly easy way to track the European progress (or lack thereof) is by following the interest rate trends in the PIIGS countries (Portugal, Ireland, Italy, Greece, and Spain). Quite simply, higher interest rates generally mean more uncertainty and risk, while lower interest rates mean more confidence and certainty. The bad news is that Greece is still in the midst of a very complex restructuring of its debt, which means Greek interest rates have been exploding upwards and investors are bracing for significant losses on their sovereign debt investments. Portugal is not in as bad shape as Greece, but the trends have been moving in a negative direction. The good news, as you can see from the chart above (Calafia Beach Pundit), is that interest rates in Ireland, Italy and Spain have been constructively moving lower thanks to austerity measures, European Central Bank (ECB) actions, and coordination of eurozone policies to create more unity and fiscal accountability.

Political Horse Race

The other horse race going on now is the battle for the Republican presidential nomination between former Massachusetts governor Mitt Romney and former House of Representatives Speaker Newt Gingrich. Some increased feistiness mixed with a little Super-Pac TV smear campaigns helped whip Romney’s horse to a decisive victory in Florida – Gingrich ended up losing by a whopping 14%. Unlike traditional horse races, we don’t know how long this Republican primary race will last, but chances are this thing should be wrapped up by “Super Tuesday” on March 6th when there will be 10 simultaneous primaries and caucuses. Romney may be the lead horse now, but we are likely to see a few more horses drop out before all is said and done.

Flies in the Ointment

As indicated previously, although 2012 has gotten off to a strong start, there are still some flies in the ointment:

• European Crisis Not Over: Many European countries are at or near recessionary levels. The U.S. may be insulated from some of the weakness, but is not completely immune from the European financial crisis. Weaker fourth quarter revenue growth was suffered by companies like Exxon Mobil Corp (XOM), Citigroup Inc. (C), JP Morgan Chase & Co (JPM), Microsoft Corp (MSFT), and IBM, in part because of European exposure.

• Slowing Profit Growth: Although at record levels, profit growth is slowing and peak profit margins are starting to feel the pressure. Only so much cost-cutting can be done before growth initiatives, such as hiring, must be implemented to boost profits.

• Election Uncertainty: As mentioned earlier, 2012 is a presidential election year, and policy uncertainty and political gridlock have the potential of further spooking investors. Much of these issues is not new news to the financial markets. Rather than reading stale, old headlines of the multi-year financial crisis, determining what happens next and ascertaining how much uncertainty is already factored into current asset prices is a much more constructive exercise.

Stocks on Sale for a Discount

A lot of the previous concerns (flies) mentioned is not new news to investors and many of these worries are already factored into the cheap equity prices we are witnessing. If everything was all roses, stocks would not be selling for a significant discount to the long-term averages.

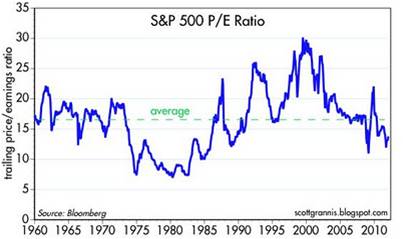

A key ratio measuring the priceyness of the stock market is the Price/Earnings (P/E) ratio. History has taught us the best long-term returns have been earned when purchases were made at lower P/E ratio levels. As you can see from the 60-year chart above (Calafia Beach Pundit), stocks can become cheaper (resulting in lower P/Es) for many years, similar to the challenging period experienced through the early 1980s and somewhat analogous to the lower P/E ratios we are presently witnessing (estimated 2012 P/E of approximately 12.4). However, the major difference between then and now is that the Federal Funds interest rate was about 20% back in the early-’80s, while the same rate is closer to 0% currently. Simple math and logic tell us that stocks and other asset-based earnings streams deserve higher prices in periods of low interest rates like today.

We are only one month through the 2012 financial market race, so it much too early to declare a Triple Crown victory, but we are off to a nice start. As I’ve said before, investing has arguably never been as difficult as it is today, but investing has also never been as important. Inflation, whether you are talking about food, energy, healthcare, leisure, or educational costs continue to grind higher. Burying your head in the sand or stuffing your money in low yielding assets may work for a wealthy few and feel good in the short-run, but for much of the masses the destructive inflation-eroding characteristics of purported “safe investments” will likely do more damage than good in the long-run. A low-cost diversified global portfolio of thoroughbred investments that balances income and growth with your risk tolerance and time horizon is a better way to maneuver yourself to the investment winner’s circle.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in XOM, MSFT, JPM, IBM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Rule of 20 Can Make You Plenty

There is an endless debate over whether the equity markets are overvalued or undervalued, and at some point the discussion eventually transitions to what the market’s appropriate P/E (Price-Earnings) level should be. There are several standard definitions used for P/Es, but typically a 12-month trailing earnings, 12-month forward earnings (using earnings forecasts), and multi-year average earnings (e.g., Shiller 10-year inflation adjusted P/E – see Foggy P/E Rearview Mirror) are used in the calculations. Don Hays at Hays Advisory (www.haysadvisory.com) provides an excellent 30+ year view of the historical P/E ratio on a forward basis (see chart below).

If you listen to Peter Lynch, investor extraordinaire, his “Rule of 20” states a market equilibrium P/E ratio should equal 20 minus the inflation rate. This rule would imply an equilibrium P/E ratio of approximately 18x times earnings when the current 2011 P/E multiple implies a value slightly above 11x times earnings. The bears may claim victory if the earnings denominator collapses, but if earnings, on the contrary, continue coming in better than expected, then the sun might break through the clouds in the form of significant price appreciation.

Just because prices have been chopped in half, doesn’t mean they can’t go lower. From 1966 – 1982 the Dow Jones Industrial index traded at around 800 and P/E multiples contracted to single digits. That rubber band eventually snapped and the index catapulted 17-fold from about 800 to almost 14,000 in 25 years. Even though equities have struggled at the start of this century, a few things have changed from the market lows of 30 years ago. For starters, we have not hit an inflation rate of 13% or a Federal Funds rate of 20% (~3.5% and 0% today, respectively), so we have some headroom before the single digit P/E apocalypse descends upon us.

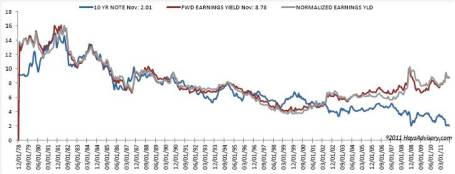

Fed Model Implies Equity Throttle

Hays Advisory exhibits another key valuation measurement of the equity market (the so-called “Fed Model”), which compares the Treasury yield of the 10-year Note with the earnings yield of stocks (see chart below).

Regardless of your perspective, the divergence will eventually take care of it in one of three ways:

1.) Bond prices collapse, and Treasury yields spike up to catch up with equity yields.

2.) Forward earnings collapse (e.g., global recession/depression), and equity yields plummet down to the low Treasury yield levels.

AND/OR

3.) Stock prices catapult higher (lower earnings yield) to converge.

At the end of the day, money goes where it is treated best, and at least today, bonds are expected to treat investors substantially worse than the unfaithful treatment of Demi Moore by Ashton Kutcher. The Super Committee may not have its act together, and Europe is a mess, but the significant earnings yield of the equity markets are factoring in a great deal of pessimism.

The holidays are rapidly approaching. If for some reason the auspice of gifts is looking scarce, then review the Fed Model and Rule of 20, these techniques may make you plenty.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Mr. Market Bullying Investors

There’s been a bully pushing investor’s around and his name is “Mr. Market.” Volatility is Mr. Market’s partner in crime, and over the last 10 trading days Mr. M has used volatility to school equity investors to the tune of 1,600+ point swings, which has contributed to equity investors’ failing grade over the last few months. Who is Mr. Market? Charles Ellis, author of Winning the Loser’s Game (1998) described him best:

“Mr. Market is a mischievous but captivating fellow who persistently teases investors with gimmicks and tricks such as surprising earnings reports, startling dividend announcements, sudden surges of inflation, inspiring presidential announcements, grim reports of commodities prices, announcements of amazing new technologies, ugly bankruptcies, and even threats of war.”

How has Mr. Market been stealing investors’ lunch money? The process really hasn’t been that difficult for him, once you consider how many times investors have been heaved into the garbage can over the last decade, forced to deal with these messy events:

• 2001 technology bubble beating

• 2006 real estate collapse

• 2008 – 2009 financial crisis and recession

• 2010 “flash crash” and soft patch

• 2011 debt ceiling debate and credit rating downgrade

With this backdrop, investors are dropping like flies due to extreme bully fatigue. Over the last four months alone, approximately $75 billion in equities been liquidated, according to data from the Investment Company Institute – this is even more money withdrawn than the outflows occurring during the peak panic months after the Lehman Brothers collapse.

The Atomic Wedgie

Mr. Market understands the severity of these prior economic scars, which have been even more painful than atomic wedgies (reference Exhibit I above), so he opportunistically is taking advantage of fragile nerves. Introducing the following scary scenarios makes collecting lunch money from panicked investors much easier for Mr. Market. What is he using to frighten investors?

- A potential Greek sovereign debt default that will trigger a collapse of the Euro.

- Slowing growth in China due to slowing developed market economic activity.

- Possible double-dip recession in the U.S. coupled with an austerity driven downturn in Europe.

- Lack of political policy response to short and long-term economic problems in Washington and abroad.

- Impending deflation caused by decelerating global growth or likely inflation brought about by central banks’ easy monetary policies (i.e., printing money).

- End of the world.

Bully Victim Protection

Of course, not all of these events are likely to occur. As a matter of fact, there are some positive forming trends, besides just improving valuations, that provide protection to bully victims:

- Not only is the earnings yield (E/P – 12-month trailing EPS/share price) trouncing the yield on the 10-year Treasury note (~8% vs. ~2%, respectively), but the dividend yield on the S&P 500 index is also higher than the 10-year Treasury note yield (source: MarketWatch). Historically, this has been an excellent time to invest in equities with the S&P 500 index up an average of 20% in the ensuing 12 months.

- Jobs data may be poor, but it is improving relative to a few years ago as depicted here:

- Record low interest rates and mortgage rates provide a stimulative backdrop for businesses and consumers. Appetite for risk taking remains low, but as history teaches us, the pendulum of fear will eventually swing back towards greed.

As I say in my James Carville peace from earlier this year, It’s the Earnings Stupid, long term prices of stocks follow the path of earnings. Recent equity price market declines have factored in slowing in corporate profits. How severely the European debt crisis, and austerity have (and will) spread to the U.S. and emerging markets will become apparent in the coming weeks as companies give us a fresh look at the profit outlook. So far, we have gotten a mixed bag of data. Alpha Natural Resources (ANR) acknowledged slowing coal demand in Asia and FedEx Corp. (FDX) shave its fiscal year outlook by less than 2% due to international deceleration. Other bellwethers like Oracle Corp. (ORCL) and Nike Inc. (NKE) reported strong growth and outlooks. In the short-run Mr. Market is doing everything in his power to bully investors from their money, and lack of international policy response to mitigate the European financial crisis and contagion will only sap confidence and drag 2011-2012 earnings lower.

Punching Mr. Market

The warmth of negative real returns in cash, bonds, and CDs may feel pleasant and prudent, but for many investors the lasting effects of inflation erosion will inflict more pain than the alternatives. For retirees with adequate savings, these issues are less important and focus on equities should be deemphasized. For the majority of others, long-term investors need to reject the overwhelming sense of fear.

As I frequently remind others, I have no clue about the short-term direction of the market, and Greece could be the domino that causes the end of the world. But what I do know is that history teaches us the probabilities of higher long-term equity returns are only improving. Mr. Market is currently using some pretty effective scare tactics to bully investors. For those investors with a multi-year time horizon, who are willing to punch Mr. Market in the nose, the benefits are significant. The reward of better long-term returns is preferable to an atomic wedgie or a head-flush in the toilet received from Mr. Market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and FDX, but at the time of publishing SCM had no direct position in ANR, ORCL, NKE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

O’Neil Swings for the Fences

Approaches used in baseball strategy are just as varied as they are in investing. Some teams use a “small ball” approach to baseball, in which a premium is placed on methodically advancing runners around the bases with the help of bunts, bases on ball, stolen bases, sacrifice flies, and hit-and- run plays. Other teams stack their line-up with power-hitters, with the sole aim of achieving extra base hits and home runs.

Investing is no different than baseball. Some investors take a conservative, diversified value-approach and seek to earn small returns on a repeated basis. Others, like William J. O’Neil, look for the opportunities to knock an investment out of the park. O’Neil has no problem of concentrating a portfolio in four or five stocks. Warren Buffett talks about how Ted Williams patiently waited for fat pitches–O’Neil is very choosy too, when it comes to taking investment swings.

The Making of a Growth Guru

Born in Oklahoma and raised in Texas, William O’Neil has accomplished a lot over his 53-year professional career. After graduating from Southern Methodist University, O’Neil started his career as a stock broker in the late-1950s. Soon thereafter in 1963, at the ripe young age of 30, O’Neil purchased a seat on the New York Stock Exchange (NYX) and started his own company, William O’Neil + Co. Incorporated. Ambition has never been in short supply for O’Neil – following the creation of his firm, O’Neil the investment guru put on his computer science hat and went onto pioneer the field of computerized investment databases. He used his unique proprietary data as a foundation to unveil his next entrepreneurial baby, Investor’s Business Daily, in 1984.

O’Neil’s Secret Sauce

The secret sauce behind O’Neil’s system is called CAN SLIM®. O’Neil isn’t a huge believer in stock diversification, so he primarily focuses on the cream of the crop stocks in upward trending markets. Here are the components of CAN SLIM® that he searches for in winning stocks:

C Current Quarterly Earnings per Share

A Annual Earnings Increases

N New Products, New Management, New Highs

S Supply and Demand

L Leader or Laggard

I Institutional Sponsorship

M Market Direction

Rebel without a Conventional Cause

In hunting for the preeminent stocks in the market, the CAN SLIM® method uses a blend of fundamental and technical factors to weed out the best of the best. I may not agree with everything O’Neil says in his book, How to Make Money in Stocks, but what I love about the O’Neil doctrine is his maverick disregard of the accepted modern finance status quo. Here is a list of O’Neil’s non-conforming quotes:

- Valuation Doesn’t Matter: “The most successful stocks from 1880 to the present show that, contrary to most investors’ beliefs, P/E ratios were not a relevant factor in price movement and have very little to do with whether a stock should be bought or sold.” (see also The Fallacy of High P/Es)

- Diversification is Bad: “Broad diversification is plainly and simply a hedge for ignorance… The best results are usually achieved through concentration, by putting your eggs in a few baskets that you know well and watching them very carefully.”

- Buy High then Buy Higher: “[Buy more] only after the stock has risen from your purchase price, not after it has fallen below it.”

- Dollar-Cost Averaging a Mistake: “If you buy a stock at $40, then buy more at $30 and average out your cost at $35, you are following up your losers and throwing good money after bad. This amateur strategy can produce serious losses and weigh down your portfolio with a few big losers.”

- Technical Analysis Matters: “Learn to read charts and recognize proper bases and exact buy points. Use daily and weekly charts to materially improve your stock selection and timing.”

- Ignore TV & So-Called Experts: “Stop listening to and being influenced by friends, associates, and the continuous array of experts’ personal opinions on daily TV shows.”

- Stay Away from Dividends: “Most people should not buy common stocks for their dividends or income, yet many people do.”

Managing Momentum Risk

Although O’Neil’s CAN SLIM® investment strategy does not rely on a full-fledged, risky style of momentum investing (see Riding the Momentum Wave), O’Neil’s investment approach utilizes very structured rules designed to limit downside risk. Since true O’Neil disciples understand they are dealing with flammable and volatile hyper-growth companies, O’Neil always keeps a safety apparatus close by – I like to call it the 8% financial fire extinguisher rule. O’Neil simply states, “Investors should definitely set firm rules limiting the loss on the initial capital they have invested in each to an absolute maximum of 7% or 8%.” If a trade is not working, O’Neil wants you to quickly cut your losses. As the “M” in CAN SLIM® indicates, downward trending markets make long position gains very challenging to come by. Raising cash and cutting margin is the default strategy for O’Neil until the next bull cycle begins.

While some components of William O’Neil’s “cup and handle” teachings (see link)are considered heresy among various traditional financial textbooks, O’Neil’s lessons and CAN SLIM® method shared in How to Make Money in Stocks provide a wealth of practical information for all investors. If you want to add a power-hitting element to your investing game and hit a few balls out of the park, it behooves you to invest some time in better familiarizing yourself with the CAN SLIM® teachings of William O’Neil.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Wade Slome, President of Sidoxia Capital Management (SCM), worked at William O’Neil + Co. Incorporated in 1993-1996. SCM and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in NYX or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Microsoft Enters Garbage Recycling Business

Microsoft Inc. (MSFT) is going green in more ways than one. Not only is Microsoft shelling out a lot of green ($8.5 billion) to acquire internet communication company Skype, but Microsoft is also going green by recycling Skype – an asset previously tossed away as garbage by eBay Inc. (EBAY). While I’m certain Microsoft executives did their due diligence and a large cadre of savvy bankers provided their stamp of approval on the deal, recycling a previously disposed item successfully poses some unique challenges.

The Problems

What could possibly go wrong in a sexy, strategic deal that plans to leverage Skype’s power of internet communication across Microsoft’s various businesses including mobile, business software, gaming, and advertising platforms?

- Sticker Shock: The Microsoft-Skype deal is still in its early phases, but the multi-billion price tag has already elicited heartburn from some investors (heart attacks among others). In Microsoft’s defense, what’s a mere $8.5 billion among friends, especially if your wallet is stuffed with over $60 billion in cash like Microsoft? With the 3-month Treasury bill currently yielding 0.02%, the massive wads of cash that Microsoft (and other tech giants) is sitting on appear to be burning a hole in buyers’ pockets. In a kooky internet world where IPO valuations of $70 billion for Facebook, $25 billion for Groupon, and $3 billion for LinkedIn are freely tossed around, an $8.5 billion Skype offer may seem like par for the course (or even a bargain). Sadly, however, I am having difficulty reconciling how Microsoft will take 663 million money-losing customers at Skype and balance the laws of economics by adding further volumes of money-losing customers. Apple Inc. (AAPL) spends about $2 billion per year in research & development, and is expected to produce more than $100 billion in revenues in fiscal 2011, while the $8.5 billion that Microsoft spent on Skype produced less than $1 billion in revenues last year. I presume Microsoft has some aggressive assumptions built into their Skype forecasts to rationalize the price paid for Skype.

- Failure Déjà Vu: Does the desire to integrate wiz-bang technology into existing product platforms sound familiar? It should – eBay Inc. (EBAY) already attempted and failed at integrating Skype before it threw in the white towel at the end of 2009 and sold a majority $1.9 billion stake of Skype shares back to a group of investors, including the Skype founders. Back in 2005, when eBay paid a then bargain of $3.1 billion for Skype (including earnouts), former CEO Meg Whitman evangelized the “Power of 3” (Skype + eBay’s Marketplace + PayPal) – I suppose new CEO John Donahoe must now promote the “Power of 2.” In Skype merger sequel of 2011, Microsoft’s CEO Steve Ballmer is espousing the benefits of Skype across Microsoft properties such as Outlook, Windows Live Messenger, Xbox, Kinect, and its newly created Nokia Corp. (NOK) relationship. Gaudy priced mergers in the internet/social media space have a way of eventually ending up in the deal graveyard. Consider AOL Inc.’s (AOL) 2008 deal with social network Bebo for $850 million – two years later AOL sold it for $10 million. News Corp’s (NWS) high profile purchase of MySpace for $580 million is reportedly looking for a new home at a fraction of the original price ($50 million). Hewlett-Packard Co.’s (HPQ) ostentatious $2.4 billion value (~125 x’s forward earnings) paid for 3Par Inc. during a bidding war with Dell Inc. (DELL) in 2010 is another recent example of a risky high-priced deal.

- Telco Carrier Skepticism: Although Microsoft has ambitions of taking over the world with Skype, the telecom service carrier companies that facilitate Skype traffic may feel differently. As the telcos spend billions to expand the global internet superhighway, if Skype is clogging traffic on their networks then the carriers will likely require additional compensation – no freeloaders allowed.

- Rocky Past Marriages: When it comes to acquisitions, Microsoft historically hasn’t fooled around as much as some other large Fortune 100 companies, nonetheless some important past relationships have gone sour. Take for instance Microsoft’s previous largest $6 billion cash acquisition of aQuantive Inc. in 2007. As Microsoft continues to chase Google Inc. (GOOG) at their heels, Microsoft has little to show for the aQuantive deal, except for a lot of employee turnover. The sizable but smaller $1.1 billion acquisition of Great Plains in 2001 has its critics too. Like Skype, the Great Plains business software deal made strategic sense, but six years after the units were fully integrated founder and owner Doug Burgum packed his bags and left Microsoft.

Consequences

What happens next for Microsoft? I know it’s difficult to imagine that Microsoft’s colossal underperformance since the beginning of 2010 could worsen – Microsoft has underperformed the market by a whopping -38% over that period – but by massively overpaying for Skype’s losses, Microsoft is not making their own job any easier. Although Microsoft has missed many key technology trends over the last few years (e.g., search, mobile, tablets, social media, etc.) and its stock has been in the dumps, the PC behemoth is looking to salvage a previously failed merger into a successful one. Time will tell if Microsoft can recycle a trashed, money losing operation into hefty green profits. If not, investors will be out for blood wondering why $8.5 billion was thrown away like garbage.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, and GOOG, but at the time of publishing SCM had no direct position in MSFT, Skype, EBAY, AOL, HPQ, DELL, NOK, Facebook, MySpace, LinkedIn, Groupon, Bebo, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Fallacy of High P/E’s

Would you pay a P/E ratio (Price-Earnings) of 1x’s future earnings for a dominant market share leading franchise that is revolutionizing the digital industry and growing earnings at an +83% compounded annual growth rate? Or how about shelling out 3x’s future profits for a company with ambitions of taking over the global internet advertising and commerce industries while expanding earnings at an explosive +51% clip? If you were capable of identifying Apple Inc. (AAPL) and Google Inc. (GOOG) as investment ideas in 2004, you would have made approximately +2,000% and +600%, respectively, over the following six years. I know looking out years into the future can be a lot to ask for in a world of high frequency traders and stock renters, but rather than focusing on daily jobless claims and natural gas inventory numbers, there are actual ways to accumulate massive gains on stocks without fixating on traditional trailing P/E ratios.

At the time in 2004, Apple and Google were trading at what seemed like very expensive mid-30s P/E ratios (currently the S&P 500 index is trading around 15x’s trailing profits) before these stocks made their explosive, multi-hundred-percent upward price moves. What seemingly appeared like expensive rip-offs back then – Apple traded at a 37x P/E ($15/$0.41) and Google 34x P/E ($85/$2.51) – were actually bargains of a lifetime. The fact that Apple’s share price appreciated from $15 to $347 and Google’s $85 to $538, hammers home the point that analyzing trailing P/E ratios alone can be hazardous to your stock-picking health.

Why P/Es Don’t Matter

In William O’Neil’s book, How to Make Money in Stocks he comes to the conclusion that analyzing P/E ratios is worthless:

“Our ongoing analysis of the most successful stocks from 1880 to the present show that, contrary to most investors beliefs, P/E ratios were not a relevant factor in price movement and have very little to do with whether a stock should be bought or sold. Much more crucial, we found, was the percentage increase in earnings per share.”

Here is what O’Neil’s data shows:

- From 1953 – 1985 the best performing stocks traded at a P/E ratio of 20x at the early stages of price appreciation versus an average P/E ratio of 15x for the Dow Jones Industrial Average over the same period. The largest winners saw their P/E multiples expand by 125% to 45x.

- From 1990 – 1995, the leading stocks saw their P/E ratios more than double from an average of 36 to the 80s. Once again, O’Neil explains why you need to pay a premium to play with the market leading stocks.

You Get What You Pay For

When something is dirt cheap, many times that’s because what you are buying is dirt. Or as William O’Neil says,

“You can’t buy a Mercedes for the price of a Chevrolet, and you can’t buy oceanfront property for the same price you’d pay for land a couple of miles inland. Everything sells for about what it’s worth at the time based on the law of supply and demand…The very best stocks, like the very best art, usually command a higher price.”

Any serious investor has “value trap” scars and horror stories to share about apparently cheap stocks that seemed like bargains, only to later plummet lower in price. O’Neil uses the example of when he purchased Northrop Grumman Corp (NOC) many years ago when it traded at 4x’s earnings, and subsequently watched it fall to a P/E ratio of 2x’s earnings.

Is Your Stock a Teen or a Senior?

A mistake people often make is valuing a teen-ager company like it’s an adult company (see also the Equity Life Cycle article). If you were offered the proposition to pay somebody else an upfront lump-sum payment in exchange for a stream of their lifetime earnings, how would you analyze this proposal? Would you make a higher lump-sum payment for a 21-year-old, Phi Beta Kappa graduate from Harvard University with a 4.0 GPA, or would you pay more for an 85 year old retiree generating a few thousand dollars in monthly Social Security income? As you can imagine, the vast majority of investors would pay more for the youngster’s income because the stream of income over 65-70 years would statistically be expected to be much larger than the stream from the octogenarian. This same net present value profit stream principle applies to stocks – you will pay a higher price or P/E for the investment opportunity that has the best growth prospects.

Price Follows Earnings

At the end of the day, stock prices follow the long-term growth of earnings and cash flows, whether a stock is considered a growth stock, a value stock, or a core stock. Too often investors are myopically focused on the price action of a stock rather than the earnings profile of a company. Or as investment guru Peter Lynch states:

”People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

“People Concentrate too much on the P (Price), but the E (Earnings) really makes the difference.”

Correctly determining how a company can grow earnings is a more crucial factor than a trailing P/E ratio when evaluating the attractiveness of a stock’s share price.

Valuations Matter

Even if you buy into the premise that trailing P/E ratios do not matter, valuation based on future earnings and cash flows is critical. When calculating the value of a company via a discounted cash flow or net present value analysis, one does not use historical numbers, but rather future earnings and cash flow figures. So when analyzing companies with apparently sky-high valuations based on trailing twelve month P/E ratios, do yourself a favor and take a deep breath before hyperventilating, because if you want to invest in unique growth stocks it will require implementing a unique approach to evaluating P/E ratios.

See also Evaluating Stocks Vegas Style

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, and GOOG, but at the time of publishing SCM had no direct position in NOC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shoring Up Your Investment Stool from Collapse

With March Madness just kicking into full gear, there’s a chance that your gluteal assets may be parked on a stool in the next two weeks. When leaning on a bar countertop, while seated on a stool, we often take for granted the vital support this device provides, so we can shovel our favorite beverage and pile of nachos into our pie holes. OK, maybe I speak for myself when it comes to my personal, gluttonous habits. But the fact remains, whether you are talking about your rump, or your investment portfolio, you require a firm foundation.

The main problem, when it comes to investments, is the lack of a tangible, visible stool to analyze. Sure, you are able to see the results of a portfolio collapse when there is no foundation to support it, or you may even be able to ignore the results when they remain above water. But many investors do not evenperform the basic due diligence to determine the quality of their investment stool. Before you place your life savings in the hands of some brokerage salesman, or in your personal investment account, you may want to make sure your stool has more than one or two legs.

In the money management world, investors typically choose to buy the stool, rather than build it, which makes perfect common sense. Many people do not have the time or emotional make-up to manage their finances. If left to do it themselves, more often than not, investors usually do a less than stellar job. Unfortunately, when many investors do outsource the management of their investments, they neglect to adequately research the investment stool they buy. Usually the wobbly industry stool operates on the two legs of performance chasing and commission generation (see Fees, Exploitation, and Confusion). For most average investors, it doesn’t take long before that investment strategy teeters and collapses.

If the average investor does not have time to critically evaluate managers that take a long-term, low-cost, tax-efficient strategy to investing, those individuals would be best served by following Warren Buffet’s advice about passive investments, “A very low-cost index is going to beat a majority of the amateur-managed money or professionally-managed money.”

The Four Legs of the Investment Stool

For DIY-ers (Do-It-Yourself-ers), you do not need to buy a stool – you can build it. There are many ways to build a stool, but these are the four crucial legs of investing that have saved my hide over my career, and can be added as support for your investment stool:

1.) Valuation: I love sustainable growth as much as anything, just as much as I would like a shiny new Ferrari. But there needs to be a reasonable price paid for growth, and paying an attractive or fair price for a marquis asset will improve your odds for long-term success.

“Valuations do matter in the stock market, just as good pitching matters in baseball.”

-Fred Hickey (High Tech Strategist)

2.) Cash Flows: Cash flows, and more importantly free cash flows (cash left over after money is spent on capital expenditures), should be investors’ metric of choice. Companies do not pay for dividends, share buybacks, and capital expenditures with pro forma earnings, or non-GAAP earnings. Companies pay for these important outlays with cash.

“In looking for stocks to buy, why do you put so much emphasis on free cash flow? Because it makes the most sense to me. My first job was at a little corner grocery store, and it seemed pretty simple. Cash goes into the register; cash comes out.”

-Bruce Berkowitz (The Fairholme Fund)

3.) Interest Rates: Money goes where it is treated best, so capital will look at the competing yields paid on bonds. Intuitively, interest factors also come into play when calculating the net present value of a stock. Just look at the low Price-Earnings ratios of stocks in the early 1980s when the Fed Funds reached about 20% (versus effectively 0% today). In the long run, higher interest rates (and higher inflation) are bad for stocks, but worse for bonds.

“I don’t know any company that has rewarded any bondholder by raising interest rates [payments] – unlike companies raising dividends.”

-Peter Lynch (Former manager of the Fidelity Magellan Fund)

4.) Quality: This is a subjective factor, but this artistic assessment is as important, if not more important than any of the previous listed factors. In searching for quality, it is best to focus on companies with market share leading positions, strong management teams, and durable competitive advantages.

“If you sleep with dogs, you’re bound to get fleas.”

-Old Proverb

These four legs of the investment stool are essential factors in building a strong investment portfolio, so during the next March Madness party you attend at the local sports bar, make sure to check the sturdiness of your bar stool – you want to make sure your assets are supported with a sturdy foundation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in Fairholme, Ferrari, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Whitney the Netflix Waffler

No, I am not talking about Meredith Whitney (see Cloudy Crystal Ball), but rather Whitney Tilson, a well-known value and hedge fund manager at T2 Partners LLC. Less than eight weeks ago, Tilson boldly and brashly exclaimed why Netflix Inc. (NFLX) was an “exceptional short” and provided reasons to the world on why Netflix was his largest short position (read Tilson’s previous post). Fifty-five days later, Mr. Tilson evidently was overtaken by a waffle craving and decided to throw in the towel by covering his Netflix short position.

What Changed in Seven and Half Weeks?

Margin Thesis Compromised: Tilson explains, “The company reported a very strong quarter that weakened key pillars of our investment thesis, especially as it relates to margins.” Really? Netflix has grown revenues for nine straight years since its IPO (Initial Public Offering) in 2002, and growth has even accelerated for two whole years (as Netflix has shifted to streaming content over snail-mail), and just in Q4 he became surprised by this multi-year trend? The Q4 growth caught Tilson off-guard, but I guess Tilson wasn’t surprised by the 7.5 million subscribers Netflix added in 2009 and first three quarters of 2010. Never mind the five consecutive years of operating margin expansion either (source: ADVFN), nor the stealthy share price move from $30 to around $225. Apparently Tilson needed the recently reported Q4 financial results to hit him over the head.

Survey Provides Earth-Shattering Results: Tilson conducted an exhaustive study of “more than 500 Netflix subscribers, that showed significantly higher satisfaction with and usage of Netflix’s streaming service than we anticipated.” Come on…Netflix has more than 20 million subscribers, and you are telling me that a questionnaire of 500 subscribers (0.0025%) is representative. Even if these results are a cornerstone of Tilson’s modified thesis, I wonder also why the survey wasn’t taken before Netflix became Tilson’s largest negative short position. In addition, I can’t say it’s much of a revelation that Tilson found “significantly higher satisfaction” among paying subscribers. That’s like me going to a Justin Bieber concert and polling J-Beeb fans whether they like his music – I’ll go out on a limb and say paying customers will generally have a positive bias in their responses.

Feedback Tilts the Scales: Tilson received a “great deal of feedback, including an open letter from Netflix’s CEO, Reed Hastings.” If I received a penny for every time I heard a CEO speak positively about their company, I would be retired on a private island drinking umbrella drinks all day. Honestly, what does Tilson expect Hastings to say, “You know Whitney, you really hit the nail on the head with your analysis…I think you’re right and you should short our stock.”

Some other inconsistencies I’m still trying to figure out in Tilson’s new waffle thesis:

Valuation Head Scratcher: Also frustrating in Tilson’s 180 degree switch is his apparent incongruous treatment of valuation. In his initial bearish piece, Tilson explains how outrageously priced Netflix share are at 63.1x the high 2010 consensus estimate, but somehow a current 75.0x multiple (~20% richer) is reason enough for Tilson to blow out his short.

Competition: Although Tilson went from 100% short Netflix to 0% short Netflix, there does not appear to be any new information regarding Netflix’s competitive dynamics from the Q4 financial release to change his view. Here is what he said in his article eight weeks ago:

“Netflix’s brand and number of customers pale in comparison to its new, direct competitors like Apple (iTunes), Google (GOOG) (YouTube), Amazon.com (AMZN) (Amazon Video on Demand), Disney (DIS) and News Corp. (NWS) (part ownership of Hulu), Time Warner (TWX, TWC) (cable, HBO, etc.), Comcast (CMCSA) (cable, NBC Universal, part ownership of Hulu), and Coinstar’s Redbox (CSTR) (30,000 kiosks renting DVDs for $1/night and email addresses for 21 million customers).”

Little is said in his short covering note, other than these negative dynamics still exist and help explain why he is not long the stock.

Gently Under the Bus

Whitney Tilson was “against Netflix before he was for it,” a stance that could generate a tear of pride from fellow waffler John Kerry. However, I want to gently place Mr. Tilson under the bus with all my comments because his sudden strange reversal shouldn’t be blown out of proportion with respect to his full body of work. As a matter of fact, I have favorably profiled Tilson in several of my previous articles (read Tilson on BP and Tilson on Fat Lady Housing).

One would think given my profitable long position in Netflix that I would be congratulating Tilson for covering his short, but I must admit that I feel a little naked with fewer contrarians rooting against me. The herd is occasionally right, but the largest returns are made by not following the herd. Short interest was about 33% of the float (shares outstanding available for trading) mid-last month, and with the recent melt-up, my guess is that short percentage has shrunk with other short covering doubters. I haven’t decided how much, if any, profits I plan to lock-in with my Netflix positions, but as Tilson points out, they are not giving Netflix away for free.

Credit should also be given to Tilson for having the thickness of skin to openly flog himself and admit failure in such an open forum. I have been known to enjoy a waffle or two in my day as well (more often in the privacy of my own kitchen), and waffling on stocks can be preferable to loving stocks to the grave. Tilson has proven firsthand that eating waffles can be very expensive and detrimental to your profit waistline. By doing more homework on your stock consumption, your waffle eating should be spread further apart, making this habit not only cheaper, but also better for your long-term investment health.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) at the time of publishing had no direct position in DIS, NWS/Hulu, TWX, TWC, CMCSA, and CSTR but SCM and some of its clients own certain exchange traded funds, NFLX, AAPL, AMZN, AAPL, and GOOG, but did not own any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Creating Your Investment Dashboard

Navigating the financial markets can be difficult in this volatile environment we’ve experienced over the last few years, which is why it is more important than ever to have a financial dashboard to ensure you do not drive off a cliff. If investors do not have the time or focus to drive their financial future, then perhaps for the safety of themselves and others, they may consider taking the bus or hiring a chauffeur. For those committed to handling their finances on their own, the road may become rocky, so here are some important factors to monitor on your financial dashboard:

1) Fundamental Direction: Before you decide on an investment destination, it is important to know whether trends are accelerating (speeding up) or deteriorating (slowing down) – see also Forecasting – Trend Analysis.

2) Are You Going the Speed limit? Nobody wants to get a costly speeding ticket, therefore assessing valuation metrics on your dashboard is a beneficiary tool. If you are speeding along the highway at a 100 miles per hour in an expensive stock (e.g., trading at a 50x+ Price/Earnings multiple), then there is little room for error. When traveling that fast you can forget about the price of a speeding ticket, because hitting a pothole at those speeds (valuation) can be much more costly to your portfolio, if you are not careful.

3) Temperature Outside: There’s a huge difference between driving in the icy-cold snow and in 100 degree heat. Each environment has its own challenges. The same principle applies to the financial markets. On occasion, sentiment can become red hot, forcing heightened caution, whereas during other periods, chilling fear can scare everyone else off the roads, leaving clear sailing ahead.

4) Optimal Tire Pressure: Low pressure or bald tires can lead to treacherous driving conditions. A company with healthy cash flow generation relative to its market capitalization can make your investment ride a lot more stable (see also Cash Flow Register). Dividends and share buybacks are generated from healthy and stable cash flows…not earnings.

5) Driver Skill Level: People generally believe they are better than average drivers, however statistics tell a different story. By definition, half of all drivers must be below average. If you are going to put your life’s retirement assets into stocks, you might as well select those companies led by seasoned management teams with proven track records.

Many investors drive blindly without relying on a dashboard. In the investment world, visibility is not very clear. Often, weather conditions in the financial markets become rainy, dark, and/or foggy. If you don’t want your portfolio to crash, it makes sense to build a reliable dashboard to navigate through the hazardous investment road conditions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

P/E Binoculars, Not Foggy Rearview Mirror

Robert Shiller is best known for his correctly bearish forecasts on the housing market, which we are continually reminded of through the ubiquitous Case-Shiller housing index, and his aptly timed 2000 book entitled Irrational Exuberance. Shiller is also well known for his cyclically adjusted 10-year price-earnings tool, also known as P/E-10. This tool chooses to take a rearview mirror look at the 10-year rolling average of the S&P composite stock index to determine whether the equity market is currently a good or bad buy. Below average multiples are considered to be predictive of higher future returns, and higher than average multiples are considered to produce lower future returns (see scatterplot chart).

Source: http://www.mebanefaber.com (June 2010)

Foggy Mirror

If you were purchasing a home, would the price 10 years ago be a major factor in your purchase decision? Probably not. Call me crazy, but I would be more interested in today’s price and even more interested in the price of the home 10 years into the future. The financial markets factor in forward looking data (not backward looking data). Conventional valuation techniques applied to various assets, take for example a bond, involve the discounting of future cash flow values back to the present – in order to determine the relative attractiveness of today’s asset price. The previous 10-years of data are irrelevant in this calculation.

Although I believe current and future expectations are much more important than stale historical data, I can appreciate the insights that can be drawn by comparing current information with historical averages. In other words, if I was purchasing a house, I would be interested in comparing today’s price to the historical 10-year average price. Currently, the P/E-10 ratio stands at a level around 22x – 38% more expensive than the 16x average value for the previous decade. That same 22x current P/E-10 ratio compares to a current forward P/E ratio of 13x. A big problem is the 22x P/E-10 is not adequately taking into account the dramatic growth in earnings that is taking place (estimated 2010 operating earnings are expected to register in at a whopping +45% growth).

Mean P/E 10 Value is 16.4x Source: http://www.multpl.com

Additional problems with P/E-10:

1) The future 10 years might not be representative of the extreme technology and credit bubble we experienced over the last 10 years. Perhaps excluding the outlier years of 2000 and 2009 would make the ratio more relevant.

2) The current P/E-10 ratio is being anchored down by extreme prices from a narrow sector of technology a decade ago. Value stocks significantly outperformed technology over the last 10 years, much like small cap stocks outperformed in the 1970s when the Nifty Fifty stocks dominated the index and then unraveled.

3) Earnings are rising faster than prices are increasing, so investors waiting for the P/E-10 to come down could be missing out on the opportunity cost of price appreciation. The distorted P/E ratios earlier in the decade virtually guarantee the P/E-10 to drop, absent a current market melt-up, because P/E ratios were so high back then.

4) The tool has been a horrible predictor over very long periods of time. For example, had you followed the tool, the red light would have caused you to miss the massive appreciation in the 1990s, and the green light in the early 1970s would have led to little to no appreciation for close to 10 years.

Shiller himself understands the shortcomings of P/E-10:

“It is also dangerous to assume that historical relations are necessarily applicable to the future. There could be fundamental structural changes occurring now that mean that the past of the stock market is no longer a guide to the future.”

How good an indicator was P/E-10 for the proponent himself at the bottom of the market in February 2009? Shiller said he would get back in the market after another 30% drop in the ratio (click here for video). As we know, shortly thereafter, the market went on a near +70% upwards rampage. I guess Shiller just needs another -55% drop in the ratio from here to invest in the market?

Incidentally, Shiller did not invent the cyclically adjusted P/E tool, as famed value investor Benjamin Graham also used a similar tool. The average investor loves simplicity, but what P/E-10 offers with ease-of-use, it lacks in usefulness. I agree with the P/E-10 intent of smoothing out volatile cycle data (artificially inflated in booms and falsely depressed in recessions), but I recommend investors pull out a pair of binoculars (current and forward P/Es) rather than rely on a foggy rearview mirror.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.