Posts tagged ‘unemployment’

Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

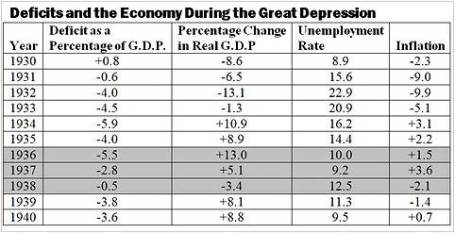

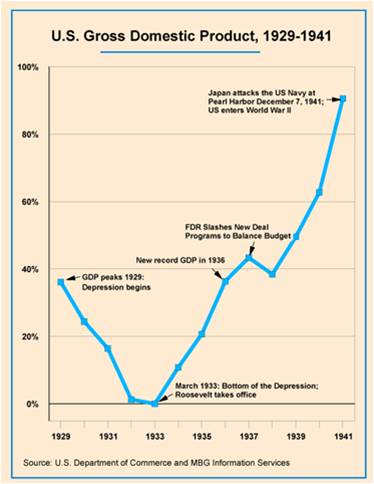

The presidential election is upon us and markets around the globe are beginning to factor in the results. More importantly, in my view, will be the post-election results of the “fiscal cliff” discussions, which will determine whether $600 billion in automated spending cuts and tax increases will be triggered. Similar dynamics in 1937 existed when President FDR (Franklin Delano Roosevelt) felt pressure to balance the budget after his 1933 New Deal stimulus package began to rack up deficits and lose steam.

What’s Similar Today

Just as there is pressure to cut spending today by Republicans and “Tea-Party” Congressmen, so too there was pressure for FDR and the Federal Reserve in 1937 to unwind fiscal and monetary stimulus. At the time, FDR thought self-sustaining growth had been restored and there was a belief that the deficits would become a drag on expansion and a source of future inflation. What’s more, FDR’s Treasury Secretary, Henry Morgenthau, believed that continued economic growth was dependent on business confidence, which in turn was dependent on creating a balanced budget. History has a way of repeating itself, which explains why the issues faced in 1937 are eerily similar to today’s discussions.

The Results

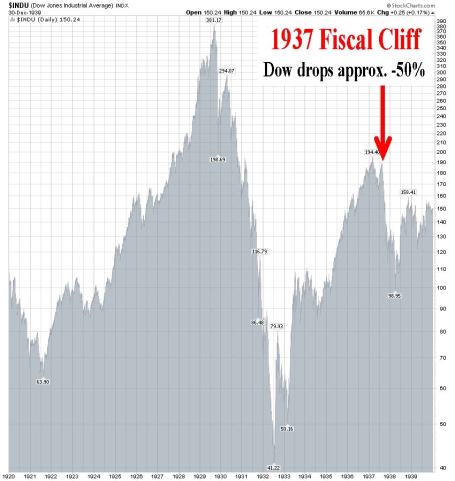

FDR was successful in dramatically reducing spending and significantly increasing taxes. Specifically, federal spending was reduced by -17% over two years and FDR’s introduction of a Social Security payroll tax contributed to federal revenues increasing by a whopping +72% over a similar timeframe. The good news was the federal deficit fell from -5.5% of GDP to -0.5%. The bad news was the economy went into a tail-spinning recession; the Dow crashed approximately -50%; and the unemployment rate burst higher by about +3.3% to +12.5%.

What’s Different This Time?

For starters, one difference between 1937 and 2012 is the level of unemployment. In 1937, unemployment was +14.3%, and today it is +8.1%. Objectively, today there could be higher percentage of the population “under-employed,” but nonetheless the job market was in worse shape back then and labor unions had much more power.

Another major difference is the stance carried by the Fed. Today, Ben Bernanke and the Fed have made it crystal clear they are in no hurry to take away any of the monetary stimulus (see Hekicopter Ben QE3 article), until we have experienced a long-lasting, sustainable recovery. Back in early 1937, the Fed increased banks’ reserve requirements twice, doubling the requirement in less than a year, thereby contracting monetary supply drastically.

Furthermore, we live in a much more globalized world. Today, central banks and governments around the world are doing their part to keep growth alive. Emerging markets are large enough now to move the needle and impact the growth of developed markets. For example, China, the #2 global superpower, continues to cut interest rates and has recently implemented a $158 billion infrastructure spending program.

Net-Net

Whether you’re a Republican or Democrat, everyone generally agrees that job creation is an important common objective, which is consistent with growing our economy. The disagreement between parties stems from the differing opinions on what are the best ways of creating jobs. From my perch, the frame of the debate should be premised on what policies and incentives should be structured to increase competitiveness. Without competitiveness there are no jobs. At the end of the day, money and capital are agnostic. Cold hard cash migrates to the countries in which it is treated best. And where the money goes is where the jobs go.

There is no single silver bullet to solve the competiveness concerns of the United States. Like baseball (since playoffs are quickly approaching), winning is not based solely on hitting, pitching, defense, or base-running. All of these facets and others are required to win. The same principles apply to our country’s competitiveness.

In order to be a competitive leader in the 21st century, here are few necessary areas in which we must excel:

Education: Chicago school unions have been in the news, and I have no problems with unions, if accountability can be structured in. Unfortunately, however, it is clear to me that for now our system is broken (a must see: Waiting for Superman). We cannot compete in the 21st century with an illiterate, uneducated workforce. Our colleges and universities are still top-notch, but as Bill Gates has stated, our elementary schools and high schools are “obsolete”.

Entitlements: Social safety nets like Social Security and Medicare are critical, but unsustainable promises that explode our debt and deficits will not make us more competitive. Politicians may gain votes by making promises in the short-run, but when those promises can’t be delivered in the medium-run or long-run, then those votes will disappear quickly. The sworn guarantees made to the 76 million Baby Boomers now entering retirement are a disaster waiting to happen. Benefits need to be reduced and or criteria need to be adjusted (i.e., means-testing, increase age requirements). The problems are clear as day, so Americans cannot walk away from this sobering reality.

Strategic Government Investment: – Government played a role in building our country’s railways, highways, and our military – a few strategic areas of our economy that have made our nation great. Thoughtful investments into areas like energy infrastructure (e.g., smart grid), internet infrastructure (e.g., higher speed super highway), and healthcare (e.g., human genome research) are a few examples of how jobs can be created while simultaneously increasing our global competitiveness. The great thing about strategic government investments is that government does NOT have to do all the heavy lifting. Rather than write all the checks and do all the job creation from Washington, government can implement these investments and create these jobs by providing incentives for the private sector. Strategic public-private partnerships can generate win-win results for government, businesses, and job seekers. If, however, you’re convinced that our government is more efficient than the private sector, then I highly encourage you to go visit your local DMV, post office, or VA to better appreciate the growth-sucking bureaucracy and inefficiency.

Taxes / Regulations / Laws: Taxes come from profits, and businesses create profits. In order to have a strong and competitive government, we need strong and competitive businesses. Higher taxes, excessive regulations, and burdensome laws will not create stronger and more competitive businesses. I acknowledge that reckless neglect and consumer exploitation will not work either, but reasonable protections for consumers and businesses can be instituted without multi-thousand page regulations. Reducing ridiculous subsidies and loopholes, while tightening tax collection processes and punishing tax dodgers makes perfect sense…so why not do it?

Politics are sharply polarized at both ends of the spectrum, but no matter who wins, our problems are not going away. We may or may not have a new president of the United States this November, but perhaps more important than the elections themselves will be the outcome of the “fiscal cliff” legislation (or lack thereof). If we want to maintain our economic power as the strongest in the world, solving this “fiscal cliff” is the key to improving our competiveness. Avoiding a messy 1937 (and 2011) political repeat will prevent us from becoming dead meat.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

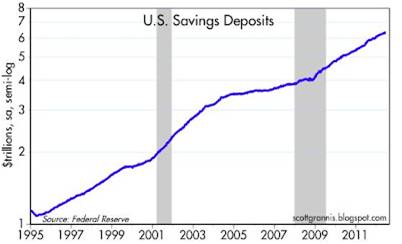

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

The Bond Binge

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

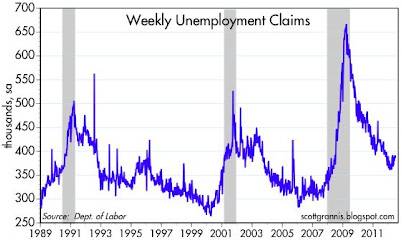

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Darwin Meets Capitalism & Private Equity

A rising discontent is spreading like wildfire in the wake of a massive financial crisis that erupted in the U.S. during 2008, and is now working its way through Europe. Irresponsible governments across the globe succumbed to the deceptive allure of leverage, and as a result racked up colossal debts and gargantuan deficits. Now governments everywhere are toggling between political gridlock and painful austerity. Citizens are feeling the pain through high unemployment, exploding education costs, crumbling social safety nets, and a general decline in the standard of living.

As a result of these dramatic changes, the contributions of capitalism are being questioned by many, whether it’s the Occupy Wall Street movement attack on the top 1%, or more recently the assault on private equity’s relevancy for a presidential candidate.

Although the media may prefer to sensationalize economic stories and tell observers, “This time is different” to boost viewership, usually the truth relies more on the nuanced evolution of issues over time. If Charles Darwin were alive today, he would understand that capitalism and democracies are evolving to massive changes in globalization, technology, and emerging markets. Darwin would appreciate the fact that capitalism can’t and won’t change overnight. Whether capitalism ultimately survives or goes extinct depends on how it adapts. Or as Darwin characterizes evolution:

It is not the strongest of the species that survives, nor the most intelligent, but the most responsive to change.

Will Capitalism Survive?

Capitalism and democracy fit like a hand in a glove, which explains why both have thrived for generations. Never mind that democracies have been around for centuries and their expansion continues unabated (see Spreading the Seeds of Democracy), nevertheless pundits feel compelled to question the sustainability of these institutions.

I guess the real response to all those experts who question the merits of capitalism is what alternative would serve us better? Would it be Socialism like we see grinding Europe to a halt? Or perhaps Communism working its wonders in North Korea and Cuba? If not that, then surely the Autocracies in Egypt and Libya are the winning formulas? The Occupy Wall Streeters may not be happy with their personal plight or the top 1%, but I don’t see them packing their bags for Greece, the Middle East or China.

There is arguably a growing disparity between rich and poor and the game of globalization is only making it more difficult for rising tides of growth to lift up our middle class. The beauty of capitalism is that money goes where it is treated best. Capitalism sucks money to the areas of the world that are the freest, most open, transparent, and practice the rule of law. Some of these components of American capitalism unquestionably eroded over the last decade or so, but the good thing is that in a democracy, citizens have the right to vote and elect growth-promoting leaders to fix problems. Growth comes from competitiveness, and competitiveness is derived from education, innovation, and pro-growth policies. Let’s hope the 2012 elections get agents of change in office.

Darwin & Private Equity

Republican Presidential primary candidate Mitt Romney has been raked over the coals for his prior professional career at private equity firm, Bain Capital. I’m convinced Charles Darwin would see private equity’s involvement as a critical factor in the process of global commerce. Businesses are like species, and only the fittest will survive.

Private equity firms prey upon weak businesses, looking to restructure and reorganize them to become more competitive. If private equity companies are bullies, then their business targets can be considered weaklings. Beating wimps into shape may not be fun to watch, but is a crucial evolutionary aspect of business. The fact of the matter is that deteriorating, uncompetitive companies cannot hire employees…only profitable, viable entities can createsustainable jobs. So our public policy officials have two choices:

• Prop up uncompetitive businesses inefficiently with tax dollars that save jobs in the short-run, but lead to bankruptcy and massive job losses in the future. Other unproductive tariffs and bailouts may garner short-term political votes, but only lead to long-term stagnancy.

OR

• Trim fat, restructure and reorganize now – similar to the swift pain experienced from extracting a rotted tooth. Jobs may be cut in the short-run, but a long-term competitively positioned company will be able to grow and create sustainable long-term jobs.

I can’t say I agree with all of private equity practices, such as leveraged recapitalizations – the practice in which private equity companies load up the target with debt so big fat dividends can be sucked out by the principals. But guess what? By doing so the principals are only reducing their own future exit value through a potential IPO (Initial Public Offering) or company sale. Moreover, if this is such an evil practice, lenders can curb the practice by simply not giving the private equity companies the needed borrowing capacity.

Capitalism and its private equity subset have gotten quite a bad rap lately, but I believe these forces are essential aspects for the rising standards of living for billions of people across the planet. When first introduced, Charles Darwin’s theory of evolution by natural selection was critically examined by many non-believers. Although capitalism will be forced to adapt to an ever-changing world and its merits have been questioned too, the chances of capitalism going extinct are about as likely as the extinction of Darwin’s evolutionary theory.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fear & Greed Occupy Wall Street in October

Excerpt from Free November Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Fear and frustration dominated investor psyches during August and September as backlash from political gridlock in the U.S. and worries of European contagion dominated action in volatile investment portfolios. Elevated 9.1% unemployment and a sluggish recovery in the U.S. also led populist Occupy Wall Street protesters to flood our nation’s streets, blaming the bankers and the wealthy as the cause for personal misfortunes and the widening gap between rich and poor. However, in the face of the palpable pessimism, economic Halloween treats and greedy corporate profits scared away bearish naysayers like invisible ghosts during the month of October.

While many investors stayed home for Halloween in the supposed comfort of their inflation-losing savings accounts and bonds, those investors choosing to brave the chilling elements in the frightening equity markets were handsomely rewarded. Stockholders tasted the sweet pleasure of a +11% October return in the S&P 500 index, the largest monthly advance in 20 years.

Of course, as I always advise, investors should not load themselves to the gills in stocks just to chase performance. Rather, investors should construct a diversified portfolio designed to meet one’s objectives, constraints, risk tolerance, and liquidity needs. Within that context, a portfolio should also periodically rebalance by selling pricey investments (i.e., Treasuries) and redeploy those proceeds into unloved investments (i.e., equities).

Glass Half Full

There is never a shortage of reasons to be fearful and a one-month rally in equities is not reason enough to blindly pile on risk, but there are plenty of reasons to counter the endless pessimism pornography peddled by media outlets on a continuous basis. Here are some of the “half-full” reasons:

- Euro Plan in Place: After months of conflicting headlines, European leaders reached an agreement to increase the European Union’s bailout fund to one trillion euros ($1.4 trillion) and negotiated a -50% debt reduction deal with Greek bondholders. In addition, European officials agreed on a plan to increase bank reserves by 106 billion euros to support potential bank losses due to European debt defaults. This plan is not a silver bullet, but it is a start.

- Bulging Corporate Profits: With the majority of S&P 500 companies now having reported their actual third quarter results, profit growth is estimated to exceed +16% for the three month period ending in September. Expectations for fourth quarter earnings are currently forecasted to top a respectable +11% growth rate (Data from Thomson Reuters).

- Tortoise-Like Growth Continues: Even though it’s Halloween, the double-dip recession boogeyman is still hiding. U.S. economic growth actually accelerated its growth to +2.5% in the third quarter on a year-over-year basis, up from +1.3% last quarter. The growth in Gross Domestic Product (GDP) was primarily driven by consumer and business spending.

- Jobs Still on the Rise: The unemployment rate remains stubbornly high, but offsetting the ongoing decline in government jobs has been a 19 consecutive month spurt in private job creation activity, resulting in +2.6 million jobs being added to the economy over the period. This doesn’t make up for the 8 million+ jobs lost during the 2008-2009 recession, but the economy is moving in the right direction.

- Consumers Opening Wallet: Consumers can be like cockroaches in that they are difficult to kill off when it comes to spending. Consumers whipped out their wallets in September as retail sales advanced at a brisk +7.9% pace (+7.8% excluding auto sales).

- Dividends on the Rise: While nervous Nellies park money in money losing cash and Treasuries (on an inflation-adjusted basis), corporations flush with cash are increasing dividends at a rapid clip. According to Standard & Poor’s rating agency, dividend increases rose over +17% during the third quarter of 2011. As of October 25th, the indicated dividend for the S&P stood at a decent +2.20% rate.

I am fully aware that equity investors are not out of the woods yet, as the European debt crisis has not been resolved, and the structural deficit/debt issues we face in the U.S. still have a long way to go before becoming disentangled. As a matter of fact, fear is building as we approach the looming deficit reduction Super Committee resolution (or lack thereof) later this month – I can hardly wait. If a $1.5 trillion bipartisan debt reduction agreement can’t be reached, some bored Occupy Wall Street protesters can shift priorities and take a tour bus to Washington D.C. to demonstrate. Regardless of the potential grand European or Washington debt plans that may or may not transpire, observers can rest assured fear and greed are two emotions that will remain alive and well when it comes to Wall Street and “Main Street” portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Job Losses = Job Creation

Apple Inc. (AAPL) is considered the quintessential innovation company. After all, if you flip over an iPad or an iPhone it will clearly state, “Designed by Apple in California. Assembled in China.” Apple is just too busy innovating to worry about dirtying their hands by assembling products – they can simply outsource that work. Many people have a problem with the millions of manufacturing jobs moving offshore, but if I am the self anointed “Innovation Czar” for the United States, I definitely favor keeping the $120,000 Apple engineering jobs over the low-cost $2 per hour jobs being lost to China (or cheaper developing country). Oh sure, I would prefer keeping both workers, but if push comes to shove, I much rather keep the six-figure job. The bad news is the displaced American iPhone/iPad assembler must find an alternative lower-skilled employment opportunity. The good news is there are plenty of service-based jobs that will NOT get outsourced to the Chinese. If displaced workers are unhappy serving lattes at Starbucks or changing bedpans at the local hospital (or other unglamorous service-based job), then they can choose to retool their skills through education, in order to land higher-paying jobs not getting outsourced.

Bass Ackwards Job Assessment

While I may agree with many points made by Time Magazine’s Fareed Zakaria in his article, The Future of Innovation: Can America Keep Pace?, I think Zakaria is looking at the job trade-off a little backwards. Here is what says about Apple-created job losses in a CNN blog post:

“Apple has about $70 billion in revenues. The company that makes Apple’s products called Foxconn is in China. They have about the same revenue – $70 billion dollars. Apple employees 50,000 people. Foxconn employs 1,000,000 people. So you can have all the innovation you want and tens of thousands of engineers in California benefit, but hundreds of thousands of people benefit in China because the manufacturing has gone there. What does that mean? America needs to innovate even more to keep pace.”

Wow, that’s very altruistic of Apple to create thousands of jobs for Foxconn in Asia, but that $70 billion in Apple revenues likely generates close to 10 times the profits that Foxconn creates (Apple had 24% net profit margins last quarter versus probably a few percent at Foxconn). As Innovation Czar, I’ll gladly take the $20 billion in Apple profits added to the U.S. economy over the last 12 months versus the $2-3 billion profits at Foxconn (my estimate). Let’s be clear, profitable companies add jobs (Apple added over 12,000 employees in fiscal 2010, up +35%) – not weak or uncompetitive companies losing money.

Although the U.S. is losing low-skilled jobs to the likes of Foxconn, guess what those $120k engineering jobs at Apple are creating? Those positions are also generating lots of $12/hour service jobs. When you are paying your workers billions of dollars, like Apple, a lot of those dollars have a way of recirculating through our economy. For instance, if I am a six-figure employee at Apple, I am likely funding leisure jobs in Tahoe for family vacations; supporting jobs at Cheesecake Factory (CAKE) and Chipotle Mexican Grill (CMG) because my demanding schedule at Apple means more take-out meals; and creating jobs for auto workers at Ford (F) thanks to my new SUV purchase.

Margin Surplus Redux

The same arguments I make in the Apple vs. Foxconn comparison are very similar to the case I wrote about in Margin Surplus Retake, which compares the profit and trade deficit dynamics occurring in a $1,000 Toshiba laptop sale. Although Toshiba and its foreign component counterparts may recognize twice the revenues in a common laptop sale as American suppliers (contributing to our country’s massive trade deficit), Intel Corp. (INTC) and Microsoft Corp. (MSFT) generate six times the profits as Toshiba and company. The end result is a massive profit or margin surplus for the Americans – a better barometer to financial reality than stale government trade deficit statistics.

There are obviously no silver bullets or easy answers to resolve these ever-growing economic issues, but as political gridlock grinds innovation to a halt, globalization is accelerating. The rest of the world is racing to narrow the gap of our innovative supremacy, but our sense of entitlement will get us nowhere. Zakaria points out that by 2013, China is expected to overtake the U.S. as the leading scientific research publisher and after we held a three-fold increase in advanced engineering and technology masters degrees in 1995, China surpassed us in 2005 (63,514 in China vs. 53,349 in the U.S.). China may not be home to Facebook or Google Inc. (GOOG), but Baidu Inc. (BIDU) is headquartered in China with a market capitalization of $43 billion and Tencent Holdings is valued at more than $50 billion (not to mention Tencent has roughly the same number of users as Facebook – more than 600 million).

The jobless recovery has been painful for the 14 million unemployed, but there is hope for all, if innovation and education (see Keys to Success) can create more six-figure Apple jobs to offset less valuable jobs lost to outsourcing. In order to narrow the chasm between rich and poor in our country, Americans need to climb the labor ladder of innovation. Contrary to Fareed Zakaria’s assertion, swapping quality job gains with crappy job losses, is an economic trade I would make every day and twice on Sunday. If the country wants to return to the path of economic greatness and sustainable job creation, the country needs to embrace this idea of outsourced creative destruction.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, and GOOG, but at the time of publishing SCM had no direct position in Foxconn, Facebook, MSFT, INTC, CAKE, CMG, F, BIDU, Tencent, Toshiba, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Listening for Dinner Bell or Penalty Whistle?

Excerpt from my monthly newsletter (sign-up on the right of page)…

Investors are eagerly waiting on the sidelines wondering whether to listen for a dinner bell signaling the time to sink their teeth into traditional equity investments, or respond to a penalty whistle by nervously maintaining money in depleted, inflation-losing CDs. A large swath of investors are still scarred from the losses experienced from the 2008-2009 financial crisis and are trying to rationalize the recent +80% move in equity markets (S&P 500 index) over the last 18 months. Eating saltine crackers and drinking water in CDs and money market accounts yielding < 1% feels OK when the world is collapsing around you, but eventually people realize retirement goals are tough to achieve with the money stuffed under the mattress.

Here are some recent bells and whistles we are listening to:

Mid-Term Elections: Regardless of your politics, Republicans are forecasted to regain control of the House of Representatives, while expectations for a narrow Democrat Senate majority remains the consensus. Currently, Democrat Jerry Brown is a handful of points in the lead over Meg Whitman for the California governor’s race. Another issue voters are closely monitoring is the likelihood of Bush tax-cut extensions.

Printing Press Part II: The Federal Reserve has strongly hinted of another round at the printing press in an effort to stimulate the economy by keeping interest rates low (e.g., record low 30-year fixed mortgage rates around 4.2%). The Fed accomplishes this so-called Quantitative Easing (or QE2) by purchasing Treasuries and mortgage backed securities – pumping more dollars into the financial system to expand credit and loans. In addition, QE2 is structured to stimulate the meager 0.8% core inflation experienced over the last 12 months (Bloomberg) to a Goldilocks level – not too hot and not too cold. QE2 asset purchase estimates are all over the map, but estimates generally stand at the low end of the original $200 billion to $2 trillion range.

Growth Continues: Although companies are sitting on record piles of cash ($1.8 trillion for all non-financial companies), chief executive officers continue to have short arms with their deep pockets when it comes to spending on new hires. Persistent growth for five consecutive quarters (2% GDP expansion in Q2), coupled with tight cost controls, is resulting in 46% estimated growth in 2010 corporate profits as measured by the average of S&P 500 companies. For the time being, “double dip” worries have been put on hold for this jobless recovery.

Unemployment Hypochondria: As I wrote in an earlier Investing Caffeine article (READ HERE), there is an almost obsessive focus on the unemployment rate, which although moving in the right direction, remains at a stubbornly high 9.6% rate nationally. Fresh new employment data will be released this Friday.

Foreclosure-gate: As foreclosures have increased and the decline in the housing market has matured, investors have grown more impatient with collections from mortgage backed securities originators. Banks and other mortgage lenders could face more than $100 billion in losses (CNBC) in mortgage “putbacks” related to improper packaging and terms disclosed to investors. Lawyers are salivating at the opportunity of litigating the thousands of potential cases across the country.

Create Your Own Blueprint – Block Noise

In reality, there is no dinner bell or penalty whistle when it comes to investing. Sure, we hear dinner bells and whistles every day on TV from strategists and economists, but in this sordid, cacophony of daily noise, the long line-up of soothsayers are constantly switching back and forth between optimistic bells and pessimistic whistles. The consistent onslaught of this indiscernible noise serves no constructive purpose for the average investor. I strongly believe the correct plan of attack is to create a customized investment plan that meets your long-term objectives, constraints, and risk tolerance. By creating a diversified portfolio of low-cost tax-efficient products and strategies, I believe investors will be more securely positioned for a more comfortable and less stressful retirement.

I have my own opinions on the economic environment, which I detail in excruciating detail through my InvestingCaffeine.com writings. These macro-economic opinions are stimulating but have little to no bearing on the construction of my investment portfolios. More important is focusing on the investment areas with the best fundamental prospects, while balancing risk and return for each client.

Despite what I just said, if you are still determined to know my opinions on the market direction, then follow me to the dinner table; I just heard the dinner bell ring.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Short Arms, Deep Pockets

Companies have deep pockets flush with cash, but are plagued with short arms, unwilling to reach into their wallets to make substantive new hires. I have talked about “unemployment hypochondria” in the past but is this cautious behavior rational?

The short answer is yes, and it is very typical in light of the similar “jobless recoveries” we experienced in 1991 and 2001. After suffering the worst financial crisis in a generation, employers’ wounds are still not completely healed and the frightening memories of 2008-2009 are still fresh in their minds.

Linchpin Labor

The globalization cat is out of the bag, and technology is only accelerating the commoditization of labor. When labor can be purchased for $1 per hour in China or $.50 per hour in India , and in many instances no strategic benefit lost, then why are so many people surprised about the hemorrhaging of $25 per hour manufacturing jobs to cheaper locales? Agriculture and related industries used to account for more than 90% of our economy about 150 years ago – today agriculture makes up about 2% of our economic output. Even though this dominating sector withered away on a relative basis, the United States became the global powerhouse innovator of the 20th century.

Innovative companies understand that true value is created by those workers who make themselves indispensable – or what Seth Godin calls “Linchpins.” Apple Inc. (AAPL) understands these trends. If you don’t believe me, just flip over an iPhone and read where it clearly states, “Designed by Apple in California. Assembled in China.” (see BELOW).

We are falling further behind our global brethren in math and science, and our immigration policy is all backwards (Keys to Success). Education, creativity, ingenuity, and entrepreneurial spirit are the main ingredients necessary to climb the labor food chain. For those workers that make themselves linchpins, their services will be in demand during good times and bad times.

Jobs = Heavy Hiking Boots

Like scared hikers jettisoning heavy hiking boots to escape a pursuing grizzly bear, business owners will eventually need to purchase a new pair of boots, if they want to hike the mountain to face the next challenge. Right now, businesses are content waiting it out, more worried about the potential of a bear jumping out to devour them.

Although businesses may not be plunging into hiring a substantial number of new workers, positive leading indicators are becoming more apparent. Beyond the obvious improvement in the explicit job numbers (e.g., nine consecutive months of private job creation), other factors such as increased temporary workers, accelerating job listings, and increased capital expenditures are the precursors to sustained job hiring.

Quarterly Capital Carrots

Capital expenditures generally lead to more immediate productivity improvements and do not have a complete negative and immediate impact on the sacred EPS (earnings per share) and income statement metrics. On the other hand, hiring a new employee has an instant depressing effect on expenses, thereby dragging down the beloved EPS figure. What’s more, new employees do not typically become productive or sales generative for months. If you consider the heavy explicit wages coupled with implicit training costs, until the coast is clear and confidence overcomes fear, businesses are not going to dip their hands into their cash-filled pockets to hire workers willy-nilly.

As previously mentioned, improved business confidence is being signaled by increased capital spending. Just over the last week, investors have witnessed significantly expanded capital expenditures across a broad array of industries. Here are a few random samplings:

September 2010 – Quarterly Capital Expenditures

Q3 – 2010 Q3 – 2009 YOY%

Apple Inc. (AAPL) $760 mil vs. $459 mil +66%

Halliburton Company (HAL) $557 mil vs. $440 mil +27%

Coca Cola Company (KO) $442 mil vs. $419 mil +5%

Dominos Pizza Inc. (DPZ) $5.2 mil vs. $4.1 mil +26%

Intel Corp. (INTC) $1.4 bill vs $944 mil +44%

Although the pace of the recovery is losing steam, companies’ health persists to strengthen, as evidenced in part by the +45% growth in 2010 S&P 500 profits, swelling record cash piles, and increasing corporate confidence (rising capital expenditures). Despite these positive leading indicators, business owners are reluctant to dip their short arms into their deep cash-filled pockets to hire new employees. Given our experience over the last few decades this corporate behavior is perfectly consistent with recent jobless recoveries. Until its clear the economic bear is hibernating, businesses will continue building their cash warchests. Everyone will be happier once we are done running from bears, and instead chasing bulls.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, but at the time of publishing SCM had no direct position in HAL, KO, DPZ, INTC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Earnings Showing Speedy Growth

With approximately 2/3 of the S&P 500 companies reporting, Thomson Reuters is reporting not only are 78% of those companies beating analyst expectations, but they are also beating them by a large margin (~16%). The financial sector is still rather volatile and is distorting comparisons, but if you look at the non-financial sector, profit growth is on pace to grow +35% this quarter as compared to +18% last quarter. Earnings are not the only thing growing…so are revenues. After four quarters of revenue declines, sales are on track to rise +11% this quarter (versus +8% last quarter) thanks to almost 80% of the S&P 500 companies reporting revenue growth (rather than declines) in the first quarter of 2010.

Signs of Employment Improvement

Unemployment at 9.7% remains stubbornly high, but with corporation’s newfound revenue growth, there are signs companies are becoming more confident in the hiring department as well. Typically the sequence of a business cycle follows the pattern of cutting expenses and increasing layoffs into a recession; building cash at the cycle trough while running leaner expenses and staff; improving productivity with capital expenditures and technology purchases before hiring; and then as the recovery firms up, companies enjoy widening margins with sales growth, resulting in the confidence to hire. Take for example JP Morgan (JPM) mentioned they plan to hire 9,000 workers in the U.S. this year and Intel (INTC) another 1,000 new positions.

Growth is Global

With all the headlines about Greece’s financial woes, one might underestimate the recovery abroad as well. The average earnings growth rate estimates for the G6 stock markets is +41.6% and +21.9% for 2010 and 2011 according to Ed Yardeni, but a majority of the growth is not coming from the Euro zone.

There is still no shortage of issues to worry about, assuming we understand a Utopia does not exist. Besides elevated unemployment, other issues to remain concerned about include: a lack of credit accessibility for small and medium businesses; massive government debt and deficits; and diminishing impacts in the coming quarters from government stimulus and Federal Reserve monetary stimulus.

Regardless of the nervousness, evidence continues to build for a continuation of better than expected earnings. The music will not last forever and eventual stop, but until then, our economy will enjoy the speedier than anticipated earnings growth recovery.

Read Whole Wall Street Journal Article on Earnings (Subscription)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in JPM, INTC, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Indicators Like Kissing Your Sister

The economy is on the mend, but we are obviously not out of the woods. Leverage and asset inflation through the housing bubble were major causes of the financial crisis of 2008-09. Now some of the major indicators are turning upwards with GDP expected to rise around +3% in Q3 this year and we are seeing housing units up, housing prices up, and housing inventories down (charts below). Although some of these numbers may create some warm and fuzzy sensations, abnormally high unemployment rates, massive budget deficits, and stuttering consumer confidence make this rebound feel more like kissing your sister.

There are, however, other signs of economic strength. For example, credit appears to be healing as well. Moodys predicts global speculative debt default rates will peak in Q4 this year at 12.5% – lower than the 18% Moodys predicted earlier this year in January. The CEO Confidence Board index, which typically leads profit growth by two quarters, jumped to a five year high in the 3rd quarter. The recovery is not limited to our domestic economy either – the International Monetary Fund (IMF) recently raised its global growth forecasts in 2010 from +2.5% to +3.1%.

How sustainable is the recovery? Bears like Nouriel Roubini still think we are likely heading into a double-dip recession, perhaps by mid-2010, once the temporary home purchase credits expire and the stimulus funds run out. A collapse in the dollar due to exploding debt and rising deficits is feared to cause a spiraling in debt costs – another factor that could cause a relapse into recession. Unemployment remains at an abnormally 26 year high at 9.8% (September) and any self-maintaining recovery will require an improvement from this deteriorating trend. Before consumers freely open their wallets and purses, consumer confidence could use a boost in light of the recent -10% month-to-month drop in October.

Fewer people are debating the existence of “green shoots,” however now the discussion is turning to sustainability. Time will tell whether those feelings of harmless sibling cheek pecks will lead to the discovery of a new long-lasting romantic relationship with a non-family member.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Tortuous Path to Productivity

There is a silver lining to the deep, tortuous job cuts in this severe recession and it is called “productivity.” Those fortunate enough to retain their jobs are forced to become more productive. In layman’s terms, productivity simply is output divided by hours worked.

Unemployment dropped to 9.4% in July, thanks in part to a decline in the job losses to -247,000 from a peak in January of -741,000 job losses. During this period of job-loss cratering, we managed to sustain a decline of a mere -1% in Q2 Gross Domestic Product (GDP). How could we lose more than 6 million jobs since the beginning of 2008 and still be on a path to recovery? A large contributor is our friend, productivity, which came in at a whopping +6.4% in Q2 – the highest in six years.

Productivity increased in part because of a slashing of work-hours by employers. Employees that have maintained employment are therefore forced to produce more output (goods and services) per unit hour of employment. In this severe recession that we are pulling out of, the American worker is being stretched like a rubber band. At some point, the “Law of Diminishing Returns” kicks in and employers are forced to hire new employees to meet demand levels, or the rubber band will snap.

The prime ways of increasing productivity are raising the amount of capital per worker (capital intensity) and also elevating the workers’ average level of skill, education, and training (labor quality).

Not only are the surviving U.S. workers toiling harder, they are not getting pay increases large enough to offset inflation. For example, Q2 hourly compensation increased +0.2%, but after accounting for inflation, real hourly compensation was actually down -1.1%.

As the MarketWatch article points out:

The early stages of recovery are typically the best for productivity: Output is rising, but cost-cutting plans are still being implemented… Productivity gains are the key to higher living standards, higher wages, increased profits and low inflation… Productivity averaged about 2.7% annually from 1948 to 1970, then slowed to 1.6% from 1971 to 1995. Since then, productivity has grown about 2.5% annually. In 2008, productivity increased 1.8%.

Productivity allows the U.S. to produce more goods and services with fewer workers. For instance, the MarketWatch article also highlights the U.S. is producing 20% more output relative to a decade ago, yet employment has not changed at all over that time period.

We are certainly not out of the woods when it comes to the recession, and for those lucky enough to maintain employment, they are being asked (forced) to work more for less pay. These productivity improvements feel like torture to the survivors, however this pain will eventually lead to economic gain.

Wade W. Slome, CFA, CFP

Plan. Invest. Prosper.