Posts tagged ‘uncertainty’

Animal Spirits to Animal Hibernation

Investor mood or sentiment can change rather quickly. Immediately after the 2024 presidential elections, positive animal spirits catapulted the stock market higher due to hopes of stimulating tax cuts and deregulation legislation. However, those warm and fuzzy feelings soured last month, as investor focus shifted to on-again, off-again tariff talks, and stagflation concerns, which have converted animal spirits into gloomy feelings of hibernation.

As a result, the advancing bull market took a breather and transformed into a weary bear during March. For the month, the S&P 500 (-5.8%), NASDAQ (-8.2%), and the Dow Jones Industrial Average (-4.2%) all fell significantly in the wake of tariffs, inflation, and recession worries.

Lovely Liberation Day or Tariff Trouble?

Since the President took office in January, he has announced, reversed, and implemented tariffs across a wide range of countries and sectors, including China, Canada, Mexico, the EU, Colombia, Venezuela, steel, aluminum, oil, automobiles, digital services taxes, and more.

The day of reckoning begins on April 2nd, designated Liberation Day by the president. This is when the president and the White House officially announce global reciprocal tariffs on foreign countries in an attempt to reverse the nation’s large trade deficit (see chart below) and bring manufacturing back to the United States. For example, if Germany subsidizes BMW cars sold in the U.S. while simultaneously placing tariffs (i.e., additional taxes) on American Ford Explorers sold in Germany, the president wants to impose equivalent reciprocal tariffs on those same BMWs sold in the U.S. in an effort to level the trading playing field. On the surface, a $131 billion trade deficit sounds very significant, but when compared to a $30 trillion economy (Gross Domestic Product – GDP), this negative trade balance represents less than 0.5% of GDP – effectively a rounding error. I have previously written how tariffs represent more of a molehill than a mountain (see Tariff Sheriff), in part because consumer spending and services make up the vast majority of our country’s economic activity, whereas trade and manufacturing are relatively smaller segments.

Source: Trading Economics

Driving home the point that tariffs are more bark than bite, Senior White House trade and manufacturing counselor Peter Navarro recently stated the 2025 tariffs could add $700 billion annually to U.S. revenues, including $100 billion from the recently announced 25% auto tariffs. Many economists believe this collection estimate is too optimistic. However, even if this target is achievable, $700 billion only represents a measly 2% of overall GDP.

Tariffs = Recession or Stagflation?

With the recent stock market downdraft and growing concerns related to tariffs, some economists and pundits are raising the probability of a recession and the possibility of inflation accompanying an economic downturn (i.e., stagflation).

Economic data should clear some of the fog. Fresh employment numbers will be released this Friday, which should shine some light on the health of the economy. Irrespective of this month’s results, the most recent 4.1% unemployment rate (see chart below), though slightly higher over the last two years, does not strongly indicate a recession.

Source: Trading Economics

Other “hard” data, such as GDP, also suggest a slowing economy rather than a recession. For instance, a recent survey of 14 economists estimates the economy is growing at a paltry +0.3% rate in Q1 – 2025 versus +2.3% in Q4 – 2024. Data is continually changing, but if a looming recession were imminent, corporate earnings would likely be trending downward, not upwards, as evident in the chart below.

Source: Yardeni Research

Tariff Inflation Has Yet to Arrive

There is no doubt tariffs function as a tax hike on consumers because U.S. companies that pay the tariffs on imported goods are eventually forced to raise prices to maintain profit margins or limit margin degradation.

Nonetheless, inflation did not spike under President Trump’s first term. Even if the president’s new policies result in more aggressive tariff actions this go-around, inflation will likely remain in check due to the point mentioned earlier – imported goods represent a small percentage of overall consumer and business purchases.

Tariff implementation is just beginning, so only time will tell how pervasive inflation will become. However, what we do know now is that inflation has declined dramatically over the last couple of years and has not yet spiked (see Consumer Price Index chart below).

Source: Calafia Beach Pundit

Where Could I Be Wrong?

I have explained how some of the lagging “hard” data does not signal recession or stagflation, but what could I be missing? For starters, some of the leading “soft” data (e.g., surveys) indicate various cracks in the economic foundation are forming. Take the recent Consumer Confidence data (see chart below), which has weakened dramatically from pre-COVID and even post-COVID levels.

Source: Trading Economics

It’s not just consumers who are feeling uneasy about the economic environment; businesses are as well. Another soft data point flashing red is the NFIB Small Business Uncertainty index, which recently reported its second-highest reading in 48 years (see chart below). Even if my argument that tariffs are too small to materially impact the economy holds, if the psychological effects of tariff uncertainty paralyzes consumer and business economic activity to a standstill, then tariffs could indeed become a substantial factor.

Source: National Federation of Independent Business (NFIB)

What Comes Next After Liberation Day?

Liberation Day is unlikely to trigger an immediate and sustained V-shaped recovery in the stock market because international trading partners will be forced to announce retaliatory tariffs in response to President Trump’s reciprocal tariffs, potentially leading to additional reactionary tariffs by the U.S.

Additionally, the reciprocal tariffs announced on April 2nd will likely serve as a starting point for subsequent negotiations with trading partners. Without a comprehensive resolution, investor sentiment will likely remain somewhat unresolved and unsettled. Regardless of your views on the size and impact of tariffs, Liberation Day will at least bring some clarity and reduce the uncertainty surrounding the current murky and chaotic environment.

The multi-year bull market continued its charge after the presidential election, but investor sentiment has weakened the bull run due to tariff uncertainty. In response, the excited bull has temporarily turned into a sleepy bear. Depending on how these tariff events unfold, we will soon find out whether Liberation Day will awaken the bear to hunt for bulls or send it into deep hibernation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in F or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Uncertainty: A Love-Hate Relationship

An often over-quoted saying is “The stock market hates uncertainty.” However, the wealthiest investor of all-time has a different perspective about uncertainty:

“The future is never clear. You pay a very high price in the stock market for a cheery consensus. Uncertainty is the friend of the buyer of long-term values.”

-Warren Buffett

Buffett understands the benefits of long-term compounding and the beauty of buying fear and selling greed. Unfortunately, CNBC and every other media outlet do not carry the words “long-term” in their vernacular. Peddling F.U.D. (fear, uncertainty, doubt) equates to eyeballs and clicks, which equates to more advertising dollars. With the volatility index trading at fear-rich Brexit levels above 20, traders are certainly long on F.U.D. Time will tell whether the elections will increase or decrease F.U.D., but unless there is a contested election a la 2000 (Bush-Gore), there will be one less election to worry about and investors can then go back to normal worrying and political bashing.

As I have noted on multiple occasions, from a stock market standpoint, whomever wins (Republican or Democrat) should have no bearing on the performance of the stock market over the medium term as long as there remains gridlock in Washington (see also Fall is Here: Change is Near). Most Americans despise political inactivity, but if like many investors you believe in fiscal discipline, then you prefer fighting over spending, and generally, the more gridlock, the less spending.

In other words, fiscal discipline is likely to win IF there is a split Congress (House & Senate) or if the winning presidential party loses both the Senate and the House. For what it’s worth, Nate Silver, the guy who accurately predicted all 50 states in the 2012 presidential election is currently predicting gridlock (i.e., a split Congress), but the presidential and Congressional polls have been generally tightening across the board. For now, with just three days left before the election, investors have chosen to shoot now, and ask questions later, as evidenced by the 420 point decline in the Dow Jones Industrial Average during the first half of the 4th quarter.

My crystal ball is just as foggy as anybody else’s, and increased volatility in the short-run should come as no surprise to anyone. As in any volatile investment environment, during periods of turbulence, you should compile your shopping list to opportunistically purchase securities selling at a discount. There is no reason to be a hero, but you should prudently deploy cash or readjust your asset allocation, if there is a significant sell-off in risky assets. The same principle works in reverse. If for some unlikely reason, there is a post Brexit-like snapback, one should consider trimming or selling overbought positions.

The main point in periods like these is to let objective reasoning drive your decisions (or lack of decisions), rather than emotions. There has always been a love-hate relationship with uncertainty for traders and investors alike. If you are doing your job correctly, long-term investors should relish F.U.D. because as the saying goes, “This too shall pass.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page

2012 Investing Caffeine Greatest Hits

Between Felix Baumgartner flying through space at the speed of sound and the masses flapping their arms Gangnam style, we all still managed to survive the Mayan apocalyptic end to the world. Investing Caffeine also survived and managed to grow it’s viewership by about +50% from last year.

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2013!

Here are some of the most popular Investing Caffeine postings over the year:

Explaining how billions of dollars in stock selling can lead to doubling in stock prices.

2) Uncertainty: Love It or Hate It?

Source: Photobucket

Good investors love ambiguity.

3) USA Inc.: Buy, Hold or Sell?

What would you do if our country was a stock?

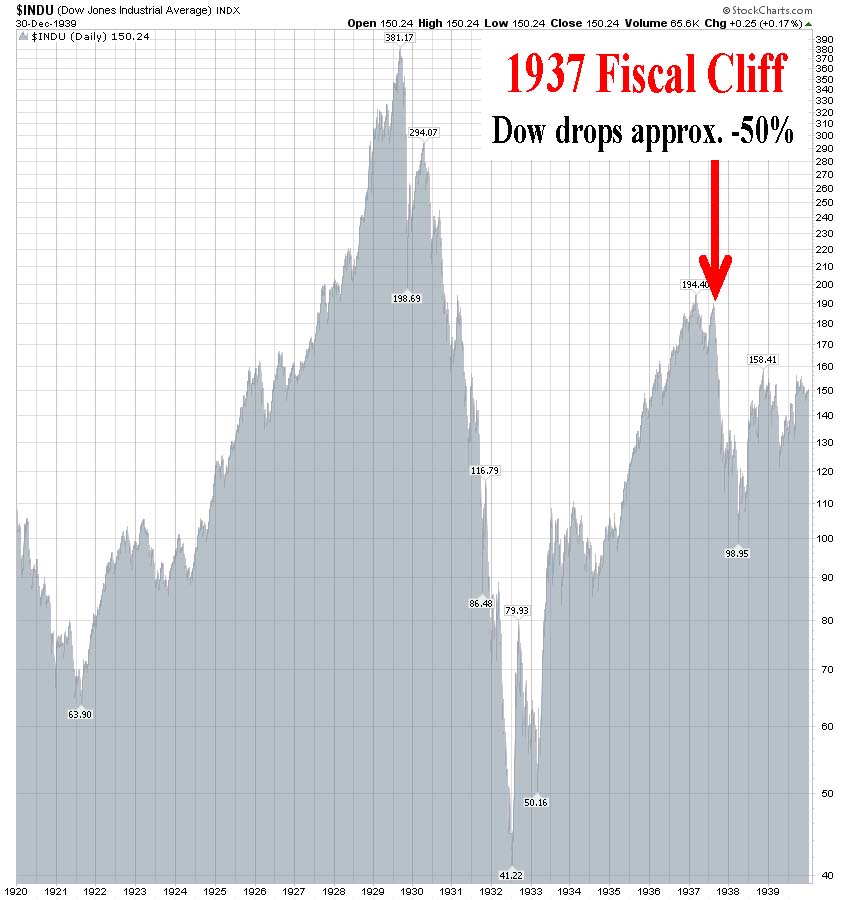

4) Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

Source: StockCharts.com

Determining whether history will repeat itself after the presidential elections.

5) Robotic Chain Saw Replaces Paul Bunyan

How robots are changing the face of the global job market.

6) Floating Hedge Fund on Ice Thawing Out

Lessons learned from Iceland four years after Lehman Brothers.

7) Sidoxia’s Investor Hall of Fame

Continue reading at IC & perhaps you too can become a member?!

8) Broken Record Repeats Itself

It appears that the cycle from previous years is happening again.

9) The European Dog Ate My Homework

Explaining the tight correlation of European & U.S. markets, and what to do about it.

10) Cash Security Blanket Turns into Tourniquet

Stock market returns are beginning to make change perceptions about holding cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.