Posts tagged ‘Trading’

New Year, New Clean Slate

Stock and bond market returns in 2022 were disappointing, but we now get to start 2023 with a clean slate. Before we turned the page on another annual chapter, Santa Claus chose to finish last year by placing a lump of coal in investor stockings, as evidenced by the S&P 500 index decline of -5.9% during December.

Good News & Bad News

There is some good news and bad news as it relates to this year’s underwhelming stock market results (-19.4%). The bad news is last year turned out to be the 4th worst year in the stock market since World War II (1945) and also marked the worst year since 2008. Here’s a summary of the S&P 500’s worst years over the last eight decades:

2008: -38.5%

1974: -29.7%

2002: -23.4%

2022: -19.4%

Source: CNBC (Bob Pisani)

The good news is that the stock market is up 81% of the time in subsequent years following down years. The average increase in bounce-back years is +14%. In another study of down years, the analysis showed that after the stock market has fallen -20% or more, stock prices were higher on average by +15% one year later, +26% two years later, and +29% three years later. Nothing is guaranteed in life, but as Mark Twain famously stated, “History does not repeat itself, but it often rhymes.”

2022: The Year of No Shock Absorbers (Worst Bond Market Ever)

The stock market receives most of the media glory and reporting, however the bond market is the Rodney Dangerfield of asset classes, it “gets no respect.” Typically, during weak stock markets (i.e., “bear markets”), the bond or fixed income investments in a diversified portfolio act as shock absorbers to cushion the blow of volatile stock prices. More specifically, in a typical bear market, the economy generally slows down causing demand to decelerate, and interest rates to decline, which causes the values of bonds to increase. Therefore, as stock prices decline, the gains from bonds in your portfolio usually help offset stock losses. Unfortunately, this scenario didn’t happen in 2022, but rather investors experienced a double negative whammy. Not only did stocks experience one of its worst years in decades, the bond market also suffered what many pundits are describing as the “Worst Bond Market Ever” – see chart below.

Why in particular did bonds perform so poorly this year, when they commonly outperform in slow or recessionary economic conditions? For starters, interest rates spent most of 2022 increasing at the fastest pace in more than four decades (see chart below). An unanticipated rise in inflation was the main culprit, which was caused by spiking energy prices from Russia’s invasion of Ukraine; COVID-related supply chain disruptions; unprecedented fiscal stimulus (trillions of dollars in infrastructure spending and incentives); record monetary stimulus (QE – Quantitative Easing); and extended years of ZIRP (Zero Interest Rate Policy). For these reasons, and others, bonds collapsed in sympathy with deteriorating stock prices.

Room for Optimism in 2023

Last year was challenging, however, not all is lost. The Federal Reserve, inflation, interest rates, Ukraine, and cryptocurrency volatility (e.g., Bitcoin down -64% in 2022) dominated headlines this year, but many of these headwinds could abate or reverse in 2023. For example, there are numerous indicators pointing to peaking and/or declining inflation, which, if true, could create a tailwind for investors this year. Bolstering this argument are the current weakening trends we are witnessing in the housing market, which should ripple through the economy to cool inflation (see chart below).

And if it’s not declining home prices, lower energy prices have also filtered through the global economy to lower transportation and shipping costs (e.g., freight rates from China to West Coast are down -90%). What’s more, a stronger dollar has contributed to declining commodity prices as well.

Although inflation still has a long way to go before reaching the Federal Reserve’s 2% target rate, broad inflation measures, such as the GDP Deflator, are showing a significant decrease in inflation (see chart below). By analyzing the various disinflationary tea leave markers, we can gain some confidence regarding future interest rates. Observing the fastest rate hike cycle by the Fed in decades informs us that we are likely closer to an end of rate hikes (i.e., pause or cut), rather than the beginning. If correct, tamer inflation means 2023 could prove to be a better environment for both stock and bond investors.

In summary, last year was painful across the board, but investors are starting this year with a clean slate and signs are pointing to a potential reversal in inflation and interest rate headwinds. With the change of the calendar, a messy 2022 could turn into a spick-and-span 2023.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Jan. 3, 2023). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

April Flowers Have Investors Cheering Wow-sers!

Normally April showers bring May flowers, but last month the spring weather was dominated by sunshine that caused stock prices to blossom to new, all-time record highs across all major indexes. More specifically, the S&P 500 jumped +5.2% last month, the NASDAQ catapulted +5.4%, and the Dow Jones Industrial Average rose +2.7%. For the year, the Dow and S&P 500 index both up double-digit percentages (11%), while the NASDAQ is up a few percentage points less than that (8%).

What has led to such a bright and beaming outlook by investors? For starters, economic optimism has gained momentum as the global coronavirus pandemic appears to be improving after approximately 16 months. Not only are COVID-19 cases and hospitalizations rates declining, but COVID-19 related deaths are dropping as well. A large portion of the progress can be attributed to the 246 million vaccine doses administered so far in the United States.

Blossoming Economy

As a result of the improving COVID-19 health climate, economic activity, as measured by Gross Domestic Product (GDP), expanded by a healthy +6.4% rate during the first quarter. Economists are forecasting second quarter growth to accelerate to an even more brilliant rate of +10%.

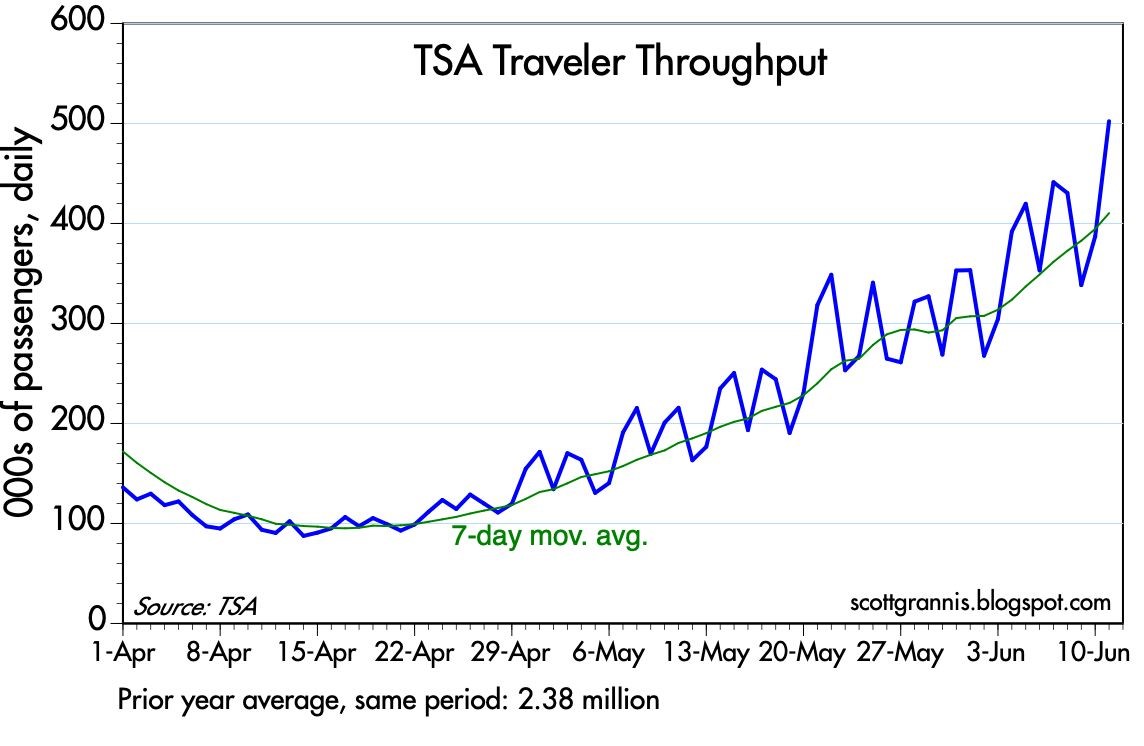

As the economy further re-opens and pent-up consumer demand is unleashed, activity is sprouting up in areas like airlines, hotels, restaurants, bars, movie theaters and gyms. An example of consumer demand climbing can be seen in the volume of passenger traffic in U.S. airports, which has increased substantially from the lows a year ago, as shown below in the TSA (Transportation Security Administration) data.

A germinating economy also means a healthier employment market and more jobs. The chart below shows the dramatic decline in the number of jobless receiving benefits and pandemic unemployment assistance.

Fed Fertilizer & Congressional Candy

Monetary and fiscal stimulus are creating fertile ground for the surge in growth as well. The Federal Reserve has been clear in their support for the economy by effectively maintaining its key interest rate target at 0%, while also maintaining its monthly bond buying program at $120 billion – designed to sustain low interest rates for the benefit of consumers and businesses.

From a fiscal perspective, Congress is serving up some sweet candy by doling out free money to Americans. So far, roughly $4 trillion of COVID-19 related stimulus and relief have passed Congress (see also Consumer Confidence Flies), and now President Biden is proposing roughly an additional $4 trillion of stimulus in the form of a $2 trillion jobs and infrastructure plan and a $1.8 trillion American Families Plan.

Candy and Spinach

While Congress is serving up trillions in candy, eventually, Americans are going to have to eat some less appetizing spinach in the form of higher taxes. Generally speaking, nobody likes higher taxes, so the question becomes, how does the government raise the most revenue (taxes) without upsetting a large number of voters? As 17th century French statesman Jean-Baptiste Colbert proclaimed, “The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.”

President Biden has stated he will only increase income taxes on people earning more than $400,000 annually and increase capital gains taxes for those earning more than $1,000,000 per year. According to CNBC, those earning more than $400,000 only represents 1.8% of total taxpayers.

Bitter tasting spinach for Americans may also come in the form of higher inflation (i.e., a general rise in a basket of goods and services), which silently eats away at everyone’s purchasing power, especially those retirees surviving on a fixed income. Federal Reserve Chairman Jerome Powell sees any increase in inflation as transitory, but if prices keep rising, the Federal Reserve will be forced to increase interest rates. Such a reversal in rates could choke off economic growth and potentially force the economy into a recession.

If you strip out volatile energy prices, the good news is that underlying inflation has not spiraled higher out of control, as you can see from the chart below.

In addition to the concerns of potential higher taxes, inflation, and rising interest rate policies from the Federal Reserve, for many months I have written about my apprehension about the speculation in SPACs (Special Purpose Acquisition Companies) and cryptocurrencies like Bitcoin. There are logical explanations to invest selectively into SPACs and purchase Bitcoin as a non-correlated asset for diversification purposes and a hedge against the dollar. But unfortunately, if history repeats itself, speculators will eventually end up in a pool of tears.

While there are certainly some storm clouds on the horizon (e.g., taxes, inflation, rising interest rates, speculative trading), April bloomed a lot of flowers, and the near-term forecast remains very sunny as the economy emerges from a global pandemic. As long as the government continues to provide candy to millions of Americans; the Federal Reserve remains accommodative in its policies; and the surge in pent-up demand persists to drive economic growth, we likely have some more time before we are forced to eat our spinach.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 3, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Consumer Confidence Flies as Stock Market Hits New Highs

As the economy starts reopening from a global pandemic that is improving, consumers and businesses are beginning to see a light at the end of the tunnel. The surge in the recently reported Consumer Confidence figures to a new one-year high (see chart below) is evidence the recovery is well on its way. A stock market reaching new record highs is further evidence of the reopening recovery. More specifically, the Dow Jones Industrial Average catapulted 2,094 points higher (+6.2%) for the month to 32,981 and the S&P 500 index soared +4.2%. A rise in interest rate yields on the 10-Year Treasury Note to 1.7% from 1.4% last month placed pressure on technology growth stocks, which led to a more modest gain of +0.4% in the tech-heavy NASDAQ index during March.

Comeback from COVID

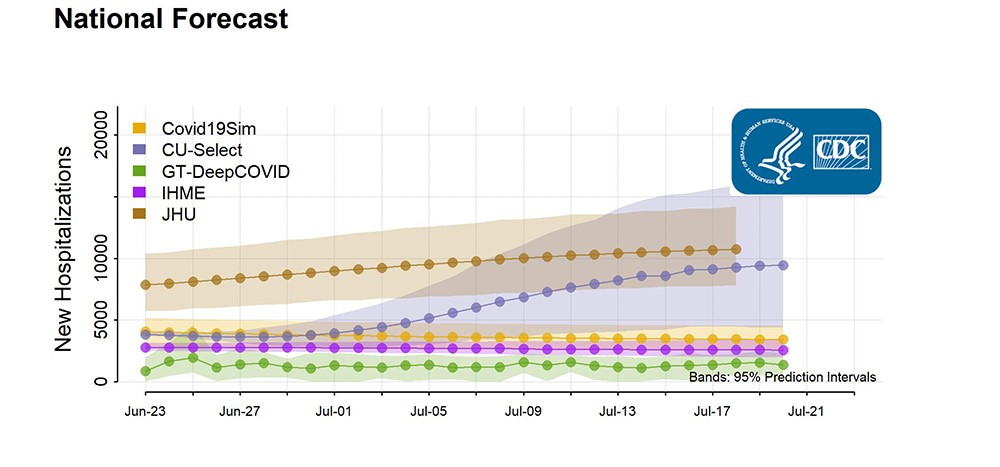

With a combination of 150 million vaccine doses administered and 30 million cumulative COVID cases, the U.S. population has creeped closer toward herd immunity protection against the virus and pushed down hospitalizations dramatically (see chart below).

Also contributing to investor optimism have been the rising values of investments and real estate assets thanks to an improving economy and COVID case count. As you can see from the chart below, the net worth of American households has more than doubled from the 2008-2009 financial crisis to approximately $130 trillion dollars, which in turn has allowed consumers to responsibly control and manage their personal debt. Unfortunately, the U.S. government hasn’t been as successful in keeping debt levels in check.

Spending and Paying for Infrastructure Growth

Besides focusing on positive COVID trends, investors have also centered their attention on the passage of a $1.9 trillion stimulus bill last month and a new proposed $2.3 trillion infrastructure bill that President Biden unveiled details on yesterday. At the heart of the multi-trillion dollar spending are the following components (see also graphic below):

- $621 billion modernize transportation infrastructure

- $400 billion to assist the aging and disabled

- $300 billion to boost the manufacturing industry

- $213 billion to build and retrofit affordable housing

- $100 billion to expand broadband access

With over $28 trillion in government debt, how will all this spending be funded? According to The Fiscal Times, there are four main tax categories to help in the funding:

Corporate Taxes: Raising the corporate tax rate to 28% from 21% is expected to raise $730 billion over 10 years

Foreign Corporate Subsidiary Tax: A new global minimum tax on foreign subsidiaries of American corporations is estimated to raise $550 billion

Capital Gains Tax on Wealthy: Increasing income tax rates on capital gains for wealthy individuals is forecasted to raise $370 billion

Income Tax on Wealthy: Lifting the top individual tax rate back to 39.6% for households earning more than $400,000 per year is seen to bring in $110 billion

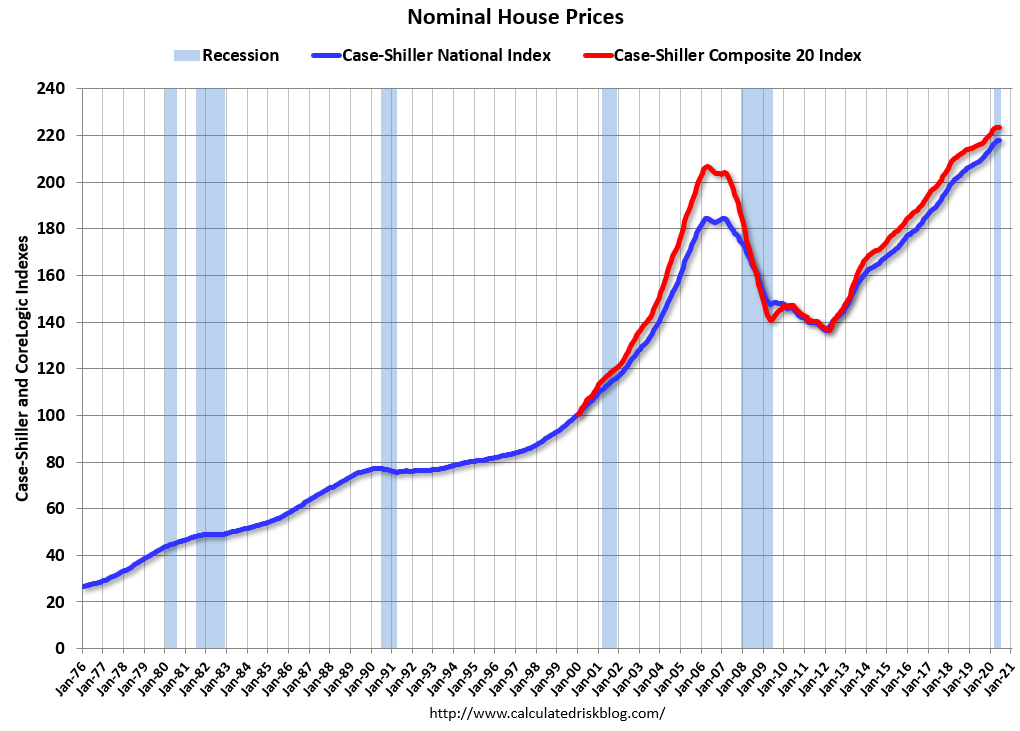

Besides the economy being supported by government spending, growth and appreciation in the housing market are contributing to GDP growth. The recently released housing data shows housing prices accelerating significantly above the peak levels last seen before the last financial crisis (see chart below).

Although the economy appears to be on solid footing and stock prices have marched higher to new record levels, there are still plenty of potential factors that could derail the current bull market advance. For starters, increased debt and deficit spending could lead to rising inflation and higher interest rates, which could potentially choke off economic growth. Bad things can always happen when large financial institutions take on too much leverage (i.e., debt) and speculate too much (see also Long-Term Capital Management: When Genius Failed). The lesson from the latest, crazy blow-up (Archegos Capital Management) reminds us of how individual financial companies can cause billions in losses and cause ripple-through effects to the whole financial system. And if that’s not enough to worry about, you have rampant speculation in SPACs (Special Purpose Acquisition Companies), Reddit meme stocks (e.g., GameStop Corp. – GME), cryptocurrencies, and NFTs (Non-Fungible Tokens).

Successful investing requires a mixture of art and science – not everything is clear and you can always find reasons to be concerned. At Sidoxia Capital Management, we continue to find attractive opportunities as we strive to navigate through areas of excess speculation. At the end of the day, we remain disciplined in following our fundamental strategy and process that integrates the four key legs of our financial stool: corporate profits, interest rates, valuations, and sentiment (see also Don’t Be a Fool, Follow the Stool). As long as the balance of these factors still signal strength, we will remain confident in our outlook just like consumers and investors are currently.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Ponder Stimulus Size as Rates Rise

Stock prices rose again last month in part based on passage optimism of a government stimulus package (currently proposed at $1.9 trillion). But the rise happened before stock prices took a breather during the last couple of weeks, especially in hot growth sectors like the technology-heavy QQQ exchange traded fund, which fell modestly by -0.1% in February. As some blistering areas cooled off, investors decided to shift more dollars into the value segment of the stock market (e.g., the Russell 1000 Value index soared +6% last month). Over the same period, the S&P 500 and Dow Jones Industrial Average indexes climbed +2.6% and +3.2%, respectively.

What was the trigger for the late-month sell-off? Many so-called pundits point to a short-term rise in interest rates. While investor anxiety heightened significantly at the end of the month, the S&P 500 dropped a mere -3.5% from all-time record highs after a slingshot jump of +73.9% from the March 2020 lows.

Do Rising Interest Rates = Stock Price Declines?

Conventional wisdom dictates that as interest rates rise, stock prices must fall because higher rates are expected to pump the breaks on economic activity and higher yielding fixed income investments will serve as better alternatives to investing in stocks. Untrue. There are periods of time when stock prices move higher even though interest rates also move higher

Take 2013 for example – the yield on the benchmark 10-Year Treasury Note climbed from +1.8% to 3.0%, while the S&P 500 index catapulted +29.6% higher (see charts below).

Similarly to now, during 1994 we were still in a multi-decade, down-trending interest rate environment. However, from the beginning of 1994 to the middle of 1995 the Federal Reserve hiked the Federal Funds interest rate target from 3% to 6% (and the 10-Year Treasury yield temporarily climbed from about 6% to 8%), yet stock prices still managed to ascend +17% over that 18-month period. The point being, although rising interest rates are generally bad for asset price appreciation, there are periods of time when stock prices can move higher in synchronization with interest rates.

What’s the Fuss about Stimulus?

One of the factors keeping the stock market afloat near record highs is the prospect of the federal government passing a COVID stimulus package to keep the economic recovery continuing. Even though there is a new administration in the White House, Democrats hold a very narrow majority of seats in Congress, leaving a razor thin margin to pass legislation. This means President Biden needs to keep moderate Democrats like Joe Manchin in check, and/or recruit some Republicans to jump on board to pass his $1.9 trillion COVID stimulus plan. If the bill is passed as proposed, “The relief plan would enhance and extend jobless benefits, provide $350 billion to state and local governments, send $1,400 to many Americans and fund vaccine distribution, among other measures,” according to the Wall Street Journal.

Valuable Vaccines

Fresh off the press, we just received additional good news on the COVID vaccine front. The U.S. Food and Drug Administration (FDA) approved the third vaccine for COVID-19 by Johnson & Johnson (JNJ). This J&J treatment is also the first single-dose vaccine to be distributed, unlike the other two vaccines manufactured by Pfizer Inc. (PFE) and Moderna Inc. (MRNA), which both require two shots. Johnson & Johnson expects to ship four million doses immediately and 20 million doses by the end of March.

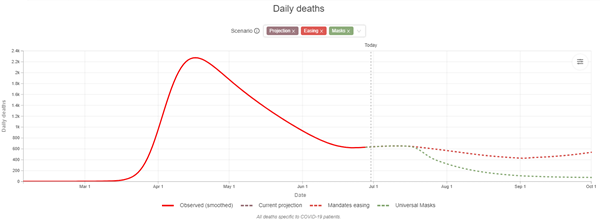

So far, over 50 million doses of the COVID vaccines have been administered, and the White House believes they can go from currently about 1.5 million injections per day to approximately 4 million people per day by the end of March. The combination of the vaccines, mitigation behavior, and a slow march towards herd immunity have resulted in encouraging COVID trends, as you can see from the chart below. However, the bad news is new COVID cases, hospitalizations, and deaths still remain above peak levels experienced last spring and summer.

Revived Recovery

Thanks to the improving COVID trends, a continued economic recovery driven by reopenings, along with fiscal and monetary stimulus, business profits and revenues have effectively recovered all of the 2020 pandemic losses within a year (see chart below).

But with elevated stock prices have come elevated speculation, which we have seen bubble up in various forms. With the rising tide of new investors flooding onto new trading platforms like Robinhood, millions of individuals are placing speculative bets in areas like Bitcoin; new SPACs (Special Purpose Acquisition Companies); overpriced, money-losing cloud software companies; and social media recommended stocks found on Reddit’s WallStreetBets like GameStop (GME), which was up +150% alone last week. At Sidoxia Capital Management, we don’t spend a lot of time chasing the latest fad or stock market darling. Nevertheless, as long-term investors, we continue to find attractively valued investment opportunities that align with our clients’ objectives and constraints.

Overall, the outlook for the end of this pandemic looks promising as multiple COVID vaccines get administered, and the economic recovery gains steam with the help of reopenings and stimulus. If rising interest rates and potential inflation accelerate, these factors could slow the pace of the recovery and limit future stock market returns. However, if you follow a systematic, disciplined, long-term investment plan, like we implement at Sidoxia, you will be in a great position to prosper financially over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MRNA, PFE, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME, JNJ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Market Drops as GameStop Pops

The stock market started with a bang this year with the S&P 500 index at first climbing +3% in January before ending with a whimper and a monthly decline of -1%. This performance followed a strong finish to a wild 2020 presidential election year (the S&P 500 rose +16%). There has been plenty of focus on the coronavirus health crisis and vaccine distribution (100 million doses in 100 days), along with debates over a $1.9 trillion proposed relief package by newly elected President Joe Biden, but there has been another story stealing attention in the financial market headlines…GameStop.

If a global pandemic and a populist attack on the Capitol were not enough for investors, the Reddit (WallStreetBets) and Robinhood revolution coordinated a mass attack on privileged hedge funds and short sellers by squeezing out-of-favor stocks like GameStop (Ticker: GME) to stratospheric levels (up +1,625% to $325/share in January alone) causing an estimated $20 billion of losses for many wealthy elites. To put the meteoric rise into perspective, before GameStop shares reached $325, the stock was valued below $20/share last month and has climbed more than 100x-fold from a low $2.57/share nine months ago (see chart below).

What Exactly Happened?

Well, millions of users on the social media platform Reddit banded together on a forum called “wallstreetbets” (see graphic below). WallStreetBets was established in 2012 and had approximately 1 million subscribers at the beginning of 2021 – today it has more than 7 million subscribers. Millions of these anti-establishment WallStreetBets followers effectively colluded together to inflate the share price of GameStop by ganging up on the many short sellers who were betting that GameStop share price would drop. In other words, Reddit-Robinhood buyer gains led to short seller losses. One hedge fund in particular, Melvin Capital, lost billions of dollars on its GameStop short bet and saw its fund performance decline by a whopping -53% in one month…ouch!

The Reddit WallStreetBets forum may have served as the match in this wildfire, but in order to trigger an inferno, a brokerage account is needed. A trading platform allows individual traders on Reddit to level the playing field against the hedge fund professionals and short sellers. The fuel for the GameStop detonation was Robinhood, a fintech (Financial Technology) brokerage firm founded in Silicon Valley in 2013 by two Stanford University graduates. The mission of the company is to “democratize finance for all.” But let’s not forget what Thomas Jefferson noted, “A democracy is nothing more than mob rule, where fifty-one percent of the people may take away the rights of the other forty-nine.” The Reddit-Robinhood mob certainly proved this point.

Although Robinhood was initially seen as a saint in the free trading revolution, eventually many of the brokerage company’s disciples became disenfranchised. Many users subsequently turned on the company and considered Robinhood a villain that was rigging the system when CEO Vlad Tenev halted the ability of its 13+ million users to buy GameStop shares.

Many traders came to the conclusion that Robinhood was working to save the perceived hedge fund bad guys by the firm temporarily terminating user purchases in GameStop stock. Mr. Tenev blamed regulatory capital requirements as a reason for disallowing Robinhood-ers to buy GameStop last week, which was a major contributing factor to why the stock price plummeted by -44% on January 28th. The following day, Robinhood partially reversed its stance and subsequently allowed minimal daily purchases of one share.

How Does Short Selling Work?

In the stock market, you can make gains by buying shares that go up in price, or you can make profits by short selling shares that go down in price. If you buy a stock, the most money you could lose is -100% of your original investment. For example, if you invest $1,000 into GameStop stock by buying 50 shares at $20 each, if the stock price goes to $0, the most the investor/trader could lose is 100% of their $1,000 original investment.

On the flip side, if you short a stock, the potential losses are limitless. For example, if you (or a hedge fund manager) shorts $1,000 of GameStop stock by selling 50 shares short at $20 each, if the stock price goes to $60, the short seller just loss -200% of their original investment [($20/shr – $60/shr) X 50 shares] = -$2,000. If GameStop goes to $100, the short seller loses -400%, and if GameStop price goes to $220, the short seller loses -1,000%. As you can see, the higher the price goes, there are infinite potential losses of the investor, trader, or hedge fund manager.

If a stock price continues to move higher, the only way for a short seller to stop the bleeding (i.e., close their short position or “bet”) is to buy shares. As a reminder, a buyer of stock closes their position by selling shares after they originally buy shares. A short seller closes their position by buying shares after they initially sell shares short. So again, if GameStop share price continues to move higher, the only way for GameStop short sellers to stop their losses is to buy more GameStop shares. This is the equivalent of pouring gasoline on a blazing fire because as millions of Reddit/Robinhood-ers are pushing GameStop’s share price higher almost every day, short selling hedge fund managers are left scrambling for the exits and forced to close their positions at even higher prices (i.e., larger losses).

What Does This All Mean?

Whether you are talking about speculation in Bitcoin, the rise of SPACs (Special Purpose Acquisition Companies), the increase in the number of IPOs (Initial Public Offerings), or the Reddit-Robinhood Revolution, risk appetite has been on the rise and long-term investors should proceed very cautiously. Just as many have experienced on trips to Las Vegas, big winnings can quickly turn to huge losses. Although it’s certainly fun to watch the individual Davids take down the hedge fund/short selling Goliaths, if the Reddit-Robinhood community gets too aggressive in its speculation, history shows us they will end up being the ones swimming in their tears or stoned to death.

If you need assistance navigating through all these land mines, please give us a call at Sidoxia Capital Management (949-258-4322) for a complimentary portfolio review.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME, AMC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

New Year’s Resolutions and Vaccine Distributions

Many people were ready to flush 2020 down the toilet after the novel coronavirus (COVID-19) global pandemic dominated the daily headlines, but panic eventually turned into optimism. With last year and a new year celebration now behind us, the annual tradition of creating a New Year’s resolution to better one’s life will be a challenge for many in 2021. Why? Well, from a financial perspective, the stock market, as measured by the S&P 500 index, finished the year at another mind-boggling, all-time record high (+16% for the year), making 2020 a tough act to follow.

One area of the stock market performed exceptionally well. With millions of employees, students, and bored Americans locked down for much of the year, demand for computers, mobile phones, and internet-connected televisions swelled. Due to a flood of sales into devices, gadgets, equipment, and software, technology stocks became huge beneficiaries in 2020. The performance of this sector can be gauged by the results of the tech-heavy NASDAQ index, which skyrocketed an astounding +44%.

Countering the Confusion

Given this unexpected surge in stock prices, many casual observers are asking how is it possible the Dow Jones Industrial Average capped off a year above the 30,000 level (best ever) after a year when 80 million people contracted COVID-19 and almost 2 million humans died from the virus?

This month, we will try to answer this confusing question. We shall explore the factors behind the unprecedented collapse early in the year and the subsequent recovery in stock prices surrounding this perplexing virus.

We’ve experienced a lot over the last year: death, destruction, an emotionally divisive presidential election, social distancing, face-coverings, Amazon deliveries, Netflix binging, DoorDash food deliveries, hand-sanitizer stocking, toilet-paper runs, and endless pants-less Zoom video sessions. After all this insanity, here are some reasons for why your and my investment accounts and 401(k) balances still managed to appreciate significantly last year:

- A COVID Cure: Although roughly only 4 million doses of the COVID-19 vaccine have been administered to date (after a 20 million goal), the government has contracted for the delivery of 400 million vaccine doses from Pfizer Inc. (PFE) and Moderna Inc. (MRNA) by summertime. With these two FDA (Food and Drug Administration) approvals alone, these doses should be enough to vaccinate all but about 60 million of the roughly 260 million adult Americans who are eligible to be inoculated. Even better, each of these cures appear to be over 90% effective. What’s more, in the not-too-distant future, additional relief is on its way in the form of further vaccine approvals by the likes of Johnson & Johnson (JNJ), Novavax Inc. (NVAX), AstraZeneca (AZN), and the Sanofi (SNY) / GlaxoSmithKline (GSK).

- Fed Firemen to the Rescue: As the COVID flames are blazing with record numbers of cases, hospitalizations, and deaths, the Federal Reserve firemen have come to an economic rescue by providing accommodative monetary policies. By effectively setting the benchmark Fed Funds Rate to 0% (see chart below), our central bank is not only stimulating loan activity for businesses, but also lowering the cost of mortgages and credit cards for consumers. In addition, the Fed has been providing support to financial markets and invigorating the economy through its asset purchases. More specifically, the Fed outlined its activities in its most recent December statement:

“The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.“

- Economic Recovery is Well on its Way: In addition to the unmatched monetary policy stimulus from the Federal Reserve, we have also experienced an unparalleled $4 trillion in fiscal stimulus to trigger a sharp rebound in economic activity (see red line in chart below). There have been multiple rounds of PPP (Paycheck Protection Program) loans given to small businesses, millions of direct checks distributed to unemployed individuals, along with a host of other programs covering the healthcare, education, and infrastructure industries. As a result of these measures, coupled with the vaccines unleashing massive amounts of pent-up demand, pundits are forecasting above-trendline economic GDP growth in 2021 approximately 4% – 5% (e.g., Merrill Lynch +4.6%, Goldman Sachs +5.9%, and the Federal Reserve +3.7% to +5.0%).

As part of the recovery, the banner year in stocks has also helped catapult consumer household balance sheets to over $120 trillion dollars, while simultaneously reducing debt (leverage) ratios (see chart below).

Flies in the Ointment

It’s worth noting that not all is well in COVID-land. Unemployment rates remain at elevated recessionary levels and industries such as travel, leisure, and restaurants persist in devastation by the pandemic. Politically, the hotly contested 2020 presidential election has largely been resolved, but a Georgia runoff vote this week for two Senate seats could swing full control of Congress to the Democrats. With the stock market at fresh new highs, a Democrat sweep in Georgia would likely be interpreted as a mandate for President-elect Biden to increase taxes for many people and businesses. Under this scenario, a temporary downdraft in the market should come as no surprise to any investor. However, any potential tax hikes on corporations and the wealthy should be accompanied with more infrastructure spending and fiscal spending, which could offset the drag of taxes to varying degrees.

Although Sidoxia Capital Management is still finding plenty of opportunities in the stock market while considering these record low interest rates (yield on 10-year Treasury Note of only 0.92%), areas of vulnerability still exist in recent high-flying, money-losing IPOs (Initial Public Offerings) such as Snowflake Inc. (SNOW), Airbnb Inc (ABNB), and DoorDash Inc (DASH).

Other cautionary areas of excess speculation include the hundreds of SPAC (Special Purpose Acquisition Company) deals totaling more than $70 billion in 2020, and the reemergence of Bitcoin froth (up greater than +300% this year). The recent rush into Bitcoin has been fierce, but industry veterans with memory greater than a gnat recall that Bitcoin plummeted more than -80% from its peak to trough in 2018. Suffice it to say, Bitcoin is not for the faint of heart and buyers should beware.While there was a lot of pain and suffering experienced by millions due to the COVID-19 global pandemic, there was a lot to be thankful for as well, including vaccines to cure the global pandemic. Even though we had another record year at Sidoxia Capital Management, there is always room for improvement. At Sidoxia our New Year’s resolution is always the same: Provide superior investment management and financial planning services, as we build sustaining, long-term relationships with our clients.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 4, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN, NFLX, MRNA, ZM, PFE, NVAX, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in DASH, JNJ, AZN, SNY, GSK, SNOW, ABNB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Politics & COVID Tricks

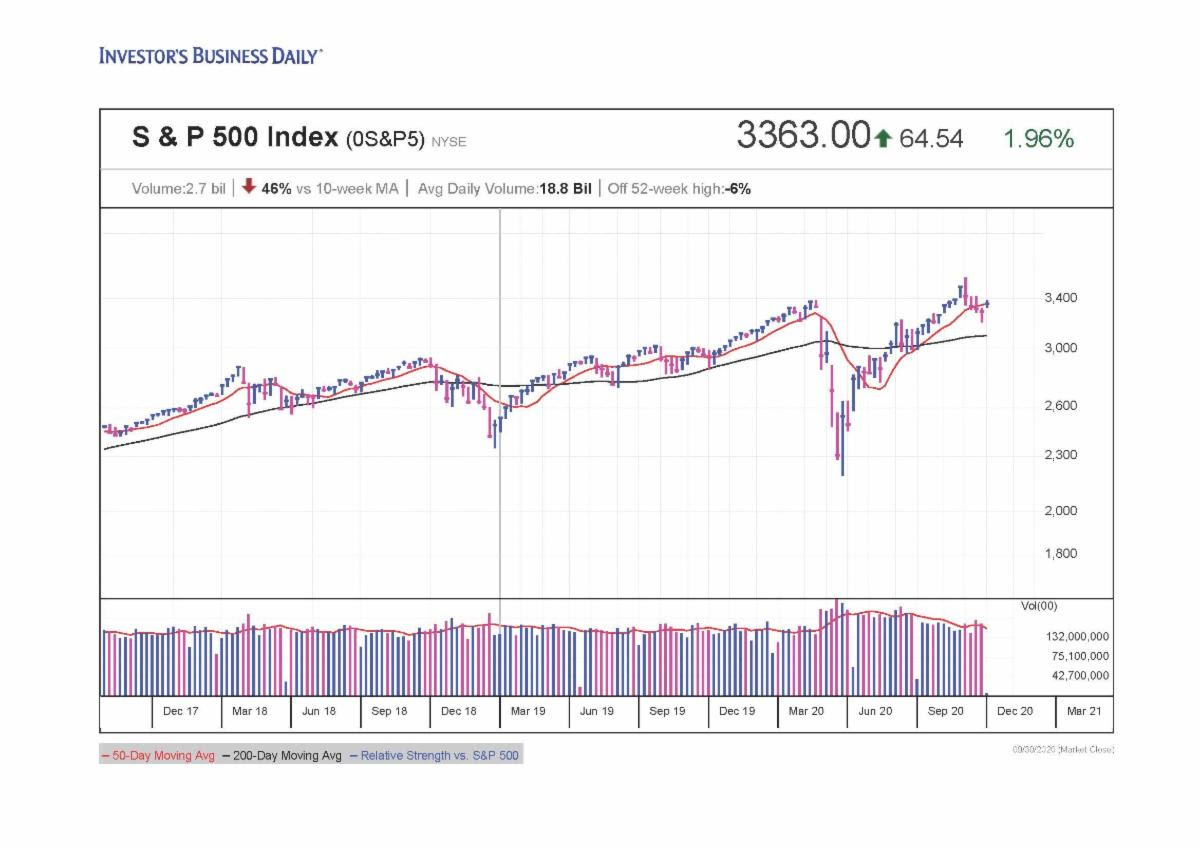

Thanks to a global epidemic, trillions of dollars instantly disappeared during the first quarter of this year, and then, abracadabra…the losses turned into gains and magically reappeared in the subsequent two quarters. After a stabilization in the spread of the COVID-19 virus earlier this year, the stock market rebounded for five consecutive months, at one point rebounding +64% (from late March to early September) – see chart below. However, things became a little bit trickier for the recent full month as concerns heightened over the outcome of upcoming elections; uncertainty over a potential coronavirus-related stimulus package agreement; and fears over a fall resurgence in COVID-19 cases. Although the S&P 500 stock index fell -3.9% and the Dow Jones Industrial Average slipped -2.3% during September, the same indexes levitated +8.5% and +7.6% for the third quarter, respectively.

Source: Investors.com

Washington Worries

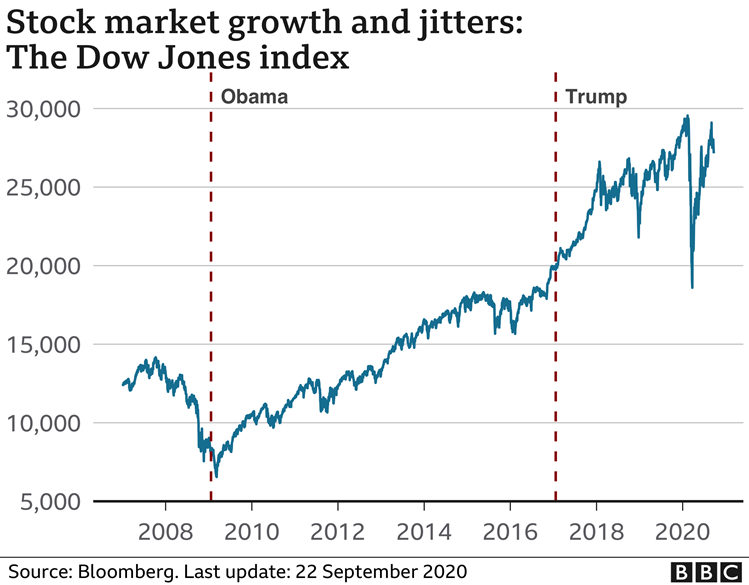

Anxiety over politics is nothing new, and as I’ve written extensively in my Investing Caffeine blog, history teaches us that politics have little to do with the long-term performance of the overall stock market (e.g., see Politics & Your Money). Nobody knows with certainty how the elections will impact the financial markets and economy (myself included). But what I do know is that many so-called experts said the stock market would decline if Barack Obama won the presidential election…in reality the stock market soared. I also know the so-called experts said the stock market would decline if Donald Trump won the presidential election… in reality the stock market soared. So, suffice it to say, I don’t place a lot of faith into what any of the so-called political experts say about the outcome of upcoming elections (see the chart below).

COVID Coming Back?

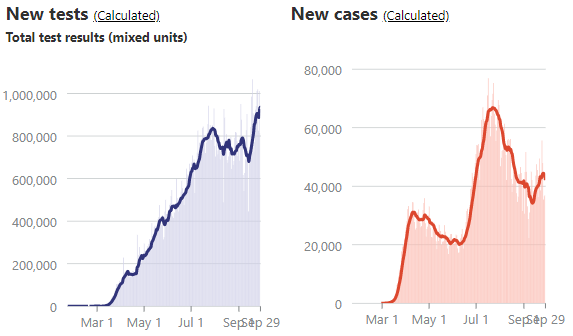

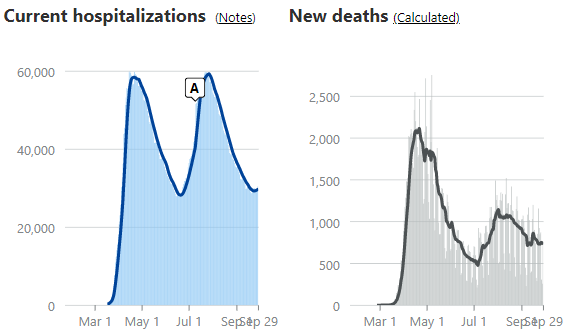

One of the reasons stock prices have risen more than 50%+ is due to a stabilization in COVID-19 virus trends. As you can see from the charts below, new tests, hospitalizations, and death rates are generally on good trajectories, according to the COVID Tracking Project. However, new COVID cases have bumped higher in recent weeks. This recent, troubling trend has raised the question of whether another wave of cases is building in front of a dangerous, seasonally-cooler fall flu season. Traditionally, it’s during this fall period in which contagious viruses normally spread faster.

Source: The COVID Tracking Project

Regardless of the trendline in new cases, there is plenty of other promising COVID developments to help fight this pandemic, such as the pending approvals of numerous vaccines, along with improved therapies and treatments, such as therapeutics, steroids, blood thinners, ventilators, and monoclonal antibodies.

Business Bounce

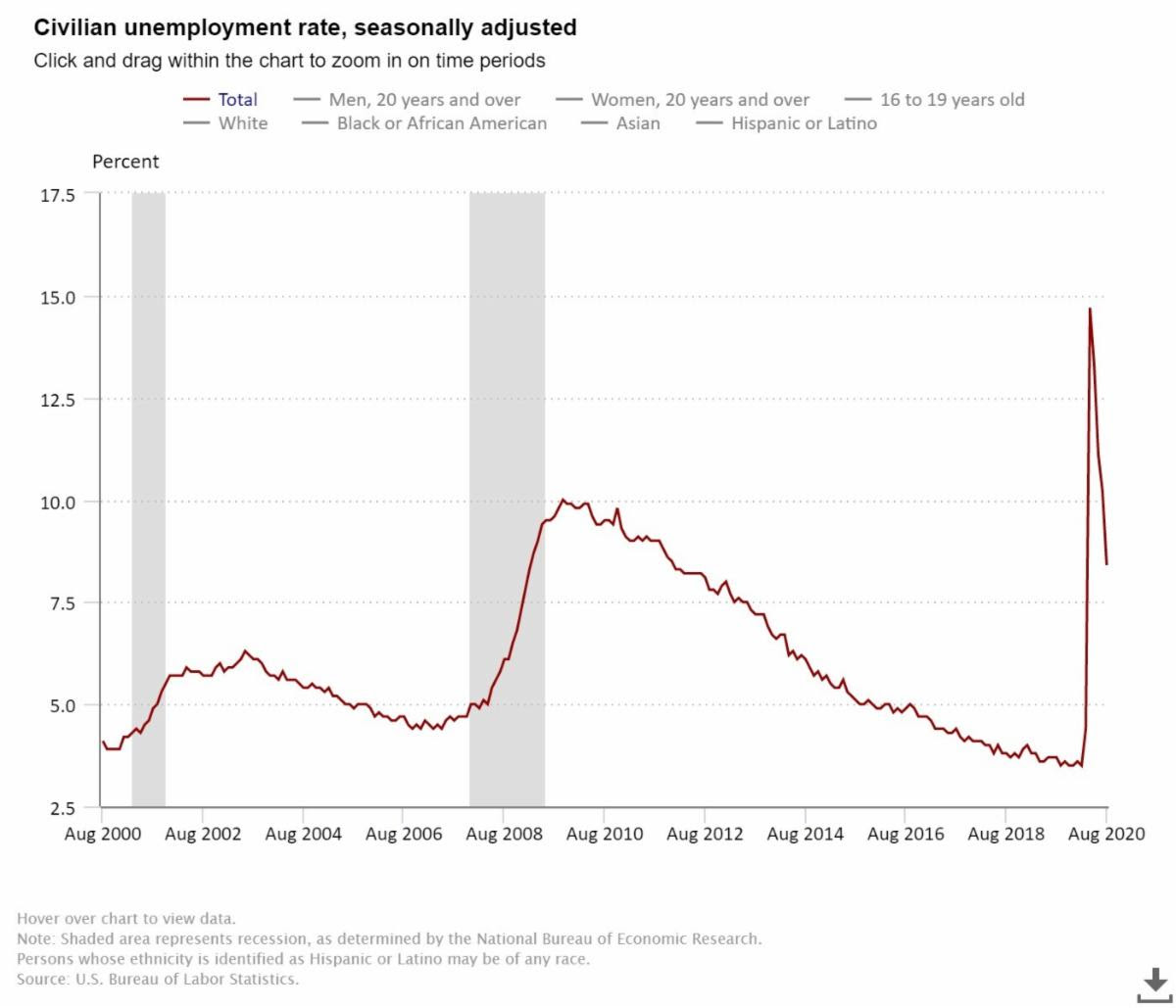

From the 10,000-foot level, despite worries over various political outcomes, the economy is recovering relatively vigorously. As you can see from the chart below, the rebound in employment has been fairly swift. After peaking in April at 14.7%, the most recent unemployment rate has declined to 8.4%, and a closely tracked ADP National Employment Report was released yesterday showing a higher than expected increase in new private-sector monthly jobs (749,000 vs. 649,000 median estimate).

Source: U.S. Bureau of Labor Statistics

From a housing perspective, house sales have been on fire. Record-low interest rates, mortgage rates, and refinancing rates have been driving higher home purchases and rising prices. Urban flight to the suburbs has also been a big housing tailwind due to the desire for more socially distanced room, additional home office space, and expansive backyards. Adding fuel to the housing fire has been record low supply (i.e., home inventories). The robust demand is evident by the record Case-Shiller home prices (see chart below).

Source: Calculated Risk

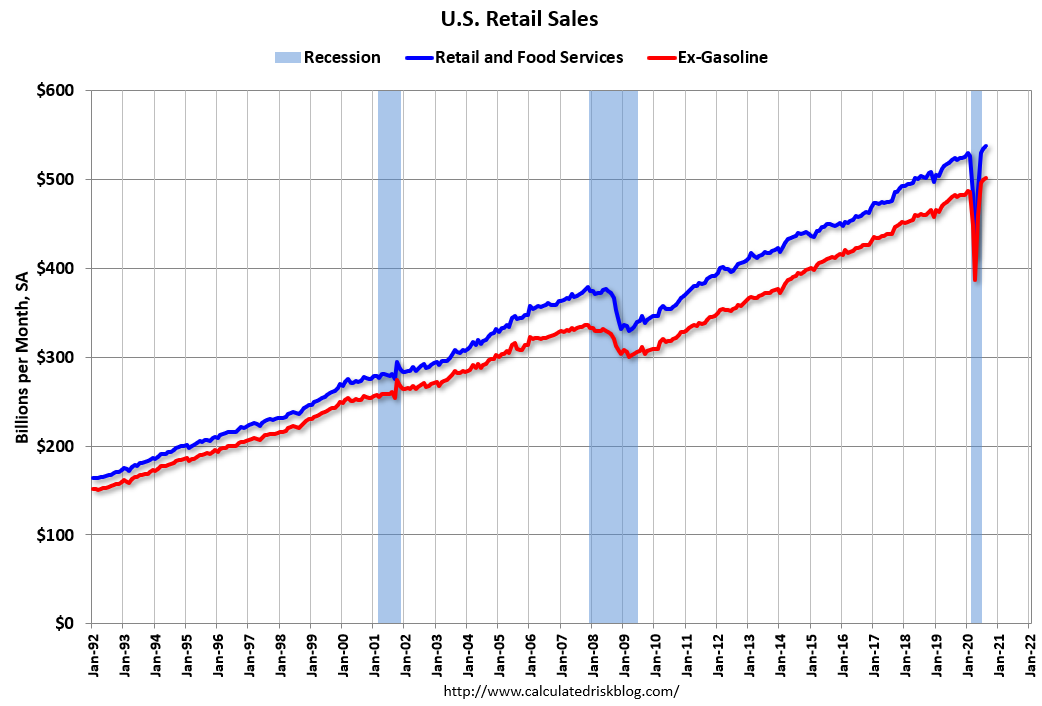

There are plenty of industries hurting, including airlines, cruise lines, hotels, retailers, and restaurants but the economic rebound along with government stimulus (i.e., direct government checks and unemployment relief payments) have led to record retail sales (see chart below). Spending could cool if an additional coronavirus-related stimulus package agreement is not reached, but until the government checks stop flowing, consumers will keep spending.

Source: Calculated Risk

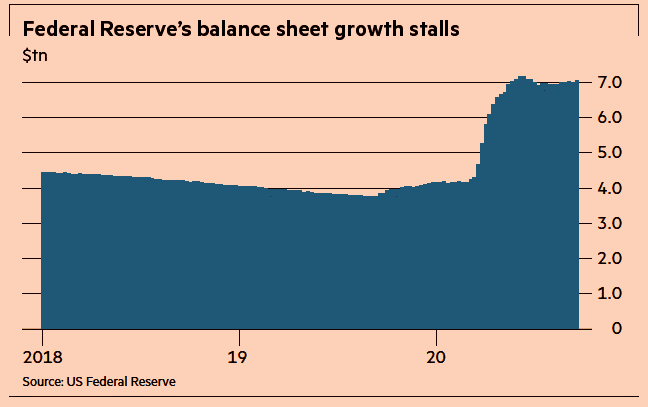

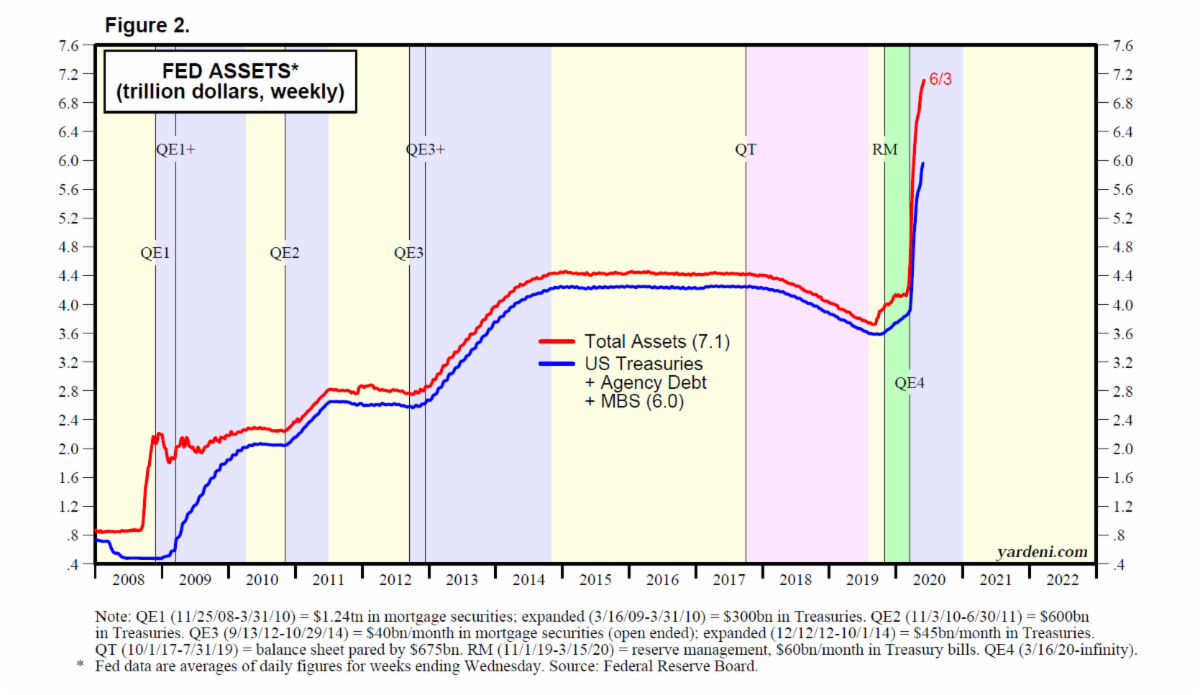

Besides trillions of dollars in fiscal relief injected into the economy, the Federal Reserve has also provided trillions in unprecedented relief (see chart below) through its government and corporate bond buying programs, in addition to its Main Street Lending Program.

Source:The Financial Times

There has been a lot of political hocus pocus and COVID smoke & mirrors that have much of the population worried about their investments. In every presidential election, you have about half the population satisfied with the winner, and half the population disappointed in the winner…this election will be no different. The illusion of fear and chaos is bound to create some short-term financial market volatility over the next month, but behind the curtains there are numerous positive, contributing factors that are powering the economy and stock market forward. Do yourself a favor by focusing on your long-term financial future and don’t succumb to politics and COVID tricks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Pedal to the Metal Leads to Record Rebound

Like a race car pushing the pedal to the metal, the stock market sped to its best quarterly stock market gains in decades. The +20% rebound in the 2nd quarter S&P 500 index was the best result achieved since 1998. Moreover, the Dow Jones Industrial Average saw its largest quarterly gain (+18%) since 1987, and the technology-heavy NASDAQ index (+31%) saw the most appreciation since 2001. While a snap-back after a shockingly dismal 1st quarter should come as no surprise to many investors, the pace of this rebound is unlikely to be sustainable at this trajectory, given the challenging economic backdrop and COVID public health crisis.

Racing Ahead Via Re-Opening

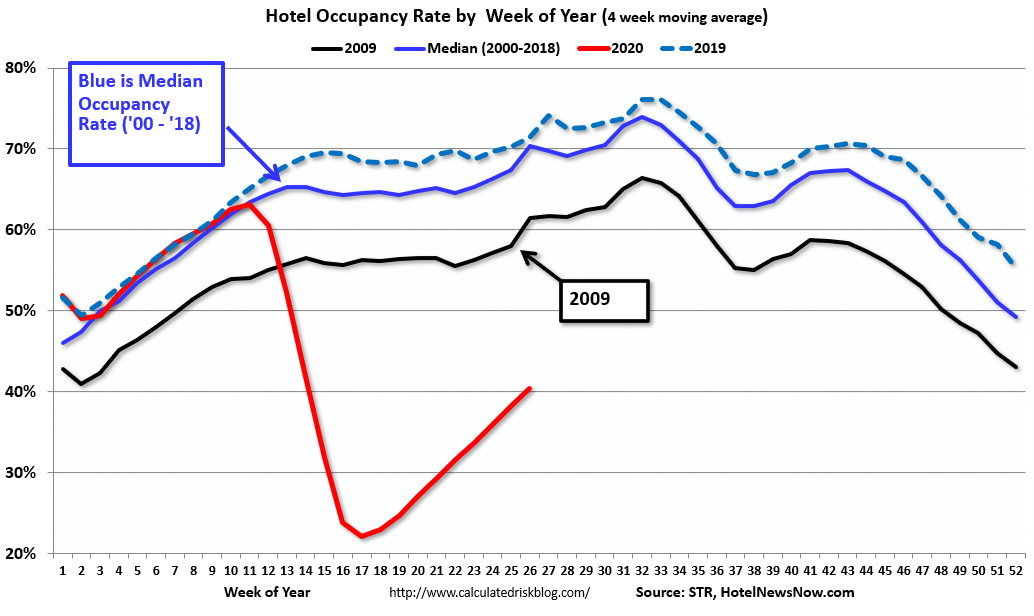

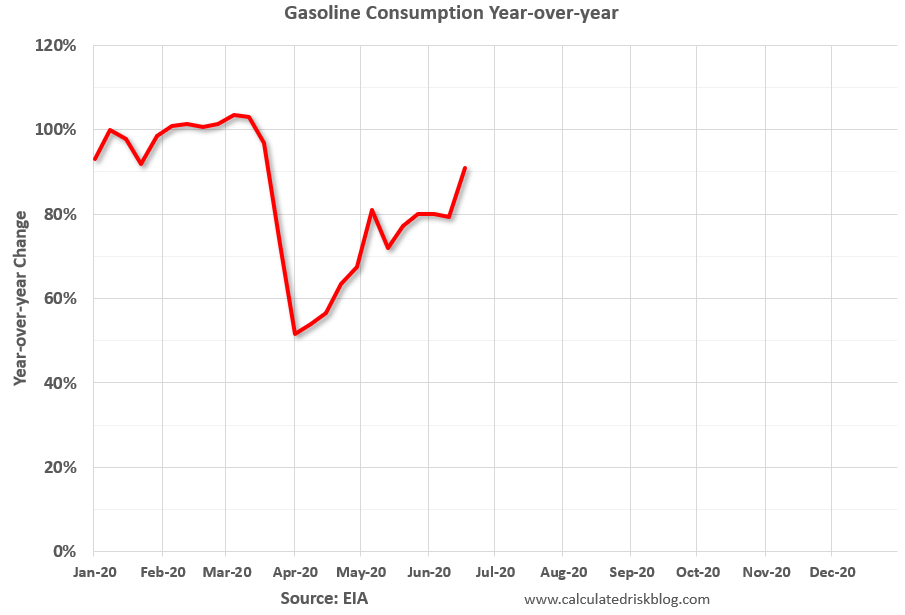

After experiencing six months of the coronavirus pandemic, the country has been re-opening across all 50 states at differing paces. We can see the benefits of a V-shaped recovery in various indicators, such as the following:

- Airline Traffic

- Hotel Occupancy

- Gasoline Consumption

Thanks to unprecedented support from the Federal Reserve in the form of trillions of dollars in stimulative money printing that has been injected into the economy (see chart below), and trillions of government support (including 4.8 million PPP [Payroll Protection Program] loans totaling $519 billion), the economic benefits of the re-openings have been tangible. Not only did the economy unexpectedly add 2.5 million jobs last month, but economic growth is also projected to rebound in the back-half of 2020. More specifically, Treasury Secretary Steven Mnuchin recently testified in front of Congress that 3rd quarter economic growth (GDP – Gross Domestic Product) is currently projected at +17%, and 4th quarter at +9%.

The Stubborn Virus Remains

Many Americans feel liberated from the lifting of stay-at-home orders, but if the re-openings are not handled with proper precautions, the consequences can result in an economic equivalent of serious speeding tickets or jail time. We have experienced this phenomenon firsthand as a surge of new COVID-19 infections has spread predominately across the Southern and Western states, skewed towards younger Americans.

Now that the economic genie has been released out of the bottle, it’s going to be very difficult for state governors and city mayors to stuff the genie back in. Even if the new surge in COVID-19 cases continues, we are more likely to see required health guidelines instituted (e.g., mandatory mask wearing) or rollbacks in certain re-opening phases (e.g., closures of bars, restaurants, and other large gathering establishments). For instance, Disneyland (ticker: DIS) hit some speed bumps when the company just announced its re-opening originally scheduled for mid-July has been delayed indefinitely.

Although COVID infections have been on the rise, driven in part by complacent or irresponsible younger individuals not adhering to social distancing and mask-wearing recommendations, the healthcare treatment regimens have kept the level of deaths at a flat rate (see chart below) and national hospitalization rates at a relatively stable level (see chart below).

The Bridge to a Vaccine

Despite the recent rise in COVID-19 cases, investors have been focused more on the half-glass full developments relating to the pandemic. Approved therapeutics, such as remdesivir by Gilead Sciences Inc. (GILD) and dexamethasone, have proven effective in treating COVID. In addition, ventilator and PPE (Personal Protective Equipment) supplies have become plentiful; virus testing has risen dramatically (see also COVID Comeback); and contact tracing is slowly improving. If you layer in the more than 100 vaccines being developed, including expected Phase 3 trials this year by Pfizer Inc. (PFE), Moderna Inc. (MRNA), Astrazeneca PLC (AZN), Glaxosmithkline PLC (GSK), and Johnson & Johnson (JNJ), there is room for optimism. With all these developments, coupled with more stringent guidelines by governors/federal government/health agencies, and more responsible behavior by individuals (i.e., social distancing, personal hygiene, mask wearing), especially in hot spot regions, there is a credible bridge to managing the virus until a vaccine is approved.

The stock market has been racing ahead at an amazing pace in recent months (+41% since late-March), but with the COVID public health crisis starting to overheat the engine with rising COVID cases, investors should not be shocked to see the driver tap the economic brakes a little in the coming months. For long-term investors like my clients, Sidoxia Capital Management will continue to take advantage of opportunities, while pushing to safely avoid the risky potholes, during these highly volatile times. In periods like these, when your race car has created a large lead, it’s perfectly okay to reassess your circumstances and temporarily take your foot off the pedal before the next turn.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, MRNA, PFE, JNJ, AZN, GSK, and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The COVID Comeback

Rocky Balboa (“The Italian Stallion”) the underdog boxer from the movie, Rocky, was down and out until he was given the opportunity to fight World Heavyweight Champion, Apollo Creed. Like the stock market during early 2020, Rocky was up against the ropes and got knocked down, but eventually he picked himself up and rebounded to victory in his rematch with Creed.

The stock market comeback also persisted last month as the COVID-19 pandemic health situation continued to stabilize and the broader economy accelerated business re-openings. For the month, the Dow Jones Industrial Average increased +4.3% (+1,037 points to 25,383), while the S&P 500 index bounced+5.3%, and the NASDAQ catapulted the most by +6.8%.

How can the stock market (i.e., the Dow) rebound +39%, or more than 7,100 points, from the March 2020 lows? The large move is even more surprising once you consider 41 million people have lost their jobs since the epidemic hit American soil (see chart below), and COVID-19 related deaths have climbed to over 100,000 people.

Getting Back to Fighting Shape

By the time we reached Rocky VI, Rocky Balboa was retired and recovered from brain damage. But Rocky is no quitter, and he trained himself into championship fighting condition and got back into the boxing ring. With unemployment rates approaching Great Depression levels, the U.S. economy has been experiencing challenging circumstances as well – a self-induced coma (shutdown). Fortunately, our country has been slowly recovering day-by-day, and week-by-week. The economy may not be back to peak fighting shape, but activity is slowly and consistently getting better.

There are many different perspectives in looking at this extremely complex, unprecedented coronavirus pandemic. The speed and pace of selling stocks during February and March reached radically-high panic levels, as measured by objective indicators like the Volatility Index (i.e., the VIX – or Fear Gauge). However, like a coiled spring, the stock market sprung back up during April and May as stay-at-home orders and quarantine measures around the world significantly bent the curve of COVID-19 infections and deaths (see chart below). As you can see, with the exception of a few countries globally (e.g., Brazil and Russia), the number of daily confirmed deaths has been broadly declining for many weeks.

Estimated infections have been coming down as well, according to the Institute for Health Metrics and Evaluation (IMHE). IMHE estimates also show the number of daily infections has consistently been coming down over the last couple months.

In addition to the stay-at-home orders and social distancing protocols, what has also contributed to the declines in COVID-19 deaths and infections? Two words…”increased testing.” Although, arguably COVID-19 testing got off to a rough start, as seen in the chart below, nevertheless daily tests have risen dramatically over the last couple months from about 100,000 per day to roughly 500,000 per day (see chart below). Increased testing capacity has and will continue to help better control the spread (or lack thereof) of the virus.

Not only has the spread of the coronavirus been substantially mitigated, but the fighting economy has also received an adrenaline shot in the form of trillions of dollars of fiscal and monetary support as I described in my previous article ( see also Recovering from the Coma).

Investors Need to Keep Guard Up

Like Rocky Balboa, the U.S. is a strong, respected fighter but even though strength is being regained, the economy and stock market is susceptible to a surprise upper-cut punch or hook. What could potentially hurt the financial comeback?

- Flare Ups & Second Wave: As cities, counties, and states carry on with expanded business openings, we could experience “flare ups” of COVID-19 infections or a “second wave.” But the good news is, we should be in much better shape to handle these scenarios thanks to expanded stockpiles of ventilators; larger supplies of PPE (Personal Protective Equipment) for frontline workers; increased production of therapeutic drugs like remdesivir from Gilead Sciences Inc. (GILD); and improved contact tracing from the magnified number of tests. And this analysis doesn’t even contemplate the more than 100 vaccines being developed (i.e., a potential cure) for COVID-19, which could be available in limited quantities as early as the end of this year.

- Social Unrest: The death of George Floyd, an African-American man who died after a Minneapolis police officer forcefully restrained George by keeping his knee on his neck, which triggered lethal complications to the victim. As a result, nationwide racial injustice protests and disruptive violence have erupted, thereby forcing government intervention with the hope of limiting violence and damage caused by non-peaceful protesters.

- Strained Relations with China Due to Actions in Hong Kong: Recent political actions mandated by the Chinese government to strip autonomy from Hong Kong has strained relations with the United States, and progress made with the previous U.S. – China trade deal could erode.

- Inflation: Despite no near-term evidence of rising prices, the unparalleled increase of trillions of dollars in fiscal debt and deficits has the credible long-term potential of creating incendiary inflation that could burn through consumers’ buying power.

Rocky Balboa faced many formidable foes in the boxing ring, including Clubber Lang (Mr. T) and Russian Ivan Drago, but Rocky survived and persevered. The stock market is bound to face future punches from unforeseen challengers in the form of impending known and unknown threats, but the alarmist calls for a COVID knockout appear to be overstated.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

January a Ball After Year-End Fall

Investors were cheerfully dancing last month after the stock market posted its best January in 30 years and the best monthly performance since October 2015 (see chart below). More specifically, the S&P 500 index started the year by catapulting +7.9% higher (the best January since 1987), and the Dow Jones Industrial Average climbed 1,672 points to 25,000, or +7.2%. But over the last few months there has been plenty of heartburn and volatility. The December so-called Santa Claus rally did not occur until a large pre-Christmas pullback. From the September record high, stocks temporarily fell about -20% before the recent jolly +15% post-Christmas rebound.

Source: FactSet via The Wall Street Journal

Although investors have been gleefully boogying on the short-run financial dance floor, there have been plenty of issues causing uncomfortable blisters. At the top of the list is China-U.S. trade. The world is eagerly watching the two largest global economic powerhouses as they continue to delicately dance through trade negotiations. Even though neither country has slipped or fallen since the 90-day trade truce, which began on December 1 in Buenos Aires, the stakes remain high. If an agreement is not reached by March 2, tariffs on imported Chinese goods would increase to 25% from 10% on $200 billion worth of Chinese goods, thereby raising prices for U.S. consumers and potentially leading to further retaliatory responses from Beijing.

When it comes to the subjects of intellectual property protection and forced technology transfers of American companies doing business in China, President Xi Jinping has been uncomfortably stepping on President Donald Trump’s toes. Nothing has been formally finalized, however Chinese officials have signaled they are willing to make some structural reforms relating to these thorny issues and have also expressed a willingness to narrow the trade deficit with our country by purchasing more of our exports. Besides procuring more American energy goods, the Chinese have also committed to buy 5,000,000 tons of our country’s soybeans to feed China’s hungry population of 1.4 billion people.

Reaching a trade settlement is important for both countries, especially in light of the slowing Chinese economy (see chart below) and the dissipating stimulus benefits of the 2018 U.S. tax cuts. Slowing growth in China has implications beyond our borders as witnessed by slowing growth in Europe as evidenced by protests we have seen in France and the contraction of German manufacturing (the first time in over four years). Failed Brexit talks of the U.K. potentially leaving the European Union could add fuel to the global slowdown fire if an agreement cannot be reached by the March 29th deadline in a couple months.

Source: Wind via The Wall Street Journal

While the temporary halt to the longest partial federal government shutdown in history (35 days) has brought some short-term relief to the 800,000 government workers/contractors who did not receive pay, the political standoff over border security may last longer than expected, which may further dampen U.S. economic activity and growth. Whether the hot-button issue of border wall funding is resolved by February 15th will determine if another shutdown is in the cards.

Despite China trade negotiations and the government shutdown deadlock placing a cloud over financial markets, brighter skies have begun to emerge in other areas. First and foremost has been the positive shift in positioning by the Federal Reserve as it relates to monetary policy. Not only has Jay Powell (Fed Chairman) communicated a clear signal of being “patient” on future interest rate target increases, but he has also taken the Fed off of “autopilot” as it relates to shrinking the Fed’s balance sheet – a process that can hinder economic growth. Combined, these shifts in strategy by the Fed have been enthusiastically received by investors, which has been a large contributor to the +15% rebound in stock prices since the December lows. Thanks to this change in stance, the inverted yield curve bogeyman that typically precedes post-World War II recessions has been held at bay as evidenced by the steepening yield curve (see chart below).

Source: Calafia Beach Pundit

Other areas of strength include the recent employment data, which showed 304,000 jobs added in January, the 100th consecutive month of increased employment. Fears of an imminent recession that penetrated psyches in the fourth quarter have abated significantly in January in part because of the notable strength seen in 4th quarter corporate profits, which so far have increased by +12% from last year, according to FactSet. The strength and rebound in overall commodity prices, including oil, seem to indicate any potential looming recession is likely further out in time than emotionally feared.

Source: Calafia Beach Pundit

As the chart above shows, over the last four years, spikes in fear (red line) have represented beneficial buying opportunities of stocks (blue line). The pace of gains in January is just as unsustainable as the pace of fourth-quarter losses were in stock prices. Uncertainties may remain on trade, shutdowns, geopolitics, and other issues but don’t throw away your investing dance shoes quite yet…the ball and music experienced last month could continue for a longer than expected period of time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.