Posts tagged ‘taxes’

Dividends: From Sapling to Abundant Fruit Tree

Dividends are like fruit and an investment in stock is much like purchasing a sapling. When purchasing a stock (sapling) the goal is two-fold: 1) Buy a sapling (tree) that is expected to bear a lot of fruit; and 2) Pay a cheap or fair price. If the right saplings are purchased at the right prices, then investors can enjoy a steady diet of fruit that has the potential of producing more fruit each year. Fruit can come in the form of future profits, but as we will see, the sweetness of a profitable company also paying dividends can prove much more fruitful over the long-term.

Investing in growth equities at reasonable prices seems like a pretty intelligent strategy, but of late the vast majority of fresh investor capital has been piling into bonds. This is not a flawed plan for retirees (and certain wealthy individuals) and should be a staple in all investment portfolios, to a degree (some of my client portfolios contain more than 80%+ in fixed income-like securities), but for many investors this overly narrow bond focus can lead to suboptimal outcomes. Right now, I like to think of bonds like a reliable bag of dried fruit, selling for a costly price. However, unlike stocks, bonds do not have the potential of raising periodic payments like a sapling with strong growth prospects. “Double-dippers” who are expecting the economy to spiral into a tailspin, along with nervous snakebit equity investors, prefer the reliability of the bagged dry fruit (bonds)… no matter how high the price.

How Sweet is the Fruit? How Does a +2,300% Yield Sound?

Not only do equities offer the potential of capital appreciation, but they also present the prospect of dividend hikes in the future – important characteristics, especially in inflationary environments. Bonds, on the other hand, offer static fixed payments (no hope of interest rate hikes) with declining purchasing power during periods of escalating general prices.

Given the possibility of a “double-dip” recession, one would expect corporate executives to be guarding their cash with extreme stinginess. On the contrary, so far in 2010, companies have shown their confidence in the recovery by increasing or initiating dividends at a +55% higher clip versus the same period last year. Underpinning these announcements, beyond a belief in an economic recovery, are large piles of cash growing on the balance sheets of nonfinancial companies. According to Standard & Poor’s (S&P), cash hit a record $837 billion at the end of March, up from $665 billion last year.

The S&P 500 dividend yield at 2.06% may not sound overwhelmingly high, but with CDs and money markets paying next to nothing, the Federal Funds rate at effectively 0%, and the 10-Year Treasury Note yielding an uninspiring 3.11%, the S&P yield looks a little more respectable in that light.

If the stock market yield doesn’t enthuse you, how does a +2,300% yield sound to you? That’s roughly what a $.05 (split adjusted) purchase of Wal-Mart (WMT) stock in 1972 would be earning you today based on the current $1.21 dividend per share paid today. That return alone is mind-blowing, but this analysis doesn’t even account for the near 1,000-fold increase in the stock price over the similar timeframe. That’s what happens if you can find a company that increases its dividend for 37 consecutive years.

Procter & Gamble (PG) is another example. After PG increased its dividend for 54 consecutive years, from a split-adjusted $.01 per share in 1970 to a $1.93 payout today, original shareholders are earning an approximate 245% yield on their initial investment (excluding again the massive capital appreciation over 40 years). There’s a reason investment greats like Warren Buffett have invested in great dividend franchises like WMT, PG, KO, BUD, WFC, and AXP.

Bad Apples do Exist

Dividend payment is not guaranteed by any means, as evidenced by the dividend cuts by financial institutions during the 2008-2009 crisis (e.g., BAC, WFC, C) or the discontinuation of BP PLC’s (BP) dividend after the Gulf of Mexico oil spill disaster. Bonds are not immune either. Although bonds are perceived as “safe” investments, the interest and principal payment streams are not fully insured – just ask bondholders of bankrupt companies like Lehman Brothers, Visteon, Tribune, or the countless other companies that have defaulted on their debt promises.

This is where doing your homework by analyzing a company’s competitive positioning, financial wherewithal, and corporate management team can lead you to those companies that have a durable competitive advantage with a corporate culture of returning excess capital to shareholders (see Investing Caffeine’s “Education” section). Certainly finding a WMT and/or PG that will increase dividends consistently for decades is no easy chore, but there are dozens of budding possibilities that S&P has identified as “Dividend Aristocrats” – companies with a multi-year track record of increasing dividends. And although there is uncertainty revolving around dividend taxation going into 2011, I believe it is fair to assume dividend payment treatment will be more favorable than bond income.

Apple Allocation

Growth companies that reinvest profits into new value-expanding projects and/or hoard cash on the balance sheet may make sense conceptually, but dividend paying cultures instill a self-disciplining credo that can better ensure proper capital stewardship by corporate boards. All too often excess capital is treated as funny money, only to be flushed away by overpaying for some high-profile acquisition, or meaningless share buybacks that merely offset generous equity grants to employees.

So, when looking at new and existing investments, consider the importance of dividend payments and dividend growth potential. Investing in an attractively priced sapling with appealing growth prospects can lead to incredibly fruitful returns.

Read the Whole WSJ Article on Dividends

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in BAC, WFC, C, BP, PG, KO, BUD, WFC, AXP, Lehman Brothers, Visteon, Tribune, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

EBITDA: Sniffing Out the Truth

Financial analysts are constantly seeking the Holy Grail when it comes to financial metrics, and to some financial number crunchers EBITDA (Earnings Before Interest Taxes Depreciation and Amortization – pronounced “eebit-dah”) fits the bill. On the flip side, Warren Buffett’s right hand man Charlie Munger advises investors to replace EBITDA with the words “bullsh*t earnings” every time you encounter this earnings metric. We’ll explore the good, bad, and ugly attributes of this somewhat controversial financial metric.

The Genesis of EBITDA

The origin of the EBITDA measure can be traced back many years, and rose in popularity during the technology boom of the 1990s. “New Economy” companies were producing very little income, so investment bankers became creative in how they defined profits. Under the guise of comparability, a company with debt (Company X) that was paying interest expense could not be compared on an operational profit basis with a closely related company that operated with NO debt (Company Z). In other words, two identical companies could be selling the same number of widgets at the same prices and have the same cost structure and operating income, but the company with debt on their balance sheet would have a different (lower) net income. The investment banker and company X’s answer to this apparent conundrum was to simply compare the operating earnings or EBIT (Earnings Before Interest and Taxes) of each company (X and Z), rather than the disparate net incomes.

The Advantages of EBITDA

Although there is no silver bullet metric in financial statement analysis, nevertheless there are numerous benefits to using EBITDA. Here are a few:

- Operational Comparability: As implied above, EBITDA allows comparability across a wide swath of companies. Accounting standards provide leniency in the application of financial statements, therefore using EBITDA allows apples-to-apples comparisons and relieves accounting discrepancies on items such as depreciation, tax rates, and financing choice.

- Cash Flow Proxy: Since the income statement traditionally is the financial statement of choice, EBITDA can be easily derived from this statement and provides a simple proxy for cash generation in the absence of other data.

- Debt Coverage Ratios: In many lender contracts certain debt provisions require specific levels of income cushion above the required interest expense payments. Evaluating EBITDA coverage ratios across companies assists analysts in determining which businesses are more likely to default on their debt obligations.

The Disadvantages of EBITDA

While EBITDA offers some benefits in comparing a broader set of companies across industries, the metric also carries some drawbacks.

- Overstates Income: To Charlie Munger’s point about the B.S. factor, EBITDA distorts reality. From an equity holder’s standpoint, in most instances, investors are most concerned about the level of income and cash flow available AFTER all expenses, including interest expense, depreciation expense, and income tax expense.

- Neglects Working Capital Requirements: EBITDA may actually be a decent proxy for cash flows for many companies, however this profit measure does not account for the working capital needs of a business. For example, companies reporting high EBITDA figures may actually have dramatically lower cash flows once working capital requirements (i.e., inventories, receivables, payables) are tabulated.

- Poor for Valuation: Investment bankers push for more generous EBITDA valuation multiples because it serves the bankers’ and clients’ best interests. However, the fact of the matter is that companies with debt or aggressive depreciation schedules do deserve lower valuations compared to debt-free counterparts (assuming all else equal).

Wading through the treacherous waters of accounting metrics can be a dangerous game. Despite some of EBITDA’s comparability benefits, and as much as bankers and analysts would like to use this very forgiving income metric, beware of EBITDA’s shortcomings. Although most analysts are looking for the one-size-fits-all number, the reality of the situation is a variety of methods need to be used to gain a more accurate financial picture of a company. If EBITDA is the only calculation driving your analysis, I urge you to follow Charlie Munger’s advice and plug your nose.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Short-Termism & Extremism: The Death Knell of our Future

In recent times, American society has been built on a foundation of instant gratification and immediate attacks, whether we are talking about politics or economics. Often, important issues are simply presented as black or white in a way that distorts the truth and rarely reflects reality, which in most cases is actually a shade of grey. President Obama is discovering the challenges of governing a global superpower in the wake of high unemployment, a fragile economy, and extremist rhetoric from both sides of the political aisle. Rather than instituting a promise of change, President Obama has left the natives restless, wondering whether a “change for worse” is actually what should be expected in the future.

Massachusetts voters made a bold and brash statement when they elected Republican Senator Scott Brown to replace the vacated Massachusetts Senate seat of late, iconic Democratic Senator Edward Kennedy – a position he held as a Democrat for almost 47 years. Obama’s response to this Democratic body blow and his fledging healthcare reform was to go on a populist rampage against the banks with a tax and break-up proposal. Undoubtedly, financial reform is needed, but the timing and tone of these misguided proposals unfortunately does not attack the heart of the financial crisis causes – excessive leverage, lack of oversight, and irresponsible real estate loans (see also, Investing Caffeine article on the subject).

With that said, I would not write President Obama’s obituary quite yet. President Reagan was left for dead in 1982 before his policies gained traction and he earned a landslide reelection victory two years later. In order for President Obama to reverse his plummeting approval ratings and garner back some of his election campaign mojo, he needs to lead more from the center. Don’t take my word for it, review Pew Research’s data that shows Independents passing up both Republicans and Democrats. The overall sour mood is largely driven by the economic malaise experienced by all in some fashion, and unfortunately has contributed to short-termism and extremism.

Technology has flattened the world and accelerated the exchange of information globally at the speed of light. Any action, recommendation, or gaffe that deviates from the approved script immediately becomes a permanent fixture on someone’s lifetime resume. Our comments and decisions become instant fodder for the worldly court of opinion, thanks to 24/7 news cycles and millions of passionate opinions blasted immediately through cyberspace and around the globe.

Short-termism and extremism can be just as poisonous in the economic world as in the political world. This dynamic became evident in the global financial crisis. Short-termism is just another phrase for short-term profit focus, so when more and more leverage led to more and more profits and higher asset prices, the financial industry became blinded to the long-term consequences of their short-term decisions.

Solutions:

- Small Bites First: Rather than trying to ram through half-baked, massive proposals laced with endless numbers of wasteful pork barrel projects, why not focus on targeted and surgical legislation first? If education, deficit-reduction, and job creation are areas of common interest for Republicans and Democrats, then start with small legislation in these areas first. More ambitious agendas can be sought out later.

- Embrace Globalization: Based on the “law of large numbers” and the scale of the United States economy, our slice of the global economic pie is inevitably going to shrink over time. How does the $14 trillion U.S economy manage to grow if its share is declining? Simple. By eschewing protectionist policies, and embracing globalization. Developing country populations are joining modern society on a daily basis as they integrate productivity-enhancing innovations used by developed worlds for decades. In a flat world, the narrowing of the productivity gap is only going to accelerate. The question then becomes, does the U.S. want to participate in this accelerating growth of developing markets or sit idly on the sideline watching our competitors eat our lunch?

- Hail Long-Termism and Centrism: Regulations and incentives need to be instituted in such a fashion that irresponsible behavior occurring in the name of instant short-term profits is replaced with rules that induce sustainable profits and competitive advantages over our economic neighbors. Much of the financial industry is scratching and screaming in the face of any regulatory reform suggestions. The bankers’ usual response to reform is to throw out scare tactics about the inevitable damage caused by reform to the global competitiveness of our banking industry. No doubt, the case of “anti-competiveness” is a valid argument and any reforms passed could have immediate negative impacts on short-term profits. Like the bitter taste of many medicines, I can accept regulatory remedies now, if the long-term improvements outweigh the immediate detrimental aspects.

The focus on short-termism and extremism has created an acidic culture in both Washington and on “Main Street,” making government changes virtually impossible. If President Obama wants to implement the change he campaigned on, then he needs to take a more centrist view that concentrates on enduring benefits – not immediate political gains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Article first submitted to Alrroya.com before being published on Investing Caffeine.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but at the time of publishing had no direct positions in securities mentioned in the article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

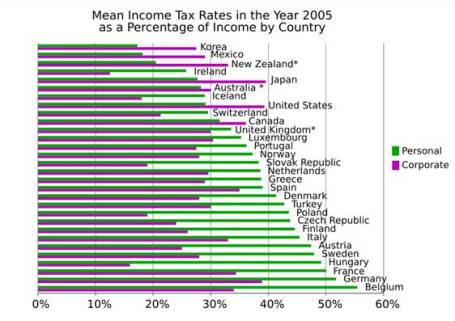

Plucking the Feathers of Taxpaying Geese

“The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.” ~Jean Baptist Colbert

With exploding deficits, multiple wars, healthcare reform, and a sluggish economy, there are two logical immediate choices on how to improve our current financial situation:

1) Cut spending. This is not a desirable option for politicians since benefit cuts to voters are not appreciated come re-election period.

2) Raise Taxes. Not desirable from a voter standpoint either, but the Obama administration has chosen to target the rich – the smaller voting population. This can of course backfire, when many of these wealthy individuals are campaign contributors or have ties to lobbyists who are backing the President’s agendas.

The tax-paying geese are getting fatter, but before the goose can be put in the oven, the feathers need plucking with the goal of minimizing hissing. Sure, I am an advocate for tax cuts like most taxpayers. I’m even a larger proponent, if Congress had the political gumption to cut spending to fund the tax drops. Unfortunately, politicians view expense reduction as suicide because cutting programs or benefits will only lead to fewer reelection votes. Congressmen are perfectly fine letting taxpayers live high on the hog for now, and just saddle future generations with our mounting debt problems.

What’s Fair?

The current strategy is based on taxing the wealthy to fund deficits, healthcare, wars, debt, etc. Since the rich represent a smaller proportion of voters, from the egotistical politician standpoint (reelection is paramount), this wealth distribution strategy appears more palatable to incumbent legislators. Democrats would rather focus on squeezing a narrower demographic footprint of voters versus an across the board tax increase, which would impact all taxpayers. Merely taxing the rich can certainly backfire however, especially if the wealthy demographic getting taxed is the exact population paying for the politicians’ reelection and lobbying agendas.

But at what point is taxing the rich unfair and counterproductive? Currently the top 10% of the nation that earns more than $92,400 a year, pay about 72% of the country’s income taxes. Ari Fleischer, former G.W. Bush Press Secretary compares the current tax policy to an “inverted pyramid scheme” in a Wall street Journal Op-Ed earlier this year. Like an upside spinning top, the whirling pyramid is supported by a narrow, pointy pinnacle.

Fleischer goes onto add:

“According to the CBO, those who made less than $44,300 in 2001 — 60% of the country — paid a paltry 3.3% of all income taxes. By 2005, almost all of them were excused from paying any income tax. They paid less than 1% of the income tax burden. Their share shrank even when taking into account the payroll tax. In 2001, the bottom 60% paid 16.3% of all taxes; by 2005 their share was down to 14.3%. All the while, this large group of voters made 25.8% of the nation’s income. When you make almost 26% of the income and you pay only 0.6% of the income tax, that’s a good deal, courtesy of those who do pay income taxes.”

Cheaters Should Not Be Exempt (See Celebrity Tax Evader Article)

Certainly loopholes and undeserving credits for multinationals and the wealthy should be removed as well. The House of Representatives recently approved a $387 million boost for the IRS to fund a high-wealth unit focusing on trusts, real estate investments, privately held companies and other business entities controlled by rich individuals (read Reuters article). The IRS is also opening new criminal offices in Beijing, Panama City and Sydney to focus on international enforcement of tax cheaters. At the center of the IRS’ offshore effort is the legal cases against Swiss banking giant UBS (stands for Union Bank of Switzerland), which resulted in UBS agreeing to turn over almost 5,000 client names and pay $780 million to settle tax evasion charges.

Taxes in 2010 and Beyond

When it comes to future taxes, a lot of details remain up in the air. What we do know is that the 2001 Bush tax cuts are set to expire in 2010 and the Obama administration has indicated they want to raise taxes on the rich (those earning more than $250,000) and keep the cuts static for those in the lower paying tax brackets.

- Healthcare: If healthcare reform will indeed pass, those benefits won’t be free. The Obama administration is backing a House bill that creates a 5.4% surtax on income over $500,000 for single filers or $1 million for couples.

- Income Taxes: On the income tax front, Obama and some Democrats are pushing to have the two highest tax brackets revert back to the pre-2001 levels of 36% and 39.6%.

- Capital Gains: If the Obama administration gets its way, capital-gains tax rates would go back to 20% for wealthier individuals and qualified dividends would be taxed as ordinary income up to the top rate of 39.6%.

- Estate Taxes: The House passed a bill earlier this month that makes the 2009 estate tax provisions permanent (i.e., a 45% top marginal rate on estates larger than $3.5 million or $7 million for married couples). If the Senate were not to pass the bill, current law has the estate tax rate reverting to a 55% rate on estates worth more than $1 million after next year.

Given the exploding deficits and weary economy, which is recovering from a severe economic crisis, getting our tax policy situation back in order is critical. Having politicians make tough tax policy decisions runs contrary to their partisan reelection agendas, however our country needs to pluck more feathers from our taxpaying geese to face these monumental economic challenges…even if it requires listening to irritating hissing from our citizens.

Ari Fleischer WSJ Op-Ed From Earlier This Year

Article on Tax Policy Issues for 2010 and Beyond

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in an security referenced, including UBS. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Secure Your GPS (Global Portfolio Specialist)

We’ve all been there, our head in our hands, lost in the middle of nowhere. One reason for blame can be overconfidence in the directions provided or our map reading abilities. Now we have GPS (Global Positioning System) devices – a tool I now could never live without. In the investment world, with the damage that has been done, intelligent advice is needed more than ever. Unfortunately, there is no GPS device to guide our investments, but many individuals would do their self a favor by finding the right experienced professional advisor to act as your GPS device (Global Portfolio Specialist).

Getting from point A to point B in the real world can be quite simple. In the investment world, the roadways are constantly shifting. Changes in interest rates, tax policies, unemployment, fiscal initiatives can represent obstacles, the equivalent of road construction barriers, potholes, erosion, mudslides, and earthquakes in our quest for financial freedom. Navigating these winding paths can require a GPS advice. Asking for help or directions can be embarrassing and castigating for some, especially for some proud males. Stubbornly appearing to have the answer can be more important for some, and can cloud the decision making process – even if assistance can lead to the most efficient path to prosperity.

Having a guide at your fingertips as you meet unknown forks in the road is a nice asset to have. Unfortunately finding the right guide is much easier said than done, many guides can have ulterior motives and hidden agendas that conflict with yours. So although, having a guide may be ideal, finding the right guide requires a lot of research (read how to find an advisor). The scope of qualifications between the capabilities of one advisor compared to another can be like comparing a plastic butter knife with a stainless steel swiss-army knife. The cheap butter knife may handle a few simple needs, but most investors would be better served by someone with a breadth of tools that can assist you with a diverse set of circumstances.

The old cliché states men hate to get directions while women seek a security blanket (a plan). GPS is not full proof, as occasionally the software is not updated or gets confused. But tech geeks like me have grown to love the assistance and benefit from the heightened efficiency and safety it provides. Not only am I more confident, but it also gets me to where I want to go in less time.

Having your guide is important when it comes to investments, but having someone with expertise in tax planning (should I consider Roth conversion in 2010?); estate planning (what impact will the expected changes in the estate tax rate have on my future?); and insurance planning (do I have adequate life, health, and business insurance?) can be critical. All these areas can have a profound impact on whether you achieve your personal and financial goals.

Along the road of life, there can be many bumps, twists and turns. If you would like the assistance of a professional advisor, consider doing your homework and finding the appropriate GPS. Here is a checklist:

1) Where are You Now? This means taking inventory of your assets and liabilities, getting a handle on your income and expenses, and having a firm understanding of your tax and family planning issues (will, trust, powers of attorneys, etc.)

2) Where are You Going? Next you need to know where you want to go? You may have a rough idea, but in order to create a coherent plan, goals need to be defined.

3) Create a Plan. Everyone’s map or blueprint will look different. Some will need highly detailed directions, while others due to different circumstances may have less complex needs or shorter distances to travel. Some may need guidance and directions to reach an adjacent state, while others may have more ambitious goals or planning needed to reach the peak of Mount Everest. Different destinations and circumstances will require different planning.

4) Monitor and Adjust Plan as Necessary. Road conditions, weather, breakdowns, flight cancellations, among many other unforeseen circumstances can change the path to your goal. That’s why it’s so important to review, not only the changes in external circumstances, such as the financial markets, but also any individual changes whether it’s health, family, personal, or goal related.

Some people prefer to do things the old-fashion way or are happy with subpar technology (i.e., compass). However, if you do not want to get lost, or want a clearer defined map, then it’s time to shop for that new Global Portfolio Specialist who can help guide you to your destination.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) or its clients owns certain exchange traded funds, but currently has no direct position in GRMN. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Celebrity Tax Evaders Run But Can’t Hide

As Mark Twain said, “The only certainties in life are death and taxes.” That is, of course, unless you decide to not pay your taxes. Some well known celebrities fall into this camp.

The financial crisis has hit the economy hard and the impact has been felt directly by our nation’s cash register (i.e., the Internal Revenue Service – IRS). Based on 2006 IRS data, the U.S. had about an 84% Voluntary Compliance Rate (VCR) by tax payers in 2001; a goal of 85% VCR in 2009; and Senate Finance Committee Chairman Max Baucus has thrown out a 90% voluntary compliance goal by 2017. Those collection goals may be a little ambitious given the recession and the escalating unemployment trends over 2008 – 2009.

So who makes up the deadbeats who have deliberately or unintentionally not paid their taxes? Obviously 10-15% of the non-paying tax-payer base is a large number, but the real fun comes by tracking the smaller celebrity component of the tax evaders. Let’s take a look at some of the more prominent dodgers (data provided by The Daily Beast):

- O.J. Simpson: In 2007 the state of California placed listed Mr. Simpson as one of their worst tax offenders, owing close to $1.5 million. Currently he is serving a 33-year sentence in a Nevada prison for an armed robbery and kidnapping conviction.

- Willie Nelson: The long-haired hippy and king of country music, Willie Nelson, was hunted down by the IRS for $16.7 million in 1990. Fortunately for him, his star-power allowed him to record albums and pay back his debt by 1993.

- Wesley Snipes: The Blade movie star claimed the reason he owed more than $17 million in taxes, penalties, and interest is because he was a “non-resident alien.” The judge didn’t buy the explanation, and now he is appealing a three-year prison sentence.

- Pete Rose: “Charlie Hustle,” the all-star baseball player of the Cincinnati Reds served five months in prison for not paying taxes on his autograph, memorabilia, and horse-racing income. Mr. Rose cleared the slate by performing 1,000 hours of community service and paying off $366,000 in debt.

- Nicolas Cage: Not sure if he is shooting a movie in New Orleans, but Mr. Cage is attempting to iron out a $6.2 million tax liability through a Louisiana court for his failure to keep up with 2007 taxes.

- Judy Garland: Men are not the only non-compliers, even if they account for the majority. Judy Garland, from Wizard of Oz fame, had her own tax problems. Besides tax evasion charges in the early 1950s, she accumulated about $4 million in IRS debt after her 1964 variety show (The Judy Garland Show) was cancelled.

- Al Capone: One of most well known cases in tax evasion history is tied to famous mobster Al Capone. After a long, controversial trial, Mr. Capone was convicted and handed an 11-year sentence, predominantly at Alcatraz. He got out early on parole in 1939 and kept a relatively low profile.

There are countless others that have gotten into tax problems with the IRS. Many of them make plenty of money to pay their taxes, however spending habits, laziness, or aggressive tax accountants may explain the reasons behind the tax evasion problems.

See a more complete media gallery of tax evaders here, provided by The Daily Beast.

Regardless of the celebrities’ tax-paying compliance rates, the IRS will have its collection hands full, given the sad state of the current economic environment and the crafty tax-dodging techniques pursued by some citizens. Unlike others, I’ll make sure to write myself a note, reminding me to write a check to my friends at the IRS on April 15th – especially if it involves millions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

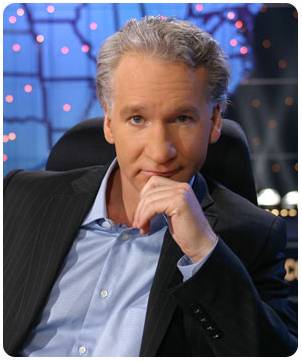

Maher Cheerleads No Profit Healthcare

Bill Maher, shock-comedian and host of Real Time with Bill Maher on HBO, has made up a new rule in a recent article, “Not Everything in America Has to Make a Profit.”

Hey Bill, that sounds intriguing. I’ve got an idea – how about you decide to work for no profit? If free healthcare is a right for every American, then why should people pay for your stupid jokes? If I have a right to free healthcare, then why not a right to free laughs?

Don’t get me wrong, our system is broke and needs to be fixed. The real question, is insuring an additional 50 million uninsured, by the same bureaucratic healthcare system leading the Medicare train-wreck, our best approach in solving our healthcare crisis? Sure, doing nothing should not be a fallback, but I’m not sure a trillion dollar healthcare plan with Washington bureaucrats is the best idea either? I’m not against government involvement, but before we dive headfirst into the deep-end with additional deficit exploding plans, why not wade in the shallow end and slowly roll-out success-based models that prove their superiority first.

I’m no medical expert, but let’s take the best structures, whether it’s the Mayo Clinic, Cleveland Clinic, or other leading structures and have the government manage a steady roll-out. If the government can prove a lower-cost, more efficient way of serving higher quality care, then by all means…let’s see it. Some argue we don’t have time to test new models, well unfortunately our disastrous system took decades to create and a pork-filled bill through Congress is not going to be an immediate silver-bullet for our dire healthcare problems.

Getting back to Mr. Maher’s profit objections on healthcare, I wonder if he’s ever complained or contemplated the innovations created by the profit-laden healthcare system. Whether it’s an MRI, hip replacement, cholesterol drug, cancer test, glaucoma treatment, ADHD medication or the hundreds of other beneficial advancements, maybe Mr. Maher should ask and understand where all these innovations came from? The answer: good old profits that were invested in critical research and development. Without those profits, there would be fewer and less impactful healthcare innovation for millions of Americans.

As for the firemen who do not “charge” or make a profit, I would like to remind Mr. Maher who is paying their fair share for those services consumed by hundreds of millions of Americans – it’s those same “soulless vampires making money off human pain” that you castigate. Profitable corporations are funding those essential government services with tax dollars derived from, you guessed it, profits. If we can find a lower-cost, more efficient way of serving the public services by the government, then as Phil Knight from Nike (NKE) says, “Just Do It!” Unfortunately, I prefer to see some tangible proof first, before spending hundreds of billions of tax dollars.

Healthy Incentives

From an early age, even as babies, we are incentivized for certain behavior. Whether it’s offering M&Ms to potty-train a two year old, or submitting six-figure bonuses to a fifty-two year old for hitting department profit targets, incentives always plays a central role in shaping behavior. Figure out the desired behavior and create incentives for your subjects (and penalties for non-compliance).

As the government comes up with a public solution, I have no problem with Washington pressuring insurance companies and the medical industry to become more efficient and provide a higher threshold of care. I’m confident that structures can be put in place that mitigate conflicts of interest (i.e., pure profit motive), while increasing the standard of care and efficiency. Rewarding the healthcare industry with incentives, rather than just simply beating them over the head with lower reimbursements under a single-payer system, may produce longer-lasting, sustainable benefits.

In certain areas of society, such as policemen/women, firefighters, national defense, and doctors there has always been a view that government is better suited for handling certain services. However, sometimes government does not implement the proper incentive plans, which then leads to bureaucracy, inefficiency, and excessive costs. Eventually, these negative trends overwhelm the system into failure, much like sand grinding engine gears to a halt.

Bill, I appreciate your viewpoint, and I like you would love if everything was free. For starters, I’ll look for your press release announcing the cancellation of your multi-million contract with HBO, closely followed by the revelation of your pro-bono comedy work. Here’s to profitless prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in NKE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Studies Show Investors Ready to Look at New Advisors

Breaking up is tough to do, especially when you’ve had a chummy relationship with your financial advisor. BusinessWeek recently ran an article urging investors to seek a second opinion, much the same way people do when they request opinions from more than one doctor.

Read BusinessWeek Article: Thinking of Switching Financial Planners?

“Just as a good doctor should respect your decision to see a second opinion, so should your financial adviser be open to review.”

Unfortunately, when it comes to money, the average investor focuses more on the emotional aspects of the client –advisor relationship rather than the objective facts. Given the volatility in the financial markets, investors continue to sift through the rubble over the last 18 months, only to find commissions, fees, taxes, and misallocated portfolios.

A Wall Street Journal article in April highlighted the survey from Prince & Associates Inc., which showed more than 75% of investors with more than $1 million to invest plan to move some money away from their investors – more than 50% intend to leave their advisors altogether. According to the Spectrem Group (July 2009 BusinessWeek article), only 36% of millionaires believe their advisors performed well through the financial crisis of 2008-2009. Another study done by the Wharton School of Business and State Street Advisors showed that only 31% of investing clients are extreme satisfied, even though their Advisors think 65% of the clients are very satisfied.

Over our lives, we have switched CPAs, attorneys, hair-stylists and auto-mechanics, so why the difficulty in considering advisor change? The emotional aspects and uncertainty of the financial markets can cloud the decision making process. That’s why now, better than ever, it is an ideal time to ask tough questions and shop around for the top advice you deserve. In addition to bad advice, commissions and fees could be eating away at your investment returns, forcing a later than anticipated retirement or a lower quality of life. I myself prefer filet mignon over macaroni & cheese.

Given the unabated free-fall of last fall appears to have abated and the economy appears to be finding firmer footing, do yourself a favor and get a second opinion – there’s not a lot of downside.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.