Posts tagged ‘stock market’

More Treats, Less Tricks

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 2, 2015). Subscribe on the right side of the page for the complete text.

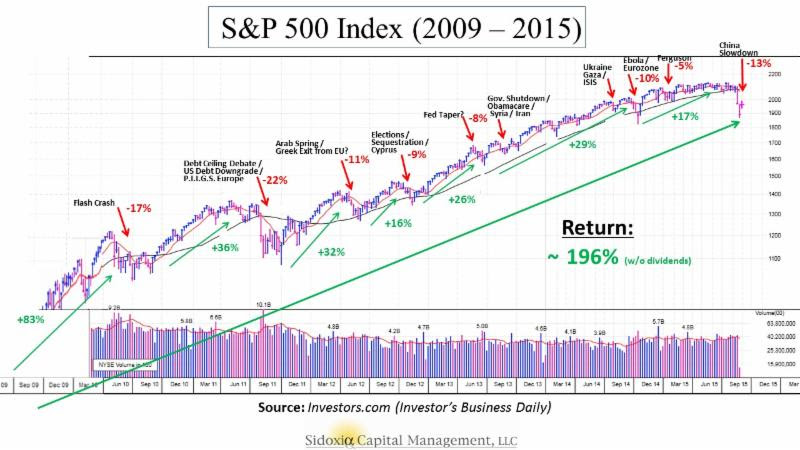

Have you finished licking the last of your Halloween chocolate-covered fingers and scheduled your next cavity-filled dental appointment? After a few challenging months, the normally spooky month of October produced an abundance of sweet treats rather than scary tricks for stock market investors. In fact, the S&P 500 index finished the month with a whopping +8.3% burst, making October the tastiest performing month since late 2010. This came in stark contrast to the indigestion experienced with the -8.7% decline over the previous two months.

What’s behind all these sweet gains? For starters, fears of a Chinese economic sugar-high ending in a crash have abated for now. With that said, “Little Red Riding Hood” is not out of the woods quite yet. Like a surprising goblin or ghost popping out to scare you at a Halloween haunted house, China could still rear its ugly head in the future due to its prominent stature as the second largest global economy. We have been forced to deal with similar on-again-off-again concerns associated with Greece.

The good news is the Chinese government and central bank are not sitting on their hands. In addition to interest rate cuts and corruption crackdowns, Chinese government officials have even recently halted its decades-long one-child policy. China’s new two-child policy is designed to spur flagging economic growth and also reverse the country’s aging demographic profile.

Also contributing to the stock market’s sugary October advances is an increasing comfort level with the Federal Reserve’s eventual interest rate increase. Just last week, the central bank released the statement from its October Federal Open Market Committee meetings stating it will determine whether it will be “appropriate” to increase interest rates at its next meetings, which take place on December 15th and 16th. Interest rate financial markets are now baking in a roughly 50% probability of a Fed interest rate hike next month. Initially, the October Fed statement was perceived negatively by investors due to fears that higher rates could potentially choke off economic growth. Within a 30 minute period after the announcement, stock prices reversed course and surged higher. Investors interpreted the Fed signal of a possible interest rate hike as an upbeat display of confidence in a strengthening economy.

As I have reiterated on numerous occasions (see also Fed Fatigue), a +0.25% increase in the Federal Funds rate from essentially a level of 0% is almost irrelevant in my eyes – just like adjusting the Jacuzzi temperature from 102 degrees down to 101 degrees is hardly noticeable. More practically speaking, an increase from 14.00% to 14.25% on a credit card interest rate will not deter consumers from spending, just like a 3.90% mortgage rising to 4.15% will not break the bank for homebuyers. On the other hand, if interest rates were to spike materially higher by 3.00% – 4.00% over a very short period of time, this move would have a much more disruptive impact, and would be cause for concern. Fortunately for equity investors, this scenario is rather unlikely in the short-run due to virtually no sign of inflation at either the consumer or worker level. Actually, if you read the Fed’s most recent statement, Fed Chairwoman Janet Yellen indicated the central bank intends to maintain interest rates below “normal” levels for “some time” even if the economy keeps chugging along at a healthy clip.

If you think my interest rate perspective is the equivalent of me whistling past the graveyard, history proves to be a pretty good guide of what normally happens after the Fed increases interest rates. Bolstering my argument is data observed over the last seven Federal Reserve interest rate hike cycles from 1983 – 2006 (see table below). As the statistics show, stock prices increased an impressive +20.9% on average over Fed interest rate “Tightening Cycles.” It is entirely conceivable that the announcement of a December interest rate hike could increase short-term volatility. We saw this rate hike fear phenomenon a few months ago, and also a few years ago in 2013 (see also Will Rising Rates Murder Market?) when Federal Reserve Chairman Ben Bernanke threatened an end to quantitative easing (a.k.a., “Taper Tantrum”), but eventually people figured out the world was not going to end and stock prices ultimately moved higher.

Besides increased comfort with Fed interest rate policies, another positive contributing factor to the financial market rebound was the latest Congressional approval of a two-year budget deal that prevents the government from defaulting on its debt. Not only does the deal suspend the $18.1 trillion debt limit through March 2017 (see chart below), but the legislation also lowers the chance of a government shutdown in December. Rather than creating a contentious battle for the fresh, incoming Speaker of the House (Paul Ryan), the approved budget deal will allow the new Speaker to start with a clean slate with which he can use to negotiate across a spectrum of political issues.

Source: Wall Street Journal

Remain Calm – Not Frightened

Humans, including all investors, are emotional beings, but the best investors separate fear from greed and are masters at making unemotional, objective decisions. Just as everything wasn’t a scary disaster when stocks declined during August and September, so too, the subsequent rise in October doesn’t mean everything is a bed of roses.

Every three months, thousands of companies share their financial report cards with investors, and so far with more than 65% of the S&P 500 companies reporting their results this period, corporate America is not making the honor roll. Collapsing commodity prices, including oil, along with the rapid appreciation in the value of the U.S. dollar (i.e., causing declines in relatively expensive U.S. exports), third quarter profit growth has declined -1%. If you exclude the energy sector from the equation, corporations are still not making the “Dean’s List,” however the report cards look a lot more respectable through this lens with profits rising +6% during the third quarter. A sluggish third quarter GDP (Gross Domestic Product) growth report of +1.5% is further evidence the economy has plenty of room to improve the country’s financial GPA.

Historically speaking, October has been a scary period, if you consider the 1929 and 1987 stock market crashes occurred during this Halloween month. Now that investors have survived this frightening period, we will see if the “Santa Claus Rally” will arrive early this season. Stock market treats have been sweet in recent weeks, but investors cannot lose sight of the long-term. With interest rates near generational lows, investors need to make sure they are efficiently investing their investment funds in a low-cost, tax-efficient, diversified manner, subject to personal time horizons and risk tolerances. Over the long-run, meeting these objectives will create a lot more treats than tricks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Bungee Market

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (September 1, 2015). Subscribe on the right side of the page for the complete text.

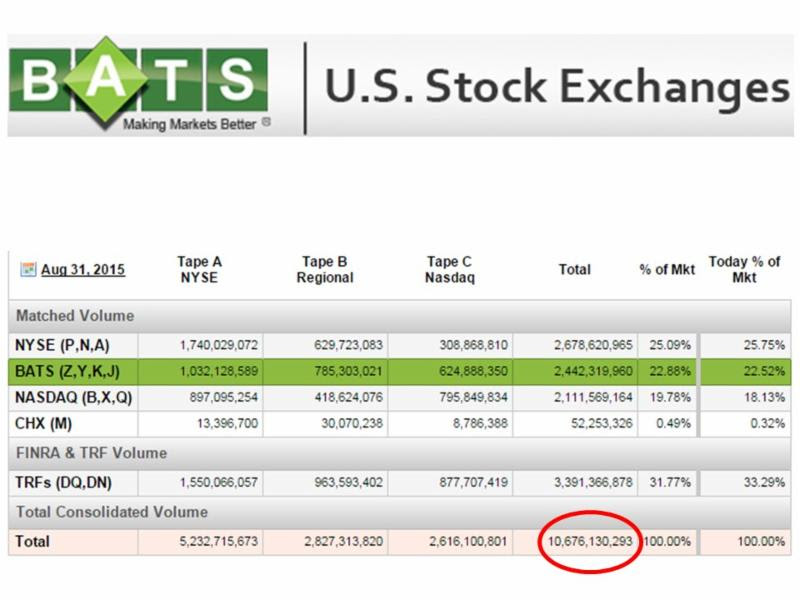

Are you an adrenaline junkie? You may be one and not even know it. If you are an investor in the stock market, you may have noticed a sinking feeling in your investment portfolio before a sharp bounce-back, much like a bungee jump. Before the recent drop of -6.6% in the Dow during August, some stock investors got lulled into a state of complacency, considering a tripling in stock prices over the last six years.

Almost any current or future news headline has the capability of potentially triggering a short-term bungee jump in stock prices. Now, worries over the health of the Chinese economy and financial markets, coupled with concerns of an impending rate hike by the Federal Reserve have created some tension for global financial markets. The slowdown in China should not be ignored, but as famed investor Bill Nygren pointed out, its impact should be placed in the proper context. China only represents 15% of global economic activity and U.S. exports to China only account for 0.7% of our GDP.

- 5% market corrections, 3 times per year on average (“correction” = price decline);

- 10% market corrections, 1 time per year on average; and

- 20% market corrections, 1 time every 3.5 years on average.

Welcome Back Volatility! Mini Flash Crash

- Economic growth revised higher (Q2 GDP raised to +3.7% from +2.3%)

- Unemployment rate continues to drop ( at 5.3%, a 7-year low)

- Interest rates near historic lows (3.95%, 30-year mortgage rate), which will remain massively stimulative even if the Fed modestly increases short-term rates

- U.S. corporate profits are near record highs (despite dampening effect of the strong U.S. dollar on exports)

- Reasonable valuations (improved after latest index price declines)

- Housing market on a steady recovery (existing home sales at multi-year highs and pricing up +6% vs. July of last year)

- Massively accommodative central banks around the globe (e.g., European Central Bank and People’s Bank of China)

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Investors Take a Vacation

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 3, 2015). Subscribe on the right side of the page for the complete text.

It’s summertime and the stock market has taken a vacation, and it’s unclear when prices will return from a seven month break. It may seem like a calm sunset walk along the beach now that Greek worries have temporarily subsided, but concerns have shifted to an impending Federal Reserve interest rate hike, declining commodity prices, and a Chinese stock market crash, which could lead to a painful sunburn.

If you think about it, stock investors have basically been on unpaid vacation since the beginning of the year, with the Dow Jones Industrial Index (17,690) down -0.7% for 2015 and the S&P 500 (2,104) up + 2.2% over the same time period (see chart below). Despite mixed results for the year, all three main stock indexes rebounded in July (including the tech-heavy NASDAQ +2.8% for the month) after posting negative returns in June. Overall for 2015, sector performance has been muddled. There has been plenty of sunshine on the Healthcare sector (+11.7%), but Energy stocks have been stuck in the doldrums (-13.4%), over the same timeframe.

Source: Yahoo! Finance

Chinese Investors Suffer Heat Stroke

Despite gains for U.S. stocks in July, the overheated Chinese stock marketcaused some heat stroke for global investors with the Shanghai Composite index posting its worst one month loss (-15%) in six years, wiping out about $4 trillion in market value. Before coming back down to earth, the Chinese stock market inflated by more than +150% from 2014.

Driving the speculative fervor were an unprecedented opening of 12 million monthly accounts during spring, according to Steven Rattner, a seasoned financier, investor, and a New York Times journalist. Margin accounts operate much like a credit card for individuals, which allowed these investors to aggressively gamble on the China market upswing, but during the downdraft investors were forced to sell stocks to generate proceeds for outstanding loan repayments. It’s estimated that 25% of these investors only have an elementary education and a significant number of them are illiterate. Further exacerbating the sell-off were Chinese regulators artificially intervening by halting trading in about 500 companies on the Shanghai and Shenzhen exchanges last Friday, equivalent to approximately 18% of all listings.

Although China, as the second largest economy on the globe, is much more economically important than a country like Greece, recent events should be placed into proper context. For starters, as you can see from the chart below, the Chinese stock market is no stranger to volatility. According to Fundstrat Global Advisors, the Shanghai composite index has experienced 10 bear markets over the last 25 years, and the recent downdraft doesn’t compare to the roughly -75% decline we saw in 2007-2008. Moreover, there is no strong correlation between the Chinese stock market. Only 15% of Chinese households own stocks, or measured differently, only 6% of household assets are held in stocks, says economic-consulting firm IHS Global Insight. More important than the question, “What will happen to the Chinese stock market?,” is the question, “What will happen to the Chinese stock economy?,” which has been on a perennial slowdown of late. Nevertheless, China has a 7%+ economic growth rate and the highest savings rate of any major country, both factors for which the U.S. economy would kill.

Source: Yardeni.com

Don’t Take a Financial Planning Vacation

While the financial markets continue to bounce around and interest rates oscillate based on guesswork of a Federal Reserve interest rate hike in September, many families are now returning from vacations, or squeezing one in before the back-to-school period. The sad but true fact is many Americans spend more time planning their family vacation than they do planning for their financial futures. Unfortunately, individuals cannot afford to take a vacation from their investment and financial planning. At the risk of stating the obvious, planning for retirement will have a much more profound impact on your future years than a well-planned trip to Hawaii or the Bahamas.

We live in an instant gratification society where “spend now, save later” is a mantra followed by many. There’s nothing wrong with splurging on a vacation, and to maintain sanity and family cohesion it is almost a necessity. However, this objective does not have to come at the expense of compromising financial responsibility – or in other words spending within your means. Investing is a lot like consistent dieting and exercising…it’s easy to understand, but difficult to sustainably execute. Vacations, on the other hand, are easy to understand, and easy to execute, especially if you have a credit card with an available balance.

It’s never too late to work on your financial planning muscle. As I discuss in a previous article (Getting to Your Number) , one of the first key steps is to calculate an annual budget relative to your income, so one can somewhat accurately determine how much money can be saved/invested for retirement. Circumstances always change, but having a base-case scenario will help determine whether your retirement goals are achievable. If expectations are overly optimistic, spending cuts, revenue enhancing adjustments, and/or retirement date changes can still be made.

When it comes to the stock market, there are never a shortage of concerns. Today, worries include a Greek eurozone exit (“Grexit”); decelerating China economic growth and a declining Chinese stock market; and the viability of Donald’s Trump’s presidential campaign (or lack thereof). While it may be true that stock prices are on a temporary vacation, your financial and investment planning strategies cannot afford to go on vacation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Digesting Stock Gains

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (June 1, 2015). Subscribe on the right side of the page for the complete text.

Despite calls for “Sell in May, and go away,” the stock market as measured by both the Dow Jones Industrial and S&P 500 indexes grinded out a +1% gain during the month of May. For the year, the picture looks much the same…the Dow is up around +1% and the S&P 500 +2%. After gorging on gains of +30% in 2013 and +11% in 2014, it comes as no surprise to me that the S&P 500 is taking time to digest the gains. After eating any large pleasurable meal, there’s always a chance for some indigestion – just like last month. More specifically, the month of May ended as it did the previous six months…with a loss on the last trading day (-115 points). Providing some extra heartburn over the last 30 days were four separate 100+ point decline days. Realized fears of a Greek exit from the eurozone would no doubt have short-term traders reaching for some Tums antacid. Nevertheless, veteran investors understand this is par for the course, especially considering the outsized profits devoured in recent years.

The profits have been sweet, but not everyone has been at the table gobbling up the gains. And with success, always comes the skeptics, many of whom have been calling for a decline for years. This begs the question, “Are we in a stock bubble?” I think not.

Bubble Bites

Most asset bubbles are characterized by extreme investor/speculator euphoria. There are certainly small pockets of excitement percolating up in the stock market, but nothing like we experienced in the most recent burstings of the 2000 technology and 2006-07 housing bubbles. Yes, housing has steadily improved post the housing crash, but does this look like a housing bubble? (see New Home Sales chart)

Source: Dr. Ed’s Blog

Another characteristic of a typical asset bubble is rabid buying. However, when it comes to the investor fund flows into the U.S. stock market, we are seeing the exact opposite…money is getting sucked out of stocks like a Hoover vacuum cleaner. Over the last eight or so years, there has been almost -$700 billion that has hemorrhaged out of domestic equity funds – actions tend to speak louder than words (see chart below):

Source: Investment Company Institute (ICI)

Source: Investment Company Institute (ICI)

The shift to Exchange Traded Funds (ETFs) offered by the likes of iShares and Vanguard doesn’t explain the exodus of cash because ETFs such as S&P 500 SPDR ETF (SPY) are suffering dramatically too. SPY has drained about -$17 billion alone over the last year and a half.

With money flooding out of these stock funds, how can stock prices move higher? Well, one short answer is that hundreds of billions of dollars in share buybacks and trillions in mergers and acquisitions activity (M&A) is contributing to the tide lifting all stock boats. Low interest rates and stimulative monetary policies by central banks around the globe are no doubt contributing to this positive trend. While the U.S. Federal Reserve has already begun reversing its loose monetary policies and has threatened to increase short-term interest rates, by any objective standard, interest rates should remain at very supportive levels relative to historical benchmarks.

Besides housing and fund flows data, there are other unbiased sentiment indicators that indicate investors have not become universally Pollyannaish. Take for example the weekly AAII Sentiment Survey, which shows 73% of investors are currently Bearish and/or Neutral – significantly higher than historical averages.

The Consumer Confidence dataset also shows that not everyone is wearing rose-colored glasses. Looking back over the last five decades, you can see the current readings are hovering around the historical averages – nowhere near the bubblicious 2000 peak (~50% below).

Source: Bespoke

Recession Reservations

Even if you’re convinced there is no imminent stock market bubble bursting, many of the same skeptics (and others) feel we’re on the verge of a recession – I’ve been writing about many of them since 2009. You could choke on an endless number of economic indicators, but on the common sense side of the economic equation, typically rising unemployment is a good barometer for any potentially looming recession. Here’s the unemployment rate we’re looking at now (with shaded periods indicating prior recessions):

As you can see, the recent 5.4% unemployment rate is still moving on a downward, positive trajectory. By most peoples’ estimation, because this has been the slowest recovery since World War II, there is still plenty of labor slack in the market to keep hiring going.

An even better leading indicator for future recessions has been the slope of the yield curve. A yield curve plots interest rate yields of similar bonds across a range of periods (e.g., three-month bill, six-month bill, one-year bill, two-year note, five-year note, 10-year note and 30-year bond). Traditionally, as short-term interest rates move higher, this phenomenon tends to flatten the yield curve, and eventually inverts the yield curve (i.e., short-term interest rates are higher than long-term interest rates). Over the last few decades, when the yield curve became inverted, it was an excellent leading indicator of a pending recession (click here and select “Animate” to see amazing interactive yield curve graph). Fortunately for the bulls, there is no sign of an inverted yield curve – 30-year rates remain significantly higher than short-term rates (see chart below).

Stock market skeptics continue to rationalize the record high stock prices by pointing to the artificially induced Federal Reserve money printing buying binge. It is true that the buffet of gains is not sustainable at the same pace as has been experienced over the last six years. As we continue to move closer to full employment in this economic cycle, the rapid accumulated wealth will need to be digested at a more responsible rate. An unexpected Greek exit from the EU or spike in interest rates could cause a short-term stomach ache, but until many of the previously mentioned indicators reach dangerous levels, please pass the gravy.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in SPY and other certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Time for Your Retirement Physical

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (October 1, 2014). Subscribe on the right side of the page for the complete text.

As a middle-aged man, I’ve learned the importance of getting my annual physical to improve my longevity. The same principle applies to the longevity of your retirement account. With the fourth quarter of the calendar year officially underway, there is no better time to probe your investment portfolio and prescribe some recommendations relating to your financial goals.

A physical is especially relevant given all the hypertension raising events transpiring in the financial markets during the third quarter. Although the large cap biased indexes (Dow Jones Industrials and S&P 500) were up modestly for the quarter (+1.3% and +0.6%, respectively), the small and mid-cap stock indexes underperformed significantly (-8.0% [IWM] and -4.2% [SPMIX], respectively). What’s more, all the daunting geopolitical headlines and uncertain macroeconomic data catapulted the Volatility Index (VIX – aka, “Fear Gauge”) higher by a whopping +40.0% over the same period.

- What caused all the recent heartburn? Pick your choice and/or combine the following:

- ISIS in Iraq

- Bombings in Syria

- End of Quantitative Easing (QE) – Impending Interest Rate Hikes

- Mid-Term Elections

- Hong Kong Protests

- Tax Inversions

- Security Hacks

- Rising U.S. Dollar

- PIMCO’s Bill Gross Departure

(See Hot News Bites in Newsletter for more details)

As I’ve pointed out on numerous occasions, there is never a shortage of issues to worry about (see Series of Unfortunate Events), and contrary to what you see on TV, not everything is destruction and despair. In fact, as I’ve discussed before, corporate profits are at record levels (see Retail Profits chart below), companies are sitting on trillions of dollars in cash, the employment picture is improving (albeit slowly), and companies are finally beginning to spend (see Capital Spending chart below):

Retail Profits

Source: Dr. Ed’s Blog

Capital Spending

Source: Calafia Beach Pundit

Even during prosperous times, you can’t escape the dooms-dayers because too much of a good thing can also be bad (i.e., inflation). Rather than getting caught up in the day-to-day headlines, like many of us investment nerds, it is better to focus on your long-term financial goals, diversification, and objective financial metrics. Even us professionals become challenged by sifting through the never-ending avalanche of news headlines. It’s better to stick with a disciplined, systematic approach that functions as shock absorbers for all the inevitable potholes and speed bumps. Investment guru Peter Lynch said it best, “Assume the market is going nowhere and invest accordingly.” Everyone’s situation and risk tolerance is different and changing, which is why it’s important to give your financial plan a recurring physical.

Vacation or Retirement?

Keeping up with the Joneses in our instant gratification society can be a taxing endeavor, but ultimately investors must decide between 1) Spend now, save later; or 2) Save now, spend later. Most people prefer the more enjoyable option (#1), however these individuals also want to retire at a young age. Often, these competing goals are in conflict. Unless, you are Oprah or Bill Gates (or have rich relatives), chances are you must get into the practice of saving, if you want a sizeable nest egg…before age 85. The problem is Americans typically spend more time planning their vacation than they do planning for retirement. Talking about finances with an advisor, spouse, or partner can feel about as comfortable as walking into a cold doctor’s office while naked under a thin gown. Vulnerability may be an undesirable emotion, but often it is a necessity to reach a desired goal.

Ignorance is Not Bliss – Avoid Procrastination

Many people believe “ignorance is bliss” when it comes to healthcare and finance, which we all know is the worst possible strategy. Normally, individuals have multiple IRA, 401(k), 529, savings, joint, trust, checking and other accounts scattered around with no rhyme or reason. As with healthcare, reviewing finances most often takes place whenever there is a serious problem or need, which is usually at a point when it’s too late. Unfortunately, procrastination typically wins out over proactiveness. Just because you may feel good, or just because you are contributing to your employer’s 401(k), doesn’t mean you shouldn’t get an annual physical for your health and finances. I’m the perfect example. While I feel great on the outside, ignoring my high cholesterol lab results would be a bad idea.

And even for the DIY-ers (Do-It-Yourself-ers), rebalancing your portfolio is critical. In the last fifteen years, overexposure to technology, real estate, financials, and emerging markets at the wrong times had the potential of creating financial ruin. Like a boat, your investment portfolio needs to remain balanced in conjunction with your goals and risk tolerance, or your savings might tip over and sink.

Financial markets go up and down, but your long-term financial well-being does not have to become hostage to the daily vicissitudes. With the fourth quarter now upon us, take control of your financial future and schedule your retirement physical.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in IWM, SPMIX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Back to the Future: Mag Covers (Part I)

Magazine Covers Part II – – – Magazine Covers Part III

I’m not referring to the movie, Back to the Future, about a plutonium-powered DeLorean time machine that finds Marty McFly (played by Michael J. Fox) traveling back in time. Rather, I am shining the light on the uncanny ability of media outlets (specifically magazines) to mark key turning points in financial markets – both market bottoms and market tops. This will be the first in a three part series, providing a few examples of how magazines have captured critical periods of maximum fear (buying opportunities) and greed (selling signals).

People tend to have short memories, especially when it comes to the emotional rollercoaster ride we call the stock market. Thanks to globalization, the internet, and the 24/7 news cycle, we are bombarded with some fear factor to worry about every day. Although I might forget what I had for breakfast, I have been a student of financial market history and have experienced enough cycles to realize as Mark Twain famously stated, “History never repeats itself, but it often rhymes” (read previous market history article). In that vein, let us take a look at a few covers from the 1970s:

Newsweek’s “The Big Bad Bear” issue came out on September 9, 1974 when the collapse of the so-called “Nifty Fifty” (the concentrated set of glamour stocks or “Blue Chips”) was in full swing. This group of stocks, like Avon, McDonalds, Polaroid, Xerox, IBM and Disney, were considered “one-decision” stocks investors could buy and hold forever. Unfortunately, numerous of these hefty priced stocks (many above a 50 P/E) came crashing down about 90% during the1973-74 period.

Why the glum sentiment? Here are a few reasons:

- Exiting Vietnam War

- Undergoing a Recession

- 9% Unemployment

- Arab Oil Embargo

- Watergate: Presidential Resignation

- Franklin National Failure

Not a rosy backdrop, but was this scary and horrific phase the ideal time to sell, as the magazine cover may imply? No, actually this was a shockingly excellent time to purchase equities. The Dow Jones Industrial Average, priced at 627 when the magazine was released, is now trading around 10,247…not too shabby a return considering the situation looked pretty darn bleak at the time.

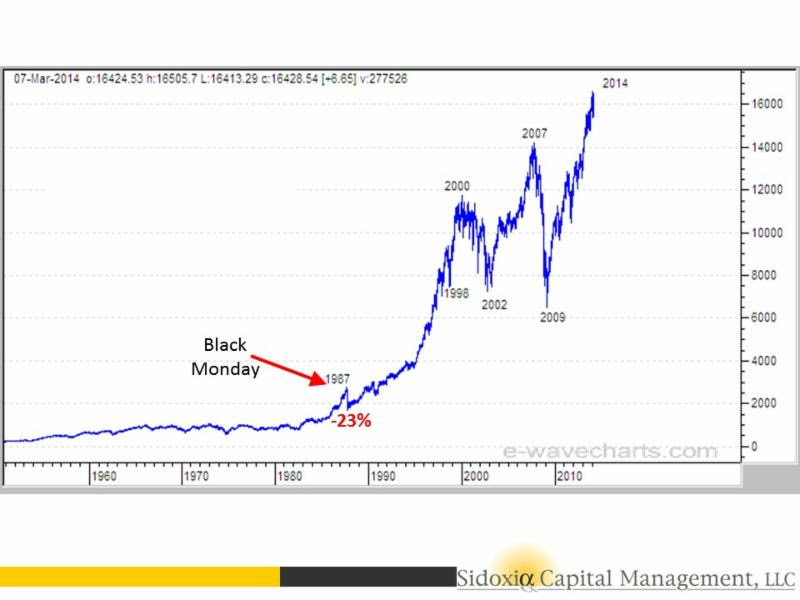

Reports of the Market’s Death Greatly Exaggerated

Sticking with the Mark Twain theme, the reports of the market’s demise was greatly exaggerated too – much the same way we experienced the overstated reaction to the financial crisis early in 2009. BusinessWeek’s August 13, 1979 magazine captured the essence of the bearish mood in the article titled, “The Death of Equities.” This article came out, of course, about 18 months before a multi-decade upward explosion in prices that ended in the “Dot-com” crash of 2000. In the late 1970s, inflation reached double digit levels; gold and oil had more than doubled in price; Paul Volcker became the Federal Reserve Chairman and put on the economic brakes via a tough, anti-inflationary interest rate program; and President Jimmy Carter was dealing with an Iranian Revolution that led to the capture of 63 U.S. hostages. Like other bear market crashes in our history, this period also served as a tremendous time to buy stocks. As you can see from the chart above, the Dow was at 833 at the time of the magazine printing – in the year 2000, the Dow peaked at over 14,000.

This walk down memory lane is not complete. Conveniently, the Back to the Future story was designed as a trilogy (just like my three-part magazine review). You can relive Parts II & III here: Magazine Covers Part II – – – Magazine Covers Part III

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) has a short position in MCD at the time this article was originally posted. SCM owns certain exchange traded funds, IBM, and DIS, but currently has no direct position in Avon (AVP), Polaroid, Xerox (XRX). No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Market Champagne Sits on Ice

Summer may be coming to an end, but the heat in the stock market has not cooled down, as the stock market registered its hottest August performance in 14 years (S&P 500 index up +3.8%). With these stellar results, one would expect the corks to be popping, cash flowing into stocks, and the champagne flowing. However, for numerous reasons, we have not seen this phenomenon occur yet. Until the real party begins, I suppose the champagne will stay on ice.

At the end of last year, I wrote further about the inevitable cash tsunami topic in an article entitled, “Here Comes the Dumb Money.” At that point in time, stocks had remarkably logged an approximate +30% return, and all indications were pointing towards an upsurge of investor interest in the stock market. So far in 2014, the party has continued as stocks have climbed another +8.4% for the year, but a lot of the party guests have not arrived yet. With the water temperature in the pool being so enticing, one would expect everyone to jump in the stock market pool. Actually, we have seen the opposite occur as -$12 billion has been pulled out of U.S. stock funds so far in 2014 (see ICI chart below).

How can the market be up +8.4% when money is coming out of stocks? For starters, companies are buying stock by the hundreds of billions of dollars. An estimated $480 billion of stock was purchased by corporations last year via share repurchase authorizations. Adding fuel to the stock fire are near record low interest rates. The ultra-low rates have allowed companies to borrow money at unprecedented rates for the purpose of not only buying back chunks of stock, but also buying the stock of whole companies (Mergers & Acquisitions). Thomson Reuters estimates that M&A activity in 2014 has already reached $2.2 trillion, up more than +70% compared to the same period last year.

Another factor contributing to the lackluster appetite for stocks is the general public’s apathy and disinterest in the market. This disconnected sentiment was captured beautifully by a recent Gallup survey, which asked people the following question:

As you can see, only 7% of the respondents realized that stocks were up by more than +30% in 2013. More specifically, the S&P 500 (Large Cap) index was up +29.6%, S&P 600 (Small Cap) +39.7%, and the S&P 400 (Mid Cap) +31.6% (all percentages exclude dividends). Despite these data points, if taken with near 15-year low household stock ownership data, the results prove sentiment is nowhere near the euphoric phases reached before the 2000 bubble burst or the 2006-2008 real estate collapse.

Beyond the scarring effects of the 2008-2009 financial crisis, tempered moods regarding stocks can also be attributed to fresher geopolitical concerns (i.e., military tensions in Ukraine, Islamic extremists in Iraq, and missile launches from the Gaza Strip). The other area of never-ending anxiety is Federal Reserve monetary policy. The stock market, which has tripled in value from early 2009, has skeptics continually blaming artificial Quantitative Easing/QE policies (stimulative bond purchases) as the sole reason behind stocks advance. With current Fed Chair Janet Yellen pulling 70% of the QE punch bowl away (bond purchases now reduced to $25 billion per month), the bears are having a difficult time explaining rising stock prices and declining interest rates. Once all $85 billion in monthly QE purchases are expected to halt in October, skeptics will have one less leg on their pessimistic stool to sit on.

Economy and Profits Play Cheery Tune

While geopolitical and Federal Reserve clouds may be preventing many sourpusses from joining the stock party, recent economic and corporate data have party attendees singing a cheery tune. More specifically, the broadest measurement of economic activity, GDP (Gross Domestic Product), came in at a higher-than-expected level of +4.2% for the 2nd quarter (see Wall Street Journal chart below).

Moreover, the spike in July’s Durable Goods orders also paints a healthy economic picture (see chart below). The data is volatile (i.e., Boeing Co orders – BA), nevertheless, CEO confidence is on the rise. Improved confidence results in executives opening up their wallets and investing more into their businesses.

Source: Calafia Beach Pundit

Last but not least, the lifeblood of appreciating stock prices (earnings/profits) have been accelerating higher. In the most recent quarterly results, we saw a near doubling of the growth rate from 1st quarter’s +5% growth rate to 2nd quarter’s +10% growth rate (see chart below).

Source: Dr. Ed’s Blog

With the S&P 500 continuing to make new record highs despite scary geopolitical and Federal Reserve policy concerns, the stock market party is still waiting for guests to arrive. When everyone arrives and jumps in the pool, it will be time to pop the corks and sell. Until then, there is plenty of appreciation potential as the champagne sits on ice.

Psst…Do You Want to Join the Club?

#2. Don’t waste your time listening to the media.

Like dieting, the framework is simple to understand, but difficult to execute. Theoretically, if you follow Rule #1, you don’t have worry about Rule #2. Unfortunately, many people have no rules or discipline in place, and instead let their emotions drive all investing decisions. When it comes to following the media, Mark Twain stated it best:

“If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.”

It’s fine to be informed, as long as the deluge of data doesn’t enslave you into bad, knee-jerk decision-making. You’ve seen those friends, family members and co-workers who are glued to their cell phones or TVs while insatiably devouring real-time data from CNBC, CNN, or their favorite internet blog. The grinding teeth and sweaty palms should be a dead giveaway that these habits are not healthy for investment account balances or blood pressure.

Thanks to the endless scary headlines and stream of geopolitical turmoil (fear sells), millions of investors have missed out on one of the most staggering bull market rallies in history. More specifically, the S&P 500 index (large capitalization companies) has almost tripled in value from early 2009 (666 to 1,931) and the S&P 600 index (small capitalization companies) almost quadrupled from 181 to 645.

The Challenge

Becoming a member of the Successful Investors Club (SIC) is no easy feat. As I’ve written in the past, the human brain has evolved dramatically over tens of thousands of years, but the troubling, emotionally-driven amygdala tissue mass at the end of the brain stem (a.k.a., “Lizard Brain“) still remains. The “Lizard Brain” automatically produces a genetic flight response to perceived worrisome stimuli surrounding us. In other words, our “Lizard Brain” often interprets excessively sensationalized current events as a threat to our financial security and well-being.

It’s no wonder amateur investors have trouble dealing with the incessantly changing headlines. Yesterday, investors were panicked over the P.I.I.G.S (Portugal, Italy, Ireland, Greece, Spain), the Arab Spring (Tunisia, Egypt, Iran, etc.), and Cyprus. Today, it’s Ukraine, Argentina, Israel, Gaza, Syria, and Iraq. Tomorrow…who knows? It’s bound to be another fiscally irresponsible country, terrorist group, or autocratic leader wreaking havoc upon their people or enemies.

During the pre-internet or pre-smartphone era, the average person couldn’t even find Ukraine, Syria, or the Gaza Strip on a map. Today, we are bombarded 24/7 with frightening stories over these remote regions that have dubious economic impact on the global economy.

Take the Ukraine for example, which if you think about it is a fiscal pimple on the global economy. Ukraine’s troubled $177 billion economy, represents a mere 0.29% of the $76 trillion global GDP. Could an extended or heightened conflict in the region hinder the energy supply to a much larger and significant European region? Certainly, however, Russian President Vladimir Putin doesn’t want the Ukrainian skirmish to blow up out of control. Russia has its own economic problems, and recent U.S. and European sanctions haven’t made Putin’s life any easier. The Russian leader has a vested economic interest to keep its power hungry European customers happy. If not, the U.S.’s new found resurgence in petroleum supplies from fracking will allow our country to happily create jobs and export excess reserves to a newly alienated EU energy buyer.

The Solution

Rather than be hostage to the roller coaster ride of rising and falling economic data points, it’s better to follow the sage advice of investing greats like Peter Lynch, who averaged a +29% return per year from 1977 – 1990.

Here’s what he had to say about news consumption:

“If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Rather than fret about the direction of the market, at Sidoxia Capital Management we are focused on identifying the best available opportunities, given any prevailing economic environment (positive or negative). We assume the market will go nowhere and invest our client assets (and personal assets) accordingly by focusing on those areas we see providing the most attractive risk-adjusted returns. Investors who try to time the market, fail miserably over the long-run. If timing the market were easy, you would see countless people’s names at the tops of the Forbes billionaire list – regrettably that simply is not the case.

Since “fear” sells in the media world, it’s always important to sift through the deluge of data to gain a balanced perspective. During panic periods, it’s important to find the silver linings. When everyone is euphoric, it’s vital to discover reasons for caution.

While a significant amount of geopolitical turmoil occurred last month, it’s essential to remember the underlying positive fundamentals propelling the stock market to record highs. The skeptics of the recovery and record stock market point to the Federal Reserve’s unprecedented, multi-trillion dollar money printing scheme (Quantitative Easing – QE) and the inferior quality of the jobs created. Regarding the former point, if QE has been so disastrous, I ask where is the run-away inflation (see chart below)? While the July jobs report may show some wage pressure, you can see we’re still a long ways away from the elevated pricing levels experienced during the 1970s-1980s.

Source: Calafia Beach Pundit

A final point worth contemplating as it relates to the unparalleled Fed Policy actions was highlighted by strategist Scott Grannis. If achieving real economic growth through money printing was so easy, how come Zimbabwe and Argentina haven’t become economic powerhouses? The naysayers also fail to acknowledge that the Fed has already reversed the majority of its stimulative $85 billion monthly bond buying program (currently at $25 billion per month). What’s more, the Federal Open Market Committee has already signaled a rate hike to 1.13% in 2015 and 2.50% in 2016 (see chart below).

Source: Financial Times

The rise in interest rates from generationally low levels, especially given the current status of our improving economy, as evidenced by the recent robust +4.0% Q2-GDP report, is inevitable. It’s not a matter of “if”, but rather a matter of “when”.

On the latter topic of job quality, previously mentioned, I can’t defend the part-time, underemployed nature of the employment picture, nor can I defend the weak job participation rate. In fact, this economic recovery has been the slowest since World War II. With that said, about 10 million private sector jobs have been added since the end of the Great Recession and the unemployment rate has dropped from 10% to 6.1%. However you choose to look at the situation, more paychecks mean more discretionary dollars in the wallets and purses of U.S. workers. This reality is important because consumer spending accounts for 70% of our country’s economic activity.

While there is a correlation between jobs, interest rates, and the stock market, less obvious to casual observers is the other major factor that drives stock prices…record corporate profits. That’s precisely what you see in the chart below. Not only are trailing earnings at record levels, but forecasted profits are also at record levels. Contrary to all the hyped QE Fed talk, the record profits have been bolstered by important factors such as record manufacturing, record exports, and soaring oil production …not QE.

Join the Club

Those who have been around the investing block a few times realize how challenging investing is. The deafening information noise instantaneously accessed via the internet has only made the endeavor of investing that much more challenging. But the cause is not completely lost. If you want to join the bull market and the SIC (Successful Investors Club), all you need to do is follow the two top secret rules. Creating a plan and sticking to it, while ignoring the mass media should be easy enough, otherwise find an experienced, independent investment advisor like Sidoxia Capital Management to help you join the club.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds ans securities, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Sports & Investing: Why Strong Earnings Can Hurt Stock Prices

With the World Cup in full swing and rabid fans rooting for their home teams, one may notice the many similarities between investing in stocks and handicapping in sports betting. For example, investors (bettors) have opposing views on whether a particular stock (team) will go up or down (win or lose), and determine if the valuation (point spread) is reflective of the proper equilibrium (supply & demand). And just like the stock market, virtually anybody off the street can place a sports bet – assuming one is of legal age and in a legal betting jurisdiction.

Soon investors will be poring over data as part of the critical, quarterly earnings ritual. With some unsteady GDP data as of late, all eyes will be focused on this earnings reporting season to reassure market observers the bull advance can maintain its momentum. However, even positive reports may lead to unexpected investor reactions.

So how and why can market prices go down on good news? There are many reasons that short-term price trends can diverge from short-run fundamentals. One major reason for the price-fundamental gap is this key factor: “expectations”. With such a large run-up in the equity markets (up approx. +195% from March 2009) come loftier expectations for both the economy and individual companies. For instance, just because corporate earnings unveiled from companies like Google (GOOG/GOOGL), J.P. Morgan (JPM), and Intel (INTC) exceed Wall Street analyst forecasts does not mean stock prices automatically go up. In many cases a stock price correction occurs due to a large group of investors who expected even stronger profit results (i.e., “good results, but not good enough”). In sports betting lingo, the sports team may have won the game this week, but they did not win by enough points (“cover the spread”).

Some other reasons stock prices move lower on good news:

- Market Direction: Regardless of the underlying trends, if the market is moving lower, in many instances the market dip can overwhelm any positive, stock- specific factors.

- Profit Taking: Many times investors holding a long position will have price targets or levels, if achieved, that will trigger selling whether positive elements are in place or not.

- Interest Rates: Certain valuation techniques (e.g. Discounted Cash Flow and Dividend Discount Model) integrate interest rates into the value calculation. Therefore, a climb in interest rates has the potential of lowering stock prices – even if the dynamics surrounding a particular security are excellent.

- Quality of Earnings: Sometimes producing winning results is not enough (see also Tricks of the Trade article). On occasion, items such as one-time gains, aggressive revenue recognition, and lower than average tax rates assist a company in getting over a profit hurdle. Investors value quality in addition to quantity.

- Outlook: Even if current period results may be strong, on some occasions a company’s outlook regarding future prospects may be worse than expected. A dark or worsening outlook can pressure security prices.

- Politics & Taxes: These factors may prove especially important to the market this year, since this is a mid-term election year. Political and tax policy changes today may have negative impacts on future profits, thereby impacting stock prices.

- Other Exogenous Items: Natural disasters and security attacks are examples of negative shocks that could damage price values, irrespective of fundamentals.

Certainly these previously mentioned issues do not cover the full gamut of explanations for temporary price-fundamental gaps. Moreover, many of these factors could be used in reverse to explain market price increases in the face of weaker than anticipated results.

If you’re traveling to Las Vegas to place a wager on the World Cup, betting on winning favorites like Germany and Argentina may not be enough. If expectations are not met and the hot team wins by less than the point spread, don’t be surprised to see a decline in the value of your bet.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, GOOG, and GOOGL, but at the time of publishing had no direct positions in JPM and INTC. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Only Thing to Fear is the Unknown Itself

Martin Luther King, Jr. famously stated, “The only thing we have to fear is fear itself,” but when it comes to the stock market, the only thing to fear is the “unknown.” As much as people like to say, “I saw that crisis coming,” or “I knew the bubble was going to burst,” the reality is these assertions are often embellished, overstated, and/or misplaced.

How many people saw these events coming?

- 1987 – Black Monday

- Iraqi War

- Thai Baht Currency Crisis

- Long-Term Capital Management Collapse & Bailout

- 9/11 Terrorist Attack

- Lehman Brothers Bankruptcy / Bear Stearns Bailout

- Flash Crash

- U.S. Debt Downgrade

- Arab Spring

- Sequestration Cuts

- Cyprus Financial Crisis

- Federal Reserve (QE1, QE2, QE3, Operation Twist, etc.)

Sure, there will always be a prescient few who may actually get it right and profit from their crystal balls, but to assume you are smart enough to predict these events with any consistent accuracy is likely reckless. Even for the smartest and brightest minds, uncertainty and doubt surrounding such mega-events leads to inaction or paralysis. If profiting in advance of these negative outcomes was so easy, you probably would be basking in the sun on your personal private island…and not reading this article.

Coming to grips with the existence of a never-ending series of future negative financial shocks is the price of doing business in the stock market, if you want to become a successful long-term investor. The fact of the matter is with 7 billion people living on a planet orbiting the sun at 67,000 mph, the law of large numbers tells us there will be many unpredictable events caused either by pure chance or poor human decisions. As the great financial crisis of 2008-2009 proved, there will always be populations of stupid or ignorant people who will purposely or inadvertently cause significant damage to economies around the world.

Fortunately, the power of democracy (see Spreading the Seeds of Democracy) and the benefits of capitalism have dramatically increased the standards of living for hundreds of millions of people. Despite horrific outcomes and unthinkable atrocities perpetrated throughout history, global GDP and living standards continue to positively march forward and upward. For example, consider in my limited lifespan, I have seen the introduction of VCRs, microwave ovens, mobile phones, and the internet, while experiencing amazing milestones like the eradication of smallpox, the sequencing of the human genome, and landing space exploration vehicles on Mars, among many other unimaginable achievements.

Despite amazing advancements, many investors are paralyzed into inaction out of fear of a harmful outcome. If I received a penny for every negative prediction I read or heard about over my 20+ years of investing, I would be happily retired. The stock market is never immune from adverse events, but chances are a geopolitical war in Ukraine/Iraq; accelerated Federal Reserve rate tightening; China real estate bubble; Argentinian debt default; or other current, worrisome headline is unlikely to be the cause of the next -20%+ bear market. History shows us that fear of the unknown is more rational than the fear of the known. If you can’t come to grips with fear itself, I fear your long-term results will lead to a scary retirement.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.