Posts tagged ‘stock market’

Fall is Here: Change is Near

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2016). Subscribe on the right side of the page for the complete text.

Although the fall season is here and the leaf colors are changing, there are a number of other transforming dynamics occurring this economic season as well. The S&P 500 index may not have changed much this past month (down -0.1%), but the technology-laden NASDAQ index catapulted higher (+1.9% for the month and +6.0% for 2016).

With three quarters of the year now behind us, beyond experiencing a shift in seasonal weather, a number of other changes are also coming. For starters, there’s no ignoring the elephant in the room, and that is the presidential election, which is only weeks away from determining our country’s new Commander in Chief. Besides religion, there are very few topics more emotionally charged than politics – whether you are a Republican, Democrat, Independent, Libertarian, or some combination thereof. Even though the first presidential debate is behind us, a majority of voters are already set on their candidate choice. In other words, open-minded debate on this topic can be challenging.

Hearing critical comments regarding your favorite candidate are often interpreted in the same manner as receiving critical comments about a personal family member – people often become defensive. The good news, despite the massive political divide currently occurring in the country and near-record low politician approval ratings in Congress , politics mean almost nothing when it comes to your money and retirement (see also Politics & Your Money). Regardless of what politicians might accomplish (not much), individuals actually have much more control over their personal financial future than politicians.

While inaction may rule the day currently, more action generally occurs during a crisis – we witnessed this firsthand during the 2008-2009 financial meltdown. As Winston Churchill famously stated,

“You can always count on Americans to do the right thing – after they’ve tried everything else.”

Political discourse and gridlock are frustrating to almost everyone from a practical standpoint (i.e., “Why can’t these idiots get something done in Washington?!”), however from an economic standpoint, gridlock is good (see also Who Said Gridlock is Bad?) because it can keep a responsible lid on frivolous spending. Educated individuals can debate about the proper priorities of government spending, but most voters agree, maintaining a sensible level of spending and debt should be a bipartisan issue.

From roughly 2009 – 2014, you can see how political gridlock has led to a massive narrowing in our government’s deficit levels (chart below) – back to more historical levels.This occurred just as rising frustration with Washington has been on the rise.

The Fed: Rate Revolution or Evolution?

Besides the changing season of politics, the other major area of change is Federal Reserve monetary policy. Even though the Fed has only increased interest rates once over the last 10 years, and interest rates are at near-generational lows, investors remain fearful. There is bound to be some short-term volatility if interest rates rise to 0.50% – 0.75% in December, as currently expected. However, if the Fed continues at its current snail’s pace, it won’t be until 2032 before they complete their rate hike cycles.

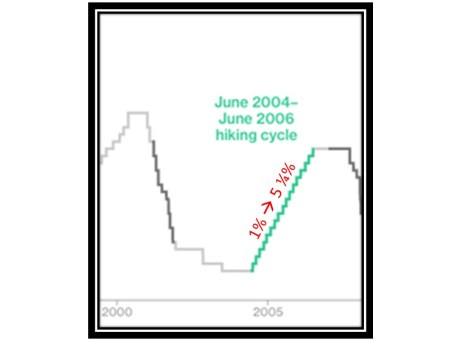

We can put the next rate increase into perspective by studying history. More specifically, the Fed raised interest rates 17 times from 2004 – 2006 (see chart below). Fortunately over this same time period, the world didn’t end as the Fed increased interest rates from 1.00% to 5.25% (stocks prices actually rose around +11%). The same can be said today – the world won’t likely end, if interest rates rise from 0.50% to 0.75% in a few months.

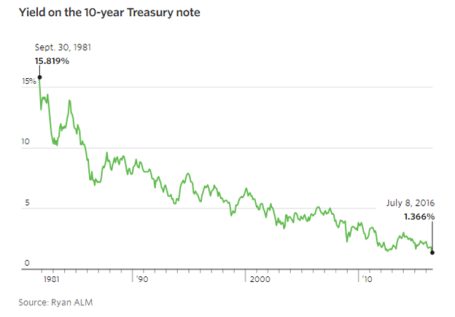

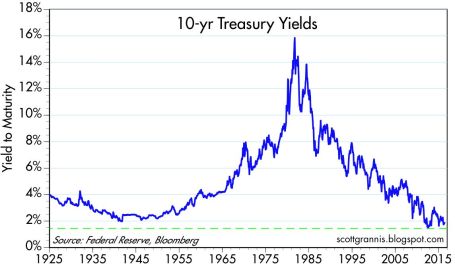

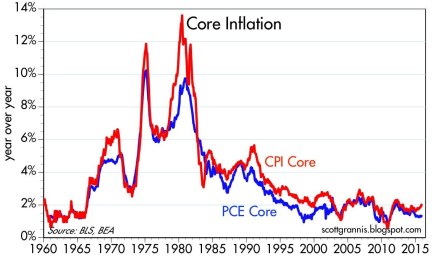

The next question becomes, why are interest rates so low? There are many reasons and theories, but a few of the key drivers behind low rates include, slower global economic growth, low inflation, high demand for low-risk assets, technology, and demographics. I could devote a whole article to each of these factors, and indeed in many cases I have, but suffice it to say that there are many reasons beyond the oversimplified explanation that artificial central bank intervention has led to a 35 year decline in interest rates (see chart below).

Change is a constant, and with fall arriving, some changes are more predictable than others. The timing of the U.S. presidential election outcome is very predictable but the same cannot be said for the timing of future interest rate increases. Irrespective of the coming changes and the related timing, history reminds us that concerns over politics and interest rates often are overblown. Many individuals remain overly-pessimistic due to excessive, daily attention to gloomy and irrelevant news headlines. Thankfully, stock prices are paying attention to more important factors (see Don’t Be a Fool) and long-term investors are being rewarded with record high stock prices in recent weeks. That’s the type of change I love.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Stocks Winning Olympic Gold

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2016). Subscribe on the right side of the page for the complete text.

The XXXI Olympics in Rio, Brazil begin this week, but stocks in 2016 have already won a gold medal for their stellar performance. The S&P 500 index has already triumphantly sprinted to new, all-time record highs this month. A significant portion of the gains came in July (+3.6%), but if you also account for the positive results achieved in the first six months of 2016, stocks have advanced +6.3% for the year. If you judge the 2%+ annualized dividend yield, the total investment return earns an even higher score, coming closer to +8% for the year-to-date period.

No wonder the U.S. is standing on the top of the economic podium compared to some of the other international financial markets, which have sucked wind during 2016:

- China Shanghai Index: -15.8%

- Japan Nikkei Index: -12.9%

- French Paris CAC Index: -4.3%

- German Dax Index: -3.8%

- Europe MSCI Index: -3.5%

- Hong Kong Heng Sang Index: -0.1%

While there are some other down-and-out financial markets that have rebounded significantly this year (e.g., Brazil +61% & Russia +23%), the performance of the U.S. stock market has been impressive in light of all the fear, uncertainty, and doubt blanketing the media airwaves. Consider the fact that the record-breaking performance of the U.S. stock market in July occurred in the face of these scary headlines:

- Brexit referendum (British exit from the European Union)

- Declining oil prices

- Declining global interest rates

- More than -$11,000,000,000,000.00 (yes trillions) in negative interest rate bonds

- Global terrorist attacks

- Coup attempt in Turkey

- And oh yeah, a contentious domestic presidential election

With so many competitors struggling, and the investment conditions so challenging, then how has the U.S. prospered with a gold medal performance in this cutthroat environment? For many individuals, the answer can be confusing. However, for Sidoxia’s followers and clients, the strong pillars for a continued bull market have been evident for some time (described again below).

Bull Market Pillars

Surprising to some observers, stocks do not read pessimistic newspaper headlines or listen to gloomy news stories. In the short-run, stock prices can get injured by emotional news-driven traders and speculators, but over the long-run, stocks and financial markets are drawn like a magnet to several all-important metrics. What crucial metrics am I referring to? As I’ve reiterated in the past, the key drivers for future stock price appreciation are corporate profits, interest rates, valuations (i.e., price levels), and sentiment indicators (see also Don’t Be a Fool).

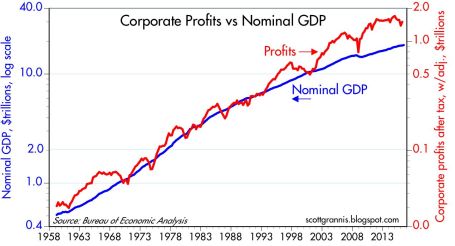

Stated more simply, money goes where it is treated best, and with many bonds and savings accounts earning negative or near 0% interest rates, investors are going elsewhere – for example, stocks. You can see from the chart below, economy/stocks are treated best by rising corporate profits, which are at/near record high levels. With the majority of stocks beating 2nd quarter earnings expectations, this shot of adrenaline has given the stock market an added near-term boost. A stabilizing U.S. dollar, better-than-expected banking results, and firming commodity prices have all contributed to the winning results.

Price Follows Earnings…and Recessions

What history shows us is stock prices follow the direction of earnings, which helps explain why stock prices generally go down during economic recessions. Weaker demand leads to weaker profits, and weaker profits lead to weaker stock prices. Fortunately for U.S. investors, there currently are no definitive signs of imminent recession clouds. Scott Grannis, the editor of Calafia Beach Pundit, sums up the relationship between recessions and the stock market here:

“Recessions typically follow periods of excesses—soaring home prices, rising inflation, widespread optimism—rather than periods dominated by risk aversion such as we have today. Risk aversion can still be found in abundance: just look at the extremely low level of Treasury yields, and the lack of business investment despite strong corporate profits.”

Similar to the Olympics, achieving success in investing can be very challenging, but if you want to win a medal, you must first compete. If you’re not investing, you’re not competing. And if you’re not investing, you have no chance of winning a financial gold medal. Just as in the Olympics, not everyone can win, and there are many ups and downs along the way to victory. Rather than focusing on the cheers and boos of the crowd, implementing a disciplined and diversified investment strategy that accounts for your time horizon, objectives, and risk tolerance is the championship approach that will increase your probability of landing on the Olympic medal podium.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Technical Analysis – Astrology or Lob Wedge?

Investing comes in many shapes and sizes. And like religion (see Investing Religion article), most investment strategies are built on the essential belief that following certain rules and conventions will eventually lead to profit enlightenment. When it comes to technical analysis (TA), a discipline used with the principal aim of predicting future prices from past patterns, some consider it a necessity for making money in the market. Others, regard the practice of TA as a pseudoscience, much like astrology.

I feel there is a proper place for TA on selective basis, which I will describe later, but for the most part I agree with some of the legendary investors who have chimed in on the subject:

Warren Buffett: “I realized technical analysis didn’t work when I turned the charts upside down and didn’t get a different answer.”

Peter Lynch: “Charts are great for predicting the past.”

Technical Analysis Linguistics

Fundamental analysis, the antithesis of technical analysis, strives to predict future price direction by analyzing facts and data surrounding a company, industry, and/or economy. It too comes with its own syntax and versions, for example: value, growth, top-down, bottom-up, quantitative, etc.

I do not claim to be a TA expert, however in my many years of investing I have come across a smorgasbord of terms and flavors surrounding the discipline. Describing and explaining the density of material surrounding TA would encompass too large of a scope for this article, but here are some prevalent terms one should come to grips with if you want to become a technical analysis guru:

Technical Analysis Approaches

- Elliot Wave

- Relative strength / Momentum (see Momentum Investing article)

- MACD (Moving Average Convergence / Divergence)

- Fibonacci retracement

- Dow Theory

- Stochastics

- Bollinger bands

Price Patterns

- Head and shoulders

- Double bottom

- Cup and handle

- Channels

- Breakouts

- Pivot points

- Candlesticks

- Resistance/Support

- Dead cat bounce (my personal favorite)

Each of these patterns are supposes to provide insight into the future direction of price. At best, I would say the academic research surrounding the subject is “inconclusive,” and at worst I’d say it’s considered a complete “sham.”

The Lob Wedge

As I’ve stated earlier, I fall in the skeptical camp when it comes to TA, since fundamental analysis is the main engine I use for generating and tracking my investment ideas. For illustrative purposes, you may consider fundamental analysis as my group of drivers and irons. I do, however, utilize selective facets of TA much like I use a lob wedge in golf for a limited number of specific situations (e.g., shots over high trees, downhill lies, and fast greens). When it comes to trading, I do believe there is some value in tracking the relationship of extreme trading volume (high or low), especially when it is coupled with extreme price movement (high or low). The economic laws of supply and demand hold true for stock trades just as they do for guns and butter, and sharp moves in these components can provide insights into the psychological mindset of investors with respect to a security (or broader market). Beyond trading volume, there are a few other indicators that I utilize as part of my trading strategies, but these tactics play a relatively minor role, since most of my core positions are held on a multi-year time horizon.

Overall, there is a stream of wasteful noise, volatility, and misinformation that permeates the financial markets on a daily basis. A major problem with technical analysis is the many false triggered signals, which in many cases lead to excessive trading, transaction costs, and ultimately subpar investment returns. Although I remain a skeptic on the subject of technical analysis and I may not read my horoscope today, I will continue to keep a lob wedge in my golf bag with the hopes of finding new, creative ways of using it to my advantage.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own exchange traded funds and various securities, including BRK.B, but at time of publishing had no direct position in BRK.A or any company mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

EU Marriage Ends in Messy Brexit Divorce

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2016). Subscribe on the right side of the page for the complete text.

What Just Happened?

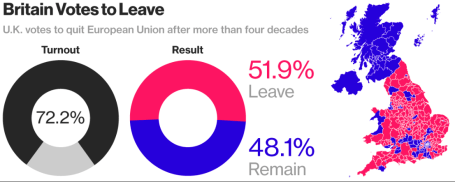

Breakups are never easy, especially when they come as a surprise. That’s exactly what happened with last week’s “Brexit” (British exit) referendum results. History was made when 51.9% of the United Kingdom (U.K.) voters from England, Scotland, Wales and Northern Ireland cast their vote to divorce (“Leave”) their country from the European Union (EU). In the end, the 48.1% of U.K. voters could not generate enough support to “Remain” in the EU (see chart below). Despite torrential downpours in southern Britain, voter turnout was extraordinarily high, as 72% of the 46.5 million registered voters came out in full force to have their voices heard.

Divorce is never cheap, and UK Prime Minister David Cameron paid the ultimate price with his defeat in the Brexit referendum…the loss of his job. Immediately following the release of the referendum results, Cameron, the British Prime Minister since 2010 and leader of the Conservative Party, immediately announced his resignation, effective no later than October 2016 after the selection of his successor.

Source: Bloomberg

One of the reasons behind the shock of the Brexit Leave decision is the longstanding relationship the U.K. has had with the EU. European Union membership first began in 1957 with Belgium, France, Germany, Italy, Luxembourg, and Netherlands being the founding countries of this new political-economic union.

A few decades later, the U.K. officially joined the EU in 1973 with Ireland and the Denmark, shortly before Margaret Thatcher came into power. If you fast forward to today, some 43 years after U.K. originally joined the EU, the Brexit decision represents the largest turning point in European political history. Not since the 1989 falling of the Berlin Wall and the subsequent demise of the Cold War in the Soviet Union has such a large, earth-moving political shift occurred.

Today, there are 28 member countries in the EU with Croatia being the newest member in 2013. Despite the Brexit outcome, there still is a backlog of countries wanting to join the EU club, including Turkey, Serbia, Albania, and Montenegro (and this excludes Scotland, which has voiced an interest in leaving the U.K. for the EU).

What Were Investors’ Reactions?

Financial markets around the world were caught off guard, given many pre-referendum polls were showing the Remain camp with a slight edge, along with British betting parlors that were handicapping an overwhelming victory for the Remain camp. Here’s a summary of stock market reactions around the globe from June 23rd to June 30th:

U.S. (S&P 500): -0.7%

U.K. (FTSE 100): +2.6%

Japan (Nikkei): -4.1%

Germany (DAX): -5.6%

Hong Kong (Hang Seng): +0.4%

China (Shanghai): +1.3%

India (BSE): -0.0%

Surprisingly, modest monthly gains achieved in the S&P 500 prior to the Brexit vote (up +0.8%) were quickly pared after the results came in but remained positive for the entire month (up +0.1%). For the year, U.S. stocks are up a limited +2.7%, which isn’t too bad considering investors’ current mood.

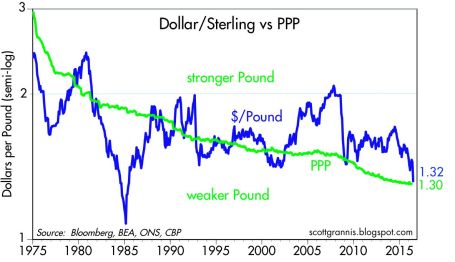

Stocks were not the only financial market disrupted after the Brexit announcement, foreign exchange currency rates were unstable as well. The British pound dived to a 30-year low shortly after the vote to a level of approximately $1.33/£, and was down more than -10% on the day of the announcement (see chart below). UK banks like Barclays PLC (BCS) and Lloyds Banking Group PLC (LYG) also saw their share prices significantly pressured as EU regulatory risks of losing access to European customers and negative global interest rates further squeeze the banks’ profit margins.

To put the currency picture into perspective, the value of the British pound ($2.64/£) peaked in March 1972 at a rate about double the U.S. dollar today. On the positive side of the ledger, a weaker British pound could help boost exports and vacation time to Stonehenge or London, but there is also a risk for a spike of inflation (or stagflation) on the country’s roughly $740 billion in imports (e.g., food, energy, and raw materials).

Source: Calafia Beach Pundit

Why Did it Happen?

While economically prosperous regions like London and Scotland voted heavily for Remain, the message for change of the Leave camp resonated well with working class towns and rural areas of England (seen here). Besides a geographic split, there was also a demographic divide between voters. As you can see from the YouGov poll below, the majority of younger citizens overwhelmingly voted for Remain, and vice versa for older citizens as it relates to the Leave vote.

18-24: 75% Remain

25-49: 56% Remain

50-64: 44% Remain

65+: 39% Remain

While geography and demographics certainly played a key role in the outcome of the EU Leave referendum result, at the core of the movement also was a populist discontent with immigration and the negative economic consequences created by globalization. There are many reasons behind the sluggish economic global recovery, even if the U.S. is doing best out of the developed countries, but rightly or wrongly, immigration policies and protectionism played a prominent part in the Brexit.

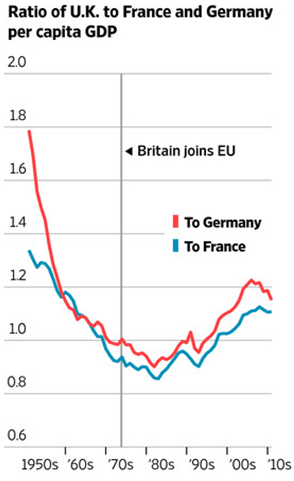

At the heart of the populist sentiment of lost control to Brussels (EU) and immigration is the question of whether the benefits of globalization have outweighed the costs. The spread of globalization and expanded EU immigration has disenfranchised many lower skill level workers displaced by eastern European immigrants, Syrian refugees and innovative solutions like automated machinery, software, and electronic equipment. Economic history clearly shows the answer to the effectiveness of globalization is a resounding “yes”, but the post-financial crisis recovery has been disappointingly sluggish, so a component of the populist movement has felt an urgency to find a scapegoat. The benefits of globalization can be seen in the chart below, as evidenced by the increases in per capita GDP of the UK relative to Germany and France, after joining the EU in 1973. Many observers are quick to identify the visible consequences of globalization (i.e., lower-paying job losses), but fail to identify the invisible benefits (i.e., productivity, lower prices, investment in higher-paying job gains).

Source: The Wall Street Journal

What happens next?

While some EU leaders want to accelerate the Brexit transition, in actuality, this will require a long, drawn-out negotiation process between the still-unnamed new UK Prime Minister and EU officials. The complete EU-Brexit deal will take upwards of two-years to complete, once Article 50 of the EU Lisbon Treaty has been triggered – likely in October.

In light of the unchartered nature of the Brexit Leave vote, nobody truly knows if this decision will ultimately compromise the existential reality of the EU. Time will tell whether Brexit will merely be a small bump on the long EU road, or the beginning of a scary European domino effect that causes the 28 EU country bloc to topple. If the U.K. is successful in negotiating EU trade agreements with separate European countries, the Brexit even has a longer-term potential of benefiting economic activity. Regardless of the EU outcome, the long-term proliferation of capitalism and democracy is likely to prevail because citizens vote with their wallets and capital goes where it is treated best.

What does Brexit Mean for Global Markets?

The short answer is not much economically, however there have been plenty of less substantial events that have roiled financial markets for relatively short periods of time. There are two basic questions to ask when looking at the economic impact of Brexit:

1) What is the Brexit impact on the U.S. economy?

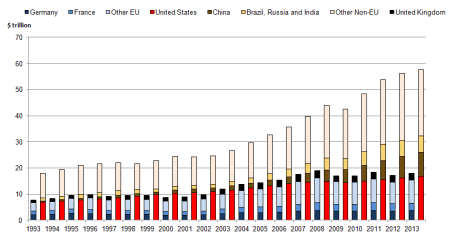

If you objectively analyze the statistics, U.S. companies sold approximately $56 billion of goods to the U.K. last year (our #7 trading partner). Even if you believe in the unlikely scenario of a severe U.K. economic meltdown, the U.K. trade figure is a rounding error in the whole global economic scheme of things. More specifically, $56 billion in trade with the U.K. equates to about .003 of the United States’ $18+ trillion GDP (Gross Domestic Product).

2) What is the Brexit impact on the global economy?

The U.K.’s GDP amounts to about $3 trillion dollars. Of that total, U.K. exports to the EU account for a reasonably insignificant $300 billion. As you can see from the chart below, $300 billion in UK exports to the EU are virtually meaningless and coincidentally equate to about .003 of the world’s $78 trillion estimated GDP.

Source: The National Archives

What to Do Next?

Like many divorces, the U.K. Brexit may be messy and drawn out, until all the details are finalized over the next couple years. It’s important that you establish a strong foundation with your investments and do not divorce the sound, fundamental principles needed to grow and preserve your portfolio. As is usually the case, panicking or making an emotional decision relating to your investments during the heat of some geopolitical crisis rarely translates into an optimal decision over the long-run. As I repeatedly have advised over the years, these periods of volatility are nothing new (see also Series of Unfortunate Events).

If you catch your anxiety or blood pressure rising, do yourself a favor and turn off your TV, radio, or electronic device. A more productive use of time is to calmly review your asset allocation and follow a financial plan, with or without the assistance of a financial professional, so that you are able to achieve your long-term financial goals. This strategy will help you establish a more durable, long-lasting, and successful marriage with your investments.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Cleaning Out Your Investment Fridge

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2016). Subscribe on the right side of the page for the complete text.

Summer is quickly approaching, but it’s not too late to do some spring cleaning. This principle not only applies to your cluttered refrigerator with stale foods but also your investment portfolio with moldy investments. In both cases, you want to get rid of the spoiled goods. It’s never fun discovering a science experiment growing in your fridge.

Over the last three months, the stock market has been replenished after a rotten first two months of the year (S&P 500 index was down -5.5% January through February). The +1.5% increase in May added to a +6.6% and +0.3% increase in March and April (respectively), resulting in a three month total advance in stock prices of +8.5%. Not surprisingly, the advance in the stock market is mirroring the recovery we have seen in recent economic data.

After digesting a foul 1st quarter economic Gross Domestic Product (GDP) reading of only +0.8%, activity has been smelling better in the 2nd quarter. A recent wholesome +3.4% increase in April durable goods orders, among other data points, has caused the Atlanta Federal Reserve Bank to raise its 2nd quarter GDP estimate to a healthier +2.9% growth rate (from its prior +2.5% forecast).

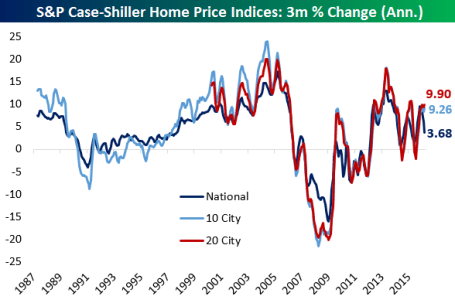

Consumer spending, which accounts for roughly 70% of our country’s economic activity, has been on the rise as well. The improving employment picture (5.0% unemployment rate last month) means consumers are increasingly opening their wallets and purses. In addition to spending more on cars, clothing, movies, and vacations, consumers are also doling out a growing portion of their income on housing. Housing developers have cautiously kept a lid on expansion, which has translated into limited supply and higher home prices, as evidenced by the Case-Shiller indices charted below.

Source: Bespoke

Spoiling the Fun?

While the fridge may look like it’s fully stocked with fresh produce, meat, and dairy, it doesn’t take long for the strawberries to get moldy and the milk to sour. Investor moods can sour quickly too, especially as they fret over the impending “Brexit” (British Exit) referendum on June 23rd when British voters will decide whether they want to leave the European Union. A “yes” exit vote has the potential of roiling the financial markets and causing lots of upset stomachs.

Another financial area to monitor relates to the Federal Reserve’s monetary policy and its decision when to further increase the Federal Funds interest rate target at its June 14th – 15th meeting. With the target currently set at an almost insignificantly small level of 0.25% – 0.50%, it really should not matter whether Chair Janet Yellen decides to increase rates in June, July, September and/or November. Considering interest rates are at/near generational lows (see chart below), a ¼ point or ½ point percentage increase in short-term interest rates should have no meaningfully negative impact on the economy. If your fridge was at record freezing levels, increasing the temperature by a ¼ or ½ degree wouldn’t have a major effect either. If and when short-term interest rates increase by 2.0%, 3.0%, or 4.0% in a relatively short period will be the time to be concerned.

Source: Scott Grannis

Keep a Fresh Financial Plan

As mentioned earlier, your investments can get stale too. Excess cash sitting idly earning next-to-nothing in checking, savings, CDs, or in traditional low-yielding bonds is only going to spoil rapidly to inflation as your savings get eaten away. In the short-run, stock prices will move up and down based on frightening but insignificant headlines. However, in the long-run, the more important issues are determining how you are going to reach your retirement goals and whether you are going to outlive your savings. This mindset requires you to properly assess your time horizon, risk tolerance, income needs, tax situation, estate plan, and other unique circumstances. Like a balanced diet of various food groups in your refrigerator, your key personal financial planning factors are dependent upon you maintaining a properly diversified asset allocation that is periodically rebalanced to meet your long-term financial goals.

Whether you are managing your life savings, or your life-sustaining food supply, it’s always best to act now and not be a couch potato. The consequences of sitting idle and letting your investments spoil away are a lot worse than letting the food in your refrigerator rot away.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Energizer Market… Keeps Going and Going

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 2, 2016). Subscribe on the right side of the page for the complete text.

Boom, boom, boom…it keeps going…and going…and going…

You’ve seen the commercials: A device operating on inferior batteries dies just as a drum-beating, battery operated Energizer bunny comes speeding and spiraling across the television screen. Onlookers waiting for the battery operated toy to run out of juice, instead gaze in amazement as they watch the energized bunny keep going and going. The same phenomenon is occurring in the stock market, as many observers eagerly await for stock prices to die. The obituary of the stock market has been written many times over the last eight years (see Series of Unfortunate Events). Mark Twain summed up this sentiment well, when after a premature obituary was written about him, he quipped, “The reports of my death are greatly exaggerated.”

With fears abound, stocks added to their annual gains by finishing their third consecutive positive month with the S&P 500 indexes and Dow Jones Industrial Average advancing +0.5% and +0.3%, respectively. Skeptics and worry-warts have been concerned about stocks plummeting ever since the Financial Crisis of 2008-2009. We experienced a 100 year flood then, and as a consequence, scarred investors now expect the 100 year flood to repeat every 100 days (see also 100 Year Flood). Given the damage created in the wake of the “Great Recession,” many individuals have become afraid of their own shadow. The shadows currently scaring investors include the following:

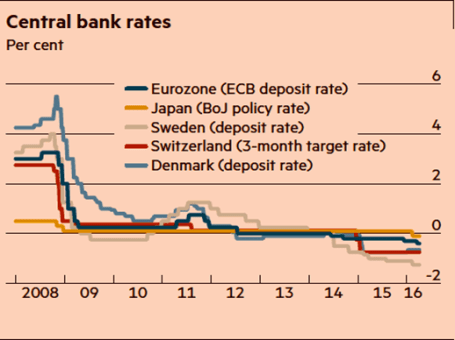

- Negative Interest Rates: The unknown consequences of negative interest rate policies by central banks (see chart below).

- U.S. Monetary Policy: The potential continuation of the Federal Reserve hiking interest rates.

- Sluggish Economic Growth: With a GDP growth figure up only +0.5% during the first quarter many people are worried about the vulnerability of slipping into recession.

- Brexit Fears: Risk of Britain exiting the European Union (a.k.a. “Brexit”) will blanket the airwaves as the referendum approaches next month

For these reasons, and others, the U.S. central bank is likely to remain accommodative in its stance (i.e., Fed Chairwoman Janet Yellen is expected to be slow in hitting the economic brakes via interest rate hikes).

Source: Financial Times. Central banks continue with attempts to stimulate with zero/negative rates.

Climbing the Wall of Worry

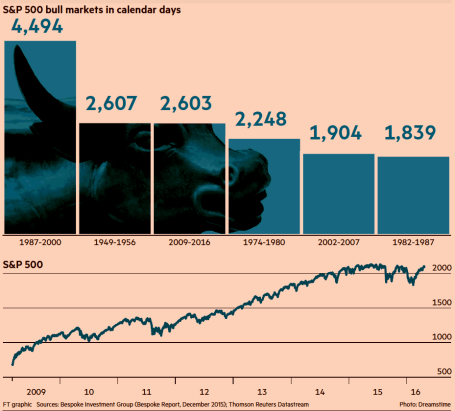

Despite all these concerns, stock prices continue climbing the proverbial “wall of worry” while approaching record levels. As famed investor Sir John Templeton stated on multiple occasions, “Bull markets are born on pessimism, and they grow on skepticism, mature on optimism, and die on euphoria.” It’s obvious to me there currently is no euphoria in the overall market, if you consider investors have withdrawn $2 trillion in stock investments since 2007. The phenomenon of stocks moving higher in the face of bad news is nothing new. A recent study conducted by the Financial Times newspaper shows the current buoyant bull market entering the second longest advancing period since World War II (see chart below).

Source: Financial Times

There will never be a shortage of concerns or bad things occurring in a world of 7.4 billion people, but the Energizer bunny U.S. economy has proven resilient. Our economy is entering its seventh consecutive year of expansion, and as I recently pointed out the job market keeps plodding along in the right direction – unemployment claims are at a 43-year low (see Spring Has Sprung). Over the last few years, these job gains have come despite corporate profits being challenged by the headwinds of a stronger U.S. dollar (hurts our country’s exports) and tumbling energy profits. Fortunately, the negative factors of the dollar and oil prices have stabilized lately, and these dynamics are in the process of shifting into tailwinds for company earnings. The -5.7% year-to-date decline in the Dollar Index coupled with the recent rebound in oil prices are proof that the economic laws of supply-demand eventually respond to large currency and commodity swings. With the number of rigs drilling for oil down by approximately -80% over the last two years, it comes as no surprise to me that a drop in oil supply has steadied prices.

The volatility in oil prices has been amazing. Energy companies have been reeling as oil prices dropped -76% from a 2014-high of $108 per barrel to a 2016-low of $26 per barrel. Since then, the picture has improved significantly. Crude oil prices are now hovering around $46 per barrel, up +76%.

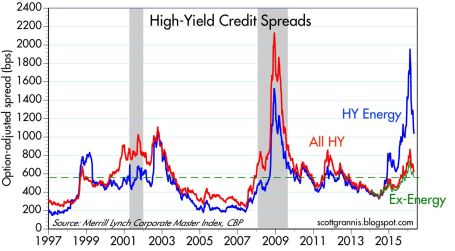

Energy Bankruptcy & Recessionary Fears Abate

If you take a look at the borrowing costs of high-yield companies in the chart below (Calafia Beach Pundit), you can see that prior spikes in the red line (all high-yield borrowing costs) were correlated with recessions – represented by the gray periods occurring in 2001 and 2008-09. During 2016, you can see from the soaring blue line, investors were factoring in a recession for high-yield energy companies (until the oil price recovery), but the non-energy companies (red-green lines) were not anticipating a recession for the other sectors of the economy. Bottom-line, this chart is telling you the knee-jerk panic of recessionary fears during the January-February period of this year has quickly abated, which helps explain the sharp rebound in stock prices.

After a jittery start to 2016 when economic expectations were for a dying halt, investors have watched stocks recharge their batteries in March and April. There are bound to be more fits and starts in the future, as there always are, but for the time being this Energizer bunny stock market and economy keeps going…and going…and going…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Michael Jordan and Market Statistics

Basketball is in the air as the NBA playoffs are once again upon us. While growing up in high school, Michael Jordan was my basketball idol, and he dominated the sport globally at the highest level. I was a huge fanatic. Besides continually admiring my MJ poster-covered walls, I even customized my own limited edition Air Jordan basketball shoes by applying high school colors to them with model paint – I would not recommend this fashion experiment to others.

Eventually the laws of age, physics, and gravity took over, as Jordan slowly deteriorated physically into retirement. On an infinitesimally smaller level, I also experienced a similar effect during my 30s when playing in an old man’s recreational basketball league. Day-by-day, month-by-month, and year-by-year, I too got older and slower (tough to believe that’s possible) as I watched all the 20-somethings run circles around me – not to mention my playing time was slashed dramatically. Needless to say, I too was forced into retirement like Michael Jordan, but nobody retired my number, and I still have not been inducted into the Hall of Fame.

“Air Wade” Before Retirement: No Photoshop in 1988, just an optical illusion created by an 8-foot rim.

Financial markets are subject to similar laws of science (economics) too. The stock market and the economy get old and tired just like athletes, as evidenced by the cyclical nature of bear markets and recessions. Statistics are a beautiful thing when it comes to sports. Over the long run, numbers don’t lie about the performance of an athlete, just like statistics over the long run don’t lie about the financial markets. When points per game, shooting percentage, rebounds, assists, minutes played, and other measurements are all consistently moving south, then it’s safe to say fundamentals are weakening.

I’ve stated it many times in the past, and I’ll state it again, these are the most important factors to consider when contemplating the level and direction of the stock market (see also Don’t Be a Fool, Follow the Stool).

- Profits

- Interest Rates

- Valuations

- Sentiment

While the absolute levels of these indicators are important, the trend or direction of each factor is also very relevant. Let’s review these factors a little more closely.

- Profits: Profits and cash flows, generally speaking, are the lifeblood behind any investment and currently corporate profits are near record levels. When it comes to the S&P 500, the index is currently expected to generate a 2016 profit of $117.47. Considering a recent price closing of 2,092 on the index, this translates into a price-earnings ratio (P/E) of approximately 17.8x or a 5.6% earnings yield. This earnings yield can be compared to the 1.9% yield earned on the 10-Year Treasury Note, which is even lower than the 2.1% dividend yield on the S&P 500 (a rare historical occurrence). If history repeats itself, the 5.6% earnings yield on stocks should double to more than 10% over the next decade, however the yield on 10-year Treasuries stays flat at 1.9% over the next 10 years. The strong dollar and the implosion of the energy sector has put a lid on corporate profits over the last year, but emerging signs are beginning to show these trends reversing. Stabilizing profits near record levels should be a positive contributor to stocks, all else equal.

- Interest Rates: Pundits have been pointing to central banks as the sole reason for low/negative interest rates globally (see chart below). NEWS FLASH: Central banks have been increasing and decreasing interest rates for decades, but that hasn’t stopped the nearly unabated 36-year decline in interest rates and inflation (see chart below). As I described in previous articles (see Why 0% Rates?), technology, globalization, and the rise of emerging markets is having a much larger impact on interest rates/inflation than monetary policies. If central banks are so powerful, then why after eight years of loose global monetary policies hasn’t inflation accelerated yet? Regardless, all else equal, these historically low interest rates are horrible for savers, but wonderful for equity investors and borrowers.

Source: Calafia Beach Pundit

- Valuations: The price you pay for an investment is one of the, if not the, most important factors to consider. I touched upon valuations earlier when discussing profits, and based on history, there is plenty of evidence to support the position that valuations are near historic averages. Shiller CAPE bears have been erroneously screaming bloody murder over the last seven years as prices have tripled (see Shiller CAPE smells like BS). A more balanced consideration of valuation takes into account the record low interest rates/inflation (see The Rule of 20).

- Sentiment: There are an endless number of indicators measuring investor optimism vs. pessimism. Generally, most experienced investors understand these statistics operate as valuable contrarian indicators. In other words, as Warren Buffett says, it is best to “buy fear, and sell greed.” While I like to track anecdotal indicators of sentiment like magazine covers, I am a firm believer that actions speak louder than words. If you consider the post-crisis panic of dollars flowing into low yielding bonds – greater than $1 trillion more than stocks (see Chicken vs. Beef ) you will understand the fear and skepticism remaining in investors minds. The time to flee stocks is when everyone falls in love with them.

Readers of Michael Lewis’s book Moneyball understand the importance statistics can play in winning sports. Michael Jordan may not have been a statistician like Billy Beane, because he spent his professional career setting statistical records, not analyzing them. Unfortunately, my basketball career never led me to the NBA or Hall of Fame, but I still hope to continue winning in the financial markets by objectively following the all-important factors of profits, interest rates, valuations, and sentiment.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Invest with a Telescope…Not a Microscope

It was another bloody week in the stock market (S&P 500 index dropped -3.1%), and any half-glass full data was interpreted as half-empty. The week was epitomized by a Citigroup report entitled “World Economy Trapped in a Death Spiral.” A sluggish monthly jobs report on Friday, which registered a less than anticipated addition of 151,000 jobs, painted a weakening employment picture. Professional social media site LinkedIn Corp. (LNKD) added fuel to the fire with a soft profit forecast, which resulted in the stock getting almost chopped in half (-44%)…in a single day (ouch).

It’s funny how quickly the headlines can change – just one week ago, the Dow Jones Industrial index catapulted higher by almost +400 points in a single day and we were reading about soaring stocks.

Coherently digesting the avalanche of diverging and schizophrenic headlines is like attempting to analyze a windstorm through a microscope. A microscope is perfect for looking at a single static item up close, but a telescope is much better suited for analyzing a broader set of data. With a telescope, you are better equipped to look farther out on the horizon, to anticipate what trends are coming next. The same principle applies to investing. Short-term traders and speculators are great at using a short-term microscope to evaluate one shiny, attention-grabbing sample every day. The investment conclusion, however, changes the following day, when a different attention-grabbing headline is analyzed to a different conclusion. As Mark Twain noted, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.”

Short-termism is an insidious disease that will slowly erode short-run performance and if not controlled will destroy long-run results as well. This is not a heretic concept. Some very successful investors have preached this idea in many ways. Here are a few of them:

‘‘We will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen.” –Warren Buffett (Annual Newsletter 1994)

‘‘If you spend more than 14 minutes a year worrying about the market, you’ve wasted 12 minutes’’ –Peter Lynch

“Excessive short-termism results in permanent destruction of wealth, or at least permanent transfer of wealth” -Jack Gray Grantham

On the flip side, those resilient investors who have succeeded through investment cycles understand the importance of taking a long-term view.

“Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.” –Peter Lynch

“The farther you can lengthen your time horizon in the investment process, the better off you will be.” – David Nelson (Legg Mason)

“Long term owners are more relaxed, more informed, more patient, less emotional.” –John Templeton

“If you are really a long-term investor, you will view a bear market as an opportunity to make money.” –John Templeton

“Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.” –Don Hays

“In the long run, one of the greatest risk to your net worth is not owning stocks. Bonds do not grow. They can only return their face value at maturity…Inflation is a silent, insidious tax that erodes your net worth…Fortunately, there is an easy way to keep pace with and even beat inflation, and this is stocks.” – John Spears

“In the short-term, the stock market is a voting machine; in the long-term a weighing machine.” -Benjamin Graham

There has been a lot of pain experienced so far in 2016, and there may be more to come. However, trying to time the market and call a bottom is a fruitless effort. Great companies and investments do not disappear in a bear market. At times like these, it is important to stick to a systematic, disciplined approach that integrates valuation and risk controls based on where we are in an economic cycle. Despite all the recent volatility, as I’ve repeated many times, the key factors driving the direction of the stock market are the following: 1) Corporate profits; 2) Interest rates; 3) Valuations; and 4) Sentiment (see also Don’t Be a Fool, Follow the Stool). Doom and gloom “Death Spiral” headlines may currently rule the day, but the four key stock-driving factors on balance remain skewed towards the positive…if you have the ability to put away your microscope and take out your telescope.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in LNKD or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Financial Markets Recharge with a Nap…Zzzzzz

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 4, 2016). Subscribe on the right side of the page for the complete text.

Did you enjoy your New Year’s festivities? If you were like me and ate excessively and drank too much egg nog, you may have decided along the line to take a nap. It’s not a bad idea to recharge those batteries before implementing those New Year’s resolutions and jumping on the treadmill. That’s exactly what happened in the financial markets this year. After six consecutive years of positive returns in the Dow Jones Industrial Average (2009 – 2014), stock markets took a snooze in 2015, as measured by the S&P 500 and Dow, which were each down -0.7% and -2.2%, respectively. And bonds didn’t fare any better, evidenced by the -1.9% decline in the Aggregate Bond ETF (AGG), over the same time period. Given the deep-seated fears about the Federal Reserve potentially catapulting interest rates higher in 2015, investors effectively took a big yawn by barely nudging the 10-year Treasury Note yield higher by +0.1% from 2.2% to 2.3%.

Even though 2015 ended up being a quiet year overall, there were plenty of sweet dreams mixed in with scary nightmares during the year-long nap:

INVESTMENT SWEET DREAMS

Diamonds in the Rough: While 2015 stock prices were generally flat to down around the globe (Vanguard Total Word -4.2%), there was some sunshine and rainbows gleaming for a number of segments in the market. For example, handsome gains were achieved in the NASDAQ index (+5.7%); Biotech Index – BTK (+10.9%); Consumer Discretionary ETF – XLY (+8.3%); Health Care ETF – VHT (+5.8%); Information Technology ETF – VGT (+4.6%); along with numerous other investment areas.

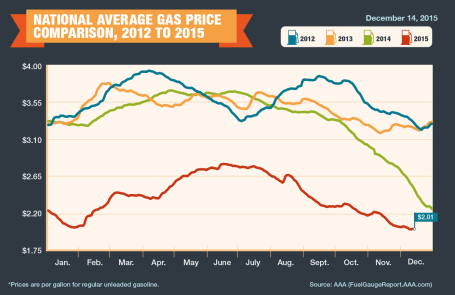

Fuel Fantasy Driven by Low Gas Prices: Gas prices averaged $2.01 per gallon nationally in December (see chart below), marking the lowest prices seen since 2009. Each penny in lower gas prices roughly equates to $1 billion in savings, which has strengthened consumers’ balance sheets and contributed to the multi-year economic expansion. Although these savings have partially gone to pay down personal debt, these gas reserves have also provided a financial tailwind for record auto sales (estimated 17.5million in 2015) and a slow but steady recovery in the housing market. The outlook for “lower-for-longer” oil prices is further supported by an expanding oil glut from new, upcoming Iranian supplies. Due to the lifting of economic sanctions related to the global nuclear deal, Iran is expected to deliver crude oil to an already over-supplied world energy market during the first quarter of 2016. Additionally, the removal of the 40-year ban on U.S. oil exports -could provide a near-term ceiling on energy prices as well.

Counting Cash Cows

Catching some shut-eye after reading frightening 2015 headlines on the China slowdown, $96 billion Greek bailout/elections, and Paris/San Bernardino terrorist attacks forced some nervous investors to count sheep to fall asleep. However, long-term investors understand that underpinning this long-lived bull market are record revenues, profits, and cash flows. The record $4.7 trillion dollars in 2015 estimated mergers along with approximately $1 trillion in dividends and share buybacks (see chart below) is strong confirmation that investors should be concentrating on counting more cash cows than sheep, if they want to sleep comfortably.

INVESTMENT NIGHTMARES

Creepy Commodities: Putting aside the -30% collapse in WTI crude oil prices last year, commodity investors overall were exhausted in 2015. The -24% decline in the CRB Commodity Index and the -11% weakening in the Gold Index (GLD) was further proof that a strong U.S. dollar, coupled with stagnant global growth, caused investors a lot of tossing and turning. While bad for commodity exporting countries, the collapse in commodity prices will ultimately keep a lid on inflation and eventually become stimulative for those consumers suffering from lower standards of living.

Dollar Dread: The +25% spike in the value of the U.S. dollar over the last 18 months has made life tough for multinational companies. If your business received approximately 35-40% of their profits overseas and suddenly your goods cost 25% more than international competitors, you might grind your teeth in your sleep too. Monetary policies around the globe, including the European Union, will have an impact on the direction of future foreign exchange rates, but after a spike in the value of the dollar in early 2015, there are signs this scary move may now be stabilizing. Although multinationals are getting squeezed, now is the time for consumers to load up on cheap imports and take that bargain foreign vacation they have long been waiting for.

January has been a challenging month the last couple years, and inevitably there will be additional unknown turbulence ahead – the opening day of 2016 not being an exception (i.e., China slowdown concerns and Mideast tensions). However, given near record-low interest rates, record corporate profits, and accommodative central bank policies, the 2015 nap taken by global stock markets should supply the necessary energy to provide a lift to financial markets in the year ahead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions VHT, AGG, and in certain exchange traded funds (ETFs), but at the time of publishing had no direct position VT, BTK, XLY, VGT, GLD, or in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bargain Hunting for Doorbuster Discounts

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2015). Subscribe on the right side of the page for the complete text.

It’s that time of year again when an estimated 135 million bargain shoppers set aside personal dignity and topple innocent children in the name of Black Friday holiday weekend, doorbuster discounts. Whether you are buying a new big screen television at Amazon for half-off or a new low-cost index fund, everyone appreciates a good value or bargain, which amplifies the importance of the price you pay. Even though consumers are estimated to have spent $83 billion over the post-turkey-coma, holiday weekend, this spending splurge only represents a fraction of the total 2015 holiday shopping season frenzy. When all is said and done, the average person is projected to dole out $805 for the full holiday shopping season (see chart below) – just slightly higher than the $802 spent over the same period last year.

While consumers have displayed guarded optimism in their spending plans, Americans have demonstrated the same cautiousness in their investing behavior, as evidenced by the muted 2015 stock market gains. More specifically, for the month of November, stock prices increased by +0.32% for the Dow Jones Industrial Average (17,720) and +0.05% for the S&P 500 index (2,080). For the first 11 months of the year, the stock market results do not look much different. The Dow has barely slipped by -0.58% and the S&P 500 has inched up by +1.01%.

Given all the negative headlines and geopolitical concerns swirling around, how have stock prices managed to stay afloat? In the face of significant uncertainty, here are some of the calming factors that have supported the U.S. financial markets:

- Jobs Piling Up: The slowly-but-surely expanding economy has created about 13 million new jobs since late 2009 and the unemployment rate has been chopped in half (from a peak of 10% to 5%).

Source: Calafia Beach Pundit

- Housing Recovery: New and existing home sales are recovering and home prices are approaching previous record levels, as the Case-Shiller price indices indicate below.

Source: Calculated Risk Blog

- Strong Consumer: Cars are flying off the shelves at a record annualized pace of 18 million units – a level not seen since 2000. Lower oil and gasoline prices have freed up cash for consumers to pay down debt and load up on durable goods, like some fresh new wheels.

Source: Calculated Risk Blog

Despite a number of positive factors supporting stock prices near all-time record highs and providing plenty of attractive opportunities, there are plenty of risks to consider. If you watch the alarming nightly news stories on TV or read the scary newspaper headlines, you’re more likely to think it’s Halloween season rather than Christmas season.

At the center of the recent angst are the recent coordinated terrorist attacks that took place in Paris, killing some 130 people. With ISIS (Islamic State of Iraq and Syria) claiming responsibility for the horrific acts, political and military resources have been concentrated on the ISIS occupied territories of Syria and Iraq. Although I do not want to diminish the effects of the appalling and destructive attacks in Paris, the events should be placed in proper context. This is not the first or last large terrorist attack – terrorism is here to stay. As I show in the chart below, there have been more than 200 terrorist attacks that have killed more than 10 people since the 9/11 attacks. Much of the Western military power has turned a blind eye towards these post-9/11 attacks because many of them have taken place off of U.S. or Western country soil. With the recent downing of the Russian airliner (killing all 224 passengers), coupled with the Paris terror attacks, ISIS has gained the full military attention of the French, Americans, and Russians. As a result, political willpower is gaining momentum to heighten military involvement.

Source: Wikipedia

Investor anxiety isn’t solely focused outside our borders. The never ending saga of when the Federal Reserve will initiate its first Federal Funds interest rate target increase could finally be coming to an end. According to the CME futures market, there currently is a 78% probability of a 0.25% interest rate increase on December 16th. As I have said many times before, interest rates are currently near generational lows, and the widely communicated position of Federal Reserve Chairwoman Yellen (i.e., shallow slope of future interest rate hike trajectory) means much of the initial rate increase pain has likely been anticipated already by market participants. After all, a shift in your credit card interest rate from 19.00% to 19.25% or an adjustment to your mortgage rate from 3.90% to 4.15% is unlikely to have a major effect on consumer spending. In fact, the initial rate hike may be considered a vote of confidence by Yellen to the sustainability of the current economic expansion.

Shopping Without My Rose Colored Glasses

Regardless of the state of the economic environment, proper investing should be instituted through an unemotional decision-making process, just as going shopping should be an unemotional endeavor. Price and value should be the key criteria used when buying a specific investment or holiday gift. Unfortunately for many, emotions such as greed, fear, impatience, and instant gratification overwhelm objective measurements such as price and value.

As I have noted on many occasions, over the long-run, money unemotionally moves to where it is treated best. From a long-term perspective, that has meant more capital has migrated to democratic and capitalistic countries with a strong rule of law. Closed, autocratic societies operating under corrupt regimes have been the big economic losers.

With all of that set aside, the last six years have created tremendous investment opportunities due to the extreme investor risk aversion created by the financial crisis – hence the more than tripling in U.S. stock prices since March 2009.

When comparing the yield (i.e., profit earned on an investment) between stocks and bonds, as shown in the chart below, you can see that stock investors are being treated significantly better than bond investors (6.1% vs. 4.0%). Not only are bond investors receiving a lower yield than stock investors, but bond investors also have no hope of achieving higher payouts in the future. Stocks, on the other hand, earn the opportunity of a double positive whammy. Not only are stocks currently receiving a higher yield, but stockholders could achieve a significantly higher yield in the future. For example, if S&P 500 earnings can grow at their historic rate of about 7%, then the current stock earnings yield of 6.1% would about double to 12.0% over the next decade at current prices. The inflated price and relative attractiveness of stocks looks that much better if you compare the 6.1% earnings yield to the paltry 2.2% 10-Year Treasury yield.

Source: Yardeni.com

This analysis doesn’t mean everyone should pile 100% of their portfolios into stocks, but it does show how expensively nervous investors are valuing bonds. Time horizon, risk tolerance, and diversification should always be pillars to a disciplined, systematic investment strategy, but as long as these disparities remain between the earnings yields on stocks and bonds, long-term investors should be able to shop for plenty of doorbuster discount bargain opportunities.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.