Posts tagged ‘sp500’

Fed Injects Rate Cut Adrenaline

There were a lot of injections, of the COVID vaccine variety, four years ago, but now the Federal Reserve is injecting some financial adrenaline through stimulative interest rate cuts. Expectations are for seven more -0.25% cuts over the next 12 months, but this cycle started two weeks ago when the FOMC (Federal Open Market Committee) initiated a larger -0.50% reduction in the benchmark federal funds rate target (see chart below). For now, investors have enjoyed the boost of adrenaline, which should help lower consumer interest rates on things like home mortgages, credit cards, and car loans.

Source: Yardeni.com

For the month, the S&P 500 climbed +2.0%, the Dow Jones Industrial +1.9%, and the NASDAQ index +2.7%. The monthly gains are adding to a 2024 that is shaping up to be a potentially banner year. With one quarter left in the year, the S&P has catapulted +21% higher, the Dow Jones Industrial Average +12%, and the NASDAQ index +21% for the first nine months.

Economy Strong, So Why Cut Now?

Before the Fed’s last action a couple weeks ago, the last Fed rate cut occurred in 2020 (a -1.50% cut) in the midst of a global pandemic with the aim of boosting financial activity while the brick-and-mortar economy had effectively been shut down. But compared to today, the economy is performing much better. Second quarter GDP growth came in at +3.0% with 3rd quarter GDP growth forecasts coming in at +3.1%.

So, if things look so great, why would the Fed be cutting rates to stimulate the economy now? In short, inflation has been coming down (see chart below) from a peak of 9.1% a couple years ago to 2.5% last month (near the Fed’s long-term 2.0% target). And although the current unemployment rate is low at 4.2%, it has nevertheless weakened and climbed substantially from a 3.4% level last year).

Source: Trading Economics

China Chugs Higher

While the U.S. economy has been leading developed countries during the post-COVID recovery period, China’s financial system has been struggling due to a collapsing real estate market and deteriorating consumer spending. As a result, the Chinese stock market has been drastically underperforming other foreign markets, until Beijing just recently announced a number of stimulus initiatives last week in hopes of buoying economic growth closer to its 5% target.

Here are some of the Chinese government measures:

- China plans to issue 2 trillion yuan in special sovereign bonds

- China’s central bank cut its reserve requirement ratio by 50 basis points

- Fiscal policies to focus on increasing consumer subsidies and controlling government debt

- Shanghai, Shenzhen plan to lift key home purchase restrictions

Investors cheered the announcements by binge-buying Chinese stocks, as you can see from the CSI 300 China index, which rocketed +21% higher last month – the largest monthly gain since 2008.

AI Revolution Continues

While economic headwinds and tailwinds continue to swirl, the AI (Artificial Intelligence) revolution has persisted in the background. While some traders have solely focused on AI juggernaut NVIDIA Corp. (NVDA), which has steamrolled its way into becoming a three trillion-dollar valued company, there are other tech titan companies like Oracle Corp. (ORCL), which are also riding the AI wave. Just last month, Oracle’s billionaire founder, Larry Ellison, stated, “We have 162 data centers now. I expect we will have 1,000 or 2,000 or more data centers…around the world.” Each large-scaled data center can cost in the hundreds of millions or multi-billion-dollar range. With hundreds of billions (if not trillions) of dollars to be spent on the multi-year AI infrastructure buildout, as you can imagine, there is a large, diverse ecosystem of other companies that stand to benefit. At Sidoxia Capital Management (www.Sidoxia.com), we have identified a wide swath of AI investments that have benefited our investors and stand to do so in the future.

Flies in the Ointment

By simply judging the performance of the U.S. stock market, one might think there is nothing for investors to worry about. But as is always the case, there still remain some flies in the ointment. With a tight, hotly-contested presidential election just one month away, coupled with escalated wars in the Mideast and Ukraine, future volatility or a correction in the stock market should come as no surprise to anyone, especially in light of the rich gains already registered this year. Another concern is the risk of rising inflation, which could rear its ugly head again if the Federal Reserve misjudges its rate-cutting program and overheats the economy.

Normally, interest rate cuts are reserved by the Fed for periods when the economy is headed towards a recession or there are major systemic disruptions in the financial system, which affect market liquidity and/or bank lending. That’s not the case today. Thanks to declining inflation and a robust but weakening job market, the Fed has been equipped to provide investors with a healthy injection of adrenaline through an early round of interest rate cuts, which has contributed to the powerful stock market gains. So far, the adrenaline is doing its job.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including AMZN, MSFT, META, GOOGL, NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

No Pain, No Gain

Long-term success is rarely achieved without some suffering. In other words, you are unlikely to enjoy gains without some pain. Last month was certainly painful for stock market investors. On the heels of concerns over the Russia-Ukraine war, Federal Reserve interest rate hikes, China-COVID lockdowns, inflation/supply chain disruptions, and a potential U.S. recession, the S&P 500 index declined -8.8% for the month, while the technology-heavy NASDAQ index fell -13.3%, and the Dow Jones Industrial Average weakened by -4.9%.

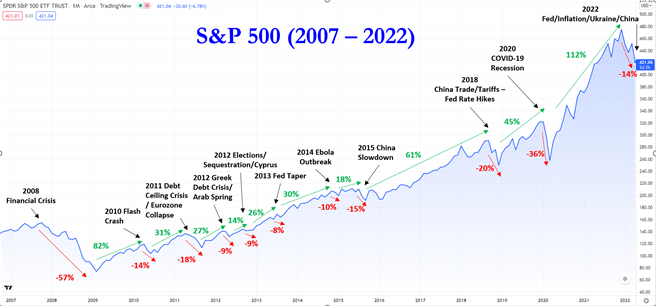

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way. As you can see from the chart below, there have been no shortage of issues and events to worry about over the last 15 years (2007 – 2022):

- 2008-2009: Financial Crisis

- 2010: Flash Crash (electronic trading collapse)

- 2011: Debt Ceiling – Eurozone Collapse

- 2012: Greek Debt Crisis – Arab Spring (anti-government protests)

- 2012: Presidential Elections – Sequestration (automatic spending cuts) – Cyprus Financial Crisis

- 2013: Federal Reserve Taper Tantrum (threat of removing monetary policy accommodation)

- 2014: Ebola Virus Outbreak

- 2015: China Economic Slowdown

- 2018: China Trade Tariffs – Federal Reserve Interest Rate Hikes

- 2020: COVID-19 Global Pandemic – Recession

- 2022: Russia-Ukraine War -Federal Reserve Interest Rate Hikes – Inflation/Supply Chain – Slowing China

So, that’s the bad news. The good news is that after the stock market eventually bottomed (S&P 500) around each of these events, one year later, stock prices rebounded on average approximately +32%, and prices moved even higher in the following two years. Suffice it to say, in most instances, patiently waiting and taking advantage of heightened volatility usually results in handsome rewards for investors over the long-run. As Albert Einstein stated, “In the middle of every difficulty lies an opportunity.”

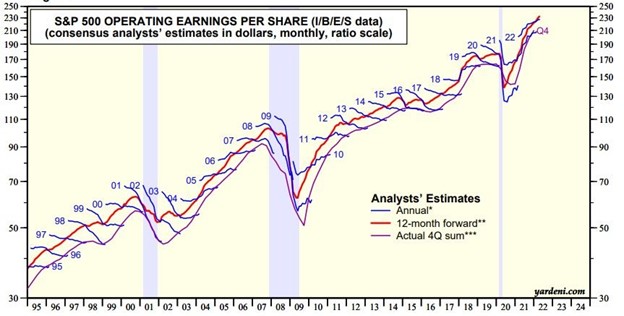

There have been plenty of false recession scares in the past, and this could prove to be the case again. Although I have noted some of the key headwinds the economy faces above, it is worth noting that current corporate profits remain at/near all-time record highs (see chart below) and the 3.6% unemployment rate effectively stands at/near generationally record low levels. What’s more, housing remains strong, and consumer balance sheets remain very healthy as a result of elevated savings rates that occurred during COVID.

The S&P 500 is already off -14% from its highest levels experienced at the beginning of the year. Although there are no clear signs of a looming recession presently, if history is a guide, much of the pessimism is likely already discounted in current stock prices. Stated differently, even if the economy were to suffer a garden-variety recession, we may already be closer to a bottom than the potential gains from a subsequent rebound. The 15-year chart shows that stock prices have become significantly more attractively valued in recent months.

Panic is rarely a profitable strategy, so now is probably not the best time to knee-jerk react to the price declines. Peter Lynch, arguably one of the greatest all-time investors (see Inside the Brain of an Investing Genius), said it best when he stated, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Market corrections are never comfortable, but successful, long-term investing comes with a price…no pain, no gain!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 2, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.