Posts tagged ‘soft landing’

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Hard Landing to Soft Landing to No Landing?

I haven’t received my pilot’s license yet, but in trying to figure out whether the economy is heading for a hard landing, soft landing, or no landing, I’m planning to enroll in flight school soon! With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected. As you can see in the chart below, economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter.

How have investors been interpreting this confusing array of landing scenarios? The stock market has stabilized and risen since last October (S&P +13.7%) but has also hit a temporary air pocket last month (-2.6%). Similarly, the Dow Jones Industrial Average has rebounded +13.9% since October, but pulled back further in February (-4.2%). As mentioned earlier, investors are having difficulty reading all the economic dials, instruments, and controls in the cockpit because there is no consensus on interest rates, inflation, economic growth, corporate earnings growth, and employment.

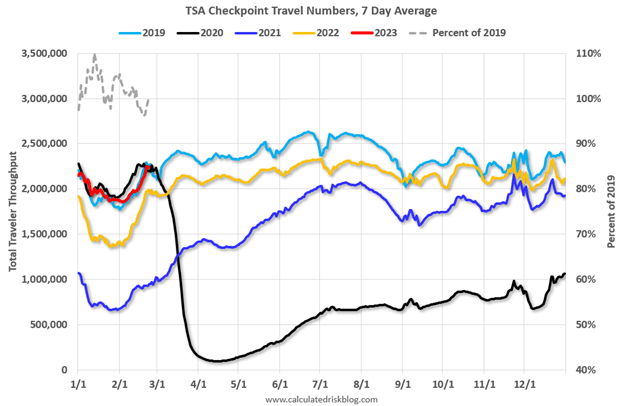

At the one end of the spectrum, you have a consumer who remains employed and willing to spend his/her savings accumulated during the pandemic. Case in point, air travel has hit pre-pandemic levels of 2019, despite business travelers staying at home conducting business on Zoom (see red line on chart below).

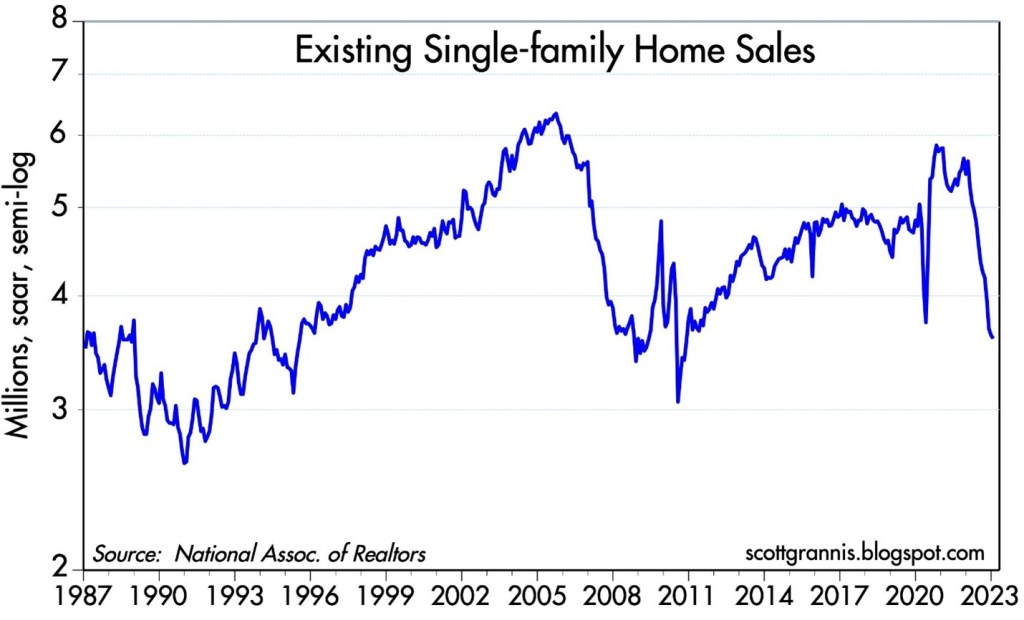

At the other end of the spectrum, we are witnessing the crippling effects that 7% mortgage rates can have on the $4 trillion real estate industry. As you can see from the chart below, sales of existing homes have plummeted at the fastest rate since the beginning of the 2008 Financial Crisis.

With all of that said, there is a consensus building that inflation is steadily coming down. Even the very skeptical and hawkish Federal Reserve Chairman, Jerome Powell, acknowledged that the “disinflationary process has begun.” We can see that in this inflation expectation chart below (green line), which measures the average anticipated inflation over the next five years by comparing the difference in yields between the five-year Treasury Notes and the five-year TIPS (Treasury Inflation Protection Securities).

Although, currently, there are many financial crosswinds swirling, the good news is that in the near-term, the economy has been maintaining its elevation and there is no imminent sign of a hard landing. We certainly could face the potential of turbulence and changing weather conditions, but that is always the case when you invest in the financial markets. If, however, inflation continues to move in the same direction, and growth continues to surprise on the upside, there may be no landing at all. Under this scenario of maintaining a comfortable altitude, I guess I can put my pilot training on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.