Posts tagged ‘sentiment indicators’

Waiting for the Hundred Minute Flood

Investors have been scarred over the last decade and many retirees have seen massive setbacks to their retirement plans. We have witnessed the proverbial “100 year flood” twice in the 2000s in the shape of a bursting technology and credit bubble in 2000 and 2008, respectively. The instantaneous transmission of data around the globe, facilitated by 24/7 news cycles and non-stop internet access, has only accelerated investor panic attacks – the 100 year flood is now expected every 100 minutes.

If drowning in the 100 year flood of events surrounding Bear Stearns, Lehman Brothers, Washington Mutual, AIG, Fannie Mae, Freddie Mac, TARP bank bailouts, Bernie Madoff’s Ponzi scheme, and Eliot Spitzer’s prostitute appreciation activities were not enough in 2008, investors (and many bearish bloggers) have been left facing the challenge of reconciling an +80% move in the S&P 500 index and +100% move in the NASDAQ index with the following outcomes (through the bulk of 2009 and 2010):

- Flash crash, high frequency traders, and “dark pools”

- GM and Chrysler’s bankruptcies

- Dubai debt crisis

- Goldman Sachs – John Paulson hearings

- Tiger Woods cheating scandal

- Greece bailout

- BP oil spill

- Healthcare reform

- China real estate bubble concerns

- Congressional leadership changes

- European austerity riots

- North Korea – South Korea provocations

- Insider trading raids

- Ireland bailout

- Next: ?????

With all this dreadful news, how in the heck have the equity markets about doubled from the lows of last year? The “Zombie Bears,” as Barry Ritholtz at The Big Picture has affectionately coined, would have you believe this is merely a dead-cat bounce in a longer-term bear-market. Never mind the five consecutive quarters of GDP growth, the 10 consecutive months of private job creation, or the record 2010 projected profits, the Zombie Bears attribute this fleeting rebound to temporary stimulus, short-term inventory rebuild, and unsustainable printing press activity by Federal Reserve Chairman Ben Bernanke.

Perhaps the Zombie Bears will change their mind once the markets advance another 25-30%? Regardless of the market action, individual investors have taken the pessimism bait and continue to hide in their caves. This strategy makes sense for wealthy retirees with adequate resources, but for the vast majority of Americans, earning next to nothing on their nest egg in cash and overpriced Treasuries isn’t going to help much in achieving your retirement goals. Unless of course, you like working as a greeter at Wal-Mart in your 80s and eating mac & cheese for breakfast, lunch, and dinner.

This Time is Different

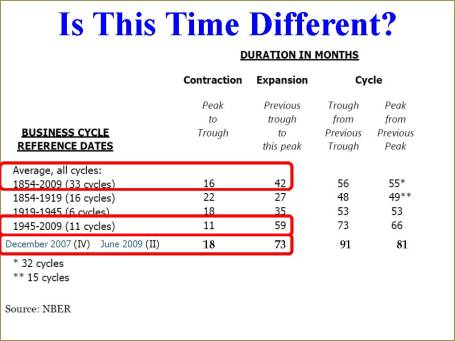

The Zombies would also have you believe this time is different, or in other words, historical economic cycles do not apply to the recent recession. I’ll stick with French novelist Alphonse Karr (1808-1890) who famously stated, “The more things change, the more things stay the same.”

As you can see from the data below, the recent recession lasted two months longer than the 16 month cycle average from 1854 – 2009. We have had 33 recessions and 33 recoveries, so I am going to go out on a limb and say this time will not be any different. Could we have a double dip recession? Sure, but odds are on our side for an average five year expansion, not the 18 month expansion experienced thus far.

The Grandma Sentiment Indicator

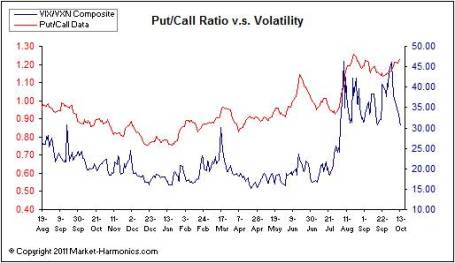

I love all these sentiment indicators, surveys, and various ratios that constantly get thrown around the blogosphere because it is never difficult to choose one matching a specific investment thesis. Strategists urge us to follow the actions of the “smart money” and do the opposite (like George Costanza) when looking at the “dumb money” indicators. The bears would also have you believe the world is coming to an end if you look at the current put/call data (see Smart Money Prepares for Sell Off). Instead, I choose to listen to my grandma, who has wisely reminded me that actions speak louder than words. Right now, those actions are screaming pure, unadulterated fear – a positive contrarian dynamic.

Over the last few years there has been more than $250 billion in equity outflows according to data from the Investment Company Institute (ICI). Bond funds on the other hand have taken in an unprecedented $376 billion in 2009 and about another $216 billion in 2010 through August.

As investment guru Sir John Templeton famously stated, “Bull markets are born on pessimism and they grow on skepticism, mature on optimism, and die on euphoria.” Judging by the asset outflows, I would say we haven’t quite reached the euphoria phase quite yet. I won’t complain though because the more fear out there, the more opportunity for me and my investors.

As I have consistently stated, I have no clue what equity markets are going to do over the next six to twelve months, nor does my bottom-up philosophy rely upon making market forecasts to succeed. Evaluating investor sentiment and timing economic cycles are difficult skills to master, but judging by the panicked actions and bond heavy asset inflows, investors are nervously awaiting another 100 year flood to occur in the next hundred minutes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, WMT, and AIG derivative security, but at the time of publishing SCM had no direct position in Bear Stearns, Lehman Brothers, JPM, Washington Mutual, Fannie Mae, Freddie Mac, GS, BP, GM, Chrysler, and any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sentiment Indicators: Reading the Tea Leaves

Market commentators and TV pundits are constantly debating whether the market is overbought or oversold. Quantitative measures, often based on valuation measures, are used to support either case. But the debate doesn’t stop there. As a backup, reading the emotional tea leaves of investor attitudes is relied upon as a fortune telling stock market ritual (see alsoTechnical Analysis article). Generally these tools are used on a contrarian basis when deciding about purchase or sale timing. The train of thought follows excessive optimism is tied to being fully invested, therefore the belief is only one future direction left…down. The thought process is also believed to work in reverse.

Actions Louder Than Words

When it comes to investing, I believe actions speak louder than words. For example, words answered in a subjective survey mean much less to me in gauging optimism or pessimism than what investors are really doing with their cool, hard cash. Asset flow data indicates where money is in fact going. Currently the vast majority of money is going into bonds, meaning the public hates stocks. That’s fine, because without pessimism, there would be fewer opportunities.

Most sentiment indicators are an unscientific cobbling of mood surveys designed to check the pulse of investors. How is the data used? As mentioned above, the sentiment indicators are commonly used as a contrarian tool…meaning: sell the market when the mood is hot and buy the market when it is cold.

Here are some of the more popular sentiment indicators:

1) Sentiment Surveys (AAII/NAAIM/Advisors): Each measures different bullish/bearish opinions regarding the stock market.

2) CBOE Volatility Index (VIX): The “fear gauge” developed using implied option volatility (read also VIX article).

3) Breadth Indicators (including Advanced-Decline and High-Low Ratios): Measures the number of up stocks vs. down stocks. Used as measurement device to identify extreme points in a market cycle.

4) NYSE Bullish Percentage: Calculates the percentage of bullish stock price patterns and used as a contrarian indicator.

5) NYSE 50-Day and 200-Day Moving Average: Another technical price indicator that is used to determine overbought and oversold price conditions.

6) Put/Call Ratio: The number of puts purchased relative to calls is used by some to measure the relative optimism/pessimism of investors.

7) Volume Spikes: Optimistic or pessimistic traders will transact more shares, therefore sentiment can be gauged by tracking volume metrics versus historical averages.

Sentiment Shortcomings

From a ten thousand foot level, the contrarian premise of sentiment indicators makes sense, if you believe as Warren Buffett does that it is beneficial to buy fear and sell greed. However, many of these indicators are more akin to reading tea leaves, than utilizing a scientific tool. Investors enjoy black and white simplicity, but regrettably the world and the stock market come in many shades of gray. Even if you believe mood can be accurately measured, that doesn’t account for the ever-changing state of human temperament. For instance, in a restaurant setting, my wife will change her menu choice four times before the waiter/waitress takes her order. Investor sentiment can be just as fickle depending on the Dubai, Greece, Swine Flu, or foreclosure headline du jour.

Other major problems with these indicators are time horizon and degree of imbalance. Yeah, an index or stock may be oversold, but by how much and over what timeframe? Perhaps a security is oversold on an intraday chart, but dramatically overbought on a monthly basis? Then what?

The sentiment indicators can also become distorted by a changing survey population. Average investors have fled the equity markets and have followed the pied piper Bill Gross to fixed income nirvana. What we have left are a lot of unstable high frequency traders who often change opinions in a matter of seconds. These loose hands are likely to warp the sentiment indicator results.

Strange Breed

Investors are strange and unique animals that continually react to economic noise and emotional headlines in the financial markets. Despite the infinitely complex world we live in, people and investors use everything available at their disposal in an attempt to make sense of our endlessly random financial markets. One day interest rate declines are said to be the cause of market declines because of interest rate concerns. The next day, interest rate declines due to “quantitative easing” comments by Federal Reserve Chairman Ben Bernanke are attributed to the rise in stock prices. So, which one is it? Are rate declines positive or negative for the market?

On a daily basis, the media outlets are arrogant enough to act like they have all the answers to any price movement, rather than chalking up the true reason to random market volatility, sensationalistic noise, or simply more sellers than buyers. Virtually any news event will be handicapped for its market impact. If Ben Bernanke farts, people want to know what he ate and what impact it will have on Fed policy.

Sentiment indicators are some of the many tools used by professionals and non-professionals alike. While these indicators pose some usefulness, overreliance on reading these sentiment tea leaves could prove hazardous to your fortune telling future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.