Posts tagged ‘recession’

This Too Shall Pass

Ever since December 31st last year when China alerted the WHO (World Health Organization) about several cases of unusual pneumonia in Wuhan, a port city of 11 million people in the central Hubei province, the dark coronavirus (Covid-19) clouds began to form. Last week, the storm came rumbling through with a vengeance.

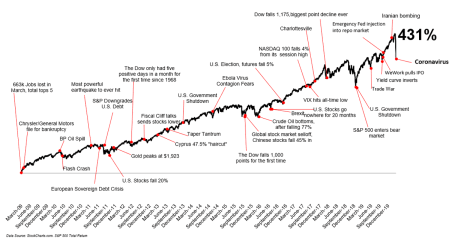

I have been investing for close to 30 years, so facing these temporary bouts of thunder and lightning is nothing new for me. Although the pace of this week’s -3,583 point drop in the Dow Jones Industrial Average was particularly noteworthy, we experienced a more severe -5,000 point correction a little more than a year ago due to China trade war concerns and our Federal Reserve increasing interest rates. What happened after that year-end 2018 drop? Stock prices skyrocketed more than +7,800 points (+36%) to a new record high on February 12th, just a few weeks ago. Over the long-run, stock prices have always eventually moved up to new record highs, but this week reminds us that volatility is a normal occurrence.

This week also reminds us that the best decisions made in life generally are not emotionally panicked ones. The same principle applies to investing. So rather than knee-jerk react to the F.U.D. (Fear, Uncertainty, Doubt), let’s take a look at some of the current facts as it relates to coronavirus (Covid-19):

- The number of deaths this season in the U.S. from the common flu: 18,000. The number of deaths in the U.S. from coronavirus: 2 individuals (both in WA with underlying health conditions).

- The number of new coronavirus cases in China is declining. Confirmed infections have fallen from more than 2,000 per day to a few hundred. People are going back to work and companies like Starbucks are re-opening their China stores for business.

- Coronavirus is relatively benign compared to other contagious pathogens. Roughly 98% of infected individuals fully recover, and deaths are limited to people with weakened immune systems, who in many cases are suffering from other illnesses.

- Previous viral outbreaks, which were significantly more fatal, were all contained, e.g., SARS (2003-04), MERS (2012), and Ebola (2014-16). In each instance, the stock market initially fell, and then subsequently fully recovered.

- Although the coronavirus has accelerated in areas outside of China, there are dozens of different companies currently developing a vaccine. If a working vaccine is discovered, a rebound could occur as fast as the drop.

- Governments and central banks are not sitting on their hands. Coordinated efforts are being instituted to curtail the spread of the virus and also provide liquidity to financial markets.

The actual death toll from the coronavirus is relatively small compared to other pandemics, catastrophes (e.g., 9/11), and wars. However, the hangover effect from the fear, uncertainty, and panic that can manifest in the days, weeks, and months after global events can last for some time. I expect the same to occur in the coming weeks and months as the drip of continued coronavirus headlines blankets social media and the news.

I don’t want to sugar coat the economic impact from a potential pandemic because quarantining 60 million people in China, instituting global travel bans, and closing areas of gathering has and will continue to have a material economic impact. Although history would indicate otherwise, it is certainly possible the current situation could worsen and lead to a global recession. Even if that were the case, I believe we are more likely closer to a bottom, than we are to a top, especially given how low interest rates are now. More specifically, we just hit an all-time record low yield of 1.13% on the 10-Year Treasury. In other words, putting money in the bank isn’t going to earn you much.

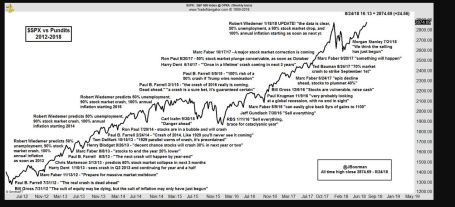

In summary, the current situation experienced this week is nothing new – we’ve lived through similar situations many times (see chart above). The short-run headlines can get more painful, but in the meantime, you can wash your hands and bathe in Purell. This too shall pass.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 2, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in SBUX or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Movie Deja Vu – Coronavirus

I have seen this movie before. I love the stock market, but I do actually have other outside interests, including seeing movies. What better indoor winter activity than watching movies?! The Hollywood excitement continues this Sunday for the 92nd Academy Awards. My popcorn consumption has been generous this year as I have seen seven of the nine Best Picture nominated films with the exception of Jojo Rabbit and Little Women.

With a lifetime of movie watching under my belt, there is no shortage of redundant movie themes, whether it’s happy endings in romantic comedies, triumphant patriotism in war flicks, or gory blood spatters in horror films. Just as repetitive as these story lines have been in films, the redundant theme of pandemic health panics continues to plague investors every time a new contagious disease is announced. The newest debut is coronavirus. While coronavirus is playing on the big screen, the presidential impeachment trial, and January 31st Brexit deadline have been sideshows. Stay tuned for that breaking news!

Doctor Wade’s Diagnosis

Although I have not added M.D. to my list of professional credentials (CFA, CFP), Dr. Wade has enough medical experience to identify historical patterns. Most recently, the media covering the Wuhan coronavirus originating in the central Chinese province of Hubei (see map below) has unnecessarily terrorized the global masses with F.U.D. (Fear, Uncertainty, Doubt). While we likely know the ending of this health scare movie (i.e., humanity survives and life goes on), the timing, and scope remain uncertain.

2020: Sickness After Healthy Start

After an healthy start to the 2020 stock market show (S&P 500 index zoomed +3.3% higher), investors viewing the coronavirus plot unfold subsequently were sickened with an S&P decline of -3.4% to finish the month slightly down from year-end (-0.2% from December 31st to January 31st). The Dow Jones Industrial Average was hit slightly worse, down 282 points for the month to 28,256, or -1.0%.

How do we know this infectious coronavirus disease scare shall too pass? Well, over the last few decades, there have been many more lethal diseases that have been put to bed. Here’s a list of some of these high profile, safely-controlled infectious diseases:

- Severe Acute Respiratory Syndrome (SARS)

- Middle East Respiratory Syndrome (MERS)

- Ebola

- Zika Virus

- Bird Flu

- Swine Flu

- H1N1 Virus

- Mad Cow

- Hoof-and-Mouth

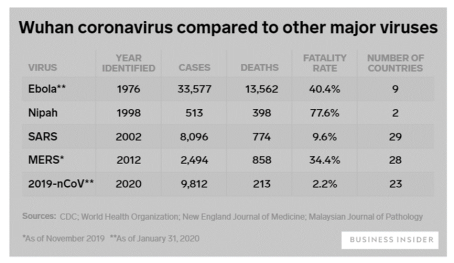

A chart comparing the severity and timing of some of the major viruses can be seen below.

While the human impact has been tragic, coronavirus has also struck a blow to the global economy. The pandemic prequel that mostly closely matches coronavirus is SARS, which also originated in China during 2003 in the province of Guandong. Most notable to me is the fatality rate for coronavirus of just 2.2% versus 9.6% for SARS. While coronavirus is less deadly than SARS, coronavirus is objectively more contagious than SARS and could have an incubation period of 14 days (significantly longer than SARS, which could increase the rate of infections). In fact, there were more confirmed cases of coronavirus in one month than all the reported cases of SARS identified over a span of nine months. Even so, as the chart shows, coronavirus deaths remain the lowest.

Economic Impact

The damaging economic impact of the coronavirus pandemic continues to escalate rapidly on a daily basis as governments, global health agencies, corporations, and individuals respond. Even though coronavirus appears to be much less lethal than SARS, we can scale current economic estimates based on the relative costs incurred during SARS. Some reports show the 2003 SARS situation costing the global economy $40 – $60 billion and 2.8 milllion Chinese jobs, while the potential hit in lost global growth from coronavirus could total $160 billion, according to Warwick McKibbin, a Australian National University economics professor.

The Chinese government fully realizes the amount of financial destruction caused by the SARS outbreak, and therefore is not sitting idly as it relates to the coronavirus. Back during SARS, the government did not institute quarantine measures nor publish the SARS’ genome (necessary to test and track virus) until four months had passed. After the first coronavirus patient was diagnosed around December 1st (two months ago) and the spread of the virus accelerated, the Chinese local governments expanded mandatory factory shutdowns for the Lunar New Year from January 31st to February 9th. What’s more, Wuhan, a city of 11 million residents at the epicenter of the illness, recently closed the area’s outgoing airport and railway stations and suspended all public transport. Chinese government officials have since extended the travel ban to 16 neighboring cities with a combined population of more than 50 million people, including Huanggang, a city next to Wuhan with 7.5 million people, essentially placing those cities on lock down.

Private companies are taking action as well. Companies such as Disney, Tesla, Amazon, Google, Apple, McDonalds, Starbucks, and more than a dozen airlines, cruise lines, casinos, and other global companies with significant footprints in China are suspending operations, temporarily shutting factories and instituting travel restrictions.

No Need to Panic Yet

Before you quarantine yourself in your basement, and take full-body showers in hand sanitizer, let’s take a look at some of those annoying things called facts:

- There have been zero (0) coronavirus deaths in the United States, and eight diagnosed cases (at time of press).

- There have been approximately 10,000 Americans killed by the flu since October 2019.

Apparently casual American observers are unable to filter out the true signals being lost in the avalanche of blood-curdling, panicked virus headlines. Tufts Medical Center infectious disease specialist Dr. Shira Doron highlighted this message when she stated the following, “The likelihood of an American being killed by the flu compared to being killed by the coronavirus is probably approaching infinity.” Of the limited number of coronavirus deaths thus far, one study of 41 Wuhan coronavirus death cases showed the median age is around 75 years old. For most people (i.e., those who are not elderly or young children), I guess the moral of this story is to turn the TV off, go get your flu shot, and fall asleep with few worries.

There may be some more coronavirus pain and suffering ahead until this tragic human and economic pandemic comes under control. During the SARS outbreak (November 2002 – July 2003), peak-to-trough stock prices temporarily fell by -16% before marching upwards to new record highs. However, if this movie finishes like so many other similar infectious diseases, the coronavirus fever should break soon enough, and investors will be satisfied with new opportunities and another happy ending to the story.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 3, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFS) and DIS, TSLA, AMZN, GOOGL, AAPL, and MCD, but at the time of publishing had no direct position in SBUX or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

A Tale of Two Years: Happy & Not-So-Happy

Happy New Year! If you look at the stock market, 2019 was indeed a happy one. The S&P 500 index rose +29% and the Dow Jones Industrial Average was up +22%. Spectacular, right? More specifically, for the S&P 500, 2019 was the best year since 2013, while the Dow had its finest 12-month period since 2017. Worth noting, although 2019 made investors very happy, 2018 stock returns were not-so-happy (S&P 500 dropped -6%).

Source: Investor’s Business Daily

As measured against almost any year, the 2019 results are unreasonably magnificent. This has many prognosticators worrying that these gains are unsustainable going into 2020, and many pundits are predicting death and destruction are awaiting investors just around the corner. However, if the 2019 achievements are combined with the lackluster results of 2018, then the two-year average return (2018-2019) of +10% looks more reasonable and sustainable. Moreover, if history is a guide, 2020 could very well be another up year. According to Barron’s, stocks have finished higher two-thirds of the time in years following a +25% or higher gain.

With the yield on the 10-Year Treasury Note declining from 2.7% to 1.9% in 2019, it should come as no surprise that bonds underwent a reversal of fortune as well. All else equal, both existing bond and stock prices generally benefit from declining interest rates. The U.S. Aggregate Bond Index climbed +5.5% in 2019, a very respectable outcome for this more conservative asset class, after the index experienced a modest decline in 2018.

Happy Highlights

What contributed to the stellar financial market results in 2019? There are numerous contributing factors, but here are a few explanations:

Source: Dr. Ed’s Blog

Source: Dr. Ed’s Blog

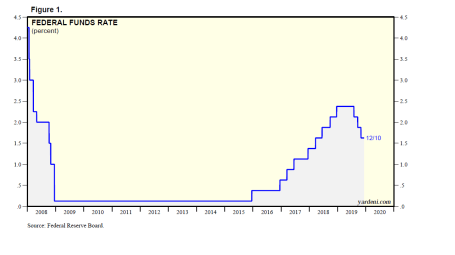

- Federal Reserve Cuts Interest Rates: After slamming on the brakes in 2018 by hiking interest rates four times, the central bank added stimulus to the economy by cutting interest rates three times in 2019 (see chart above).

- Phase I Trade Deal with China: Washington and Beijing reached an initial trade agreement that will reduce tariffs and force China to purchase larger volumes of U.S. farm products.

- Healthy Economy: 2019 economic growth (Gross Domestic Product) is estimated to come in around +2.3%, while the most recent unemployment rate of 3.5% remains near a 50-year low.

- Government Shutdown Averted: Congress approved $1.4 trillion in spending packages to avoid a government shutdown. The spending boosts both the military and domestic programs and the signed bills also get rid of key taxes to fund the Affordable Care Act and raises the U.S. tobacco buying age to 21.

- Brexit Delayed: The October 31, 2019 Brexit date was delayed, and now the U.K. is scheduled to leave the European Union on January 31, 2020. EU officials are signaling more time may be necessary to prevent a hard Brexit.

- Sluggish Global Growth Expected to Rise in 2020: Global growth rates are expected to increase in 2020 with little chance of recessions in major economies. The Financial Times writes, “The outlook from the models shows global growth rates rising next year, returning roughly to trend rates. Recession risks are deemed to be low, currently standing about 5 per cent for the US and 15 per cent for the eurozone.”

- Potential Bipartisan Infrastructure Spend: In addition to the $1.4 trillion in aforementioned spending, Nancy Pelosi, the Speaker of the Democratic-controlled House of Representatives, said she is willing to work with the Republicans and the White House on a stimulative infrastructure spending bill.

2018-2019 Lesson Learned

One of the lessons learned over the last two years is that listening to the self-proclaimed professionals, economists, strategists, and analysts on TV, or over the blogosphere, is dangerous and usually a waste of your time. For stock market participants, listening to experienced and long-term successful investors is a better strategy to follow.

Conventional wisdom at the beginning of 2018 was that a strong economy, coupled with the Tax Reform Act that dramatically reduced tax rates, would catapult corporate profits and the stock market higher. While many of the talking heads were correct about the trajectory of S&P 500 profits, which propelled upwards by an astonishing +24%, stock prices still sank -6% in 2018 (as mentioned earlier). If you fast forward to the start of 2019, after a -20% correction in stock prices at the end of 2018, conventional wisdom stated the economy was heading into a recession, therefore stock prices should decline further. Wrong!

As is typical, the forecasters turned out to be completely incorrect again. Although profit growth for 2019 was roughly flat (0%), stock prices, as previously referenced, unexpectedly skyrocketed. The moral of the story is profits are very important to the direction of future stock prices, but using profits alone as a timing mechanism to predict the direction of the stock market is nearly impossible.

So, there you have it, 2018 and 2019 were the tale of two years. Although 2018 was an unhappy year for investors in the stock market, 2019’s performance made investors happier than average. When you combine the two years, stock investors should be in a reasonably good mood heading into 2020 with the achievement of a +10% average annual return. While this multi-year result should keep you happy, listening to noisy pundits will make you and your investment portfolio unhappy over the long-run. Rather, if you are going to heed the advice of others, it’s better to pay attention to seasoned, successful investors…that will put a happy smile on your face.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Glass Half Empty Becomes Record Glass Half Full

Oh my! What a difference a few months makes. Originally, what looked like an economic glass half empty in December has turned into a new record glass half full. What looked like Armageddon in December has turned into a v-shaped bed of roses to new all-time record stock market highs for the S&P 500 index (see chart below). For the recent month, the S&P 500 climbed another +3.9% to 2,945, bringing total 2019 gains to an impressive +17.5% advance. Before you get too excited, it’s worth noting stocks were down in value during 2018. When you combine 2018-2019, appreciation over the last 16 months equates to a more modest +10.2% expansion. Worth noting, since the end of 2017, profits have climbed by more than +20%, which means stocks are cheaper today as measured by Price-Earnings ratios (P/E) than two years ago (despite the historic, record levels). For any confused investors, we can revisit this topic for discussion in a future writing.

Source: Trading Economics

From Famine to Feast

As I noted in my “December to Remember” article, there were no shortage of concerns ranging from impeachment to Brexit. How do those concerns look now? Let’s take a look:

Government Shutdown: The longest government shutdown in history (35 days) ended on January 25, 2019 with minimal broad-based economic damage.

Global Trade (China): Rhetoric coming from President Trump and his administration regarding a trade deal resolution with China has been rather optimistic. In fact, a CNBC survey shows 77% of respondents believe that the U.S. and China will complete a trade deal.

Federal Reserve Interest Rate Policy: After consistently increasing interest rates nine times since the end of 2015 until late 2018, Federal Reserve Chairman Jerome Powell signaled he was effectively taking monetary policy off rate-hiking “autopilot” and would in turn become “patient” as it relates to increasing future interest rates. Interestingly, traders are now forecasting a 70% chance of a rate cut before January 29, 2020.

Mueller Investigation: Special counsel Robert Mueller released his widely anticipated report that investigated Russian collusion and obstruction allegations by the president and his administration. In Mueller’s 22-month report he could “not establish that members of the Trump Campaign conspired or coordinated with the Russian government in its election interference activities.” As it relates to obstruction, Mueller effectively stated the president attempted to obstruct justice but was not successful in achieving that goal. Regardless of your political views, uncertainty surrounding this issue has been mitigated.

New Balance of Power in Congress: Democrats took Congressional control of the House of Representatives and reintroduced gridlock. But followers of mine understand gridlock is not necessarily a bad thing.

Brexit Deal Uncertainty: After years of negotiations for Britain to exit the European Union (EU), the impending Brexit deadline of March 29th came and went. EU an UK leaders have now agreed to extend the deadline to October 31st, thereby delaying any potential negative impact from a hard UK exit from the EU.

Recession Fears: Fears of a fourth quarter global slowdown that would bleed to a recession on U.S. soil appear to have been laid to bed. The recently reported first quarter economic growth (Gross Domestic Product – GDP) figures came in at a healthy+3.2% annualized growth rate, up from fourth quarter growth of +2.2%, and above consensus forecasts of 2.0%.

Curve Concern

The other debate swirling around the investment community this month was the terrifying but wonky “inverted yield curve.” What is an inverted yield curve? This is a financial phenomenon, when interest rate yields on long-term bonds are lower than interest rate yields on short-term bonds. Essentially when these dynamics are in place, bond investors are predicting slower economic activity in the future (i.e., recession). The lower future rates effectively act as a way to stimulate prospective growth amid expected weak economic activity. Furthermore, lower future rates are a symptom of stronger demand for longer-term bonds. It’s counterintuitive for some, but higher long-term bond prices result in lower long-term bond interest rate yields. If this doesn’t make sense, please read this. Why is all this inverted yield curve stuff important? From World War II, history has informed us that whenever this phenomenon has occurred, it has been a great predictor for a looming recession.

As you can see from the chart below, whenever the yield curve (red line) inverts (goes below zero), you can see that a recession (gray vertical bar) occurs shortly thereafter. In other words, an inverted yield curve historically has been a great way to predict recessions, which normally is almost an impossible endeavor – even for economists, strategists, and investment professionals.

Source: Calafia Beach Pundit

Although the curve inverted recently (red line below 0), you can see from the chart, historically recessions (gray vertical bars) have occurred only when inflation-adjusted interest rates (blue line) have climbed above 2%. Well, the data clearly shows inflation-adjusted interest rates are still well below 1%, therefore an impending recession may not occur too soon. Time will tell if these historical relationships will hold, but rest assured this is a dynamic I will be following closely.

It has been a crazy 6-9 months in the stock market with price swings moving 20% in both directions (+/-), but it has become increasingly clear that a multitude of 2018 fears causing the glass to appear half empty have now abated. So long as economic growth continues at a healthy clip, corporate profits expand to (remain at) record levels, and the previously mentioned concerns don’t spiral out of control, then investors can credibly justify these record levels…as they peer into a glass half full.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

March Madness Leads to Gladness

As usual, there was plenty of “madness” in March, and this year did not disappoint. Just as is the case with the annual NCAA basketball tournament, certain investors suffered the agony of defeat in the financial markets, but overall, the thrill of victory triumphed in March. So much so that the S&P 500 index posted its largest first-quarter gain in more than 20 years. Not only did the major indexes post gains for the month, but the winning record looks even better for the year-to-date results. For 2019, the S&P 500 index is up +13.1%; the Dow Jones Industrial Average +11.2%; and the tech-heavy NASDAQ index +16.5% for the year. The monthly gains in the major indexes were more muted, ranging from 0% for the Dow to +2.6% for the NASDAQ.

Busy? Listen to Wade discuss this article and other topics each week on the Weekly Grind podcast:

While 2018 ended with a painful injury (S&P 500 -6.2% in Q4), on fears of a deteriorating China trade deal and a potentially overly aggressive Federal Reserve hiking interest rates, the stock market ultimately recovered in 2019 on changing perceptions. Jerome Powell, the Federal Reserve Chairman, indicated the Fed would be more “patient” going forward in increasing interest rates, and President Trump’s tweet-storm on balance has been optimistic regarding the chances of hammering out a successful trade deal with China.

With the new cautious Fed perspective on interest rates, the yield on the 10-Year Treasury Note fell by -0.28% for the quarter from 2.69% to 2.41%. In fact, investors are currently betting there is a greater than 50% probability the Fed will cut interest rates before year-end. Moreover, in testimony before Congress, Powell signaled the economic dampening policy of reducing the Fed’s balance sheet was almost complete. All else equal, the shift from a perceived rate-hiking Fed to a potentially rate-cutting Fed has effectively turned an apparent headwind into tailwind. Consumers are benefiting from this trend in the housing market, as evidenced by lower 30-year fixed mortgage rates, which in some cases have dropped below 4%.

Economy: No Slam Dunk

However, not everything is a slam dunk in the financial markets. Much of the change in stance by the Fed can be attributed to slowing economic growth seen both here domestically and abroad, internationally.

Here in the U.S., the widely followed monthly jobs number last month only showed a gain of 20,000 jobs, well below estimates of 180,000 jobs. This negative jobs surprise was the biggest miss in more than 10 years. Furthermore, the overall measure for our nation’s economic activity, growth in Gross Domestic Product (GDP), was revised downward to +2.2% in Q4, below a previous estimate of +2.6%. The so-called “inverted yield curve” (i.e., short-term interest rates are higher than long-term interest rates), historically a precursor to a recession, is consistent with slowing growth expectations. This inversion temporarily caused investors some heartburn last month.

If you combine slowing domestic economic growth figures with decelerating manufacturing growth in Europe and China (e.g. contracting Purchasing Managers’ Index), then suddenly you end up with a slowing global growth picture. In recent months, the U.S. economy’s strength was perceived as decoupling from the rest of the world, however recent data could be changing that view.

Fortunately, the ECB (European Central Bank) and China have not been sitting on their hands. ECB President Mario Draghi announced three measures last month that could cumulatively add up to some modest economic stimulus. First, it “expects the key ECB interest rates to remain at their present levels at least through the end of 2019.” Second, it committed to reinvesting all maturing bond principal payments in new debt “for an extended period of time.” And third, the ECB announced a new batch of “Targeted Long-Term Refinancing Operations” starting in September. Also, Chinese Premier Li Keqiang announced the government will reduce taxes, primarily Value Added Taxes (VAT) and social security taxes (SST). Based on the rally in equities, it appears investors are optimistic these stimulus efforts will eventually succeed in reigniting growth.

Volume of Political Noise Ratcheted Higher

While I continually try to remind investors to ignore politics when it comes to their investment portfolios, the deafening noise was especially difficult to overlook considering the following:

- Mueller Report Completed: Robert Mueller’s Special Counsel investigation into potential collusion as it relates Russian election interference and alleged obstruction of justice concluded.

- Michael Cohen Testifies: Former President Trump lawyer, Michael Cohen, testified in closed sessions before the House and Senate intelligence committees, and in public to the House Oversight Committee. In the open session, Cohen, admitted to paying hush money to two women during the election. Cohen called President Trump a racist, a conman, and a cheat but Cohen is the one heading to jail after being sentenced for lying to Congress among other charges.

- Manafort Sentenced: Former Trump Campaign Chairman Paul Manafort was sentenced to prison on bank and tax fraud charges.

- North Korea No Nuke Deal: In geopolitics,President Trump flew 21 hours to Vietnam to meet for a second time with North Korean leader Kim Jong Un on denuclearization of the Korean peninsula. The U.S. president ended up leaving early, empty handed, without signing an agreement, after talks broke down over sanction differences.

- Brexit Drama Continues: The House of Commons in the lower house of the U.K. Parliament continued to stifle Prime Minister Theresa May’s plan to exit the European Union with repeated votes rejecting her proposals. Brexit outcomes remain in flux, however the European Union did approve an extension to May 22 to work out kinks, if the House can approve May’s plan.

Positive Signals Remain

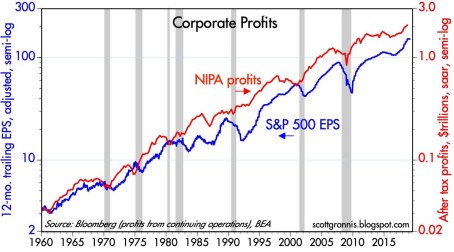

March Madness reminds us that a big lead can be lost quickly, however a few good adjustments can also swiftly shift momentum in the positive direction. Although growth appears to be slowing both here and internationally, corporate profits are not falling off a cliff, and earnings remain near record highs (see chart below).

Source: Calafia Beach Pundit

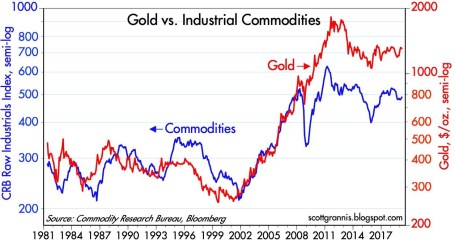

Similar to the stock market, commodities can be a good general barometer of current and future economic activity. As you can see from the chart below, not only have commodity prices remained stable in the face of slowing economic data, but gold prices have not spiked as they did during the last financial crisis.

Source: Calafia Beach Pundit

After 2018 brought record growth in corporate profits and negative returns, 2019 is producing a reverse mirror image – slow profit growth and record returns. The volatile ending to 2018 and triumphant beginning to 2019 is a reminder that “March Madness” does not need to bring sadness…it can bring gladness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Gloom to Boom

Gloomy clouds rolled in late last year in the form of a government shutdown; U.S. – China trade war tensions; hawkish Federal Reserve interest rate policies; a continued special counsel investigation by Robert Mueller into potential Russian election interference; a change in the Congressional balance of power; Brexit deal uncertainty; and U.S. recession concerns, among other worries. These fear factors contributed to a thundering collapse in stock prices during the September to December time frame of approximately -20% in the S&P 500 index (from the September 21st peak until the December 24th trough).

However, the dark storm clouds quickly lifted once Santa Claus delivered post-Christmas stock price gains that have continued through February. More specifically, since Christmas Eve, U.S. stocks have rebounded a whopping +18%. On a shorter term basis, the S&P 500 index and the Dow Jones Industrial Average have both jumped +11.1% in 2019. January showed spectacular gains, but last month was impressive as well with the Dow climbing +3.7% and the S&P +3.0%.

The rapid rise and reversal in negative sentiment over the last few months have been aided by a few positive developments.

- Strong Earnings Growth: For starters, 2018 earnings growth finished strong with an increase of roughly +13% in Q4-2018, thereby bringing the full year profit surge of roughly +20%. All else equal, over the long run, stock prices generally follow the path of earnings growth (more on that later).

- Solid Economic Growth: If you shift the analysis from the operations of companies to the overall performance of the economy, the results in Q4 – 2018 also came in better than anticipated (see chart below). For the last three months of the year, the U.S. economy grew at a pace of +2.6% (higher than the +2.2% GDP [Gross Domestic Product] growth forecast), despite headwinds introduced by the temporary U.S. federal government shutdown and the lingering Chinese trade spat. For the full-year, GDP growth came in very respectably at +2.9%, but critics are dissecting this rate because it was a hair below the coveted 3%+ target of the White House.

Source: The Wall Street Journal

- A More Accommodative Federal Reserve: As mentioned earlier, a major contributing factor to the late-2018 declines was driven by a stubborn Federal Reserve that was consistently raising their interest rate target (an economic-slowing program that is generally bad for stocks and bonds), which started back in late 2015 when the Federal Funds interest rate target was effectively 0%. Over the last three years, the Fed has raised its target rate range from 0% to 2.50% (see chart below), while also bleeding off assets from its multi-trillion dollar balance sheet (primarily U.S. Treasury and mortgage-backed securities). The combination of these anti-stimulative policies, coupled with slowing growth in major economic regions like China and Europe, stoked fears of an impending recession here in the U.S. Fortunately for investors, however, the Federal Reserve Chairman, Jerome Powell, came to the rescue by essentially implementing a more “patient” approach with interest rate increases (i.e., no rate increases expected in the foreseeable future), while simultaneously signaling a more flexible approach to ending the balance sheet runoff (take the program off “autopilot).

Source: Dr. Ed’s Blog

The Stock Market Tailwinds

For those of you loyal followers of my newsletter articles and blog articles over the last 10+ years, you understand that my generally positive stance on stocks has been driven in large part by a couple of large tailwinds (see also Don’t Be a Fool, Follow the Stool):

#1) Low Interest Rates – Yes, it’s true that interest rates have inched higher from “massively low” levels to “really low” levels, but nevertheless interest rates act as the cost of holding money. Therefore, when inflation is this low, and interest rates are this low, stocks look very attractive. If you don’t believe me, then perhaps you should just listen to the smartest investor of all-time, Warren Buffett. Just this week the sage billionaire reiterated his positive views regarding the stock market during a two hour television interview, when he once again echoed his bullish stance on stocks. Buffett noted, “If you tell me that 3% long bonds will prevail over the next 30 years, stocks are incredibly cheap… if I had a choice today for a ten-year purchase of a ten-year bond at whatever it is or ten years, or– or buying the S&P 500 and holding it for ten years, I’d buy the S&P in a second.”

#2) Rising Profits – In the short-run, the direction of profits (orange line) and stock prices (blue line) may not be correlated (see chart below), but over the long-run, the correlation is amazingly high. For example, you can see this as the S&P 500 has risen from 666 in 2009 to 2,784 today (+318%). More recently, profits rose about +20% during 2018, yet stock prices declined. Moreover, profits at the beginning of 2019 (Q1) are forecasted to be flat/down, yet stock prices are up +11% in the first two months of the year. In other words, the short-term stock market is schizophrenic, so focus on the key long-term trends when planning for your investments.

Source: Macrotrends

Although 2018 ended with a gloomy storm, history tells us that sunny conditions have a way of eventually returning unexpectedly with a boom. Rather than knee-jerk reacting to volatile financial market conditions after-the-fact, do yourself a favor and create a more versatile plan that deals with many different weather conditions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

P.S.

Wade’s Investing Caffeine Podcast Has Arrived!

Wade Slome, founder of Sidoxia Capital Management, author of How I Managed $20 Billion Dollars by Age 32, and lead editor of the Investing Caffeine blog has launched the Caffeine Corner investment podcast.

The Investing Caffeine podcast is designed to wake up your investment brain with weekly overviews of financial markets and other economic-related topics.

Don’t miss out! Follow us on either SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

Another Month, Another Record

The S&P 500 eclipsed the 2,900 level and the NASDAQ jumped over 8,000 this month – both all-new record highs. The Dow Jones Industrial average also temporarily catapulted above 26,000 in August, but remains 2% shy of the January 2018 record highs. For the year, here are what the gains look like thus far:

- S&P 500: +5.3% (2,902)

- NASDAQ: +17.5% (8,110)

- Dow Jones Industrial: +5.0% (25,965)

For months, and even years, I have written how investors have underestimated the strength of this bull market, which has been driven by an incredible earnings growth, low interest rates, reasonable valuations, and a skeptical mass market of investors. As I pointed out in the article, Why the Masses Missed the 10-Year Bull Market, stock ownership has gone down during this massive quadrupling in the bull market. And many investors have missed the fruits of the bull market due to an over-focus on uncertain politics and scary headlines.

Nothing lasts forever, however, so another correction will likely be in the cards, just as we experienced this February when the S&P 500 index temporarily fell -18% from the January peak. But as I have highlighted previously, attempting to forecast or predict a correction is a Fool’s Errand. At Sidoxia we implement a disciplined, systematic process to identify attractive investments through our proprietary S.H.G.R. model (see also Holy Grail) and the four legs of our macroeconomic framework (earnings, interest rates, valuation, and investor sentiment – see Follow the Stool). With stock prices bouncing around near record highs, it is surprising to some that anxiety still remains elevated, primarily due to polarizing politics and an unfounded fear of an imminent recession.

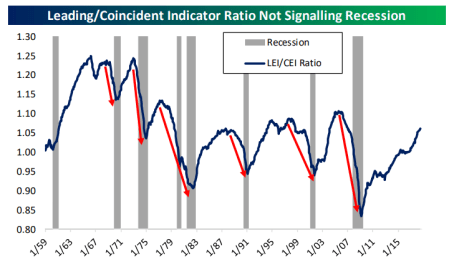

Despite all the hand wringing going on over political headlines, the fact remains the economic tailwinds have “trumped” any political concerns. After a strong Q2 GDP reading of +4.2%, according to numerous economists, Q3 is tracking for another healthy +3% gain. As the Leading & Coincident Indicator chart shows below, there currently is no sign of an imminent recession.

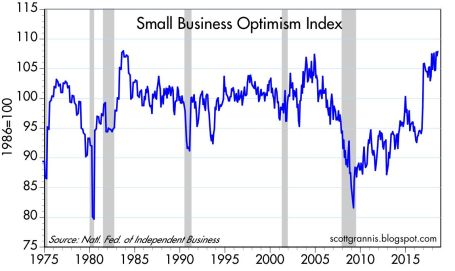

And jobs remain plentiful in part because of Small Business Optimism (see chart below). It’s common knowledge that small businesses generate the vast majority of new jobs, so these optimism levels hovering near 35-year highs augur well for future hiring, job growth, and investment.

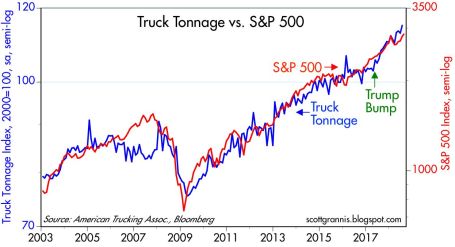

The real economy, as measured by the shipment of goods, is trucking along as well (see the truck tonnage chart below).

Source: Scott Grannis

While all the positives above have been highlighted already, in the forefront has been an endless string of doomsday forecasts. Scott Grannis captured this sentiment in a six-year chart created by TradeNavigator.com (click here).

As we enter the tenth year of this bull stock market, politics remain polarizing and skepticism reigns supreme. However, until the storm clouds come rolling in, the economy keeps expanding and prices keep moving higher. If the trend continues, as has been the case in recent years, next month’s title could be the same, “Another Month, Another Record.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (September 4, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Keeping the Economy Afloat

There have been plenty of concerns about rising interest rates, flattening yield curves, and potential recessions, but we all know that consumer spending accounts for roughly two-thirds of our country’s economy. Well, I certainly met my personal economic duty this summer by putting my consumer spending responsibilities to work. Not only did my family vacation involve approximately 5,700 miles of cross-country flying, but also 1,400 miles of driving all over the East Coast. By placing my credit card charging limits to the test on hotels, Airbnb, restaurants, gasoline, and overpriced tourist activities, I may have single-handedly kept the economy afloat for the rest of 2017.

Here’s a synopsis of the Slome family adventure and my spending spree binge.

Bon Jour Montreal!

View of the city from Mount Royal.

Montréal is the cultural, French-speaking crown jewel of Canada. Unbeknownst to me, the largest city in Canada’s province of Québec is actually a floating island on the Saint Lawrence River. The city name, Montreal, is actually derived from the prominent and picturesque hill at the heart of the city, Mount Royal.

Port of Montreal – Cirque de Soleil tents in the background.

Finger Lakes Fun

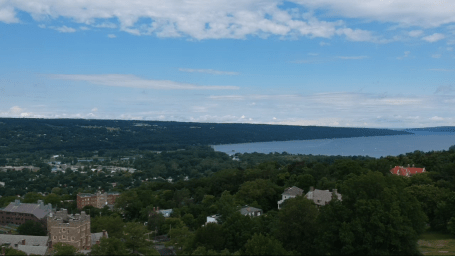

Ithaca, New York is located at the base of the Finger Lakes (Cayuga Lake) in upstate New York. With a population of around 30,000, this college town is home to my business school alma mater (Cornell University), which was founded in 1865 and home to a total of more than 20,000 students.

Taughannock Falls, which is Native American for “great fall in the woods,” is a 215-foot waterfall making it the highest single-drop waterfall east of the Rocky Mountains.

My drone shot of Cayuga Lake and a small portion of the Cornell University campus.

Niagara Falls

We chose to check out the 176-foot Niagara Falls from the Canadian side of the U.S.-Canada border. About 34 million gallons per minute flows during the summer time, and our drenched extremities were proof positive of this fact.

Panoramic view of Niagara Falls from Journey Behind the Falls.

View of Horseshoe Falls from 520 feet in the air while on the rotating restaurant in the Skylon Tower.

Rockin’ It in Cleveland

Cleveland is the second-largest city in Ohio, located on Lake Eerie. Even though the Cleveland Cavaliers may have lost in the NBA Finals to the Golden State Warriors, the city still rocks. The “Forest City” is home to the famous Rock and Roll Hall of Fame designed by renowned architect I. M. Pei and the well-known West Side Market.

The iconic pyramid-shaped Rock and Roll Hall of Fame located on the beautiful Lake Eerie waterfront.

It’s a little known fact that Cleveland is home to the original Christmas Story movie house. The movie was set in the early-1940s but released in 1983. Nostalgic items such as the infamous leg lamp, Red Ryder Carbine Action 200-shot Range Model BB gun, and photos of Ralphie can be found in the adjacent museum.

Slomes Seize Steel City

We discovered the vibrant city of Pittsburgh, also known as the “Steel City” and “City of Bridges” (446 bridges), at the intersection of the Allegheny, Monongahela, and Ohio Rivers “Three Rivers”. This sports-driven city is home to the World Champion Penguins (hockey), Steelers (football), and Pirates (baseball) professional teams. My dad grew up here and attended the University of Pittsburgh (“Pitt”) for both his undergraduate and medical school degrees. The rolling hills landscape provides some breathtaking views of the city, especially from Mount Washington.

Downtown Pittsburgh from Mount Washington.

The 42-story Gothic Cathedral of Learning located at the center of the Pitt campus – the second tallest university building in the world.

Gettysburg – Civil War Galore

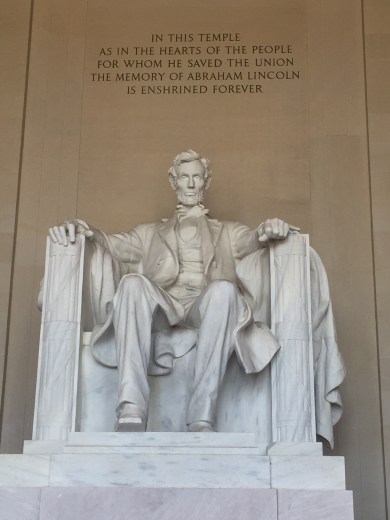

As we began our eastward trek, Gettysburg, Pennsylvania offered a beneficial dual purpose in providing both a valuable history lesson and also a pit-stop on the way to our next vacation location. It was dumb luck rather than strategic planning that landed us at Gettysburg on the 154th anniversary of the greatest but bloodiest Civil War battle in July 1863 (half way through the Civil War 1861 – 1865). The United States of America may have looked a lot different if the 75,000 Confederate troops led by General Robert E. Lee would have defeated the 97,000 Union troops commanded by General George Meade. However, when all was said and done, the anti-slavery Union troops defeated the Confederates over a three-day battle, which resulted in more than 6,000 deaths and greater than 50,000 casualties. President Abraham Lincoln honored the fallen Union soldiers in his famous two-minute Gettysburg address four months after the battle (November 1963). In the speech, Lincoln provided an important historical context of the battle, which ultimately turned the tide of the Civil War in the Union’s favor as they fought for human equality.

A view from the Gettysburg battlefield on the 154thanniversary of the famous Confederate-Union clash.

Looking for enlightenment as I sit next to Abe outside the Gettysburg Museum.

Wade Watches Washington

Stopping at the nation’s capital was a logical progression, as we continued our East Coast adventure. Whether you are a political junky or not, it’s difficult to not get sucked into the grandeur of this majestic city of roughly one million (including commuters) on the Potomac River. The District of Columbia borders the states of Virginia and Maryland and is named after President George Washington, a man who shares the same birthday with me. Between the memorials, monuments, museums, entertainment options, and restaurants, there is no shortage of activities to choose from in this spectacular city.

The Lincoln Memorial had new meaning after our Gettysburg visit.

We stopped to say hello to President Trump, then the president and I both decided to send out a tweet.

Beach Blast

Completing our journey at Virginia Beach was no accident. All of our speed vacationing required a little R&R, and turned out to be a blast in more than one way. Not only did we enjoy soaking in the miles of beaches and hundreds of hotels and restaurants along the oceanfront, but we also appreciated the 4th of July fireworks blasting right outside our beach resort.

Nice view outside our oceanfront room.

A little relaxing cruise time down the strand.

Like any vacation, the 2017 summer family adventure eventually came to an end. No matter what I believe or say, the debate about the timing of the next recession and/or bear market will rage on for eternity. But the fact remains, despite an unemployment rate of 4.4% near cyclically low levels, there is still a record high of six million job openings available, which means there is still plenty of slack in the economy to sustain economic expansion. Although I will continue to save and strive to maintain positive investment performance figures, I will also do my best to keep the economy afloat with my consumer spending and travel binging habits.

P.S. If you spend more time vacation planning than investment planning, give us a call…we can help!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Head Fakes Surprise as Stocks Hit Highs

In a world of seven billion people and over 200 countries, guess what…there are a plethora of crises, masses of bad people, and plenty of lurking issues to lose sleep over.

The fear du jour may change, but as the late-great investor Sir John Templeton correctly stated:

“Bull markets are born on pessimism and they grow on skepticism, mature on optimism, and die on euphoria.”

And for the last decade since the 2008-2009 Financial Crisis, it’s clear to me that the stock market has climbed a lot of worry, pessimism, and skepticism. Over the last decade, here is a small sampling of wories:

With over five billion cell phones spanning the globe, fear-inspiring news headlines travel from one end of the world to the other in a blink of an eye. Fortunately for investors, the endless laundry list of crises and concerns has not broken this significant, multi-year bull market. In fact, stock prices have more than tripled since early 2009. As famed hedge fund manager Leon Cooperman noted:

“Bull markets don’t die from old age, they die from excesses.”

On the contrary to excesses, corporations have been slow to hire and invest due to heightened risk aversion induced by the financial crisis. Consumers have saved more and lowered personal debt levels. The Federal Reserve took unprecedented measures to stimulate the economy, but these efforts have since been reversed. The Fed has even signaled its plan to reduce its balance sheet later this year. As the expansion has aged, corporations and consumer risk aversion has abated, but evidence of excesses remains paltry.

Investors may no longer be panicked, but they remain skeptical. With each subsequent new stock market high, screams of a market top and impending recession blanket headlines. As I pointed out in my March Madness article, stocks have made new highs every year for the last five years, but continually I get asked, “Wade, don’t you think the market is overheated and it’s time to sell?”

For years, I have documented the lack of stock buying evidenced by the continued weak fund flow sales. If I could summarize investor behavior in one picture, it would look something like this:

Corrections have happened, and will continue to occur, but a more significant decline will likely happen under specific circumstances. As I point out in Half Empty, Half Full?, the time to become more cautious will be when we see a combination of the following trends occur:

- Sharp increase in interest rates

- Signs of a significant decline in corporate profits

- Indications of an economic recession (e.g., an inverted yield curve)

- Spike in stock prices to a point where valuation (prices) are at extreme levels and skeptical investor sentiment becomes euphoric

Attempting to predict a market crash is a Fool’s Errand, but more important for investors is periodically reviewing your liquidity needs, time horizon, risk tolerance, and unique circumstances, so you can optimize your asset allocation. There will be plenty more head fake surprises, but if conditions remain the same, investors should not be surprised by new stock highs.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fall is Here: Change is Near

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2016). Subscribe on the right side of the page for the complete text.

Although the fall season is here and the leaf colors are changing, there are a number of other transforming dynamics occurring this economic season as well. The S&P 500 index may not have changed much this past month (down -0.1%), but the technology-laden NASDAQ index catapulted higher (+1.9% for the month and +6.0% for 2016).

With three quarters of the year now behind us, beyond experiencing a shift in seasonal weather, a number of other changes are also coming. For starters, there’s no ignoring the elephant in the room, and that is the presidential election, which is only weeks away from determining our country’s new Commander in Chief. Besides religion, there are very few topics more emotionally charged than politics – whether you are a Republican, Democrat, Independent, Libertarian, or some combination thereof. Even though the first presidential debate is behind us, a majority of voters are already set on their candidate choice. In other words, open-minded debate on this topic can be challenging.

Hearing critical comments regarding your favorite candidate are often interpreted in the same manner as receiving critical comments about a personal family member – people often become defensive. The good news, despite the massive political divide currently occurring in the country and near-record low politician approval ratings in Congress , politics mean almost nothing when it comes to your money and retirement (see also Politics & Your Money). Regardless of what politicians might accomplish (not much), individuals actually have much more control over their personal financial future than politicians.

While inaction may rule the day currently, more action generally occurs during a crisis – we witnessed this firsthand during the 2008-2009 financial meltdown. As Winston Churchill famously stated,

“You can always count on Americans to do the right thing – after they’ve tried everything else.”

Political discourse and gridlock are frustrating to almost everyone from a practical standpoint (i.e., “Why can’t these idiots get something done in Washington?!”), however from an economic standpoint, gridlock is good (see also Who Said Gridlock is Bad?) because it can keep a responsible lid on frivolous spending. Educated individuals can debate about the proper priorities of government spending, but most voters agree, maintaining a sensible level of spending and debt should be a bipartisan issue.

From roughly 2009 – 2014, you can see how political gridlock has led to a massive narrowing in our government’s deficit levels (chart below) – back to more historical levels.This occurred just as rising frustration with Washington has been on the rise.

The Fed: Rate Revolution or Evolution?

Besides the changing season of politics, the other major area of change is Federal Reserve monetary policy. Even though the Fed has only increased interest rates once over the last 10 years, and interest rates are at near-generational lows, investors remain fearful. There is bound to be some short-term volatility if interest rates rise to 0.50% – 0.75% in December, as currently expected. However, if the Fed continues at its current snail’s pace, it won’t be until 2032 before they complete their rate hike cycles.

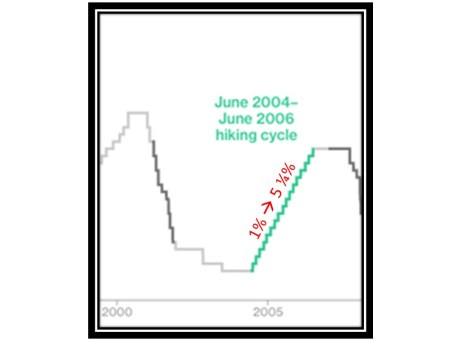

We can put the next rate increase into perspective by studying history. More specifically, the Fed raised interest rates 17 times from 2004 – 2006 (see chart below). Fortunately over this same time period, the world didn’t end as the Fed increased interest rates from 1.00% to 5.25% (stocks prices actually rose around +11%). The same can be said today – the world won’t likely end, if interest rates rise from 0.50% to 0.75% in a few months.

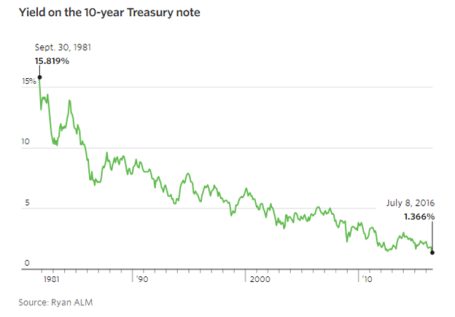

The next question becomes, why are interest rates so low? There are many reasons and theories, but a few of the key drivers behind low rates include, slower global economic growth, low inflation, high demand for low-risk assets, technology, and demographics. I could devote a whole article to each of these factors, and indeed in many cases I have, but suffice it to say that there are many reasons beyond the oversimplified explanation that artificial central bank intervention has led to a 35 year decline in interest rates (see chart below).

Change is a constant, and with fall arriving, some changes are more predictable than others. The timing of the U.S. presidential election outcome is very predictable but the same cannot be said for the timing of future interest rate increases. Irrespective of the coming changes and the related timing, history reminds us that concerns over politics and interest rates often are overblown. Many individuals remain overly-pessimistic due to excessive, daily attention to gloomy and irrelevant news headlines. Thankfully, stock prices are paying attention to more important factors (see Don’t Be a Fool) and long-term investors are being rewarded with record high stock prices in recent weeks. That’s the type of change I love.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.