Posts tagged ‘Politics’

Flogging the Financial Firefighter

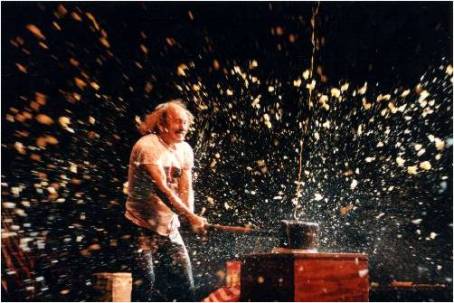

There we were in the fall of 2008, our economic system burning up in flames, as we all watched century-old financial institutions falling like flies. At the center of the inferno was Federal Reserve Chairman Ben Bernanke. In coordination with other government agencies and officials, Bernanke managed to prevent the worse financial crisis since the Great Depression from completely scorching the economy into ruin. After successfully hosing down the flames (at least temporarily), Ben Bernanke is now being singled out as the scapegoat and getting flogged for being a major participant in the financial crisis.

Execution Threatened Water Damage

In hind-sight could Bernanke have made better decisions? Certainly. Despite the Federal Reserve dousing out the flames, politicians are pointing the finger at Bernanke for causing water damage. I’m going to go out on a limb and say water damage is preferable to the alternative – a whole community of properties burned down to a large pile of charred ash.

Democrats are now flailing in the wake of the Massachusetts Democratic Senate seat loss to Republican Scott Brown. Even though I question President Obama’s blame-game tax and overhaul tactics (see Surgery or Amputation article), to his credit Obama realizes the instability of mass proportion that would occur if the reappointment of Bernanke were to come to fruition. If the head of the globe’s largest financial system is going to be kicked to the curb after saving our economy at the edge of an abyss, then heaven please help us.

Politics Will Reign Supreme in 2010

“Change” was promised in the 2008 Presidential election and the impatient natives are not seeing results fast enough, given lofty unemployment rates and unsuccessful implementation of other initiatives (thus far). Needless to say, the media is going to be awash in an orgy of political mudslinging and campaign promises that will overwhelm the airwaves for the balance of the year.

From a market standpoint, Republicans and Democrats, alike, do share some common ground…jobs. As a countervailing trend to the forces dragging down the economy, the unified focus on job creation should provide some support to the financial markets.

Unfortunately, the independence of the Federal Reserve is being dragged into the political ring as Ben Bernanke’s reappointment process cannot escape the Capitol Hill circus. Berkshire Hathaway (BRKA/B) CEO Warren Buffett has likely handicapped the market’s reaction to a failed Bernanke reappointment when he recently stated, “Just tell me a day ahead of time so I can sell some stocks.” If the fires of 2008 concerned you, you may want to have your fire alarm and water hose ready for action if Chairman Bernanke is shown the exit.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Plucking the Feathers of Taxpaying Geese

“The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.” ~Jean Baptist Colbert

With exploding deficits, multiple wars, healthcare reform, and a sluggish economy, there are two logical immediate choices on how to improve our current financial situation:

1) Cut spending. This is not a desirable option for politicians since benefit cuts to voters are not appreciated come re-election period.

2) Raise Taxes. Not desirable from a voter standpoint either, but the Obama administration has chosen to target the rich – the smaller voting population. This can of course backfire, when many of these wealthy individuals are campaign contributors or have ties to lobbyists who are backing the President’s agendas.

The tax-paying geese are getting fatter, but before the goose can be put in the oven, the feathers need plucking with the goal of minimizing hissing. Sure, I am an advocate for tax cuts like most taxpayers. I’m even a larger proponent, if Congress had the political gumption to cut spending to fund the tax drops. Unfortunately, politicians view expense reduction as suicide because cutting programs or benefits will only lead to fewer reelection votes. Congressmen are perfectly fine letting taxpayers live high on the hog for now, and just saddle future generations with our mounting debt problems.

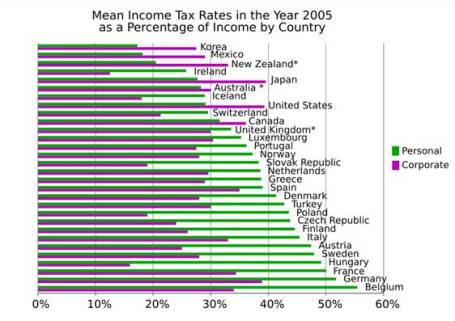

What’s Fair?

The current strategy is based on taxing the wealthy to fund deficits, healthcare, wars, debt, etc. Since the rich represent a smaller proportion of voters, from the egotistical politician standpoint (reelection is paramount), this wealth distribution strategy appears more palatable to incumbent legislators. Democrats would rather focus on squeezing a narrower demographic footprint of voters versus an across the board tax increase, which would impact all taxpayers. Merely taxing the rich can certainly backfire however, especially if the wealthy demographic getting taxed is the exact population paying for the politicians’ reelection and lobbying agendas.

But at what point is taxing the rich unfair and counterproductive? Currently the top 10% of the nation that earns more than $92,400 a year, pay about 72% of the country’s income taxes. Ari Fleischer, former G.W. Bush Press Secretary compares the current tax policy to an “inverted pyramid scheme” in a Wall street Journal Op-Ed earlier this year. Like an upside spinning top, the whirling pyramid is supported by a narrow, pointy pinnacle.

Fleischer goes onto add:

“According to the CBO, those who made less than $44,300 in 2001 — 60% of the country — paid a paltry 3.3% of all income taxes. By 2005, almost all of them were excused from paying any income tax. They paid less than 1% of the income tax burden. Their share shrank even when taking into account the payroll tax. In 2001, the bottom 60% paid 16.3% of all taxes; by 2005 their share was down to 14.3%. All the while, this large group of voters made 25.8% of the nation’s income. When you make almost 26% of the income and you pay only 0.6% of the income tax, that’s a good deal, courtesy of those who do pay income taxes.”

Cheaters Should Not Be Exempt (See Celebrity Tax Evader Article)

Certainly loopholes and undeserving credits for multinationals and the wealthy should be removed as well. The House of Representatives recently approved a $387 million boost for the IRS to fund a high-wealth unit focusing on trusts, real estate investments, privately held companies and other business entities controlled by rich individuals (read Reuters article). The IRS is also opening new criminal offices in Beijing, Panama City and Sydney to focus on international enforcement of tax cheaters. At the center of the IRS’ offshore effort is the legal cases against Swiss banking giant UBS (stands for Union Bank of Switzerland), which resulted in UBS agreeing to turn over almost 5,000 client names and pay $780 million to settle tax evasion charges.

Taxes in 2010 and Beyond

When it comes to future taxes, a lot of details remain up in the air. What we do know is that the 2001 Bush tax cuts are set to expire in 2010 and the Obama administration has indicated they want to raise taxes on the rich (those earning more than $250,000) and keep the cuts static for those in the lower paying tax brackets.

- Healthcare: If healthcare reform will indeed pass, those benefits won’t be free. The Obama administration is backing a House bill that creates a 5.4% surtax on income over $500,000 for single filers or $1 million for couples.

- Income Taxes: On the income tax front, Obama and some Democrats are pushing to have the two highest tax brackets revert back to the pre-2001 levels of 36% and 39.6%.

- Capital Gains: If the Obama administration gets its way, capital-gains tax rates would go back to 20% for wealthier individuals and qualified dividends would be taxed as ordinary income up to the top rate of 39.6%.

- Estate Taxes: The House passed a bill earlier this month that makes the 2009 estate tax provisions permanent (i.e., a 45% top marginal rate on estates larger than $3.5 million or $7 million for married couples). If the Senate were not to pass the bill, current law has the estate tax rate reverting to a 55% rate on estates worth more than $1 million after next year.

Given the exploding deficits and weary economy, which is recovering from a severe economic crisis, getting our tax policy situation back in order is critical. Having politicians make tough tax policy decisions runs contrary to their partisan reelection agendas, however our country needs to pluck more feathers from our taxpaying geese to face these monumental economic challenges…even if it requires listening to irritating hissing from our citizens.

Ari Fleischer WSJ Op-Ed From Earlier This Year

Article on Tax Policy Issues for 2010 and Beyond

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in an security referenced, including UBS. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Friedman Looks to Flatten Problems in Flat World

Thomas Friedman, author of recent book Hot, Flat, and Crowded and New York Times columnist, combines a multi-discipline framework in analyzing some of the most complex issues facing our country, from both an economic and political perspective. Friedman’s distinctive lens he uses to assimilate the world, coupled with his exceptional ability of breaking down and articulating these thorny challenges into bite-sized stories and analogies, makes him a one-of-a-kind journalist. Whether it’s explaining the history of war through McDonald’s hamburgers, or using the Virgin Guadalupe to explain the rise of China, Friedman brings highbrow issues down to the eye-level of most Americans.

In his seminal book, The World is Flat, Friedman explains how technology has flattened the global economy to a point where U.S. workers are fighting to keep their domestic tax preparation and software engineering jobs, as new emerging middle classes from developing countries, like China and India, steal work.

The Flat World

In boiling down the recent financial crisis, Friedman used Iceland to explain the “flattening” of the globe:

“Fifteen British police departments lost all their money in Icelandic online savings accounts. Like who knew? I knew the world was flat – I didn’t know it was that flat…that Iceland would become a hedge fund with glaciers.”

The left-leaning journalist hasn’t been afraid to bounce over to the “right” when it comes to foreign affairs and certain fiscally conservative issues. For example, he initially full-heartedly supported George W. Bush’s invasion of Iraq. And on global trade, he has a stronger appreciation of the economic benefits of free trade as compared to traditionally Democratic protectionist views.

Calling All Better Citizens

In a recent Charlie Rose interview, Friedman’s patience with our country’s citizenry has worn thin – he believes government leaders cannot be relied on to solve our problems.

When it comes to the massive deficits and foreign affair issues, Friedman comes to the conclusion we need to cut expenses or raise taxes. By creating a $1 per gallon gasoline tax, Friedman sees a “win-win-win-win” solution. Not only could the country wean itself off foreign oil addiction from authoritarian governments and create scores of new jobs with E.T. (Energy Technologies), the tax could also raise money to reduce our fiscal deficit, and pay for expanded healthcare coverage.

It’s fairly clear to me that government can’t show the leadership in cutting expenses. Since cutting benefits for voters won’t get you re-elected, taxes most certainly will have to go up. Wishful thinking that a recovering economy will do the dirty, debt-cutting work is probably naïve. If forced to pick a poison, the gas tax is Friedman’s choice. I’m not so sure the energy lobby would feel the same?

Political gridlock has always been an obstacle for getting things done in Washington. Technology, scientific polling, 24/7 news cycles, and deep-pocketed lobbyists are only making it tougher for our country to deal with our difficult challenges. Regardless of whether Friedman’s gasoline tax is the silver bullet, I welcome the clear, passionate voice from somebody that understands the challenges of living in a flat world.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) owns certain exchange traded funds (BKF, FXI) and has a short position in MCD at the time this article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.