Posts tagged ‘Politics’

Shoot First and Ask Later?

The financial markets have been hit by a tsunami on the heels of idiotic debt negotiations, a head-scratching credit downgrade, and slowing economic data after a wallet-emptying spending binge by the government. These chain of events have forced many investors and speculators alike to shoot first, and ask questions later. Is this the right strategy? Well, if you think the world is going to end and we are in a global secular bear market stifled by a choking pile of sovereign debt, then the answer is a resounding “yes.” If however, you believe the blood curdling screams from an angered electorate will eventually influence existing or soon-to-be elected politicians in dealing with the obvious, then the answer is probably “no.”

Plug Your Ears

Anybody that says they confidently know what is really going to happen over the next six months is a moron. You can ask those same so-called talking head experts seen over the airwaves if they predicted the raging +35% upward surge last summer, right after the market tanked -17% on “double-dip” concerns and Fed Chairman Ben Bernanke gave his noted quantitative easing speech in Jackson Hole, Wyoming. I’m still flicking through the channels looking for the professionals who perfectly envisaged the panicked buying of the same downgraded Treasuries Standard and Poor’s pooped on. Oh sure, it makes perfect sense that trillions of dollars would flock to the warmth and coziness of sub-2% yielding debt in a country exploding with unsustainable obligations and deficits, fueled by a Congress that can barely blows its nose to a successful negotiation.

The moral of the story is that nobody knows the future with certainty – no matter how much CNBC producers would like you to believe the opposite is true. Some of the arguably smartest people in the world have single handedly triggered financial market implosions. Consider Robert Merton and Myron Scholes, both renowned Nobel Prize winners, who brought global financial markets to its knees in 1998 when Merton and Scholes’s firm (Long Term Capital Management) lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Or ask yourself how well Fed Chairmen Alan Greenspan and Ben Bernanke did in predicting the credit crisis and housing bubble.

If the strategist or trader du jour squawking on the boob-tube was really honest, he or she would steal the sage words of wisdom from the television series secret agent Angus MacGyver who articulated, “Only a fool is sure of anything, a wise man keeps on guessing.”

Listen to the “E”-Word

If you can’t trust all the squawkers, then whom can you trust (besides me of course…cough, cough)? The answer is no different than the person you would look for in other life-important decisions. If you needed a serious heart by-pass surgery, would you get advice from a nurse or medical professor, or would you listen more closely to the top cardiologist at the Mayo Clinic who performed over 2,000 successful surgeries? If you were looking for a pilot to fly your plane, would you prefer a 25-year-old flight attendant, or a 55-year old steely veteran who has 10 million miles of flight experience? OK, I think you get the point…legitimate experience with a track record is key.

Unfortunately, most of the slick, articulate people we see on television may look experienced and have some gray hair, but the only thing they are experienced at is giving opinions. As my great, great grandmother once told me, “Opinions are a dime a dozen, but experience is much more valuable” (embellished for dramatic effect). You are better off listening to experienced professionals like Warren Buffett (listen to his recent Charlie Rose interview), who have lived through dozens of crises and profited from them – Buffett becoming the richest person on the planet doesn’t just come from dumb luck.

If you are having trouble sleeping, you either are taking too much risk, or do not understand the nature of the risk you are taking (see Sleeping like a Baby). Things can always get worse, and the risk of a self-fulfilling further decline is a possibility (read about Soros and Reflexivity). If you are determined to make changes to your portfolio, use a scalpel, and not an axe. The recent extreme volatility makes times like these ideal for reviewing your financial position, goals, and risk tolerance. But before you shoot your portfolio first, and ask questions later, prevent a prison sentence of panic, or your financial situation may end up behind bars.

[tweetmeme source=”WadeSlome” only_single=false https://investingcaffeine.com/2011/08/20/shoot-first-and-ask-later/%5D

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MHP, CMCSA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Plumbers & Cops: Can the Debt Ceiling be Fixed?

The ceiling is leaking, but it’s unclear whether it will be repaired? Rather than fix the seeping fiscal problem, Democrats and Republicans have stared at the leaky ceiling and periodically applied debt ceiling patches every year or two by raising the limit. Nanosecond debt ceiling coverage has reached a nauseating level, but this issue has been escalating for many months. Last fall, politicians feared their long-term disregard of fiscally responsible policies could lead to a massive collapse in the financial ceiling protecting us, so the President called in the bipartisan plumbers of Alan Simpson & Erskine Bowles to fix the leak. The commission swiftly identified the problems and came up with a deep, thoughtful plan of action. Unfortunately, their recommendations were abruptly dismissed and Washington fell back into neglect mode, choosing instead to bicker like immature teenagers. The result: poisonous name calling and finger pointing that has placed Washington politicians one notch above Cuba’s Fidel Castro, Venezuela’s Hugo Chavez, and Iran’s Mahmoud Ahmadinejad on the list of the world’s most hated leaders. Strategist Ed Yardeni captured the disappointment of American voters when he mockingly states, “The clowns in Washington are making people cry rather than laugh.”

Although despair is in the air and the outlook is dour, our government can redeem itself with the simple passage of a debt ceiling increase, coupled with credible spending reduction legislation (and possibly “revenue enhancers” – you gotta love the tax euphimism).

The Elephant in the Room

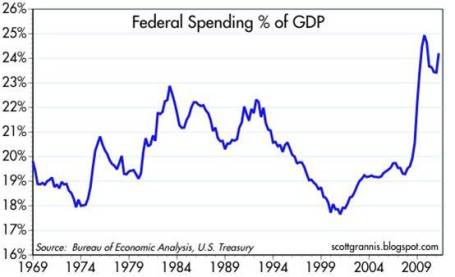

Our country’s spending problems is nothing new, but the 2008-2009 financial crisis merely amplified and highlighted the severity of the problem. The evidence is indisputable – we are spending beyond our means:

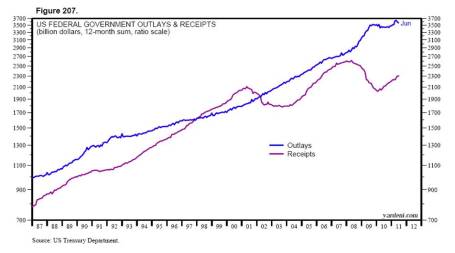

If the federal spending to GDP chart is not convincing enough, then review the following graph:

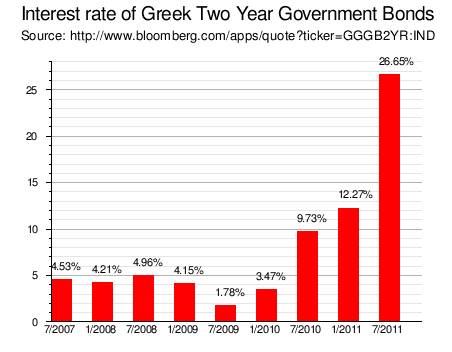

You don’t need to be a brain surgeon or rocket scientist to realize government expenditures are massively outpacing revenues (tax receipts). Expenditures need to be dramatically reduced, revenues increased, and/or a combination thereof. Applying for a new credit card with a limit to spend more isn’t going to work anymore – the lenders reviewing those upcoming credit applications will straightforwardly deny the applications or laugh at us as they gouge us with prohibitively high borrowing costs. The end result will be the evaporation of entitlement programs as we know them today (including Medicare and Social Security). For reference of exploding borrowing costs, please see Greek interest rate chart below. The mathematical equation for the Greek financial crisis (and potentially the U.S.) is amazingly straightforward…Loony Spending + Looney Politicians = Loony Interest Rates.

To illustrate my point further, imagine the government owning a home with a mortgage payment tied to a 2.5% interest rate (a tremendously low, average borrowing cost for the U.S. today). Now visualize the U.S. going bankrupt, which would then force foreign and domestic lenders to double or triple the rates charged on the mortgage payment (in order to compensate the lenders for heightened U.S. default risk). Global investors, including the Chinese, are pointing a gun at our head, and if a political blind eye on spending continues, our foreign brethren who have provided us with extremely generous low priced loans will not be bashful about pulling the high borrowing cost trigger. The ballooning mortgage payments resulting from a default would then break an already unsustainably crippling budget, and the government would therefore be placed in a position of painfully slashing spending. Too extreme a shift towards austerity could spin a presently wobbling economy into chaos. That’s precisely the situation we face under a no-action Congressional default (i.e., no fix by August 2nd or shortly thereafter). To date, the Chinese have collected their payments from us with a nervous smile, but if the U.S. can’t make some fiscally responsible choices, our Asian Pacific pals will be back soon with a baseball bat to collect.

The Cops to the Rescue

Any parent knows disciplining teenagers doesn’t always work out as planned. With fiscally irresponsible spending habits and debt load piling up to the ceiling, politicians are stealing the prospects of a brighter future from upcoming generations. The good news is that if the politicians do not listen to the parental voter cries for fiscal sanity, the capital market cops will enforce justice for the criminal negligence and financial thievery going on in Washington. Ed Yardeni calls these capital market enforcers the “bond vigilantes.” If you want proof of lackadaisical and stubborn politicians responding expeditiously to capital market cops, please hearken back to September 2008 when Congress caved into the $700 billion TARP legislation, right after the Dow Jones Industrial average plummeted 777 points in a single day.

Who exactly are these cops? These cops come in the shape of hedge funds, sovereign wealth funds, pension funds, endowments, mutual funds, and other institutional investors that shift their dollars to the geographies where their money is treated best. If there is a perceived, heightened risk of the United States defaulting on promised debt payments, then global investors will simply take their dollar-denominated investments, sell them, and then convert them into currencies/investments of more conscientious countries like Australia or Switzerland.

Assisting the capital market cops in disciplining the unruly teenagers are the credit rating agencies. S&P (Standard and Poor’s) and Moody’s (MCO) have been watching the slow-motion train wreck develop and they are threatening to downgrade the U.S.’ AAA credit rating. Republicans and Democrats may not speak the same language, but the common word in both of their vocabularies is “reelection,” which at some point will effect a reaction due to voter and investor anxiety.

Nobody wants to see our nation’s pipes burst from excessive debt and spending, and if the political plumbers can repair the very obvious and fixable fiscal problems, we can move on to more important challenges. It’s best we fix our problems by ourselves…before the cops arrive and arrest the culprits for gross negligence.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MCO, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

It’s the Earnings, Stupid

Political strategist James Carville famously stated, “It’s the economy stupid,” during the 1992 presidential campaign. Despite a historic record approval rating of 90 by President George H.W. Bush after the 1991 Gulf War victory, Bush Sr. still managed to lose the election to President Bill Clinton because of a weak economy. President Barack Obama would serve himself well to pay attention to history if he wants to enter the “two-termer” club. Pundits are placing their bets on Obama due to his large campaign war chest, a post-Osama bin Laden extinguishment approval bump, and a cloudy Republican candidate weather forecast. If however, the unemployment rate remains elevated and the current administration ignores the spending/debt crisis, then the President’s re-election hopes may just come crashing down.

Price Follows Earnings

The similarly vital relationship between the economy and politics applies to the relationship of earnings and the equity markets too. Instead of the key phrase, “It’s the economy stupid,” in the stock market, “It’s all about the earnings stupid” is the crucial guideline. The balance sheet may play a role as well, but at the end of the day, the longer-term trend in stock prices eventually follows earnings and cash flows (i.e., investors will pay a higher price for a growing stream of earnings and a lower price for a declining or stagnant stream of earnings). Ultimately, even value investors pay more attention to earnings in the cases where losses are deteriorating or hemorrhaging (e.g. a Blockbuster or Enron). Another main factor in stock price valuations is interest rates. Investors will pay more for a given stream of earnings in a low interest rate environment relative to a high interest rate environment. Investors lived through this in the early 1980s when stocks traded at puny 7-8x P/E ratios due to double-digit inflation and a Federal Funds rate that peaked near 20%.

Bears Come Out of Hibernation

Today, earnings portray a different picture relative to the early eighties. Not only are S&P 500 operating earnings growing at a healthy estimated rate of +17% in 2011, but the 10-year Treasury note is also trading at a near-record low yield of 3.06%. In spite of these massively positive earnings and cash flow dynamics occurring over the last few years, the recent -3% pullback in the S&P 500 index from a month ago has awoken some hibernating bears from their caves. Certainly a slowing or pause in the overall economic indicators has something to do with the newfound somber mood (i.e., meager Q1 real GDP growth of +1.8% and rising unemployment claims). Contributing to the bears’ grumpy moods is the economic debt hangover we are recovering from. However, a large portion of the fundamental economic expansion experienced by corporate America has not been fueled by the overwhelming debt still being burned off throughout the financial sector and eventually our federal and state governments. Companies have become leaner and meaner – not only paying down debt, but also increasing dividends, buying back stock, and doing more acquisitions. The corporate debt-free muscle is further evidenced by the $100 billion in cash held by the likes of IBM, Microsoft Corp. (MSFT), and Google Inc. (GOOG) – and still growing.

At a 13.5x P/E multiple of 2011 earnings, perhaps the stock market is pricing in an earnings slowdown? But as of last week, about 70% of the S&P 500 companies reporting Q1 earnings have exceeded expectations. If this trend continues, perhaps we will see James Carville on CNBC rightfully shouting the maxim, “It’s the earnings, stupid!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in IBM, MSFT, Blockbuster, Enron, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rebuilding after the Political & Economic Tsunami

Excerpt from Free April Sidoxia Monthly Newsletter (Subscribe on right-side of page)

The Start of the Arab Uprising

The Arab uprising grew its roots from an isolated and disgraced Tunisian fruit vendor (26- year-old Mohammed Bouazizi) who burned himself to death in protest of the persistent, deep-seeded corruption prevalent throughout the government (view excellent 60 Minutes story on Tunisia uprising). The horrific death ultimately led to the swift removal of Egypt’s 30-year President Hosni Mubarak, whose ejection was spurred by massive Facebook-organized protests. Technology has flattened the world and accelerated the sharing of powerful ideas, which has awoken Arab citizens to see the greener grass across other global democratic nations. Facebook, Twitter, and LinkedIn can be incredible black-holes of productivity destroyers (I know firsthand), but as recent events have proven, these social networking services, which handle about 1 billion users globally, can also serve valuable purposes.

As the flames of unrest have been fanned across the Middle East and Northern Africa, autocratic dictators haven’t had the luxury of idly sitting on their hands. Instead, these leaders have been pushed to relent to the citizens’ wishes by addressing previously taboo issues, such as human rights, corruption, and economic opportunity. These fresh events feel like new-found changes, but these major social tectonic shifts have been occurring throughout history, including our lifetimes (e.g., Tiananmen Square massacre and the fall of the Berlin Wall).

Good News or Bad News?

Recent headlines have created angst among the masses, and the uncertainty has investors asking a lot of questions. Besides radioactive concerns in both Japan and the Middle East (one actual, one figurative), the “worry list” of items continues to stack higher. Oil prices, inflation, the collapsing dollar, exploding deficits, a China bubble, foreclosures, unemployment, quantitative easing (QE2), mountainous debt, 2012 elections, and the end of the world among others, are worries crowding people’s brains. Incredibly, somehow the market still manages to grind higher. More specifically, the Dow Jones Industrial Average has climbed a very respectable +6.4% for 2011.

With the endless number of worries, how on earth could the major market indexes still advance, especially after a doubling in value from 24 months ago? For one, these political and economic shocks are nothing new. History has shown us that democratic, capitalistic markets ultimately move higher in the face of wars, assassinations, banking crises, currency crises, and various other stock market frauds and scandals. I’m willing to go out on a limb and say these worrisome events will continue this year, next year, and even over the next decade.

Most baby boomers living in the early 1980s remember when 30-year mortgage rates on homes reached 18.5%, inflation hit 14.8%, and the Federal Funds interest rate peaked near 20%. Boomers also survived Vietnam, Watergate, the Middle East oil embargo, Iranian hostage crisis, 1987 Black Monday, collapse of the S&L banks, the rise and fall of the Cold War, Gulf War I/II, yada, yada, yada. Despite all these cataclysmic events, from the last birth of the Baby Boomers (1964), the Dow Jones Industrial catapulted from about 890 to 12,320. This is no April Fool’s joke! The market has increased a whopping 14-fold (without dividends) in the face of all this gruesome news. You won’t find that story on the front-page of The Wall Street Journal.

Lost Decade Goes on Sale

The gains over the last four and half decades have been substantial, but much more is said about the recent “Lost Decade.” Although it has generally been a lousy decade for most investors in the stock market, eventually the stock market follows the direction of profits. What the popular press negates to mention is that S&P 500 operating earnings have more than doubled from about $47 in 1999 to an estimated $97 in 2011. Over the same period, the price of the market has been chopped by more than half (i.e., the Price – Earnings multiple has been cut from 29x to 13.5x). With stocks selling at greater than -50% off from 1999, no wonder smart investors like Warren Buffett are buying America – Buffett just spent $9 billion in cash on buying Lubrizol Corp (LZ). Retail investors absolutely loved stocks in 2000 at the peak, believing there was virtually no risk. Now the tables have been turned and while stock prices are trading at a -50% discount, retail investors are intensely skeptical and nervous about the prospects for stocks. Shoppers don’t usually wait for prices to go up 30% and then say, “Oh goody, prices are much higher now, so I think I will buy!” but that is what they are saying now.

I don’t want to oversell my enthusiasm, because the deals were dramatically better in March of 2009. Hindsight is 20-20, but at the nadir of the stock market, stock prices traded at bargain basement levels of 7x times 2011 earnings. We may not see opportunities like that again in our lifetime, so sitting in cash may not be the most advisable positioning.

Although I would argue every investor should have some exposure to equities, an investor’s time horizon, objectives, constraints and risk tolerance should be the key determinants of whether your investment portfolio should have 5% equity exposure or 95% exposure.

So while the economic and political dominoes may appear to be tumbling based on the news du jour, don’t let the headlines and the so-called media pundits scare you into paralysis. Bad news and tragedy will continue, but fortunately when it comes to prosperity, history is on our side. As you attempt to organize and pickup the financial pieces of the last few years, make sure you have a disciplined, long-term investment plan that adapts to changing market and personal conditions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in LZ, Facebook, Twitter, LinkedIn, BRKA/B, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Will the Fiscal Donkey Fly?

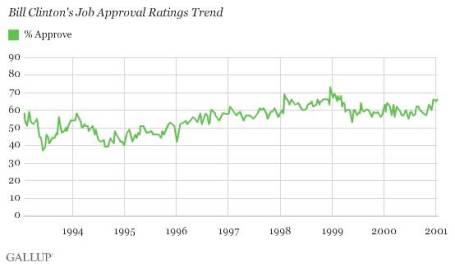

Will Barack Obama become a “one-termer” like somewhat recent Presidents, Democrat Jimmy Carter (1977-1981) and Republican George H.W. Bush #41 (1989-1993)? Or will Obama get the Democratic donkey off the ground like Bill Clinton managed to do after the 1994 mid-term election when Republican Newt Gingrich spearheaded the Contract with America, which led to a similar Republican majority in the House of Representatives. Clinton’s approval ratings were in the dumps at the time, comparable to voter’s current lackluster opinion of Obama and his spending spree (see also Profitless Healthcare).

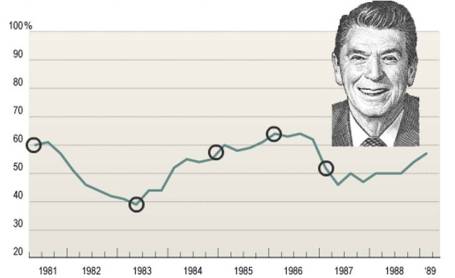

Reagan Rebound

Similarly, Republican Ronald Reagan (1981-1989) was picking up the pieces with his lousy approval rating after the 1982 midterm election. Tax cuts, “trickle-down” supply side economics, and a tough stance on the Russian Cold War turned around the economy and his approval rating and catapulted him to reelection in a landslide victory. Reagan carried 49 states with the help of Reagan Democrats (one-quarter of registered Democrats voted for him).

One should be clear though, popularity is not the only factor that plays into reelection success. George H. W. Bush had the highest average approval rating in five decades (60.9% approval), only superseded by John F. Kennedy (70.1% approval). The economy, international politics, and other external factors also play a large role in the reelection process.

Flying Donkey Time?

If President Obama wants to get the Democratic donkey off the ground and raise his current approval rating of 47% and remedy his self-admitted “shellacking” by the Republicans, then he will need to shift his hard-left political agenda more towards the middle, like Clinton did in 1994. If he leads on ideology alone, then the next two years will likely be a long tough slog for him and his Democratic colleagues.

In order to shift toward the center and gain more Independent voters, Obama will need to find common ground with Republicans and Tea-Partiers. Obama has already conceded in principle to extend the Bush tax cuts, but if he wants to gain more political capital, he will have to gain some ground in the area of fiscal responsibility. With the help of a strong economy, Clinton managed to run surpluses, but front and center today is a $1.3 trillion deficit and over $13 trillion in debt. The first step in building any credibility on the issue will come on December 1st when the president’s bi-partisan commission for deficit reduction will release its report.

It will be interesting which party will show leadership in making unpopular spending cuts, just as the 2012 re-election cycle just begins. The elephants in the room are the entitlements (Medicare and Social Security), and although less talked about, efficient cuts to defense spending should be put on the table. Sure, pork barrel spending, inefficient subsidies, tax loopholes, are gaps that need to be filled, but they alone are rounding errors given our country’s unsustainable current circumstances. Whether or not politicians (red or blue) will point out the unpopular elephants in the room will be interesting to watch.

Financial irresponsibility at the consumer and corporate level were major drivers behind the 2008-2009 financial crisis, and both individuals and businesses are responsibly adjusting their expense structures and balance sheets. Our government has to wake up to reality and adjust its expense structure and balance sheet too. Although foreign countries have reacted (i.e., European austerity), egotistical American politicians on both sides of the aisle haven’t quite woken up and smelled the coffee yet. Thank goodness for the democracy that we live in because citizens are pointing to the elephants in the room and demanding reckless spending and debt levels to come under control. If President Barack Obama doesn’t want to become another one-termer, he’ll have to move more to the center and get the finances of our country under control. If the stubborn donkey refuses to deal with reality and remains flightless, hopefully an elephant or ship-full of tea partiers can get this grass roots call for fiscal sanity off the ground.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sachs Prescribes Telescope Over Microscope

Jeffrey Sachs, Professor at Columbia University and one of Time magazine’s “100 most influential people” recommends that our country takes a longer-term view in handling our problems (read Sachs’s full bio). Instead of analyzing everything through a microscope, Sachs realizes that peering out over the horizon with a telescope may provide a clearer path to success versus getting sidetracked in the emotional daily battles of noise.

I do my fair share of media and politician bashing, but every once in a while it’s magnificent to discover and enjoy a breath of fresh common sense, like the advice coming from Sachs. Normally, I become suffocated with a wet blanket of incessant, hyper-sensitive blabbering that comes from Washington politicians and airwave commentators. With the advent of this thing we call the “internet,” the pace and volume of daily information (see TMI “Too Much Information” article) crossing our eyeballs has only snowballed faster. Rather than critically evaluate the fear-laced news, the average citizen reverts back to our Darwinian survival instincts, or to what Seth Godin calls the “Lizard Brain. ”

Sachs understands the lingering nature to our country’s problems, so in pulling out his long-term telescope, he created a broad roadmap to recovery – many of the points to which I agree. Here is an abbreviated list of his quotes:

On Short-Termism:

“Despite the evident need for a rise in national saving after 2008, President Barack Obama tried to prolong the consumption binge by aggressively promoting home and car sales to already exhausted consumers, and by cutting taxes despite an unsustainable budget deficit. The approach has been hyper short-term, driven by America’s two-year election cycle. It has stalled because US consumers are taking a longer-term view than the politicians.”

On Differences between China and the U.S.:

“China saves and invests; the US talks, consumes, borrows, and talks some more.”

On Why Tax Cuts and Stimulus Alone Won’t Work:

“Short-term tax cuts or transfers on top of America’s $1,500bn budget deficit are unlikely to do much to boost demand, while they would greatly increase anxieties over future fiscal retrenchment. Households are hunkering down, and many will regard an added transfer payment as a temporary windfall that is best used to pay down debt, not boost spending.”

On Malaise Hampering Businesses:

“Businesses, for their part, are distressed by the lack of direction….Uncertainty is a real killer.”

On 5-Point Plan to a U.S. Recovery:

1) Increased Clean Energy Investments: The recovery needs “a significant boost in investments in clean energy and an upgraded national power grid.”

2) Infrastructure Upgrade: “A decade-long program of infrastructure renovation, with projects such as high-speed inter-city rail, water and waste treatment facilities and highway upgrading, co-financed by the federal government, local governments and private capital.”

3) Further Education: “More education spending at secondary, vocation and bachelor-degree levels, to recognize the reality that tens of millions of American workers lack the advanced skills needed to achieve full employment at the salaries that the workers expect.”

4) Infrastructure Exports to the Poor: “Boost infrastructure exports to Africa and other low-income countries. China is running circles around the US and Europe in promoting such exports of infrastructure. The costs are modest – essentially just credit guarantees – but the benefits are huge, in increased exports, support for African development and a boost in geopolitical goodwill and stability.”

5) Deficit Reduction Plan: “A medium-term fiscal framework that will credibly reduce the federal budget deficit to sustainable levels within five years. This can be achieved partly by cutting defense spending by two percentage points of gross domestic product.”

Rather than succumb to the nanosecond, fear-induced headlines that rattle off like rapid fire bullets, Sachs supplies thoughtful long-term oriented solutions and ideas. The fact that Sachs mentions the word “decade” three times in his Op-ed highlights the lasting nature of these serious problems our country faces. To better see and deal with these challenges more clearly, I suggest you borrow Sachs’s telescope, and leave the microscope in the lab.

Read Full Financial Times Article by Jeffrey Sachs

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Gekko & Greed – Friedman & Freedom

As the old saying goes, the more things change, the more things stay the same. The topic of greed, fat cat bankers, and political self-preservation is just as prevalent and relevant today as it was three decades ago, as evidenced by Milton Friedman’s past television interview (see video below). Milton Friedman and Gordon Gekko, the conniving financier from Oliver Stone’s movie Wall Street played by Michael Douglas, both may not philosophically agree on all aspects of life and politics but Friedman would likely buy into much of Gekko’s view on greed:

“Greed, for lack of a better word, is good. Greed is right, greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms; greed for life, for money, for love, knowledge has marked the upward surge of mankind. And greed, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the USA.”

Although Friedman held some extreme views on certain issues, fundamentally underlying all his principles was his convicted belief in freedom – political, individual, and economic freedom.

Some things never change – Milton Friedman talks about greed and capitalism with Phil Donahue.

Background

Milton Friedman (1912-2006), one of the greatest economists of the 20th Century was a Nobel Prize winner in economics, Professor at the University of Chicago (1946-1977), and an economic advisor to President Ronald Reagan. Friedman’s laissez-faire economic views coupled with his belief that government should be severely restricted, not only had a significant influence on the field of economics in the United States, but also globally. His body of work was expansive, but some major areas of contribution include his impact on Federal Reserve monetary policy; his written work on consumption and the natural rate of unemployment; and his rejection of the Phillips curve (the inverse relation of inflation relative to unemployment), to name a few.

Political & Economic Firestorm on the Horizon

Although Friedman is tightly associated with his Republican advisor work (including Ronald Reagan), he strictly considered himself a Libertarian at the core. As much as politically left leaning Americans are blaming the 2008-2009 financial crisis on Friedman-backed deregulation and a lack of government oversight, Conservatives and Libertarians are screaming bloody murder at the Democratic controlled Congress when it comes to all the bailouts, stimulus, and entitlement legislation. If Milton Friedman is looking down upon us now, my guess is that his vote is to flush all the proposed government spending down the toilet, let the failing financial institutions drown, and for Gordon Gekko’s sake, let the greedy, fat cat bankers thrive.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct position on any security referenced. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Money Goes Where Treated Best

“The world is going to hell in a handbasket” seems to be a prevailing sentiment among many investors. Looking back, a lack of fiscal leadership in Washington, coupled with historically high unemployment, has only fanned the flames of restlessness. A day can hardly go by without hearing about some fiscal problem occurring somewhere around the globe. Geographies have ranged from Iceland to Dubai, and California to Greece. Regardless, eventually voters force politicians to take notice, as we recently experienced in the Massachusetts vote for Senator.

Time to Panic?

So is now the time to panic? Entitlement obligations such as Social Security and Medicare, when matched with a rising interest payment burden from our ballooning debt, stands to consume the vast majority of our country’s revenues in the coming decades (if changes are not made). It’s clear to most that the current debt trajectory is not sustainable – see also Debt: The New Four-Letter Word. With that said, historical debt levels have actually been at higher levels before. For example, during World War II, debt levels reached 122% of GDP (Gross Domestic Product). Since promises generally garner votes, politicians have traditionally found it easier to legislate new spending into law rather than cutting back existing spending and benefits.

Money Goes Where it’s Treated Best

If our government leaders choose to ignore the growing upswell in fiscal discontent, then the global financial markets will pay more attention and disapprove less diplomatically. As the globe’s reserve currency, the U.S. Dollar stands to collapse if a different direction is not forged, and interest costs could skyrocket to unpalatable levels. Fortunately, the flat world we live on has created some of these naturally occurring governors to forcibly direct sovereign entities to make better decisions…or suffer the consequences. Right now Greece is paying for the financial sins of its past, which includes widening deficits and untenable debt levels.

As new, growing powers such as China, Brazil, India, and other emerging countries fight for precious capital to feed the aspirational goals of their rising middle classes, money will migrate to where it is treated best. Speculative money will flow in and out of various capital markets in the short-run, but ultimately capital flows where it is treated best. Meaning, those countries with policies fostering fiscal conservatism, financial transparency, prudent regulations, pro-growth initiatives, tax incentives, order of law, and other capital-friendly guidelines will enjoy their fair share of the spoils. The New York Times editorial journalist Tom Friedman coined the term “golden straitjacket” in describing this naturally occurring restraint system as a result of globalization.

Push Comes to Shove

Push will eventually come to shove, but the real question is whether we will self-impose fiscal restraint on ourselves, or will the global capital markets shove us in that direction, like the markets are doing to Greece (and other financially strapped nations) today? I am hopeful it will be the former. Why am I optimistic? Although more government spending has typically lead to more votes for politicians, cracks in the support wall have surfaced through the Massachusetts Senatorial vote, and rising populist sentiment, as manifested through the “Tea Party” movement (previously considered a fringe group).

Political gridlock has traditionally been par for the course, but crisis usually leads to action, so I eventually expect change. I am banking on the poisonous and sour mood permeating through the country’s voter base, in conjunction with the collapse of foreign currencies, to act as a catalyst for financial reform. If not, resident capital and domestic jobs will exodus to other countries, where they will be treated best.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including emerging market-based ETFs), but at time of publishing had no direct positions in securities mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Short-Termism & Extremism: The Death Knell of our Future

In recent times, American society has been built on a foundation of instant gratification and immediate attacks, whether we are talking about politics or economics. Often, important issues are simply presented as black or white in a way that distorts the truth and rarely reflects reality, which in most cases is actually a shade of grey. President Obama is discovering the challenges of governing a global superpower in the wake of high unemployment, a fragile economy, and extremist rhetoric from both sides of the political aisle. Rather than instituting a promise of change, President Obama has left the natives restless, wondering whether a “change for worse” is actually what should be expected in the future.

Massachusetts voters made a bold and brash statement when they elected Republican Senator Scott Brown to replace the vacated Massachusetts Senate seat of late, iconic Democratic Senator Edward Kennedy – a position he held as a Democrat for almost 47 years. Obama’s response to this Democratic body blow and his fledging healthcare reform was to go on a populist rampage against the banks with a tax and break-up proposal. Undoubtedly, financial reform is needed, but the timing and tone of these misguided proposals unfortunately does not attack the heart of the financial crisis causes – excessive leverage, lack of oversight, and irresponsible real estate loans (see also, Investing Caffeine article on the subject).

With that said, I would not write President Obama’s obituary quite yet. President Reagan was left for dead in 1982 before his policies gained traction and he earned a landslide reelection victory two years later. In order for President Obama to reverse his plummeting approval ratings and garner back some of his election campaign mojo, he needs to lead more from the center. Don’t take my word for it, review Pew Research’s data that shows Independents passing up both Republicans and Democrats. The overall sour mood is largely driven by the economic malaise experienced by all in some fashion, and unfortunately has contributed to short-termism and extremism.

Technology has flattened the world and accelerated the exchange of information globally at the speed of light. Any action, recommendation, or gaffe that deviates from the approved script immediately becomes a permanent fixture on someone’s lifetime resume. Our comments and decisions become instant fodder for the worldly court of opinion, thanks to 24/7 news cycles and millions of passionate opinions blasted immediately through cyberspace and around the globe.

Short-termism and extremism can be just as poisonous in the economic world as in the political world. This dynamic became evident in the global financial crisis. Short-termism is just another phrase for short-term profit focus, so when more and more leverage led to more and more profits and higher asset prices, the financial industry became blinded to the long-term consequences of their short-term decisions.

Solutions:

- Small Bites First: Rather than trying to ram through half-baked, massive proposals laced with endless numbers of wasteful pork barrel projects, why not focus on targeted and surgical legislation first? If education, deficit-reduction, and job creation are areas of common interest for Republicans and Democrats, then start with small legislation in these areas first. More ambitious agendas can be sought out later.

- Embrace Globalization: Based on the “law of large numbers” and the scale of the United States economy, our slice of the global economic pie is inevitably going to shrink over time. How does the $14 trillion U.S economy manage to grow if its share is declining? Simple. By eschewing protectionist policies, and embracing globalization. Developing country populations are joining modern society on a daily basis as they integrate productivity-enhancing innovations used by developed worlds for decades. In a flat world, the narrowing of the productivity gap is only going to accelerate. The question then becomes, does the U.S. want to participate in this accelerating growth of developing markets or sit idly on the sideline watching our competitors eat our lunch?

- Hail Long-Termism and Centrism: Regulations and incentives need to be instituted in such a fashion that irresponsible behavior occurring in the name of instant short-term profits is replaced with rules that induce sustainable profits and competitive advantages over our economic neighbors. Much of the financial industry is scratching and screaming in the face of any regulatory reform suggestions. The bankers’ usual response to reform is to throw out scare tactics about the inevitable damage caused by reform to the global competitiveness of our banking industry. No doubt, the case of “anti-competiveness” is a valid argument and any reforms passed could have immediate negative impacts on short-term profits. Like the bitter taste of many medicines, I can accept regulatory remedies now, if the long-term improvements outweigh the immediate detrimental aspects.

The focus on short-termism and extremism has created an acidic culture in both Washington and on “Main Street,” making government changes virtually impossible. If President Obama wants to implement the change he campaigned on, then he needs to take a more centrist view that concentrates on enduring benefits – not immediate political gains.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Article first submitted to Alrroya.com before being published on Investing Caffeine.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds but at the time of publishing had no direct positions in securities mentioned in the article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

![940614_83408820[1]](https://investingcaffeine.com/wp-content/uploads/2011/08/940614_834088201.jpg?w=455)