Posts tagged ‘Politics’

Take Me Out to the Stock Game

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (October 1, 2013). Subscribe on the right side of the page for the complete text.

The Major League Baseball playoffs are just about to start, and the struggling U.S. economy is also trying to score some more wins to make the postseason as well. In 2008 and early 2009, the stock market looked more like The Bad News Bears with the S&P 500 index losing -58% of its value from the peak to the trough. The overleveraged (debt-laden) financial system, banged by a speculative housing bubble, swung the global economy into recession and put a large part of the economic team onto the disabled list.

Since the lows of 2009, S&P 500 stocks have skyrocketed +152%, including an +18% gain in 2013, and a +3% jump in September alone. With that incredible track record, one might expect a euphoric wave of investors pouring into the stock market stadium, ready to open their wallets at the financial market concession stand. Au contraire. Despite the dramatic winning streak, investors remain complacent skeptics, analyzing and critiquing every political, economic, and financial market movement and gyration.

Unfortunately, as stock prices have scored massive gains, many market followers have been too busy eating peanuts and drinking beer, rather than focusing on the positive economic statistics in the scorebook, such as these:

15/16 Quarters of Positive GDP Growth:

|

| Source: Crossing Wall Street |

Precipitous Drop in Unemployment Claims: The lowest level since 2007 (7.5 million private sector jobs added since employment trough).

|

| Source: Bespoke |

All-Time Record Corporate Profits:

|

| Source: Ed Yardeni |

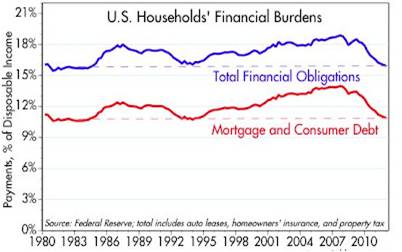

Financially Healthier Consumer – Lower Debt & Higher Net Worth:

|

| Source: Scott Grannis |

Improving Housing Market:

|

| Source: Scott Grannis |

While you can see a lot of financial momentum is propelling Team USA, there are plenty of observers concerned more about potential slumps and injuries emanating from a lineup of uncertainties. Currently, the fair-weather fans who are sitting in the bleachers are more interested in the uncertainty surrounding a government shutdown, debt ceiling negotiations, Syrian unrest, Iranian nuclear discussions, Obamacare defunding, and an imminent tapering of the Federal Reserve’s QE bond purchasing program (see Perception vs. Reality). The fearful skepticism of the fans has manifested itself in the form of a mountain of cash ($7 trillion), which is rapidly eroding to inflation and damaging millions of retirees’ long-term goals (see chart below). The fans sitting in the bleachers are less likely to buy long-term season tickets until some of these issues are settled.

|

| Source: Scott Grannis – $3 trillion added since crisis. |

The aforementioned list of worries are but a few of the concerns that have investors biting their nails. While there certainly is a possibility the market could be thrown a curve ball by one of these issues, veteran all-star investors understand there are ALWAYS uncertainties, and when the current list of concerns eventually gets resolved or forgotten, you can bet there will be plenty of new knuckle-balls and screw-balls (i.e., new list of worries) to fret over in the coming weeks, months, and years (see Back to the Future I, II,& III). Ultimately, the vast majority of concerns fade away.

Yoooouuuuuu’rrrreee Out!

The politicians in Washington are a lot like umpires, but what our country really needs are umpires who can change and improve the rules, especially the silly, antiquated ones (see also Strangest Baseball Rules). The problem is that bad rules (not good ones) often get put in place so the umpires/politicians can keep their jobs at the expense of the country’s best interest.

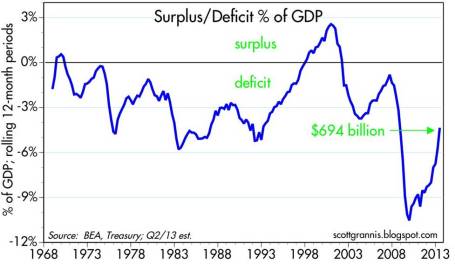

When umpires (politicians) cannot agree on how to improve the rules, gridlock actually is the next best outcome (see Who Said Gridlock is Bad?). The fact of the matter is that deficits and debt/GDP ratios have declined dramatically in recent years due in part to bitter political feuds (see chart below). When responsible spending is put into action, good things happen and a stronger economic foundation can be established to cushion future crises.

|

| Source: Scott Grannis |

There is plenty of room for improvement, but the statistics speak for themselves, which help explain why patient fans/investors have been handsomely rewarded with a homerun over the last four years. October historically has been a volatile month for the stock market, and the looming government shutdown and $16.7 trillion debt ceiling negotiations may contribute to some short-term strike-outs. However, if history proves to be a guide, stocks on average rise +4.26% during the last three months of the year (source: Bespoke), meaning the game may just not be over yet. With plenty of innings remaining for stocks to continue their upward trajectory, I still have ample time to grab my hot dog and malt during the 7th inning stretch.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in TSLA, PBI, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Who Said Gridlock is Bad?

Living in Southern California is extraordinary, but just like anything else, there are always tradeoffs, including traffic. Living in the United States is extraordinary too, but one of the detrimental tradeoffs is political gridlock…or is it? I am just as frustrated as anybody else that the knucklehead politicians in Washington can’t get their act together (especially on bipartisan issues such as taxes/immigration/deficits, etc.), but as it turns out, gridlock has created a significant financial silver lining.

Let’s take a look at some of the positive impacts of gridlock:

1) Federal Spending as % of GDP Declines

The demands of both Tax-and-Spend Democrats and Tea-Partier Republicans fell on deaf ears thanks to gridlock. The U.S. didn’t institute the depth of austerity that the far-right wanted, and Congress didn’t implement the additional fiscal stimulus the far-left desired. The result has been a slow but steady recovery, which has brought spending closer to historical averages.

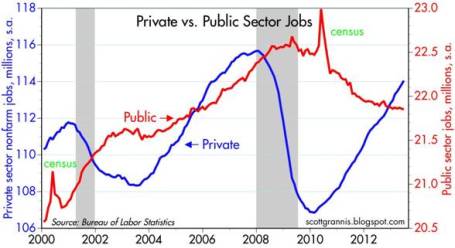

2) Private vs. Public Sector

The implementation of more responsible (or less irresponsible) government spending has freed up resources and allowed the private sector to slowly add jobs. The next wave of sequestration spending cuts may unleash some more pain on the public sector and delay overall economic recovery further, but just like dieting, we will feel much better once we have shed more debt and spending – at least as a percentage of GDP.

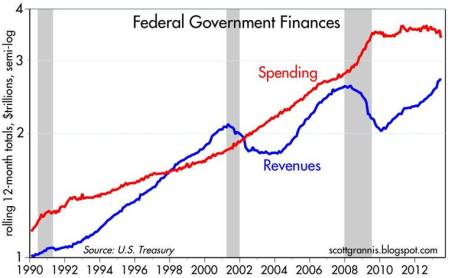

3) Deficit Reduced Significantly

The chart above is closely tied to point #1 (government spending), but as you can see, revenues have climbed significantly since 2010. I would argue plain economic cyclicality has more impact on the volatility of revenues. Blaming the current administration on the collapse or crediting them for the rebound is probably overstated. Comprehensive tax reform would likely have a lot more impact on the slope of revenues relative to the recent tax policy changes.

The same picture can be seen from a different angle, as shown above (Deficit as % of GDP). While the absolute dollar amounts are staggeringly high, as a percentage of GDP, the percentage has been chopped by more than half since the peak of the crisis.

Everyone would like to see politicians solve all of our problems, but as we have experienced, deep philosophical differences can lead to political gridlock. When it comes to our nation’s finances, gridlock may not be optimal, but you can also see that a stalemate is not always the worst outcome either. As politicians continue to scream at each other with purple faces, I will monitor the developments from my car radio while in California gridlocked traffic…sunroof open of course.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Lily Pad Jumping & Term Paper Cramming

Article is an excerpt from previously released Sidoxia Capital Management’s complementary December 3, 2012 newsletter. Subscribe on right side of page.

Over the last year, investors’ concerns have jumped around like a frog moving from one lily pad to the next. From the debt ceiling debate to the European financial crisis, and then from the presidential election to now the “fiscal cliff.” With the election behind us (Obama winning 332 electoral votes vs 206 for Romney; and Obama 50.8% of the popular vote vs 47.5% for Romney), the frog’s bulging eyes are squarely focused on the fiscal cliff. For the uninformed frogs that have been swimming underwater, the fiscal cliff is the roughly $600 billion in automatic tax hikes and spending cuts that are scheduled to be triggered by the end of this year, if Congress cannot come to some type of agreement (for more fiscal cliff information see videos here). The mathematical consequences are clear: Congress + No Deal = Recession.

While political brinksmanship and theater are nothing new, the explosive amount of data is something new. In our mobile world of 6 billion cell phones (more than the number of toothbrushes on our planet) and trillions of text messages sent annually, nobody can escape the avalanche of global data. Google (GOOG), Facebook (FB), Twitter, and millions of blogs (including this one) didn’t exist 15 years ago, therefore fiscal boogeymen like obscure Greek debt negotiations and Chinese PMI figures wouldn’t have scared pre-internet generations underneath their beds like today’s investors. The fact of the matter is our country has triumphed over plenty of significant issues (many of them scarier than today’s headlines), including wars, assassinations, currency crises, banking crises, double digit inflation, SARS, mad cow disease, flash crashes, Ponzi schemes, and a whole lot more.

Although today’s jumpy investors may worry about the lily pads of a double-dip recession in the US, a financial meltdown in Europe, and/or a hard landing in China, fiscal frogs will undoubtedly be worried about different lily pads (concerns) twelve months from now. This may not be an insightful observation for day traders, but for the other 99% of investors, taking a longer term view of the daily news cycle may prove beneficial.

Fiscal Cliff Term Paper Due on Friday December 21st

As a college student, chugging Jolt Cola, in combination with a couple dosages of NoDoz, was part of the routine procrastination process the day before a term paper was due. Apparently Congress has also earned a PhD in procrastination, judging by the last minute conclusion of the debt ceiling negotiations last summer. There are only a few more weeks until politicians break for the Christmas holiday break, therefore I am setting an Investing Caffeine mandated fiscal cliff due date of December 21st. Could Congress turn in its term paper early? Anything is possible, but unfortunately turning in the assignment early is highly unlikely, especially when politically bashing your opponent is perceived as a better re-election tactic compared to bipartisan negotiation.

A higher probability scenario involves Americans stuck listening to Nancy Pelosi, Harry Reid, John Boehner, and Mitch McConnell on a daily basis as these politicians finger-point and call the other side obstructionists. While I’m not alone in believing a deal will ultimately get done before Christmas, how credible and substantive the announcement will be depends on whether the politicians seriously face entitlement and tax reforms. Regardless, any deal announced by Investing Caffeine’s December 21st due date will likely be received well by the market, as long as a framework for entitlement and tax reform is laid out for 2013.

Frog News Bites

Source: Photobucket

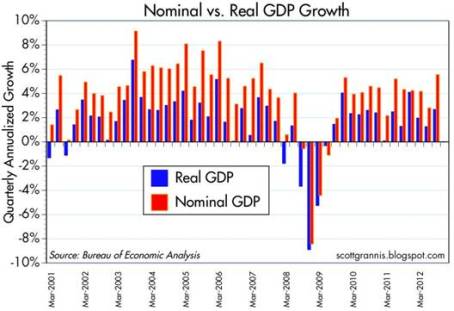

GDP Revised Higher: Despite all the gloom and uncertainties, the barometer of the economy’s health (i.e., Real Gross Domestic Product), was revised higher to 2.7% growth for the third quarter (from 2.0%). Nominal growth, a related measurement that includes inflation, reached a five-year high of 5.55%. In the wake of Superstorm Sandy, which caused upwards of $50 billion in damage, fourth quarter GDP numbers are likely to be artificially depressed. The silver lining, however, is first quarter 2013 figures may get an economic boost from reconstruction efforts.

Source: Calafia Beach Pundit

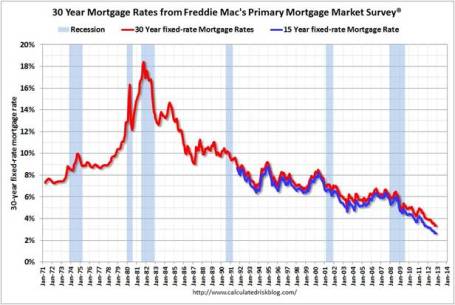

Housing Recovery Continues: Buoyed by record low interest rates (30-yr fixed mortgages < 3.5%), housing sales and prices continue on an upward trajectory. New home sales came in at 368,000 in October, below expectations, but sales are still up around +20% from 2011 (Calculated Risk).

Source: Calculated Risk

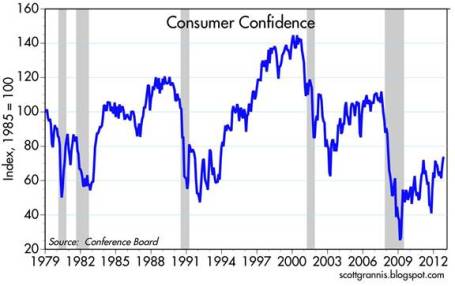

Confidence Still Low but Climbing: The recently reported consumer confidence figures reached the highest level in more than four years, but as Scott Grannis highlights, this is nothing to write home about. These current confidence levels match where we were during the 1990-91 and 1980-82 recessions.

Source: Calafia Beach Pundit

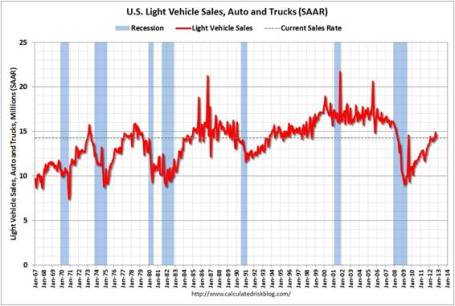

Car Sales Picking Up: Fiscal cliff discussions haven’t discouraged consumers from buying cars. As you can see from the chart below, car and truck sales reached 14.3 million annualized units in October. November sales are expected to rise about +13% on a year-over-year basis, reaching approximately 15.3 million units.

Source: Calculated Risk

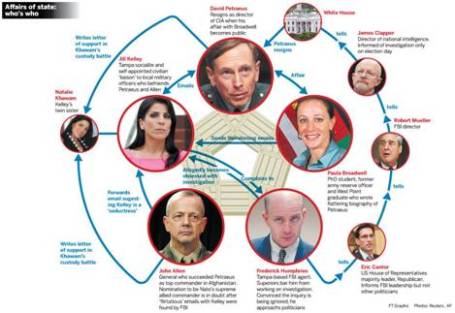

CIA Chief Fired in Sex Scandal: If you didn’t get enough of the Lindsay Lohan bar brawl dirt in New York, never fear, there was plenty of salacious details emanating from Washington DC this month. A complicated web of Florida socialites, a biographer, email chains, and a bare-chested FBI agent led to the firing of CIA director David Petraeus.

Source: The Financial Times

Death to Twinkies: After lining stomachs with golden cream-filled cakes for more than 80+ years, Hostess Brands was forced to halt production of Twinkies, Ding Dongs, and Ho Hos. Negotiations with union bakers crumbled, which led to Hostess Brands’ Chapter 7 bankruptcy and liquidation proceedings. My financial brain understands, but my sweet tooth is still grieving (see also Twinkie Investing).

Source: Photobucket

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in FB, Twitter or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

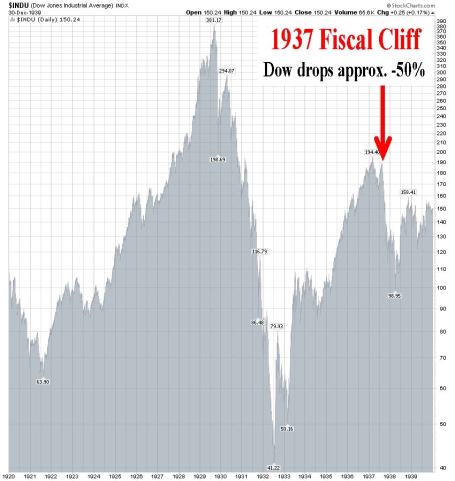

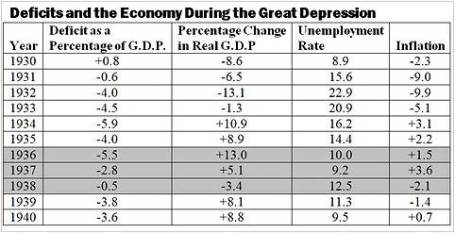

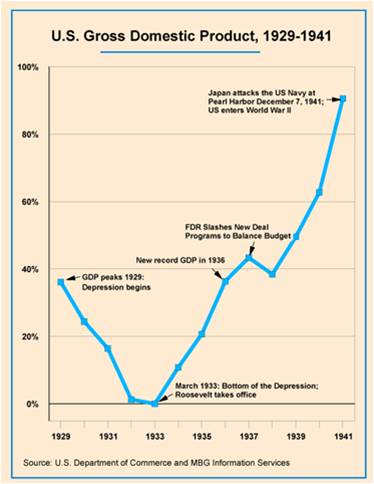

The presidential election is upon us and markets around the globe are beginning to factor in the results. More importantly, in my view, will be the post-election results of the “fiscal cliff” discussions, which will determine whether $600 billion in automated spending cuts and tax increases will be triggered. Similar dynamics in 1937 existed when President FDR (Franklin Delano Roosevelt) felt pressure to balance the budget after his 1933 New Deal stimulus package began to rack up deficits and lose steam.

What’s Similar Today

Just as there is pressure to cut spending today by Republicans and “Tea-Party” Congressmen, so too there was pressure for FDR and the Federal Reserve in 1937 to unwind fiscal and monetary stimulus. At the time, FDR thought self-sustaining growth had been restored and there was a belief that the deficits would become a drag on expansion and a source of future inflation. What’s more, FDR’s Treasury Secretary, Henry Morgenthau, believed that continued economic growth was dependent on business confidence, which in turn was dependent on creating a balanced budget. History has a way of repeating itself, which explains why the issues faced in 1937 are eerily similar to today’s discussions.

The Results

FDR was successful in dramatically reducing spending and significantly increasing taxes. Specifically, federal spending was reduced by -17% over two years and FDR’s introduction of a Social Security payroll tax contributed to federal revenues increasing by a whopping +72% over a similar timeframe. The good news was the federal deficit fell from -5.5% of GDP to -0.5%. The bad news was the economy went into a tail-spinning recession; the Dow crashed approximately -50%; and the unemployment rate burst higher by about +3.3% to +12.5%.

What’s Different This Time?

For starters, one difference between 1937 and 2012 is the level of unemployment. In 1937, unemployment was +14.3%, and today it is +8.1%. Objectively, today there could be higher percentage of the population “under-employed,” but nonetheless the job market was in worse shape back then and labor unions had much more power.

Another major difference is the stance carried by the Fed. Today, Ben Bernanke and the Fed have made it crystal clear they are in no hurry to take away any of the monetary stimulus (see Hekicopter Ben QE3 article), until we have experienced a long-lasting, sustainable recovery. Back in early 1937, the Fed increased banks’ reserve requirements twice, doubling the requirement in less than a year, thereby contracting monetary supply drastically.

Furthermore, we live in a much more globalized world. Today, central banks and governments around the world are doing their part to keep growth alive. Emerging markets are large enough now to move the needle and impact the growth of developed markets. For example, China, the #2 global superpower, continues to cut interest rates and has recently implemented a $158 billion infrastructure spending program.

Net-Net

Whether you’re a Republican or Democrat, everyone generally agrees that job creation is an important common objective, which is consistent with growing our economy. The disagreement between parties stems from the differing opinions on what are the best ways of creating jobs. From my perch, the frame of the debate should be premised on what policies and incentives should be structured to increase competitiveness. Without competitiveness there are no jobs. At the end of the day, money and capital are agnostic. Cold hard cash migrates to the countries in which it is treated best. And where the money goes is where the jobs go.

There is no single silver bullet to solve the competiveness concerns of the United States. Like baseball (since playoffs are quickly approaching), winning is not based solely on hitting, pitching, defense, or base-running. All of these facets and others are required to win. The same principles apply to our country’s competitiveness.

In order to be a competitive leader in the 21st century, here are few necessary areas in which we must excel:

Education: Chicago school unions have been in the news, and I have no problems with unions, if accountability can be structured in. Unfortunately, however, it is clear to me that for now our system is broken (a must see: Waiting for Superman). We cannot compete in the 21st century with an illiterate, uneducated workforce. Our colleges and universities are still top-notch, but as Bill Gates has stated, our elementary schools and high schools are “obsolete”.

Entitlements: Social safety nets like Social Security and Medicare are critical, but unsustainable promises that explode our debt and deficits will not make us more competitive. Politicians may gain votes by making promises in the short-run, but when those promises can’t be delivered in the medium-run or long-run, then those votes will disappear quickly. The sworn guarantees made to the 76 million Baby Boomers now entering retirement are a disaster waiting to happen. Benefits need to be reduced and or criteria need to be adjusted (i.e., means-testing, increase age requirements). The problems are clear as day, so Americans cannot walk away from this sobering reality.

Strategic Government Investment: – Government played a role in building our country’s railways, highways, and our military – a few strategic areas of our economy that have made our nation great. Thoughtful investments into areas like energy infrastructure (e.g., smart grid), internet infrastructure (e.g., higher speed super highway), and healthcare (e.g., human genome research) are a few examples of how jobs can be created while simultaneously increasing our global competitiveness. The great thing about strategic government investments is that government does NOT have to do all the heavy lifting. Rather than write all the checks and do all the job creation from Washington, government can implement these investments and create these jobs by providing incentives for the private sector. Strategic public-private partnerships can generate win-win results for government, businesses, and job seekers. If, however, you’re convinced that our government is more efficient than the private sector, then I highly encourage you to go visit your local DMV, post office, or VA to better appreciate the growth-sucking bureaucracy and inefficiency.

Taxes / Regulations / Laws: Taxes come from profits, and businesses create profits. In order to have a strong and competitive government, we need strong and competitive businesses. Higher taxes, excessive regulations, and burdensome laws will not create stronger and more competitive businesses. I acknowledge that reckless neglect and consumer exploitation will not work either, but reasonable protections for consumers and businesses can be instituted without multi-thousand page regulations. Reducing ridiculous subsidies and loopholes, while tightening tax collection processes and punishing tax dodgers makes perfect sense…so why not do it?

Politics are sharply polarized at both ends of the spectrum, but no matter who wins, our problems are not going away. We may or may not have a new president of the United States this November, but perhaps more important than the elections themselves will be the outcome of the “fiscal cliff” legislation (or lack thereof). If we want to maintain our economic power as the strongest in the world, solving this “fiscal cliff” is the key to improving our competiveness. Avoiding a messy 1937 (and 2011) political repeat will prevent us from becoming dead meat.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Private Equity: Parasite or Pollinator?

In the wild, there exist both parasitic and symbiotic relationships. In the case of blood thirsty ticks that feed off deer, this parasitic relationship differs from the symbiotic association of nectar-sucking bees and pollen-hungry flowers. These are merely a few examples, but suffice it to say, these same intricate interactions occur in the business world as well.

Our economy is a complex jungle of relationships, spanning governments, businesses, consumers, investors, and many intermediaries, including private equity (PE) firms. With the November election rapidly approaching, more attention is being placed on how private equity firms fit into the economic food chain. Figuring out whether PE firms are more like profit-sucking parasites or constructive job creating mechanisms has moved to the forefront, especially given presidential candidate Mitt Romney’s past ties to Bain Capital, a successful private equity firm he founded in 1984.

Currently it is politically advantageous to portray PE professionals as greedy, job-cutting outsourcers – I’m still waiting for the political ad showing a PE worker clubbing a baby seal or plucking the legs off of a Daddy Long Legs spider. While I’d freely admit a PE pro can be just as gluttonous as an investment banker, hedge fund manager, or venture capitalist, simplistic characterizations like these miss the beneficial effects these firms provide to the overall economy. Capitalism is the spine that holds our economy together and has allowed us to grow into the greatest superpower on the planet. Private equity is but a small part of our capitalistic ecosystem, but plays a valuable role nonetheless.

While there are many perspectives on the role of private equity in our economy, here are my views on a few of the hot button issues:

Job Creation: Although I believe PE firms are valuable to our economy, I think it is a little disingenuous of Romney and his supporters to say Bain was a net “job creator” to the tune of 100,000+ jobs during his tenure. The fact of the matter is PE firms’ priority is to create profitable returns for its investors, and if that requires axing heads, then so be it – most PE firms have no qualms doing precisely that. Romney et al point to successes like Staples Inc. (SPLS), Dominos Pizza Inc. (DPZ) and Sports Authority, Inc., where profitability and success ultimately led to job expansion. From my viewpoint, I believe these examples are more the exception than the rule. Not surprisingly, any job losses executed in the early years of a PE deal will eventually require job additions if the company survives and thrives. Let’s face it, no company can cut its way to prosperity in perpetuity.

Competitveness: Weak, deteriorating, or bankrupt companies cannot and will not hire. Frail or mismanaged companies will sooner or later be forced to cut jobs on their own –the same protocol applied by opportunistic PE vultures swarming around. While PE firms typically focus on bloated or ineffective companies, I think the media outlets overemphasize the cost-cutting aspects of these deals. Sure, PE companies cut jobs, outsource functions, and cut benefits in the name of profits, but that alone is not a sustainable strategy. Trimming fat, by replacing complacent management teams, investing in modern software/equipment, expanding markets, and implementing accountability are all paramount factors in making these target companies more efficient and competitive in the long-run.

Financial Markets-Arbiter: At the end of the day, I think the IPO/financial markets are the final arbiters of how much value PE firms create, not only for investors, but also for the economy overall. If greedy PE firms’ sole functions were to saddle companies with massive debts, cut heads off, and then pay themselves enormous dividends, then there would never be a credible exit strategy for investors to cash out. If PE firms are correctly performing their jobs, then they will profitably create leaner more efficient durable companies that will be able to grow earnings and create jobs over the long-term. If they are unsuccessful in this broad goal, then the PE firm will never be able to profitably exit their investment via a corporate sale or public offering.

Bain Banter: Whether you agree with PE business practices or not, it is difficult to argue with the financial success of Bain Capital. According to a Wall Street Journal article, Bain Capital deals between 1984 – 1999 produced the following results:

“Bain produced about $2.5 billion in gains for its investors in the 77 deals, on about $1.1 billion invested. Overall, Bain recorded roughly 50% to 80% annual gains in this period, which experts said was among the best track records for buyout firms in that era.”

Critics are quick to point out the profits sucked up by PE firms, but they neglect to acknowledge the financial benefits that accrue to the large number of pension fund, charity, and university investors. Millions of middle-class American workers, retirees, community members, teachers, and students are participating in those same blood sucking profits that PE executives are slurping down.

Even though I believe private equity is a net-positive contributor to competiveness and economic growth in recent decades, there is no question in my mind that these firms participated in a massive bubble in the 2005-2007 timeframe. Capital was so cheap and abundant, prices on these deals escalated through the roof. What’s more, the excessive amounts of leverage used in those transactions set these deals up for imminent failure. PE firms and their investors have lost their shirts on many of those deals, and the typical 20%+ historical returns earned by this asset class have become long lost memories. Attractive returns do not come without risk.

With the presidential election rhetoric heating up, the media will continue to politicize, demonize and oversimplify the challenges surrounding this asset class. Despite its shortcomings, private equity will continue to have a positive symbiotic relationship with the economy…rather than a parasitic one.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in SPLS, DPZ, Sports authority, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The European Dog Ate My Homework

I never thought my daily routine would be dominated by checking European markets before our domestic open, but these days it is appearing like the European tail is wagging the global dog. Tracking Spanish bond yields from the Tesoro Publico and the Italia Borsa index is currently having a larger bearing on my portfolio than U.S. fundamentals. When explaining short term performance to others, I feel a little like an elementary school student making an excuse that my dog ate my homework.

Although the multi-year European saga has gone on for years, this too shall pass. What’s more, despite the bailouts of Portugal, Ireland, and Greece in recent years, the resilient U.S. economy has recorded 11 consecutive quarters of GDP (Gross Domestic Product) growth and added more than 4 million jobs, albeit at a less than desirable pace.

Could it get worse? Certainly. Will it get worse before it gets better? Probably. Is worsening European fundamentals and a potential Greek eurozone exit already factored into current stock prices? Possibly. The truth of the matter is that nobody knows the answers to these questions with certainty. At this point, the probability of an unknown or unexpected event in a different geography is more likely to be the cause of our economic downfall than a worsening European crisis. As sage investor and strategist Don Hays aptly points out, “When everyone is concerned about a problem, that problem is solved.” That may be overstating the truth a bit, but I do believe the issues absent from current headlines are the matters we should be most concerned about.

The European financial crisis may drag on for a while longer, but nothing lasts forever. Years from now, worries about the PIIGS countries (Portugal, Ireland, Italy, Greece, Spain) will switch to others, like the BRICs (Brazil, Russia, India, China) or other worry geography du jour. The issues of greatest damage in 2008-2009, like Bear Stearns, Lehman Brothers, AIG, CDS (credit default swaps), and subprime mortgages, didn’t dominate the headlines for years like the European crisis stories of today. As compared to Europe’s problems, these prior pains felt like Band Aids being quickly ripped off.

Correlation Conundrum

Eventually European worries will be put on the backburner, but until some other boogeyman dominates the daily headlines, our financial markets will continue to correlate tightly with European security prices. How does one fight these tight correlations? For starters, the correlations will not stay tight forever. If an investor can survive through the valley of strong security association, then the benefits will eventually accrue.

Although the benefits from diversification may disappear in the short-run, they should not be fully forgotten. Bonds, cash, and precious metals (i.e., gold) proved to be great portfolio diversifiers in 2008 and early 2009. Commodities, inflation protection, floating rate bonds, real estate, and alternative investments, are a few asset classes that will help diversify portfolios. Risk is defined in many circles as volatility (i.e., standard deviation) and combining disparate asset classes can lower volatility. But risk, defined as the potential of experiencing permanent losses, can also be controlled by focusing on valuation. By in large, large cap dividend paying stocks have struggled for more than a decade, despite equity dividend yields for the S&P 500 exceeding 10-year Treasury yields (the first time in more than 50 years). Investing in large companies with strong balance sheets and attractive growth prospects is another strategy of lowering portfolio risk.

Politics & Winston Churchill

Some factors however are out of shareholders hands, such as politics. As we know from last year’s debt ceiling melee and credit downgrade debacle, getting things done in Washington is very challenging. If you think achieving consensus in one country is difficult, imagine what it’s like in herding 17 countries? That’s the facts of life we are dealing with in the eurozone right now.

Although I am optimistic something will eventually get done, I consider myself a frustrated optimist. I am frustrated because of the gridlock, but optimistic because these problems are not rocket science. Rather these challenges are concepts my first grade child could understand:

• Expenses are running higher than revenues. You must cut expenses, increase revenues, or a combination thereof.

• Adding debt can support growth, but can lead to inflation. Cutting debt can hinder growth, but leads to a more sustainable fiscal state of wellbeing.

Relieving all the excess global leverage is a long, tortuous process. We saw firsthand here in the U.S. what happened to the U.S. real estate market and associated financial institutions when irresponsible debt consumption took place. Fortunately, corporations and consumers adjusted their all-you-can-eat debt buffet habits by going on a diet. As a matter of fact, corporations today are holding records amounts of cash and debt service loads for consumers has been reduced to levels not seen in decades (see chart below). Unlike governments, luckily CEOs and individuals do not need Congressional approval to adapt to a world of reality – they can simply adjust spending habits.

Governments, on the other hand, generally do need legislative approval to adjust spending habits. Regrettably, cutting the benefits of your constituents is not a real popular political strategy for accumulating votes or brownie points. If you don’t believe me, see what voters are doing to their leaders in Europe. Nicolas Sarkozy is the latest European leader to be booted from office due to austerity backlash and economic frustration. No less than nine European leaders have been cast aside since the financial crisis began.

The fate for U.S. politicians is less clear as we enter into a heated presidential election over the next six months. We do however know how the mid-term Congressional elections fared for the incumbents…not all sunshine and roses. Until elections are completed, we are resigned to the continued mind-numbing political gridlock, with no tangible resolutions to the trillion dollar deficits and gargantuan debt load. Obviously, most citizens would prefer a forward looking strategic plan from politicians (rather than a reactive one), but there are no signs that this will happen anytime soon…in either party.

Realistically though, tough decisions made by politicians only occur during crises, and if this slow-motion train wreck continues along this same path, then at least we have something to look forward to – forced resolution. We are seeing this firsthand in Greece. The “bond vigilantes” (see Plumbers & Cops) and responsible parents (i.e., Germany) have given Greece two options:

1.) Fix your financial problems and receive assistance; or

2.) Leave the EU (return to the Drachma currency) and figure your problems out yourself.

Panic has a way of forcing action, and we are approaching that “when push comes to shove” moment very quickly. I believe the Europeans are currently taking a note from our strategic playbook, which basically is the spaghetti approach – throw lots of things up on the wall and see what sticks. Or as Winston Churchill stated, “You can always count on Americans to do the right thing – after they’ve tried everything else.”

There is no question, the European sovereign debt issue is a complete mess, and there are no clear paths to a quick solution. Until voters force politicians into making tough unpopular decisions, or leaders come together with forward looking answers, the default position will be to keep kicking the fiscal can issues down the road. In the absence of political leadership, eventually the crisis will naturally force tough decisions to be made. Until then, I will go on explaining to others how the European dog ate my homework.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including commodities, inflation protection, floating rate bonds, real estate, dividend, and alternative investment ETFs), but at the time of publishing SCM had no direct position in AIG, JNJ, Bear Stearns, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Darwin Meets Capitalism & Private Equity

A rising discontent is spreading like wildfire in the wake of a massive financial crisis that erupted in the U.S. during 2008, and is now working its way through Europe. Irresponsible governments across the globe succumbed to the deceptive allure of leverage, and as a result racked up colossal debts and gargantuan deficits. Now governments everywhere are toggling between political gridlock and painful austerity. Citizens are feeling the pain through high unemployment, exploding education costs, crumbling social safety nets, and a general decline in the standard of living.

As a result of these dramatic changes, the contributions of capitalism are being questioned by many, whether it’s the Occupy Wall Street movement attack on the top 1%, or more recently the assault on private equity’s relevancy for a presidential candidate.

Although the media may prefer to sensationalize economic stories and tell observers, “This time is different” to boost viewership, usually the truth relies more on the nuanced evolution of issues over time. If Charles Darwin were alive today, he would understand that capitalism and democracies are evolving to massive changes in globalization, technology, and emerging markets. Darwin would appreciate the fact that capitalism can’t and won’t change overnight. Whether capitalism ultimately survives or goes extinct depends on how it adapts. Or as Darwin characterizes evolution:

It is not the strongest of the species that survives, nor the most intelligent, but the most responsive to change.

Will Capitalism Survive?

Capitalism and democracy fit like a hand in a glove, which explains why both have thrived for generations. Never mind that democracies have been around for centuries and their expansion continues unabated (see Spreading the Seeds of Democracy), nevertheless pundits feel compelled to question the sustainability of these institutions.

I guess the real response to all those experts who question the merits of capitalism is what alternative would serve us better? Would it be Socialism like we see grinding Europe to a halt? Or perhaps Communism working its wonders in North Korea and Cuba? If not that, then surely the Autocracies in Egypt and Libya are the winning formulas? The Occupy Wall Streeters may not be happy with their personal plight or the top 1%, but I don’t see them packing their bags for Greece, the Middle East or China.

There is arguably a growing disparity between rich and poor and the game of globalization is only making it more difficult for rising tides of growth to lift up our middle class. The beauty of capitalism is that money goes where it is treated best. Capitalism sucks money to the areas of the world that are the freest, most open, transparent, and practice the rule of law. Some of these components of American capitalism unquestionably eroded over the last decade or so, but the good thing is that in a democracy, citizens have the right to vote and elect growth-promoting leaders to fix problems. Growth comes from competitiveness, and competitiveness is derived from education, innovation, and pro-growth policies. Let’s hope the 2012 elections get agents of change in office.

Darwin & Private Equity

Republican Presidential primary candidate Mitt Romney has been raked over the coals for his prior professional career at private equity firm, Bain Capital. I’m convinced Charles Darwin would see private equity’s involvement as a critical factor in the process of global commerce. Businesses are like species, and only the fittest will survive.

Private equity firms prey upon weak businesses, looking to restructure and reorganize them to become more competitive. If private equity companies are bullies, then their business targets can be considered weaklings. Beating wimps into shape may not be fun to watch, but is a crucial evolutionary aspect of business. The fact of the matter is that deteriorating, uncompetitive companies cannot hire employees…only profitable, viable entities can createsustainable jobs. So our public policy officials have two choices:

• Prop up uncompetitive businesses inefficiently with tax dollars that save jobs in the short-run, but lead to bankruptcy and massive job losses in the future. Other unproductive tariffs and bailouts may garner short-term political votes, but only lead to long-term stagnancy.

OR

• Trim fat, restructure and reorganize now – similar to the swift pain experienced from extracting a rotted tooth. Jobs may be cut in the short-run, but a long-term competitively positioned company will be able to grow and create sustainable long-term jobs.

I can’t say I agree with all of private equity practices, such as leveraged recapitalizations – the practice in which private equity companies load up the target with debt so big fat dividends can be sucked out by the principals. But guess what? By doing so the principals are only reducing their own future exit value through a potential IPO (Initial Public Offering) or company sale. Moreover, if this is such an evil practice, lenders can curb the practice by simply not giving the private equity companies the needed borrowing capacity.

Capitalism and its private equity subset have gotten quite a bad rap lately, but I believe these forces are essential aspects for the rising standards of living for billions of people across the planet. When first introduced, Charles Darwin’s theory of evolution by natural selection was critically examined by many non-believers. Although capitalism will be forced to adapt to an ever-changing world and its merits have been questioned too, the chances of capitalism going extinct are about as likely as the extinction of Darwin’s evolutionary theory.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Political Art of Investment Commentators

There are approximately 2 billion people surfing the internet globally and over 150 million bloggers (source: blogpulse.com) spewing their thoughts out into cyberspace. Throw in economists, strategists, columnists, and the talking heads on television, and you can sleep comfortably knowing there will never be a shortage of opinions for investors to sift through. The real question regarding the infinite number of ideas floating around from the “market commentators” is how useful or harmful is all this information? These diverse points of view, like guns, can be useful or dangerous – depending on an investor’s experience and knowledge level. Deciphering the nuances and variances of investment opinions can be very challenging for an untrained investing eye or ear. While there are plenty of diamonds in the rough to be discovered in the investment advice buffet, there are also a plethora of landmines and booby traps that could explode investment portfolios – especially if these volatile opinions are not handled with care.

No Credentials Required

Unlike dentists, lawyers, accountants, or doctors, becoming a market commentator requires little more than a pulse. All a writer, squawker, or blogger really needs is an internet connection, a keyboard, and something interesting or provocative to talk about. Are any credentials required to blast toxic gibberish to the millions among the masses? Unfortunately there are no qualifications required…scary thought indeed.

In order to successfully navigate the choppy investment opinion waters, investors need to be self-aware enough to answer the following key questions:

• What is your investment time horizon?

• What is your risk tolerance? (see also Sleeping like a Baby)

With these answers in hand, you can now begin to evaluate the credibility and track record of the market commentators and match your personal time horizon and risk profile appropriately. Ideally, investors would seek out prudent long-term counsel, but in this instant gratification society we live in, immediate fear and greed sells advertisements and attracts viewers. Even if media producers and editors of all stripes believed focusing on multi-year time horizons is most beneficial for investors, some serious challenges arise. The brutal reality is that concentrating on the lackluster long-term does not generate a lot of advertisement revenue or traffic. The topics of dollar-cost averaging, asset allocation, diversification, and rebalancing are about as exciting as watching an infomercial marathon (OK, actually this is quite funny) or paint dry. More interesting than the sleepy, uninspiring topics of long-term value creation are stories about terrorist threats, DSK sex scandals, Bernie Madoff Ponzi schemes, currency crises, hacking misconduct, bailouts, tsunamis, earthquakes, hurricanes, 50-day moving averages…OK, you get the idea.

Focus on Long-Term and Do Not Succumb to Short-Termism

Regrettably, there is a massive disconnect between the nano-second time horizons of market commentators and the time horizons of most investors. Moreover, this short-termism dispersed instantaneously via Facebook, Google (GOOG), Twitter, and traditional media channels, has sadly infected the psyches and investment habits of ordinary investors. If you don’t believe me, then check out some of the John Bogle’s work, which shows how dramatically investors underperform the benchmark thanks to emotionally charged reactions (see Fees, Exploitation, and Confusion Hammer Investors).

Although myopic short-termism is not the solution, extending time horizons too long does no good for investors either. As economist John Maynard Keynes astutely noted, “In the long run we are all dead.” But surely bloggers and pundits alike could provide perspectives in multiple year timeframes, rather than in multiple hours. Investors would be served best by turning off the TV, PC, or cell phone, and using the resulting free time to read a good book about the virtues of patient investing from successful long-term investors. Stuffing cash under the mattress, parking it in a 0.5% CD, or panicking into sub-2% Treasuries probably is not going to get the job done for your whole portfolio when inflation, longer life expectancies, and the unsustainable trajectory of entitlements destroy the value of your hard-earned nest egg.

Investment Commentators Look into Politician Mirror

Heading into a heated election year with volatility reaching historic heights in the financial markets, both politicians and investment commentators have garnered a great deal of the media spotlight. With the recent heightened interest in the two fields, some common characteristics between politicians and investment commentators have surfaced. Here are some of the similarities:

- Politicians have a short-term incentives to get re-elected and not get fired, even if there is an inherent conflict with the long-term interest of their constituents; Investment commentators have a short-term incentives to follow the herd and not get fired, even if there is an inherent conflict with the long-term interest of their constituents;

- Many politicians have extreme views that conflict with peers because blandness does not get votes; Many investment commentators have extreme views that conflict with peers because blandness does not get votes;

- Many politicians lack practical experience that could benefit their followers, but the politicians have the gift of charisma to mask their inexperience; Many investment commentators lack practical experience that could benefit their followers, but the commentators have the gift of charisma to mask their inexperience;

Investing has never been so difficult, and also has never been so important, which behooves investors to carefully consider portfolio actions taken based on a very volatile and inconsistent opinions from a group of bloggers, economists, strategists, columnists, and various other media commentators. Investors are bombarded with an avalanche of ever-changing daily data, much of which is irrelevant and should be ignored by long-term investors. As you weigh the precious value of your political votes in the upcoming election season, I urge you to back the candidates that represent your long-term interests. With regard to the financial markets, I also urge you to back the investment commentators that support your long-term interests – the success of your financial future depends on it.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and GOOG, but at the time of publishing SCM had no direct position in Facebook, Twitter, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page

Shoot First and Ask Later?

The financial markets have been hit by a tsunami on the heels of idiotic debt negotiations, a head-scratching credit downgrade, and slowing economic data after a wallet-emptying spending binge by the government. These chain of events have forced many investors and speculators alike to shoot first, and ask questions later. Is this the right strategy? Well, if you think the world is going to end and we are in a global secular bear market stifled by a choking pile of sovereign debt, then the answer is a resounding “yes.” If however, you believe the blood curdling screams from an angered electorate will eventually influence existing or soon-to-be elected politicians in dealing with the obvious, then the answer is probably “no.”

Plug Your Ears

Anybody that says they confidently know what is really going to happen over the next six months is a moron. You can ask those same so-called talking head experts seen over the airwaves if they predicted the raging +35% upward surge last summer, right after the market tanked -17% on “double-dip” concerns and Fed Chairman Ben Bernanke gave his noted quantitative easing speech in Jackson Hole, Wyoming. I’m still flicking through the channels looking for the professionals who perfectly envisaged the panicked buying of the same downgraded Treasuries Standard and Poor’s pooped on. Oh sure, it makes perfect sense that trillions of dollars would flock to the warmth and coziness of sub-2% yielding debt in a country exploding with unsustainable obligations and deficits, fueled by a Congress that can barely blows its nose to a successful negotiation.

The moral of the story is that nobody knows the future with certainty – no matter how much CNBC producers would like you to believe the opposite is true. Some of the arguably smartest people in the world have single handedly triggered financial market implosions. Consider Robert Merton and Myron Scholes, both renowned Nobel Prize winners, who brought global financial markets to its knees in 1998 when Merton and Scholes’s firm (Long Term Capital Management) lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Or ask yourself how well Fed Chairmen Alan Greenspan and Ben Bernanke did in predicting the credit crisis and housing bubble.

If the strategist or trader du jour squawking on the boob-tube was really honest, he or she would steal the sage words of wisdom from the television series secret agent Angus MacGyver who articulated, “Only a fool is sure of anything, a wise man keeps on guessing.”

Listen to the “E”-Word

If you can’t trust all the squawkers, then whom can you trust (besides me of course…cough, cough)? The answer is no different than the person you would look for in other life-important decisions. If you needed a serious heart by-pass surgery, would you get advice from a nurse or medical professor, or would you listen more closely to the top cardiologist at the Mayo Clinic who performed over 2,000 successful surgeries? If you were looking for a pilot to fly your plane, would you prefer a 25-year-old flight attendant, or a 55-year old steely veteran who has 10 million miles of flight experience? OK, I think you get the point…legitimate experience with a track record is key.

Unfortunately, most of the slick, articulate people we see on television may look experienced and have some gray hair, but the only thing they are experienced at is giving opinions. As my great, great grandmother once told me, “Opinions are a dime a dozen, but experience is much more valuable” (embellished for dramatic effect). You are better off listening to experienced professionals like Warren Buffett (listen to his recent Charlie Rose interview), who have lived through dozens of crises and profited from them – Buffett becoming the richest person on the planet doesn’t just come from dumb luck.

If you are having trouble sleeping, you either are taking too much risk, or do not understand the nature of the risk you are taking (see Sleeping like a Baby). Things can always get worse, and the risk of a self-fulfilling further decline is a possibility (read about Soros and Reflexivity). If you are determined to make changes to your portfolio, use a scalpel, and not an axe. The recent extreme volatility makes times like these ideal for reviewing your financial position, goals, and risk tolerance. But before you shoot your portfolio first, and ask questions later, prevent a prison sentence of panic, or your financial situation may end up behind bars.

[tweetmeme source=”WadeSlome” only_single=false https://investingcaffeine.com/2011/08/20/shoot-first-and-ask-later/%5D

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MHP, CMCSA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

![940614_83408820[1]](https://investingcaffeine.com/wp-content/uploads/2011/08/940614_834088201.jpg?w=455)