Posts tagged ‘Peter Schiff’

Getting off the Market Timing Treadmill

Most investors have been stuck on the financial treadmill of the 2000s and have nothing to show for it, other than battle scars from the 2008-2009 financial crisis. A lot of running, sweating, and jumping has produced effectively no results. Most media outlets continue to focus on the “lost decade” (see other Lost Decade story) in which investors have earned nothing in the equity markets. After a decade of excess in the 1990s should the majority of investors be surprised? Investing is no different than dieting and exercise – those topics are easy to understand but difficult to execute.

Where are the Billionaire Market Timers?

The financial industry oversimplifies investing and sells market timing as an effortless path to riches – even in tough times. In the search of the financial Holy Grail, the industry constantly crams new software bells and whistles and so-called “can’t lose” strategies down the throats of individual investors. Sadly, there is no miracle system, wonder algorithm, or get rich scheme that can sustainably last the test of time. Sure, a minority of speculators can get lucky and make money by following a risky strategy in the short-run, but as the global economic disaster caused by LTCM (Long Term Capital Management) taught us, even certain successful trading strategies or computer algorithms can stop working in a heartbeat and lead to a widespread bloodbath.

Are you still a believer in market timing? If so, then where are all the billionaire market timers? Famed growth manager, Peter Lynch astutely noted:

“I can’t recall ever once having seen the name of a market timer on Forbes‘ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.”

Certainly, there are some hedge fund managers that have hit home runs with amazing market calls, but time will be the arbiter in determining whether they can stay on top.

Sage Speak on Market Timing

If you don’t believe me about market timing, then listen to what knowledgeable investors and thought leaders have to say on the subject. Larry Swedroe, a principal at Buckingham Asset Management, compiled a list including the following quotes:

- Warren Buffett (Investor extraordinaire): “We continue to make more money when snoring than when active.” He adds, “The only value of stock forecasters is to make fortune-tellers look good.”

- Jason Zweig (Columnist): “Whenever some analyst seems to know what he’s talking about, remember that pigs will fly before he’ll ever release a full list of his past forecasts, including the bloopers.” (See also Peter Schiff and Meredith Whitney stories)

- Bernard Baruch (Financier): “Only liars manage to always be out during bad times and in during good times.”

- Jonathan Clements (Columnist): “What to do when the market goes down? Read the opinions of the investment gurus who are quoted in the WSJ. And, as you read, laugh. We all know that the pundits can’t predict short-term market movements. Yet there they are, desperately trying to sound intelligent when they really haven’t got a clue.”

- David L. Babson (Investment Manager): “It must be apparent to intelligent investors that if anyone possessed the ability to do so [forecast the immediate trend of stock prices] consistently and accurately he would become a billionaire so quickly he would not find it necessary to sell his stock market guesses to the general public.”

- Peter Lynch (Retired Growth Manager): “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Market Timing Road Rules

Rather than make guesses regarding the direction of the market, here are some investment rules to follow:

- Rule #1: Do not attempt to market time. Statistically it is a certainty that a minority of the millions of investors can time the market in the short-run – the problem is that very few, if any, can time the market for sustainable periods of time. Don’t try to be the hero, because often you will become the goat.

- Rule #2: Patiently make good investments, regardless of the economic conditions. It is best to assume the market will go nowhere and invest accordingly. Paying attention to a hot or cold economy leads to investors chasing their tails. Good investments should outperform in the long-run, regardless of the macroeconomic environment.

- Rule #3: Diversify. In the midst of the crisis, diversification didn’t cure simultaneous drops in most asset classes, however ownership of government Treasuries, cash, and certain commodities provided a cushion from the economic blows. Longer-term, the benefits of diversification become more apparent – it makes absolute sense to spread your risk around.

In some respects, there is always an aspect of timing to investing, but as referenced by some of the intelligent professionals previously, the driving force behind an investment decision should not be, “I think the market is going up,” or “I think the market is going down” – those thought processes are recipes for disaster. I strongly believe an investment process that includes patience, discipline, diversification, valuation sensitivity, and low-cost/ tax-efficient products and strategies will get you off the financial treadmill and move you closer to reaching your financial goals.

Read the Full Larry Swedroe Story

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in BRKA or any other security mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Extrapolation: Dangers of Mixing Cyclical & Secular

One of the toughest jobs in making investment decisions is determining whether changes in profit growth rates are due to cyclical trends or secular trends. The growth of technology and the advent of the internet have not only accelerated the pace of information exchange, but these advancements have also led to the explosion of information (read more).

Drowning in too much information can make the most basic decisions confusing. One of the dreaded by-products of “information overload” is extrapolation. When faced with making a difficult or time consuming decision, many investors choose the path of least resistance, which is to fall back on our good friend…extrapolation.

Rather than taking the time of gathering the appropriate data, exploring both sides of an argument, and having objective information guide educated decisions, many investors open their drawers and grab their trusty ruler. The magic ruler is a wonderful straight-edged tool that can coherently connect any two data points. The beauty of the wooden instrument is the never-ending ability to bolt on a simple convenient story on why a short-term trend will persist forever (upwards or downwards).

We saw it firsthand as the world got sucked down the drain of the global financial crisis. Throughout 2008 bearish pundits like Nouriel Roubini, Peter Schiff, Meredith Whitney, and Jimmy Rogers came out of the woodwork (read more about Pessimism Porn) comparing the environment to the Great Depression and calling for economic collapse. Needless to say, equity markets rebounded significantly in 2009. The vicious rally was not strong enough, nor has the economic data turned adequately rosy for the bears to pack up their bags and hibernate. To be fair, the panicked moods have subsided for “Happy Abby” (Abby Joseph Cohen – Goldman Sachs strategist) to make a few short cameos on CNBC (read more), but we are far from the euphoric heights of the late ‘90s.

I think recent comments by John Authers, columnist at The Financial Times, captures the essence of the current sour mood despite the economic and equity market rebounds:

“Last year’s rebound was, most likely, a bear market bounce. The central hypothesis remains intact. On balance of probabilities, the rally since March has been a (very big) rally within a bear market, and the downward move is a (not so big) correction to that rally. There is no new reason to fear we will revisit the lows of 2009, but every reason to believe that stocks are still fundamentally mired in a bear market.”

Just as overly pessimistic bearishness can cloud judgment, so too can rose colored glasses. Chief economist at the National Association of Realtors, David Lereah, is an example of how biased bullishness can cloud reasoning too. Among the many comments that made Lereah a lightning rod, in July 2006 he noted the real estate “market is stabilizing” and followed up six months later by claiming, “It appears we have established a bottom.”

Extrapolation is a fun, easy tool, but at some point the simple laws of economics must kick into gear. Supply and demand generally do not rise and fall in a linear fashion in perpetuity. As the saying goes, “The herd is often led to the slaughterhouse.” Rather, I argue mean- reversion is a much more powerful tool than extrapolation for investors (read more).

The country faces many critical problems that cannot be ignored and politicians need to show leadership in addressing them. I encourage and remind people that we have survived through multiple wars, assassinations, currency crises, banking crises, SARS, mad cow, swine flu, widening deficits, recessions, and even political gridlock. So next time someone tells you the world is coming to the end, or a stock is going to the moon, do yourself a favor by putting away the ruler and aggregating the relevant data on both sides of an argument before jumping to hasty conclusions.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in LM, or GS. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Back to the Future: Mag Covers (Part III)

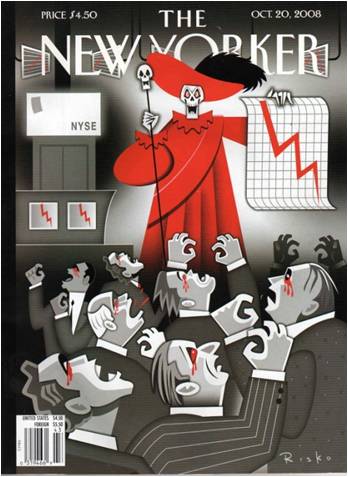

Congratulations to those who have graduated through my first two articles (Part I and Part II) regarding the use of media magazine covers as contrarian investment indicator tools. We’ve reviewed magazine’s horrendous ability of predicting market shifts during the 1970s and Tech Bubble of 2000, and now we will take a peek at the “Great Recession” of 2008 and 2009. If you have the stamina to complete this final article, your diploma and selfless glory will be waiting for you at the end.

This magazine cover series was not designed to be utilized as an exploitable investment strategy, but rather to increase awareness and raise skepticism surrounding investment content. Just because something is written or said by journalist or blogger does not mean it is a fact (although I fancy facts). In the field of investing, along with other behavioral disciplines, there are significant gray areas left open to interpretation. A more educated, critical eye exercised by the general public will perhaps release us from the repetitive boom-bust cycles we’ve become accustomed to. Perhaps my goal is naïve and idealistic, nonetheless I dare to dream.

The wounds from a year ago are still fresh, and we have not fully escaped from the problems that originally got us into this mess, but it is amazing what a 60%+ market move since March can do to the number of “Great Depression” references. Let’s walk down calamity memory lane over the last year:

Great Depression Redux?

Months ago we were in the midst of a severe recession, and the media was not shy about jumping on the “pessimism porn” bandwagon for the sake of ratings. Like a Friday the 13th sequel (nice tie in!), CNBC just weeks ago was plugging the crisis anniversary of the Lehman Brothers failure. Time magazine’s portrayal of the financial crisis as the next Great Depression, including the soup kitchen lines, mass unemployment, and collapse of thousands of banks, was used like chum to feed the frenzy of shocked investing onlookers. Unemployment rates are still creeping up, albeit at a slower rate, but we are nowhere near the 25% levels seen in the Great Depression.

American Disintegration

One of my favorite articles (read here) of the global crisis was written by The Wall Street Journal late last year about a Russian Professor, Igor Panarin (also a former KGB analyst). I find it absurdly amusing that the WSJ would even give credence to this story, but perhaps now I can look forward to an Op-Ed in their newspaper from Iranian President Mahmoud Ahmadinejad or North Korean Leader Kim Jong Ill. Not only did Professor Panarin pronounce the complete evaporation of the United States, but he also provided a specific timeframe. In late June or early July 2010, he expects the U.S. to fall into civil war and subsequently get carved up into six pieces by particular foreign regions, including China, Mexico, E.U., Japan, Canada, and Russia (which will control Alaska of course). I guess Sarah Palin will not be a happy camper?

Other Crisis Souvenirs

Market Mayhem

Lessons Learned

Contrarianism for the sake of contrarianism is not necessarily a good thing. Trend can be your friend too. Bubbles take much longer to inflate than they burst, so it may be in your best interest to ride the wave of ecstasy for longer than the early alarm ringers. Take for example Alan Greenspan’s infamous irrational exuberance speech in 1996, when the NASDAQ index was trading around 1300. As we all know, the NASDAQ went on to pierce the 5000 mark, four years later. Sorry Al…right idea, but a tad early. Although he may have been correct directionally, his timing and degree were way off. Pundits like Nouriel Roubini and Peter Schiff are other examples of prognosticators who identified the financial crisis many years before the catastrophe actually hit. As I noted previously, trading based on magazine covers was not conceived as a legitimate investable strategy, but as I’ve shown they can be indicators of sentiment. And these sentiment indicators can be used as a valuable apparatus in your toolbox to prevent harmful decisions at the worst possible times.

Thanks for coming Back to the Future on this historical tour of cover stories. Now that you have graduated with honors, next time you are in line at the grocery store, feel free to flash your diploma to receive a discount on a magazine purchase.

Class dismissed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Clashing Views with Dr. Roubini

The say keep your friends close, and your enemies even closer. Nouriel Roubini, professor of economics and international business at the NYU Stern School of Business, is not an enemy, but I think his fluctuating views (see previous story) and Armageddon expectations are off base. Perma-bears like Roubini and Peter Schiff (view article) have gloated and danced in the media limelight due to their early but eventually right calls. Over the last seven months or so, their forecasts on the U.S. economy and markets have been off the mark. With that said, even those with competing views at times can find common ground. For Nouriel and I, we currently share similar beliefs on gold (see my article on gold).

Here’s what Professor Roubini has to say:

“ I don’t believe in gold. Gold can go up for only two reasons. [One is] inflation, and we are in a world where there are massive amounts of deflation because of a glut of capacity, and demand is weak, and there’s slack in the labor markets with unemployment peeking above 10 percent in all the advanced economies. So there’s no inflation, and there’s not going to be for the time being.The only other case in which gold can go higher with deflation is if you have Armageddon, if you have another depression. But we’ve avoided that tail risk as well. So all the gold bugs who say gold is going to go to $1,500, $2,000, they’re just speaking nonsense. Without inflation, or without a depression, there’s nowhere for gold to go. Yeah, it can go above $1,000, but it can’t move up 20-30 percent unless we end up in a world of inflation or another depression. I don’t see either of those being likely for the time being. Maybe three or four years from now, yes. But not anytime soon.”

My thoughts on oil are less bearish, but nonetheless more cautious given the massive price bounce to around $80 per barrel. Could I see prices coming down to $50 like Roubini feels is appropriate? Certainly. With the $100+ per barrel swing we saw last year, I cannot discount completely the possibility of that scenario. However, unlike gold, oil has a much stronger utility value, and based on the slow adoption of more expensive alternative energies, this commodity will be in strong demand for many years to come. The pace of global economic recovery, especially in countries like China, India, and Brazil provide an underlying demand for the petroleum product. In order to understand the underlying bid for this economic lubricant, all one has to do is look at the appetite of emerging economies like China when it comes to this black gold (see my article on China).

And where does Roubini think markets go from here?

“If the recovery of the economy is going to be anemic, sub-par, below-trend and U-shaped, there is going to be a correction. And therefore my view is to stay away from risky assets. Stay in liquid assets. I don’t know when the correction is going to occur, it could be a while longer, but eventually it will be a pretty ugly correction, across many different asset classes.”

Perhaps Roubini’s “double dip” fears will eventually come true – and he leaves himself plenty of room with vague loose language – however, I follow the philosophy of Peter Lynch: ‘‘If you spend more than 14 minutes a year worrying about the market, you’ve wasted 12 minutes.” Great companies don’t disappear in challenging markets – they become cheaper – and new innovative companies emerge to replace the old guard.

As much as I would like to be right all the time, that’s not the case. In order to learn from past mistakes and continually improve my process, it’s important to get the views of others…even from those with clashing perspectives.

Read IndexUniverse.com Interview with Nouriel Roubini Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct long or short positions in gold positions, however accounts do have long exposure to certain energy stocks and ETFs. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shiny Metal Shopping with Schiff, Rogers, and Faber

There I am, strolling through Costco (COST) with a pallet full of toilet paper, Diet Coke, and a garbage bag-sized bag of tortilla chips on my flat orange cart. As I roll into the cash register, I feel a cold panic grab me, only to realize I forgot my 25 pound gold brick in my car trunk as a method of payment for my necessities. Sound far-fetched? Probably not, if you are a part of the hyper-inflationary “Three Musketeers”: Peter Schiff, Jimmy Rogers, and Marc Faber.

Here is what some of the “world-is-ending” crowd is saying:

Peter Schiff (President of Euro Pacific Capital – Connecticut Senator Candidate): He sees the market potentially going much higher, but “it doesn’t matter how much money we have because we’re not going to be able to buy anything with it.”

Marc Faber (a.k.a.,“Dr Doom”, creator of the Gloom Boom & Doom Report): When asked by faux frog boiler and Fox News reporter Glenn Beck if he believes “it is 100% guaranteed that we are going to have hyper-inflation like Zimbabwe,” Faber’s short and to-the-point response was simply, “Yes, that’s correct.”

Jimmy Rogers (Chairman of Rogers Holdings): “I’m afraid they’re printing so much money that stocks could go to 20,000 or 30,000,” Rogers said. “Of course it would be in worthless money, but it could happen and you could lose a lot of money being short,” he adds. Mr. Rogers likes gold too: “I own gold, I’m not selling it.”

PRICING IN GOLD

One consistent theme heard from these three economic bears is that the Dow and other market indexes should be measured on a gold adjusted basis. Since Peter Schiff’s Dow 10,000 to 3,000 forecast never came to fruition (See Schiff’s other questionable predictions), he rationalizes it this way, “So if you price the 2002 Dow in gold, the Dow is at 3,000 now.” Marc Faber makes a similar argument by saying the Dow could double from today, but with gold tripling your worth will be down. That’s funny, because if I price the Dow based on 2002 lumber prices (rather than gold), the Dow would actually be up to about 20,000 (more than 2x its value today)! If prices should truly be measured in gold, then why doesn’t Goldman Sachs’ (GS) and others provide inflation adjusted price targets on their research reports? If gold is the true measure of value, then why can’t I pay off my American Express (AXP) bill by mailing in my gold necklace?

GOLD FEVER

With the effective quadrupling of gold prices in the last seven years (~$250/oz to ~$1,000/oz), gold bugs are more confidently pounding their chests and throwing out multi-thousand, frothy price targets. For example, Peter Schiff predicted $2,000 per ounce by 2009 (who knows, maybe he’ll be right and gold will be up another 100% in the ne next 90 days…cough, cough). Not only are you hearing the strategists and investors bang their drums more loudly, but gold advertisements are plastered all over the radio, television, and internet. Here are a few excerpts*:

- “Watch your gold investments be “on the money” every 9 out of 10 times.”

- “Gold prices could reach $2,300 an ounce or more before it’s over. Buyers of gold bullion at $900 an ounce could earn a return of +155%. That’s very good. But there’s an even BETTER WAY!”

- “Discover Our Little Known “Gold Price Predictor” That Has Been Spot On Every Single Time… Since 1901..!”

- “Turn EVERY $1 Of GOLD Into $10…Or MORE!”

Sources: streetauthority.com and soverignsociety.com

ALTERNATIVE SCENARIO

Another scenario to consider is a complete collapse in gold prices (and surge in the dollar) like we saw in the early 1980s We experienced about a -65% drop in gold prices (~$800/oz. to $300/oz.) from 1980-1982 and saw ZERO price appreciation for about a 25 year period. When did this abysmal period for gold begin? Right about the same time that Paul Volcker raised interest rates to fight inflation. Hmmm, I wonder what next direction of interest rates will be, especially with the Federal Funds rate currently at effectively 0%? Could we see a repeat of the early ‘80s? Seems like a possibility to me. Certainly if you fall into the Marshal Law, civil unrest, soup kitchen, and bread line camp, like the “Three Musketeers,” then burying tons of gold in your homemade bunker may indeed be an appropriate strategy.

Another head scratcher is all the talk revolving around an inflation driven market rebound. If inflation is truly the worry, then shouldn’t the “Three Musketeers” be massively short and be concerned about declining PE (Price/Earnings) multiples, like the single digit PE levels we saw in the late-1970s and early-1980s (when we were experiencing double-digit inflation)?

As I have chronicled, there can be some mixed interpretations regarding the direction of future gold prices. If you think a repeat of Volcker driven gold price collapse of the early ‘80s is possible, then establishing a heavy short position may be the ticket for you. If on the other hand, you are in the gold $4,000 camp, then it might be best to carry a few extra gold bars in the trunk for your next Costco trip.

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct long or short positions in COST, GS, AXP or gold positions. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Emperor Schiff Has No Clothes

In the Hans Christian Andersen fairy tale The Emperor’s New Clothes, the emperor unwittingly hires two swindlers whom he pays to create a special make-believe suit, which the cons claim appears invisible to stupid people. When the emperor cannot visibly see his clothes, he sheepishly avoids confronting the swindlers to escape appearing stupid. Not until a little boy, who is watching the royal precession, points out the “emperor has no clothes” does the emperor finally realize he has been had.

Peter Schiff, former stockbroker and President of Euro Pacific Capital, has been proudly parading along the business media network on route to his senatorial candidacy, taking credit for accurately predicting the timing of the economic financial collapse. Endless amounts of praise have swarmed the airwaves and cyberspace through countless interviews and YouTube clips.

Maybe the same lessons learned from aforementioned fairy tale can be applied to Mr. Schiff? Perhaps he too wears no clothes?!

Let’s take a look at Mr. Schiff’s track record. Certainly Mr. Schiff was correctly bearish on the housing market, albeit about five years too early. I thought “timing is everything?” Apparently not for the media masses judging Peter Schiff’s track record. Let’s take a look at the chief tea-leaf reader in 2002 when he was calling for NASDAQ to reach 500 and the Dow Jones Industrials to reach 2000.

As you can see documented in the video, the Dow didn’t ever come remotely close to collapsing from 10,000 to 2,000 and the NASDAQ didn’t plummet from 1,700 to anywhere near 500. The significant percentage of the Fortune 500 he predicted to file bankruptcy never materialized either. Rather the market proceeded to march upwards on a five year bull market run that led to a doubling in the S&P 500 index from the bottom in 2002. Like a broken clock, if you stubbornly stick to one position, chances are you will eventually become right (at least twice per day).

I am not the only person to question the accuracy of Mr. Schiff’s persistently bearish and often inaccurate calls.

For one, Mike Shedlock of Mish’s Global Economic Trend Analysis gave an incredibly detailed review of Schiff’s track record in an article titled, “Peter Schiff was Wrong.” To get a little flavor of the piece, here is an excerpt:

12 Ways Schiff Was Wrong in 2008

- Wrong about hyperinflation

- Wrong about the dollar

- Wrong about commodities except for gold

- Wrong about foreign currencies except for the Yen

- Wrong about foreign equities

- Wrong in timing

- Wrong in risk management

- Wrong in buy and hold thesis

- Wrong on decoupling

- Wrong on China

- Wrong on US treasuries

- Wrong on interest rates, both foreign and domestic

Todd Sullivan from Seeking Alpha wrote an equally scathing, although shorter, look at Mr. Schiff’s track record.

More recently the ever-bearish Schiff continues to call for a collapse in the U.S. dollar and economy but refuses to short (bet against) the U.S. market because a hyper-inflationary period may ensue, driving U.S. index prices higher. Wait a second; is he saying that buying U.S. equities would be a good hedge against rising inflation? All this talking in circles is getting me dizzy. As for his position on gold, just last year he said gold would hit $2,000 per ounce by 2009 – well if it rises 100%+ in the next few months, then Mr. Schiff will be right on target.

Peter Schiff certainly lacks no confidence in making bold predictions despite his spotty record. Whether you think Peter Schiff is an overly bearish buffoon filled with hot air, or you think he is the greatest market prognosticator since sliced bread, it never hurts to wipe your eyes to make sure the media king du jour is wearing clothes?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Is the Recession Over?

Dennis Kneale, bullish commentator on CNBC presented his case on why he thinks the recession is over:

Positive Technical Indicators: Kneale points out that in recent history when the 50-day moving price average cuts upward through the 200-day moving average there is a positive directional bias for the market in the ensuing months.

Personal Income: +1.4% in May for 2 consecutive months.

Personal Spending: Consumer spending was up again in May, and up more than in April.

University of Michigan Consumer Sentiment: The survey rose again to a reading of 70.8 in the recent measurement period.

VIX Volatity Index: The so called “Fear Index” is down -43% in about 3 months – stabilizing to a more normalized level. He argues this should bring in some cash on the sidelines into the stock market.

Eric Schmidt Positive: CEO of search giant, Google, says the worst is behind for the U.S. economy.

Most of the guests rang a more cautious tone, not the least of which, Peter Schiff sees Armageddon ahead for the U.S. economy. Mr. Schiff goes on to compare CNBC to the Gardening channel with all the talk about “green shoots.” Not to mention, he sees the trillions of stimulus dollars only providing a temporary, artificial boost that will eventually cause a horrible economic hangover. Lucky for Peter, he has perfectly timed the international rebound in 2009…cough, cough.