Posts tagged ‘Peter Lynch’

Playing the Field with Your Investments

For some, casually dating can be fun and exciting. The same goes for trading and speculating – the freedom to make free- wheeling, non-committal purchases can be exhilarating. Unfortunately the costs (fiscally and emotionally) of short-term dating/investing often outweigh the benefits.

Fortunately, in the investment world, you can get to know an investment pretty well through fundamental research that is widely available (e.g., 10Ks, 10Qs, press releases, analyst days, quarterly conference calls, management interviews, trade rags, research reports). Unlike dating, researching stocks can be very cheap, and you do not need to worry about being rejected.

Dating is important early in adulthood because we make many mistakes choosing whom we date, but in the process we learn from our misjudgments and discover the important qualities we value in relationships. The same goes for stocks. Nothing beats experience, and in my long investment career, I can honestly say I’ve dated/traded a lot of pigs and gained valuable lessons that have improved my investing capabilities. Now, however, I don’t just casually date my investments – I factor in a rigorous, disciplined process that requires a serious commitment. I no longer enter positions lightly.

One of my investment heroes, Peter Lynch, appropriately stated, “In stocks as in romance, ease of divorce is not a sound basis for commitment. If you’ve chosen wisely to begin with, you won’t want a divorce.”

Charles Ellis shared these thoughts on relationships with mutual funds:

“If you invest in mutual funds and make mutual funds investment changes in less than 10 years…you’re really just ‘dating.’ Investing in mutual funds should be marital – for richer, for poorer, and so on; mutual fund decisions should be entered into soberly and advisedly and for the truly long term.”

No relationship comes without wild swings, and stocks are no different. If you want to survive the volatile ups and downs of a relationship (or stock ownership), you better do your homework before blindly jumping into bed. The consequences can be punishing.

Buy and Hold is Dead…Unless Stocks Go Up

If you are serious about your investments, I believe you must be mentally willing to commit to a relationship with your stock, not for a day, not for a week, or not for a month, but rather for years. Now, I know this is blasphemy in the age when “buy-and-hold” investing is considered dead, but I refute that basic premise whole-heartedly…with a few caveats.

Sure, buy-and-hold is a stupid strategy when stocks do nothing for a decade – like they have done in the 2000s, but buying and holding was an absolutely brilliant strategy in the 1980s and 1990s. Moreover, even in the miserable 2000s, there have been many buy-and-hold investments that have made owners a fortune (see Questioning Buy & Hold ). So, the moral of the story for me is “buy-and-hold” is good for stocks that go up in price, and bad for stocks that go flat or down in price. Wow, how deeply profound!

To measure my personal commitment to an investment prospect, a bachelorette investment I am courting must pass another test…a test from another one of my investment idols, Phil Fisher, called the three-year rule. This is what the late Mr. Fisher had to say about this topic:

“While I realized thoroughly that if I were to make the kinds of profits that are made possible by [my] process … it was vital that I have some sort of quantitative check… With this in mind, I established what I called my three-year rule.” Fisher adds, “I have repeated again and again to my clients that when I purchase something for them, not to judge the results in a matter of a month or a year, but allow me a three year period.”

Certainly, there will be situations where an investment thesis is wrong, valuation explodes, or there are superior investment opportunities that will trigger a sale before the three-year minimum expires. Nonetheless, I follow Fisher’s rule in principle in hopes of setting the bar high enough to only let the best ideas into both my client and personal portfolios.

As I have written in the past, there are always reasons of why you should not invest for the long-term and instead sell your position, such as: 1) new competition; 2) cost pressures; 3) slowing growth; 4) management change; 5) valuation; 6) change in industry regulation; 7) slowing economy; 8 ) loss of market share; 9) product obsolescence; 10) etc, etc, etc. You get the idea.

Don Hays summed it up best: “Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.”

Peter Lynch shares similar sympathies when it comes to noise in the marketplace:

“Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

Every once in a while there is validity to some of the concerns, but more often than not, the scare campaigns are merely Chicken Little calling for the world to come to an end.

Patience is a Virtue

In the instant gratification society we live in, patience is difficult to come by, and for many people ignoring the constant chatter of fear is challenging. Pundits spend every waking hour trying to explain each blip in the market, but in the short-run, prices often move up or down irrespective of the daily headlines. Explaining this randomness, Peter Lynch said the following:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

Long-term investing, like long-term relationships, is not a new concept. Investment time horizons have been shortening for decades, so talking about the long-term is generally considered heresy. Rather than casually date a stock position, perhaps you should commit to a long-term relationship and divorce your field-playing habits. Now that sounds like a sweet kiss of success.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Eggs or Oatmeal: Binging on Over-Analysis

I about chuckled my way out of my chair when ESPN reminded me of the absurd over-analysis that takes place in the sports world (I can’t wait for the 8 hour pre-game show before the upcoming Super Bowl) through a 30-second, football commercial. Typically when sports analysts get together, the most irrelevant issues are scrutinized under a microscope. After endless wasted amounts of time, the viewer is generally left with lots of worthless information about an immaterial topic. In this particular video, San Diego NFL quarterback Phillip Rivers innocently asks Sunday Countdown football analysts Chris Berman, Mike Ditka, Keyshawn Johnson, Tom Jackson, and Cris Carter whether they would like some eggs or oatmeal for breakfast?

Mayhem ensues while the analysts breakdown everything from the pros of frittatas and brats to the cons of cholesterol and sauerkraut. After listening to all the jaw flapping, Phillip Rivers is left dejected, banging his head against the kitchen refrigerator. It is funny, I feel much the same way as Phillip Rivers does when I’m presented with same overkill analysis found plastered over the financial media and blogosphere.

Analysis of Over-Analysis

Just as I mock the excess analysis occurring in the financial world, I will move ahead and assess this same over-thinking (that’s what we bloggers do). If this much analysis takes place when examining simple options such as eggs vs. oatmeal, or AFC vs. NFC, just imagine the endless debate that arises when discussing the merits of investing in a simple, diversified domestic equity mutual fund. Sounds simple on paper, but if I want to be intellectually honest, I first need to compare this one fund versus the thousands of other equity fund offerings, not to mention the thousands of other ETFs (Exchange Traded Funds), bond funds, lifecycle funds, annuities, index funds, private equity funds, hedge funds, and other basket-related investment vehicles.

Mutual funds are only part of the investment game. We haven’t even scratched the surface of individual securities, futures, options, currencies, CDs, real estate, mortgage backed securities, or other derivatives.

The investment menu is virtually endless (see TMI – Too Much Information), and new options are created every day – many of which are indecipherable to large swaths of investors (including professionals).

Sidoxia’s Questions of Engagement

Not all analysis is psychobabble, but separating the wheat from the manure can be difficult. Before engaging in the never-ending over-analysis taking place in the financial world, answer these three questions:

1.) “Do I Care?” If the latest advance-decline statistics on the NYSE don’t tickle your fancy, or the latest “breaking news” headline on monthly pending home sales doesn’t float your boat, then maybe it’s time to do something more important like…absolutely anything else.

2.) “Do I Understand?” If conversation drifts towards complex currency swaptions comparing the Thai Baht against the Brazilian Real, then perhaps it’s time to leave the room.

3.) “Is This New News?” Not sure if you heard, but there’s this new shiny metal called gold, and it’s the cure-all for inflation, deflation, and any-flation (hyperbole for those not able to translate my written word sarcasm). The point being, ask yourself if the information you receive is valuable and actionable. Typically the best investment ideas are not discussed 24/7 over every media venue, but rather in the boring footnotes of an unread annual report.

Investing in the Stock Market

For individual securities it’s best to stick to your circle of competence with companies and industries you understand – masters like Peter Lynch and Warren Buffett appreciate this philosophy. Once you find an investment opportunity you understand, you need a way of appraising the value and gauging a company’s growth trajectory. As Charlie Munger and Warren Buffett have described, “value and growth are two sides of the same coin.” Cigar-butt investing solely using value-based metrics is not enough. Even value jock Warren Buffet appreciates the merit of a good business with sustainable expansion prospects. As a matter of fact, some of Buffett’s best performing stocks are considered the greatest growth stocks of all-time. If you cannot assign a price (or range), then you are merely playing the speculation game. Speculation often comes in the form of stock tips (i.e.,stock broker or Jim Cramer) and day trading (see Momentum Investing and Technical Analysis).

We live in a world of endless information, and the analysis can often become overkill. So when overwhelmed with data, do yourself a favor by asking yourself the three questions of engagement – that way you will not miss the forest for the trees. As for stocks, stick with industries and companies you understand and develop a disciplined investment process by appraising both the growth and valuation components of the investment. If making these decisions are too difficult, perhaps you should stay in the kitchen and have Phillip Rivers whip you up some scrambled eggs or serve you a bowl of oatmeal.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in DIS, BRKA/B, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Shanking Your Way to Success: Tiger Woods & Roger McNamee

Spring has sprung and that means golf is back in full swing with the Masters golf tournament kicking off next week in Augusta, Georgia. Next week also marks the return of Tiger Woods in his first competition since news of Tiger’s sex scandal and car crash originally broke. As an avid golf fan (and occasional frustrated player), I must admit I do find a devilish sense of guilty pleasure every time I see a pro golfer shank a ball into the thick of the woods or plop one in the middle of the drink. I mean, how many hundreds of balls have I donated to golf courses across this great nation? Let’s face it, no matter how small, people derive some satisfaction from seeing others commit similar mistakes…misery loves company. Even the world’s elite, including Tiger Woods, slip up periodically.

For quite possibly the worst, nightmarish, meltdown classic of all-time, you may recall Frenchman John van de Velde’s 18th hole collapse at the 1999 British Open in Carnoustie, Scotland.

Investment Pros Shank Too

Investment legend Peter Lynch (see Investment Caffeine profile on Lynch), who trounced the market with a +29% annual return average from 1977-1990, correctly identified the extreme competitiveness of the stock-picking world when he stated, “If you’re terrific in this business you’re right six times out of ten.” Even with his indelible record, Lynch had many disastrous stocks, including American International Airways, which went from $11 per share down to $0.07 per share. Famous early 20th Century trader Jesse Livermore puts investment blundering into context by adding, “If a man didn’t make mistakes he’d own the world in a month.”

Mistakes, plain and simply, are a price of playing the investment game. Or as the father of growth investing Phil Fisher noted (see Investment Caffeine profile on Fisher), “Making mistakes is an inherent cost of investing just like bad loans are for the finest lending institutions.”

McNamee’s Marvelous Misfortune

Since the investment greats operate under the spotlight, many of their poor decisions cannot be swept under the rug. Take Roger McNamee, successful technology investor and co-founder of Elevation Partners (venture capital) and Silver Lake Partners (private equity). His personal purchase of 2.3 million shares ($37 million) in smartphone and handheld computer manufacturer Palm Inc. (PALM) has declined by more than a whopping -75% since his personal purchase just six months ago at $16.25 share price (see also The Reformed Broker). McNamee is doing his best to recoup some of his mojo with his hippy-esque band Moonalice – keep an eye out for tour dates and locations.

Lessons Learned

More important than making repeated mistakes is what you do with those mistakes. “Insanity is doing the same thing over and over again, and expecting different results,” observed Albert Einstein. Learning from your mistakes is the most important lesson in hopes of mitigating the same mistakes in the future. Phil Fisher adds, “I have always believed that the chief difference between a fool and a wise man is that the wise man learns from his mistakes, while the fool never does.” As part of my investment process, I always review my errors. By explicitly shaming myself and documenting my bad trades, I expect to further reduce the number of poor investment decisions I make in the future.

With the Masters just around the corner, I must admit I eagerly wait to see how Tiger Woods will perform under extreme pressure at one of the grandest golf events of the year. I will definitely be rooting for Tiger, although you may see a smirk on my face if he shanks one into the trees.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing had no direct positions in PALM or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Inside the Brain of an Investing Genius

Those readers who have frequented my Investing Caffeine site are familiar with the numerous profiles on professional investors of both current and prior periods (See Profiles). Many of the individuals described have a tremendous track record of success, while others have a tremendous ability of making outrageous forecasts. I have covered both. Regardless, much can be learned from the successes and failures by mirroring the behavior of the greats – like modeling your golf swing after Tiger Woods (O.K., since Tiger is out of favor right now, let’s say Phil Mickelson). My investment swing borrows techniques and tips from many great investors, but Peter Lynch (ex-Fidelity fund manager), probably more than any icon, has had the most influence on my investing philosophy and career as any investor. His breadth of knowledge and versatility across styles has allowed him to compile a record that few, if any, could match – outside perhaps the great Warren Buffett.

Consider that Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500 index for that period). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Cynics believed that Magellan was too big to adequately perform at $1, $2, $3, $5 and then $10 billion, but Lynch ultimately silenced the critics. Despite the fund’s gargantuan size, over the final five years of Lynch’s tenure, Magellan outperformed 99.5% of all other funds, according to Barron’s. How did Magellan investors fare in the period under Lynch’s watch? A $10,000 investment initiated when he took the helm would have grown to roughly $280,000 (+2,700%) by the day he retired. Not too shabby.

Background

Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Like the previously mentioned Warren Buffett, Peter Lynch shared his knowledge with the investing masses through his writings, including his two seminal books One Up on Wall Street and Beating the Street. Subsequently, Lynch authored Learn to Earn, a book targeted at younger, novice investors. Regardless, the ideas and lessons from his writings, including contributing author to Worth magazine, are still transferrable to investors across a broad spectrum of skill levels, even today.

The Lessons of Lynch

Although Lynch has left me with enough financially rich content to write a full-blown textbook, I will limit the meat of this article to lessons and quotations coming directly from the horse’s mouth. Here is a selective list of gems Lynch has shared with investors over the years:

Buy within Your Comfort Zone: Lynch simply urges investors to “Buy what you know.” In similar fashion to Warren Buffett, who stuck to investing in stocks within his “circle of competence,” Lynch focused on investments he understood or on industries he felt he had an edge over others. Perhaps if investors would have heeded this advice, the leveraged, toxic derivative debacle occurring over previous years could have been avoided.

Do Your Homework: Building the conviction to ride through equity market volatility requires rigorous homework. Lynch adds, “A company does not tell you to buy it, there is always something to worry about. There are always respected investors that say you are wrong. You have to know the story better than they do, and have faith in what you know.”

Price Follows Earnings: Investing is often unnecessarily made complicated. Lynch fundamentally believes stock prices will follow the long-term trajectory of earnings growth. He makes the point that “People may bet on hourly wiggles of the market, but it’s the earnings that waggle the wiggle long term.” In a publicly attended group meeting, Michael Dell, CEO of Dell Inc. (DELL), asked Peter Lynch about the direction of Dell’s future stock price. Lynch’s answer: “If your earnings are higher in 5 years, your stock will be higher.” Maybe Dell’s price decline over the last five years can be attributed to its earnings decline over the same period? It’s no surprise that Hewlett-Packard’s dramatic stock price outperformance (relative to DELL) has something to do with the more than doubling of HP’s earnings over the same time frame.

Valuation & Price Declines: “People Concentrate too much on the P (Price), but the E (Earnings) really makes the difference.” In a nutshell, Lynch believes valuation metrics play an important role, but long-term earnings growth will have a larger impact on future stock price appreciation.

Two Key Stock Questions: 1) “Is the stock still attractively priced relative to earnings?” and 2) “What is happening in the company to make the earnings go up?” Improving fundamentals at an attractive price are key components to Lynch’s investing strategy.

Lynch on Buffett: Lynch was given an opportunity to write the foreword in Buffett’s biography, The Warren Buffett Way. Lynch did not believe in “pulling out flowers and watering the weeds,” or in other words, selling winners and buying losers. In highlighting this weed-flower concept, Lynch said this about Buffett: “He purchased over $1 billion of Coca-Cola in 1988 and 1989 after the stock had risen over fivefold the prior six years and over five-hundredfold the previous sixty years. He made four times his money in three years and plans to make a lot more the next five, ten, and twenty years with Coke.” Hammering home the idea that a few good stocks a decade can make an investment career, Lynch had this to say about Buffett: “Warren states that twelve investments decisions in his forty year career have made all the difference.”

You Don’t Need Perfect Batting Average: In order to significantly outperform the market, investors need not generate near perfect results. According to Lynch, “If you’re terrific in this business, you’re right six times out of 10 – I’ve had stocks go from $11 to 7 cents (American Intl Airways).” Here is one recipe Lynch shares with others on how to beat the market: “All you have to do really is find the best hundred stocks in the S&P 500 and find another few hundred outside the S&P 500 to beat the market.”

The Critical Element of Patience: With the explosion of information, expansion of the internet age, and the reduction of trading costs has come the itchy trading finger. This hasty investment principle runs contrary to Lynch’s core beliefs. Here’s what he had to say regarding the importance of a steady investment hand:

- “In my investing career, the best gains usually have come in the third or fourth year, not in the third or fourth week or the third or fourth month.”

- “Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

- “Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

- “The key to making money in stocks is not to get scared out of them.”

Bear Market Beliefs: “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession,” says Lynch. The media responds in exactly the opposite manner – bear markets lead to an inundation of headlines driven by panic-based fear. Lynch shares a similar sentiment to Warren Buffett when it comes to the media holding a glass half full view in bear markets.

Market Worries: Is worrying about market concerns worth the stress? Not according to Lynch. His belief: “I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” Just this last March, Lynch used history to drive home his views: “We’ve had 11 recessions since World War II and we’ve had a perfect score — 11 recoveries. There are a lot of natural cushions in the economy now that weren’t there in the 1930s. They keep things from getting out of control. We have the Federal Deposit Insurance Corporation [which insures bank deposits]. We have social security. We have pensions. We have two-person, working families. We have unemployment payments. And we have a Federal Reserve with a brain.”

Thoughts on Cyclicals: Lynch divided his portfolio into several buckets, and cyclical stocks occupied one of the buckets. “Cyclicals are like blackjack: stay in the game too long and it’s bound to take all your profit,” Lynch emphasized.

Selling Discipline: The rationale behind Lynch’s selling discipline is straightforward – here are some of his thoughts on the subject:

- “When the fundamentals change, sell your mistakes.”

- “Write down why you own a stock and sell it if the reason isn’t true anymore.”

- “Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling.”

Distilling the genius of an investing legend like Peter Lynch down to a single article is not only a grueling challenge, but it also cannot bring complete justice to the vast accomplishments of this incredible investment legend. Nonetheless, his record should be meticulously studied in hopes of adding jewels of investment knowledge to the repertoires of all investors. If delving into the head of this investing mastermind can provide access to even a fraction of his vast knowledge pool, then we can all benefit by adding a slice of this greatness to our investment portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in DELL, KO, HPQ or any other security mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Getting off the Market Timing Treadmill

Most investors have been stuck on the financial treadmill of the 2000s and have nothing to show for it, other than battle scars from the 2008-2009 financial crisis. A lot of running, sweating, and jumping has produced effectively no results. Most media outlets continue to focus on the “lost decade” (see other Lost Decade story) in which investors have earned nothing in the equity markets. After a decade of excess in the 1990s should the majority of investors be surprised? Investing is no different than dieting and exercise – those topics are easy to understand but difficult to execute.

Where are the Billionaire Market Timers?

The financial industry oversimplifies investing and sells market timing as an effortless path to riches – even in tough times. In the search of the financial Holy Grail, the industry constantly crams new software bells and whistles and so-called “can’t lose” strategies down the throats of individual investors. Sadly, there is no miracle system, wonder algorithm, or get rich scheme that can sustainably last the test of time. Sure, a minority of speculators can get lucky and make money by following a risky strategy in the short-run, but as the global economic disaster caused by LTCM (Long Term Capital Management) taught us, even certain successful trading strategies or computer algorithms can stop working in a heartbeat and lead to a widespread bloodbath.

Are you still a believer in market timing? If so, then where are all the billionaire market timers? Famed growth manager, Peter Lynch astutely noted:

“I can’t recall ever once having seen the name of a market timer on Forbes‘ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.”

Certainly, there are some hedge fund managers that have hit home runs with amazing market calls, but time will be the arbiter in determining whether they can stay on top.

Sage Speak on Market Timing

If you don’t believe me about market timing, then listen to what knowledgeable investors and thought leaders have to say on the subject. Larry Swedroe, a principal at Buckingham Asset Management, compiled a list including the following quotes:

- Warren Buffett (Investor extraordinaire): “We continue to make more money when snoring than when active.” He adds, “The only value of stock forecasters is to make fortune-tellers look good.”

- Jason Zweig (Columnist): “Whenever some analyst seems to know what he’s talking about, remember that pigs will fly before he’ll ever release a full list of his past forecasts, including the bloopers.” (See also Peter Schiff and Meredith Whitney stories)

- Bernard Baruch (Financier): “Only liars manage to always be out during bad times and in during good times.”

- Jonathan Clements (Columnist): “What to do when the market goes down? Read the opinions of the investment gurus who are quoted in the WSJ. And, as you read, laugh. We all know that the pundits can’t predict short-term market movements. Yet there they are, desperately trying to sound intelligent when they really haven’t got a clue.”

- David L. Babson (Investment Manager): “It must be apparent to intelligent investors that if anyone possessed the ability to do so [forecast the immediate trend of stock prices] consistently and accurately he would become a billionaire so quickly he would not find it necessary to sell his stock market guesses to the general public.”

- Peter Lynch (Retired Growth Manager): “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Market Timing Road Rules

Rather than make guesses regarding the direction of the market, here are some investment rules to follow:

- Rule #1: Do not attempt to market time. Statistically it is a certainty that a minority of the millions of investors can time the market in the short-run – the problem is that very few, if any, can time the market for sustainable periods of time. Don’t try to be the hero, because often you will become the goat.

- Rule #2: Patiently make good investments, regardless of the economic conditions. It is best to assume the market will go nowhere and invest accordingly. Paying attention to a hot or cold economy leads to investors chasing their tails. Good investments should outperform in the long-run, regardless of the macroeconomic environment.

- Rule #3: Diversify. In the midst of the crisis, diversification didn’t cure simultaneous drops in most asset classes, however ownership of government Treasuries, cash, and certain commodities provided a cushion from the economic blows. Longer-term, the benefits of diversification become more apparent – it makes absolute sense to spread your risk around.

In some respects, there is always an aspect of timing to investing, but as referenced by some of the intelligent professionals previously, the driving force behind an investment decision should not be, “I think the market is going up,” or “I think the market is going down” – those thought processes are recipes for disaster. I strongly believe an investment process that includes patience, discipline, diversification, valuation sensitivity, and low-cost/ tax-efficient products and strategies will get you off the financial treadmill and move you closer to reaching your financial goals.

Read the Full Larry Swedroe Story

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in BRKA or any other security mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fees, Exploitation and Confusion Hammer Investors

The financial industry is out to hammer you. If you haven’t figured that out, then it’s time to wake up to the cruel realities of the industry. Let’s see what it takes to become the hammer rather than receiving the brunt of the pounding, like the nail.

Fees, Fees, Fees

I interface with investors of all stripes and overwhelmingly the vast majority of them have no idea what they are paying in fees. When I ask investors what fees, commissions, and transactions costs are being siphoned from their wallets, I get the proverbial deer looking into the headlight response. And who can blame them? Buried in the deluge of pages and hiding in the fine print is a list of load fees, management fees, 12b-1 fees, administrative fees, surrender charges, transaction costs, commissions, and more. One practically is required to obtain a law degree in order to translate this foreign language.

Wolf in Sheep’s Clothing

These wolves don’t look like wolves. These amicable individuals have infiltrated your country clubs, groups, volunteer organizations, and churches. The following response is what I usually get: “Johnny, my financial consultant, is such a nice man – we have known him for so long.” Yeah, well maybe the reason why Johnny is so nice and happy is because of the hefty fees and commissions you are paying him. Rather than paying for an expensive friend, maybe what you need is someone who can accelerate your time to retirement or improve your quality of life. If you prefer eating mac and cheese over filet mignon, or are looking to secure a position at Wal-Mart as a greeter in your 80s, then don’t pay any attention to the fees you may be getting gouged on.

I don’t want to demonize all practitioners and aspects of the financial industry, but like Las Vegas, there is a reason the industry makes so much money. The odds and business practices are stacked in their favor, so focus on protecting yourself.

Confusion

Investors face a very challenging environment these days, needing to decipher everything from Dubai debt defaults and PIIGS sovereign risk (Portugal-Ireland-Italy-Greece-Spain) to proposed new banking regulation and massive swings in the U.S. dollar. If our brightest economists and government officials can’t decipher these issues and “time the market,” then how in the heck are aggressive financial salesmen and casual investors supposed to digest all this ever-changing data? Making matters worse, the media continuously pours gasoline on fear-inducing uncertainties and shovels piles of greed-motivating fodder, which only serves to make matters more confusing for investors. Do yourself a favor and turn off the television. There are better ways of staying informed, without succumbing to sensationalized media stories, like reading Investing Caffeine!

Pushy financial salespeople complicate the situation by attempting to “wow” clients with fancy acronyms and industry jargon in hopes of impressing a prospect or client. In some situations, this superficial strategy may confuse an investor into thinking the consultant is knowledgeable, but in more instances than not, if the salesperson doesn’t know how to explain the investment concept in terms you understand, then there’s a good chance they are just blowing a lot of hot air.

Here’s what famous growth investor William O’Neil has to say about advice:

“Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

Amen.

Mistake of Trying to Time Market

My best advice to you is not to try and time the market. Even for the speculators with correct timing on one trade rarely get the move right the next time. As previously mentioned, even the smartest people on our planet have failed miserably, so I don’t recommend you trying it ether.

Here are a few examples of timing gone awry:

- Nobel Prize winners Robert Merton and Myron Scholes incorrectly predicted the direction of various economic variables in 1998, while investing client money at Long Term Capital Management. As a result of their poor timing, they single-handedly almost brought the global financial markets to their knees.

- Former Federal Reserve Chairman, Alan Greenspan, is famously quoted for his “irrational exuberance” speech in 1996 when the NASDAQ index was trading around 1,300. Needless to say, the index went on to climb above 5,000 in the coming years. Not such great timing Al.

- More recently, Ben Bernanke assumed the Federal Reserve Chairman role (arguably the most powerful financial position in our Universe) in February 2006. Unfortunately even he could not identify the credit and housing bubble that soon burst right under his nose.

Some of the best advice I have come across comes from Peter Lynch, former Fidelity manager of the Magellan Fund. From 1977-1990 his fund’s investment return averaged +29% PER YEAR. Here’s what he has to say about investment timing in the market:

“Worrying about the stock market 14 minutes per year is 12 minutes too many.”

“Anyone can do well in a good market, assume the market is going nowhere and invest accordingly.”

Rather than attempting to time the market, I would encourage you to focus on discovering a disciplined, systematic investment approach that can work in various market environments (see also, One Size Does Not Fit All).

Financial Carnage

The long-term result for investors playing the game, with rules stacked against them, is financial carnage.

If you don’t believe me, then just ask John Bogle, chairman of one of the fastest growing and most successful large financial firms in the industry. His 1984-2002 study shows how badly the average investor gets slammed, thanks to aggressive fees peddled by forceful financial salesmen and the urging into destructive emotional decisions. Specifically, the study shows the battered average fund investor earning a meager 2.7% per year while the overall stock market earned +12.9% annually over the period.

It’s Your Investment Future

Given the economic times we are experiencing now, there is more confusion than ever in the marketplace. Insistent financial salespeople are using aggressive smoke and mirror tactics, which in many cases leads to unfortunate and damaging investment outcomes. Do your best to prepare and educate yourself, so you can become the hammer and not the nail.

It’s your investment future – invest it wisely.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including Vanguard ETFs and funds), but at time of publishing had no direct positions in securities mentioned in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Equities Up, But Investors Queasy

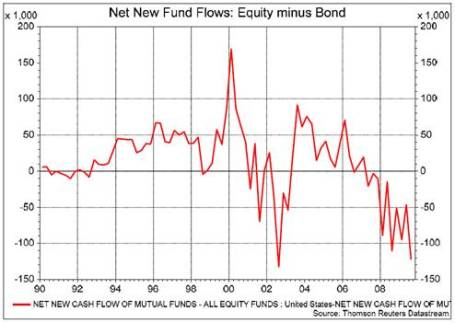

The market may have recovered partially from its illness over the last two years, but investors are still queasy when it comes to equities. The market is up by more than +60% since the March 2009 lows despite the unemployment rate continuing to tick higher, reaching 10.2% in October. Even though equity markets have rebounded, recovering investors have flocked to the drug store with their prescriptions for bonds. Mark Dodson, CFA, from Hays Advisory published a telling chart that highlights the extreme aversion savers have shown towards stocks.

Dodson adds:

“Net new fund mutual fund flows favor bonds over stocks dramatically, so much so that flows are on the cusp of breaking into record territory, with the previous record occurring back in the doldrums of the 2002 bear market. Given nothing but the chart (above), we would never in a million years guess that the stock market has rallied 50-60% off the March lows. It looks more like what you would see right in the throes of a nasty stock market decline.”

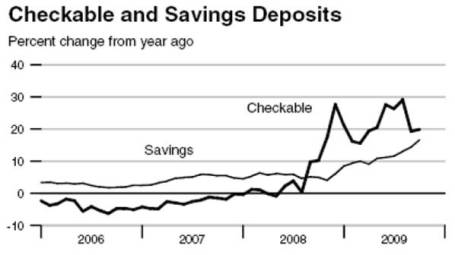

Checking and savings data from the Federal Reserve Bank of Saint Louis further corroborates the mood of the general public as the nausea of the last two years has yet to wear off. The mountains of cash on the sidelines have the potential of fueling further gains under the right conditions (see also Dry Powder Piled High story).

As Dodson notes in the Hays Advisory note, not everything is doom and gloom when it comes to stocks. For one, insider purchases according to the Emergent Financial Gambill Ratio is the highest since the recent bear market came to a halt. This trend is important, because as Peter Lynch emphasizes, “There are many reasons insiders sell shares but only one reason they buy, they feel the price is going up.”

What’s more, the yield curve is the steepest it has been in the last 25 years. This opposing signal should provide comfort to those blue investors that cried through inverted yield curves (T-Bill yields higher than 10-Year Notes) that preceded the recessions of 2000 and 2008.

Equity investors are still feeling ill, but time will tell if a dose of bond selling and a prescription for “cash-into-stocks” will make the queasy patient feel better?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Not So Good, Bad, and Ugly

There’s a new bounty hunter in town, and it’s not Clint Eastwood from the legendary western film The Good, the Bad and the Ugly. Rather, it’s John Carney from Clusterstock who is keeping the bold bears honest, even though they have received their heads handed to them in this supposed “sucker, bear-market rally.” Perhaps, the bears will ultimately be proven right, but in the mean time, these tape fighters are losing blood by the quart.

Music from what Quentin Tarantino calls the best-directed film of all-time.

I find the existence of accountability sheriffs in the business media world rejuvenating since these roles are sorely lacking. Too often, so-called pundits spout off bold assertive predictions and industry commentators make no effort to review the track records of those prognosticators. I commend many of the industry practitioners for putting their necks out on the line, but viewers need some sort of historical batting average to judge the odds of forecast reliability. The game of predictions is no science, but there can be some objective responsibility instituted by media researchers and commentators. Media outlets provide carte blanche to predictors without doing homework on the guests. Unfortunately, time-strapped viewers have little to no time to research commentator track records.

Typically how it works, especially in the massively fragmented media world (which I admittedly participate in on a relatively small scale), you have countless voices making extreme predictions across the broad economic and financial globe. Eventually, some forecasts will be right, including those correct for the wrong reasons – just think back to your statistics class where you learned about the “law of large numbers” or the family living room where the broken clock provides correct time twice a day (see my other article on bold predictions). Since any human likes to be associated with greatness, these future-seers are strolled into media studios, put on a pedestal and asked to share their brilliance, all without critically reviewing the past record of the purported expert.

Rather than make bold predictions about market direction, which is virtually impossible to predict with accuracy on a sustainable basis, I choose to look at the market with a perspective similar to the greats. For example, Peter Lynch who earned +29% per year from 1977 – 1990 (achieving about double the market return) says it’s best to “assume the market is going nowhere and invest accordingly.” Realizing your fallibility is important also. Even with Lynch’s incredible track record, he knows “you’re terrific in this business [if] you’re right six times out of 10.” According to Lynch fretting about the market direction is also useless: “If you spend more than 14 minutes a year worrying about the market, you’ve wasted 12 minutes.” Interestingly, even Warren Buffett, arguably the greatest investor of all-time, never comments on short-term directions of the market, despite being hailed as the “Oracle of Omaha.”

Predictions and forecasts will never go away, but I will sleep better at night knowing sheriffs like John Carney are keeping track of the good, the bad and the ugly. Who knows, maybe he’ll even take me on as a deputy.

View John Carney’s Full Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in BRKA/B. Please read disclosure language on IC “Contact” page.

Walking on Egg Shells

The recent stock market rally has investors walking on egg shells. “Nervous Nelly” investors panicked on the way down last year, and now they are fearful and skeptical about the sustainability of the fierce six-month rally. The S&P 500 is up about 60% from the latest bear market lows, but I think the recent New Jersey Business News (NJBN) article captures the investor sentiment perfectly, “I’m scared, I’m scared, I’m scared,” investor Dania Leon said. “Why are we up, especially with unemployment as high as it is? I don’t feel great because I worry that we could have a 500- or 600-point drop in a day and I won’t be quick enough to pull out of it in time.”

Will investors ever be comfortable? Well yes, of course, exactly at the right time to sell. Calm and complacency will most likely settle in once the economic headlines are on a clear path to recovery. At that point, the market, like a game of chess, will likely have already anticipated the recovery.

Until then, the whipsaw syndrome seems to have taken effect on investors. The NJBN article goes onto expand on investors’ emotional scars:

“They’ve been traumatized twice,” said Michal Strahilevitz, a business professor at Golden Gate University who studies the psychology of individual investors. “First they lost a lot and got out. And now they’ve watched it climb up. It’s a lot of regret, and for people who are investing for their family, it’s a lot of guilt.”

Trillions of low yielding cash continues to sit on the sidelines, waiting for the inevitable 10% “pullback.” Strategist Laszlo Birinyi sees little evidence for an imminent correction, “Give me the evidence…in 1982 we went 424 days before we had a correction. In 2000, we went seven years before we had a 10% correction. In 2002, we went three or four years.” (For more on Mr. Birinyi, see http://is.gd/3xS5u)

At the end of the day, as great growth investor Peter Lynch said, it’s the direction of corporate earnings that will ultimately drive the market higher or lower. “People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.” Right now based on the strength of the rally, the market is telling us that third quarter corporate earnings should come in better than analyst expectations. Perhaps we get a yawner response (sell on the news reaction), or if improvement outright stalls, perhaps we will get the mother of all expected corrections?

All these mind games make for an extremely tiresome investing mental tug-of-war. I choose not to get caught up in this game of market timing, but rather I choose to let the investment opportunity-set drive my investment decisions. I have taken some chips off the table during this rebound but I am still finding plenty of other fertile opportunities to redeploy capital. As others nervously walk on egg shells, I opt to clean up the mess and look for a clearer investment path.

Read the Full NJBN Article Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Quarterly Earnings Avalanche – What the %&*$# is Going On?

Last week we received an avalanche of earnings reports (with a ton more reporting this week) and investors are now interpreting the data.

The recent stock market rally can be simply boiled down to companies releasing better than expected quarterly earnings. As my great pal Peter Lynch says, “People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.” A whopping 77% of S&P 500 companies that have reported Q2 (June) earnings thus far have reported earnings results better than Wall Street expectations. Earnings estimates are being ratcheted up for the first time since August 2007. Intel got the party started in the technology world, trouncing both top and bottom line estimates. Certainly, overall, the top line results for corporations have been more challenging and mixed. However, with additional earnings available to companies, more resources can be plowed back into future marketing and revenue generating activities. Moreover, due to the extreme cost-cutting measures taken, once the economy recovers, corporations will be able to tap into the enormous earnings power potential created.

Click Here for CNBC Quarterly Earnings Recap

Across all industries, whether it’s Fred Smith (CEO at FedEx) or Eric Schmidt (CEO at Google), we’re hearing a common theme that although the environment remains challenging, we have stabilized with the worst behind us. When and by what degree the economy turns around is still unclear, but all I know is that great companies don’t disappear in bear markets and as a country we have persevered through many, many recessions and financial crises in our history. In times like these, market leaders and industry innovators use their competitive advantages to step on the throats of their competitors and do whatever it takes to gain market share, so that when things actually do turn, the tide will carry them to the front of the pack.

Although the quarterly reported earnings coming out have in general been relatively anemic, investors should not sit idle. I continue to scour income statements, balance sheets, and cash flow statements to see who is gaining share at the expense of their peers. At the end of the day those share gainers are the ones that will be growing earnings and cash flows the fastest when the economy turns. Investors shouldn’t forget the lessons of 2008 and 2009. Although not all the economic news headlines were bad in the first half of 2008 (as the stock market began its rapid descent), the same principle applies in reverse – as the market has rebounded from the March lows, not all the economic news has been encouraging. Volatility can in fact be a beautiful thing, if you have a disciplined systematic approach in place that opportunistically takes advantage of appealing prospects as they arise. Without doubt, the relative attractiveness of the overall market is less than it was in March 2009, but let’s not forget the stock market is still more than 35% below the market highs of late 2007.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.