Posts tagged ‘nvda’

As We Give Thanks, AI and Mag 7 Take Cash to the Bank

Market volatility resurfaced last month as speculation intensified over whether an AI bubble may be forming—and potentially bursting. Yet despite the jitters, equity markets remain solidly positive for the year (S&P 500 +16.5%, NASDAQ +21.0%, Dow +12.2%) – see S&P 500 chart below. A significant portion of the gains have been powered in large part by ongoing strength in the Magnificent 7. Standouts such as NVIDIA (+31.8%) and Alphabet (+68.1%) have been instrumental in carrying the broader indices higher.

Even with these sizable year-to-date gains, memories of the 2000 Tech Bubble and 2008 Financial Crisis resurfaced and prompted investors to temporarily tap the brakes. Mid-month, the NASDAQ retreated roughly -9% from its October peak. After a month-end bounce, the S&P 500 finished essentially flat (+0.1%), the NASDAQ slipped -1.5%, and the Dow eked out a +0.3% increase.

OpenAI and the $1.4 Trillion Question

At the center of the AI controversy sits OpenAI, parent of the three-year-old technology toddler, ChatGPT (Generative Pre-trained Transformer), which now boasts more than 800 million global users (see chart below). The company reportedly runs at a $20 billion annual revenue pace, yet faces difficult questions about how it intends to fund its staggering $1.4 trillion AI infrastructure commitments.

Those concerns came to a head when tech investor Brad Gerstner pressed CEO Sam Altman on his podcast last month. Instead of answering how OpenAI plans to underwrite such an enormous buildout, Altman childishly shot back defensively:

“If you want to sell your shares, I’ll find you a buyer.” (See clip here — or full interview here)

Source: Digital Information World

OpenAI is a key player, but just one component in the vast—and rapidly expanding—web of global AI infrastructure. Gartner, a global research and advisory firm, forecasts $2 trillion of AI investment in 2026, while NVIDIA CEO Jensen Huang recently said:

“Over the next five years, we’re going to scale into… effectively a $3 to $4 trillion AI infrastructure opportunity.”

These provocative “Is this a bubble?” questions make for great headlines, but to truly evaluate AI sustainability, it’s wise to follow the classic Watergate guidance from of All the President’s Men character, Deep Throat (FBI Associate Director, Mark Felt), who tells journalist Bob Woodward to “follow the money,” if he wants to get to the bottom of the Watergate scandal.

The same principle applies to investors who follow the money – the picture looks very different from past bubbles.

Forget Pets.com—Today’s AI Buildout Is Being Funded by Cash-Rich Titans

Unlike the flimsy, profitless internet startups of the late 1990s—companies that raised billions based on “eyeballs” and cocktail-napkin business plans—the current AI buildout is being financed largely by profitable cash-generating giants.

Yes, some firms like Oracle (ORCL) are leaning on debt financing for data-center expansion. But the overwhelming majority of AI capex is being funded by customers and by the cash flow of the Magnificent 7, a group with the financial firepower to sustain multi-year spending without relying heavily on capital markets.

This dynamic alone separates today’s environment from classic bubble conditions.

Do the Magnificent 7 Really Deserve a $22 Trillion Valuation?

The Mag 7 represent only 1% of S&P 500 constituents yet account for a massive 35% of the index’s market value. That concentration understandably raises eyebrows, evoking historical parallels to the “Nifty Fifty” of the 1970s or the “Four Horsemen” of the 1990s.

But headline concentration can be misleading—because the fundamentals tell a very different story. Here are some of the major disparities:

1.) Mag 7 Share of Profits Matches Their Share of Market Value: The Mag 7 collectively contribute $22 trillion of the S&P 500’s $58 trillion total value (below). Said differently, the market values and weightings of the Mag 7 equate to about $22 trillion and 37% of the S&P 500, respectively:

· Nvidia Corp: $4.3T & 7.0%

· Apple Inc.: $4.1 T & 6.7%

· Alphabet Inc.: $3.9 T & 6.3%

· Microsoft Corp.: $3.7 T & 5.9%

· Amazon.com Inc.: $2.5 T & 4.0%

· Meta Platforms Inc.: $1.6T & 2.6%

· Tesla Inc.: $1.4T & 2.3%

· TOTAL: $22T / 37%

Source: Slickcharts

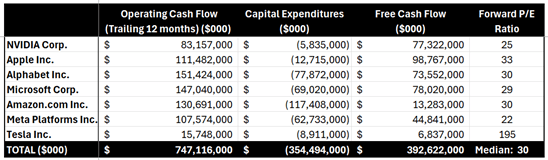

Conveniently (and importantly), the Mag 7’s roughly $747 billion in annual cash flow (see table below) is a good proxy for their profit contribution to the $2 trillion in S&P profits.

Source: SEC Filings & MarketSurge

The $747 billion in Mag 7 cash flows divided by the $2 trillion in S&P 500 coincidentally also equates to 37% ($747B/$2T).

These calculations of the Mag 7 are not bubble math—these calculation comparisons are rational math. Arguments could be made that Mag 7 market values are actually undervalued (not in bubble territory) and should appreciate to a higher percentage of the S&P 500 weightings because these 7 stocks are growing sales and profits faster than compared to the other “absentee” 493 stocks in the index.

2.) Mag 7 are Swimming in Cash: That $747 billion in annual cash flow is on track to hit a jaw-dropping $1 trillion, giving these firms ample capital to fund AI buildouts without substantially accessing the equity or credit markets. The ability to self-fund a multi-trillion-dollar infrastructure expansion is the opposite of bubble behavior.

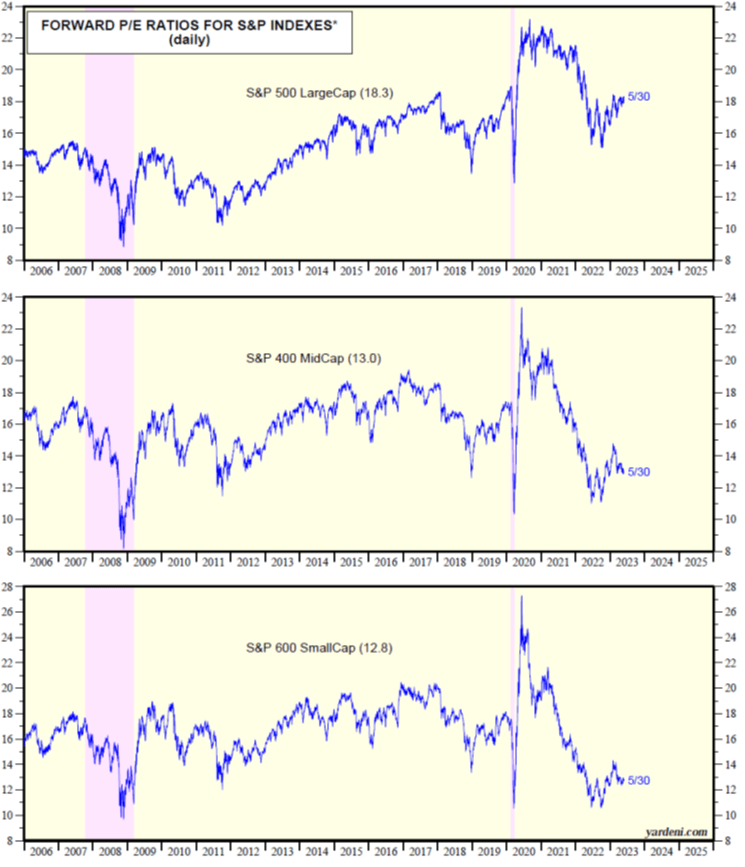

3.) Valuations Are Elevated—but Far from Bubble Territory: During the 2000 Tech Bubble, many leading tech names traded at 100x+ earnings (See also: Rational or Irrational Exuberance. Today, the Mag 7 trade at a median forward P/E around 30x. Expensive? Historically, yes, versus long-term averages, but nowhere near historical extremes. Relative to growth, profitability, and cash flow, valuations are far more grounded today than during prior manias.

The bottom line is there is plenty to be thankful for and bubble fears are overstated. Despite pockets of AI froth, the underlying economic engine powering AI adoption is real, profitable, and well-capitalized. When investors follow the money, they discover:

· The Mag 7 generate over one-third of S&P 500 profits

· They generate and hold hundreds of billions in cash

· They largely fund their own AI capital expenditures

· Valuations remain far below bubble-era extremes

Investors have a lot to be thankful for. And while volatility will likely continue, the ingredients for a classic, catastrophic AI bubble are noticeably absent. For disciplined, long-term investing strategies like those employed at Sidoxia Capital Management, this environment still offers abundant opportunity—without the need to fear a pricked AI balloon anytime soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Dec. 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Time in the Market Beats Timing the Market

It was another great year in the stock market. But predicting the timing of a bear or bull market is more challenging. Fortunately for investors, the stock market is up a lot more of the time than it is down. More specifically, over the last century, the stock market has been up 73% of the time for one-year periods and 94% of the time for 10-year periods (see graphic below and Time is What Matters). That’s why investors’ time in the market beats the fools’ errand strategy of trying to time the market. The long-term, consistent upward trend in stock prices makes investing in the stock market akin to sailing around the world with a persistent tailwind for the whole trip.

Source: Capital Group and S&P 500 Index

Many people believe investing in the stock market is gambling, but 73% and 94% odds for stock market gains seem a lot better than the probabilities of making money in Las Vegas. I explored this concept further in one of my recent articles (see Elections Status Quo). Even with those favorable, lopsided odds, recessions do occur, albeit infrequently. As you can see from the chart below, since World War II, we have experienced a dozen recessions averaging 10 months in duration. And guess what? Successful post-recession recoveries have equaled 100% (12 for 12). Despite the short-lived bear markets, stock prices have appreciated more than 30x-fold since the end of World War II.

Source: Yardeni.com

2024 Predictions

There were plenty of pundits and talking heads who falsely predicted a recession in 2024, but the odds certainly worked in investors’ favor. For 2024, the S&P 500 index gained +23%, and this comes on the heels of a banner 2023, which was up +24%. Experiencing back-to-back +20%-years is a rare occurrence, which hasn’t occurred since the late-1990s. As we look into 2025, achieving three consecutive positive years in the stock market is not unprecedented, but as I mentioned earlier, predicting the timing of a down market can be tricky.

Case in point, predicting the outcome of stock returns, even with perfect information can be very daunting. What would have been your prediction of the 2024 stock market return, if I told you the following events were to occur this year (in no particular order)?

- Two assassination attempts on a presidential candidate

- An ongoing bloody war between Russia and Ukraine that reaches one million deaths

- Brutal Israeli-Hamas war in Gaza moves into its second year

- Nationwide Palestinian protests across college campuses

- Israeli-Hezbollah war commences in Lebanon

- Rebels in Syria topple the Assad regime

- A hotly contested presidential election triggering fears of a civil war

- A Baltimore bridge collapses killing six people and costing the overall economy upwards of $10 billion

- After crypto exchange goes bankrupt, CEO is sentenced to 25 years in prison for fraud

Most intelligently honest people would not have predicted a +23% return, but that is exactly what happened. As part of this extended bull market, some major stock market milestones were achieved: 1.) the Dow Jones Industrial average eclipsed 40,000; 2.) the main benchmark S&P 500 index surpassed 6,000; and 3.) the NASDAQ index temporarily triumphed the 20,000 level. The market took a breather in December (the Dow -5.3% and S&P -2.5%), so we have momentarily pulled back from some of these key levels.

What Next in 2025?

As I alluded to earlier, pulling off a three-peat in 2025 with a third consecutive year of gains may be a difficult feat, but not impossible. There remains some room for optimism. First of all, we have an accommodative Federal Reserve that has cut interest rates three times in 2024 (see chart below) from a target of 5.5% to 4.5% (see red line). Currently, expectations are set for the Fed to make another two interest rate cuts in 2025. All else equal, this should provide some mild stimulus for both borrowers and investors in 2025.

Source: Yardeni.com

Next, we have a new pro-business administration entering the White House that has promised lower taxes and less regulation, which should aid business profits. Tariff policies remain a wildcard, but if used judiciously for negotiation purposes, perhaps there could be more bark than bite from the rhetoric. Time will tell.

The 2024 chapter has closed, and we have started the 2025 chapter. Regardless of the outcome this year, history teaches us the time in the market is much more important than timing the market. This philosophy has served Sidoxia Capital Management and its clients well over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fed Injects Rate Cut Adrenaline

There were a lot of injections, of the COVID vaccine variety, four years ago, but now the Federal Reserve is injecting some financial adrenaline through stimulative interest rate cuts. Expectations are for seven more -0.25% cuts over the next 12 months, but this cycle started two weeks ago when the FOMC (Federal Open Market Committee) initiated a larger -0.50% reduction in the benchmark federal funds rate target (see chart below). For now, investors have enjoyed the boost of adrenaline, which should help lower consumer interest rates on things like home mortgages, credit cards, and car loans.

Source: Yardeni.com

For the month, the S&P 500 climbed +2.0%, the Dow Jones Industrial +1.9%, and the NASDAQ index +2.7%. The monthly gains are adding to a 2024 that is shaping up to be a potentially banner year. With one quarter left in the year, the S&P has catapulted +21% higher, the Dow Jones Industrial Average +12%, and the NASDAQ index +21% for the first nine months.

Economy Strong, So Why Cut Now?

Before the Fed’s last action a couple weeks ago, the last Fed rate cut occurred in 2020 (a -1.50% cut) in the midst of a global pandemic with the aim of boosting financial activity while the brick-and-mortar economy had effectively been shut down. But compared to today, the economy is performing much better. Second quarter GDP growth came in at +3.0% with 3rd quarter GDP growth forecasts coming in at +3.1%.

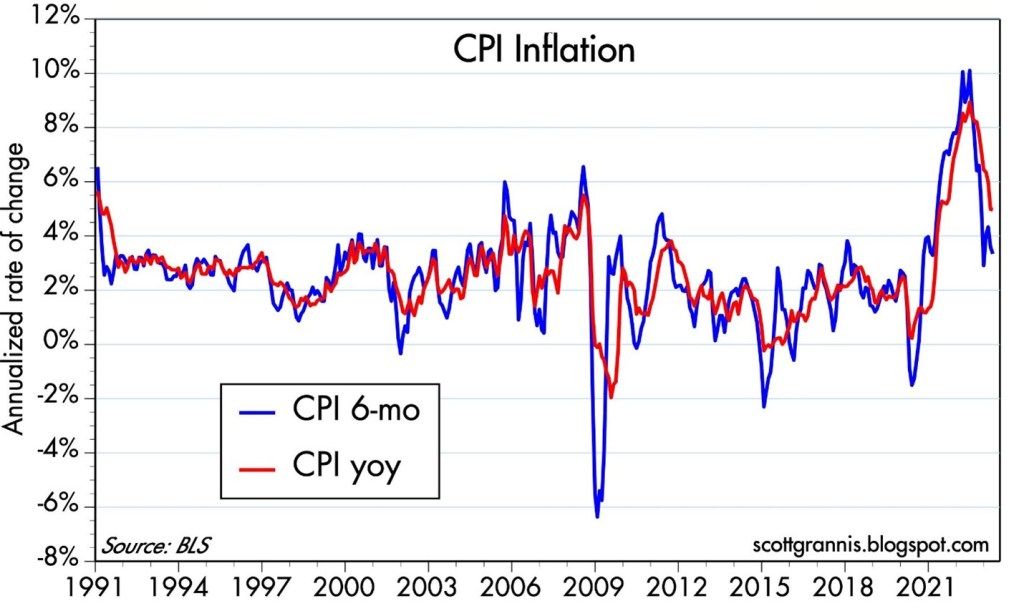

So, if things look so great, why would the Fed be cutting rates to stimulate the economy now? In short, inflation has been coming down (see chart below) from a peak of 9.1% a couple years ago to 2.5% last month (near the Fed’s long-term 2.0% target). And although the current unemployment rate is low at 4.2%, it has nevertheless weakened and climbed substantially from a 3.4% level last year).

Source: Trading Economics

China Chugs Higher

While the U.S. economy has been leading developed countries during the post-COVID recovery period, China’s financial system has been struggling due to a collapsing real estate market and deteriorating consumer spending. As a result, the Chinese stock market has been drastically underperforming other foreign markets, until Beijing just recently announced a number of stimulus initiatives last week in hopes of buoying economic growth closer to its 5% target.

Here are some of the Chinese government measures:

- China plans to issue 2 trillion yuan in special sovereign bonds

- China’s central bank cut its reserve requirement ratio by 50 basis points

- Fiscal policies to focus on increasing consumer subsidies and controlling government debt

- Shanghai, Shenzhen plan to lift key home purchase restrictions

Investors cheered the announcements by binge-buying Chinese stocks, as you can see from the CSI 300 China index, which rocketed +21% higher last month – the largest monthly gain since 2008.

AI Revolution Continues

While economic headwinds and tailwinds continue to swirl, the AI (Artificial Intelligence) revolution has persisted in the background. While some traders have solely focused on AI juggernaut NVIDIA Corp. (NVDA), which has steamrolled its way into becoming a three trillion-dollar valued company, there are other tech titan companies like Oracle Corp. (ORCL), which are also riding the AI wave. Just last month, Oracle’s billionaire founder, Larry Ellison, stated, “We have 162 data centers now. I expect we will have 1,000 or 2,000 or more data centers…around the world.” Each large-scaled data center can cost in the hundreds of millions or multi-billion-dollar range. With hundreds of billions (if not trillions) of dollars to be spent on the multi-year AI infrastructure buildout, as you can imagine, there is a large, diverse ecosystem of other companies that stand to benefit. At Sidoxia Capital Management (www.Sidoxia.com), we have identified a wide swath of AI investments that have benefited our investors and stand to do so in the future.

Flies in the Ointment

By simply judging the performance of the U.S. stock market, one might think there is nothing for investors to worry about. But as is always the case, there still remain some flies in the ointment. With a tight, hotly-contested presidential election just one month away, coupled with escalated wars in the Mideast and Ukraine, future volatility or a correction in the stock market should come as no surprise to anyone, especially in light of the rich gains already registered this year. Another concern is the risk of rising inflation, which could rear its ugly head again if the Federal Reserve misjudges its rate-cutting program and overheats the economy.

Normally, interest rate cuts are reserved by the Fed for periods when the economy is headed towards a recession or there are major systemic disruptions in the financial system, which affect market liquidity and/or bank lending. That’s not the case today. Thanks to declining inflation and a robust but weakening job market, the Fed has been equipped to provide investors with a healthy injection of adrenaline through an early round of interest rate cuts, which has contributed to the powerful stock market gains. So far, the adrenaline is doing its job.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including AMZN, MSFT, META, GOOGL, NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bad News is Good News?

Remember that global pandemic back in 2020 called COVID-19 that killed over 350,000 people in the U.S.? That same year, the unemployment rate reached a sky-high level of 14.9% (vs. 3.9% most recently) and the economy went into recession with GDP (Gross Domestic Product) declining by -2.2%. With the whole population locked in their homes and 9.4 million businesses closed, this debacle doesn’t sound like a real great environment for the stock market. What did the stock market actually do in 2020? The S&P 500 surged +16.3% (see chart below). Bad economic news turned out to be good news for stocks.

On the flip side, during 2022, the economy was firing on all cylinders. GDP was advancing at a reasonable +1.9% growth rate, and the unemployment rate stood at a near generationally low rate of 3.6%. What did the stock market do? It fell -19%. This time around, good economic news meant bad news for stock prices, primarily because the Federal Reserve was slamming the brakes on the economy by increasing the Federal Funds interest rate target.

These examples are powerful reminders that the direction of economic trends does not necessarily move in tandem with the direction of the stock market. Just this last month, investors experienced this same phenomenon when GDP growth figures were revised lower from +1.6% to +1.3%, and pending home sales dropped by -7.7% to the lowest level in four years during the pandemic. What did the stock market do last month? The S&P climbed +4.8% and the NASDAQ soared +6.9%. Once again, bad news has equaled good news due to higher hopes for Fed interest rate cuts.

For the year, the S&P has already appreciated a very respectable +10.6%. This stellar performance has come despite heated election concerns, persistent wars overseas, nervousness over the Federal Reserve’s monetary policy, and wild volatility in the cryptocurrency markets.

Fighting against these headwinds has been the tsunami of corporate investing dollars piling into the Artificial Intelligence (AI) spending tidal wave. I have been writing about this trend for a while (see AI World) and NVIDIA Corp (NVDA) confirmed this trend a couple weeks ago, when the AI juggernaut reported its fiscal first quarter financial results. Not only did NVIDIA more than triple its revenue above $26 billion for the three-month period compared to last year, but the company also increased its net profit by more than seven-fold to almost $15 billion for the quarter, in addition to announcing a 10-for-1 stock split (see chart below).

What these examples teach you is that it is a fruitless effort for investors to try to time the market based on economic news headlines. Yet, every day you turn on the television or comb through the avalanche of news headlines through various media outlets, there is always some Armageddon story about an impending market crash, or some other speculative, get-rich-quick scheme. As Warren Buffett states, “Investing is like dieting. Easy to understand, but difficult to execute.”

In other words, there is no simple solution to investing. It requires patience, discipline, and financial emotional wherewithal to allow the power of long-term compounding to grow your retirement nest egg. Short-term news cycle headlines shouldn’t drive portfolio decision-making, but rather your personal objectives, goals, and risk tolerance. These items are not static, and can change over time, therefore it’s important to revisit your asset allocation periodically as financial circumstances and life events change your objectives.

Of course, improving economic news can also lead to rising stock prices, just as deteriorating economic news can result in declining prices. Regardless, attempting to time the market is a fool’s errand. Rather than trying to maneuver in and out of the stocks, long-term investors should focus more intently on the four key factors that drive the direction of the stock market: corporate profits, interest rates, valuations, and investor sentiment (see also Don’t Be a Fool, Follow the Stool). If you understand the stock market doesn’t logically follow the daily headlines, and instead you follow the key fundament factors driving equity markets, then your investment portfolio should be blessed with plenty of good news.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 3, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA,, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Art of Maximizing Gains and Minimizing Taxes in a World of AI

The AI Wave

The weather may be cold during winter, but stocks were scorching hot last month, fueled in part by the surge in performance from AI (Artificial Intelligence) stocks. More specifically, the Dow Jones Industrial Average was up +2.2% to 38,996. The S&P 500 surged +5.2% to 5,096. And the AI-heavy Nasdaq index climbed the most by +6.1% to 16,092.

Leading the bull market brigade higher was NVIDIA Corp (NVDA), which saw its stock launch higher by +29% for the month after reporting eye-popping quarterly revenues of $22 billion, more than tripling versus last year’s comparable quarter. Customers of NVIDIA, like Meta Platforms, Inc. (META), are also benefiting from the rising tide of investor sentiment.

To put this AI wave into perspective, you need look no further than to the comments made by Meta CEO Mark Zuckerberg, who stated by the end of 2024, the company should have 350,000 of NVIDIA’s H100 graphics processing units (GPUs) as part of the company’s AI infrastructure. At roughly $25,000 to $30,000 per GPU, the total cost is likely approaching $10 billion for just this one NVIDIA customer. Also, Dell Technologies’ (DELL) stock price opened more than +30% higher today after reporting quarterly financial results that exceeded forecasts due to robust demand for AI servers, which led to their backlog almost doubling in three months to $2.9 billion.

When you have corporate America in addition to the large cloud data center providers (think Amazon Web Services, Microsoft Azure, and Google Cloud) all battling to secure NVIDIA chips for their generative AI, machine learning initiatives, you can understand why NVIDIA’s stock is up +250% in one year to a company value of $2 trillion.

Japan’s Nikkei & Dow Both Break 39,000 Record Concurrently

Not only did the Dow hit an all-time record high of 39,000 last month, but a stunning coincidence also occurred in Japan. The Nikkei 225, which is like the Japanese equivalent of the Dow Jones Industrial Average, also hit a record high of 39,000 last month. What’s the big difference between these two indexes simultaneously surpassing a record 39,000 in the same month?

It took the Nikkei over 34 years to surpass its previous record peak, which was last achieved in 1989 when Japan experienced a massive bursting of an asset bubble. On the other hand, it merely took the Dow just one month to break its previous record…not four decades. Worth noting, so far in 2024, the Nikkei has been the world’s best-performing major index surging 19%, almost triple the gain of the S&P 500 index.

Tax Time

April is fast approaching, which means it’s that time of the year when Uncle Sam will come knocking on your door with your tax bill. Perhaps your taxes have already been prepaid and a refund is coming your way. Regardless, the goal of long-term investing is to master the art of maximizing returns and limiting taxes subject to your risk tolerance.

How does one create an investment masterpiece? One way to maximize return is to lower costs, including lower management fees, fund fees, and transaction costs. You can think of these investment costs as a leaky faucet. In the short-run, most people do not care about or are unaware of a leak.

The same principle applies to investment fees/costs. Investors can ignore these fees in the short-term, but over months or years, these costs can become enormous and destructive. I experienced this firsthand. Recently, normal monthly water bill was $40, but one leaky toilet resulted in an $800 monthly bill…ouch! Just imagine what unknown leaky costs on your investments could mean for your retirement. Do you want high or unknown investment fees to delay your retirement by years? I think not. Focus on lower costs because quite simply, the less you pay, the more you keep, and the earlier you can retire.

Another way to maximize your investment performance is to benefit from the power of compounding. This phenomenon can only be achieved via the snowball-effect of long-term investing. This is why Albert Einstein called compounding the “8th Wonder of the World.” At Sidoxia Capital Management, we have experienced this marvel on many of our investments, including our exponential gains in Amazon.com, which we first purchased in 2008 at s split-adjusted price of about $2.95 per share. The stock price recently closed at $177, a 60-fold increase from our initial purchase.

The risk-adjusted aspect of your nest-egg is also important because most people should consider decreasing risk as you more closely approach retirement age, especially if you are planning to tap your investments for liquidity. If risk wasn’t a consideration, going to the Las Vegas roulette table and betting your life savings on black might be a good idea. Sure, you might have a chance of doubling your money instantly, but you could also lose it all in a blink of an eye.

Another way of thinking about risk, since we are in the heart of ski season, is to contemplate a ski instructor’s advice for an 80-year-old beginner vs. an experienced Olympic downhill gold medalist. It wouldn’t make sense for the 80-year-old beginner to train on the steep, advanced black diamond runs. Similarly, it wouldn’t make sense for the gold-medalist Olympian to train on the flat beginner runs. The same concept holds true for investing. Young investors generally can take on more risk, while retirees often should be more conservative in their asset allocation, especially if they need liquidity from their investments to fund their living expenses and lifestyle.

Although it would be nice to have ChatGPT create a luxurious retirement for you with a click of a button, unfortunately life is not that simple. You certainly can, and should, take advantage of the AI revolution in your investment portfolio to support your retirement goals, but successful investing requires more than that. With over 30 years of investment experience under my belt, at Sidoxia, we understand there are multiple facets to successful investing. In a diversified portfolio that that takes account of your risk tolerance, we strongly believe low-cost, tax-efficient, long-term investing is the best way to create your retirement masterpiece.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, including NVDA, META, GOOGL, AMZN, MSFT, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in DELL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

AI Revolution and Debt Ceiling Resolution

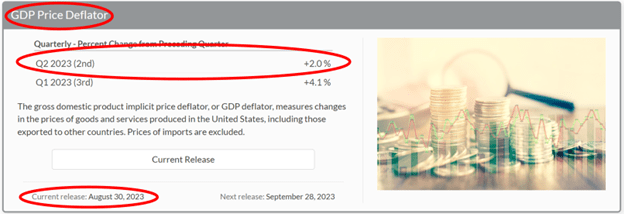

On the surface, last month’s performance of the stock market as measured by the S&P 500 index (+0.3%) seemed encouraging, but rather pedestrian. Fears of sticky-high inflation, more potential Federal Reserve interest rate hikes, contagion uncertainty surrounding a mini-banking crisis, along with looming recession concerns led to a -3.5% monthly decline in the Dow Jones Industrial Average (-1,190 points). The good news is that inflation is declining (see chart below) and currently the Federal Reserve is expected to pause from increasing interest rates in June (the first time in more than a year).

Source: Calafia Beach Pundit

Overall stock market performance has been a mixed-bag at best. Adding to investor anxiety, if you haven’t been living off-the-grid in a cave, is the debt ceiling negotiations. Essentially, our government has maxed out its credit card spending limit, but Republicans and Democrats have agreed in principle on a resolution for an expanded credit line. More specifically, the House of Representatives just approved to raise the debt ceiling by a resounding margin of 314 – 117. If all goes well, after months of saber rattling and brinksmanship, the bill should be finalized by the Senate and signed by the President over the next two days.

Beyond the Washington bickering, and under the surface, an artificial intelligence (AI) revolution has been gaining momentum and contributed to the technology-heavy NASDAQ catapulting +5.8% for the month and +23.6% for 2023. At the center of this disruptive and transformational AI movement is NVIDIA Corp., a leading Silicon Valley chip manufacturer of computationally-intensive GPUs (graphics processing units), which are used in generative AI models such as OpenAI’s ChatGPT (see NVIDIA products below). Adoption and conversations surrounding NVIDIA’s AI technology have been spreading like wildfire across almost every American industry, resulting in NVIDIA’s stratospheric stock performance (+36% for the month, +159% for the year, +326% on a 3-year basis).

Source: NVIDIA Corp. – the computing engines behind the AI revolution.

Why Such the Fuss Over AI?

Some pundits are comparing AI proliferation to the Industrial Revolution – on par with productivity-enhancing advancements like the steam engine, electricity, personal computers, and the internet. The appetite for this new technology is ravenous because AI is transforming a large swath of industries with its ability to enhance employee efficiency. By leveraging machine learning algorithms and massive amounts of data, generative AI enables businesses to automate repetitive tasks, streamline processes, and unlock new levels of productivity. A study released by MIT researchers a few months ago showed that workers were 37% more efficient using ChatGPT.

If you have created an account and played around with ChatGPT at all you can quickly realize there are an endless number of potential applications and use-cases across virtually all industries and job functions. Already, application of generative AI systems is disrupting e-commerce, marketing, customer service, healthcare, robotics, computer vision, autonomous vehicles, and yes, even accounting. Believe it or not, ChatGPT recently passed the CPA exam! Maybe ChatGPT will do my taxes next year?

Other industries are quickly being disrupted too. Lawyers may feel increased pressure when contracts or briefs can be created with a click of the button. Schools and teachers are banning ChatGPT too in hopes of not creating lazy students who place cheating and plagiarism over critical thinking.

At one end of the spectrum, some doomsday-ers believe AI will become smarter than humans, replace everyone’s job, and AI robots will take over the world (see Elon Musk warns AI could cause “civilization destruction”). At the other end of the spectrum, others see AI as a transformational tool to help worker productivity. As generative AI continues to advance, its impact on employee efficiency will only grow, optimizing processes, driving innovation, and reshaping industries for a more productive future. Embracing this transformative technology will be critical for businesses seeking to thrive in the new digital age.

2023 Stock Performance Explained – Index Up but Most Stocks Down

Although 2022 was a rough year for the stock market (i.e., S&P 500 down -19%), stock prices have rebounded by +20% from the October 2022 lows, and +9% this year. This surge can be in large part attributed to the lopsided performance of the top 1% of stocks in the S&P 500 index (Apple Inc., Microsoft Corp., Amazon.com Inc., NVIDIA Corp., and Alphabet-Google), which combined account for almost 25% of the index’s total value. These top 5 consumer and enterprise technology companies have appreciated on average by an astounding +60% in the first five months of the year and represent a whopping $9 trillion in value. It gets a little technical, but it’s worth noting these larger companies have a disproportionate impact on the calculation of the return percentages, and vice versa for the smaller companies. To put these numbers in context, Apple’s $2.8 trillion company value is greater than the Gross Domestic Product (GDP) of many entire countries, including Italy, Canada, Australia, South Korea, Brazil, and Russia.

On the other hand, if we contrast the other 99% of the S&P 500 index (495 companies), these stocks are down -1% each on average for 2023 (vs +60% for the top 5 mega-stocks). If you look at the performance summary below, you can see that basically every other segment of the stock market outside of technology (e.g., small-cap, value, mid-cap, industrial) is down for the year.

2023 Year-To-Date Performance (%)

S&P 500: +8.9%

S&P 500 (Equal-Weight): -1.2%

S&P Small-Cap Index: -2.3%

Russell 1000 Value Index: -2.0%

S&P Mid-Cap Index: -0.7%

Dow Jones Industrial: -0.7%

While most stocks have dramatically underperformed technology stocks this year, this phenomenon can be explained in a few ways. First of all, smaller companies are more cyclically sensitive to an economic slowdown, and do not have the ability to cut costs to the same extent as the behemoth companies. The majority of stocks have factored in a slowdown (or mild recession) and this is why valuations for small-cap and mid-cap stocks are near multi-decade lows (12.8x and 13.0x, respectively) – see chart below.

Source: Yardeni.com

The stock market pessimists have been calling for a recession for going on two years now. Not only has the recession date continually gotten delayed, but the severity has also been reduced as corporate profits remain remarkably resilient in the face of numerous economic headwinds. Regardless, investors can stand on firmer ground now knowing we are upon the cusp of an AI revolution and near the finish line of a debt ceiling resolution.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.