Posts tagged ‘META’

A.I. Field of Dreams

In the 1989 Academy Award–nominated film Field of Dreams, the lead character Ray Kinsella (played by Kevin Costner) hears a mysterious voice whisper, “If you build it, he will come.” Acting on blind faith, Ray builds a baseball diamond in the middle of his Iowa cornfield, risking financial ruin. Against all logic, the field draws a flood of visitors.

Today, a similar “field of dreams” is being built—not with corn, but with data centers. Instead of baseball players, it is artificial intelligence (AI) models, applications, and users who are coming.

The Market’s AI Momentum

The AI boom has already reshaped markets with all three benchmarks hitting record highs. Last month, the S&P 500 climbed +1.9%, while the NASDAQ rose +1.6% and Dow Jones Industrial Average surged +3.2%. Year to date, the indexes are up +10%, +11%, and +7%, respectively.

Behind this surge lies an unprecedented wave of AI infrastructure investment. Hyperscalers—Amazon.com (AMZN), Microsoft Corp. (MSFT), Google-Alphabet (GOOGL), Meta Platforms (META), and others—are pouring hundreds of billions into AI, much of it flowing directly to NVIDIA Corp. (NVDA), the undisputed leader in GPUs (Graphic Processing Units) powering the world’s AI engines. How large is the spending? NVIDIA CEO Jensen Huang estimates $3 trillion to $4 trillion will be spent this decade to fuel the AI revolution.

Source: Visual Capitalist

The Scale of AI’s Buildout

To put this into perspective:

- Amazon is projected to spend over $100 billion in 2025 alone, more than its cumulative capital expenditures from 2000–2020 combined.

Meta is constructing its $10 billion+ Hyperion data center in Louisiana—a sprawling 4 million sq. ft. complex across 2,250 acres, powered by a $4 billion natural gas plant. The footprint is so gargantuan it could cover much of Manhattan (see graphic below).

- xAI’s Colossus, a 750,000 sq. ft. data center in Memphis, Tennessee was completed in just 122 days—equivalent to building 418 homes in half the time it normally takes to construct one house (see slide below).

Source: BOND (Global Technology Investment Firm)

This breakneck pace of spending underscores the urgency and competitive pressure driving the global AI arms race.

The Origin of the AI Floodgates Opening

The spark was lit on November 30, 2022, when OpenAI released its LLM (large language model) called ChatGPT. Within two months, it amassed 100 million users.

Today, ChatGPT’s metrics have blasted much higher (see slide below):

- 800 million weekly active users

- 20 million paid subscribers

- $3.7 billion in revenue (as of April 2025)

Source: BOND (Global Technology Investment Firm)

But OpenAI is far from alone. Google (Gemini), xAI (Grok), Anthropic (Claude), Meta (LLaMA), Amazon (Titan), Perplexity, and DeepSeek are all competing with their own LLMs. In total, over 1 million machine learning models now exist (see slide below) — each requiring costly compute power and pricey data centers.

Source: BOND (Global Technology Investment Firm)

Bubble or Productivity Breakthrough?

With trillions flowing into AI, a natural question arises: Is this a bubble?

Even OpenAI CEO Sam Altman admits we’re in an AI bubble :

“When bubbles happen, smart people get overexcited about a kernel of truth…Someone is going to lose a phenomenal amount of money… and a lot of people are going to make a phenomenal amount of money.”

Both realities can be true:

- Yes, hyperscalers are spending like “drunken sailors.”

- Yes, AI demand and productivity benefits are real and growing exponentially.

Consider the trajectory of global cloud revenues: from nearly $0 a decade ago to $300 billion today—a +37% CAGR (see chart below).

Source: BOND (Global Technology Investment Firm)

And the primary reason for cloud growth can be attributed to AI productivity benefits. A recent SAP survey found that workers using AI save nearly one hour per day on average. That’s transformative for companies: higher productivity without needing proportional hiring.

AI Use Cases Expanding Aggressively

AI’s applications now span nearly every sector (see slide below):

- Technology – software engineering, code generation

- Customer Service & Marketing – customer support and call centers

- Transportation – autonomous vehicles and logistics

- Healthcare – drug discovery and development

- Supply Chains – precision manufacturing and optimization

- Automation – multi-purpose robotics

- Cybersecurity – threat detection and prevention

- Education – personalized lessons and curriculums

- Energy – grid optimization and demand forecasting

Source: BOND (Global Technology Investment Firm)

The New Field of Dreams

Throughout history, every great leap—printing press, steam engine, electricity, internet—has required massive upfront investment before the payoff arrived. AI is following the same path. Today, we are in the midst of building a new AI Field of Dreams. However, now, the data centers are the new baseball fields. And as with Ray Kinsella’s diamond, the masses are indeed coming.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GOOGL, META, AMZN, MSFT, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SAP or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Mission Accomplished?

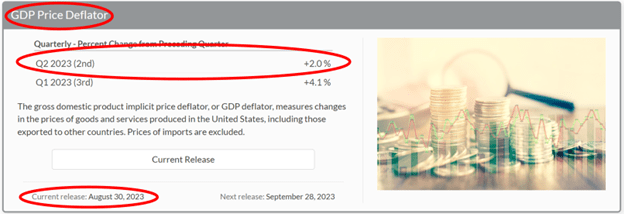

The Federal Reserve has a “dual mandate” designed to “foster economic conditions that achieve both stable prices and maximum sustainable employment.” The “dual mandate” is obviously a moving target, but it appears for now, based on the Fed’s explicit goals, Fed Chairman, Jerome Powell, has accomplished the central bank’s mission. More specifically, inflation, according to the just-reported BEA’s (Bureau of Economic Analysis) GDP Price Deflator statistics, has plummeted dramatically to the Fed’s goal of 2.0% from the sky-high inflation number of 9.1% a year ago (see chart below). Meanwhile, the economy continues to grow (+2.0% GDP growth in the 2nd quarter), and the long-awaited recession boogeyman has yet to appear.

Source: Bureau of Economic Analysis

Rate Pig Moving Through Economic Python

How has inflation plunged so quickly? For starters, in addition to the Fed’s restrictive policy of reducing the balance sheet, since the beginning of last year, the Fed has also effectively slammed the brakes on the economy by taking their target interest rate from 0% to 5.5%. The pace and scale of the interest rate increases have been reduced this year, however it is possible there might be more rate hikes ahead (currently, pundits are betting for no more rate increases this year, although a boost in November is possible if economic data accelerates). Like a pig working its way through the economic python, the large interest rate increases naturally take a while to work their way through the consumer, commercial, and government credit markets.

To put things in better perspective, a study done earlier this year showed the average 30-year monthly mortgage payment for a $500,000 home was higher by more than $800 (up +44%) versus a year ago! But wait, it’s not just consumers feeling the pinch of higher rates. Businesses and governments in all shapes and sizes have felt the pain as well from higher borrowing costs. Post-COVID supply chain constraints and disruptions have eased too, which have helped choke down the high inflation numbers. In the background, let’s not also forget about the disinflationary benefits of ever-expanding technology adoption coupled with the related productivity advantages (see also AI Revolution).

As a result of these dynamics, we are now starting to see cracks appear in our country’s employment foundation as this month’s JOLTs (Job Openings and Labor Turnover – see black line in chart below) and ADP monthly job additions data, which both came in disappointingly low compared to forecasts. Chairman Powell must be ecstatic inflation has plummeted, while the unemployment rate remains near multi-decade lows, and Gross Domestic Product (GDP) growth continues expanding (i.e., no recession in sight).

Source: Calculated Risk and U.S. Bureau of Labor Statistics

Hot Summer, Hot Stocks

Economic activity clearly can and will change, but the stock market has been like the weather this summer…hot. However, after experiencing up-months in six out of the first seven months of 2023, the S&P 500 index decided to take a small breather this month. For August, the S&P slipped -1.8%, but the month was a tale of two cities. By the middle of the month, the index had fallen by roughly -6% on fears of potentially more aggressive interest rate hikes by the Federal Reserve due to better than anticipated economic data. In other words, inflation fears were on the rise and the 10-Year Treasury Note yield temporarily climbed to a 52-week high. By the end of the month, economic data cooled, interest rates dropped a little, and stock prices rebounded smartly by +4.0% to finish the month on a strong note.

For the year, the S&P’s remain strongly positive, up +17.4%. As I have written in the past, the seven largest companies in the S&P 500 index (a.k.a., The Magnificent 7: Apple Inc.; Microsoft Corp.; Alphabet Inc.; Amazon.com, Inc.; NVIDIA Corp.; Tesla, Inc.; and Meta Platforms, Inc.) have contributed to a significant portion of the year’s gains – the average Magnificent 7 stock has skyrocketed an eye-popping +99.0% with NVIDIA being the largest winner, more than tripling in value during the first eight months of the year.

The Federal Reserve can admit they were late to the game in taming out-of-control inflation, but Fed Chair Powell has been swift in moving to preserve his legacy as an inflation fighter. Now that inflation is coming under control and the economy is beginning to cool, Powell needs to make sure he doesn’t murder the economy into recession with overzealous future interest rate increases. Time will tell if the mission has already been accomplished, but so far, the Fed has been delicately balancing an economic soft landing and stock market investors like it.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (September 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, MSFT, GOOGL, AMZN, NVDA, TSLA, META, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.