Posts tagged ‘meme stocks’

Trade & OBBB Deals Sealed, Fed Dread, and AI/Meme Dreams

As the stock market reached new all-time highs, investors had plenty to juggle—both in Washington, D.C., and on Wall Street. The S&P 500 climbed +2.2%, the NASDAQ surged +3.7%, and the Dow Jones Industrial Average edged higher by +0.1% for the month.

The One Big Beautiful Bill

What has fueled the rally? A major catalyst was President Trump’s signing of the One Big Beautiful Bill Act (OBBB) on July 4th. The nearly 900-page legislation spans a broad range of economic issues including tax reform, healthcare, energy policy, and national security.

According to the Congressional Budget Office (CBO), the combined impact of tax cuts, new spending, and spending reductions will result in a net cost of $3.4 trillion over 10 years (see chart above). Supporters of the bill argue that this projection underestimates the long-term stimulative effects of tax relief and strategic investments. Whether the deficit widens as the CBO projects, or narrows thanks to a stronger, growing economy, remains to be seen.

Trade Deals Sealed

Since Liberation Day on April 2nd, trade negotiations have progressed unevenly. The administration’s reciprocal tariff hikes were paused through August 1st to allow final agreements to be reached. Following months of tough rhetoric, multiple major trading partners ultimately signed deals before the deadline—including the European Union, Japan, the United Kingdom, Vietnam, and South Korea—thereby avoiding punitive tariffs.

Talks with our two key trading partners, Mexico and Canada, remain ongoing. While Mexico was granted a 90-day extension amid constructive dialogue, Trump slapped a 35% tariff on Canada (from 25%) due to what the White house said was “continued inaction and retaliation.” The tariff pause with China stops on August 12th.

Here’s a list of the new country tariffs released by the president late yesterday: CLICK HERE

Regardless of all the tariff uncertainty, investor sentiment improved last month as the terms of the signed deals were significantly milder than originally feared.

Adding to the optimism:

- Core inflation in June remained modest at 2.8% (Reuters), and

- Tariff revenues collected through July reached $126 billion, beating initial estimates (Politico) – see chart below. Strategist Ed Yardeni forecasts that 2025 tariff revenues could surge to between $400 billion and $500 billion (Barron’s).

Source: Politico

Fed Dread

Of course, when it comes to financial markets, everything can’t just be rainbows and unicorns without something for investors to worry about—and this month, a key concern remains Federal Reserve policy. Critics, including the president, argue that interest rates are too high, with the Federal Funds Rate currently set at 4.25%–4.50% (Yardeni Research) – see chart below.

By comparison:

- The European Central Bank’s Deposit Facility Rate stands at 2.00%, and

- The Bank of Japan’s overnight rate is only 0.50%.

Source: Yardeni Research

Fed Chair Jerome Powell has held off on further cuts, citing the need for more clarity on inflation and labor market data, especially in light of recent tariffs. Ironically, when the Fed last cut rates by -1.00% late last year, the 10-year Treasury yield rose by roughly +1% (see chart above), reflecting fears of rising inflation.

This week, the Fed held rates steady for the fifth consecutive meeting (YouTube). Notably, two FOMC members—Christopher Waller and Michelle Bowman—dissented, voting in favor of a rate cut. It was the first dual dissent by Fed governors in over 30 years—a clear signal of division inside the central bank.

Meme Dreams

With the major indexes at new highs, speculation has returned in full force. Money-losing, struggling companies like Opendoor Technologies, GoPro Inc., and Kohl’s Corp. saw their shares double, triple, or even quadruple over a short span (WSJ) – see chart below. We saw similar trends occur during the GameStop and AMC meme craze in 2021.

Source: The Wall Street Journal

Adding fuel to the fire:

- Cryptocurrency prices are on the rise again.

- Euphorically priced IPOs (Initial Public Offerings) like Figma, Inc. (FIG), which more than tripled in value ($115 per share) on its first trading day above its offering price ($33 per share) valuing the company above $50 billion – more than 30 times next year’s forecasted revenues.

- SPACs (Special Purpose Acquisition Companies)—often criticized for poor governance—are staging a comeback.

Combined, all these trends raise concerns about froth, which investors have experienced at previous peaks.

Climb in AI Stocks Persists

No discussion of this rally would be complete without highlighting the AI mega-cap giants. Companies like Alphabet (Google), Meta (Facebook), Microsoft, and Amazon all recently announced capital expenditures for 2025 that will likely exceed an astounding $350 billion —most of it allocated to AI infrastructure.

Meanwhile, NVIDIA Corp., the AI-chip juggernaut and major beneficiary of all the AI capex, has seen its share price soar +63% in just three months, reaching a staggering $4.4 trillion market value.

Source: Yardeni Research

Valuations High but Fundamentals Remain Strong

While stock valuations remain elevated above historical averages (the S&P 500 red line trades at 22x forward earnings, according to Yardeni) – see chart above, the macro backdrop remains supportive:

- The economy is strong,

- Unemployment is low,

- Corporate profits are growing, and

- Monetary policy may turn more accommodative in coming months.

In this momentum environment, the market should continue its productive juggling, but if the frothy or economic winds worsen, investors should be prepared for a dropped ball.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GOOGL, META, AMZN, MSFT, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in OPEN, GPRO, KSS, GME, AMC, FIG or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Return to Rationality?

As the worst pandemic in more than a generation is winding down in the U.S., people are readjusting their personal lives and investing worlds as they transition from ridiculousness to rationality. After many months of non-stop lockdowns, social distancing, hand-sanitizers, mask-wearing, and vaccines, Americans feel like caged tigers ready to roam back into the wild. An incredible amount of pent-up demand is just now being unleashed not only by consumers, but also by businesses and the economy overall. This reality was also felt in the stock market as the Dow Jones Industrial Average powered ahead another 654 points last month (+1.9%) to a new record level (34,529) and the S&P 500 also closed at a new monthly high (+0.6% to 4,204). For the year, the bull market remains intact with the Dow gaining almost 4,000 points (+12.8%), while the S&P 500 has also registered a respectable +11.9% return.

The story was different last year. The economy and stock market temporarily fell off a cliff and came to a grinding halt in the first quarter of 2020. However, with broad distribution of the vaccines and antibodies gained by the previously infected, herd immunity has effectively been reached. As a result, the U.S. COVID-19 pandemic has essentially come to an end for now and stock prices have continued their upward surge since last March.

Insanity to Sanity?

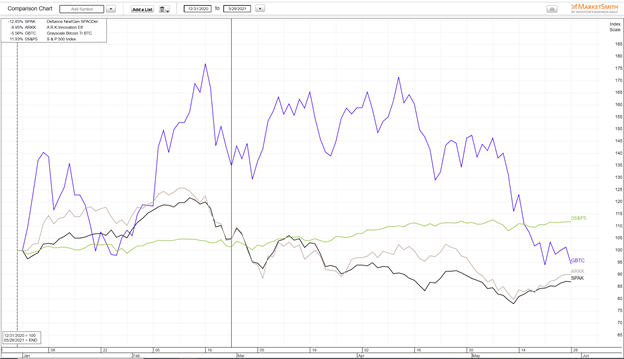

With the help of the Federal Reserve keeping interest rates at near-0% levels, coupled with trillions of dollars in stimulus and proposed infrastructure spending, corporate profits have been racing ahead. All this free money has pushed speculation into areas such as cryptocurrencies (i.e., Bitcoin, Dogecoin, Ethereum), SPACs (Special Purpose Acquisition Companies), Reddit meme stocks (GameStop Corp, AMC Entertainment), and highly valued, money-losing companies (e.g., Spotify, Uber, Snowflake, Palantir Technologies, Lyft, Peloton, and others). The good news, at least in the short-term, is that some of these areas of insanity have gone from stratospheric levels to just nosebleed heights. Take for example, Cathie Wood’s ARK Innovation Fund (ARKK) that invests in pricey stocks averaging a 91x price-earnings ratio, which exceeds 4x’s the valuation of the average S&P 500 stock. The ARK exchange traded fund that touts investments in buzzword technologies like artificial intelligence, machine learning, and cryptocurrencies rocketed +149% last year in the middle of a pandemic, but is down -10.0% this year. The Grayscale Bitcoin Trust fund (GBTC) that skyrocketed +291% in 2020 has fallen -5.6% in 2021 and -48.1% from its peak. What’s more, after climbing by more than +50% in less than four months, the Defiance NextGen SPAC fund (SPAK) has declined by -28.9% from its apex just a few months ago in February. You can see the dramatic 2021 underperformance in these areas in the chart below.

Inflation Rearing its Ugly Head?

The economic resurgence, weaker value of the U.S. dollar, and rising stock prices have pushed up inflation in commodities such as corn, gasoline, lumber, automobiles, housing, and a whole host of other goods (see chart below). Whether this phenomenon is “transitory” in nature, as Federal Reserve Chairman Jerome Powell likes to describe this trend, or if this is the beginning of a longer phase of continued rising prices, the answer will be determined in the coming months. It’s clear the Federal Reserve has its hands full as it attempts to keep a lid on inflation and interest rates. The Fed’s success, or lack thereof, will have significant ramifications for all financial markets, and also have meaningful consequences for retirees looking to survive on fixed income budgets.

As we have worked our way through this pandemic, all Americans and investors look to change their routines from an environment of irrationality to rationality, and insanity to sanity. Although the bull market remains alive and well in the stock market, inflation, interest rates, and speculative areas like cryptocurrencies, SPACs, meme-stocks, and nosebleed-priced stocks remain areas of caution. Stick to a disciplined and diversified investment approach that incorporates valuation into the process or contact an experienced advisor like Sidoxia Capital Management to assist you through these volatile times.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME, AMC, SPOT, UBER, SNOW, PLTR, LYFT, PTON, GBTC, SPAK, ARKK or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.