Posts tagged ‘MBA’

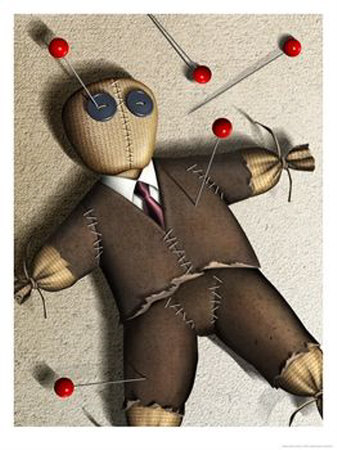

Business Theory: Voodoo or Value?

Michael E. Porter, a former aeronautical engineer graduate turned Harvard Economics PhD professor, came out with a revolutionary article thirty years ago (How Competitive Forces Shape Strategy) in which he describes the Five Forces of competition that shape the profitability dynamics of an industry. Since then, Porter’s management theories have continued to spread and his knowledge is continually sought after. Some people believe Porter’s Five Forces, and other management business theories, are pure voodoo.

In a recent HBR (Harvard Business Review) article, Andrew O’Connell completed a book review of The Management Myth: Why the “Experts” Keep Getting it Wrong written by Matthew Stewart, a former consultant. Mr. Stewart (a former consultant turned non-believer) exposes the sham of the business consulting industry by outlining the outrageous fees paid by clients and the “mumbo-jumbo” language spouted out by newly minted MBAs.

In a similarly titled article (the Management Myth) written in 2006, Mr. Stewart goes on to say:

“The impression I formed of the M.B.A. experience was that it involved taking two years out of your life and going deeply into debt, all for the sake of learning how to keep a straight face while using phrases like “out-of-the-box thinking,” “win-win situation,” and “core competencies.”… M.B.A.s have taken obfuscatory jargon—otherwise known as bullshit—to a level that would have made even the Scholastics blanch.”

Some other interesting comments include his views on failing companies:

“In fact, we kind of liked failing businesses: there was usually plenty of money to be made in propping them up before they finally went under. After Enron, true enough, Arthur Andersen sank. But what happened to such stalwarts as McKinsey, which generated millions in fees from Enron and supplied it with its CEO?”

Too often with many books, a silver bullet or holy-grail is searched for. The true answer – there is no easy solution. I believe tools or frameworks, like Porter’s Five Forces, can create significant benefits by forcing practitioners into thinking about competition and profits in new ways. Although the lessons may not be worth millions in consulting fees, the education may be worth the $21.95 cost of a book (including free shipping) from Amazon. Mr. Stewart would likely take umbrage with these views, especially since I have an MBA from Cornell.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Jack Welch University: Diploma or Black Belt?

You too can get your name plastered across a university (or online) for a measly $2 million. That’s what Jack Welch did when he purchased a 12% stake in the primarily online Masters of Business Administration Program (MBA) of Chancellor University. The name of the school according to The Wall Street Journal will be the Jack Welch Institute (JWI).

According to the WSJ:

Boston research firm EduVentures Inc. estimates that 11% of the roughly 18.5 million U.S. college students took most of their classes online in the fall of 2008, up from 1% a decade ago.Online higher education will generate revenue of $11.5 billion this year, EduVentures says. But “there is a concern about quality,” says EduVentures Chief Executive Tom Dretler, because there’s “much, much less selectivity” of students in the admissions process.

So what does a Jack Welch student receive upon graduation – a diploma or a General Electric (GE) Six Sigma Black Belt? And what about Jack’s hard-nosed, no-nonsense business approach? Will all students learn how to negotiate like Jack, especially when it comes to retirement perks? The $21,000 tuition bill sounds steep on the surface, but well worth it if graduates can finagle exit package perks like Welch’s $86,000 a year consultant fee, use of an $80,000 per month Manhattan apartment, court-side seats to the New York Knicks and U.S. Open, seating at Wimbledon, box seats at Red Sox and Yankees baseball games, country club fees, security services and restaurant bills (The New York Times), not to mention a limousine, a cook, free flowers, country-club memberships and a charge account at Jean Georges restaurant.

Now that’s an MBA degree that may attract interest.

Wade W. Slome, CFA, CFP® www.Sidoxia.com