Posts tagged ‘mag 7’

As We Give Thanks, AI and Mag 7 Take Cash to the Bank

Market volatility resurfaced last month as speculation intensified over whether an AI bubble may be forming—and potentially bursting. Yet despite the jitters, equity markets remain solidly positive for the year (S&P 500 +16.5%, NASDAQ +21.0%, Dow +12.2%) – see S&P 500 chart below. A significant portion of the gains have been powered in large part by ongoing strength in the Magnificent 7. Standouts such as NVIDIA (+31.8%) and Alphabet (+68.1%) have been instrumental in carrying the broader indices higher.

Even with these sizable year-to-date gains, memories of the 2000 Tech Bubble and 2008 Financial Crisis resurfaced and prompted investors to temporarily tap the brakes. Mid-month, the NASDAQ retreated roughly -9% from its October peak. After a month-end bounce, the S&P 500 finished essentially flat (+0.1%), the NASDAQ slipped -1.5%, and the Dow eked out a +0.3% increase.

OpenAI and the $1.4 Trillion Question

At the center of the AI controversy sits OpenAI, parent of the three-year-old technology toddler, ChatGPT (Generative Pre-trained Transformer), which now boasts more than 800 million global users (see chart below). The company reportedly runs at a $20 billion annual revenue pace, yet faces difficult questions about how it intends to fund its staggering $1.4 trillion AI infrastructure commitments.

Those concerns came to a head when tech investor Brad Gerstner pressed CEO Sam Altman on his podcast last month. Instead of answering how OpenAI plans to underwrite such an enormous buildout, Altman childishly shot back defensively:

“If you want to sell your shares, I’ll find you a buyer.” (See clip here — or full interview here)

Source: Digital Information World

OpenAI is a key player, but just one component in the vast—and rapidly expanding—web of global AI infrastructure. Gartner, a global research and advisory firm, forecasts $2 trillion of AI investment in 2026, while NVIDIA CEO Jensen Huang recently said:

“Over the next five years, we’re going to scale into… effectively a $3 to $4 trillion AI infrastructure opportunity.”

These provocative “Is this a bubble?” questions make for great headlines, but to truly evaluate AI sustainability, it’s wise to follow the classic Watergate guidance from of All the President’s Men character, Deep Throat (FBI Associate Director, Mark Felt), who tells journalist Bob Woodward to “follow the money,” if he wants to get to the bottom of the Watergate scandal.

The same principle applies to investors who follow the money – the picture looks very different from past bubbles.

Forget Pets.com—Today’s AI Buildout Is Being Funded by Cash-Rich Titans

Unlike the flimsy, profitless internet startups of the late 1990s—companies that raised billions based on “eyeballs” and cocktail-napkin business plans—the current AI buildout is being financed largely by profitable cash-generating giants.

Yes, some firms like Oracle (ORCL) are leaning on debt financing for data-center expansion. But the overwhelming majority of AI capex is being funded by customers and by the cash flow of the Magnificent 7, a group with the financial firepower to sustain multi-year spending without relying heavily on capital markets.

This dynamic alone separates today’s environment from classic bubble conditions.

Do the Magnificent 7 Really Deserve a $22 Trillion Valuation?

The Mag 7 represent only 1% of S&P 500 constituents yet account for a massive 35% of the index’s market value. That concentration understandably raises eyebrows, evoking historical parallels to the “Nifty Fifty” of the 1970s or the “Four Horsemen” of the 1990s.

But headline concentration can be misleading—because the fundamentals tell a very different story. Here are some of the major disparities:

1.) Mag 7 Share of Profits Matches Their Share of Market Value: The Mag 7 collectively contribute $22 trillion of the S&P 500’s $58 trillion total value (below). Said differently, the market values and weightings of the Mag 7 equate to about $22 trillion and 37% of the S&P 500, respectively:

· Nvidia Corp: $4.3T & 7.0%

· Apple Inc.: $4.1 T & 6.7%

· Alphabet Inc.: $3.9 T & 6.3%

· Microsoft Corp.: $3.7 T & 5.9%

· Amazon.com Inc.: $2.5 T & 4.0%

· Meta Platforms Inc.: $1.6T & 2.6%

· Tesla Inc.: $1.4T & 2.3%

· TOTAL: $22T / 37%

Source: Slickcharts

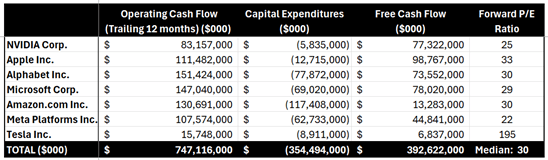

Conveniently (and importantly), the Mag 7’s roughly $747 billion in annual cash flow (see table below) is a good proxy for their profit contribution to the $2 trillion in S&P profits.

Source: SEC Filings & MarketSurge

The $747 billion in Mag 7 cash flows divided by the $2 trillion in S&P 500 coincidentally also equates to 37% ($747B/$2T).

These calculations of the Mag 7 are not bubble math—these calculation comparisons are rational math. Arguments could be made that Mag 7 market values are actually undervalued (not in bubble territory) and should appreciate to a higher percentage of the S&P 500 weightings because these 7 stocks are growing sales and profits faster than compared to the other “absentee” 493 stocks in the index.

2.) Mag 7 are Swimming in Cash: That $747 billion in annual cash flow is on track to hit a jaw-dropping $1 trillion, giving these firms ample capital to fund AI buildouts without substantially accessing the equity or credit markets. The ability to self-fund a multi-trillion-dollar infrastructure expansion is the opposite of bubble behavior.

3.) Valuations Are Elevated—but Far from Bubble Territory: During the 2000 Tech Bubble, many leading tech names traded at 100x+ earnings (See also: Rational or Irrational Exuberance. Today, the Mag 7 trade at a median forward P/E around 30x. Expensive? Historically, yes, versus long-term averages, but nowhere near historical extremes. Relative to growth, profitability, and cash flow, valuations are far more grounded today than during prior manias.

The bottom line is there is plenty to be thankful for and bubble fears are overstated. Despite pockets of AI froth, the underlying economic engine powering AI adoption is real, profitable, and well-capitalized. When investors follow the money, they discover:

· The Mag 7 generate over one-third of S&P 500 profits

· They generate and hold hundreds of billions in cash

· They largely fund their own AI capital expenditures

· Valuations remain far below bubble-era extremes

Investors have a lot to be thankful for. And while volatility will likely continue, the ingredients for a classic, catastrophic AI bubble are noticeably absent. For disciplined, long-term investing strategies like those employed at Sidoxia Capital Management, this environment still offers abundant opportunity—without the need to fear a pricked AI balloon anytime soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Dec. 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Mideast War an Investor Bore as Markets Soar

If I told you at the beginning of the year that the U.S. would bomb key nuclear sites in Iran, would you have guessed that Middle East stability would follow—and that global financial markets would soar to record highs? Personally, I wouldn’t have bet on that outcome. But that’s exactly what happened last month. While geopolitical dynamics remain fluid, markets shrugged off the chaos. The S&P 500 rallied +5.0%, the Dow Jones Industrial Average climbed +4.3%, and the NASDAQ catapulted +6.6%, powered largely by artificial intelligence stocks like NVIDIA Corp., which surged +16.9% for the month to a market value of $3.9 trillion (more on AI below). This is an important reminder that trading off of news headlines is a fool’s errand.

Economy Resilient Despite Tariffs and Geopolitical Turmoil

Source: Calafia Beach Pundit

Credit Default Swaps (CDS) act as insurance contracts that protect investors against corporate debt defaults. During financial stress—like the 2008 crisis or the COVID crash in 2020—CDS prices surge as investors seek protection. Today, however, CDS prices are falling across both high-yield (junk bonds) and investment-grade (Blue Chip) debt. As seen in the chart above, the cost to insure corporate bonds has declined steadily over the past two years. This signals bond investors aren’t worried about a recession or a wave of defaults, despite tariff policy uncertainty, geopolitical risk, and modest GDP growth.

Inflation Tame as Tariffs Loom

President Trump has repeatedly criticized Fed Chair Jerome Powell for not cutting interest rates, calling him everything from a “dummy” to a “major loser” and a “stupid person” to a “numbskull”. While the name-calling is colorful, the economic pressure is real: U.S. GDP contracted -0.5% in Q1 2025. Powell, however, wants to see the full impact of upcoming tariffs before making a move. . A new tariff deadline looms on July 9th, and the market is anxiously awaiting clarity. But even if tariffs are implemented, many economists believe the inflationary impact will be temporary—what’s known as a one-time price shock.

Source: Calafia Beach Pundit

The Fed’s preferred inflation gauge—the Personal Consumption Expenditure (PCE) index—has been easing and is now near the 2% target (see chart above). With inflation cooling, Trump’s case for rate cuts gains credibility. Still, the Fed appears in no rush. It will take time to understand the lasting effects of the tariff rollout.

AI Wave Fueling Markets

For a generation, the semiconductor revolution has quietly powered innovation, guided by Moore’s Law—the principle that chip performance doubles roughly every two years (see my article The Traitorous 8). Sixty years after Gordon Moore wrote his seminal article, “Cramming More Components onto Integrated Circuits”, the power of software is catching up. NVIDIA’s Grace Blackwell GB200 chip contains an astronomical 208 billion transistors, supercharging AI software models like ChatGPT.

The AI revolution is fueling trillions in global investment and rapidly transforming industries – from data centers and self-driving cars to robotics and drug discovery. It’s important to realize that this AI arms race is not just occurring in the United States. AI investment spending extends way beyond Silicon Valley to countries like Saudi Arabia, Singapore, and China.

The AI boom is not a U.S.-only phenomenon. Countries like China, Saudi Arabia, and Singapore are pouring capital into AI, creating a global arms race in tech. In the U.S., the four biggest hyperscalers—Amazon, Microsoft, Google, and Meta—are projected to spend over $300 billion on capital expenditures in 2025 alone (see chart below).

To illustrate the scale: Amazon is forecasted to spend more than $100 billion in CapEx this year. For context, that’s 40% more than the company spent over the entire 2000–2020 period combined.

Source: The Financial Times

The Stargate Initiative: AI Infrastructure on a Galactic Scale

A prime example of the AI gold rush is the $500 billion Stargate initiative, with Phase 1 already underway in Abilene, Texas (see rendering below). The initial construction includes two buildings totaling 1,000,000 square feet. Ultimately, the full project will cove about 1,000 acres and be powered by an on-site natural gas facility generating 360 megawatts—enough to support 300,000 homes.

A huge portion of the project costs are dedicated to the budget for NVIDIA super chips. Oracle Corp. has committed $40 billion to purchase 400,000 of NVIDIA’s GB200 chips, making this project a centerpiece of the global AI infrastructure boom. Just this week, Oracle also announced a new $30 billion cloud deal, which will soak up a good chunk of the data center supply created by the database and enterprise software company.

Source: CoStar

The Big Picture: Volatility and Opportunity

There’s no shortage of risk—geopolitics, inflation, Fed uncertainty, tariffs. But the economy is showing surprising resilience. If tariff clarity improves, interest rate cuts materialize, and AI capital spending accelerates, a “boring” market could rapidly turn into a soaring one.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.