Posts tagged ‘Lehman Brothers’

Floating Hedge Fund on Ice Thawing Out

These days, pundits continue to talk about how the same financial crisis plaguing Greece and its fellow PIIGS partners (Portugal, Ireland, Italy & Spain) is about to plow through the eurozone and then ultimately the remaining global economy with no mercy. If all the focus is being placed on a diminutive, calamari-eating, Ouzo-drinking society like Greece, whose economy matches the size of Maryland, then why not evaluate an even more miniscule, PIIGS prequel country…Iceland.

That’s right, the same Iceland that just four years ago people were calling a “hedge fund on ice.” You know, that frozen island that had more foreign depositors investing in their banks than people living in the country. Before Icelandic banks became more than 75% of the overall stock market, and Gordon Gekko became the country’s patron saint, Iceland was more known for fishing. The fishing industry accounted for about half of Iceland’s exports, and the next largest money maker may have been Bjork, the country’s famed and quirky female singer.

In looking back at the financial crisis of 2008-2009, as it turned out, Iceland served as a canary in the global debt binging coal mine. In order to attract the masses of depositors to Icelandic banks, these financial institutions offered outrageous, unsustainable interest rates to yield-starved customers. How did the Icelandic bankers offer such high rates? Well of course, it was those can’t-lose American subprime mortgages that were offering what seemed like irresistibly high yields. Of course, what seemed like a dream at the time, eventually turned into a nightmare once the scheme unraveled. Ultimately, it became crystal clear that the subprime borrowers could not pay the outrageous rates, especially after rates unknowingly reset to untenable levels for many borrowers.

At the peak of the crisis, the Icelandic banks were holding amounts of debt exceeding six times the Icelandic GDP (Gross Domestic Product) and these lenders suffered more than $100 billion in losses. One of the Icelandic banks was even funding a large condominium project in my neighboring Southern California city of Beverly Hills. When the excrement hit the fan after Lehman Brothers went bankrupt, it didn’t take long for Iceland’s stock market to collapse by more than -95%; Iceland’s Krona to crumple; and eventually the trigger of Iceland’s multi-billion bailout by numerous constituents, including the IMF (International Monetary Fund).

Bitter Medicine First, Improvement Next

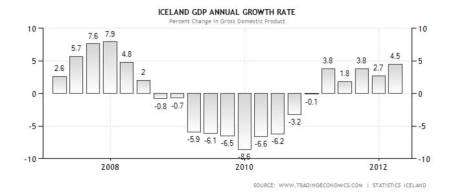

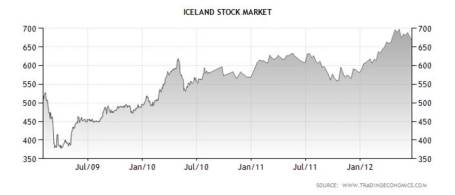

Today, four years after the subprime implosion and Lehman debacle, the hedge fund on ice known as Iceland is beginning to thaw, and their economic picture is looking much brighter (see charts below). GDP growth is the highest it has been in four years (4.5% recently); the stock market has catapulted upwards (almost doubling from the lows); and the Iceland unemployment rate has declined from over 9% a few years ago to about 7% today.

Re-jiggering a phony economy with a faulty facade cannot be repaired overnight. However, now that the banking system has been allowed to clear out its excesses, Iceland can move forward. One tailwind behind the economy has been Iceland’s weaker currency, which has led to a +17% increase in foreign tourist nights at Icelandic hotels through April this year. What’s more, tourist traffic at Iceland’s airport hit a record in May. Iceland has taken its bitter medicine, adjusted, and is currently reaping some of the rewards.

Although the detrimental effects of austerity experienced by the economies and banks of Greece, Spain, and Italy crowd out most of today’s headlines, Iceland is not the only country to make painful changes to its fiscal ways and then taste the sweetness of progress. Let’s not forget the Guinness drinking Irish. Ireland, like Greece, Portugal, and Spain received a bailout, but Ireland’s banking system was arguably worse off than Spain’s, yet Ireland has seen its borrowing costs on its 10-year bond decrease dramatically from 9.2% at the beginning of 2011 to about 7.4% this month (still high, but moving in the right direction). The same can be said for the United States. Our banks were up against the ropes, but after some recapitalization, tighter oversight, and stricter lending standards, our banks have gotten back on track and have helped assist our economy grow for 11 consecutive quarters (albeit at uninspiring growth rates).

The austerity versus growth debate will no doubt continue to circulate through media circles. In my view, these arguments are too simplistic and one dimensional. Every country has its unique culture and distinct challenges, but even countries with massive financial excesses can steer themselves back to a path of growth. A floating hedge fund on ice to the north of us has proven that fact to us, as we witness brighter days beginning to thaw Iceland’s chilly economy to expansion again.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in Lehman Brothers, Guinness, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sleeping like a Baby with Your Investment Dollars

Amidst the recent, historically high volatility in the financial markets, there have been a large percentage of investors who have been sleeping like a baby – a baby that stays up all night crying! For some, the dream-like doubling of equity returns achieved from the first half of 2009 through the first half of 2011 quickly turned into a nightmare over the last few weeks. We live in an inter-connected, globalized world where news travels instantaneously and fear spreads like a damn-bursting flood. Despite the positive returns earned in recent years, the wounds of 2008-2009 (and 2000 to a lesser extent) remain fresh in investors’ minds. Now, the hundred year flood is expected every minute. Every European debt negotiation, S&P downgrade, or word floating from Federal Reserve Chairman Ben Bernanke’s lips, is expected to trigger the next Lehman Brothers-esque event that will topple the global economy like a chain of dominoes.

Volatility Victims

The few hours of trading that followed the release of the Federal Reserve’s August policy statement is living proof of investors’ edginess. After initially falling approximately -400 points in a 30 minute period late in the day, the Dow Jones Industrial Average then climbed over +600 points in the final hour of trading, before experiencing another -400 point drop in the first hour of trading the next day. Many of the day traders and speculators playing with the explosively leveraged exchange traded funds (e.g., TNA, TZA, FAS, FAZ), suffered the consequences related to the panic selling and buying that comes with a VIX (Volatility Index) that climbed about +175% in 17 days. A VIX reading of 44 or higher has only been reached nine times in the last 25 years (source: Don Hays), and is normally associated with significant bounce-backs from these extreme levels of pessimism. Worth noting is the fact that the 2008-2009 period significantly deteriorated more before improving to a more normalized level.

Keys to a Good Night’s Sleep

The nature of the latest debt ceiling negotiations and associated Standard & Poor’s downgrade of the United States hurt investor psyches and did little to boost confidence in an already tepid economic recovery. Investors may have had some difficulty catching some shut-eye during the recent market turmoil, but here are some tips on how to sleep comfortably.

• Panic is Not a Strategy: Panic selling (and buying) is not a sustainable strategy, yet we saw both strategies in full force last week. Emotional decisions are never the right ones, because if they were, investing would be quite easy and everyone would live on their own personal island. Rather than panic-sell, investments should be looked at like goods in a grocery store – successful long-term investors train themselves to understand it is better to buy goods when they are on sale. As famed growth investor Peter Lynch said, “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession.”

• Long-Term is Right-Term: Everybody would like to retire at a young age, and once retired, live like royalty. Admirable goals, but both require bookoo bucks. Unless you plan on inheriting a bunch of money, or working until you reach the grave, it behooves investors to pull that money out from under the mattress and invest it wisely. Let’s face it, entitlements are going to be reduced in the future, just as inflation for food, energy, medical, leisure and other critical expenses continue eroding the value of your savings. One reason active traders justify their knee-jerk actions and derogatory description of long-term investors is based on the stagnant performance of U.S. equity markets over the last decade. Nonetheless, the vast number of these speculators fail to recognize a more than tripling in average values in markets like Brazil, India, China, and Russia over similar timeframes. Investing is a global game. If you do not have a disciplined, systematic long-term investment strategy in place, you better pray you don’t lose your job before age 70 and be prepared to eat Mac & Cheese while working as a Wal-Mart (WMT) greeter in your 80s.

• Diversification: Speaking of sleep, the boring topic of diversification often puts investors to sleep, but in periods like these, the power of diversification becomes more evident than ever. Cash, metals, and certain fixed income instruments were among the investments that cushioned the investment blow during the 2008-2009 time period. Maintaining a balanced diversified portfolio across asset classes, styles, size, and geographies is crucial for investment survival. Rebalancing your portfolio periodically will ensure this goal is achieved without taking disproportionate sized risks.

• Tailored Plan Matching Risk Tolerance: An 85 year-old wouldn’t go mountain biking on a tricycle, and a 10 year-old shouldn’t drive a bus to his fifth grade class. Sadly, in volatile times like these, many investors figure out they have an investment portfolio mismatched with their goals and risk tolerance. The average investor loves to take risk in up-markets and shed risk in down-markets (risk in this case defined as equity exposure). Regrettably, this strategy is designed exactly backwards for long-term investors. Historically, actual risk, the probability of permanent losses, is much lower during downturns; however, the perceived risk by average investors is viewed much worse. Indeed, recessions have been the absolute best times to purchase risky assets, given our 11-for-11 successful track record of escaping post World War II downturns. Could this slowdown or downturn last longer than expected and lead to more losses? Absolutely, but if you are planning for 10, 20, or 30 years, in many cases that issue is completely irrelevant – especially if you are still adding funds to your investment portfolio (i.e., dollar-cost averaging). On the flip side, if an investor is retired and entirely dependent upon an investment portfolio for income, then much less attention should be placed on risky assets like equities.

If you are having trouble sleeping, then one of two things is wrong: 1.) You are taking on too much risk and should cut your equity exposure; and/or 2.) You do not understand the risk you are taking. Volatile times like these are great for reevaluating your situation to make sure you are properly positioned to meet your financial goals. Talking heads on TV will tell you this time is different, but the truth is we have been through worse times (see History Never Repeats, but Rhymes), and lived to tell the tale. All this volatility and gloom may create anxiety and cause insomnia, but if you want to quietly sleep through the noise like a content baby, make yourself a long-term financial bed that you can comfortably sleep in during good times and bad. Focusing on the despondent headline of the day, and building a portfolio lacking diversification will only lead to panic selling/buying and results that would keep a baby up all night crying.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including emerging market ETFs) and WMT, but at the time of publishing SCM had no direct position in TNA, TZA, FAS, FAZ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Measuring Chaos

An interesting study was done by Morgan Stanley Europe, in which they looked at the last 19 bear markets and subsequent rallies. I’m not sure how much weight you can put on these results since every bear market is unique in its own right, nonetheless it provides a good frame of reference for debates.

What the Morgan Stanley team found was that the median bear market resulted in a -57% decline over 30 months and the ensuing rally equaled about +71% over 17 months. The problem is that our bear market in the U.S. was much shorter than the median timeframe despite its steepness – the fall effectively began in October 2007 and bottomed in March 2009 (about 17 months in duration). Since the decline was faster in duration, does that mean the advance will be as well? Not sure. Our current rally has lasted about six months, which implies there is about another year for the rally to continue based on this data.

As I alluded to earlier, it’s hard to compare an average to a period in which we had financial institutions dropping like flies (i.e., Bear Stearns, Lehman Brothers, WaMu, Fannie Mae, AIG, etc.) and people were hiding in caves – you knew it was really serious when it even caused voracious consumers to save money…imagine that. At the end of the day, stock and index prices eventually follow earnings. Because of the severity of this downfall, earnings came down faster than prices because fundamentals deteriorated faster than cost cutting could take place. When the economy begins to recover, the opposite will occur – businesses will not be able to hire and spend as fast as earnings are growing. It will be a nice problem to have, but nonetheless characteristic of a typical economic recovery.

In the U.S., the consumer will have a lot to say about the shape of the recovery since they account for about 2/3 of our country’s economic activity. The other “X” factor will be to what extent government legislation will have an impact on the economy. There will be opportunities available domestically and internally, but in order to survive the chaos, one needs to have a diversified and balanced global approach.

Read the Full Seeking Alpha Article Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Surviving in a Post-Merger Financial World

Over the last two years we have experienced the worst financial crisis since the Great Depression. As a result, financial institutions have come under assault from all angles, including its customers, suppliers, and regulators. And as we have watched the walls cave in on the banking and brokerage industries, we have seen a tremendous amount of consolidation. Like it or not, we need to adapt to the new environment.

The accelerated change began in early 2008 with the collapse of Bear Stearns and negotiated merger with JP Morgan Chase. Since then we saw the largest investment banking failure (Lehman Brothers), and the largest banking failure in history (Washington Mutual). Other mergers included the marriage of Merrill Lynch and Bank of America, the combination of Wachovia into Wells Fargo, and most recently the blending of Smith Barney into Morgan Stanley. These changes don’t even take into account the disruption caused by the government control of Fannie Mae, Freddie Mac, and AIG.

So what does all this change mean for consumers and investors?

1) Rise in Customer Complaints: Change is not always a good thing. Customer complaints rose 54% in 2008, and climbed 86% in the first three months of 2009 according to FINRA (Financial Industry Regulatory Authority), a nongovernmental regulator of securities companies. The main complaint is “breach of fiduciary duty,” which requires the advisor to act in the best interest of the client. Making the complaint stick can be difficult if the broker only must fulfill a “suitability” standard. To combat the suitability limitation, investors would be well served by investigating an independent Registered Investment Adviser (RIA) who has a fiduciary duty towards clients.

2) Less Competition = Higher Prices: The surviving financial institutions are now in a stronger position with the power to raise prices. Pricing can surface in various forms, including higher brokerage commissions, administrative fees, management fees, ATM fees, late fees, 12b-1 fees and more.

3) Customer Service Weakens: The profit pool has shrunk as lending has slowed and the real estate gravy train has come to a screeching halt. By cutting expenses in non-revenue generating areas, such as customer service, the financial institutions are having a difficult time servicing all their client questions and concerns. There is still fierce competition for lucrative accounts, but if you are lower on the totem pole, don’t expect extravagant service.

4) Increased Regulation: Consumer pain experienced in the financial crisis will likely lead to heightened regulation. For example, the Obama administration is proposing a consumer protection agency, but it may be years before tangible benefits will be felt by consumers. Financial institutions are doing their best to remove themselves from direct oversight by paying back government loans. In the area of financial planning, proposals have been brought to Congress to raise standards and requirements, given the limited licensing requirements. Time will tell, but changes are coming.

Investing in a Post-Merger Financial World: Take control of your financial future by getting answers from your advisor and financial institution. Get a complete list of fees. Find out if they are an independent RIA with a “fiduciary duty” to act in the client’s best interest. Research the background of the advisor through FINRA’s BrokerCheck site (www.finra.org) and the SEC’s Investment Adviser Public Disclosure Web site (www.sec.gov). Get referrals and shop around for the service you deserve. Survival in a post-merger world is difficult, but with the right plan you can be successful.

For disclosure purposes, Sidoxia Capital Management, LLC is an independent Registered Investment Advisor in California.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.