Posts tagged ‘jobs’

To Taper or Not to Taper…That is the Question?

It’s not Hamlet who is providing theatrical intrigue in the financial markets, but rather Federal Reserve Chairman Ben Bernanke. Watching Bernanke decide whether to taper or not to taper the $85 billion in monthly bond purchases (quantitative easing) is similar to viewing an emotionally volatile Shakespearean drama. The audience of investors is sitting at the edge of their seats waiting to see if incoming Fed Chief will be plagued with guilt like Lady Macbeth for her complicit money printing ways or will she score a heroic and triumphant victory for her hawkish stance on quantitative easing (QE). No need to purchase tickets at a theater box office near you, the performance is coming live to your living room as Yellen’s upcoming Senate confirmation hearings will be televised this upcoming week.

Bad News = Good News; Good News = Bad News?

In deciding whether to slowly kill QE, the Fed has been stricken with the usual stream of never-ending economic data (see current data from Barry Ritholtz). Most recently, investors have followed the script that says bad news is good news for stocks and good news is bad news. So-called pundits, strategists, and economists generally believe sluggish economic data will lead the Fed to further romance QE for a longer period, while robust data will force a poisonous death to QE via tapering.

Good News

Despite the recent, tragically-perceived government shutdown, here is the week’s positive news that may contribute to an accelerated QE stimulus tapering:

- Strong Jobs: The latest monthly employment report showed +204,000 jobs added in October, almost +100,000 more additions than economists expected. August and September job additions were also revised higher.

- GDP Surprise: 3rd quarter GDP registered in at +2.8% vs. expectations of 2%.

- IPO Dough: Twitter Inc (TWTR) achieved a lofty $25,000,000,000 initial public offering (IPO) value on its first day of trading.

- ECB Cuts Rates: The European Central Bank (ECB) lowered its key benchmark refinancing rate to a record low 0.25% level.

- Service Sector Surge: ISM non-manufacturing PMI data for October came in at 55.4 vs. 54.0 estimate.

Bad News

Here is the other side of the coin, which could assist in the delay of tapering:

- Mortgage Apps Decline: Last week the MBA mortgage application index fell -7%.

- Jobless # Revised Higher: Last week’s Initial jobless Claims were revised higher by 5,000 to 345,000.

- Investors Too Happy: The spread between Bulls & Bears is highest since April 2011 as measured by Investors Intelligence

Much Ado About Nothing

With the recent surge in the October jobs numbers, the tapering plot has thickened. But rather than a tragic death to the stock market, the inevitable taper and eventual tightening of the Fed Funds rate will likely be “Much Ado About Nothing.” How can that be?

As I have written in an article earlier this year (see 1994 Bond Repeat), the modest increase in 2013 yields (up +1.35% approximately) from the July 2012 lows pales in comparison to the +2.5% multi-period hike in the 1994 Federal Funds rate by then Fed Chairman Alan Greenspan. What’s more, inflation was a much greater risk in 1994 with GDP exceeding 4.0% and unemployment reaching a hot 5.5% level.

Given an overheated economy and job market in 1994, coupled with a hawkish Fed aggressively raising rates, the impact of these factors must have been disastrous for the stock market…right? WRONG. The S&P 500 actually finished the year essentially flat (~-1.5%) after experiencing some volatility earlier in the year, then subsequently stocks went on a tear to more than triple in value over the next five years.

To taper or not to taper may be the media question du jour, however the Fed’s ultimate decision regarding QE will most likely resemble a heroic Shakespearean finale or Much Ado About Nothing. Panicked portfolios may be in love with cash like Romeo & Juliet were with each other, but overreaction by investors to future tapering and rate hikes may result in poisonous or tragic returns.

Referenced article: 1994 Bond Repeat or 2013 Stock Defeat?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in TWTR, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page. Some Shakespeare references were sourced from Kevin D. Weaver.

Who Said Gridlock is Bad?

Living in Southern California is extraordinary, but just like anything else, there are always tradeoffs, including traffic. Living in the United States is extraordinary too, but one of the detrimental tradeoffs is political gridlock…or is it? I am just as frustrated as anybody else that the knucklehead politicians in Washington can’t get their act together (especially on bipartisan issues such as taxes/immigration/deficits, etc.), but as it turns out, gridlock has created a significant financial silver lining.

Let’s take a look at some of the positive impacts of gridlock:

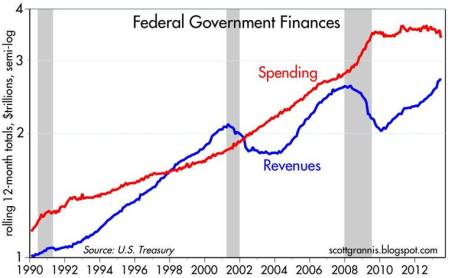

1) Federal Spending as % of GDP Declines

The demands of both Tax-and-Spend Democrats and Tea-Partier Republicans fell on deaf ears thanks to gridlock. The U.S. didn’t institute the depth of austerity that the far-right wanted, and Congress didn’t implement the additional fiscal stimulus the far-left desired. The result has been a slow but steady recovery, which has brought spending closer to historical averages.

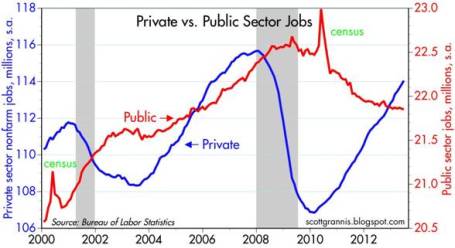

2) Private vs. Public Sector

The implementation of more responsible (or less irresponsible) government spending has freed up resources and allowed the private sector to slowly add jobs. The next wave of sequestration spending cuts may unleash some more pain on the public sector and delay overall economic recovery further, but just like dieting, we will feel much better once we have shed more debt and spending – at least as a percentage of GDP.

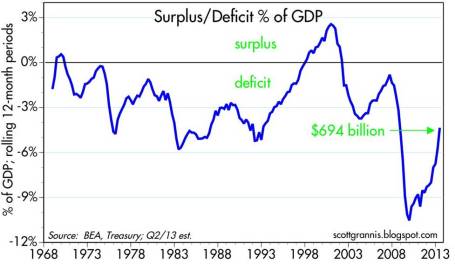

3) Deficit Reduced Significantly

The chart above is closely tied to point #1 (government spending), but as you can see, revenues have climbed significantly since 2010. I would argue plain economic cyclicality has more impact on the volatility of revenues. Blaming the current administration on the collapse or crediting them for the rebound is probably overstated. Comprehensive tax reform would likely have a lot more impact on the slope of revenues relative to the recent tax policy changes.

The same picture can be seen from a different angle, as shown above (Deficit as % of GDP). While the absolute dollar amounts are staggeringly high, as a percentage of GDP, the percentage has been chopped by more than half since the peak of the crisis.

Everyone would like to see politicians solve all of our problems, but as we have experienced, deep philosophical differences can lead to political gridlock. When it comes to our nation’s finances, gridlock may not be optimal, but you can also see that a stalemate is not always the worst outcome either. As politicians continue to scream at each other with purple faces, I will monitor the developments from my car radio while in California gridlocked traffic…sunroof open of course.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Soar and Investors Snore

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (August 1, 2013). Subscribe on the right side of the page for the complete text.

If you haven’t been paying close attention, or perhaps if you were taking a long nap, you may not have noticed that the stock market was up an astounding +5% in July (+78% if compounded annualized), pushing the S&P 500 index up +18% for the year to near all-time record highs. Wait a second…how can that be when that bald and grey-bearded man at the Federal Reserve has hinted at bond purchase “tapering” (see also Fed Fatigue)? What’s more, I thought the moronic politicians were clueless about our debt and deficit-laden economy, jobless recovery, imploding eurozone, Chinese real estate bubble, and impending explosion of inflation – all of which are expected to sink our grandchildren’s grandchildren into a standard of living not seen since the Great Depression. Okay, well a dash of hyperbole and sarcasm never hurt anybody.

This incessant stream of doom-and-gloom pouring over our TVs, newspapers, and internet devices has numbed Americans’ psyches. To prove my point, the next time you are talking to somebody at the water cooler, church, soccer game, or happy hour, gauge how excited your co-worker, friend, or acquaintance gets when you bring up the subject of the stock market. If my suspicions are correct, they are more likely to yawn or pass out from boredom than to scream in excitement or do cartwheels.

You don’t believe me? Reality dictates the wounds from the 2008-2009 financial crisis are still healing. Panic and fear may have disappeared, but skepticism remains in full gear, even though stocks have more than doubled in price in recent years. Here is some data to support my case there are more stock detractors than defenders:

Record Savings Deposits

|

| Source: Calafia Beach Pundit |

Although there are no signs of an impending recession, defensive cash hoarded in savings deposits has almost increased by $3 trillion since the end of the financial crisis.

Blah Consumer Confidence

|

| Source: Calafia Beach Pundit |

As you can see from the chart above, Consumer Confidence has bounced around quite a bit over the last 30+ years, but there is no sign that consumer sentiment has turned euphoric.

15-Year Low Stock Market Participation

|

|

Source: Gallup Poll

|

There has been a trickling of funds into stocks in 2013, yet participation in the stock market is at a 15-year low. Investors remain nervous.

Lack of Equity Fund Buying

|

| Source: ICI & Calafia Beach Pundit |

After a short lived tax-driven purchase spike in January, the buying trend quickly turned negative in the ensuing months. Modest inflows resumed into equity funds during the first few weeks of July (source: ICI), but the meager stock fund investments represent < 95% of 2012 positive bond flows ($15 billion < $304 billion, respectively). Moreover, these modest stock inflows pale in comparison to the hundreds of billions in investor withdrawals since 2008. See also Fund Flows Paradox – Investing Caffeine.

Decline in CNBC Viewership

In spite of the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (source: Value Walk). Stock investing apparently isn’t very exciting when prices go up.

The Hater’s Index:

And if that is not enough, you can take a field trip to the hater’s comment section of my most recent written Seeking Alpha article, The Most Hated Bull Market Ever. Apparently the stock market more than doubling creates some hostile feelings.

JOLLY & JOVIAL MEMO

Keeping the previous objective and subjective data points in mind, it’s clear to me the doom-and-gloom memo has been adequately distributed to the masses. Less clear, however, is the dissemination success of the jolly-and-jovial memo. I think Ron Bailey, an author and science journalist at Reason.com (VIDEO), said it best, “News is always bad news. Good news is simply not news…that is our [human] bias.” If you turn on your local TV news, I think you may agree with Ron. Nevertheless, there are actually plenty of happier news items to report, so here are some positive bullet points to my economic and stock market memo:

16th Consecutive Positive GDP Quarter*

|

| Source: Quartz.com |

The broadest measure of economic activity, GDP (Gross Domestic Product), was reported yesterday and came in better than expected in Q2 (+1.7%) for the 16th straight positive reported quarter (*Q1-2011 was just revised to fractionally negative). Obviously, the economists and dooms-dayers who repeatedly called for a double-dip recession were wrong.

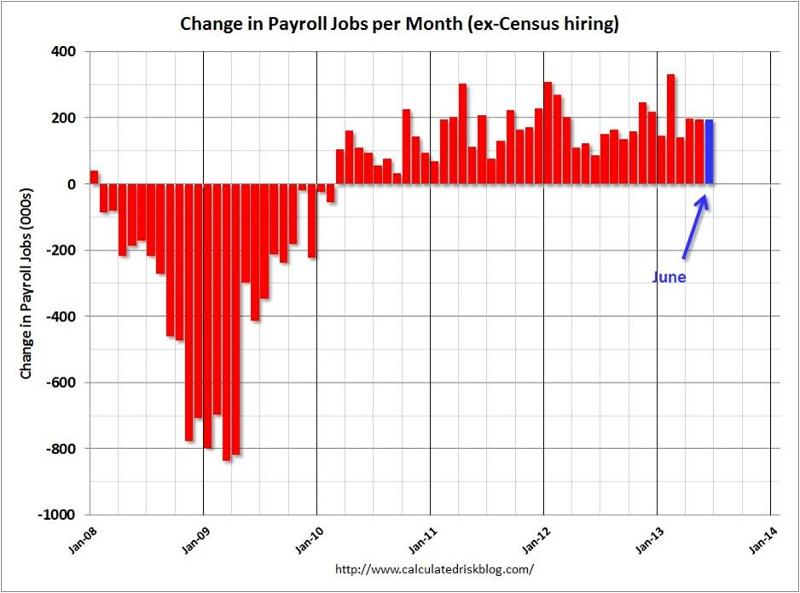

40 Consecutive Months & 7 Million Jobs

Source: Calculated Risk

The economic recovery has been painfully slow, but nevertheless, the U.S. has experienced 40 consecutive months of private sector job additions, representing +7.2 million jobs created. With about -9 million jobs lost during the most recent recession, there is still plenty of room for improvement. We will find out if the positive job creation streak will continue this Friday when the July total non-farm payroll report is released.

Housing on the Mend

|

| Source: Calafia Beach Pundit |

New home sales are up significantly from the lows; housing starts have risen about 40% over the last two years; and Case Shiller home prices rose by +12.2% in the latest reported numbers. The housing market foundation is firming.

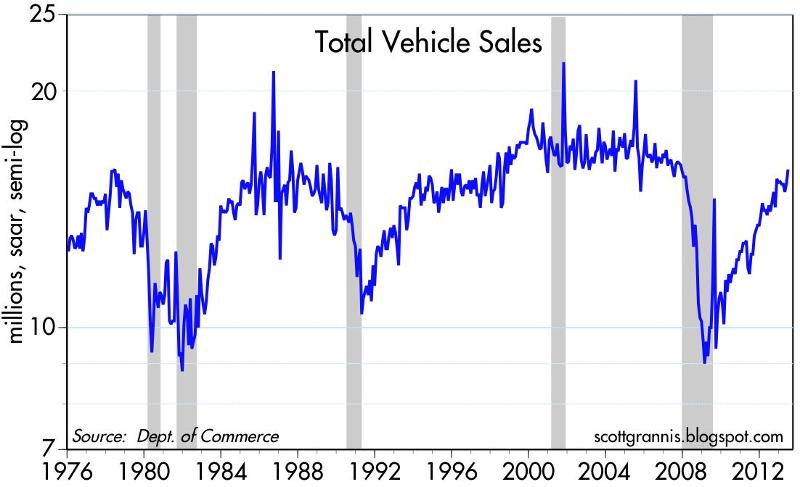

Auto Sales Rebound

|

| Source: Calafia Beach Pundit |

Auto sales remain on a tear, reaching an annualized level of 15.9 million vehicles, the highest since November 2007, and up +12% from June 2012. Car sales have almost reached pre-recessionary levels.

Record Corporate Profits

|

| Source: Dr. Ed’s Blog |

Optimistic forecasts have been ratcheted down, nonetheless corporate profits continue to grind to all-time record highs. As you can see, operating earnings have more than doubled since 2003. Given reasonable historical valuations in stocks, as measured by the P/E (Price Earnings) ratio, persistent profit growth should augur well for stock prices.

Bad Banks Bounce Back

Europe on the Comeback Trail

|

| Source: Calafia Beach Pundit |

There are signs of improvement in the Eurozone after years of recession. Talks of a European Armageddon have recently abated, in part because of Markit manufacturing manager purchasing statistics that are signaling expansion for the first time in two years.

Overall, corporations are achieving record profits and sitting on mountains of cash. The economy is continuing on a broad, steady recovery, however investors remain skeptical. Domestic stocks are at historic levels, but buying stocks solely because they are going up is never the right reason to invest. Alternatively, bunkering away excessive cash in useless, inflation depreciating assets is not the best strategy either. If nervousness and/or anxiety are driving your investment strategy, then perhaps now is the time to create a long-term plan to secure your financial future. However, if your goal is to soak up the endless doom-and-gloom and watch your money melt away to inflation, then perhaps you are better off just taking another nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Jobs and the DMV Economy

If you have ever gone to get your driver’s license at the Department of Motor Vehicles (DMV)…you may still be waiting in line? It’s a painful but often a mandatory process, and in many ways the experience feels a lot like the economic recovery we currently have been living through over the last four years. Steady progress is being made, but in general, people hardly notice the economy moving forward.

My geographic neighbor and blogger here in Orange County, California (Bill McBride – Calculated Risk) has some excellent visuals that compare our sluggish DMV economy with previous economic cycles dating back to 1948:

As you can see from the chart above, the current economic recovery (red-line), as measured by job losses, is the slowest comeback in more than a half-century. Basically, over a two year period, the U.S. lost about nine million jobs, and during the following three years the economy regained approximately seven million of those jobs – still digging out of the hole. Last Friday’s June jobs report was welcomed, as it showed net jobs of +195,000 were added during the month, and importantly the previous two months were revised higher by another +70,000 jobs. These data points combined with last month’s Fed’s QE3 tapering comments by Ben Bernanke help explain why the continued rout in 10 year Treasury rates has continued in recent weeks, propelling the benchmark rate to 2.71% – almost double the 1.39% rate hit last year amidst continued European financial market concerns.

As with most recessions or crashes, the bursting of the bubble (i.e., damage) occurs much faster than the inflation (i.e., recovery), and McBride’s time series clearly shows this fact:

While pessimists point to the anemic pace of the current recovery, the glass half-full people (myself included) appreciate that the sluggish rebound is likely to last longer than prior recoveries. There are two other key dynamics underlying the reported employment figures:

- Continued Contraction in Government Workers: Excessive government debt and deficits have led to continued job losses – state and local job losses appear to be stabilizing but federal cuts are ongoing.

- Decline in the Labor Force Participation Rate: Discouraged workers and aging Baby Boomer demographics have artificially lowered the short-term unemployment figures because fewer people are looking for work. If economic expansion accelerates, the participation contraction trend is likely to reverse.

Skepticism Reigns Supreme

Regardless of the jobs picture and multi-year expansion, investors and business managers alike remain skeptical about the sustainability of the economic recovery. Anecdotally I encounter this sentiment every day, but there are other data points that bolster my assertion. Despite the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (see Value Walk) and investments in the stock market are the lowest in 15 years (see Gallup poll chart below):

Why such skepticism? Academic research in behavioral finance highlights innate flaws in human decision-making processes. For example, humans on average weigh losses twice as much as gains as economist and Nobel prizewinner Daniel Kahneman explains in his book Thinking Fast and Slow (see Investing Caffeine article: Decision Making on Freeways and in Parking Lots). Stated differently, the losses from 2008-2009 are still too fresh in the minds of Americans. Until the losses are forgotten, and/or the regret of missing gains becomes too strong, many investors and managers will fearfully remain on the sideline.

The speed of our economic recovery is as excruciatingly agonizing, and so is waiting in line at the DMV. The act of waiting can be horrific, but obtaining a driver’s license is required for driving and investing is necessary for retirement. If you don’t want to go to investing jail, then you better get in the investing line now before job growth accelerates, because you don’t want to be sent to the back of the line where you will have to wait longer.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

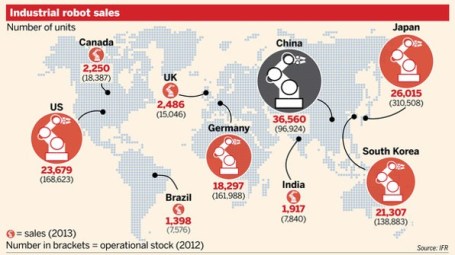

Robotic Chain Saw Replaces Paul Bunyan

The world is rapidly changing and so is the profile of jobs. Technology is advancing at an accelerating pace, and this is having enormous impacts on the look, feel, and shape of global workforce dynamics. If lumberjack Paul Bunyan and his blue ox Babe were alive today, the giant would not be chopping down trees with a plain old steel axe, but more likely Mr. Bunyan would be using a 20 inch, 8 horse-power chain saw with side-mounted tensioner purchased from ChainSawsDirect.com.

But productivity in logging is not the only industry in which output has dramatically increased over the last generation. A recent New York Times article published by John Markoff explores how robots and automation are displacing humans across many different companies and industries around the world.

In China, manufacturers have exploited the value of cheap labor in the name of low-priced exports, but with millions of workers now moving to job-filled cities, workers are now demanding higher wages and better working conditions. Besides rising wages, higher transportation costs have eaten away labor expense advantages too. One way of getting around the issues of labor costs, labor relations, and transportations costs is to integrate robots into your workplace. A robot won’t ask for a raise; it always shows up on time; you don’t have to pay for its healthcare; it can work 24/7/365 days per year; it doesn’t belong to a union; dependable quality consistency is a given; it produces products near your customers; and it won’t sue you for discrimination or sexual harassment. The initial costs of a robot may be costlier than hiring a human being by a factor of five times an annual salary, but that hasn’t stopped companies everywhere from integrating robots into their operations.

The Orange Box on Wheels

One incredible example of robot usage (not covered by Markoff) is epitomized through Amazon.com Inc.’s (AMZN) $750 million acquisition of Kiva Systems Inc. last year. In some cases, Kiva uses hundreds of autonomous mobile robots in a warehouse to create a freeway-like effect of ecommerce fulfillment that can increase worker productivity four-fold. Amazon is a true believer of the technology as evidenced by the use of Kiva robots in two of its major websites, shoe-retailer Zappos.com and baby-products site Diapers.com, but Kiva’s robots have also been used by other major retailers including Crate & Barrel, Staples Inc (SPLS), and Gap Inc (GPS). The orange square robots on wheels, which can cost in the range of $2 – $20 million per system, travel around a warehouse tracking the desired items and bring them back to a warehouse worker, ready to then be packed and shipped to a customer. Larger warehouses can use up to 1,000 of the Kiva robots. To see how this organized chaos works, check out the video below to see the swarm of orange machines dancing around the warehouse floor.

The Next Chapter

The auto and electronics industry have historically been the heaviest users of robots and automation, but those dynamics are changing. Healthcare, food, aviation, and other general industries are jumping on the bandwagon. And these trends are not just happening in developed markets, but rather emerging markets are leading the charge – even if penetration rates are lower there than in the richer countries. The robotic usage growth is rapid in emerging markets, but the penetration of robotic density per 10,000 workers in China, Brazil and India is less than 10% of that in Japan and Germany (< 20% penetration of the U.S.), according to IFR World Robotics. As a matter of fact, IFR is forecasting that China will be the top robot market by 2014.

What does this mean for jobs? Not great news if you are a low-skilled worker. Take Foxconn, the company that manufactures and assembles those nifty Apple iPhones (AAPL) that are selling by the millions and generating billions in profits. The harsh working conditions in these so-called massive sweatshops have resulted in suicides and high profile worker backlashes. Related to these issues, Foxconn dealt with at least 17 suicides over a five year period. What is Foxconn’s response? Well, besides attempting to respond to worker grievances, Foxconn chairman Terry Gou announced plans to produce 1 million robots in three years , which will replace about 500,000 jobs….ouch!

As the New York Times points out, the “Rise of Machines” is not about to result in Terminator-like robots taking over the world anytime soon:

“Even though blue-collar jobs will be lost, more efficient manufacturing will create skilled jobs in designing, operating and servicing the assembly lines, as well as significant numbers of other kinds of jobs in the communities where factories are.”

Many companies see this trend accelerating and are investing aggressively to profit from the robotic automation and productivity benefits. In today’s day and age, Paul Bunyan would have surely taken advantage of these trends, just as I plan to through Sidoxia Capital Management’s opportunistic investments in the robotic sector.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), AMZN, and AAPL, but at the time of publishing SCM had no direct positions in Foxconn/Hon Hai, Crate & Barrel, SPLS, GPS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Private Equity: Parasite or Pollinator?

In the wild, there exist both parasitic and symbiotic relationships. In the case of blood thirsty ticks that feed off deer, this parasitic relationship differs from the symbiotic association of nectar-sucking bees and pollen-hungry flowers. These are merely a few examples, but suffice it to say, these same intricate interactions occur in the business world as well.

Our economy is a complex jungle of relationships, spanning governments, businesses, consumers, investors, and many intermediaries, including private equity (PE) firms. With the November election rapidly approaching, more attention is being placed on how private equity firms fit into the economic food chain. Figuring out whether PE firms are more like profit-sucking parasites or constructive job creating mechanisms has moved to the forefront, especially given presidential candidate Mitt Romney’s past ties to Bain Capital, a successful private equity firm he founded in 1984.

Currently it is politically advantageous to portray PE professionals as greedy, job-cutting outsourcers – I’m still waiting for the political ad showing a PE worker clubbing a baby seal or plucking the legs off of a Daddy Long Legs spider. While I’d freely admit a PE pro can be just as gluttonous as an investment banker, hedge fund manager, or venture capitalist, simplistic characterizations like these miss the beneficial effects these firms provide to the overall economy. Capitalism is the spine that holds our economy together and has allowed us to grow into the greatest superpower on the planet. Private equity is but a small part of our capitalistic ecosystem, but plays a valuable role nonetheless.

While there are many perspectives on the role of private equity in our economy, here are my views on a few of the hot button issues:

Job Creation: Although I believe PE firms are valuable to our economy, I think it is a little disingenuous of Romney and his supporters to say Bain was a net “job creator” to the tune of 100,000+ jobs during his tenure. The fact of the matter is PE firms’ priority is to create profitable returns for its investors, and if that requires axing heads, then so be it – most PE firms have no qualms doing precisely that. Romney et al point to successes like Staples Inc. (SPLS), Dominos Pizza Inc. (DPZ) and Sports Authority, Inc., where profitability and success ultimately led to job expansion. From my viewpoint, I believe these examples are more the exception than the rule. Not surprisingly, any job losses executed in the early years of a PE deal will eventually require job additions if the company survives and thrives. Let’s face it, no company can cut its way to prosperity in perpetuity.

Competitveness: Weak, deteriorating, or bankrupt companies cannot and will not hire. Frail or mismanaged companies will sooner or later be forced to cut jobs on their own –the same protocol applied by opportunistic PE vultures swarming around. While PE firms typically focus on bloated or ineffective companies, I think the media outlets overemphasize the cost-cutting aspects of these deals. Sure, PE companies cut jobs, outsource functions, and cut benefits in the name of profits, but that alone is not a sustainable strategy. Trimming fat, by replacing complacent management teams, investing in modern software/equipment, expanding markets, and implementing accountability are all paramount factors in making these target companies more efficient and competitive in the long-run.

Financial Markets-Arbiter: At the end of the day, I think the IPO/financial markets are the final arbiters of how much value PE firms create, not only for investors, but also for the economy overall. If greedy PE firms’ sole functions were to saddle companies with massive debts, cut heads off, and then pay themselves enormous dividends, then there would never be a credible exit strategy for investors to cash out. If PE firms are correctly performing their jobs, then they will profitably create leaner more efficient durable companies that will be able to grow earnings and create jobs over the long-term. If they are unsuccessful in this broad goal, then the PE firm will never be able to profitably exit their investment via a corporate sale or public offering.

Bain Banter: Whether you agree with PE business practices or not, it is difficult to argue with the financial success of Bain Capital. According to a Wall Street Journal article, Bain Capital deals between 1984 – 1999 produced the following results:

“Bain produced about $2.5 billion in gains for its investors in the 77 deals, on about $1.1 billion invested. Overall, Bain recorded roughly 50% to 80% annual gains in this period, which experts said was among the best track records for buyout firms in that era.”

Critics are quick to point out the profits sucked up by PE firms, but they neglect to acknowledge the financial benefits that accrue to the large number of pension fund, charity, and university investors. Millions of middle-class American workers, retirees, community members, teachers, and students are participating in those same blood sucking profits that PE executives are slurping down.

Even though I believe private equity is a net-positive contributor to competiveness and economic growth in recent decades, there is no question in my mind that these firms participated in a massive bubble in the 2005-2007 timeframe. Capital was so cheap and abundant, prices on these deals escalated through the roof. What’s more, the excessive amounts of leverage used in those transactions set these deals up for imminent failure. PE firms and their investors have lost their shirts on many of those deals, and the typical 20%+ historical returns earned by this asset class have become long lost memories. Attractive returns do not come without risk.

With the presidential election rhetoric heating up, the media will continue to politicize, demonize and oversimplify the challenges surrounding this asset class. Despite its shortcomings, private equity will continue to have a positive symbiotic relationship with the economy…rather than a parasitic one.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in SPLS, DPZ, Sports authority, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Darwin Meets Capitalism & Private Equity

A rising discontent is spreading like wildfire in the wake of a massive financial crisis that erupted in the U.S. during 2008, and is now working its way through Europe. Irresponsible governments across the globe succumbed to the deceptive allure of leverage, and as a result racked up colossal debts and gargantuan deficits. Now governments everywhere are toggling between political gridlock and painful austerity. Citizens are feeling the pain through high unemployment, exploding education costs, crumbling social safety nets, and a general decline in the standard of living.

As a result of these dramatic changes, the contributions of capitalism are being questioned by many, whether it’s the Occupy Wall Street movement attack on the top 1%, or more recently the assault on private equity’s relevancy for a presidential candidate.

Although the media may prefer to sensationalize economic stories and tell observers, “This time is different” to boost viewership, usually the truth relies more on the nuanced evolution of issues over time. If Charles Darwin were alive today, he would understand that capitalism and democracies are evolving to massive changes in globalization, technology, and emerging markets. Darwin would appreciate the fact that capitalism can’t and won’t change overnight. Whether capitalism ultimately survives or goes extinct depends on how it adapts. Or as Darwin characterizes evolution:

It is not the strongest of the species that survives, nor the most intelligent, but the most responsive to change.

Will Capitalism Survive?

Capitalism and democracy fit like a hand in a glove, which explains why both have thrived for generations. Never mind that democracies have been around for centuries and their expansion continues unabated (see Spreading the Seeds of Democracy), nevertheless pundits feel compelled to question the sustainability of these institutions.

I guess the real response to all those experts who question the merits of capitalism is what alternative would serve us better? Would it be Socialism like we see grinding Europe to a halt? Or perhaps Communism working its wonders in North Korea and Cuba? If not that, then surely the Autocracies in Egypt and Libya are the winning formulas? The Occupy Wall Streeters may not be happy with their personal plight or the top 1%, but I don’t see them packing their bags for Greece, the Middle East or China.

There is arguably a growing disparity between rich and poor and the game of globalization is only making it more difficult for rising tides of growth to lift up our middle class. The beauty of capitalism is that money goes where it is treated best. Capitalism sucks money to the areas of the world that are the freest, most open, transparent, and practice the rule of law. Some of these components of American capitalism unquestionably eroded over the last decade or so, but the good thing is that in a democracy, citizens have the right to vote and elect growth-promoting leaders to fix problems. Growth comes from competitiveness, and competitiveness is derived from education, innovation, and pro-growth policies. Let’s hope the 2012 elections get agents of change in office.

Darwin & Private Equity

Republican Presidential primary candidate Mitt Romney has been raked over the coals for his prior professional career at private equity firm, Bain Capital. I’m convinced Charles Darwin would see private equity’s involvement as a critical factor in the process of global commerce. Businesses are like species, and only the fittest will survive.

Private equity firms prey upon weak businesses, looking to restructure and reorganize them to become more competitive. If private equity companies are bullies, then their business targets can be considered weaklings. Beating wimps into shape may not be fun to watch, but is a crucial evolutionary aspect of business. The fact of the matter is that deteriorating, uncompetitive companies cannot hire employees…only profitable, viable entities can createsustainable jobs. So our public policy officials have two choices:

• Prop up uncompetitive businesses inefficiently with tax dollars that save jobs in the short-run, but lead to bankruptcy and massive job losses in the future. Other unproductive tariffs and bailouts may garner short-term political votes, but only lead to long-term stagnancy.

OR

• Trim fat, restructure and reorganize now – similar to the swift pain experienced from extracting a rotted tooth. Jobs may be cut in the short-run, but a long-term competitively positioned company will be able to grow and create sustainable long-term jobs.

I can’t say I agree with all of private equity practices, such as leveraged recapitalizations – the practice in which private equity companies load up the target with debt so big fat dividends can be sucked out by the principals. But guess what? By doing so the principals are only reducing their own future exit value through a potential IPO (Initial Public Offering) or company sale. Moreover, if this is such an evil practice, lenders can curb the practice by simply not giving the private equity companies the needed borrowing capacity.

Capitalism and its private equity subset have gotten quite a bad rap lately, but I believe these forces are essential aspects for the rising standards of living for billions of people across the planet. When first introduced, Charles Darwin’s theory of evolution by natural selection was critically examined by many non-believers. Although capitalism will be forced to adapt to an ever-changing world and its merits have been questioned too, the chances of capitalism going extinct are about as likely as the extinction of Darwin’s evolutionary theory.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Magical Growth through Manufacturing Decline

In a data driven world, we can never get enough numbers. The market magicians and the media machines have no problem overhyping or overselling the importance of each pending data-point. With a quick economic sleight of hand, the industry pundits have converted the average investor into a frothing Pavlovian dog, begging for another market shaking statistic. One of the supposed earth-rattling data points is the monthly ISM Manufacturing Index figure, but the release of the ISM number alone isn’t enough for the audience. The real fun comes in determining whether the monthly number registers above or below a schizophrenic 50 level – a number above 50 indicates the manufacturing economy is generally expanding (August came in at 50.6).

The trick can often be surprising, but more surprising to me is the importance placed on this relatively small, disappearing segment of our economy. With the manufacturing sector now accounting for just 11-13% of GDP (see also Manufacturing – Losing Out?), shouldn’t we be focusing more on the “Services” sector of the economy, which accounts for roughly 75% of our country’s output, up from 62% in 1971 (source: Earthtrends). I believe economist Mark Perry at Carpe Diem captured this phenomenon best in his post from earlier this year (Decline of Manufacturing – The World is Much Better Off ):

The fact of the matter is that manufacturing has been declining as a percentage of GDP over the decades just as the broader economy has seen massive growth. While manufacturing got chopped in half, as a percentage of GDP, from 1970 to 2011 we have seen GDP balloon from about $1 trillion to $15 trillion. If manufacturing declined by another 50% of GDP, I’d do cartwheels to see another 15x increase in economic expansion. I acknowledge the existence of certain synergies between product development and product manufacturing, but these benefits must be weighed against higher domestic costs that could make sales potentially unviable.

The fact of the matter is that manufacturing has been declining as a percentage of GDP over the decades just as the broader economy has seen massive growth. While manufacturing got chopped in half, as a percentage of GDP, from 1970 to 2011 we have seen GDP balloon from about $1 trillion to $15 trillion. If manufacturing declined by another 50% of GDP, I’d do cartwheels to see another 15x increase in economic expansion. I acknowledge the existence of certain synergies between product development and product manufacturing, but these benefits must be weighed against higher domestic costs that could make sales potentially unviable.

Déjà Vu All Over Again

This isn’t the first time in our country’s history that we’ve experienced explosive economic growth as legacy segments of the economy decline in relative importance. Consider the share of jobs agriculture controlled in the early 1800s – a whopping 90% of jobs were tied to farms (see chart below). Today, that percentage is less than 2% in the wake of the U.S. becoming the 20th Century global superpower. History has taught us that technology can be a bitch on employment, as robots, machinery, processes, and chemistry replace the demand for human labor. As Perry points out, there is no doubt that “tractors, electricity, combines, the cotton gin, automatic milking machinery, computers, GPS, hybrid seeds, irrigation systems, herbicides, pesticides” replaced millions of farming jobs, but guess what…American ingenuity ruled the day. As it turns out, those economic resources freed up by technology and productivity were redeployed into new, expanding, job-fertile areas of the economy like, “manufacturing, health care, education, business, retail, computers, transportation, etc.”

More Apples or More GMs?

The farming lobby still cries for its inefficient, growth-muffling subsidies today, but many unproductive, unionized domestic manufacturing industries are also screaming for government assistance because cheap foreign labor and new technologies are stealing manufacturing jobs by the boatloads. So at the core, the real question is do we want government and investments supporting more companies like Apple Inc. (AAPL) or more companies like General Motors Company (GM)?

As you may know, by flipping over an iPhone, any observer can clearly notice the product is “designed by Apple in California – assembled in China.” It is clear that Apple and its customers value brains over manufacturing brawn. At $371 billion and the most valuable publicly traded stock in the universe, Apple is dominating the electronics world, all the while hiring employees by the thousands. These facts beg the question of whether Apple should revamp their manufacturing supply-chain back to the U.S. to save more domestic jobs? Of course the result of a manufacturing strategy shift to a higher cost region would make Apple less competitive, force them to charge consumers higher prices for Apple products, and open the door for competitors to freely steal market share? Would this strategy create more incremental jobs, or fewer jobs? I think I’ll side with the Steve Jobs philosophy of business, which says “more profitable businesses must fill more job openings.”

If this Apple case study isn’t illustrative enough for you, maybe you should take a look at companies like GM. The U.S. automobile industry has historically been notoriously mismanaged, thanks to a horrific manufacturing cost structure, anchored by unsustainable pension and healthcare costs. Should investors be surprised that an uncompetitive, bloated cost structure leaves companies like GM less money to invest in new products and innovation? This irrational cost management contributed to decades of market share losses to foreigners. If I’m the job creation czar in the U.S., I think I’ll choose the Apple path to job creation over GM’s route.

Global Competitiveness = Jobs

With a 9.1% unemployment rate and the recent introduction of the American Jobs Act, there has been plenty of emphasis and focus on job creation. At the end of the day, what will create durable, long-term job creation is innovative, competitively priced products and services that can be sold domestically and abroad. How do we achieve this goal? We need an education system that can teach and train a workforce sufficiently to meet the discerning tastes of a global marketplace. Government, on the other hand, needs to support (not direct) the private sector by investing in strategic areas to help global competitiveness (i.e., education, energy independence, basic research, infrastructure, entrepreneurial capital for business formation, etc.), while facilitating a business environment that incentivizes growth.

Regardless of the policy mixtures, the common denominator needs to be focused on improving global competitiveness. Excessive focus on a declining manufacturing sector and the monthly ISM data will only distract decision makers from the core issues. If the economic magician’s sleight of hand diverts investor attention for too long, we may see more jobs disappear.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and AAPL, but at the time of publishing SCM had no direct position in GM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page

Short Arms, Deep Pockets

Companies have deep pockets flush with cash, but are plagued with short arms, unwilling to reach into their wallets to make substantive new hires. I have talked about “unemployment hypochondria” in the past but is this cautious behavior rational?

The short answer is yes, and it is very typical in light of the similar “jobless recoveries” we experienced in 1991 and 2001. After suffering the worst financial crisis in a generation, employers’ wounds are still not completely healed and the frightening memories of 2008-2009 are still fresh in their minds.

Linchpin Labor

The globalization cat is out of the bag, and technology is only accelerating the commoditization of labor. When labor can be purchased for $1 per hour in China or $.50 per hour in India , and in many instances no strategic benefit lost, then why are so many people surprised about the hemorrhaging of $25 per hour manufacturing jobs to cheaper locales? Agriculture and related industries used to account for more than 90% of our economy about 150 years ago – today agriculture makes up about 2% of our economic output. Even though this dominating sector withered away on a relative basis, the United States became the global powerhouse innovator of the 20th century.

Innovative companies understand that true value is created by those workers who make themselves indispensable – or what Seth Godin calls “Linchpins.” Apple Inc. (AAPL) understands these trends. If you don’t believe me, just flip over an iPhone and read where it clearly states, “Designed by Apple in California. Assembled in China.” (see BELOW).

We are falling further behind our global brethren in math and science, and our immigration policy is all backwards (Keys to Success). Education, creativity, ingenuity, and entrepreneurial spirit are the main ingredients necessary to climb the labor food chain. For those workers that make themselves linchpins, their services will be in demand during good times and bad times.

Jobs = Heavy Hiking Boots

Like scared hikers jettisoning heavy hiking boots to escape a pursuing grizzly bear, business owners will eventually need to purchase a new pair of boots, if they want to hike the mountain to face the next challenge. Right now, businesses are content waiting it out, more worried about the potential of a bear jumping out to devour them.

Although businesses may not be plunging into hiring a substantial number of new workers, positive leading indicators are becoming more apparent. Beyond the obvious improvement in the explicit job numbers (e.g., nine consecutive months of private job creation), other factors such as increased temporary workers, accelerating job listings, and increased capital expenditures are the precursors to sustained job hiring.

Quarterly Capital Carrots

Capital expenditures generally lead to more immediate productivity improvements and do not have a complete negative and immediate impact on the sacred EPS (earnings per share) and income statement metrics. On the other hand, hiring a new employee has an instant depressing effect on expenses, thereby dragging down the beloved EPS figure. What’s more, new employees do not typically become productive or sales generative for months. If you consider the heavy explicit wages coupled with implicit training costs, until the coast is clear and confidence overcomes fear, businesses are not going to dip their hands into their cash-filled pockets to hire workers willy-nilly.

As previously mentioned, improved business confidence is being signaled by increased capital spending. Just over the last week, investors have witnessed significantly expanded capital expenditures across a broad array of industries. Here are a few random samplings:

September 2010 – Quarterly Capital Expenditures

Q3 – 2010 Q3 – 2009 YOY%

Apple Inc. (AAPL) $760 mil vs. $459 mil +66%

Halliburton Company (HAL) $557 mil vs. $440 mil +27%

Coca Cola Company (KO) $442 mil vs. $419 mil +5%

Dominos Pizza Inc. (DPZ) $5.2 mil vs. $4.1 mil +26%

Intel Corp. (INTC) $1.4 bill vs $944 mil +44%

Although the pace of the recovery is losing steam, companies’ health persists to strengthen, as evidenced in part by the +45% growth in 2010 S&P 500 profits, swelling record cash piles, and increasing corporate confidence (rising capital expenditures). Despite these positive leading indicators, business owners are reluctant to dip their short arms into their deep cash-filled pockets to hire new employees. Given our experience over the last few decades this corporate behavior is perfectly consistent with recent jobless recoveries. Until its clear the economic bear is hibernating, businesses will continue building their cash warchests. Everyone will be happier once we are done running from bears, and instead chasing bulls.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, but at the time of publishing SCM had no direct position in HAL, KO, DPZ, INTC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.