Posts tagged ‘investors’

Investors Ponder Stimulus Size as Rates Rise

Stock prices rose again last month in part based on passage optimism of a government stimulus package (currently proposed at $1.9 trillion). But the rise happened before stock prices took a breather during the last couple of weeks, especially in hot growth sectors like the technology-heavy QQQ exchange traded fund, which fell modestly by -0.1% in February. As some blistering areas cooled off, investors decided to shift more dollars into the value segment of the stock market (e.g., the Russell 1000 Value index soared +6% last month). Over the same period, the S&P 500 and Dow Jones Industrial Average indexes climbed +2.6% and +3.2%, respectively.

What was the trigger for the late-month sell-off? Many so-called pundits point to a short-term rise in interest rates. While investor anxiety heightened significantly at the end of the month, the S&P 500 dropped a mere -3.5% from all-time record highs after a slingshot jump of +73.9% from the March 2020 lows.

Do Rising Interest Rates = Stock Price Declines?

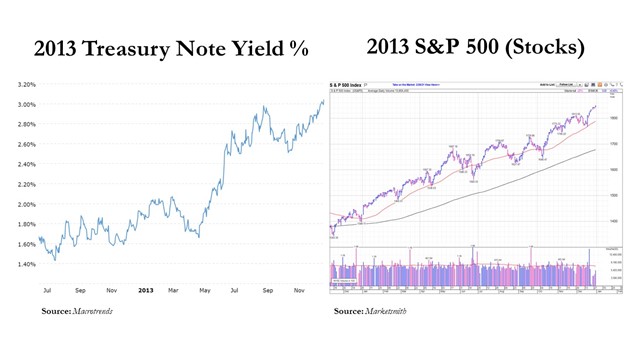

Conventional wisdom dictates that as interest rates rise, stock prices must fall because higher rates are expected to pump the breaks on economic activity and higher yielding fixed income investments will serve as better alternatives to investing in stocks. Untrue. There are periods of time when stock prices move higher even though interest rates also move higher

Take 2013 for example – the yield on the benchmark 10-Year Treasury Note climbed from +1.8% to 3.0%, while the S&P 500 index catapulted +29.6% higher (see charts below).

Similarly to now, during 1994 we were still in a multi-decade, down-trending interest rate environment. However, from the beginning of 1994 to the middle of 1995 the Federal Reserve hiked the Federal Funds interest rate target from 3% to 6% (and the 10-Year Treasury yield temporarily climbed from about 6% to 8%), yet stock prices still managed to ascend +17% over that 18-month period. The point being, although rising interest rates are generally bad for asset price appreciation, there are periods of time when stock prices can move higher in synchronization with interest rates.

What’s the Fuss about Stimulus?

One of the factors keeping the stock market afloat near record highs is the prospect of the federal government passing a COVID stimulus package to keep the economic recovery continuing. Even though there is a new administration in the White House, Democrats hold a very narrow majority of seats in Congress, leaving a razor thin margin to pass legislation. This means President Biden needs to keep moderate Democrats like Joe Manchin in check, and/or recruit some Republicans to jump on board to pass his $1.9 trillion COVID stimulus plan. If the bill is passed as proposed, “The relief plan would enhance and extend jobless benefits, provide $350 billion to state and local governments, send $1,400 to many Americans and fund vaccine distribution, among other measures,” according to the Wall Street Journal.

Valuable Vaccines

Fresh off the press, we just received additional good news on the COVID vaccine front. The U.S. Food and Drug Administration (FDA) approved the third vaccine for COVID-19 by Johnson & Johnson (JNJ). This J&J treatment is also the first single-dose vaccine to be distributed, unlike the other two vaccines manufactured by Pfizer Inc. (PFE) and Moderna Inc. (MRNA), which both require two shots. Johnson & Johnson expects to ship four million doses immediately and 20 million doses by the end of March.

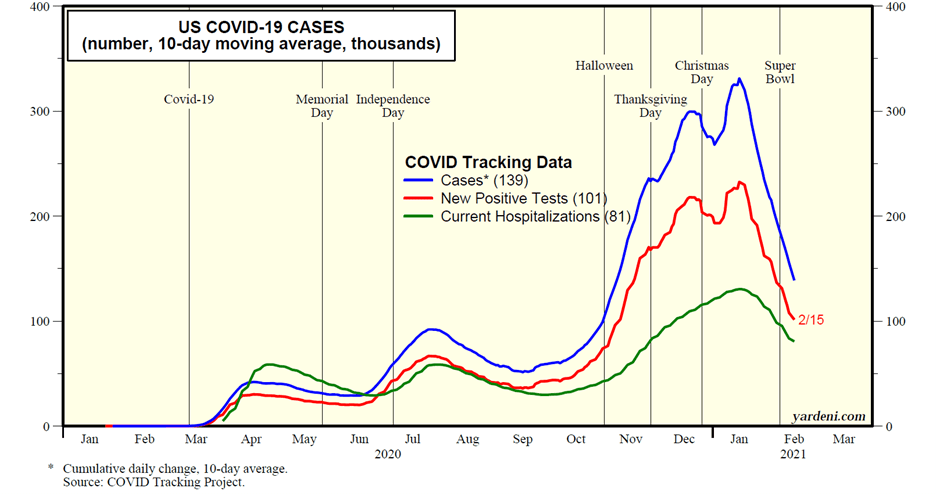

So far, over 50 million doses of the COVID vaccines have been administered, and the White House believes they can go from currently about 1.5 million injections per day to approximately 4 million people per day by the end of March. The combination of the vaccines, mitigation behavior, and a slow march towards herd immunity have resulted in encouraging COVID trends, as you can see from the chart below. However, the bad news is new COVID cases, hospitalizations, and deaths still remain above peak levels experienced last spring and summer.

Revived Recovery

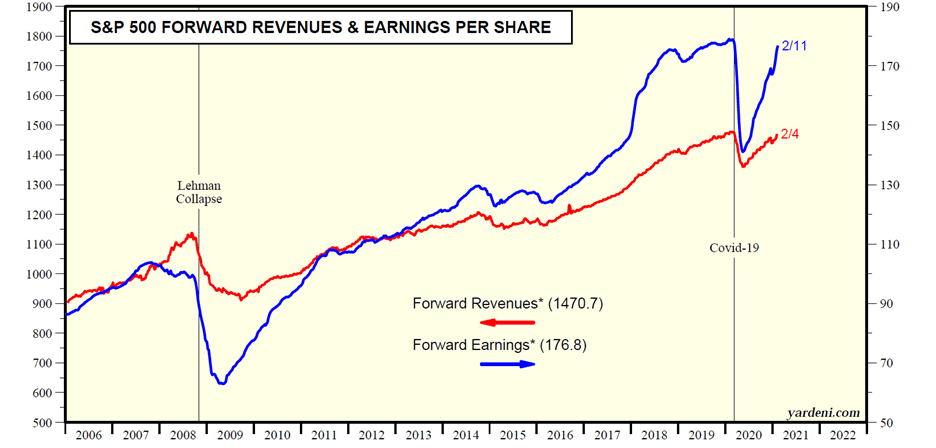

Thanks to the improving COVID trends, a continued economic recovery driven by reopenings, along with fiscal and monetary stimulus, business profits and revenues have effectively recovered all of the 2020 pandemic losses within a year (see chart below).

But with elevated stock prices have come elevated speculation, which we have seen bubble up in various forms. With the rising tide of new investors flooding onto new trading platforms like Robinhood, millions of individuals are placing speculative bets in areas like Bitcoin; new SPACs (Special Purpose Acquisition Companies); overpriced, money-losing cloud software companies; and social media recommended stocks found on Reddit’s WallStreetBets like GameStop (GME), which was up +150% alone last week. At Sidoxia Capital Management, we don’t spend a lot of time chasing the latest fad or stock market darling. Nevertheless, as long-term investors, we continue to find attractively valued investment opportunities that align with our clients’ objectives and constraints.

Overall, the outlook for the end of this pandemic looks promising as multiple COVID vaccines get administered, and the economic recovery gains steam with the help of reopenings and stimulus. If rising interest rates and potential inflation accelerate, these factors could slow the pace of the recovery and limit future stock market returns. However, if you follow a systematic, disciplined, long-term investment plan, like we implement at Sidoxia, you will be in a great position to prosper financially over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in MRNA, PFE, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME, JNJ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

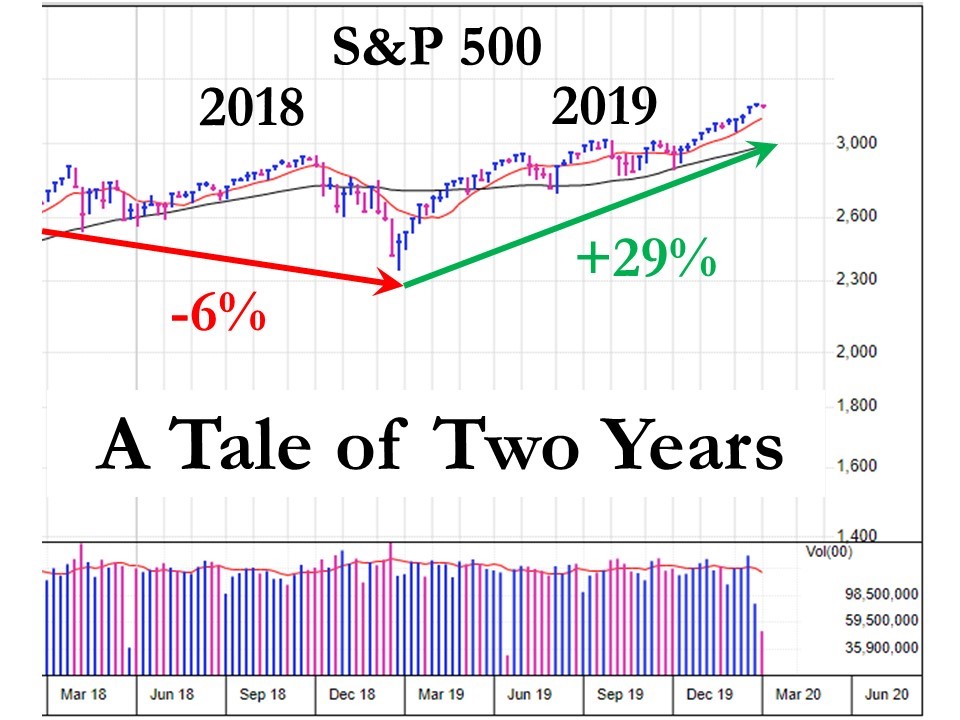

A Tale of Two Years: Happy & Not-So-Happy

Happy New Year! If you look at the stock market, 2019 was indeed a happy one. The S&P 500 index rose +29% and the Dow Jones Industrial Average was up +22%. Spectacular, right? More specifically, for the S&P 500, 2019 was the best year since 2013, while the Dow had its finest 12-month period since 2017. Worth noting, although 2019 made investors very happy, 2018 stock returns were not-so-happy (S&P 500 dropped -6%).

Source: Investor’s Business Daily

As measured against almost any year, the 2019 results are unreasonably magnificent. This has many prognosticators worrying that these gains are unsustainable going into 2020, and many pundits are predicting death and destruction are awaiting investors just around the corner. However, if the 2019 achievements are combined with the lackluster results of 2018, then the two-year average return (2018-2019) of +10% looks more reasonable and sustainable. Moreover, if history is a guide, 2020 could very well be another up year. According to Barron’s, stocks have finished higher two-thirds of the time in years following a +25% or higher gain.

With the yield on the 10-Year Treasury Note declining from 2.7% to 1.9% in 2019, it should come as no surprise that bonds underwent a reversal of fortune as well. All else equal, both existing bond and stock prices generally benefit from declining interest rates. The U.S. Aggregate Bond Index climbed +5.5% in 2019, a very respectable outcome for this more conservative asset class, after the index experienced a modest decline in 2018.

Happy Highlights

What contributed to the stellar financial market results in 2019? There are numerous contributing factors, but here are a few explanations:

Source: Dr. Ed’s Blog

Source: Dr. Ed’s Blog

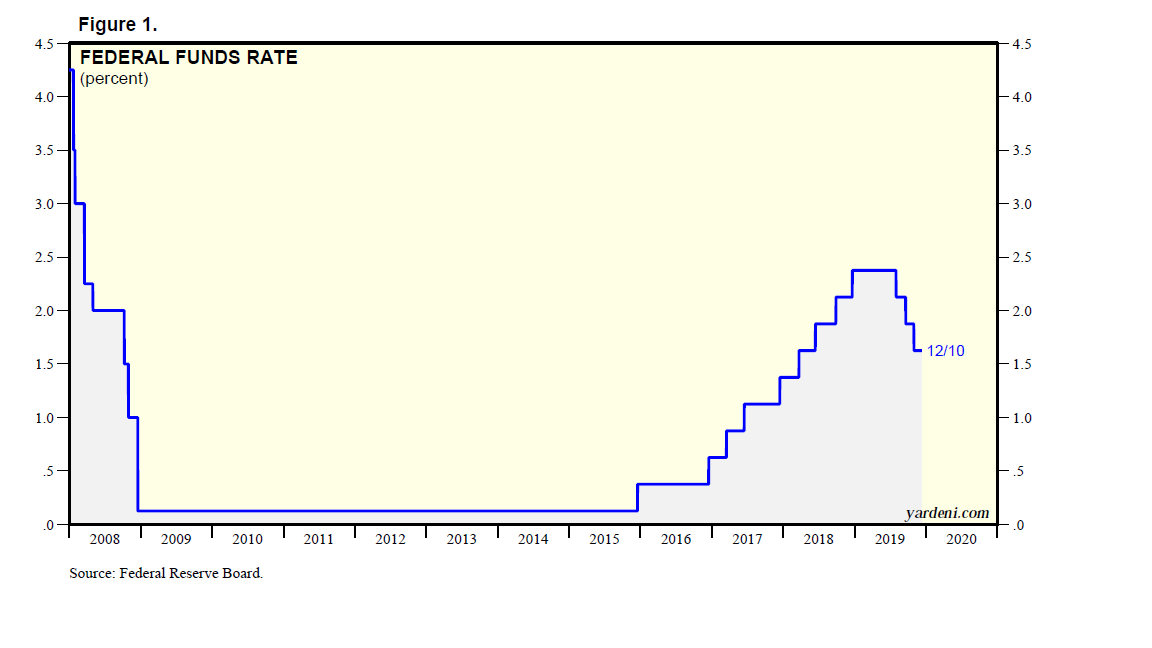

- Federal Reserve Cuts Interest Rates: After slamming on the brakes in 2018 by hiking interest rates four times, the central bank added stimulus to the economy by cutting interest rates three times in 2019 (see chart above).

- Phase I Trade Deal with China: Washington and Beijing reached an initial trade agreement that will reduce tariffs and force China to purchase larger volumes of U.S. farm products.

- Healthy Economy: 2019 economic growth (Gross Domestic Product) is estimated to come in around +2.3%, while the most recent unemployment rate of 3.5% remains near a 50-year low.

- Government Shutdown Averted: Congress approved $1.4 trillion in spending packages to avoid a government shutdown. The spending boosts both the military and domestic programs and the signed bills also get rid of key taxes to fund the Affordable Care Act and raises the U.S. tobacco buying age to 21.

- Brexit Delayed: The October 31, 2019 Brexit date was delayed, and now the U.K. is scheduled to leave the European Union on January 31, 2020. EU officials are signaling more time may be necessary to prevent a hard Brexit.

- Sluggish Global Growth Expected to Rise in 2020: Global growth rates are expected to increase in 2020 with little chance of recessions in major economies. The Financial Times writes, “The outlook from the models shows global growth rates rising next year, returning roughly to trend rates. Recession risks are deemed to be low, currently standing about 5 per cent for the US and 15 per cent for the eurozone.”

- Potential Bipartisan Infrastructure Spend: In addition to the $1.4 trillion in aforementioned spending, Nancy Pelosi, the Speaker of the Democratic-controlled House of Representatives, said she is willing to work with the Republicans and the White House on a stimulative infrastructure spending bill.

2018-2019 Lesson Learned

One of the lessons learned over the last two years is that listening to the self-proclaimed professionals, economists, strategists, and analysts on TV, or over the blogosphere, is dangerous and usually a waste of your time. For stock market participants, listening to experienced and long-term successful investors is a better strategy to follow.

Conventional wisdom at the beginning of 2018 was that a strong economy, coupled with the Tax Reform Act that dramatically reduced tax rates, would catapult corporate profits and the stock market higher. While many of the talking heads were correct about the trajectory of S&P 500 profits, which propelled upwards by an astonishing +24%, stock prices still sank -6% in 2018 (as mentioned earlier). If you fast forward to the start of 2019, after a -20% correction in stock prices at the end of 2018, conventional wisdom stated the economy was heading into a recession, therefore stock prices should decline further. Wrong!

As is typical, the forecasters turned out to be completely incorrect again. Although profit growth for 2019 was roughly flat (0%), stock prices, as previously referenced, unexpectedly skyrocketed. The moral of the story is profits are very important to the direction of future stock prices, but using profits alone as a timing mechanism to predict the direction of the stock market is nearly impossible.

So, there you have it, 2018 and 2019 were the tale of two years. Although 2018 was an unhappy year for investors in the stock market, 2019’s performance made investors happier than average. When you combine the two years, stock investors should be in a reasonably good mood heading into 2020 with the achievement of a +10% average annual return. While this multi-year result should keep you happy, listening to noisy pundits will make you and your investment portfolio unhappy over the long-run. Rather, if you are going to heed the advice of others, it’s better to pay attention to seasoned, successful investors…that will put a happy smile on your face.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Walking on Egg Shells

The recent stock market rally has investors walking on egg shells. “Nervous Nelly” investors panicked on the way down last year, and now they are fearful and skeptical about the sustainability of the fierce six-month rally. The S&P 500 is up about 60% from the latest bear market lows, but I think the recent New Jersey Business News (NJBN) article captures the investor sentiment perfectly, “I’m scared, I’m scared, I’m scared,” investor Dania Leon said. “Why are we up, especially with unemployment as high as it is? I don’t feel great because I worry that we could have a 500- or 600-point drop in a day and I won’t be quick enough to pull out of it in time.”

Will investors ever be comfortable? Well yes, of course, exactly at the right time to sell. Calm and complacency will most likely settle in once the economic headlines are on a clear path to recovery. At that point, the market, like a game of chess, will likely have already anticipated the recovery.

Until then, the whipsaw syndrome seems to have taken effect on investors. The NJBN article goes onto expand on investors’ emotional scars:

“They’ve been traumatized twice,” said Michal Strahilevitz, a business professor at Golden Gate University who studies the psychology of individual investors. “First they lost a lot and got out. And now they’ve watched it climb up. It’s a lot of regret, and for people who are investing for their family, it’s a lot of guilt.”

Trillions of low yielding cash continues to sit on the sidelines, waiting for the inevitable 10% “pullback.” Strategist Laszlo Birinyi sees little evidence for an imminent correction, “Give me the evidence…in 1982 we went 424 days before we had a correction. In 2000, we went seven years before we had a 10% correction. In 2002, we went three or four years.” (For more on Mr. Birinyi, see http://is.gd/3xS5u)

At the end of the day, as great growth investor Peter Lynch said, it’s the direction of corporate earnings that will ultimately drive the market higher or lower. “People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.” Right now based on the strength of the rally, the market is telling us that third quarter corporate earnings should come in better than analyst expectations. Perhaps we get a yawner response (sell on the news reaction), or if improvement outright stalls, perhaps we will get the mother of all expected corrections?

All these mind games make for an extremely tiresome investing mental tug-of-war. I choose not to get caught up in this game of market timing, but rather I choose to let the investment opportunity-set drive my investment decisions. I have taken some chips off the table during this rebound but I am still finding plenty of other fertile opportunities to redeploy capital. As others nervously walk on egg shells, I opt to clean up the mess and look for a clearer investment path.

Read the Full NJBN Article Here

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.