Posts tagged ‘investing’

Tips for Survival and Prosperity in Challenging Economic Times

We have all been impacted in some shape or form by the worst financial crisis experienced in a generation. The question now becomes what did we learn from this mess and how can we better prepare for a more prosperous financial future?

Here are some important tips to follow:

Save and Invest: Before paying others, pay yourself first. You can achieve this goal by saving and investing your money. Given the weak state of our government “safety net” programs, such as Medicare and Social Security, it has become more important than ever to save. Life spans are extending as well, meaning a larger “nest egg” is needed for retirement. If you don’t have the time, discipline, or emotional make-up to manage your own money, then seek out a fee-only advisor* who does not have a conflict of interest in regards to building your wealth.

Tighten Belt: In order to save and invest you need to be in a position where you are creating excess income. Cutting costs is one way to generate additional income. Eating out less, buying used, taking more affordable vacations, conserving energy, purchasing private label goods are a few easy ways to save money that will accumulate over time. If those efforts are still not adequate, one should then contemplate adjusting their living situation (i.e., down-size) or pursue additional income opportunities – either through a pay raise or higher paying job alternatives.

Pay Down Debt: If your credit card company is charging you a 15-20% rate on unpaid credit card balances and gouging you for late-fees and cash advances, then look for other sources of affordable financing. A home equity line of credit or second mortgage may make sense for some, if the fees and lower interest rates make economic sense. Contact a financial planner or tax professional to determine the appropriateness of these debt alternatives. Ultimately, the goal is to reduce debt and create more financial flexibility.

Take Free Money: If your employer offers matching payments to your retirement plan contributions, they are effectively offering you free money. Take it! The government offers you some tax deferral savings through IRA (Individual Retirement Account) contributions, so take advantage of that benefit as well.

Form a 6-Month Emergency Fund: The economy may be in a bottoming-out phase; however we are not out of the woods yet. Unemployment is approaching 10% and many companies and industries continue to struggle. Build a protective financial cushion should you or your family hit a bump in the road.

Invest in Yourself: Investing for retirement is crucial, however investing in yourself is just as, if not more, important than traditional investing. What I’m referring to is job training, education, and health awareness. We live in a globalized economy and in order to compete against those starving for our jobs, we need to improve our skills and education. Lastly, we cannot neglect our health. Finances need to be put in perspective. Our health should be a top priority and a disciplined balance between diet and exercise will not only reduce stress, but it will also improve mental health.

Times have been challenging, but when the going gets rough, the tough go saving. Take control of your financial future rather than letting economic circumstances control you. Financial success however should not come at the expense of your health, so also focus on a balanced program of diet and exercise. There are no free lunches in this world, but following these steps will help lead you on a path to prosperity – even in these challenging economic times.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Wade W. Slome, CFA, CFP is President and Founder of Sidoxia Capital Management, LLC (www.Sidoxia.com), a fee-only Registered Investment Advisory firm headquartered in Newport Beach, California.

Action Dan (Poker King) and Professional Investing

As I write in my book (How I Managed $20,000,000,000.00 by Age 32), successful investing requires skillful use of both art and science. What I find so fascinating is that the same principles apply to poker playing. Like investing, poker is also a game of skill that rewards a player who adequately understands the mathematical probabilities (science) while still able to appropriately read the behavior of his or her opponents (art). Take for example professional poker player and 1995 WSOP champ Dan Harrington. In 2003 he finished 3rd at the World Series of Poker Main Event (the Super Bowl of poker) out of a pool of 839 players. In 2004, the following year, despite the pool more than tripling to 2,576 participants, Mr. Harrington managed to finish 4th and take home a cool $1.5 million in prize money. Did luck account for this success? I think not. Odds, if left to chance, would be 1 in 25,000 for repeating this feat, according to the Economist.

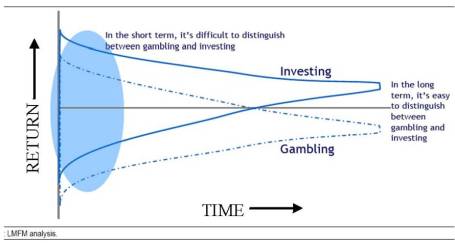

In the short-run, random volatility and luck can make the average investor look like Warren Buffett, but because of the efficiency of the market, that same average investor will look like a schmuck over the long-run. Legg Mason Funds Management put out an incredible chart that I believe so elegantly captures the incoherent and meaningless, short-term noise that the media attempts to interpret daily. What appears like outperformance in the short-run may merely be the lucky performance of a reckless speculator.

Dan Harrington, and so many other talented professionals know this fact all too well when an inexperienced “donkey” over-bets a clearly inferior hand, only to nail an inside-straight card on the “river” (last card of the round) out of pure luck – thereby knocking out a superior professional player. Over the long-run these out-of-control players end up losing all their money and professionals relish the opportunity of playing against them.

Talk to professionals and ask them what the biggest mistake new players make? The predominate answer: novices simply play too many hands. In the world of investing, the same can be said for excessive trading. Commissions, transactions costs, taxes and most importantly, ill-timed, emotionally driven trades lead the average investor to significantly underperform. I’ve referenced it before, and I’ll reference it again, John Bogle’s 1984-2002 study shows the significant drag the aforementioned costs have on professionals’ performance, and especially the average fund investor that underperformed the passive (a.k.a., “Do Nothing” strategy) S&P 500 return by more than a whopping 10% annually!

I consider myself an above average player, and I’ve won a few small tournaments, but match me up against a professional like “Action Dan” Harrington and I’ll get destroyed in the long-run. Investing, like professional poker, can lead to excess returns with the proper integration of patience and a disciplined systematic approach. I strongly believe that all great long-term investors successfully implement a strategy that marries the art and science aspects of investing. Don’t hold your breath if you expect to see me on ESPN, it may be a while before you see me at the Final Table with Dan Harrington at the World Series of Poker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and at the time of publishing had no direct positions in LM, DIS, or BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

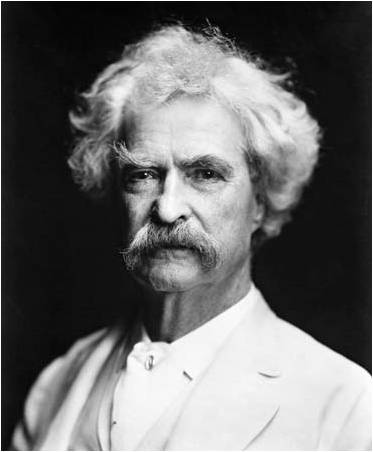

History Never Repeats Itself, But It Often Rhymes

As Mark Twain said, “History never repeats itself, but it often rhymes.” There are many bear markets with which to compare the current financial crisis we are working through. By studying the past we can understand the repeated mistakes of others (caused by fear and greed), and avoid making similar emotional errors.

Do you want an example? Here you go:

“Today there are thoughtful, experienced, respected economists, bankers, investors and businessmen who can give you well-reasoned, logical, documented arguments why this bear market is different; why this time the economic problems are different; why this time things are going to get worse — and hence, why this is not a good time to invest in common stocks, even though they may appear low.”– Jim Fullerton, former chairman of the Capital Group of the American Funds (written November 7, 1974)

Although the quote above seems appropriate for 2009, it actually is reflective of the bearish mood felt in most bear markets. We have been through wars, assassinations, banking crises, currency crises, terrorist attacks, mad-cow disease, swine flu, and yes, even recessions. And through it all, most have managed to survive in decent shape. Let’s take a deeper look.

1973-1974 Case Study:

For those of you familiar with this period, recall the prevailing circumstances:

- Exiting Vietnam War

- Undergoing a recession

- 9% unemployment

- Arab Oil Embargo

- Watergate: Presidential resignation

- Collapse of the Nifty Fifty stocks

- Rising inflation

Not too rosy a scenario, yet here’s what happened:

S&P 500 Price (12/1974): 69

S&P 500 Price (8/2009): 1,021

That is a whopping +1,380% increase, excluding dividends.

What Investors Should Do:

- Avoid Knee-Jerk Reactions to Media Reports: Whether it’s radio, television, newspapers, or now blogs, the headlines should not emotionally control your investment decisions. Historically, media venues are lousy at identifying changes in price direction. Reporters are excellent at telling you what is happening or what just happened – not what is going to happen.

- Save and Invest: Regardless of the market direction, entitlements like Medicare and social security are under stress, and life expectancies are increasing (despite the sad state of our healthcare system), therefore investing is even more important today than ever.

- Create a Systematic, Disciplined Investment Plan: I recommend a plan that takes advantage of passive, low-cost, tax-efficient investment strategies (e.g. exchange-traded and index funds) across a diversified portfolio. Rather than capitulating in response to market volatility, have a systematic process that can rebalance periodically to take advantage of these circumstances.

For DIY-ers (Do-It-Yourselfers), I suggest opening a low-cost discount brokerage account and research firms like Vanguard Group, iShares, or Select Sector SPDRs. If you choose to outsource to a professional advisor, I recommend interviewing several fee-only* advisers – focusing on experience, investment philosophy, and potential compensation conflicts of interest.

If you believe, like some economists, CEOs, and investors, we have suffered through the worst of the current “Great Recession” and you are sitting on the sidelines, then it might make sense to heed the following advice: “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.” Dean Witter made those comments 77 years ago – a few weeks before the end of worst bear market in history. The market has bounced quite a bit since March of this year, but if history is on our side, there might be more room to go.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*For disclosure purposes: Wade W. Slome, CFA, CFP is President & Founder of Sidoxia Capital Management, LLC, a fee-only investment adviser based in Newport Beach, California.

The Yuppie Bounce & the Lemming Leap

Making money in the stock market is a tough game, and most people don’t beat the market because like lemmings the average investor follows the herd mentality to underperformance. So, should Wall Street analysts and the media be crucified for their analysis? The short answer is yes. Certainly there are some exceptional analysts and journalists, however most of them merely report what is happening or are looking in the rear-view mirror. Beyond that, the vast majority of commentators prey on emotions of the public and masses by pushing them into knee-jerk selling panics at the bottom and also getting them frothing at the mouth to buy at market peaks. Can I understand why they offer such bad advice? Yes. Quite simply, the incentive structures are wrong.

If you are an analyst or journalist, the number one priority (incentive) is not to be wrong, because if they are mistaken, then job loss becomes a bona fide risk. However, if they throw in some fancy language and mix it in with a lot of caveats, there virtually is no risk of being wrong. If factors happen to change, no worries, their opinions can change too. Therefore, most analysts huddle together in tight packs reporting the same news du jour as everyone else, while mixing in a fair dosage of fear and greed to drum up more interest. These incentives align well for the journalists/analysts but unfortunately not for the average investor.

Joshua Brown over at the Reformed Broker recently wrote an excellent piece highlighting his so-called “Yuppie Bounce” example. Last winter, as all the discretionary consumer stocks (Joshua Brown calls them “waster stocks”) were getting pasted, the pundits were advising investors to pile into defensive stocks. Lo and behold, this was the absolute worst time to follow that advice. Mr. Brown gives a superb Starbucks (SBUX) versus Wal-Mart (WMT) example showing how SBUX has effectively doubled over the last nine months just as WMT flat-lined.

Investing is like a game of chess, so although a current move may sound logical, it’s more important to think about decisions multiple steps into the future. Most successful long-term investors don’t follow the conventional lines of thinking, and they are generally swimming against the tide. Therefore, if you are going to jump in with the other lemmings, make sure you have your life preserver with you.

DISCLOSURE: Some Sidoxia Capital Management and client accounts HAVE direct positions in WMT at the time the article was published. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Philosophical Friday: Investing is Like Religion

Nothing like the subject of religion to make people feel uncomfortable, so why not dive in!

Investing Is Like Religion: Everyone believes their religion will lead them down the right path to spiritual prosperity. Adherants.com divides religions into 22 separate groupings. If you look at the loosely grouped big five (Christianity, Judaism, Islam, Hinduism, and Buddhism), these cover the vast majority of religious practitioners globally – an estimated 4 billion to 5.5 billion people.

In investing, most individuals stubbornly believe their philosophy is the right way to make money. With the hopes of creating order, the investment industry relies on tools like Morningstar’s nine style box categories, which places investors in tidy, clean groups. Unfortunately, not every strategy fits nicely into a style box, especially if you try to integrate investment vehicles like hedge funds and quantitative funds.

Can’t We All Just Get Along?: I believe religions can co-exist just like different investing philosophies can co-exist. Certainly there are less worthy religions, for example you can think of cults that prey on vulnerable individuals. The same can be said for investing – as long as greed continues to exist (a certainty), there will be unscrupulous crooks and shady businesses looking to take advantage of people for a quick buck.

Regulation: I suppose our law enforcement agencies and courts serve as regulators over a small minority of churches who break the law, but given the recent collapse of parts of our financial system it makes sense we are retooling and recalibrating our oversight and regulations. There is no doubt that negative trends like the unfettered growth of toxic mortgages (including subprime), over leveraging of investment banks (ala Bear Stearns, and Lehman), and exponential growth of complex derivative products (such as CDS and CDOs) need to be controlled with more oversight. There needs to consequences to improper actions – some religions have been known to discipline their members too.

Investing Takes Faith: We have gone through an extremely trying year and a half and iconic experts like Warren Buffett have had the wherewithal to invest successfully through uncertain economic cycles because of faith in capitalism. Even at the other side of the investing spectrum, in areas like quantitative and technical trading, the practitioner still needs to have enough faith in their systems and models with the belief they have an edge that can help them outperform. Regardless of the approach, one must have faith in their investment philosophy to be successful over the long-term.

Although there countless versions of religions all over the world, I’m confident that the Church of Money Under the Mattress (CMUM) will not lead the majority of investors to the Promise Land. Even for those risk averse savers, there are ways to heighten your expected return without assuming undue risk. Irrespective of your religious beliefs, may your spiritual journey bring you hefty profits…

Wade W. Slome, CFA, CFP® (Sidoxia Capital Management, LLC)

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management and client accounts do not have direct positions in BRKA/B at the time the article was published. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Howard Right on the Mark(s)

Legendary investor Howard Marks opines on the financial markets in his recently quarterly client memo. One should pay attention to these battle-tested veterans with scars to prove their survival skills. Rather than neatly package a common theme from the long document I will highlight a few areas.

Recent Past vs. Long Past: For most of the 16 page memo Howard Marks reminisces on his 40+ years in the investment industry and contrasts the 2003-2007 period with the majority of his years. He states in the old days, “There were no swaps, index futures or listed options. Leverage wasn’t part of most institutional investors’ arsenal…or vocabulary. Private equity was unknown, and hedge funds were too few and outré to matter. Innovations like quantitative investing and structured products had yet to arrive, and few people had ever heard of ‘alpha.'”

Marks on Siegel: Marks targets Wharton Professor Jeremy Siegel as a contributor to the overly bullish mentality of 2003-2007, “Siegel’s research was encyclopedic and supported some dramatic conclusions, perhaps foremost among them his showing that there’s never been a 30-year period in which stocks didn’t outperform cash, bonds and inflation…but…30 years can be a long time to wait.”

Marks on Risk: “So yes, it’s true that investor’s can’t expect to make much money without taking risk. But that’s not the same as saying risk taking is sure to make you money…If risky investments always produced high returns, they wouldn’t be risky.” On the psychological impacts of risk, Marks goes on to say, “When investors are unworried and risk-tolerant, they buy stocks at high p/e ratios and private companies at high EBITDA multiples, and they pile into bonds despite narrow yield spreads and into real estate at minimal “cap rates.'”

On Quant Models and Business Schools: Marks quotes Warren Buffet regarding the complexity of quantitative models, “If you need a computer or a calculator to make a calculation, you shouldn’t buy it.” Charlie Munger adds his two cents on why quantitative models exist: “They teach that in business schools because, well, they’ve got to do something.”

Investing as a Mixture of Art & Science: In my book I describe investing as a combination of “Art” and “Science.” Marks addresses a s similar insight through an Albert Einstein quote:

“Not everything that can be counted counts, and not everything that counts can be counted.”

Views on the Credit Rating Agencies: To highlight the absurdity of the mortgage credit rating system, Marks compares the agencies’ ratings to hamburger: “If it’s possible to start with 100 pounds of hamburger and end up selling ten pounds of dog food, 40 pounds of sirloin and 50 pounds of filet mignon, the truth-in-labeling rules can’t be working.”

If you would like to access the remainder of memo, click here to read the rest. Overall, Mr. Marks gives a balanced view of the markets and economy, but feels “better buying opportunities lie ahead.” Thankfully, I’m finding some myself.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Calamos Still “Growing” Strong

Calamos Investments recently came out with their quarterly Market Review and Outlook. John P. Calamos, Sr., the Company founder, began investing his family’s money over 50 years ago and is well known for their successful “growth” style of investing. Calamos founded Calamos Asset Management in 1977, and won BusinessWeek’s best manager for 2003 and 2004. Over the years, the company diversified from its bread and butter convertibles into equity, enhanced fixed-income, global and international, core bond, cash management and alternative strategies. Overall, the newsletter offers a fairly sobering outlook (“Longterm Scared”); however there are some excellent investing nuggets, especially when it comes to the firm’s current positioning:

“Because we are not in a secular bull market, investing discipline is even more important. We believe these are the rules for today’s environment”:

1. Washington D.C. is the new growth city

2. Valuations will not get as stretched in the equity markets and growth expectations will be revised down considerably

3. Old-fashioned dividends mean something

4. G7 competitive devaluations and protectionist legislation will become the norm

5. To grow, emerging nations must become consumption driven and attempt to become independent of the developed nations

6. Knowledge is free, but capital may be much harder to get

7. Real returns after tax will take on new meaning

8. Baby boomers will reprioritize spending

9. The rules will change often!

Technology Exposure: For those that have followed my writings in the past, you are familiar with my positive bias towards technology. The technology sector is littered with land mines and risks. Nonetheless, through technology, our country has and will continue to innovate new products and services that will improve our standard of living. The “Technology Revolution” is not only benefiting our society, we are exporting the fruits of our discoveries to developing countries across the world. Take Intel Corporation (INTC) for example – it garnered about 85% of its revenues in 2008 from international markets.

Here is what Calamos has to say about their “Significant Overweight” exposure to the Technology sector:

“Productivity enhancement and cost controls should help technology spending.”

- We see consumers remaining willing to purchase certain “special” products such as iPhones, laptops and flat-screens.

- We have found software companies offering stable revenue streams, strong balance sheets with lots of cash, and products that offer solutions for cost reduction and productivity.

- The sector will also benefit from global infrastructure stimulus spending.

- Stock valuations are attractive and the risk/reward is compelling.

- The sector may be re-establishing its leadership position in the equity market for the first time since last decade’s collapse.”

Materials and Energy Exposure: Developing countries are joining the party too, albeit later than the rest of the partygoers. The price of admission to the party is access to valuable commodities. Calamos has other reasons to be overweight the Materials and Energy sectors:

- Muted recovery implied in stock valuations.

- Further U.S. dollar devaluation and global stimulus spending should help boost commodity prices.

- The small capitalization of this sector and volatility of commodity prices will again make it prone to large price swings.

- U.S. dollar devaluation should help support energy prices.

- Mid-East turmoil adds to the attractiveness of this sector as it can hedge unforeseen energy price spikes.

- Stock valuations appear reasonable but government intervention will make this a difficult sector to value.

Like all great managers, Calamos has taken his lumps, but through it all his firm is still “growing” strong.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Bill Miller: Revenge of the Dunce?

Bill Miller’s Legg Mason Value Trust Fund (LMVTX) was down more than -55% in 2008 and many people considered him the industry dunce – due in part to his heavily concentrated stock positions and stubborn belief of holding onto his sinking “Financial” picks. Unfortunately this stance cratered results to abysmal depths – earning his fund the infamous Morningstar 1-Star Rating. But let’s not forget Mr. Miller did not become stupid over night. From 1991 through 2005 he beat the S&P 500 every year before hitting a rough patch in 2006-2008. His previous 15 year streak was the equivalent of me hitting .400 off Randy Johnson – very few, if any, can replicate. So, is the dunce back? Thus far in 2009, his fund is up about 25% through July 26th, handily trouncing the S&P 500 by more than 14% (Morningstar). Miller remains bullish on his outlook for financial markets although he caveats his prediction with three endogenous risks:

“Rising interest rates, a sharp rise in commodity prices (especially oil), and policy errors.”

Miller also brings up a topic I have brought up on numerous occasions in my monthly newsletter, which is that investors are sitting on piles of low earning cash:

“Assets in money market funds recently exceeded those in general equity funds for the first time in over 15 years. In contrast, at the market peak in October 2007, assets in equity funds were more than 3x greater than the assets in money market funds. The return on this mountain of cash rounds to zero, which is good when stocks and bonds are falling, but far from optimal when they are rising. Although I expect credit spreads and risk aversion to remain well above the averages of the past decade, there is plenty of room for them to narrow and for equities to move higher as this cash gradually moves out the curve in search of better returns.”

The average investor is late to both coming and going from the game. Don Hays, Strategist at Hays Advisory Services, notes, “We believe all good news at the top, and we doubt and disbelieve any good news at the bottom.” I think Bill concurs when he states the following:

“The psychological cycle goes something like this: first it is said the fiscal and monetary stimuli are not sufficient and won’t work. When the markets start up and the economic forecasts begin to be revised up — where we are now — the refrain is that it is only an inventory restocking and once it is over the economy will stall or we may even have a double dip. Once the economy begins to improve, the worry is that profits will not recover enough to justify stock prices. When profits recover, it is said that the recovery will be jobless; and when the jobs start being created, the fear is that this will not be sustained.”

Miller also makes some thoughtful points on the attractiveness of the financial sector, pointing to the disappearance of many competitors, appealing valuations, and rising pre-provision earnings. On the topic of inflation, Miller remains unworried about prices spiking up. He argues, logically, that rising unemployment and excess capacity will keep a lid on prices. True, however, with exploding debt levels and deficits, coupled with the insatiable appetites of emerging markets for commodities, not to mention spiraling healthcare prices, I believe inflation concerns may be here sooner than anticipated. Let’s not forget the stagflation experienced in the 1970s.

Read the Whole Bill Miller Newsletter Here

Bill Miller is still in a deep hole that he dug for himself, but I would not count this dunce out. Mean reversion is one of the most powerful principles of finance and if you ride Bill Miller’s coat-tails on any continued rebound, it could be a prosperous, memorable ride.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Praying for a Better Market with Pope Benedict XVI

As reported on Bloomberg, the pontiff called for a new era of economic justice and for a new global authority to regulate financial institutions. Pope Benedict XVI weighed in on the markets with a 150 page document demanding a retooling of the economic and financial models that got us into this financial crisis.

In a conflicted dilemma, the video clip above ponders the question of whether sinners or saints perform better in the stock market? Unfortunately for church-goers, sin appears to perform better. The indulgent Vice Fund (VICEX) outperformed the virtuous Ave Maria Catholic Values Fund (AVEMX) for the period discussed.

I’m not sure if the Pope is going to open a margin account at Scottrade, and start day-trading levered inverse ETFs and options, but perhaps he will be praying for a better market and performance for us honest, trustworthy and faithful investors.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Rogers Sees an Explosion in Stock Prices…Or Complete Collapse

CNBC Interview with Jimmy Rogers

I love it! Jimmy Rogers, chairman of Rogers Holdings is really going out on limb this time. Well, not really. It’s more like he is on a fence, and ready to fall over to whichever side the wind blows. Let me explain this claim in more detail. With the Dow Jones Industrials Average currently trading at about 8,800, Rogers sees the market climbing higher by +240% to 30,000 or perhaps collapsing another -43% (after the worse bear market in decades) to 5,000.

“I’m afraid they’re printing so much money that stocks could go to 20,000 or 30,000,” Rogers said. “Of course it would be in worthless money, but it could happen and you could lose a lot of money being short,” he adds.

Why stop there – why not a more outrageous range of guesses between 100,000 and 1,000? If inflation is his worry, then maybe Mr. Rogers should be concerned about declining PE (Price/Earnings) multiples, which reached single digits in the late-1970s and early-1980s when we were experiencing double-digit inflation.

Thanks Jimmy, those meticulously defined predictions will make many fellow astrologists proud. These prophetic claims remind me of my prescient call this year that I would either gain 100 pounds or lose 100 pounds. So far my forecast has turned out to be spot on, however I won’t confess which direction my weight has swung.

Although Jimmy’s tone is notably pessimistic, he reminds us that this is the last time he has had NO short positions since after the “Crash of 1987.” If lightning strikes twice, maybe his actions demonstrate that now is not such a bad time to buy.

However, be wary because Rogers is not only frightened by inflation. He goes onto say that some country is going to suffer a currency crisis, but he does not know which one yet. “I expect there to be a currency crisis later this year or maybe next year,” he states. Let us hope that “Zimbabwean-esque” inflation does not take hold, otherwise we will be in line with Rogers at the grocery store buying millions of dollars in the vegetable aisle.

Jimmy Rogers is obviously a bright investor (not to mention the Wall Street bow-tie king) who has achieved great success over his career. Nonetheless, I believe he could go into a little more detail in explaining his outrageous, sensationalized claims. For some reason I don’t think this trend will change, but at a minimum, he will continue to provide food for thought and fantastic entertainment.