Posts tagged ‘investing’

Questioning the Death of Buy & Hold Investing

In the midst of the so-called “Lost Decade,” pundits continue to talk about the death of “buy and hold” (B&H) investing. I guess it probably makes sense to define B&H first before discussing it, but like most amorphous financial concepts, there is no clear cut definition. According to some strict B&H interpreters, B&H means buy and hold forever (i.e., buy today and carry to your grave). For other more forgiving Wall Street lexicon analysts, B&H could mean a multi-year timeframe. However, with the advent of high frequency trading (HFT) and supercomputers, the speed of trading has only accelerated further to milliseconds, microseconds, and even nanoseconds. Pretty soon B&H will be considered buying a stock and holding it for a day! Average mutual fund turnover (holding periods) has already declined from about 6 years in the 1950s to about 11 months in the 2000s according to John Bogle.

Technology and the lower costs associated with trading advancements is obviously a key driver to shortened investment horizons, but even after these developments, professionals success in beating the market is less clear. Passive gurus Burton Malkiel and John Bogle have consistently asserted that 75% or more of professional money managers underperform benchmarks and passive investment vehicles (e.g., index funds and exchange traded funds).

This is not the first time that B&H has been held for dead. For example, BusinessWeek ran an article in August 1979 entitled The Death of Equities (see Magazine Cover article), which aimed to eradicate any stock market believers off the face of the planet. Sure enough, just a few years later, the market went on to advance on one of the greatest, if not the greatest, multi-decade bull market run in history. People repudiated themselves from B&H back then, and while B&H was in vogue during the 1980s and 1990s it is back to becoming the whipping boy today.

Excuse Me, But What About Bonds?

With all this talk about the demise of B&H and the rise of the HFT machines, I can’t help but wonder why B&H is dead in equities but alive and screaming in the bond market? Am I not mistaken, but has this not been the largest (or darn near largest) thirty year bull market in bonds? The Federal Funds Rate has gone from 20% in 1981 to 0% thirty years later. Not a bad period to buy and hold, but I’m going to go out on a limb and say the Fed Funds won’t go from 0% to a negative -20% over the next thirty years.

Better Looking Corpse

There’s no denying the fact that equities have been a lousy place to be for the last ten years, and I have no clue what stocks will do for the next twelve months, but what I do know is that stocks offer a completely different value proposition today. At the beginning of the 2000, the market P/E (Price Earnings) valued earnings at a 29x multiple with the 10-year Treasury Note trading with a yield of about 6%. Today, the market trades at 13.5 x’s 2010 earnings estimates (12x’s 2011) and the 10-Year is trading at a level less than half the 2000 rate (2.75% today). Maybe stocks go nowhere for a while, but it’s difficult to dispute now that equities are at least much more attractive (less ugly) than the prices ten years ago. If B&H is dead, at least the corpse is looking a little better now.

As is usually the case, most generalizations are too simplistic in making a point. So in fully reviewing B&H, perhaps it’s not a bad idea of clarifying the two core beliefs underpinning the diehard buy and holders:

1) Buying and holding stocks is only wise if you are buying and holding good stocks.

2) Buying and holding stocks is not wise if you are buying and holding bad stocks.

Even in the face of a disastrous market environment, here are a few stocks that have met B&H rule #1:

Maybe buy and hold is not dead after all? Certainly there have been plenty of stinking losing stocks to offset these winners. Regardless of the environment, if proper homework is completed, there is plenty of room to profitably resurrect stocks that are left for a buy and hold death by the so-called pundits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, AMZN, ARMH, and NFLX, but at the time of publishing SCM had no direct position in GGP, APKT, KRO, AKAM, FFIV, OPEN, RVBD, BIDU, PCLN, CRM, FLS, GMCR, HANS, BYI, SWN (*2,901% is correct %), CTSH, CMI, ISRG, ESRX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Curious Case of Gen Y and Benjamin Button

If a current Gen Y-er aged backwards like Benjamin Button, he would feel right at home when it comes to investing, because acute conservatism and risk aversion have struck older and younger generations alike. The Curious Case of Benjamin Button is a story that follows the critical peaks and valleys of a boy born in his eighties, who immediately begins to reverse the aging process. Investors of all ages have suffered their peaks and valleys over the last decade, and these experiences have impacted investing attitudes and perceptions heavily during the prime earning years. For retirees, it’s virtually impossible for extreme events like the Great Depression, World War II, Vietnam, Kennedy’s assassination, and Nixon’s impeachment to NOT have had an influence on individuals’ investing behavior.

Investing Consequences on Younger Investors

If a younger Mr. Button were still alive today, there is no doubt the disheartening events experienced in his 80s would only become reinforced by the bleak occurrences in 2008-2009. His reverse aging would not only have allowed him to witness the collapse of Lehman Brothers, but also behold the demise and bailout of other gargantuan financial institutions. Today, if Benjamin wasn’t busy watching the MTV Video Music Awards, he would most likely be diligently managing his bullet-proof portfolio of cash, CDs (Certificates of Deposit), Treasury bills, and maybe some tax-free municipals if he was feeling a little spunky.

The cautious stance of youthful savers was confirmed in a recent study conducted by Merrill Lynch Global Wealth Management. The report demonstrates how the recent financial crisis has had a severe dampening impact on the risk appetites of 18-34 year old “Millennials.” So dramatic an effect was the recession, the nervous conservatism experienced by the 30-somethings was only rivaled by fear from 65 year olds. In fact, the 56% of young investors, who were more cautious today than a year ago, was the highest percentage registered by any age group.

Here’s what Christopher Geczy adjunct associate professor of finance at University of Pennsylvania’s Wharton School had to say about younger Millennials:

“We’re coming off a series of financial crises that hit this young generation at points in their lives where external events shape strong opinions…Many of them have witnessed a decline in the wealth of their families and seen their parents delay retirement or even return to the workforce.”

Beyond witnessing the challenges faced by their parents, the Millennials are encountering their own obstacles – such as joblessness. For those workers under age 35, the unemployment rate in August stood at more than 13% – significantly higher than the 9.6% national rate.

Note to Youths: Stocks for the Long Haul

In the typical life cycle of investing, investors flaunt a higher risk tolerance in their younger years and exhibit more risk aversion as they approach or enter retirement. Historically, this makes perfect sense because workers earlier in their careers have plenty of time to ride out the fluctuations associated with owning equities. Jeremy Siegel, professor at the Wharton University Professor, says stocks significantly outperform bonds by 6% per year over longer timeframes (see Siegel Digs in Heels).

For Gen Y-ers the larger risk is being too conservative, not too aggressive. Barry Nalebuff, a strategy professor at Yale’s School of Management agrees:

“The biggest risk for this generation is that they’ll live too long. With medical breakthroughs, the reality is that many of them will live beyond 100…The only way they have enough assets to last them is to invest in stocks. If they don’t, a lot of people will have to keep working way past when they want to because they won’t have enough money saved up.”

Even for those downbeat on the domestic equity markets – rightfully so with no price gains achieved over the last decade – younger investors should not lose sight of the tremendous equity opportunities available internationally (see the Blowing the Perfect Investment Game).

For many people, reverse aging may be fun for a while, but for Benjamin Button, living through the Great Depression and multiple wars as an adult would likely dampen the mood and increase risk aversion dramatically. Millennials have persevered through difficult times too. Generation Y has survived two recessionary bubbles caused by excessive technology spending and consumer credit binging, both over a short timeframe. Becoming too conservative for these investors will feel comfortable in the short-run if uncertainty continues to prevail. But investing now with adequate, diversified equity exposure is the prudent course of action. Even a wrinkly Benjamin Button could agree, wisely investing in some equities during your earlier career sure beats working as a Wal-Mart (WMT) greeter into your 80s.

Read the full Money-CNN and Newsweek articles on the subject

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in BAC/Merrill, Lehman, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

What Happens in Vegas, Stays on Wall Street

What happens in Vegas, stays in Vegas, unless it’s a habit of betting, in which case that habit will follow you back to Wall Street. Just as there are a million ways to make or lose money by investing or speculating in the market, the same principles apply to sports betting as well. Anybody who has been to Las Vegas and gone to the sportsbook knows how incredibly and insanely accurate the oddsmakers are – I speak from immature experience having traveled there for a healthy number of investment conferences and vacations. The oddsmakers are so accurate; you could say they are almost “efficient” at what they do.

But like the market, in the sports world too, efficiency has a tendency to breakdown occasionally and form bubbles. This dynamic leaves both a huge threat of substantial losses and a potential for windfall gains. Where there are bubbles forming, you are bound to find a large number of excited individuals jumping on a bandwagon. Now, let’s take a look at how the worlds of Wall Street and wagers collide and see if any lessons can be learned.

Jumping on the Stock Bandwagon

band·wag·on [band-wag-uhn]: a party, cause, movement, etc., that by its mass appeal or strength readily attracts many followers.

Everybody loves a winner and no one more so than a fresh fan jumping on the bandwagon. Living in Southern California, the bandwagon is presently fully-loaded with proclaimed Los Angeles Laker fans and USC fans, although the Trojan wagon is currently undergoing repair. It’s easy to identify bandwagoners in sports – just find the face painter, guy with a rainbow afro, Boston native sporting a Kobe Bryant jersey, or the fanatic betting on the team favored by three touchdowns. In the game of stocks, identifying the fickle but passionate followers is a little more subtle. Bandwagon status is not measured by the extent of point spreads (predicted scoring differential between two opponents), but rather by level of P/E ratios (Price-Earnings ratio) or other valuation metric of choice.

While it is clear sports bandwagoners root for the “favorites,” in the realm of investing this translates into piling onto the “growth or momentum” stocks (see Momentum Investing article) – I hate generalizing terms but that’s what we bloggers do. Value investors, on the other hand, root for (buy) the “underdogs.”

To illustrate my point, let’s take a look at a few past bandwagon momentum stocks:

- JDS Uniphase Corp. (JDSU): In 2000 we saw these bandwagoners valuing investor favorites like JDS Uniphase at a whopping $99 billion – meaning investors were willingly paying over 100x’s revenues and 600 x’s trailing earnings to own the stock. At the time, JDSU was a “New Economy” stock that was going to revolutionize the proliferation of bandwidth around the globe with their proprietary optical laser components. For those of you keeping score at home, today JDSU’s stock is valued at approximately $2 billion ($9.97), or -98% less than the market value in March 2000 (split-adjusted peak share price of $1,227.38 per share). If it wasn’t for a 1-for-8 reverse stock split in 2006, then a share of JDSU would fetch you $1.25 today, or less than the amount needed to cover an out of network ATM penalty fee.

- Crocs Inc. (CROX): Crox is another one of my favorite bandwagon stocks, because this loud plastic eyesore footwear was clearly a fad that couldn’t sustain its growth once popularity waned, despite my wife being a bandwagon-ee. Like other fad product-related stocks, the company could no longer maintain its growth once they completed stuffing the channel and their customers cried uncle from choking on inventory. Making matters worse for CROX, knockoff versions were offered for a fraction of the cost at local grocery stores and mall kiosks. After about 20 months post its IPO (Initial Public Offering), the music stopped and within 13 months the stock cratered from a $75 per share peak to $0.79 in 2008. The stock never traded at the absurd dot-com levels, but the lofty 37x P/E in 2007 quickly turned negative after close to $200 million in losses were realized in 2008 and 2009. The stock has since rebounded to $12 and change, and maybe their new Crocs high-heel line of $99.00 shoes (see here) will propel the stock higher…cough, cough.

Point Spread, Point Spread, Point Spread

In sports betting the three most important factors in making a winning bet are point spread, point spread, and point spread. Unlike the March Madness college basketball pool in which you may have participated, in the real world the participant needs to do more than just pick the winning teams – the participant must determine by how much a team will win by. Let’s take a gander at a few actual examples.

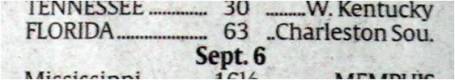

- Florida Gators vs. Charleston Southern Buccaneers (9/5/09): Without knowing a lot about the powerhouse squad from South Carolina, 99% of respondents, when asked before the game who would win, would select Florida – a consistently dominant national-powerhouse program. The question gets a little trickier when asked the question: “Will the Florida Gators win by more than 63 points?” That’s exactly the point spread sports bettors faced when deciding whether or not to place the bet – somewhat analogous to the question whether JDSU was a prudent investment at 600x’s earnings? Needless to say, although the Buccs kept it close in the first half, and only trailed by 42-3 at halftime, the Gators still managed to squeak by with a 62-3 victory. Worth noting, the 59 point margin of victory resulted in a losing wager for anyone picking the Gators.

- USC Trojans vs. Stanford Cardinal (10/6/2007): Ranked as the presumptive #1 team of the country pre-season, and entering the game with a 35-0 home-game winning streak, USC was a whopping 41 point favorite over Stanford. On the flip side, the Cardinal came into the game fresh off of a 1-11 losing season the prior year, and in the previous year the Cardinal lost to the Trojans 42-0. Stanford ended up winning the 2007 match-up by a score of 24-23, not only pulling off one of the greatest upsets of all-time, but also spoiling USC’s chances of winning the national championship.

Read more about the greatest upsets of all-time.

Beyond the Point Spread

As you can surmise from our discussion, the same point spread standards apply to investing, but when discussing stocks the spread is measured by various valuation metrics based on earnings, cash flows, book value, EBITDA, sales, and other fundamental growth factors.

Of course, in Las Vegas and on Wall Street not everyone follows traditional fundamental analysis. Some gamblers and speculators will transact solely based on less conventional methods, for example quantitative models, technical analysis and trend review (read Technical Analysis: Astrology or Lob Wedge). For example in sports, handicappers may only wager on teams with five-game winning streaks and winning home records. Whereas on Wall Street, speculators may only trade stocks with positive earnings surprises or “head-and-shoulder” patterns. Hot technicians come and go, but very few real investors survive the long haul without using fundamental analysis and valuation as key components of their winning strategies.

As I have argued, there are many ways to make (and lose) money on Wall Street or in Las Vegas, and consistently jumping on the bandwagon is a sure way to lose. For the successful minority whose performance has endured the test of time, a common thread connecting the two disciplines is the ability to determine and profit from a prudently calculated point spread/valuation. History teaches us that the same effective handicapping skills happening in Las Vegas are the same abilities needed to stay on Wall Street and win.

Wade W. Slome, CFA, CFP®

P.S. See how a pro handicapper conquered Las Vegas and placed sportsbooks on the run.

Plan. Invest. Prosper.

*DISCLOSURE: The undergraduate alma mater of Sidoxia Capital Management’s (SCM) President happens to be UCLA, so although I believe any reference to rival school USC is not provided with any malicious agenda, nonetheless there may exist an inherent conflict of interest. SCM and some of its clients own certain exchange traded funds, but at the time of publishing, SCM had no direct position in JDSU, CROX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Cindy Crawford Economy

Photo source: http://www.joyyoga.blogspot.com

I remember intently examining a few magazine covers that former supermodel Cindy Crawford adorned in my prime high school and collegiate years. Like our economy, the resultant recovery in 2009-2010 feels a little like a more mature version of Cindy Crawford (now 43 years old). Things look pretty good on the surface, but somehow people are more focused on pointing out the prominent mole, rather than appreciating the more attractive features. Many market commentators feel to be making similar judgments about the economy – we’re seeing nice-looking growth (albeit at a slowing pace) and corporations are registering exceptional results (but are not hiring). Even Ben Bernanke, our money-man superhero at the Federal Reserve, has underscored the “unusually uncertain” environment we are currently experiencing.

Certainly, the economy (and Cindy) may not be as sexy as we remember in the 1990s, but nonetheless constant improvement should be our main goal, regardless of the age or stage of recovery. Sure, Cindy chose cosmetic surgery while our government chose a stimulus (along with healthcare and financial regulatory reform) for its economic facelift. But the government must walk a fine line because if it continues to make poor decisions, our country could walk away looking like a scary, cosmetically altered version of Heidi Montag.

Our government in many ways is like Cindy Crawford’s former husband Richard Gere – if the Obama administration doesn’t play its cards right, the Democrats risk a swift divorce from their Congressional majority come this November – the same fate Richard suffered after a four year marriage with Cindy. Like a married couple, we need the federal government like a partner or spouse. Fortunately, our government has a system of checks and balances – if voters think Congress is ugly, they can always decide to break-up the relationship. Voters will make that decision in three months, just like Cindy and Richard voted to separate.

The Superpower Not Completely Washed Up

We may not have the hottest economy, but a few factors still make the equity markets look desirable:

- Corporate profit, margins, and cash levels at or near record levels. S&P profits are estimated to rise +46% in 2010.

- Interest rates are at or near record lows (Fed Funds effectively at 0% and the 10-Year Treasury Note at 2.74%).

- The stock market (as measured by the S&P 500 index) is priced at a reasonably alluring level of 13x’s 2010 profit forecasts and 12x’s 2011 earnings estimates.

Multiple Assets & Swapping

I don’t have anything against the institution of marriage (I’ve been happily married for thirteen years), but one advantage to the financial markets is that it affords you the ability to trade and own multiple assets. If a more mature Cindy Crawford doesn’t fit your needs, you can always swap or add to your current holding(s). For example, you could take more risk with a less established name (asset), for example Karolina Kurkova, or in the case of global emerging markets, Brazil. Foreign markets can be less stable and unpredictable (like Kate Moss), but can pay off handsomely, both from an absolute return basis and from a diversification perspective.

Money ultimately goes to where it is treated best in the long-term, so if Cindy doesn’t fit your style, feel free to expand your portfolio into other asset classes (e.g., stocks, bonds, real estate, commodities, etc.). Just be wary of stuffing all your money under the mattress, earning virtually nothing on your money – certainly Cindy Crawford is a much more appealing option than that.

Wade W. Slome, CFA, CFP®

P.S. For all women followers of Investing Caffeine, I will do my best to even the score, by writing next about the Marcus Schenkenberg economy.

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including those with exposure to Brazil and other emerging markets), but at the time of publishing SCM had no direct position in any other security directly referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Securing Your Bacon and Oreo Future

Stuffing money under the mattress earning next to nothing (e.g., 1.3% on a on a 1-year CD or a whopping 1.59% on a 5-year Treasury Note) may feel secure and safe, but how protected is that mattress money, when you consider the inflation eating away at its purchasing power?

We’ve all been confronted by older friends and family members proudly claiming, “When I was your age, (“fill in XYZ product here”) cost me a nickel and today it costs $5,000!” Well guess what…you’re going to become that same curmudgeon, except 20 or 30 years from now, you’re going to replace the product that cost a “nickel” with a “$15 3-D movie,” “$200 pair of jeans” and “$15,000 family health plan.” Chances are these seemingly lofty priced products and services will look like screaming bargains in the years to come.

The inflation boogeyman has been relatively tame over the last three decades. Kudos goes to former Federal Reserve Chairman Paul Volcker, who tamed out-of-control double-digit inflation by increasing short-term interest rates to 20% and choking off the money supply. Despite, the Bernanke printing presses smoking from excess activity, money has been clogged up on the banks’ balance sheets. This phenomenon, coupled with the debt-induced excess capacity of our economy, has led to core inflation lingering around the low single-digit range. Some even believe we will follow in the foot-steps of Japanese deflation (see why we will not follow Japan’s Lost Decades).

The Essentials: Oreos and Bacon

Even if you believe movie, jeans, and healthcare won’t continue inflating at a rapid clip, I’m even more concerned about the critical essentials – for example, indispensable items like Oreos and bacon. Little did you probably know, but according to ProQuest’s Historic newspaper database, a package of Oreos has more than quadrupled in price over the last 30 years to over $4.00 per package – let’s just say I’m not looking forward to spending $16.00 a pop for these heavenly, synthetic, hockey-puck-like, creamy delights.

Beyond Oreos, another essential staple of my diet came under intense scrutiny during my analysis. I’ve perused many an uninspiring chart in my day, but I must admit I experienced a rush of adrenaline when I stumbled across a chart highlighting my favorite pork product. Unfortunately the chart delivered a disheartening message. For my fellow pork lovers, I was saddened to learn those greasy, charred slices of salty protein paradise (a.k.a. bacon strips), have about tripled in price over a similar timeframe as the Oreos. Let us pray we will not suffer the same outcome again.

It’s Not Getting Any Easier

Volatility aside, investing has become more challenging than ever. However, efficiently investing your nest egg has never been more critical. Why has efficiently managing your investments become so vital? First off, let’s take a look at the entitlement picture. Not so rosy. I suppose there are some retirees that will skate by enjoying their fully allocated Social Security check and Medicare services, but for the rest of us chumps, those luxurious future entitlements are quickly turning to a mirage.

What the financial crisis, rating agency conflicts, Madoff scandal, Lehman Brothers bankruptcy, AIG collapse, Goldman Sachs hearings, FinReg legislation, etc. taught us is the structural financial system is flawed. The system favors institutions and penalizes the investor with fees, commissions, transactions costs, fine print, and layers of conflicts of interests. All is not lost however. For most investors, the money stuffed under the mattress earning nothing needs to be resourcefully put to work at higher returns in order to offset rising prices. Putting together a diversified, low-cost, tax-efficient portfolio with an investment management firm that invests on a fee-only basis (thereby limiting conflicts) will put you on a path of financial success to cover the imperative but escalating living expenses, including of course, Oreos and bacon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in KFT, GS, Lehman Brothers, AIG (however own derivative tied to insurance subsidary), or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

WEBINAR: 10 Ways to Protect & Grow Your Nest Egg

If analyzing quarterly reports, managing a hedge fund/client accounts, teaching a course, writing a second book, and squeezing in a vacation is not enough, then why not try to squeeze in a webinar too? That’s exactly what I decided to do, so please join us on Friday (7/23 @ 12:30 p.m. PST) to learn about the critical 10 Ways to Protect and Grow Your Nest Egg in Uncertain Times.

Webinar Details:

—July 23, 2010 (Friday) at 12:30 p.m. – 1:30 p.m. (Pacific Standard Time)

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code: 800 505 230

Managing your investments has never been more difficult in this volatile and uncertain world we live in. With life expectancies increasing, and ambiguity surrounding the reliability of future financial safety nets (Social Security & Medicare), prudently investing your hard earned money to protect and grow your nest egg has never been this critical.

Invest in yourself and block off some time at 12:30 p.m. PST on July 23rd to educate yourself on the “10 Ways to Protect and Grow Your Nest Egg” in a relaxed webinar setting in front of your own computer.

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 800 505 230

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Blowing the Perfect Investment Game

Armando Galarraga, pitcher from the Detroit Tigers baseball team, became a victim of a blown call by umpire Jim Joyce, resulting in a lifetime opportunity being ripped from his clutches. Not only did the error in judgment cost Galarraga a perfect game – a feat only achieved by 20 pitchers over the last 130 years – but the blunder also cost him a no-hitter. Perfect games are difficult to come by in the investment world too, but for those ambitious investors reaching for the finance Hall of Fame, I strongly believe a healthy dosage of international and emerging markets is required to achieve perfection (or significant outperformance).

The Fab Five

The oft quoted view that the U.S. was the dominant economic powerhouse in the 20th century (after Britain controlled the 19th century) led me to analyze five emerging growth markets outside of the U.S. There are some clear leaders in pursuit of 21st century economic supremacy, however nothing in the global pecking order is guaranteed. What I do know is that me and my clients will be relying on the financial tailwinds of growth coming from these international markets to provide excess return potential to my portfolios (albeit at the cost of shorter-term volatility). Even retired individuals, or those with shorter time horizons, should consider small bite sizes of these emerging markets in their portfolios, if merely for some of the diversification benefits (see diversification article).

Pundits and media types endlessly write and talk about the “lost decade,” the demise of “buy and hold,” and/or the “death of equities.” Well, as you can see, the lost decade through the first half of 2010 turned out to be a significantly lucrative period for investors with the stomach and courage to invest outside the familiar comfort zone of the United States (see chart below).

Specifically, here is the international outperformance achieved in the sample of international markets as compared to the United States (S&P 500 Index):

- Brazil +266.22% (EWZ tracking Bovespa Index)

- India +266.16% (Bombay Stock Exchange – BSE)

- Australia +68.16% (ASX 200 Index)

- China +68.06% (Shanghai Index)

- Hong Kong +39.74% (Hang Seng Index)

- United States -128.19% Average Underperformance versus five other geographic indexes.

An added kicker for investment consideration is valuation. According to The Financial Times market data section, all these international markets, with the exception of India, trade at a discount to the S&P 500 on a Price/Earnings ratio basis (P/E).

Victim of Our Own Success

In many respects, our country has continued to thrive in spite of some of our political and economic shortcomings. As you can see from the chart below (NY Times article) our country’s market share of the world’s Gross Domestic Product (GDP) has been steadily been declining since World War II (and we’ve still done OK). With U.S. GDP exceeding $14 trillion, our sheer size makes it much more difficult to grow relative to our smaller, more nimble international brethren. Given our top economic position in the world, Warren Buffett succinctly identified the force working against size when he said, “Gravity always wins.” I would expect gravitational influences to continue to weigh us down in the future, but our declining share should not be considered a detrimental trend. Globalization needs to be embraced by policymakers so we can take advantage of these faster growing countries as opportunistic export markets. We Americans can improve our standard of living while riding the coattails of our speedy neighbors. Do yourself a favor and include a healthy chunk of higher growth markets into your portfolio – it’s important you do not blow your own investment game.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including BKF, FXI, EWZ), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Gravity Takes Hold in May

Wile E. Coyote, the bumbling, roadrunner-loving carnivore from Warner Bros.’ Looney Tunes series spends a lot of time in the air chasing his fine feathered prey. Unfortunately for Mr. Coyote his genetic make-up and Acme purchases could not cure the ills caused by gravity (although user error was the downfall of Wile E’s effective Bat-Man flying outfit purchase). Just as gravity hampered the coyote’s short-term objectives, so too has gravity hampered the equity markets’ performance this May.

So far the adage of “Sell in May and walk away” has been the correct course of action. Just one day prior to the end of the month, the Dow Jones Industrial and S&P 500 indexes were on pace of recording the worst May decline in almost 50 years. If the -6.8% monthly decline in the S&P and the -7.8% drop in the S&P remains in place through the end of the month, these declines would mark the worst performance in a May month since 1962.

Should we be surprised by the pace and degree of the recent correction? Flash crash and Greece worries aside, any time a market increases +70-80% within a year, investors should not be caught off guard by a subsequent 10%+ correction. In fact corrections are a healthy byproduct of rapid advances. Repeated boom-bust cycles are not market characteristics most investors crave.

It was a volatile, choppy month of trading for the month as measured by the Volatility Index (VIX). The fear gauge more than doubled to a short-run peak of around 46, up from a monthly low close of about a reading of 20, before settling into the high 20s at last close. Digesting Greek sovereign debt issues, an impending Chinese real estate bubble bursting, budget deficits, government debt, and financial regulatory reform will determine if elevated volatility will persist. Improving macroeconomic indicators coupled with reasonable valuations appear to be factoring in a great deal of these concerns, however I would not be surprised if this schizophrenic trading will persist until we gain certainty on the midterm elections. As Wile E. Coyote has learned from his roadrunner chasing days, gravity can be painful – just as investors realized gravity in the equity markets can hurt too. All the more reason to cushion the blow to your portfolio through the use of diversification in your portfolio (read Seesawing Through Chaos article).

Happy long weekend!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in TWX, VXX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Stocks…Bonds on Steroids

With all the spooky headlines in the news today, it’s no wonder everyone is piling into bonds. The Investment Company Institute (ICI), which tracks mutual fund data, showed -88% of the $14 billion in weekly outflows came from equity funds relative to bonds and hybrid securities. With the masses flocking to bonds, it’s no wonder yields are hovering near multi-decade historical lows. Stocks on the other hand are the Rodney Dangerfield (see Doug Kass’s Triple Lindy attempt) of the investment world – they get “no respect.” By flipping stock metrics upside down, we will explore how hated stocks can become the beloved on steroids, if viewed in the proper context.

Davis on Debt Discomfort

Chris Davis, head of the $65 billion in assets at the Davis Funds, believes like I do that navigating the “bubblicious” bond market will be a treacherous task in the coming years. Davis directly states, “The only real bubble in the world is bonds. When you look out over a 10-year period, people are going to get killed.” In the short-run, inflation is not a real worry, but it if you consider the exploding deficits coupled with the exceedingly low interest rates, bond investors are faced with a potential recipe for disaster. Propping up the value of the dollar due to sovereign debt concerns in Greece (and greater Europe) has contributed to lower Treasury rates too. There’s only one direction for interest rates to go, and that’s up. Since the direction of bond prices moves the opposite way of interest rates, mean reversion does not bode well for long-term bond holders.

Earnings Yield: The Winning Formula

Average investors are freaked out about the equity markets and are unknowingly underestimating the risk of bonds. Investors would be in a better frame of mind if they listened to Chris Davis. In comparing stocks and bonds, Davis says, “If people got their statement and looked at the dividend yield and earnings yield, they might do things differently right now. But you have to be able to numb yourself to changes in stock prices, and most people can’t do that.” Humans are emotional creatures and can find this a difficult chore.

What us finance nerds learn through instruction is that a price of a bond can be derived by discounting future interest payments and principle back to today. The same concept applies for dividend paying stocks – the value of a stock can be determined by discounting future dividends back to today.

A favorite metric for stock jocks is the P/E (Price-Earnings) ratio, but what many investors fail to realize is that if this common ratio is flipped over (E/P) then one can arrive at an earnings yield, which is directly comparable to dividend yields (annual dividend per share/price per share) and bond yields (annual interest/bond price).

Earnings are the fuel for future dividends, and dividend yields are a way of comparing stocks with the fixed income yields of bonds. Unlike virtually all bonds, stocks have the ability to increase dividends (the payout) over time – an extremely attractive aspect of stocks. For example, Procter & Gamble (PG) has increased its dividend for 54 consecutive years and Wal-Mart (WMT) 37 years – that assertion cannot be made for bonds.

As stock prices drop, the dividend yields rise – the bond dynamics have been developing in reverse (prices up, yields down). With S&P 500 earnings catapulting upwards +84% in Q1 and the index trading at a very reasonable 13x’s 2010 operating earnings estimates, stocks should be able to outmuscle bonds in the medium to long-term (with or without steroids). There certainly is a spot for bonds in a portfolio, and there are ways to manage interest rate sensitivity (duration), but bonds will have difficulty flexing their biceps in the coming quarters.

Read the full article on Chris Davis’s bond and earnings yield comments

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct positions in PG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

King of Controversy Reveals Maverick Solution

Mark Cuban, provocative and brash owner of the Dallas Mavericks basketball team and #400 wealthiest person in the world ($2.4 billion net worth), according to Forbes, has never been shy about sharing his opinion. In fact, this multi-billionaire’s opinions have been discouraged on multiple occasions, as evidenced by the NBA (National Basketball Association) slapping Cuban with more than $1.6 million in fines for his outbursts.

Cuban doesn’t only provide his views on basketball, as a serial entrepreneur who cashed in his former company Broadcast.com to Yahoo! (YHOO) for $5.9 billion, he also is providing his thoughts on Wall Street and the 1,000 point “fat finger” trading meltdown from last week. What does Cuban say is the answer to the rampant speculation conducted by idiot financial engineers? “Tax the Hell Out of Wall Street,” says Cuban in his recent blog flagged by TRB’s Josh Brown.

A Taxing Solution

Specifically, Cuban wants to tax investors 25 cents per share (and 5 cents per share for stocks trading at $5 per share or less) in hopes of encouraging myopic speculating traders to become longer-term shareholders. Cuban believes this approach will weed out the day traders and investment renters who in reality “don’t add anything to the markets.” Seems like a reasonable belief to me.

According to Cuban’s math, here are some of the benefits the tax would bring to the financial system:

“If the NYSE, Nasdaq, Amex and OTC are trading 2 Billion shares a day or more, like today, thats $ 500 Million Dollars PER DAY. If there are 260 trading days a year. Thats about 130 Billion dollars a year. If volumes drop because of the tax. It is still 10s of Billions of dollars per year. Thats real money for the US Treasury. Thats also an annual payment towards the next time Wall Street screws up and we have a black swan event that no one planned on.”

Practically speaking, a flat rate 25 cent tax per share is probably not the best way to go if you were to introduce a transaction tax, but the crux of Cuban’s argument essentially would not change. Creating a flat percentage tax (e.g., 1%) would likely make more sense, even if complexity may increase relative to the 25 cent tax. Take for example Citigroup (C) and Berkshire Hathaway Class A (BRKA). Cuban’s plan would result in paying 1.2% tax on a $4.17 share of Citigroup versus only 0.00022% tax for a $116,000.00 share of Berkshire Hathaway. Simple accounting maneuvers such as reverse stock splits and slowing of stock dividends, along with reducing company dilution through share and option issuance, may be methods of circumventing some of the tax burden created under Cuban’s described proposal.

Politically, adding any tax to investing voters could be re-election suicide, so rather than calling it a trading tax, I suppose the politicians would have to come up with some other euphemism, such as “charitable administrative fee for speculative trading.” The financial industry has already become experts in taxing investors with fees (read Fees, Exploitation and Confusion), so maybe Congress could give the banks and fund companies a call for some marketing ideas.

Step 1: Transparency

The murkiness and lack of transparency across derivatives markets is becoming more and more evident by the day. Some recent events that bolster the argument include: a) New CDO (Collateralized Debt Obligation) derivative allegations surfacing against Morgan Stanley (MS); b) The SEC (Securities and Exchange Commission) charges against Goldman Sachs (GS) in the Abacus synthetic CDO deal (see Goldman Sachs article); c) The collapse of AIG’s Credit Default Swap (CDS) department and subsequent push to transfer trading to open exchanges; and d) Now we’re dealing with last week’s cascading collapse of the equity markets within minutes. The brief cratering of multiple indexes points to a potential order entry blunder and/or absence of adequate and consistent circuit breakers across a web of disparate exchanges and ECNs (Electronic Communication Networks).

The mere fact we stand here five days later with no substantive explanation for the absurd trading anomalies (see Making Megabucks 13 Minutes at a Time) is proof positive changes in derivative and exchange transparency are absolutely essential.

Step 2: Incentives

In Freakonomics, the best-selling book authored by Steven Levitt, we learn that “Incentives are the cornerstone of modern life,” and “Economics is, at root, the study of incentives.” Incentives are crucial in that they permeate virtually all aspects of financial markets, not only in assisting economic growth, but also the negative aspects of bursting financial bubbles.

Michael Mauboussin, the Chief Investment Strategist at Legg Mason (read more on Mauboussin), also expands on the role incentives played in the housing collapse:

“Many, if not most, of the parties involved in the mortgage meltdown were doing what makes sense for them—even if it wasn’t good for the system overall. Homeowners got to live in fancier homes, mortgage brokers earned fees on the mortgages they originated without having to worry about the quality of the loans, investment banks earned tidy fees buying, packaging, and selling these loans, rating agencies made money, and investors earned extra yield on so-called AAA securities. So it’s a big deal to watch and unpack incentives.”

Regulation, penalties, and fines are means of creating preventative incentives against improper or unfair behavior. Just as people have no incentive to wash a rental car, nor do high frequency traders have an incentive to invest in equity securities for any extended period of time. Adding a Cuban tax may not be a cure-all for all our country’s financial woes, but as the regulatory reform debate matures in Congress, this taxing idea emanating from the King of Controversy may be a good place to start.

Read full blog article written by Mark Cuban

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and an AIG subsidary structured security, but at the time of publishing SCM had no direct positions in YHOO, C, AIG, LM, GS, BRKA, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.