Posts tagged ‘investing’

Playing the Field with Your Investments

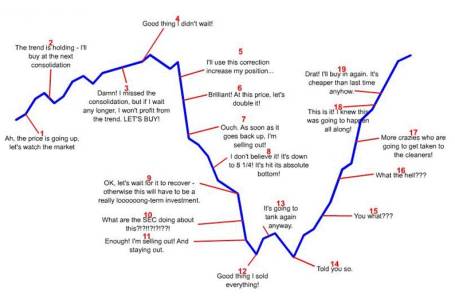

For some, casually dating can be fun and exciting. The same goes for trading and speculating – the freedom to make free- wheeling, non-committal purchases can be exhilarating. Unfortunately the costs (fiscally and emotionally) of short-term dating/investing often outweigh the benefits.

Fortunately, in the investment world, you can get to know an investment pretty well through fundamental research that is widely available (e.g., 10Ks, 10Qs, press releases, analyst days, quarterly conference calls, management interviews, trade rags, research reports). Unlike dating, researching stocks can be very cheap, and you do not need to worry about being rejected.

Dating is important early in adulthood because we make many mistakes choosing whom we date, but in the process we learn from our misjudgments and discover the important qualities we value in relationships. The same goes for stocks. Nothing beats experience, and in my long investment career, I can honestly say I’ve dated/traded a lot of pigs and gained valuable lessons that have improved my investing capabilities. Now, however, I don’t just casually date my investments – I factor in a rigorous, disciplined process that requires a serious commitment. I no longer enter positions lightly.

One of my investment heroes, Peter Lynch, appropriately stated, “In stocks as in romance, ease of divorce is not a sound basis for commitment. If you’ve chosen wisely to begin with, you won’t want a divorce.”

Charles Ellis shared these thoughts on relationships with mutual funds:

“If you invest in mutual funds and make mutual funds investment changes in less than 10 years…you’re really just ‘dating.’ Investing in mutual funds should be marital – for richer, for poorer, and so on; mutual fund decisions should be entered into soberly and advisedly and for the truly long term.”

No relationship comes without wild swings, and stocks are no different. If you want to survive the volatile ups and downs of a relationship (or stock ownership), you better do your homework before blindly jumping into bed. The consequences can be punishing.

Buy and Hold is Dead…Unless Stocks Go Up

If you are serious about your investments, I believe you must be mentally willing to commit to a relationship with your stock, not for a day, not for a week, or not for a month, but rather for years. Now, I know this is blasphemy in the age when “buy-and-hold” investing is considered dead, but I refute that basic premise whole-heartedly…with a few caveats.

Sure, buy-and-hold is a stupid strategy when stocks do nothing for a decade – like they have done in the 2000s, but buying and holding was an absolutely brilliant strategy in the 1980s and 1990s. Moreover, even in the miserable 2000s, there have been many buy-and-hold investments that have made owners a fortune (see Questioning Buy & Hold ). So, the moral of the story for me is “buy-and-hold” is good for stocks that go up in price, and bad for stocks that go flat or down in price. Wow, how deeply profound!

To measure my personal commitment to an investment prospect, a bachelorette investment I am courting must pass another test…a test from another one of my investment idols, Phil Fisher, called the three-year rule. This is what the late Mr. Fisher had to say about this topic:

“While I realized thoroughly that if I were to make the kinds of profits that are made possible by [my] process … it was vital that I have some sort of quantitative check… With this in mind, I established what I called my three-year rule.” Fisher adds, “I have repeated again and again to my clients that when I purchase something for them, not to judge the results in a matter of a month or a year, but allow me a three year period.”

Certainly, there will be situations where an investment thesis is wrong, valuation explodes, or there are superior investment opportunities that will trigger a sale before the three-year minimum expires. Nonetheless, I follow Fisher’s rule in principle in hopes of setting the bar high enough to only let the best ideas into both my client and personal portfolios.

As I have written in the past, there are always reasons of why you should not invest for the long-term and instead sell your position, such as: 1) new competition; 2) cost pressures; 3) slowing growth; 4) management change; 5) valuation; 6) change in industry regulation; 7) slowing economy; 8 ) loss of market share; 9) product obsolescence; 10) etc, etc, etc. You get the idea.

Don Hays summed it up best: “Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.”

Peter Lynch shares similar sympathies when it comes to noise in the marketplace:

“Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

Every once in a while there is validity to some of the concerns, but more often than not, the scare campaigns are merely Chicken Little calling for the world to come to an end.

Patience is a Virtue

In the instant gratification society we live in, patience is difficult to come by, and for many people ignoring the constant chatter of fear is challenging. Pundits spend every waking hour trying to explain each blip in the market, but in the short-run, prices often move up or down irrespective of the daily headlines. Explaining this randomness, Peter Lynch said the following:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

Long-term investing, like long-term relationships, is not a new concept. Investment time horizons have been shortening for decades, so talking about the long-term is generally considered heresy. Rather than casually date a stock position, perhaps you should commit to a long-term relationship and divorce your field-playing habits. Now that sounds like a sweet kiss of success.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

New Year’s Investing Resolutions

As we exit 2010 and enter 2011, many people go through the annual ritual of making personal New Year’s resolutions. Here is a list of go-to resolutions if you haven’t made one, or are having trouble coming up with one.

1) Lose weight

2) Spend More Time with Family & Friends

3) Quit Smoking

4) Quit Drinking

5) Enjoy Life More

6) Save Money & Get Out of Debt

7) Learn Something New

8) Help Others

9) Get Organized

10) Travel More

I have a few on the list above that I would like to work on, but when it comes to investing, there are a few other resolutions I am looking to make or maintain in 2011:

1) Don’t be a Hog. The last few years have produced excellent returns, but we all know that pigs get fat, and hogs get slaughtered. Cashing the register and banking some of my gains can be frustrating when positions charge higher, but sticking to a disciplined approach pays off handsomely in the long-run and helps navigate through the volatile times.

2) Follow Crash Litmus Test. Only buy what you would confidently purchase at lower prices. Sure, company or industry fundamentals can change over time, but for the vast majority of the time, companies and industries do not undergo paradigm shifts. Even though there are a 1,001 bombs that get launched daily, explaining why the world is coming to an end, I do my best to block out the useless noise and stick to the numbers and facts.

3) Remove Name Creep. It’s easy to fall in love with every new stock that walks by, but limiting the number requires a conviction discipline that pays off in the long run. Academic research and practical experience dictate diversification can be achieved without spreading yourself too thin. As Warren Buffett says, “I prefer to keep all my eggs in one basket and watch that basket closely.”

4) Tirelessly Turn Stones. I love my portfolio right now, but I know there are unique opportunities out there that can improve my results, if I take the time and make the effort.

5. Don’t Rush Into Tips. I’ve purchased or shorted securities recommended by respected investors, but it is important to do your own homework first. Even if these ideas work in the short-run, tips usually fall into loose hands and get punted at the worst times. Perform adequate due diligence to strengthen the roots of your thesis for volatile times.

6. Don’t Get Drunk on Story Stocks. There is never a shortage of great ideas, but many of them carry hefty price tags and have high expectations baked into future earnings growth estimates. Even if great stories exist in abundance, there is a shortage of great managers that can profit from great ideas. Associated high prices can however quickly turn a great story into a sad story – once excessively high expectations are not met, prices eventually will collapse.

7. Build Contingency Plan for Overconfidence. It’s important to have an exit strategy or contingency plan in place if things do not play out as planned. Overconfidence can be the pitfall for many investors, and this is not surprising when factoring in how highly people generally feel about themselves. Most believe they are better than average drivers, parents, and have superior intuition. This same overconfidence may not harm you in the real world, but in the financial markets, overconfidence can result in a woodshed beating. Confidence will not kill your portfolio, but arrogant confidence will.

8. Stick to Knitting. We all have our strengths and weaknesses. I do my best to stay away from my blind spots. As legendary baseball player Ted Williams discussed in his book The Science of Hitting, players are much better off by patiently waiting for the fat pitch in the sweet spot of the strike zone before swinging. Finding your sweet spot and not venturing out of your circle of competence is just as important in the investing world as it is in baseball hitting.

9. Trade Less. Trading is fun and exciting, but paying commissions on top of bid-ask spreads, impact costs, and other fees removes some of the enjoyment. Trading is a necessary evil to make profits, but requires the trader to be right twice – once on the sale, and another time on the purchase. Even if you are right on both sides of the trade, chances are the fees, taxes, commissions, and impact costs will remove most if not all of the profits.

10. Learn from Mistakes. Unfortunately, 2011 will be another year that I will not remain mistake-free. Conveniently forgetting investment mistakes is a great rationalization mechanism, but forever sweeping blunders under the rug without learning from them will not make you a better investor.

If you are able to set aside some of those Bonbons and pay off those credit card balances, then maybe you can join me and take on an investing resolution or two. Don’t worry, like all resolutions, you always have the option of making the resolution without following through!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Art of Weather Forecasting and Investing

I’ve lived across the country and traveled around the world and have experienced everything from triple-digit desert heat to sub-zero wind chill. The financial markets experience the same variability over time.

Forecasting the weather is a lot like forecasting the stock market. In the short-run, volatility in patterns can be very difficult to predict, but if efforts are energized into analyzing long-term factors, trends can be identified.

For example, I live here in Southern California, and although weather is fairly homogenous, the variability can be significant on a day-to-day basis. I’m much more likely to be accurate in estimating the long-term climate than the forecast seven days from now. I’m not trying to rub salt in the wounds of those people freezing in Antarctica or the upper-Midwest, but forecasting a climate of 72 degrees, sunny, and blue skies is a good fall-back scenario if you are a television weatherman in Southern California.

Charles Ellis, author of the Winning the Loser’s Game – “WTLG” (see Investing Caffeine article #1 and article #2), highlights the weather analogy more convincingly:

“Weather is about the short run; climate is about the long run – and that makes all the difference. In choosing a climate in which to build a home, we would not be deflected by last week’s weather. Similarly, in choosing a long-term investment program, we don’t want to be deflected by temporary market conditions.”

Ellis adds:

“Like the weather, the average long-term experience in investing is never surprising, but the short-term experience is constantly surprising.”

In the financial markets the weather predicting principle applies to long-term economic forecasts as well. Predicting annual GDP growth can often be more accurate than the expected change in Dow Jones Industrial Index points tomorrow or the next day.

Economic Weathermen

As I outlined in Professional Guesses Probably Wrong, economists and strategists use several means of making their guesses.

- One method is to simply not make forecasts at all, but rather use some big words and current news to explain what currently is happening in the economy and financial markets.

- A second approach used by prognosticators is to constantly change forecasts. Consider a person making a weather forecast every minute…his/her forecast would be very accurate, but it would be changing constantly and not provide much more value than what an ordinary person could gather by looking out their own window.

- Thirdly, some use the “spaghetti approach” – throw enough scenarios out there against the wall and something is bound to stick – regardless of accuracy.

- Lastly, the “extend and pretend” method is often implemented. Forecasters make big bold economic predictions that garner lots of attention, but when the expectations don’t come true, the original forecast is either forgotten by investors or the original forecast just becomes extended further into the future.

Coin Flipping

If the weather analogy doesn’t work for you, how about a coin-flipping analogy? The short-term randomness surrounding the consecutive number of heads and tails may make no sense in the short-run, but will mean revert to an average over time. In other words, it is possible for someone to flip 10 consecutive “tails,” but in the long-run, the number of times a coin will land on “tails” will come close to averaging half of all coin tosses. The same dynamic is observed in the investment world. Often, short-term spikes or declines are short lived and return toward a mean average. IN WTLG, Ellis provides some more color on the topic:

“The manager whose favorable investment performance in the recent past appears to be ‘proving’ that he or she is a better manager is often – not always, but all too often – about to produce below-average results…A large part of the apparently superior performance was not due to superior skill that will continue to produce superior results but was instead due to that particular manager’s sector of the market temporarily enjoying above-average rates of return – or luck.”

Regardless of your interests in weather forecasting or coin-flipping, when it comes to investing you will be better served by following the long-term climate trends and probabilities. Otherwise, the performance outlook for your investment portfolio may be cloudy with a chance of thunderstorms.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Ellis on Battling Demons and Mr. Market

A lot of ground was covered in the first cut of my review on Charles Ellis’s book, Winning the Loser’s Game (“WTLG”). His book covers a broad spectrum of issues and reasons that help explain why so many amateurs and professional investors dramatically underperform broad market indexes and other forms of passive investing (such as index funds).

A major component of investor underperformance is tied to the internal or emotional aspects to investing. As I have written in the past, successful investing requires as much emotional art as it does mathematical science. Investing solely based on numbers is like a tennis player only able to compete with a backhand – you may hit a few good shots, but will end up losing in the long-run to the well-rounded players.

Ellis recognizes these core internal shortcomings and makes insightful observations throughout his book on how emotions can lead investors to lose. As George J.W. Goodman noted, “If you don’t know who you are, the stock market is an expensive place to find out.” Hopefully by examining more of Ellis’s investment nuggets, we can all become better investors, so let’s take a deeper dive.

Mischievous Mr. Market

Why is winning in the financial markets so difficult? Ellis devotes a considerable amount of time in WTLG talking about the crafty guy called “Mr. Market.” Here’s how Ellis describes the unique individual:

“Mr. Market is a mischievous but captivating fellow who persistently teases investors with gimmicks and tricks such as surprising earnings reports, startling dividend announcements, sudden surges of inflation, inspiring presidential announcements, grim reports of commodities prices, announcements of amazing new technologies, ugly bankruptcies, and even threats of war.”

Investors can easily get distracted by Mr. Market, and Ellis makes the point of why we are simple targets:

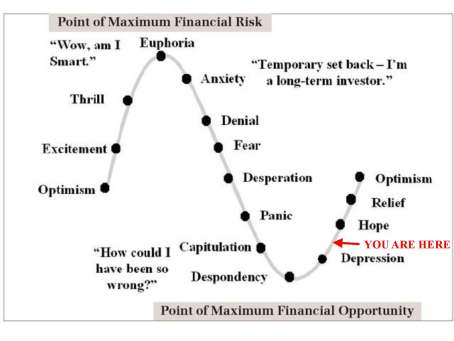

“Our internal demons and enemies are pride, fear, greed, exuberance, and anxiety. These are the buttons that Mr. Market most likes to push. If you have them, that rascal will find them. No wonder we are such easy prey for Mr. Market with all his attention-getting tricks.”

The market also has a way of lulling investors into complacency. Somehow, bull markets manage to make geniuses not only out of professionals and amateur investors, but also cab drivers and hair-dressers. Here is Ellis’s observation of how we tend to look at ourselves:

“We also think we are ‘above average’ as car drivers, as dancers, at telling jokes, at evaluating other people, as friends, as parents, and as investors. On average, we also believe our children are above average.”

This overconfidence and elevated self-assessment generally leads to excessive risk-taking and eventually hits arrogant investors over the head like a sledgehammer. Michael Mauboussin, Legg Mason Chief Investment Strategist and author of Think Twice, is a current thought leader in the field of behavioral finance that tackles many of these behavioral finance issues (read my earlier piece).

The Collateral Damage

As mentioned by Ellis in the previous WTLG article I wrote, “Eighty-five percent of investment managers have and will continue over the long term to underperform the overall market.” When emotions take over our actions, Mr. Market has a way of making investors make the worst decisions at the worst times. Ellis describes this phenomenon in more detail:

“The great risk to individual investors is not that the market can plummet, but that the investor may be frightened into liquidating his or her investments at or near the bottom and miss all the recovery, making the loss permanent. This happens to all too many investors in every terrible market drop.”

With the market about doubling from the early 2009 equity market lows, this devastating problem has become more evident. With volatility rearing its ugly head throughout 2008 and early 2009, investors bailed into low-yielding cash and Treasuries at the nastiest time. Now the stock market has catapulted upwards and those same investors now face significant interest rate risk and still are experiencing meager yields.

The Winning Formula

Ellis acknowledges the difficulty of winning at the investing game, but experience has shown him ways to combat the emotional demons. Number one…know thyself.

“’Know thyself’ is the cardinal rule in investing. The hardest work in investing is not intellectual; it’s emotional.”

Knowing thyself is easier said than done, but experience and mistakes are tremendous aids in becoming a better investor – especially if you are an investor who spends time studying the missteps and learns from them.

From a practical portfolio construction standpoint, how can investors combat their pesky emotions? Probably the best idea is to follow Ellis’s sage advice, which is to “sell down to the sleeping point. Don’t go outside your zone of competence because outside that zone you may get emotional, and being emotional is never good for your investing.”

Finding good investment ideas is just half the battle – fending off the demons and Mr. Market can be just as, if not more, challenging. Fortunately, Mr. Ellis has been kind enough to share his insights, allowing investors of all types to take this valuable investment advice to help win at a losing game.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dow Déjà Vu – Shining Rainbow or Bad Nightmare?

Excerpt from Free January Sidoxia Monthly Newsletter (Subscribe on right-side of page)

The Dow Jones Industrial Average is sitting at 11,577 points. Dick Fuld is still CEO of Lehman Brothers, AIG is still trading toxic CDS derivative contracts, and the $700 billion TARP bailout is a pre-idea about to be invented in the brain of Treasury Secretary Hank Paulson. Oops, wait a second, this isn’t the Dow 11,577of September 2008, but rather this is the Dow 11,577 of December 2010 (+11% for the year, excluding dividends). Was the -50% drop we experienced in the equity markets during 2008-2009 all just a bad dream? If not, how in the heck has the stock market climbed spectacularly? Most people don’t realize that stocks have about doubled over the last 21 months (and up roughly +20%-25% in the last 6 months) – all in the face of horrendously depressing news swirling around the media (i.e., jobs, debt, deficits, N. Korea, Iran, “New Normal,” etc.). Market volatility often does not make intuitive sense, and as a result, many market observers have been caught flat-footed.

Here are a few basic factors that average investors have not adequately appreciated:

1) Headlines are in Rearview Mirror: News that everyone reads in newspapers and magazines and hears on the television and radio is all backward looking. It’s always best to drive while looking forward through the windshield and try to anticipate what’s around the corner – not obsess with backward looking activity in the rearview mirror. That’s how the stock market works – tomorrow’s news (not yesterday’s or today’s) is what drives prices up or down. As the economy teetered on the verge of a “Great Depression-like” scenario in 2008-2009, investors became overly pessimistic and stocks became dramatically oversold. More recently, news has been perking up. Previous recessions have seen doubters slowly convert to believers and push prices higher – eventually stocks become overbought and euphoria slows the bull market. I believe we are in phase II of this three-part economic recovery.

2) Ignore Emerging Markets at Own Peril: We Americans tend to wear blinders when it comes to focusing on domestic issues. We focus more on healthcare reform and political issues, such as “Don’t Ask, Don’t Tell,” rather than the billions of foreigners chasing us as they climb the global economic ladder. Citizens in emerging markets are more concerned about out-competing and out-innovating us through educated workforces, so they can steal our jobs and buy more toasters, iPods, and cars – things we Americans have already taken for granted. The insatiable appetite of the expanding global middle class for a better standard of living is also driving ballooning commodity prices – everything from coal to copper and corn to cotton (the 4 Cs). This universal sandbox that we play in offers tremendous opportunities to grasp and tremendous threats to avoid, if investors open their eyes to these emerging market trends.

3) Capital Goes Where it’s Treated Best: Many voters are fed-up with the political climate in Washington and the sad state of economic affairs. The great thing about the global capitalistic marketplace we live in is that it does not discriminate – capital flows to where it is treated best. On a macro basis, money flows to countries that are fiscally responsible, support pro-growth initiatives, harbor educated work forces, control valuable natural resources, and honor the rule of law. On a micro basis, money flows to companies that are attractively priced and/or capable of sustainably growing earnings and cash flow. Voters and politicians will ultimately figure it out, or capital will go where it’s treated best.

Today’s Dow 11,577 is no bad dream, but rather resembles the emergence of a bright shining rainbow after a long, cold, and dark storm. The rainbow won’t stick around forever, but if investors choose to ignore the previously mentioned factors, like so many investors have overlooked, portfolio performance may turn into an ugly nightmare.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, and an AIG derivative security, but at the time of publishing SCM had no direct position in GS, any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Eggs or Oatmeal: Binging on Over-Analysis

I about chuckled my way out of my chair when ESPN reminded me of the absurd over-analysis that takes place in the sports world (I can’t wait for the 8 hour pre-game show before the upcoming Super Bowl) through a 30-second, football commercial. Typically when sports analysts get together, the most irrelevant issues are scrutinized under a microscope. After endless wasted amounts of time, the viewer is generally left with lots of worthless information about an immaterial topic. In this particular video, San Diego NFL quarterback Phillip Rivers innocently asks Sunday Countdown football analysts Chris Berman, Mike Ditka, Keyshawn Johnson, Tom Jackson, and Cris Carter whether they would like some eggs or oatmeal for breakfast?

Mayhem ensues while the analysts breakdown everything from the pros of frittatas and brats to the cons of cholesterol and sauerkraut. After listening to all the jaw flapping, Phillip Rivers is left dejected, banging his head against the kitchen refrigerator. It is funny, I feel much the same way as Phillip Rivers does when I’m presented with same overkill analysis found plastered over the financial media and blogosphere.

Analysis of Over-Analysis

Just as I mock the excess analysis occurring in the financial world, I will move ahead and assess this same over-thinking (that’s what we bloggers do). If this much analysis takes place when examining simple options such as eggs vs. oatmeal, or AFC vs. NFC, just imagine the endless debate that arises when discussing the merits of investing in a simple, diversified domestic equity mutual fund. Sounds simple on paper, but if I want to be intellectually honest, I first need to compare this one fund versus the thousands of other equity fund offerings, not to mention the thousands of other ETFs (Exchange Traded Funds), bond funds, lifecycle funds, annuities, index funds, private equity funds, hedge funds, and other basket-related investment vehicles.

Mutual funds are only part of the investment game. We haven’t even scratched the surface of individual securities, futures, options, currencies, CDs, real estate, mortgage backed securities, or other derivatives.

The investment menu is virtually endless (see TMI – Too Much Information), and new options are created every day – many of which are indecipherable to large swaths of investors (including professionals).

Sidoxia’s Questions of Engagement

Not all analysis is psychobabble, but separating the wheat from the manure can be difficult. Before engaging in the never-ending over-analysis taking place in the financial world, answer these three questions:

1.) “Do I Care?” If the latest advance-decline statistics on the NYSE don’t tickle your fancy, or the latest “breaking news” headline on monthly pending home sales doesn’t float your boat, then maybe it’s time to do something more important like…absolutely anything else.

2.) “Do I Understand?” If conversation drifts towards complex currency swaptions comparing the Thai Baht against the Brazilian Real, then perhaps it’s time to leave the room.

3.) “Is This New News?” Not sure if you heard, but there’s this new shiny metal called gold, and it’s the cure-all for inflation, deflation, and any-flation (hyperbole for those not able to translate my written word sarcasm). The point being, ask yourself if the information you receive is valuable and actionable. Typically the best investment ideas are not discussed 24/7 over every media venue, but rather in the boring footnotes of an unread annual report.

Investing in the Stock Market

For individual securities it’s best to stick to your circle of competence with companies and industries you understand – masters like Peter Lynch and Warren Buffett appreciate this philosophy. Once you find an investment opportunity you understand, you need a way of appraising the value and gauging a company’s growth trajectory. As Charlie Munger and Warren Buffett have described, “value and growth are two sides of the same coin.” Cigar-butt investing solely using value-based metrics is not enough. Even value jock Warren Buffet appreciates the merit of a good business with sustainable expansion prospects. As a matter of fact, some of Buffett’s best performing stocks are considered the greatest growth stocks of all-time. If you cannot assign a price (or range), then you are merely playing the speculation game. Speculation often comes in the form of stock tips (i.e.,stock broker or Jim Cramer) and day trading (see Momentum Investing and Technical Analysis).

We live in a world of endless information, and the analysis can often become overkill. So when overwhelmed with data, do yourself a favor by asking yourself the three questions of engagement – that way you will not miss the forest for the trees. As for stocks, stick with industries and companies you understand and develop a disciplined investment process by appraising both the growth and valuation components of the investment. If making these decisions are too difficult, perhaps you should stay in the kitchen and have Phillip Rivers whip you up some scrambled eggs or serve you a bowl of oatmeal.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in DIS, BRKA/B, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Winning Coaches Telling Players to Quit

How would you feel if your coach told you not only are you going to lose, but you should quit and join the other team? Effectively, that is what Loomis Sayles bond legend Dan Fuss (read Fuss Making a Fuss), and fellow colleagues Margie Patel (Wells Fargo Advantage Funds), and Anthony Crescenzi (PIMCO) had to say about the chances of bonds winning at the recent Advisors’ Money Show.

This is what Fuss said regarding “statistically cheap” equities:

“I’ve never seen it this good in half a century.”

Patel went on to add:

“By any measure you want to look at, free cash flow, dividend yield, P/E ratio – stocks look relatively cheap for the level of interest rates.” Stock offer a “once-in-a-decade opportunity to buy and make some real capital appreciation.”

Crescenzi included the following comments about stocks:

“Valuations are not risky…P/E ratios have been fine for a decade, in part because of the two shocks that drove investors away from equities and compressed P/E ratios.”

Bonds Dynasty Coming to End

The bond team has been winning for three decades (see Bubblicious Bonds), but its players are getting tired and old. Crescenzi concedes the “30-year journey on rates is near its ending point” and that “we are at the end of the duration tailwind.” Even though it is fairly apparent to some that the golden bond era is coming to a close, there are ways for the bond team to draft new players to manage duration (interest rate/price sensitivity) and protect oneself against inflation (read Drowning TIPS).

Equities on the other hand have had a massive losing streak relative to bonds, especially over the last decade. The equity team had over-priced player positions that exceeded their salary cap and the old market leaders became tired and old. Nothing energizes a new team better than new blood and new talent at a much more attractive price, which leaves room in the salary cap to get the quality players to win. There is always a possibility that bonds will outperform in the short-run despite sky-high prices, and the introduction of any material, detrimental exogenous variable (large country bailout, terrorist attack, etc.) could extend bonds’ outperformance. Regardless, investors will find it difficult to dispute the relative attractiveness of equities relative to prices a decade ago (read Marathon Investing: Genesis of Cheap Stocks).

As I have repeated in the past, bonds and cash are essential in any portfolio, but excessively gorging on a buffet of bonds for breakfast, lunch, and dinner can be hazardous for your long-term financial health. Maximizing the bang for your investment buck means not neglecting volatile equity opportunities due to disproportionate conservatism and scary economic media headlines.

There are bond coaches and teams that believe the winning streak will continue despite the 30-year duration of victories. Fear, especially in this environment, is often used as a tactic to sell bonds. Conflicts of interest may cloud the advice of these bond coaches, but the successful experienced coaches like Dan Fuss, Margie Patel, Anthony Crescenzi are the ones to listen to – even if they tell you to quit their team and join a different one.

Read Full Advisor Perspectives Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

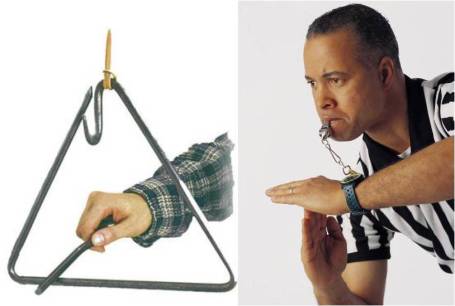

Listening for Dinner Bell or Penalty Whistle?

Excerpt from my monthly newsletter (sign-up on the right of page)…

Investors are eagerly waiting on the sidelines wondering whether to listen for a dinner bell signaling the time to sink their teeth into traditional equity investments, or respond to a penalty whistle by nervously maintaining money in depleted, inflation-losing CDs. A large swath of investors are still scarred from the losses experienced from the 2008-2009 financial crisis and are trying to rationalize the recent +80% move in equity markets (S&P 500 index) over the last 18 months. Eating saltine crackers and drinking water in CDs and money market accounts yielding < 1% feels OK when the world is collapsing around you, but eventually people realize retirement goals are tough to achieve with the money stuffed under the mattress.

Here are some recent bells and whistles we are listening to:

Mid-Term Elections: Regardless of your politics, Republicans are forecasted to regain control of the House of Representatives, while expectations for a narrow Democrat Senate majority remains the consensus. Currently, Democrat Jerry Brown is a handful of points in the lead over Meg Whitman for the California governor’s race. Another issue voters are closely monitoring is the likelihood of Bush tax-cut extensions.

Printing Press Part II: The Federal Reserve has strongly hinted of another round at the printing press in an effort to stimulate the economy by keeping interest rates low (e.g., record low 30-year fixed mortgage rates around 4.2%). The Fed accomplishes this so-called Quantitative Easing (or QE2) by purchasing Treasuries and mortgage backed securities – pumping more dollars into the financial system to expand credit and loans. In addition, QE2 is structured to stimulate the meager 0.8% core inflation experienced over the last 12 months (Bloomberg) to a Goldilocks level – not too hot and not too cold. QE2 asset purchase estimates are all over the map, but estimates generally stand at the low end of the original $200 billion to $2 trillion range.

Growth Continues: Although companies are sitting on record piles of cash ($1.8 trillion for all non-financial companies), chief executive officers continue to have short arms with their deep pockets when it comes to spending on new hires. Persistent growth for five consecutive quarters (2% GDP expansion in Q2), coupled with tight cost controls, is resulting in 46% estimated growth in 2010 corporate profits as measured by the average of S&P 500 companies. For the time being, “double dip” worries have been put on hold for this jobless recovery.

Unemployment Hypochondria: As I wrote in an earlier Investing Caffeine article (READ HERE), there is an almost obsessive focus on the unemployment rate, which although moving in the right direction, remains at a stubbornly high 9.6% rate nationally. Fresh new employment data will be released this Friday.

Foreclosure-gate: As foreclosures have increased and the decline in the housing market has matured, investors have grown more impatient with collections from mortgage backed securities originators. Banks and other mortgage lenders could face more than $100 billion in losses (CNBC) in mortgage “putbacks” related to improper packaging and terms disclosed to investors. Lawyers are salivating at the opportunity of litigating the thousands of potential cases across the country.

Create Your Own Blueprint – Block Noise

In reality, there is no dinner bell or penalty whistle when it comes to investing. Sure, we hear dinner bells and whistles every day on TV from strategists and economists, but in this sordid, cacophony of daily noise, the long line-up of soothsayers are constantly switching back and forth between optimistic bells and pessimistic whistles. The consistent onslaught of this indiscernible noise serves no constructive purpose for the average investor. I strongly believe the correct plan of attack is to create a customized investment plan that meets your long-term objectives, constraints, and risk tolerance. By creating a diversified portfolio of low-cost tax-efficient products and strategies, I believe investors will be more securely positioned for a more comfortable and less stressful retirement.

I have my own opinions on the economic environment, which I detail in excruciating detail through my InvestingCaffeine.com writings. These macro-economic opinions are stimulating but have little to no bearing on the construction of my investment portfolios. More important is focusing on the investment areas with the best fundamental prospects, while balancing risk and return for each client.

Despite what I just said, if you are still determined to know my opinions on the market direction, then follow me to the dinner table; I just heard the dinner bell ring.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Skiing Portfolios Down Bunny Slopes

Oh Nelly, take it easy…don’t get too crazy on that bunny slope. With fall officially kicking off and the crisp smell of leaves in the air, the new season also marks the beginning of the ski season. In many respects, investing is a lot like skiing. Unfortunately, many investors are financially skiing their investment portfolios down a bunny slope by stuffing their money in low yielding CDs, money market accounts, and Treasury securities. The bunny slope certainly feels safe and secure, but many investors are actually doing more long-term harm than good and could be potentially jeopardizing their retirements.

Let’s take a gander at the cautious returns offered up from the financial bunny slope products:

That CD earning 1.21% should cover a fraction of your medical insurance premium hike, or if you accumulate the interest from your money market account for a few years, perhaps it will cover the family seeing a new 3-D movie. If you also extend the maturity on that CD a little, maybe it can cover an order of chicken fingers at Applebees (APPB)?!

We all know, for much of the non-retiree population, the probability that entitlement programs like Social Security and Medicare will be wiped out or severely cut is very high. Not to mention, life expectancies for non-retirees are increasing dramatically – some life insurance actuarial tables are registering well above 100 years old. These trends indicate the criticalness of investing efficiently for a large swath of the population, especially non-retirees.

Let’s Face It, One Size Does Not Fit All

As I have pointed out in the past, when it comes to investing (or skiing), one size does not fit all (see article). Just as it does not make sense to have Bode Miller (32 year old Olympic gold medalist) ski down a beginner’s bunny slope, it also does not make sense to take a 75-year old grandpa helicopter skiing off a cornice. The same principles apply to investment portfolios. The risk one takes should be commensurate with an individual’s age, objectives, and constraints.

Often the average investor is unaware of the risks they are taking because of the counterintuitive nature of the financial market dangers. In the late 1990s, technology stocks felt safe (risk was high). In the mid-2000s, real estate felt like a sure bet (risk was high), and in 2010, Treasury bonds and gold are currently being touted as sure bets and safe havens (read Bubblicious Bonds and Shiny Metal Shopping). You guess how the next story ends?

Unquestionably, coasting down the bunny slopes with CDs, money market accounts, and Treasuries is prudent strategy if you are a retiree holding a massive nest egg able to meet all your expenses. However, if you are younger non-retiree and do not want to retire on mac & cheese or work at Wal-Mart as a greeter into your 80s, then I suggest you venture away from the bunny slope and select a more suitable intermediate path to financial success.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and WMT, but at the time of publishing SCM had no direct position in APPB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.