Posts tagged ‘investing’

Shoot First and Ask Later?

The financial markets have been hit by a tsunami on the heels of idiotic debt negotiations, a head-scratching credit downgrade, and slowing economic data after a wallet-emptying spending binge by the government. These chain of events have forced many investors and speculators alike to shoot first, and ask questions later. Is this the right strategy? Well, if you think the world is going to end and we are in a global secular bear market stifled by a choking pile of sovereign debt, then the answer is a resounding “yes.” If however, you believe the blood curdling screams from an angered electorate will eventually influence existing or soon-to-be elected politicians in dealing with the obvious, then the answer is probably “no.”

Plug Your Ears

Anybody that says they confidently know what is really going to happen over the next six months is a moron. You can ask those same so-called talking head experts seen over the airwaves if they predicted the raging +35% upward surge last summer, right after the market tanked -17% on “double-dip” concerns and Fed Chairman Ben Bernanke gave his noted quantitative easing speech in Jackson Hole, Wyoming. I’m still flicking through the channels looking for the professionals who perfectly envisaged the panicked buying of the same downgraded Treasuries Standard and Poor’s pooped on. Oh sure, it makes perfect sense that trillions of dollars would flock to the warmth and coziness of sub-2% yielding debt in a country exploding with unsustainable obligations and deficits, fueled by a Congress that can barely blows its nose to a successful negotiation.

The moral of the story is that nobody knows the future with certainty – no matter how much CNBC producers would like you to believe the opposite is true. Some of the arguably smartest people in the world have single handedly triggered financial market implosions. Consider Robert Merton and Myron Scholes, both renowned Nobel Prize winners, who brought global financial markets to its knees in 1998 when Merton and Scholes’s firm (Long Term Capital Management) lost $500 million in one day and required a $3.6 billion bailout from a consortium of banks. Or ask yourself how well Fed Chairmen Alan Greenspan and Ben Bernanke did in predicting the credit crisis and housing bubble.

If the strategist or trader du jour squawking on the boob-tube was really honest, he or she would steal the sage words of wisdom from the television series secret agent Angus MacGyver who articulated, “Only a fool is sure of anything, a wise man keeps on guessing.”

Listen to the “E”-Word

If you can’t trust all the squawkers, then whom can you trust (besides me of course…cough, cough)? The answer is no different than the person you would look for in other life-important decisions. If you needed a serious heart by-pass surgery, would you get advice from a nurse or medical professor, or would you listen more closely to the top cardiologist at the Mayo Clinic who performed over 2,000 successful surgeries? If you were looking for a pilot to fly your plane, would you prefer a 25-year-old flight attendant, or a 55-year old steely veteran who has 10 million miles of flight experience? OK, I think you get the point…legitimate experience with a track record is key.

Unfortunately, most of the slick, articulate people we see on television may look experienced and have some gray hair, but the only thing they are experienced at is giving opinions. As my great, great grandmother once told me, “Opinions are a dime a dozen, but experience is much more valuable” (embellished for dramatic effect). You are better off listening to experienced professionals like Warren Buffett (listen to his recent Charlie Rose interview), who have lived through dozens of crises and profited from them – Buffett becoming the richest person on the planet doesn’t just come from dumb luck.

If you are having trouble sleeping, you either are taking too much risk, or do not understand the nature of the risk you are taking (see Sleeping like a Baby). Things can always get worse, and the risk of a self-fulfilling further decline is a possibility (read about Soros and Reflexivity). If you are determined to make changes to your portfolio, use a scalpel, and not an axe. The recent extreme volatility makes times like these ideal for reviewing your financial position, goals, and risk tolerance. But before you shoot your portfolio first, and ask questions later, prevent a prison sentence of panic, or your financial situation may end up behind bars.

[tweetmeme source=”WadeSlome” only_single=false https://investingcaffeine.com/2011/08/20/shoot-first-and-ask-later/%5D

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MHP, CMCSA, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Innovative Bird Keeps All the Worms

As the old saying goes, “The early bird gets the worm,” but in the business world this principle doesn’t always apply. In many cases, the early bird ends up opening a can of worms while the innovative, patient bird is left with all the spoils. This concept has come to light with the recent announcement that social networking site MySpace is being sold for a pittance by News Corp. (NWS) to Specific Media Inc., an advertising network company. Although Myspace may have beat Facebook to the punch in establishing a social network footprint, Facebook steamrolled Myspace into irrelevance with a broader more novel approach. Rather than hitting a home run and converting a sleepy media company into something hip, Rupert Murdoch, CEO of News Corp. struck out and received crumbs for the Myspace sale (News Corp. sold it for $35 million after purchasing for $540 million in 2005, a -94% loss).

Other examples of “winner takes all” economics include:

Kindle vs. Book Stores: Why are Borders and Waldenbooks (BGPIQ.PK) bankrupt, and why is Barnes and Noble Inc. (BKS) hemorrhaging in losses? One explanation may be people are reading fewer books and reading more blogs (like Investing Caffeine), but the more credible explanation is that Amazon.com Inc. (AMZN) built an affordable, superior digital mousetrap than traditional books. I’ll go out on a limb and say it is no accident that Amazon is the largest bookseller in the world. Within three years of Kindle’s introduction, Amazon is incredibly selling more digital books than they are selling physical hard copies of books.

iPod vs. Walkman/MP3 Players: The digital revolution has shaped our lives in so many ways, and no more so than in the music world. It’s hard to forget how unbelievably difficult it was to fast-forward or rewind to a particular song on a Sony Walkman 30 years ago (or the hassle of switching cassette sides), but within a matter of a handful of years, mass adoption of Apple Inc.’s (AAPL) iPod overwhelmed the dinosaur Walkman player. Microsoft Corp.’s (MSFT) foray into the MP3 market with Zune, along with countless other failures, have still not been able to crack Apple’s overpowering music market positioning.

Google vs. Yahoo/Microsoft Search: Google Inc. (GOOG) is another company that wasn’t the early bird when it came to dominating a new growth industry, like search engines. As a matter of fact, Yahoo! Inc (YHOO) was an earlier search engine entrant that had the chance to purchase Google before its meteoric rise to $175 billion in value. Too bad the Yahoo management team chose to walk away…oooph. Some competitive headway has been made by the likes of Microsoft’s Bing, but Google still enjoys an enviable two-thirds share of the global search market.

Dominance Not Guaranteed

Dominant market share may result in hefty short-term profits (see Apple’s cash mountain), but early success does not guarantee long-term supremacy. Or in other words, obsolescence is a tangible risk in many technology and consumer related industries. Switching costs can make market shares sticky, but a little innovation mixed with a healthy dose of differentiation can always create new market leaders.

Consider the number one position American Online (AOL) held in internet access/web portal business during the late nineties before its walled gardens came tumbling down to competition from Yahoo, Google, and an explosion of other free, advertisement sponsored content. EBay Inc. (EBAY) is another competition casualty to the fixed price business model of Amazon and other online retailers, which has resulted in six and a half years of underperformance and a -44% decline in its stock price since the 2004 peak. Despite questionable execution, and an overpriced acquisition of Skype, eBay hasn’t been left for complete death, thanks to a defensible growth business in PayPal. More recently, Research in Motion Ltd. (RIMM) and its former gargantuan army of “CrackBerry” disciples have felt the squeeze from new smart phone clashes with Apple’s iPhone and Google’s Android operating system.

With the help of technology, globalization, and the internet, never in the history of the world have multi-billion industries been created at warp speed. Being first is not a prerequisite to become an industry winner, but evolutionary innovation, and persistently differentiated products and services are what lead to expanding market shares. So while the early bird might get the worm, don’t forget the patient and innovative second mouse gets all the cheese.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, AMZN, and GOOG, but at the time of publishing SCM had no direct position in BGPIQ.PK, NWS, YHOO, MSFT, SNE, AOL, EBAY, RIMM, Facebook, Skype, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Winning the Stock Rock Turning Game

There are a few similarities between dieting and investing. There are no shortcuts or panaceas to achieving success in either endeavor – they both require plain old hard work. Any winning investment process will have some sort of mechanism(s) to generate new stock ideas, whether done quantitatively through a screening process or more subjectively through other avenues (e.g., conferences, journals, investor contacts, field research, or Investing Caffeine – ha). As many investors would agree, discovering remarkable stock picks is no effortless undertaking. A lot of meaningless rocks need to be turned before a gem can be found, especially in an age of information overload. I believe investing guru Peter Lynch said it best:

“I always thought if you looked at ten companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at hundred you’ll find ten. The person that turns over the most rocks wins the game.”

Depending on the duration of your investment time horizon, stock gems can be more abundant in certain time periods relative to others. The shorter the timeframe, the more important timing becomes. Looking at a few major turning points illustrates my point. Although hindsight is 20/20, it is clear now (and for a minority of investors 11 years ago) that the pickings were slim in March 2000 and virtually endless in March 2009 –practically anything purchased then went up in price.

Investing is not a game of certainty, because if it was certain, everyone would be sipping umbrella drinks on their personal islands. Since investing involves a great deal of uncertainty, the name of the game is stacking probabilities in your favor. If you have a repeatable process, you should be able to outperform the markets in the long-run. In the short-run, a good process can have a bad outcome, and a bad process can have a good outcome.

Macro vs. Bottom-Up

Gaining a rough sense of the macro picture can increase the probabilities of success, but more importantly I believe a bottom-up approach (i.e., flipping over lots of stock rocks) is a better approach to raising odds in your favor. The recent volatility and pullback in the market has left a sour taste in investors’ mouths, but great opportunities still abound. That’s the thing about great stocks, they never disappear in bear markets and they eventually flourish – more often when a bull market returns.

Characterizing the macro game as difficult is stating the obvious. Although there are only about two recessions every decade, if you watch CNBC or read the paper, there are probably about 20 or 30 recessions predicted every 10 years. Very few, if any, can profitably time the scarce number of actual recessions, but many lose tons of money from the dozens of false alarms. You’re much better off by following Lynch’s credo: “Assume the market is going nowhere and invest accordingly.”

Land Mine or Gold Mine?

Not everyone believes in the painstaking process of fundamental analysis, but I in fact come from the COFC (Church of Fundamental Research), which firmly believes fundamental research is absolutely necessary in determining whether an investment is a land mine or a gold mine. Others believe that a quantitative black box (see Butter in Bangladesh), or technical analysis (see Astrology or Lob Wedge) can do the trick as a substitute. These strategies may be easier to implement, but as well-known money manager Bill Miller indicated, “This is not a business where ignorance is an asset; the more you work at it, the better you ought to be, other things equal.”

By doing your investment homework on companies, not only will you gain better knowledge of your investment, but you will better understanding of the company. Regardless of your process, I’m convinced any worthwhile strategy requires conviction. If you have loose roots of interest in a stock, the wind will blow you all over the place, and ultimately rip the roots of your flimsy thesis out of the foundation. I contend that most lazy and simplistic processes, such as buying off tips, chasing winners, or letting computers buy stocks might create short-term profits, but these methods do not engender conviction and will eventually lead speculators to the poor house. If simple short-cuts worked so well, I think the secret would have gotten out to the masses by now. Rather than trading off of tips or questionable technical indicators, Peter Lynch advises investors to do their homework and “buy what you know.”

There is no single way of making money in the stock market, but I’m convinced any worthwhile process incorporates a process of pulling weeds and watering new flowers. But to generate a continuous flow of new stock idea gems, which are necessary to win in the investment game, you will need to turn over a lot of stock rocks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Snoozing Your Way to Investment Prosperity

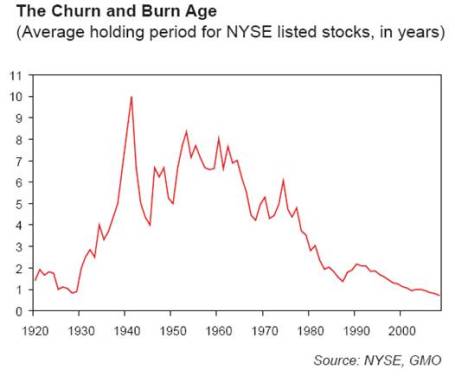

When it comes to investing, do you trade like Jim Cramer on Red Bull – grinding your teeth to every tick or news headline? With the advent of the internet, an unrelenting, real-time avalanche of news items spreads like a furious plague – just ask Anthony Weiner. As fear and greed incessantly permeate the web, and day-trading systems and software are increasingly peddled as profit elixirs, investors are getting itchier and itchier trading fingers. Just consider that investment holding periods have plummeted from approximately 10 years around the time of World War II to 8 months today (see GMO chart below). Certainly, the reduction in trading costs along with the ever-proliferating trend of technology advancements (see Buggy Whip Déjà Vu) is a contributor to the price of trading, but the ADHD-effect of information overload cannot be underestimated (see The Age of Information Overload).

But fear not, there is a prescription for those addicted, nail-biting day-traders who endlessly pound away on their keyboards with bloody hangnails. The remedy is a healthy dosage of long-term growth investing in quality companies and sustainably expanding trends. I know this is blasphemy in the era of “de-risking” (see It’s All Greek to Me), short-term “risk controls” (i.e. panicking at bottoms and chasing performance), and “benchmark hugging,” but I believe T. Rowe Price had it right:

“The growth stock theory of investing requires patience, but is less stressful than trading, generally has less risk, and reduces brokerage commissions and income taxes.”

This assessment makes intuitive sense to me, but how can one invest for the long-term when there are structural deficits, inflation, decelerating GDP growth, international nuclear catastrophes, escalated gasoline prices, and Greek debt concerns? There are always concerns, and if there none, then you should in fact be concerned (e.g., when investors piled into equities during the “New Economy” right before the bubble burst in 2000). In order to gain perspective, consider what happened at other points in history when our country was involved in war; came out of recession; faced high employment; experienced Middle East supply fears; battled banking problems; handled political scandals; and dealt with rising inflation trends. One comparably bleak period was the 1974 bear market.

Let’s take a look at how that bear market compared to the current environment:

Then (1974) Now (2011)

End of Vietnam War End of Iraq War (battles in Afghanistan and Libya)

Exiting recession Exiting recession

9% Unemployment 9% Unemployment

Arab Oil Embargo Arab Spring and Israeli-Palestinian tensions

Watergate political scandal Anthony Weiner political scandal

Franklin National Bank failure Banking system bailout

Rising inflation trends Rising inflation trends

We can debate the comparability of events and degree of pessimism, but suffice it to say the outlook was not very rosy 37 years ago, nor is it today. History never repeats itself, but it does tend to rhyme. Although attitudes were dour four decades ago, the Dow Jones exploded from 627 in late 1974 to 12,004 today. I’m not calling for another near 20-fold increase in prices over the next 37 years, but a small fraction of that improvement would put a smile on equity investors’ faces. Jim Fullerton, the former chairman of the Capital Group of the American Funds understood pundits’ skepticism during times of opportunity when he wrote the following in November 1974:

“Today there are thoughtful, experienced, respected economists, bankers, investors and businessmen who can give you well-reasoned, logical, documented arguments why this bear market is different; why this time the economic problems are different; why this time things are going to get worse — and hence, why this is not a good time to invest in common stocks, even though they may appear low.”

Rather than getting glued to the TV horror story headline du jour, perhaps investors should take some of the sage advice provided by investment Hall of Famer, Peter Lynch (Lynch averaged a +29% annual return from 1977-1990 while at Fidelity Investments). Rather than try to time the market, he told investors to “assume the market is going nowhere and invest accordingly.” And Lynch offered these additional words of wisdom to the many anxious investors who fret about macroeconomics and timing corrections:

• “It’s lovely to know when there’s recession. I don’t remember anybody predicting 1982 we’re going to have 14 percent inflation, 12 percent unemployment, a 20 percent prime rate, you know, the worst recession since the Depression. I don’t remember any of that being predicted. It just happened. It was there. It was ugly. And I don’t remember anybody telling me about it. So I don’t worry about any of that stuff. I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.”

• “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

• “Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

Real money is not made by following the crowd. Real money is made by buying quality companies and securities at attractive prices. The prescription to generating above-average profits is finding those quality market leaders (or sustainable trends) that can compound earnings growth for multiple years, not chasing every up-tick and panicking out of every down-tick. Following these doctor’s orders will lead to a strong assured mind and a healthy financial portfolio – key factors allowing you to peacefully snooze to investment prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in TROW, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Tug-of-War as Recovery Matures

Excerpt from No-Cost June 2011 Sidoxia Monthly Newsletter (Subscribe on right-side of page)

With the Rapture behind us, we can now focus less on the end of the world and more on the economic tug of war. As we approach the midpoint of 2011, equity markets were down -1.4% last month (S&P 500 index) and are virtually flat since February – trading within a narrow band of approximately +/- 5% over that period. Investors are filtering through data as we speak, reconciling record corporate profits and margins with decelerating economic and employment trends.

Here are some of the issues investors are digesting:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

- International Expansion: A weaker dollar has made domestic goods and services more affordable to foreigners, resulting in stronger sales abroad. The expansion of middle classes in developing countries is leading to the broader purchasing power necessary to drive increasing American exports.

- Rising Productivity: Cheap labor, new equipment, and expanded technology adoption have resulted in annualized productivity increases of +2.9% and +1.6% in the 4th quarter and 1st quarter, respectively. Eventually, corporations will be forced to hire full-time employees in bulk, as bursting temporary worker staffs and stretched employee bases will hit output limitations.

- Deleveraging Helps Spending: As we enter the third year of the economic recovery, consumers, corporations, and financial institutions have become more responsible in curtailing their debt loads, which has led to more sustainable, albeit more moderate, spending levels. For instance, ever since mid-2008, when recessionary fundamentals worsened, consumer debt in the U.S. has fallen by more than $1 trillion.

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

It’s the Earnings, Stupid

Political strategist James Carville famously stated, “It’s the economy stupid,” during the 1992 presidential campaign. Despite a historic record approval rating of 90 by President George H.W. Bush after the 1991 Gulf War victory, Bush Sr. still managed to lose the election to President Bill Clinton because of a weak economy. President Barack Obama would serve himself well to pay attention to history if he wants to enter the “two-termer” club. Pundits are placing their bets on Obama due to his large campaign war chest, a post-Osama bin Laden extinguishment approval bump, and a cloudy Republican candidate weather forecast. If however, the unemployment rate remains elevated and the current administration ignores the spending/debt crisis, then the President’s re-election hopes may just come crashing down.

Price Follows Earnings

The similarly vital relationship between the economy and politics applies to the relationship of earnings and the equity markets too. Instead of the key phrase, “It’s the economy stupid,” in the stock market, “It’s all about the earnings stupid” is the crucial guideline. The balance sheet may play a role as well, but at the end of the day, the longer-term trend in stock prices eventually follows earnings and cash flows (i.e., investors will pay a higher price for a growing stream of earnings and a lower price for a declining or stagnant stream of earnings). Ultimately, even value investors pay more attention to earnings in the cases where losses are deteriorating or hemorrhaging (e.g. a Blockbuster or Enron). Another main factor in stock price valuations is interest rates. Investors will pay more for a given stream of earnings in a low interest rate environment relative to a high interest rate environment. Investors lived through this in the early 1980s when stocks traded at puny 7-8x P/E ratios due to double-digit inflation and a Federal Funds rate that peaked near 20%.

Bears Come Out of Hibernation

Today, earnings portray a different picture relative to the early eighties. Not only are S&P 500 operating earnings growing at a healthy estimated rate of +17% in 2011, but the 10-year Treasury note is also trading at a near-record low yield of 3.06%. In spite of these massively positive earnings and cash flow dynamics occurring over the last few years, the recent -3% pullback in the S&P 500 index from a month ago has awoken some hibernating bears from their caves. Certainly a slowing or pause in the overall economic indicators has something to do with the newfound somber mood (i.e., meager Q1 real GDP growth of +1.8% and rising unemployment claims). Contributing to the bears’ grumpy moods is the economic debt hangover we are recovering from. However, a large portion of the fundamental economic expansion experienced by corporate America has not been fueled by the overwhelming debt still being burned off throughout the financial sector and eventually our federal and state governments. Companies have become leaner and meaner – not only paying down debt, but also increasing dividends, buying back stock, and doing more acquisitions. The corporate debt-free muscle is further evidenced by the $100 billion in cash held by the likes of IBM, Microsoft Corp. (MSFT), and Google Inc. (GOOG) – and still growing.

At a 13.5x P/E multiple of 2011 earnings, perhaps the stock market is pricing in an earnings slowdown? But as of last week, about 70% of the S&P 500 companies reporting Q1 earnings have exceeded expectations. If this trend continues, perhaps we will see James Carville on CNBC rightfully shouting the maxim, “It’s the earnings, stupid!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in IBM, MSFT, Blockbuster, Enron, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

End of the World Put on Ice

Our 3.5 billion year old planet has received a temporary reprieve, at least until the next Mayan Armageddon destroys the world in 2012. Sex, money, and doom sell and Arnold, Oprah, and the Rapture have not disappointed in generating their fair share of advertising revenue clicks.

With 2 billion people connected to the internet and 5 billion people attached to a cell phone, every sneeze, burp, and fart around the world makes daily headline news. The globalization cat is out of the bag, and this phenomenon will only accelerate in the years to come. In 1861 the Pony Express took ten days to deliver a message from New York to San Francisco, and today it takes a few seconds to deliver a message across the world over Twitter or Facebook.

The equity markets have more than doubled from the March 2009 lows and even previous, ardent bulls have turned cautious. Case in point, James Grant from the Interest Rate Observer who was “bullish on the prospects for unscripted strength in business activity” (see Metamorphosis of Bear into Bull) now sees the market as “rich” and asserts “nothing is actually cheap.” Grant rubs salt into the wounds by predicting inflation to spike to 10% (read more).

Layer on multiple wars, Middle East/North African turmoil, gasoline prices, high unemployment, mudslinging presidential election, uninspiring economic growth, and you have a large pessimistic poop pie to sink your teeth into. Bearish sentiment, as calculated by the AAII Sentiment Survey, is at a nine-month high and currently bears outweigh bulls by more than 50%.

The Fear Factor

I think Cullen Roche at Pragmatic Capitalism beautifully encapsulates the comforting blanket of fear that is permeating among the masses through his piece titled, “In Remembrance of Fear”:

“The bottom line is, stay scared. Do not let yourself feel confident, happy or wealthy. You are scared, poor and miserable. You should stay that way. You owe it to yourself. The media says so. And more importantly, there are old rich white men who need to sell books and if you’re not scared by them you’ll never buy their books. So, do yourself a favor. Buy their books and services and stay scared. You deserve it.”

Here is Cullen’s prescription for dealing with all the doom and gloom:

“Associate with people who are more scared than you. That way, you can all sit in bunkers and talk about the end of days and how screwed we all are. Think about how much better that will make you feel. Misery loves company. Do it.”

All is Not Lost

While inflation and gasoline price concerns weigh significantly on economic growth expectations, some companies are taking advantage of record low interest rates. Take for example, Google Inc.’s (GOOG) recent $3 billion bond offerings split evenly across three-year, five-year, and ten-year notes with an average interest rate of 2.3%. Although Google has languished relative to the market over the last year, the market blessed the internet giant with the next best thing to free money by pricing the deal like a AAA-rated credit. Cash-heavy companies have been able to issue low cost debt at a frantic pace for accretive EPS shareholder-friendly activities, such as acquisitions, share buybacks, and organic growth initiatives. Cash rich balance sheets have afforded companies the ability to offer shareholders a steady diet of dividend increases too.

While there is no question high oil prices have put a wet towel over consumer spending, the largest component of corporate check books is labor costs, which accounts for roughly two-thirds of corporate spending. With unemployment rate at 9.0%, this is one area with no inflation pressure as far as the eye can see. Money losing companies that go bankrupt lay-off employees, while profitable companies with stable input costs (labor) will hire more – and that’s exactly what we’re seeing today. Despite all the economic slowing and collapse anxiety, S&P 500 operating earnings, as of last week, are estimated to rise +17% in 2011. Healthy corporations coupled with a growing, deleveraged workforce will have to carry the burden of growth, as deficit and debt direction will ultimately act as a drag on economic growth in the immediate and intermediate future.

Fear and pessimism sell news, and technology is only accelerating the proliferation of this trend. The good news is that you have another 18 months until the next apocalypse on December 21, 2012 is expected to destroy the human race. Rather than attempting to time the market, I urge you to follow the advice of famed investor Peter Lynch who says, “Assume the market is going nowhere and invest accordingly.” For all the others addicted to “pessimism porn,” I’ll let you get back to constructing your bunker.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in Twitter, Facebook, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Getting & Staying Rich 101

Fred J. Young worked 27 years as a professional money manager and investment counselor in the trust department at Harris Bank in Chicago. While working there he learned a few things about wealth accumulation and preservation, which he outlines in his book How to Get Rich and Stay Rich.

There is more than one way to skin a cat, and when it comes to getting rich, Young describes the only three ways of getting loaded:

1.) Inherit It: Using this method on the path to richness generally doesn’t take a lot of blood, sweat, and tears (perhaps a little brown-nosing wouldn’t hurt), but young freely admits you can skip his book if you are fortunate enough to garner boatloads of cash through your ancestry.

2.) Marry It: This approach to wealth accumulation can require a bit more effort than method number one. However, Young explains that if the Good Lord intended you to find your lifetime lover through destiny, then if your soul-mate has a lot of dough Young advises, “You [should] graciously accept the situation. Don’t fight it.”

3.) Spend < Earn: Normally this avenue to champagne and caviar requires the most effort. How does one execute option number three? “You spend less than you earn and invest the difference in something you think will increase in value and make you rich,” simply states Young. Sounds straightforward, but what does one invest their excess cash in? Young succinctly lists the customary investment tools of choice for wealth creation:

- Real estate

- Own their own business

- Common stocks

- Savings accounts (thanks to the magic of compound interest rates) – see also Penny Saved is Billions Earned

Rich Luck

If faced with choosing between good luck and good judgment, here is Fred Young’s response:

“You should take good luck. Good luck, by definition, denotes success. Good judgment can still go wrong.”

Like many endeavors, it’s good to have some of both (good luck and good judgment).

The Role of Courage

Courage is especially important when it comes to equity investing because buying stocks includes a very counterintuitive behavioral aspect that requires courage. Following the herd of average investors and buying stocks at new highs is easy and does not require a lot of courage. Young describes the various types of courage required for successful investing:

“The courage to buy when others are selling; the courage to buy when stocks are hitting new lows; the courage to buy when the economy looks bad; courage to buy at the bottom…The times when the gloom was the thickest invariably turned out to have been the best times to buy stocks.”

Keeping the Cash

Becoming rich is only half the challenge. In many cases staying rich can be just as difficult as accumulating the wealth. Young points out the intolerable pain caused by transitioning from wealth to poverty. What is Young’s solution to this tricky problem? Seek professional help. The risks undertaken to build wealth still exist when you are rich, and those same risks have the capability of tearing financial security away.

There are three paths to riches according to Fred Young (inheritance, marriage, and prudent investing). Some of these directions leading to mega-money require more effort than others, but if you are lucky enough to have deep pockets of riches, make sure you have the discipline and focus necessary to maintain that wealth – those deep pockets could have a hole.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Fallacy of High P/E’s

Would you pay a P/E ratio (Price-Earnings) of 1x’s future earnings for a dominant market share leading franchise that is revolutionizing the digital industry and growing earnings at an +83% compounded annual growth rate? Or how about shelling out 3x’s future profits for a company with ambitions of taking over the global internet advertising and commerce industries while expanding earnings at an explosive +51% clip? If you were capable of identifying Apple Inc. (AAPL) and Google Inc. (GOOG) as investment ideas in 2004, you would have made approximately +2,000% and +600%, respectively, over the following six years. I know looking out years into the future can be a lot to ask for in a world of high frequency traders and stock renters, but rather than focusing on daily jobless claims and natural gas inventory numbers, there are actual ways to accumulate massive gains on stocks without fixating on traditional trailing P/E ratios.

At the time in 2004, Apple and Google were trading at what seemed like very expensive mid-30s P/E ratios (currently the S&P 500 index is trading around 15x’s trailing profits) before these stocks made their explosive, multi-hundred-percent upward price moves. What seemingly appeared like expensive rip-offs back then – Apple traded at a 37x P/E ($15/$0.41) and Google 34x P/E ($85/$2.51) – were actually bargains of a lifetime. The fact that Apple’s share price appreciated from $15 to $347 and Google’s $85 to $538, hammers home the point that analyzing trailing P/E ratios alone can be hazardous to your stock-picking health.

Why P/Es Don’t Matter

In William O’Neil’s book, How to Make Money in Stocks he comes to the conclusion that analyzing P/E ratios is worthless:

“Our ongoing analysis of the most successful stocks from 1880 to the present show that, contrary to most investors beliefs, P/E ratios were not a relevant factor in price movement and have very little to do with whether a stock should be bought or sold. Much more crucial, we found, was the percentage increase in earnings per share.”

Here is what O’Neil’s data shows:

- From 1953 – 1985 the best performing stocks traded at a P/E ratio of 20x at the early stages of price appreciation versus an average P/E ratio of 15x for the Dow Jones Industrial Average over the same period. The largest winners saw their P/E multiples expand by 125% to 45x.

- From 1990 – 1995, the leading stocks saw their P/E ratios more than double from an average of 36 to the 80s. Once again, O’Neil explains why you need to pay a premium to play with the market leading stocks.

You Get What You Pay For

When something is dirt cheap, many times that’s because what you are buying is dirt. Or as William O’Neil says,

“You can’t buy a Mercedes for the price of a Chevrolet, and you can’t buy oceanfront property for the same price you’d pay for land a couple of miles inland. Everything sells for about what it’s worth at the time based on the law of supply and demand…The very best stocks, like the very best art, usually command a higher price.”

Any serious investor has “value trap” scars and horror stories to share about apparently cheap stocks that seemed like bargains, only to later plummet lower in price. O’Neil uses the example of when he purchased Northrop Grumman Corp (NOC) many years ago when it traded at 4x’s earnings, and subsequently watched it fall to a P/E ratio of 2x’s earnings.

Is Your Stock a Teen or a Senior?

A mistake people often make is valuing a teen-ager company like it’s an adult company (see also the Equity Life Cycle article). If you were offered the proposition to pay somebody else an upfront lump-sum payment in exchange for a stream of their lifetime earnings, how would you analyze this proposal? Would you make a higher lump-sum payment for a 21-year-old, Phi Beta Kappa graduate from Harvard University with a 4.0 GPA, or would you pay more for an 85 year old retiree generating a few thousand dollars in monthly Social Security income? As you can imagine, the vast majority of investors would pay more for the youngster’s income because the stream of income over 65-70 years would statistically be expected to be much larger than the stream from the octogenarian. This same net present value profit stream principle applies to stocks – you will pay a higher price or P/E for the investment opportunity that has the best growth prospects.

Price Follows Earnings

At the end of the day, stock prices follow the long-term growth of earnings and cash flows, whether a stock is considered a growth stock, a value stock, or a core stock. Too often investors are myopically focused on the price action of a stock rather than the earnings profile of a company. Or as investment guru Peter Lynch states:

”People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

“People Concentrate too much on the P (Price), but the E (Earnings) really makes the difference.”

Correctly determining how a company can grow earnings is a more crucial factor than a trailing P/E ratio when evaluating the attractiveness of a stock’s share price.

Valuations Matter

Even if you buy into the premise that trailing P/E ratios do not matter, valuation based on future earnings and cash flows is critical. When calculating the value of a company via a discounted cash flow or net present value analysis, one does not use historical numbers, but rather future earnings and cash flow figures. So when analyzing companies with apparently sky-high valuations based on trailing twelve month P/E ratios, do yourself a favor and take a deep breath before hyperventilating, because if you want to invest in unique growth stocks it will require implementing a unique approach to evaluating P/E ratios.

See also Evaluating Stocks Vegas Style

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, AAPL, and GOOG, but at the time of publishing SCM had no direct position in NOC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Sigmund Freud the Portfolio Manager

Byron Wien, former investment strategist at Morgan Stanley (MS) and current Vice Chairman at Blackstone Advisory Partners (BX), traveled to Austria 25 years ago and used Sigmund Freud’s success in psychoanalytical theory development as a framework to apply it to the investment management field.

This is how Wien describes Freud’s triumphs in the field of psychology:

“He accomplished much because he successfully anticipated the next step in his developing theories, and he did that by analyzing everything that had gone before carefully. This is the antithesis of the way portfolio managers approach their work.”

Wien attempts to reconcile the historical shortcomings of investment managers by airing out his dirty mistakes for others to view.

“I think most of us have developed patterns of mistake-making, which, if analyzed carefully, would lead to better performance in the future…In an effort to encourage investment professionals to determine their error patterns, I have gathered the data and analyzed my own follies, and I have decided to let at least some of my weaknesses hang out. Perhaps this will inspire you to collect the information on your own decisions over the past several years to see if there aren’t some errors that you could make less frequently in the future.”

Here are the recurring investment mistakes Wien shares in his analysis:

Selling Too Early: Wien argues that “profit-taking” alone is not reason enough to sell. Precious performance points can be lost, especially if trading activity is done for the sole purpose of looking busy.

The Turnaround with the Heart of Gold: Sympathy for laggard groups and stocks is inherent in the contrarian bone that most humans use to root for the underdog. Wien highlights the typical underestimation investors attribute to turnaround situations – reality is usually a much more difficult path than hoped.

Overstaying a Winner: Round-trip stocks – those positions that go for long price appreciation trips but return over time to the same stock price of the initial purchase – were common occurrences for Mr. Wien in the past. Wien blames complacency, neglect, and infatuation with new stock ideas for these overextended stays.

Underestimating the Seriousness of a Problem: More often than not, the first bad quarter is rarely the last. Investors are quick to recall the rare instance of the quick snapback, even if odds would dictate there are more cockroaches lurking after an initial sighting. As Wien says, “If you’re going to stay around for things to really improve, you’d better have plenty of other good stocks and very tolerant clients.”

It may have been 1986 when Byron Wien related the shortcomings in investing with Sigmund Freud’s process of psychoanalysis, but the analysis of common age-old mistakes made back then are just as relevant today, whether looking at a brain or a stock.

See also: Killing Patients to Prosperity

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MS, BX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

![940614_83408820[1]](https://investingcaffeine.com/wp-content/uploads/2011/08/940614_834088201.jpg?w=455)