Posts tagged ‘investing’

Sifting Through the Earnings Rubble

An earthquake of second quarter earnings results have rocked the markets (better than expected earnings but sluggish revenues), and now investors are left to sift through the rubble. With thousands of these earnings reports rolling in (and many more in the coming weeks), identifying the key investment trends across sectors, industries, and geographies can be a challenging responsibility. If this was an easy duty, I wouldn’t have a job! Fortunately, having a disciplined process to sort through the avalanche of quarterly results can assist you in discovering both potential threats and opportunities.

But first things first: You will need some type of reliable screening tool in order to filter find exceptional stocks. According to Reuters, there are currently more than 46,000 stocks in existence globally. Manually going through this universe one stock at a time is not physically or mentally feasible for any human to accomplish, over any reasonable amount of time. I use several paid-service screening tools, but there are plenty of adequate free services available online as well.

Investing with the 2-Sided Coin

As Warren Buffett says, “Value and growth are two sides of the same coin.” Having a disciplined screening process in place is the first step in finding those companies that reflect the optimal mix between growth and value. I am willing to pay an elevated price (i.e., higher P/E ratio) for a company with a superior growth profile, but I want a more attractive value (i.e., cheaper price) for slower growth companies. I am fairly agnostic between the mix of the growth/value weighting dynamics, as long as the risk-reward ratio is in my favor.

Since I firmly believe that stock prices follow the long-term trajectory of earnings and cash flows, I fully understand the outsized appreciation opportunities that can arise from the “earnings elite” – the cream of the crop companies that are able to sustain abnormally high earnings growth. Or put in baseball terms, you can realize plenty of singles and doubles by finding attractively priced growth companies, but as Hall of Fame manager Earl Weaver says, “You win many more games by hitting a three-run homer than you do with sacrifice bunts.” The same principles apply in stock picking. Legendary growth investor Peter Lynch (see also Inside the Brain of an Investing Genius) is famous for saying, “You don’t need a lot of good hits every day. All you need is two to three goods stocks a decade.”

Some past successful Sidoxia Capital Management examples that highlight the tradeoff between growth and value include Wal-Mart stores (WMT) and Amazon.com (AMZN). Significant returns can be achieved from slower, mature growth companies like Wal-Mart if purchased at the right prices, but multi-bagger home-run returns (i.e., more than doubling) require high octane growth from the likes of global internet platform companies. Multi-bagger returns from companies like Amazon, Apple Inc. (AAPL), and others are difficult to find and hold in a portfolio for years, but if you can find a few, these winners can cure a lot of your underperforming sins.

Defining Growth

Fancy software may allow you to isolate those companies registering superior growth in sales, earnings, and cash flows, but finding the fastest growing companies can be the most straightforward part. The analytical heavy-lifting goes into effect once an investor is forced to determine how sustainable that growth actually is, while simultaneously determining which valuation metrics are most appropriate in determining fair value. Some companies will experience short-term bursts of growth from a single large contract; from acquisitions; and/or from one-time asset sale gains. Generally speaking, this type of growth is less valuable than growth achieved by innovative products, service, and marketing.

The sustainability of growth will also be shaped by the type of industry a company operates in along with the level of financial leverage carried. For instance, in certain volatile, cyclical industries, sequential growth (e.g. the change in results over the last three months) is the more relevant metric. However for most companies that I screen, I am looking to spot the unique companies that are growing at the healthiest clip on a year-over-year basis. These recent three month results are weighed against the comparable numbers a year ago. This approach to analyzing growth removes seasonality from the equation and helps identify those unique companies capable of growing irrespective of economic cycles.

Given that we are a little more than half way through Q2 earnings results, there is still plenty of time to find those companies reporting upside fundamental earnings surprises, while also locating those quality companies unfairly punished for transitory events. Now’s the time to sift through the earnings rubble to find the remaining buried stock gems.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, AMZN, AAPL, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Experts vs. Dart-Throwing Chimps

Daniel Kahneman, a professor of psychology at Princeton University, knows a few things about human behavior and decision making, and he has a Nobel Prize in Economics to prove it. We live in a complex world and our brains will often try to compensate by using shortcuts (or what Kahneman calls “heuristics” and “biases”), in hopes of simplifying complicated situations and problems.

When our brains become lazy, or we are not informed in a certain area, people tend to also listen to so-called experts or pundits to clarify uncertainties. In the process of their work, Kahneman and other researchers have discovered something – experts should be listened to as much as monkeys. Frequent readers of Investing Caffeine understand my shared skepticism of the talking heads parading around on TV (read first entry of 10 Ways to Destroy Your Portfolio)

Here is how Kahneman describes the reliability of professional forecasts and predictions in his recently published bestseller, Thinking, Fast and Slow:

“People who spend their time, and earn their living, studying a particular topic produce poorer predictions than dart-throwing monkeys who would have distributed their choices evenly over the options.”

Most people fall prey to this illusion of predictability created by experts, or this idea that more knowledge equates to better predictions and forecasts. One of the factors perpetuating this myth is the rearview mirror. In other words, human’s ability to concoct a credible story of past events creates a false confidence in peoples’ ability to accurately predict the future.

Here’s how Kahneman describes the phenomenon:

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained…Our tendency to construct and believe coherent narratives of the past makes it difficult for us to accept the limits of our forecasting ability. Everything makes sense in hindsight, a fact financial pundits exploit every evening as they offer convincing accounts of the day’s events. And we cannot suppress the powerful intuition that what makes sense in hindsight today was predictable yesterday. The illusion that we understand the past fosters overconfidence in our ability to predict the future.”

Even when experts are wrong about their predictions, they tend to not accept accountability. Rather than take responsibility for a bad prediction, Philip Tetlock says the errors are often attributed to “bad timing” or an “unforeseeable event.” Philip Tetlock, a psychologist at the University of Pennsylvania did a landmark twenty-year study, which was published in his book Expert Political Judgment: How Good Is It? How Can We Know? (read excellent review in The New Yorker). In the study Tetlock interviewed 284 economic and political professionals and collected more than 80,000 predictions from them. The results? The experts did worse than blind guessing.

Based on the extensive training and knowledge of these experts, many of them develop a false sense of confidence in their predictions. Or as Tetlock explains it, “They [experts] are just human in the end. They are dazzled by their own brilliance and hate to be wrong. Experts are led astray not by what they believe, but by how they think.”

Brain Blunders and Stock Picking

The buyer of a stock thinks the price will go up and the seller of a stock thinks the price will go down. Both participants engage in the transaction because they believe the current stock price is wrong. The financial services industry is built largely on this phenomenon that Kahneman calls an “illusion of skill,” or ability to exploit inefficient market pricing. Relentless advertisements and marketing pitches continually make the case that professionals can outperform the markets, but this is what Kahneman found:

“Although professionals are able to extract a considerable amount of wealth from amateurs, few stock pickers, if any, have the skill needed to beat the market consistently, year after year. Professional investors, including fund managers, fail a basic test of skill: persistent achievement…Skill in evaluating the business prospects of a firm is not sufficient for successful stock trading, where the key question is whether the information about the firm is already incorporated in the price of its stock. Traders apparently lack the skill to answer this crucial question, but they appear ignorant of their ignorance.”

For the few managers that actually do outperform, Kahneman assigns luck to the outcome, not skill:

“For a large majority of fund managers, the selection of stocks is more like rolling dice than like playing poker. Typically at least two out of three mutual funds underperform the overall market in any given year…The successful funds in any given year are mostly lucky; they have a good roll of the dice.”

The picture for individual investors isn’t any prettier. Evidence from Terry Odeam, a finance professor at UC Berkeley, who studied 100,000 individual brokerage account statements and about 163,000 trades over a seven-year period, was not encouraging. He discovered that stocks sold actually did +3.2% better than the replacement stocks purchased. And this detrimental impact on performance excludes the significant expenses related to trading.

In response to Odean’s work, Kahneman states:

“It is clear that for the large majority of individual investors, taking a shower and doing nothing would have been a better policy than implementing the ideas that came to their minds….Many individual investors lose consistently by trading, an achievement that a dart-throwing chimp could not match.”

In a future Odean paper titled, “Trading is Hazardous to your Wealth,” Odean and his colleague Brad Barber also proved that “less is more.” The results showed the most active traders had the weakest performance, and those traders who traded the least had the best returns. Interestingly, women were shown to have better investment results than men.

Regardless of whether someone is listening to an expert, fund manager, or individual investor, what Daniel Kahneman has discovered in his long, illustrious career is that humans consistently make errors. If you are wise, you will heed Kahneman’s advice by stealing the expert’s darts and handing them over to the chimp.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

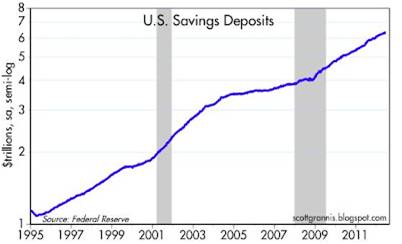

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

The Bond Binge

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

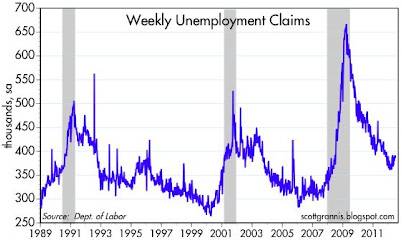

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investing with the Sentiment Pendulum

Article is an excerpt from Sidoxia Capital Management’s complementary May 2012 newsletter. Subscribe on right side of page.

The last five years have been historic in many respects. Not only have governments and central banks around the world undertaken unprecedented actions in response to the global financial crisis, but investors have ridden an emotional rollercoaster in response to historically unparalleled uncertainties.

While the nature of this past crisis has been unique, experienced investors know these fears continually manifest themselves in different forms over various cycles in time. Despite the more than doubling in equity market values over the last few years, as measured by the S&P 500 index, the emotional pendulum of investor sentiment has only partially corrected. Investor temperament has thankfully swung away from “Panic,” but has only moved closer to “Fear” and “Skepticism.” Here are some of the issues contributing to investors’ current sour mood:

The Next European Domino: The fear of the Greek domino toppling the larger Spanish and Italian economies has investors nervously chewing their finger-nails, and political turmoil in France and the Netherlands isn’t creating any additional warm and fuzzies.

Job Additions Losing Steam: New job creation here in the U.S. weakened to a lethargic monthly rate of +120,000 new jobs in March, while the unemployment rate remains stubbornly high at an 8.2% level.

Domestic Growth Losing Mojo: GDP (Gross Domestic Product) growth of +2.2% during the first quarter of 2012 also opened the door for the pessimists. Consumers are still spending (+2.9% growth), but government spending, business investment, and housing are taking wind out of the economy’s sails.

Emerging Markets Submerging: Unspectacular growth in the U.S. is not receiving any favors from slowing emerging markets like China and Brazil, which took fiscal and monetary actions to slow inflation and housing speculation in 2011.

Humpty Dumpty Politics: Presidential elections, tax policy, and deficit reduction are all concerns that carry the possibility of pushing the economic Humpty Dumpty off the wall, and as a result potentially lead to a great fall. The determination of Humpty Dumpty’s fate will likely have to wait until year-end or 2013.

Any student of history knows these fears and other concerns never go away – they simply change. But like supply and demand, gravitational forces eventually swing the emotional pendulum in the opposite direction. As Sir John Templeton so aptly stated, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” Or in other words, escalating bull markets must climb the proverbial “Wall of Worry” in order to sustain upward momentum. If there was nothing to worry about, then all the buyers would already be in the markets. We are nowhere close to experiencing “Euphoria” like we saw in stocks during the late-1990s or in the housing market around 2005.

Positively Climbing the “Wall of Worry”

With all this bad news out there, surprisingly there are some glimmers of hope chipping away at the “Wall of Worry.” Here are some of the positive factors helping turn pessimist frowns upside down:

Slow & Steady Wins the Race: The economic recovery has been weaker than hoped, but I can think of worse scenarios than 11 consecutive quarters of GDP growth and 25 straight months of private job creation, which has reduced the unemployment rate from 10.0% in October 2009 to 8.2% last month.

Earnings Machine Keeps Chugging Along: With the majority of S&P 500 companies having reported their quarterly results for the first quarter, three-fourths of the companies are beating forecasted earnings, which are currently registering in at a respectable +7.1% rate (Thomson Reuters). One company epitomizing this trend is Apple Inc. (AAPL). The near doubling in Apple’s profits during the quarter, thanks to explosive iPhone sales, pushed Apple’s shares over $600 and helped drive the NASDAQ index to its best day of the year.

Super Ben to the Rescue: The Federal Reserve has already stated their intention of keeping interest rates near 0% until 2014. The potential of additional monetary stimulus spearheaded by Federal Reserve Chairman Ben Bernanke, in the form of QE3 (Quantitative Easing Part III), may provide further needed support to the stock market (a.k.a., the “Bernanke Put”).

Return of the IPO: Initial Public Offerings (IPOs) have gained steam versus last year with more than 53 already coming to market in the first four months of 2012. This is no 1999, but a good number of deals have done quite well over the last month. For example, data analysis company Splunk Inc. (SPLK) share price is already up around 100% and the value of leisure luggage company TUMI Holdings (TUMI) has climbed over +40%. In a few weeks, the highly anticipated blockbuster Facebook (FB) IPO is expected to begin trading its shares, so we can see if the chronicled deal can live up to all the hype.

Dividends Galore: Dividend payments to stockholders are flowing at an extraordinary rate so far in 2012. Companies like IBM (increased its dividend by +13%), Exxon Mobil – (XOM +21%); Goldman Sachs – (GS +31%) are but just a few of the dividend raisers this year. Through the first three months of the year, the number of companies increasing their dividend payments was up +45% as compared to the comparable number for all of 2011.

Emerging Growth Not Dead: While worriers fret over slowing growth in China, companies like Apple grew by more than +100% in this region and collected nearly 20% of its revenues from this Asian country (~$8 billion). Coincidentally, China is expected to surpass an incredible one billion mobile connections in May – many of those iPhones. In other related news, Starbucks Corp. (SBUX) plans to triple its workforce and number of stores in China over the next three years. China has also helped fuel a backlog of Caterpillar Inc. (CAT) that is more than triple the level of 2009. Emerging markets may have slowed down in 2011, but with inflation beginning to stabilize, emerging market central banks and governments are now beginning to ease policies and reduce red-tape. For example, Brazil and India have started to lower key benchmark interest rates, and China has started to reverse capital flow restrictions.

Stay Off the Trampled Path

The mantra of “Sell in May and go away” always gets a lot of playtime around this period of the year. Over the last few years, the temporary spring/summer sell-offs have only been followed by stronger price appreciation. Individuals attempting to time the market (see also Getting Off the Treadmill) generally end up in tears. And for those traders who boast about their excellent timing (like those suspicious friends who brag about always winning in Las Vegas), we all know the truth – nobody buys at the lows and sells at the highs…except for liars.

With all the noise and cross-currents flooding the airwaves, investing for individuals without assistance has never been so difficult. But before hiding in your cave or reacting to the next scary headline about Europe, the economy, or politics, do yourself a favor by reminding yourself these chilling news items are nothing new and are often great contrarian indicators (see also Back to the Future). The emotional pendulum is constantly swinging from fear to greed and investors stand to prosper by adjusting sentiment and actions in the opposite direction. To survive in the investing wild, it is best to realize that the grass is greener and the eating more abundant when you stay off the trampled path of the herd.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, but at the time of publishing SCM had no direct position in SPLK, TUMI, IBM, XOM, GS, SBUX, CAT, FB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Time Arbitrage: Investing vs. Speculation

The clock is ticking, and for many investors that makes the allure of short-term speculation more appealing than long-term investing. Of course the definition of “long-term” is open for interpretation. For some traders, long-term can mean a week, a day, or an hour. Fortunately, for those that understand the benefits of time arbitrage, the existence of short-term speculators creates volatility, and with volatility comes opportunity for long-term investors.

What is time arbitrage? The concept is not new and has been addressed by the likes of Louis Lowenstein, Ralph Wanger, Bill Miller, and Christopher Mayer. Essentially, time arbitrage is exploiting the benefits of moving against the herd and buying assets that are temporarily out of favor because of short-term fears, despite healthy long-term fundamentals. The reverse holds true as well. Short-term euphoria never lasts forever, and experienced investors understand that continually following the herd will eventually lead you to the slaughterhouse. Thinking independently, and going against the grain is ultimately what leads to long-term profits.

Successfully executing time arbitrage is easier said than done, but if you have a systematic, disciplined process in place that assists you in identifying panic and euphoria points, then you are well on your way to a lucrative investment career.

Winning via Long-Term Investing

Legg Mason has a great graphical representation of time arbitrage:

The first key point to realize from the chart is that in the short-run it is very difficult to distinguish between gambling/speculating and true investing. In the short-run, speculators can make money just as well as anybody, and in some cases, even make more profits than long-term investors. As famed long-term investor Benjamin Graham so astutely states, “In the short run the market is a voting machine. In the long run it’s a weighing machine.” Or in other words, speculative strategies can periodically outperform in the short run (above the horizontal mean return line), while thoughtful long-term investing can underperform.

Financial Institutions are notorious for throwing up strategies on the wall like strands of spaghetti. If some short-term outperforming products spontaneously stick, then the financial institutions often market the bejesus out of them to unsuspecting investors, until the strategies eventually fall off the wall.

Beware o’ Short-Termism

I believe Jack Gray of Grantham, Mayo, Van Otterloo got it right when he said, “Excessive short-termism results in permanent destruction of wealth, or at least permanent transfer of wealth.” What’s led to the excessive short-termism in the financial markets (see Short-Termism article)? For starters, technology and information are spreading faster than ever with the proliferation of the internet, creating a sense of urgency (often a false sense) to react or trade on that information. With more than 2 billion people online and 5 billion people operating mobile phones, no wonder investors are getting overwhelmed with a massive amount of short-term data. Next, trading costs have declined dramatically in recent decades, to the point that brokerage firms are offering free trades on various products. Lower trading costs mean less friction, which often leads to excessive and pointless, profit-reducing trading in reaction to meaningless news (i.e., “noise”). Lastly, the genesis of ETFs (exchange traded funds) has induced a speculative fervor, among those investors dreaming to participate in the latest hot trend. Usually, by the time an ETF has been created, the cat is already out of the bag, and the low hanging profit fruits have already been picked, making long-term excess returns tougher to achieve.

There is never a shortage of short-term fears, and today the 2008-09 financial crisis; “Flash Crash”; debt downgrade; European calamity; upcoming presidential elections; expiring tax cuts; and structural debts/deficits are but a few of the fear issues du jour in investors’ minds. Markets may be overbought in the short-run, and a current or unforeseen issue may derail the massive bounce from early 2009. For investors who can put on their long-term thinking caps and understand the concept of time arbitrage, buying oversold ideas and selling over-hyped ones will lead to profitable usage of investment time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Munger: Buffett’s Wingman & the Art of Stock Picking

Simon had Garfunkel, Batman had Robin, Hall had Oates, Dr. Evil had Mini Me, Sonny had Cher, and Malone had Stockton. In the investing world, Buffett has Munger. Charlie Munger is one of the most successful and famous wingmen of all-time – evidenced by Berkshire Hathaway Corporation’s (BRKA/B) outperformance of the S&P 500 index by approximately +624% from 1977 – 2009, according to MarketWatch. Munger not only provides critical insights to his legendary billionaire boss, Warren Buffett, but he also is Chairman of Berkshire’s insurance subsidiary, Wesco Financial Corporation. The magic of this dynamic duo began when they met at a dinner party during 1959.

In an article he published in 2006, the magnificent Munger describes the “Art of Stock Picking” in a thorough review about the secrets of equity investing. We’ll now explore some of the 88-year-old’s sage advice and wisdom.

Model Building

Charlie Munger believes an individual needs a solid general education before becoming a successful investor, and in order to do that one needs to study and understand multiple “models.”

“You’ve got to have models in your head. And you’ve got to array your experience both vicarious and direct on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and in life. You’ve got to hang experience on a latticework of models in your head.”

Although Munger indicates there are 80 or 90 important models, the examples he provides include mathematics, accounting, biology, physiology, psychology, and microeconomics.

Advantages of Scale

Great businesses in many cases enjoy the benefits of scale, and Munger devotes a good amount of time to this subject. Scale advantages can be realized through advertising, information, psychological “social proofing,” and structural factors.

The newspaper industry is an example of a structural scale business in which a “winner takes all” phenomenon applies. Munger aptly points out, “There’s practically no city left in the U.S., aside from a few very big ones, where there’s more than one daily newspaper.”

General Electric Co. (GE) is another example of a company that uses scale to its advantage. Jack Welch, the former General Electric CEO, learned an early lesson. If the GE division is not large enough to be a leader in a particular industry, then they should exit. Or as Welch put it, “To hell with it. We’re either going to be # 1 or #2 in every field we’re in or we’re going to be out. I don’t care how many people I have to fire and what I have to sell. We’re going to be #I or #2 or out.”

Bigger Not Always Better

Scale comes with its advantages, but if not managed correctly, size can weigh on a company like an anchor. Munger highlights the tendency of large corporations to become “big, fat, dumb, unmotivated bureaucracies.” An implicit corruption also leads to “layers of management and associated costs that nobody needs. Then, while people are justifying all these layers, it takes forever to get anything done. They’re too slow to make decisions and nimbler people run circles around them.”

Becoming too large can also create group-think, or what Munger calls “Pavlovian Association.” Munger goes onto add, “If people tell you what you really don’t want to hear what’s unpleasant there’s an almost automatic reaction of antipathy…You can get severe malfunction in the high ranks of business. And of course, if you’re investing, it can make a lot of difference.”

Technology: Benefit or Burden?

Munger recognizes that technology lowers costs for companies, but the important question that many managers fail to ask themselves is whether the benefits from technology investments accrue to the company or to the customer? Munger summed it up here:

“There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.”

Buffett and Munger realized this lesson early on when productivity improvements gained from technology investments in the textile business all went to the buyers.

Surfing the Wave

When looking for good businesses, Munger and Buffett are looking to “surf” waves or trends that will generate healthy returns for an extended period of time. “When a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows,” states Munger. He notes that it’s the “early bird,” or company that identifies a big trend before others that enjoys the spoils. Examples Munger uses to illustrate this point are Microsoft Corp. (MSFT), Intel Corp. (INTC), and National Cash Register from the old days.

Large profits will be collected by those investors that can identify and surf those rare large waves. Unfortunately, taking advantage of these rare circumstances becomes tougher and tougher for larger investors like Berkshire. If you’re an elephant trying to surf a wave, you need to find larger and larger waves, and even then, due to your size, you will be unable to surf as long as small investors.

Circle of Competence

Circle of competence is not a new subject discussed by Buffett and Munger, but it is always worth reviewing. Here’s how Munger describes the concept:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

For Munger and Buffett, sticking to their circle of competence means staying away from high-technology companies, although more recently they have expanded this view to include International Business Machines (IBM), which they invested in late last year.

Market Efficiency or Lack Thereof

Munger acknowledges that financial markets are quite difficult to beat. Since the markets are “partly efficient and partly inefficient,” he believes there is a minority of individuals who can outperform the markets. To expand on this idea, he compares stock investing to the pari-mutuel system at the racetrack, which despite the odds stacked against the bettor (17% in fees going to the racetrack), there are a few individuals who can still make decent money.

The transactional costs are much lower for stocks, but success for an investor still requires discipline and patience. As Munger declares, “The way to win is to work, work, work, work and hope to have a few insights.”

Winning the Game – 10 Insights / 20 Punches

As the previous section implies, outperformance requires patience and a discriminating eye, which has allowed Berkshire to create the bulk of its wealth from a relatively small number of investment insights. Here’s Munger’s explanation on this matter:

“How many insights do you need? Well, I’d argue: that you don’t need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it….I don’t mean to say that [Warren] only had ten insights. I’m just saying, that most of the money came from ten insights.”

Chasing performance, trading too much, being too timid, and paying too high a price are not recipes for success. Independent thought accompanied with selective, bold decisions is the way to go. Munger’s solution to these problems is to provide investors with a Buffett 20-punch ticket:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches ‑ representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

The great thing about Munger and Buffett’s advice is that it is digestible by the masses. Like dieting, investing can be very simple to understand, but difficult to execute, and legends like these always remind us of the important investing basics. Even though Charlie Munger may be slowing down a tad at 88-years-old, Warren Buffett and investors everywhere are blessed to have this wingman around spreading his knowledge about investing and the art of stock picking.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in BRKA/B, GE, MSFT, INTC, National Cash Register, IBM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

U.S. – Best House in Bad Global Neighborhood

Article below represents a portion of free December 1, 2011 Sidoxia monthly newsletter (Subscribe on right-side of page)

There is no shortage of issues to worry about in our troubled global neighborhood, but then again, anybody older than 25 years old knows the world is always an uncertain place. Whether we are talking about wars (Vietnam, Cold War, Iraq); presidential calamities (Kennedy assassination, Nixon resignation/impeachment proceedings); international turmoil (dissolution of Soviet Union, 9/11 attacks, Arab Spring); investment bubbles (technology, real estate); or financial crises (S&L crisis, Long Term Capital, Lehman Brothers bankruptcy), investors always have a large menu of concerns from which they can order.

Despite the doom and gloom dominating the media airwaves, and the lackluster performance of equities experienced over the last decade, the Dow Jones Industrial Average and the S&P 500 index are both up more than 20-fold since the 1970s (those gains also exclude the positive impact of dividends).

Times Have Changed

Just a few decades ago, nobody would have talked or cared about small economies like Iceland, Dubai, and Greece. Today, technology has accelerated the forces of globalization, resulting in information travelling thousands of miles at the click of a mouse, often creating scary financial mountains out of meaningless molehills. As a result of these trends, news of Italian bond auctions, which normally would be glossed over on the evening news, instantaneously clogs our smart phones, computers, radios, and televisions. The implications of all these developments mean investing has become much more difficult, just as its importance has never been more crucial.

How has investing become more critical? For starters, interest rates are near 60-year lows and Treasury bond prices are at record highs, while inflation (food, energy, healthcare, leisure, etc.) is shrinking the value of people’s savings. Next, entitlement and pension reliability are decreasing by the minute – fiscal imbalances and unrealistic promises have contributed to a less certain retirement outlook. Layer on hyper-manic volatility of daily, multi-hundred point swings in the Dow Jones Industrial index and a less experienced investor quickly realizes investing can become an overwhelming game. Case in point is the VIX volatility index (a.k.a., the “Fear Gauge”), which has registered a whopping +57% increase in 2011.

December to Remember?

After an explosive +23% return in the S&P 500 index for 2009 (excluding dividends) and another +13% return in 2010, equity investors have taken a breather thus far in 2011 – the Dow Jones Industrial Average is up modestly (+4%) and the S&P 500 index is down fractionally (-1%). We still have the month of December to log, but in the short-run the European tail has definitely been wagging the rest of the global dog.

Although the United States knows a thing or two about lack of political leadership and coordination, herding the 17 eurozone countries to resolve the European debt financial crisis has proved even more challenging. As you can see below in the performance figures of the major global equity markets, the U.S. remains the best house in a bad neighborhood:

Our fiscal house undeniably needs some work (i.e., unsustainable deficits and bloated debt), but record corporate profits, record levels of cash, voracious consumer spending, improving employment data, and attractive valuations are all contributing to a domestic house that makes opportunities in our backyard look a lot more appealing to investors than prospects elsewhere in the global neighborhood.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and VGK, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Playing Whack-A-Mole with the Pros

Deciphering the ups and the downs of the financial markets is a lot like playing a game of Whack-A-Mole. First the market is up 300 points, then down 300 points. Next Greece and Europe are going down the drain, and then Germany and the ECB (European Central Bank) are here to save the day. The daily data points are a rapid moving target, and if history continues to serve as a guide (see History Often Rhymes with the Future), the bobbing consensus views of pundits will continue to get hammered by investors’ mallets.

Let’s take a look at recent history to see who has been the “whack-er” and whom has been the “whack-ee.” Whether it was the gloom and doom consensus view in the early 1980s (reference BusinessWeek’s 1979 front page “The Death of Equities”) or the euphoric championing of tech stocks in the 1990s (see Money magazine’s March 2000 cover, “The Hottest Market Ever”), the consensus view was wrong then, and is likely wrong again today.

Here are some of the fresher consensus views that have popped up and then gotten beaten down:

End of QE2 – The Consensus: If you rewind the clock back to June 2011 when the Federal Reserve’s $600 billion QE2 (Quantitative Easing Part II) monetary stimulus program was coming to an end, a majority of pundits expected bond prices to tank in the absence of the Fed’s Ben Bernanke’s checkbook support. Before the end of QE2, Reuters financial service surveyed 64 professionals, and a substantial majority predicted bond prices would tank and interest rates would catapult upwards. Actual Result: The pundits were wrong and rates did not go up, they in fact went down. As a result, bond prices screamed higher – bond values increased significantly as 10-year Treasury yields fell from 3.16% to a low of 1.72% last week.

Debt Ceiling Debate – The Consensus: Just one month later, Democrats and Republicans were playing a game of political “chicken” in the process of raising the debt ceiling to over $16 trillion. Bill Gross, bond guru and CEO of fixed income giant PIMCO, was one of the many pros who earlier this year sold Treasuries in droves because fears of bond vigilantes shredding prices of U.S. Treasury bonds .

Here was the prevalent thought process at the time: Profligate spending by irresponsible bureaucrats in Washington if not curtailed dramatically would cascade into a disaster, which would lead to higher default risk, cancerous inflation, and exploding interest rates ala Greece. Actual Result: Once again, the pundits were proved wrong in the deciphering of their cloudy crystal balls. Interest rates did not rise, they actually fell. As a result, bond prices screamed higher and 10-year Treasury yields dived from 2.74% to the recent low of 1.72%.

S&P Credit Downgrade – The Consensus: The S&P credit rating agency warned Washington that a failure to come to meaningful consensus on deficit and debt reduction would result in bitter consequences. Despite a $2 trillion error made by S&P, the agency kept its word and downgraded the U.S.’s long-term debt rating to AA+ from AAA. Research from JP Morgan (JPM) cautioned investors of the imminent punishment to be placed on $4 trillion in Treasury collateral, which could lead to a seizing in credit markets. Actual Result: Rather than becoming the ugly stepchild, U.S. Treasuries became a global safe-haven for investors around the world to pile into. Not only did bond prices steadily climb (and yields decline), but the value of our currency as measured by the Dollar Index (DXY) has risen significantly since then.

What is next? Nobody knows for certain. In the meantime, grab some cotton candy, popcorn, and a rubber mallet. There is never a shortage of confident mole-like experts popping up on TV, newspapers, blogs, and radio. So when the deafening noise about the inevitable collapse of Europe and the global economy comes roaring in, make sure you are the one holding the mallet and not the mole getting whacked on the head.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in JPM, MHP, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

The Political Art of Investment Commentators

There are approximately 2 billion people surfing the internet globally and over 150 million bloggers (source: blogpulse.com) spewing their thoughts out into cyberspace. Throw in economists, strategists, columnists, and the talking heads on television, and you can sleep comfortably knowing there will never be a shortage of opinions for investors to sift through. The real question regarding the infinite number of ideas floating around from the “market commentators” is how useful or harmful is all this information? These diverse points of view, like guns, can be useful or dangerous – depending on an investor’s experience and knowledge level. Deciphering the nuances and variances of investment opinions can be very challenging for an untrained investing eye or ear. While there are plenty of diamonds in the rough to be discovered in the investment advice buffet, there are also a plethora of landmines and booby traps that could explode investment portfolios – especially if these volatile opinions are not handled with care.

No Credentials Required

Unlike dentists, lawyers, accountants, or doctors, becoming a market commentator requires little more than a pulse. All a writer, squawker, or blogger really needs is an internet connection, a keyboard, and something interesting or provocative to talk about. Are any credentials required to blast toxic gibberish to the millions among the masses? Unfortunately there are no qualifications required…scary thought indeed.

In order to successfully navigate the choppy investment opinion waters, investors need to be self-aware enough to answer the following key questions:

• What is your investment time horizon?

• What is your risk tolerance? (see also Sleeping like a Baby)

With these answers in hand, you can now begin to evaluate the credibility and track record of the market commentators and match your personal time horizon and risk profile appropriately. Ideally, investors would seek out prudent long-term counsel, but in this instant gratification society we live in, immediate fear and greed sells advertisements and attracts viewers. Even if media producers and editors of all stripes believed focusing on multi-year time horizons is most beneficial for investors, some serious challenges arise. The brutal reality is that concentrating on the lackluster long-term does not generate a lot of advertisement revenue or traffic. The topics of dollar-cost averaging, asset allocation, diversification, and rebalancing are about as exciting as watching an infomercial marathon (OK, actually this is quite funny) or paint dry. More interesting than the sleepy, uninspiring topics of long-term value creation are stories about terrorist threats, DSK sex scandals, Bernie Madoff Ponzi schemes, currency crises, hacking misconduct, bailouts, tsunamis, earthquakes, hurricanes, 50-day moving averages…OK, you get the idea.

Focus on Long-Term and Do Not Succumb to Short-Termism

Regrettably, there is a massive disconnect between the nano-second time horizons of market commentators and the time horizons of most investors. Moreover, this short-termism dispersed instantaneously via Facebook, Google (GOOG), Twitter, and traditional media channels, has sadly infected the psyches and investment habits of ordinary investors. If you don’t believe me, then check out some of the John Bogle’s work, which shows how dramatically investors underperform the benchmark thanks to emotionally charged reactions (see Fees, Exploitation, and Confusion Hammer Investors).

Although myopic short-termism is not the solution, extending time horizons too long does no good for investors either. As economist John Maynard Keynes astutely noted, “In the long run we are all dead.” But surely bloggers and pundits alike could provide perspectives in multiple year timeframes, rather than in multiple hours. Investors would be served best by turning off the TV, PC, or cell phone, and using the resulting free time to read a good book about the virtues of patient investing from successful long-term investors. Stuffing cash under the mattress, parking it in a 0.5% CD, or panicking into sub-2% Treasuries probably is not going to get the job done for your whole portfolio when inflation, longer life expectancies, and the unsustainable trajectory of entitlements destroy the value of your hard-earned nest egg.

Investment Commentators Look into Politician Mirror

Heading into a heated election year with volatility reaching historic heights in the financial markets, both politicians and investment commentators have garnered a great deal of the media spotlight. With the recent heightened interest in the two fields, some common characteristics between politicians and investment commentators have surfaced. Here are some of the similarities:

- Politicians have a short-term incentives to get re-elected and not get fired, even if there is an inherent conflict with the long-term interest of their constituents; Investment commentators have a short-term incentives to follow the herd and not get fired, even if there is an inherent conflict with the long-term interest of their constituents;

- Many politicians have extreme views that conflict with peers because blandness does not get votes; Many investment commentators have extreme views that conflict with peers because blandness does not get votes;

- Many politicians lack practical experience that could benefit their followers, but the politicians have the gift of charisma to mask their inexperience; Many investment commentators lack practical experience that could benefit their followers, but the commentators have the gift of charisma to mask their inexperience;

Investing has never been so difficult, and also has never been so important, which behooves investors to carefully consider portfolio actions taken based on a very volatile and inconsistent opinions from a group of bloggers, economists, strategists, columnists, and various other media commentators. Investors are bombarded with an avalanche of ever-changing daily data, much of which is irrelevant and should be ignored by long-term investors. As you weigh the precious value of your political votes in the upcoming election season, I urge you to back the candidates that represent your long-term interests. With regard to the financial markets, I also urge you to back the investment commentators that support your long-term interests – the success of your financial future depends on it.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and GOOG, but at the time of publishing SCM had no direct position in Facebook, Twitter, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page

WEBINAR: Panic or Attack?! Preserving Your Financial Future (8/26/11)

Webinar Details:

—August 26, 2011 (Friday) at 11:30 a.m. – 12:30 p.m. (Pacific Standard Time)

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 808 610 841

The financial markets are experiencing historic extremes in volatility. Fears of a European financial contagion are spreading and frustrations with Washington politicians are reaching a feverish pitch. What should investors and retirees do now?

Is now the time to cut losses, or are opportunities of a lifetime developing?

Tune in for this timely review of the financial markets and listen-in to valuable advice on how to preserve your financial future.

CLICK HERE TO CONNECT TO WEBINAR

Toll Free # (if not using PC): 1-877-669-3239

Access Code 808 610 841

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.