Posts tagged ‘investing’

Politics & Your Money

Will you be able to retire, and what impact will the elections have on your financial future? Answering these questions can be a scary endeavor. And unless you have been living in a cave, you may have noticed we are in the middle of a heated U.S. presidential election campaign between Donald Trump and Hillary Clinton. Regardless of which side of the political fence you stand on, the prospects of your retirement are much more likely to be impacted by your personal actions than by the actions of Washington politicians.

Even if you despise politics and were living in a cave (with WiFi access), there’s a high probability you would be overloaded with detailed and dogmatic online editorials from overconfident Facebook friends. Besides offering self-assured predictions, these impassioned political pleas generally itemize the top 10 reasons your favorite candidate is a moron, and another 10 reasons why their candidate is the greatest.

Your friends’ opinions may have pure intentions, but unfortunately, rarely, if ever, do their thoughts alter your views. A reference from a recent Legal Watercooler article summed it up best:

“Political Facebook rants changed my mind…said nobody, ever.”

Nearly as ineffectual as political Facebook opinions on your politics is the ineffectual influence of presidential elections on your finances. For example, over the last four decades, stock prices have gone up and down during both Republican and Democrat presidential terms. The picture looks much the same, if you analyze the fiscal performance of conservatives and liberals since 1970 – debt burdens as a percentage of economic output have risen and fallen under both political parties. No matter who wins the presidency, many investors forget the ability of that individual to affect change is highly dependent upon the political balance of power in Congress. If Congress holds a split majority in the House and Senate, or the opposition party commands the entire Congress, then the winning presidential candidate will be largely neutered.

Rather than panic over a political loss or celebrate a candidate’s victory, here are some tangible actions to improve your finances:

- Organize. Typically individuals have investment and saving accounts scattered with no cohesive accounting or strategy. Get your financial house in order by gathering and organizing all your accounts.

- Budget. Spend less than you take in. Or in other words…save. You can achieve this goal in one of two ways – cut your spending, or increase your income.

- Create a Plan. When do you plan to retire? How much money do you need for retirement? What asset allocation and risk profile should you adopt to meet your financial goals?

If you have difficulty with any of these actions, then meet with an experienced financial professional to assist you.

Politics can trigger very emotional responses. However, realizing your actions have a much more direct impact on your finances than political Facebook rants and temporary elections will benefit you in achieving your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds and FB, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

EU Marriage Ends in Messy Brexit Divorce

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2016). Subscribe on the right side of the page for the complete text.

What Just Happened?

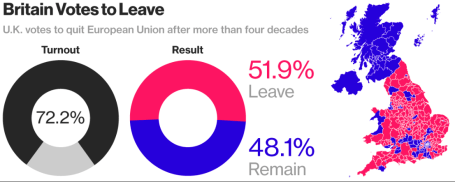

Breakups are never easy, especially when they come as a surprise. That’s exactly what happened with last week’s “Brexit” (British exit) referendum results. History was made when 51.9% of the United Kingdom (U.K.) voters from England, Scotland, Wales and Northern Ireland cast their vote to divorce (“Leave”) their country from the European Union (EU). In the end, the 48.1% of U.K. voters could not generate enough support to “Remain” in the EU (see chart below). Despite torrential downpours in southern Britain, voter turnout was extraordinarily high, as 72% of the 46.5 million registered voters came out in full force to have their voices heard.

Divorce is never cheap, and UK Prime Minister David Cameron paid the ultimate price with his defeat in the Brexit referendum…the loss of his job. Immediately following the release of the referendum results, Cameron, the British Prime Minister since 2010 and leader of the Conservative Party, immediately announced his resignation, effective no later than October 2016 after the selection of his successor.

Source: Bloomberg

One of the reasons behind the shock of the Brexit Leave decision is the longstanding relationship the U.K. has had with the EU. European Union membership first began in 1957 with Belgium, France, Germany, Italy, Luxembourg, and Netherlands being the founding countries of this new political-economic union.

A few decades later, the U.K. officially joined the EU in 1973 with Ireland and the Denmark, shortly before Margaret Thatcher came into power. If you fast forward to today, some 43 years after U.K. originally joined the EU, the Brexit decision represents the largest turning point in European political history. Not since the 1989 falling of the Berlin Wall and the subsequent demise of the Cold War in the Soviet Union has such a large, earth-moving political shift occurred.

Today, there are 28 member countries in the EU with Croatia being the newest member in 2013. Despite the Brexit outcome, there still is a backlog of countries wanting to join the EU club, including Turkey, Serbia, Albania, and Montenegro (and this excludes Scotland, which has voiced an interest in leaving the U.K. for the EU).

What Were Investors’ Reactions?

Financial markets around the world were caught off guard, given many pre-referendum polls were showing the Remain camp with a slight edge, along with British betting parlors that were handicapping an overwhelming victory for the Remain camp. Here’s a summary of stock market reactions around the globe from June 23rd to June 30th:

U.S. (S&P 500): -0.7%

U.K. (FTSE 100): +2.6%

Japan (Nikkei): -4.1%

Germany (DAX): -5.6%

Hong Kong (Hang Seng): +0.4%

China (Shanghai): +1.3%

India (BSE): -0.0%

Surprisingly, modest monthly gains achieved in the S&P 500 prior to the Brexit vote (up +0.8%) were quickly pared after the results came in but remained positive for the entire month (up +0.1%). For the year, U.S. stocks are up a limited +2.7%, which isn’t too bad considering investors’ current mood.

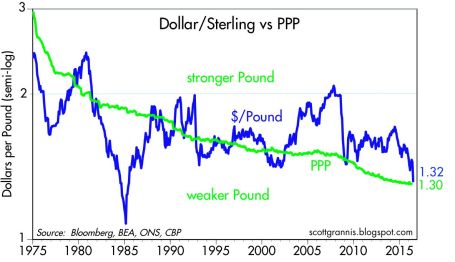

Stocks were not the only financial market disrupted after the Brexit announcement, foreign exchange currency rates were unstable as well. The British pound dived to a 30-year low shortly after the vote to a level of approximately $1.33/£, and was down more than -10% on the day of the announcement (see chart below). UK banks like Barclays PLC (BCS) and Lloyds Banking Group PLC (LYG) also saw their share prices significantly pressured as EU regulatory risks of losing access to European customers and negative global interest rates further squeeze the banks’ profit margins.

To put the currency picture into perspective, the value of the British pound ($2.64/£) peaked in March 1972 at a rate about double the U.S. dollar today. On the positive side of the ledger, a weaker British pound could help boost exports and vacation time to Stonehenge or London, but there is also a risk for a spike of inflation (or stagflation) on the country’s roughly $740 billion in imports (e.g., food, energy, and raw materials).

Source: Calafia Beach Pundit

Why Did it Happen?

While economically prosperous regions like London and Scotland voted heavily for Remain, the message for change of the Leave camp resonated well with working class towns and rural areas of England (seen here). Besides a geographic split, there was also a demographic divide between voters. As you can see from the YouGov poll below, the majority of younger citizens overwhelmingly voted for Remain, and vice versa for older citizens as it relates to the Leave vote.

18-24: 75% Remain

25-49: 56% Remain

50-64: 44% Remain

65+: 39% Remain

While geography and demographics certainly played a key role in the outcome of the EU Leave referendum result, at the core of the movement also was a populist discontent with immigration and the negative economic consequences created by globalization. There are many reasons behind the sluggish economic global recovery, even if the U.S. is doing best out of the developed countries, but rightly or wrongly, immigration policies and protectionism played a prominent part in the Brexit.

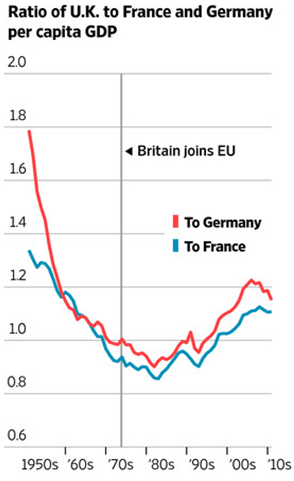

At the heart of the populist sentiment of lost control to Brussels (EU) and immigration is the question of whether the benefits of globalization have outweighed the costs. The spread of globalization and expanded EU immigration has disenfranchised many lower skill level workers displaced by eastern European immigrants, Syrian refugees and innovative solutions like automated machinery, software, and electronic equipment. Economic history clearly shows the answer to the effectiveness of globalization is a resounding “yes”, but the post-financial crisis recovery has been disappointingly sluggish, so a component of the populist movement has felt an urgency to find a scapegoat. The benefits of globalization can be seen in the chart below, as evidenced by the increases in per capita GDP of the UK relative to Germany and France, after joining the EU in 1973. Many observers are quick to identify the visible consequences of globalization (i.e., lower-paying job losses), but fail to identify the invisible benefits (i.e., productivity, lower prices, investment in higher-paying job gains).

Source: The Wall Street Journal

What happens next?

While some EU leaders want to accelerate the Brexit transition, in actuality, this will require a long, drawn-out negotiation process between the still-unnamed new UK Prime Minister and EU officials. The complete EU-Brexit deal will take upwards of two-years to complete, once Article 50 of the EU Lisbon Treaty has been triggered – likely in October.

In light of the unchartered nature of the Brexit Leave vote, nobody truly knows if this decision will ultimately compromise the existential reality of the EU. Time will tell whether Brexit will merely be a small bump on the long EU road, or the beginning of a scary European domino effect that causes the 28 EU country bloc to topple. If the U.K. is successful in negotiating EU trade agreements with separate European countries, the Brexit even has a longer-term potential of benefiting economic activity. Regardless of the EU outcome, the long-term proliferation of capitalism and democracy is likely to prevail because citizens vote with their wallets and capital goes where it is treated best.

What does Brexit Mean for Global Markets?

The short answer is not much economically, however there have been plenty of less substantial events that have roiled financial markets for relatively short periods of time. There are two basic questions to ask when looking at the economic impact of Brexit:

1) What is the Brexit impact on the U.S. economy?

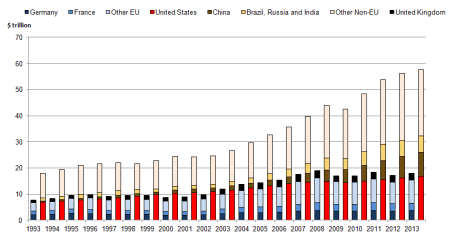

If you objectively analyze the statistics, U.S. companies sold approximately $56 billion of goods to the U.K. last year (our #7 trading partner). Even if you believe in the unlikely scenario of a severe U.K. economic meltdown, the U.K. trade figure is a rounding error in the whole global economic scheme of things. More specifically, $56 billion in trade with the U.K. equates to about .003 of the United States’ $18+ trillion GDP (Gross Domestic Product).

2) What is the Brexit impact on the global economy?

The U.K.’s GDP amounts to about $3 trillion dollars. Of that total, U.K. exports to the EU account for a reasonably insignificant $300 billion. As you can see from the chart below, $300 billion in UK exports to the EU are virtually meaningless and coincidentally equate to about .003 of the world’s $78 trillion estimated GDP.

Source: The National Archives

What to Do Next?

Like many divorces, the U.K. Brexit may be messy and drawn out, until all the details are finalized over the next couple years. It’s important that you establish a strong foundation with your investments and do not divorce the sound, fundamental principles needed to grow and preserve your portfolio. As is usually the case, panicking or making an emotional decision relating to your investments during the heat of some geopolitical crisis rarely translates into an optimal decision over the long-run. As I repeatedly have advised over the years, these periods of volatility are nothing new (see also Series of Unfortunate Events).

If you catch your anxiety or blood pressure rising, do yourself a favor and turn off your TV, radio, or electronic device. A more productive use of time is to calmly review your asset allocation and follow a financial plan, with or without the assistance of a financial professional, so that you are able to achieve your long-term financial goals. This strategy will help you establish a more durable, long-lasting, and successful marriage with your investments.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Cleaning Out Your Investment Fridge

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2016). Subscribe on the right side of the page for the complete text.

Summer is quickly approaching, but it’s not too late to do some spring cleaning. This principle not only applies to your cluttered refrigerator with stale foods but also your investment portfolio with moldy investments. In both cases, you want to get rid of the spoiled goods. It’s never fun discovering a science experiment growing in your fridge.

Over the last three months, the stock market has been replenished after a rotten first two months of the year (S&P 500 index was down -5.5% January through February). The +1.5% increase in May added to a +6.6% and +0.3% increase in March and April (respectively), resulting in a three month total advance in stock prices of +8.5%. Not surprisingly, the advance in the stock market is mirroring the recovery we have seen in recent economic data.

After digesting a foul 1st quarter economic Gross Domestic Product (GDP) reading of only +0.8%, activity has been smelling better in the 2nd quarter. A recent wholesome +3.4% increase in April durable goods orders, among other data points, has caused the Atlanta Federal Reserve Bank to raise its 2nd quarter GDP estimate to a healthier +2.9% growth rate (from its prior +2.5% forecast).

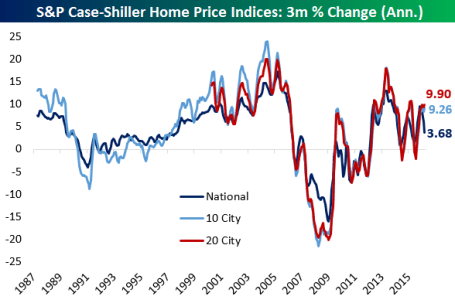

Consumer spending, which accounts for roughly 70% of our country’s economic activity, has been on the rise as well. The improving employment picture (5.0% unemployment rate last month) means consumers are increasingly opening their wallets and purses. In addition to spending more on cars, clothing, movies, and vacations, consumers are also doling out a growing portion of their income on housing. Housing developers have cautiously kept a lid on expansion, which has translated into limited supply and higher home prices, as evidenced by the Case-Shiller indices charted below.

Source: Bespoke

Spoiling the Fun?

While the fridge may look like it’s fully stocked with fresh produce, meat, and dairy, it doesn’t take long for the strawberries to get moldy and the milk to sour. Investor moods can sour quickly too, especially as they fret over the impending “Brexit” (British Exit) referendum on June 23rd when British voters will decide whether they want to leave the European Union. A “yes” exit vote has the potential of roiling the financial markets and causing lots of upset stomachs.

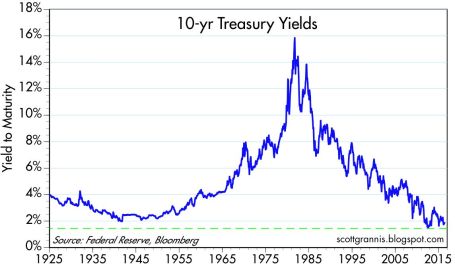

Another financial area to monitor relates to the Federal Reserve’s monetary policy and its decision when to further increase the Federal Funds interest rate target at its June 14th – 15th meeting. With the target currently set at an almost insignificantly small level of 0.25% – 0.50%, it really should not matter whether Chair Janet Yellen decides to increase rates in June, July, September and/or November. Considering interest rates are at/near generational lows (see chart below), a ¼ point or ½ point percentage increase in short-term interest rates should have no meaningfully negative impact on the economy. If your fridge was at record freezing levels, increasing the temperature by a ¼ or ½ degree wouldn’t have a major effect either. If and when short-term interest rates increase by 2.0%, 3.0%, or 4.0% in a relatively short period will be the time to be concerned.

Source: Scott Grannis

Keep a Fresh Financial Plan

As mentioned earlier, your investments can get stale too. Excess cash sitting idly earning next-to-nothing in checking, savings, CDs, or in traditional low-yielding bonds is only going to spoil rapidly to inflation as your savings get eaten away. In the short-run, stock prices will move up and down based on frightening but insignificant headlines. However, in the long-run, the more important issues are determining how you are going to reach your retirement goals and whether you are going to outlive your savings. This mindset requires you to properly assess your time horizon, risk tolerance, income needs, tax situation, estate plan, and other unique circumstances. Like a balanced diet of various food groups in your refrigerator, your key personal financial planning factors are dependent upon you maintaining a properly diversified asset allocation that is periodically rebalanced to meet your long-term financial goals.

Whether you are managing your life savings, or your life-sustaining food supply, it’s always best to act now and not be a couch potato. The consequences of sitting idle and letting your investments spoil away are a lot worse than letting the food in your refrigerator rot away.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Energizer Market… Keeps Going and Going

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 2, 2016). Subscribe on the right side of the page for the complete text.

Boom, boom, boom…it keeps going…and going…and going…

You’ve seen the commercials: A device operating on inferior batteries dies just as a drum-beating, battery operated Energizer bunny comes speeding and spiraling across the television screen. Onlookers waiting for the battery operated toy to run out of juice, instead gaze in amazement as they watch the energized bunny keep going and going. The same phenomenon is occurring in the stock market, as many observers eagerly await for stock prices to die. The obituary of the stock market has been written many times over the last eight years (see Series of Unfortunate Events). Mark Twain summed up this sentiment well, when after a premature obituary was written about him, he quipped, “The reports of my death are greatly exaggerated.”

With fears abound, stocks added to their annual gains by finishing their third consecutive positive month with the S&P 500 indexes and Dow Jones Industrial Average advancing +0.5% and +0.3%, respectively. Skeptics and worry-warts have been concerned about stocks plummeting ever since the Financial Crisis of 2008-2009. We experienced a 100 year flood then, and as a consequence, scarred investors now expect the 100 year flood to repeat every 100 days (see also 100 Year Flood). Given the damage created in the wake of the “Great Recession,” many individuals have become afraid of their own shadow. The shadows currently scaring investors include the following:

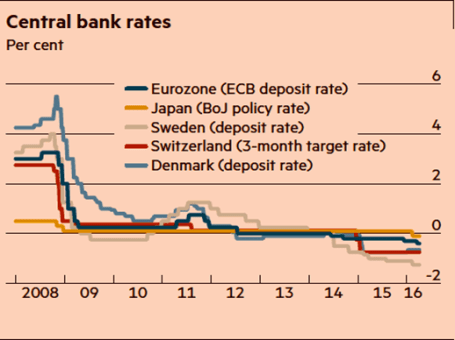

- Negative Interest Rates: The unknown consequences of negative interest rate policies by central banks (see chart below).

- U.S. Monetary Policy: The potential continuation of the Federal Reserve hiking interest rates.

- Sluggish Economic Growth: With a GDP growth figure up only +0.5% during the first quarter many people are worried about the vulnerability of slipping into recession.

- Brexit Fears: Risk of Britain exiting the European Union (a.k.a. “Brexit”) will blanket the airwaves as the referendum approaches next month

For these reasons, and others, the U.S. central bank is likely to remain accommodative in its stance (i.e., Fed Chairwoman Janet Yellen is expected to be slow in hitting the economic brakes via interest rate hikes).

Source: Financial Times. Central banks continue with attempts to stimulate with zero/negative rates.

Climbing the Wall of Worry

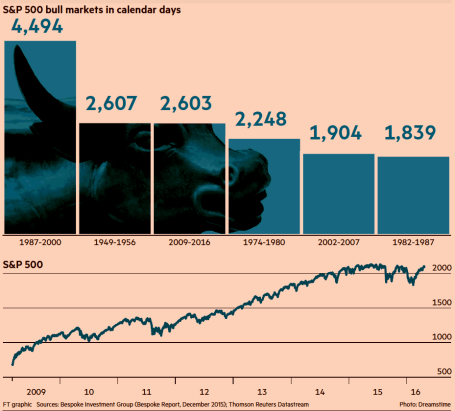

Despite all these concerns, stock prices continue climbing the proverbial “wall of worry” while approaching record levels. As famed investor Sir John Templeton stated on multiple occasions, “Bull markets are born on pessimism, and they grow on skepticism, mature on optimism, and die on euphoria.” It’s obvious to me there currently is no euphoria in the overall market, if you consider investors have withdrawn $2 trillion in stock investments since 2007. The phenomenon of stocks moving higher in the face of bad news is nothing new. A recent study conducted by the Financial Times newspaper shows the current buoyant bull market entering the second longest advancing period since World War II (see chart below).

Source: Financial Times

There will never be a shortage of concerns or bad things occurring in a world of 7.4 billion people, but the Energizer bunny U.S. economy has proven resilient. Our economy is entering its seventh consecutive year of expansion, and as I recently pointed out the job market keeps plodding along in the right direction – unemployment claims are at a 43-year low (see Spring Has Sprung). Over the last few years, these job gains have come despite corporate profits being challenged by the headwinds of a stronger U.S. dollar (hurts our country’s exports) and tumbling energy profits. Fortunately, the negative factors of the dollar and oil prices have stabilized lately, and these dynamics are in the process of shifting into tailwinds for company earnings. The -5.7% year-to-date decline in the Dollar Index coupled with the recent rebound in oil prices are proof that the economic laws of supply-demand eventually respond to large currency and commodity swings. With the number of rigs drilling for oil down by approximately -80% over the last two years, it comes as no surprise to me that a drop in oil supply has steadied prices.

The volatility in oil prices has been amazing. Energy companies have been reeling as oil prices dropped -76% from a 2014-high of $108 per barrel to a 2016-low of $26 per barrel. Since then, the picture has improved significantly. Crude oil prices are now hovering around $46 per barrel, up +76%.

Energy Bankruptcy & Recessionary Fears Abate

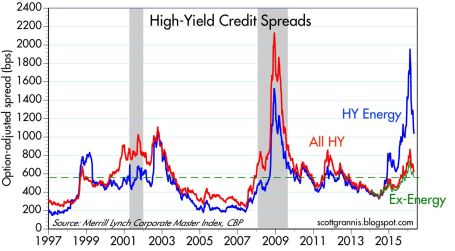

If you take a look at the borrowing costs of high-yield companies in the chart below (Calafia Beach Pundit), you can see that prior spikes in the red line (all high-yield borrowing costs) were correlated with recessions – represented by the gray periods occurring in 2001 and 2008-09. During 2016, you can see from the soaring blue line, investors were factoring in a recession for high-yield energy companies (until the oil price recovery), but the non-energy companies (red-green lines) were not anticipating a recession for the other sectors of the economy. Bottom-line, this chart is telling you the knee-jerk panic of recessionary fears during the January-February period of this year has quickly abated, which helps explain the sharp rebound in stock prices.

After a jittery start to 2016 when economic expectations were for a dying halt, investors have watched stocks recharge their batteries in March and April. There are bound to be more fits and starts in the future, as there always are, but for the time being this Energizer bunny stock market and economy keeps going…and going…and going…

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Avoiding Automobile and Portfolio Crashes

Personal opinions of oneself don’t always mirror reality. Self perceptions relating to both driving and investing can be inflated. For example, the National Highway Traffic Safety Administration (NHTSA) reports that 95% of crashes are caused by human error, but 75% of drivers say they are better drivers than most.

Contributing factors to crashes include: 1) Distractions; 2) Alcohol; 3) Unsafe behavior (i.e., speeding); 4) Time of day (fatality rate is 3x higher at night); 5) Lack of safety belt; 6) Weather; and 7) Time of week (weekends are worst crash days).

A spokesman for the Insurance Institute for Highway Safety is quick to point out that driving behind the wheel is the riskiest activity most people engage in on a daily basis – more than 40,000 driving related fatalities occur each year. Careful common sense helps while driving, but driving sober at 4 a.m. (very few drivers on the road) on a weekday with your seatbelt on won’t hurt either.

Avoiding a Portfolio Crash

Another dangerous activity frequently undertaken by Americans is investing, despite people’s inflated beliefs of their money management capabilities. Investing, however, does not have to be harmful if proper precautions are taken.

Here is some of the hazardous behaviors that should be avoided by those maneuvering an investment portfolio:

1) Trading Too Much: Excessive trading leads to undue commissions, transaction costs, bid-ask spread, impact costs. Many of these costs are opaque or invisible and won’t necessarily be evident right away. But like a leaky boat, direct and indirect trading costs have the potential of sinking your portfolio.

2) Worrying about the Economy Too Much: The country experiences about two recessions a decade, nonetheless our economy continues to grow. If macroeconomics still worry you, then look abroad for even healthier growth – considerable international exposure should aid the long-term success of your portfolio and assist you in sleeping better at night.

3) Emotionally Reacting – Not Objectively Planning: News is bad, so sell. News is good, so buy. This type of conduct is a recipe for portfolio disaster. Better to do as Warren Buffett says, “Be fearful when others are greedy, and be greedy when others are fearful.” The long-term fundamental prospects for any investment are much more important than the daily headlines that get the emotional juices flowing.

4) Hostage to Short-term Time Horizon: Rather than worry about the next 10 days, you should be focused on the next 10 years. The further out you can set your time horizon, the better off you will be. Patience is a virtue.

5) Incongruent Portfolio with Risk: Many retirees got caught flat-footed in the midst of the global financial crisis of 2008-09 with investment portfolios heavy in equities and real estate. Diversified portfolios including fixed-income, commodities, international exposure, cash, and alternative investments should be optimized to meet your specific objectives, constraints, risk tolerance, and time horizon.

6) Timing the Market: Attempting to time the market can be hazardous to your investment health (see Market Timing article). If you really want to make money, then avoid the masses – the grass is greener and the eating better away from the herd.

Driving and investing can both be dangerous activities that command responsible behavior. Do yourself a favor and protect yourself and your portfolio from crashing by taking the appropriate precautions and avoiding the common hazardous mistakes.

Read Full Forbes Article on Driving Dangers

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Winning the Loser’s Game

During periods of heightened volatility like those recently experienced, it’s easy to get caught up in the emotional heat of the moment. I find time is better spent returning to essential investing fundamentals, like the ones I read in the investment classic by Charles Ellis, Winning the Loser’s Game – “WTLG”. To put my enthusiasm in perspective, WTLG has even achieved the elite and privileged distinction of making the distinguished “Recommended Reading” list of Investing Caffeine (located along the right-side of the page). Wow…now I know you are really impressed.

The Man, The Myth, the Ellis

For those not familiar with Charley Ellis, he has a long, storied investment career. Not only has he authored 12 books, including compilations on Goldman Sachs (GS) and Capital Group, but his professional career dates back prior to 1972, when he founded institutional consulting firm Greenwich Associates. Besides earning a college degree from Yale University, and an MBA from Harvard Business School, he also garnered a PhD from New York University. Ellis also is a director at the Vanguard Group and served as Investment Committee chair at Yale University along investment great David Swensen (read also Super Swensen) from 1992 – 2008.

For those not familiar with Charley Ellis, he has a long, storied investment career. Not only has he authored 12 books, including compilations on Goldman Sachs (GS) and Capital Group, but his professional career dates back prior to 1972, when he founded institutional consulting firm Greenwich Associates. Besides earning a college degree from Yale University, and an MBA from Harvard Business School, he also garnered a PhD from New York University. Ellis also is a director at the Vanguard Group and served as Investment Committee chair at Yale University along investment great David Swensen (read also Super Swensen) from 1992 – 2008.

With this tremendous investment experience come tremendous insights. The original book, which was published in 1998, is already worth its weight in gold (even at $1,384 per ounce), but the fifth edition of WTLG is even more valuable because it has been updated with Ellis’s perspectives on the 2008-2009 financial crisis.

Because the breadth of topics covered is so vast and indispensable, I will break the WTLG review into a few parts for digestibility. I will start off with the these hand-picked nuggets:

Defining the “Loser’s Game”

Here is how Charles Ellis describes the investment “loser’s game”:

“For professional investors, “the ‘money game’ we call investment management evolved in recent decades from a winner’s game to a loser’s game because a basic change has occurred in the investment environment: The market came to be dominated in the 1970s and 1980s by the very institutions that were striving to win by outperforming the market. No longer is the active investment manager competing with cautious custodians or amateurs who are out of touch with the market. Now he or she competes with other hardworking investment experts in a loser’s game where the secret to winning is to lose less than others lose.”

Underperformance by Active Managers

Readers that have followed Investing Caffeine for a while understand how I feel about passive (low-cost do-nothing strategy) and active management (portfolio managers constantly buying and selling) – read Darts, Monkeys & Pros. Ellis’s views are not a whole lot different than mine – here is what he has to say while not holding back any punches:

“The basic assumption that most institutional investors can outperform the market is false. The institutions are the market. They cannot, as a group, outperform themselves. In fact, given the cost of active management – fees, commissions, market impact of big transactions, and so forth-85 percent of investment managers have and will continue over the long term to underperform the overall market.”

He goes on to say individuals do even worse, especially those that day trade, which he calls a “sucker’s game.”

Exceptions to the Rule

Ellis’s bias towards passive management is clear because “over the long term 85 percent of active managers fall short of the market. And it’s nearly impossible to figure out ahead of time which managers will make it into the top 15 percent.” He does, however, acknowledge there is a minority of professionals that can beat the market by making fewer mistakes or taking advantage of others’ mistakes. Ellis advocates a slow approach to investing, which bases “decisions on research with a long-term focus that will catch other investors obsessing about the short term and cavitating – producing bubbles.” This is the strategy and approach I aim to achieve.

Gaining an Unfair Competitive Advantage

According to Ellis, there are four ways to gain an unfair competitive advantage in the investment world:

1) Physical Approach: Beat others by carrying heavier brief cases and working longer hours.

2) Intellectual Approach: Outperform by thinking more deeply and further out in the future.

3) Calm-Rational Approach: Ellis describes this path to success as “benign neglect” – a method that beats the others by ignoring both favorable and adverse market conditions, which may lead to suboptimal decisions.

4) Join ‘em Approach: The easiest way to beat active managers is to invest through index funds. If you can’t beat index funds, then join ‘em.

The Case for Stocks

Investor time horizon plays a large role on asset allocation, but time is on investors’ side for long-term equity investors:

“That’s why in the long term, the risks are clearly lowest for stocks, but in the short term, the risks are just as clearly highest for stocks.”

Expanding on that point, Ellis points out the following:

“Any funds that will stay invested for 10 years or longer should be in stocks. Any funds that will be invested for less than two to three years should be in “cash” or money market instruments.”

While many people may feel stock investing is dead, but Ellis points out that equities should return more in the long-run:

“There must be a higher rate of return on stocks to persuade investors to accept risks of equity investing.”

The Power of Regression to the Mean

Investors do more damage to performance by chasing winners and punishing losers because they lose the powerful benefits of “regression to the mean.” Ellis describes this tendency for behavior to move toward an average as “a persistently powerful phenomenon in physics and sociology – and in investing.” He goes on to add, good investors know “that the farther current events are away from the mean at the center of the bell curve, the stronger the forces of reversion, or regression, to the mean, are pulling the current data toward the center.”

The Power of Compounding

For a 75 year period (roughly 1925 – 2000) analyzed by Ellis, he determines $1 invested in stocks would have grown to $105.96, if dividends were not reinvested. If, however, dividends are reinvested, the power of compounding kicks in significantly. For the same 75 year period, the equivalent $1 would have grown to $2,591.79 – almost 25x’s more than the other method (see also Penny Saved is Billion Earned).

Ellis throws in another compounding example:

“Remember that if investments increase by 7 percent per annum after income tax, they will double every 10 years, so $1 million can become $1 billion in 100 years (before adjusting for inflation).”

The Lessons of History

As philosopher George Santayana stated – “Those who cannot remember the past are condemned to repeat it.” Details of every market are different, but as Ellis notes, “The major characteristics of markets are remarkably similar over time.”

Ellis appreciates the importance of history plays in analyzing the markets:

“The more you study market history, the better; the more you know about how securities markets have behaved in the past, the more you’ll understand their true nature and how they probably will behave in the future. Such an understanding enables us to live rationally with markets that would otherwise seem wholly irrational.”

Home Sweet International Home

Although Ellis’s recommendation to diversify internationally is not controversial, his allocation recommendation regarding “full diversification” is a bit more provocative:

“For Americans, this would mean about half our portfolios would be invested outside the United States.”

This seems high by traditional standards, but considering our country’s shrinking share of global GDP (Gross Domestic Product), along with our relatively small share of the globe’s population (about 5% of the world’s total), the 50% percentage doesn’t seem as high at first blush.

Beware the Broker

This is not new territory for me (see Financial Sharks, Fees/Exploitation, and Credential Shell Game), and Ellis warns investors on industry sales practices:

“Those oh so caring and helpful salespeople make their money by convincing you to change funds. Friendly as they may be, they may be no friend to your long-term investment success.”

Unlike a lot of other investing books, which cover a few aspects to investing, Winning the Loser’s Game covers a gamut of crucial investment lessons in a straightforward, understandable fashion. A lot of people play the investing game, but as Charles Ellis details, many more investors and speculators lose than win. For any investor, from amateur to professional, reading Ellis’s Winning the Loser’s Game and following his philosophy will not only help increase the odds of your portfolio winning, but will also limit your losses in sleep hours.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Financial Markets Recharge with a Nap…Zzzzzz

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 4, 2016). Subscribe on the right side of the page for the complete text.

Did you enjoy your New Year’s festivities? If you were like me and ate excessively and drank too much egg nog, you may have decided along the line to take a nap. It’s not a bad idea to recharge those batteries before implementing those New Year’s resolutions and jumping on the treadmill. That’s exactly what happened in the financial markets this year. After six consecutive years of positive returns in the Dow Jones Industrial Average (2009 – 2014), stock markets took a snooze in 2015, as measured by the S&P 500 and Dow, which were each down -0.7% and -2.2%, respectively. And bonds didn’t fare any better, evidenced by the -1.9% decline in the Aggregate Bond ETF (AGG), over the same time period. Given the deep-seated fears about the Federal Reserve potentially catapulting interest rates higher in 2015, investors effectively took a big yawn by barely nudging the 10-year Treasury Note yield higher by +0.1% from 2.2% to 2.3%.

Even though 2015 ended up being a quiet year overall, there were plenty of sweet dreams mixed in with scary nightmares during the year-long nap:

INVESTMENT SWEET DREAMS

Diamonds in the Rough: While 2015 stock prices were generally flat to down around the globe (Vanguard Total Word -4.2%), there was some sunshine and rainbows gleaming for a number of segments in the market. For example, handsome gains were achieved in the NASDAQ index (+5.7%); Biotech Index – BTK (+10.9%); Consumer Discretionary ETF – XLY (+8.3%); Health Care ETF – VHT (+5.8%); Information Technology ETF – VGT (+4.6%); along with numerous other investment areas.

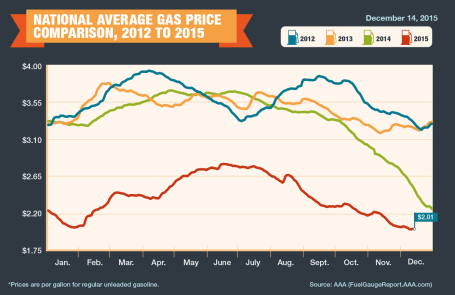

Fuel Fantasy Driven by Low Gas Prices: Gas prices averaged $2.01 per gallon nationally in December (see chart below), marking the lowest prices seen since 2009. Each penny in lower gas prices roughly equates to $1 billion in savings, which has strengthened consumers’ balance sheets and contributed to the multi-year economic expansion. Although these savings have partially gone to pay down personal debt, these gas reserves have also provided a financial tailwind for record auto sales (estimated 17.5million in 2015) and a slow but steady recovery in the housing market. The outlook for “lower-for-longer” oil prices is further supported by an expanding oil glut from new, upcoming Iranian supplies. Due to the lifting of economic sanctions related to the global nuclear deal, Iran is expected to deliver crude oil to an already over-supplied world energy market during the first quarter of 2016. Additionally, the removal of the 40-year ban on U.S. oil exports -could provide a near-term ceiling on energy prices as well.

Counting Cash Cows

Catching some shut-eye after reading frightening 2015 headlines on the China slowdown, $96 billion Greek bailout/elections, and Paris/San Bernardino terrorist attacks forced some nervous investors to count sheep to fall asleep. However, long-term investors understand that underpinning this long-lived bull market are record revenues, profits, and cash flows. The record $4.7 trillion dollars in 2015 estimated mergers along with approximately $1 trillion in dividends and share buybacks (see chart below) is strong confirmation that investors should be concentrating on counting more cash cows than sheep, if they want to sleep comfortably.

INVESTMENT NIGHTMARES

Creepy Commodities: Putting aside the -30% collapse in WTI crude oil prices last year, commodity investors overall were exhausted in 2015. The -24% decline in the CRB Commodity Index and the -11% weakening in the Gold Index (GLD) was further proof that a strong U.S. dollar, coupled with stagnant global growth, caused investors a lot of tossing and turning. While bad for commodity exporting countries, the collapse in commodity prices will ultimately keep a lid on inflation and eventually become stimulative for those consumers suffering from lower standards of living.

Dollar Dread: The +25% spike in the value of the U.S. dollar over the last 18 months has made life tough for multinational companies. If your business received approximately 35-40% of their profits overseas and suddenly your goods cost 25% more than international competitors, you might grind your teeth in your sleep too. Monetary policies around the globe, including the European Union, will have an impact on the direction of future foreign exchange rates, but after a spike in the value of the dollar in early 2015, there are signs this scary move may now be stabilizing. Although multinationals are getting squeezed, now is the time for consumers to load up on cheap imports and take that bargain foreign vacation they have long been waiting for.

January has been a challenging month the last couple years, and inevitably there will be additional unknown turbulence ahead – the opening day of 2016 not being an exception (i.e., China slowdown concerns and Mideast tensions). However, given near record-low interest rates, record corporate profits, and accommodative central bank policies, the 2015 nap taken by global stock markets should supply the necessary energy to provide a lift to financial markets in the year ahead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions VHT, AGG, and in certain exchange traded funds (ETFs), but at the time of publishing had no direct position VT, BTK, XLY, VGT, GLD, or in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bargain Hunting for Doorbuster Discounts

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2015). Subscribe on the right side of the page for the complete text.

It’s that time of year again when an estimated 135 million bargain shoppers set aside personal dignity and topple innocent children in the name of Black Friday holiday weekend, doorbuster discounts. Whether you are buying a new big screen television at Amazon for half-off or a new low-cost index fund, everyone appreciates a good value or bargain, which amplifies the importance of the price you pay. Even though consumers are estimated to have spent $83 billion over the post-turkey-coma, holiday weekend, this spending splurge only represents a fraction of the total 2015 holiday shopping season frenzy. When all is said and done, the average person is projected to dole out $805 for the full holiday shopping season (see chart below) – just slightly higher than the $802 spent over the same period last year.

While consumers have displayed guarded optimism in their spending plans, Americans have demonstrated the same cautiousness in their investing behavior, as evidenced by the muted 2015 stock market gains. More specifically, for the month of November, stock prices increased by +0.32% for the Dow Jones Industrial Average (17,720) and +0.05% for the S&P 500 index (2,080). For the first 11 months of the year, the stock market results do not look much different. The Dow has barely slipped by -0.58% and the S&P 500 has inched up by +1.01%.

Given all the negative headlines and geopolitical concerns swirling around, how have stock prices managed to stay afloat? In the face of significant uncertainty, here are some of the calming factors that have supported the U.S. financial markets:

- Jobs Piling Up: The slowly-but-surely expanding economy has created about 13 million new jobs since late 2009 and the unemployment rate has been chopped in half (from a peak of 10% to 5%).

Source: Calafia Beach Pundit

- Housing Recovery: New and existing home sales are recovering and home prices are approaching previous record levels, as the Case-Shiller price indices indicate below.

Source: Calculated Risk Blog

- Strong Consumer: Cars are flying off the shelves at a record annualized pace of 18 million units – a level not seen since 2000. Lower oil and gasoline prices have freed up cash for consumers to pay down debt and load up on durable goods, like some fresh new wheels.

Source: Calculated Risk Blog

Despite a number of positive factors supporting stock prices near all-time record highs and providing plenty of attractive opportunities, there are plenty of risks to consider. If you watch the alarming nightly news stories on TV or read the scary newspaper headlines, you’re more likely to think it’s Halloween season rather than Christmas season.

At the center of the recent angst are the recent coordinated terrorist attacks that took place in Paris, killing some 130 people. With ISIS (Islamic State of Iraq and Syria) claiming responsibility for the horrific acts, political and military resources have been concentrated on the ISIS occupied territories of Syria and Iraq. Although I do not want to diminish the effects of the appalling and destructive attacks in Paris, the events should be placed in proper context. This is not the first or last large terrorist attack – terrorism is here to stay. As I show in the chart below, there have been more than 200 terrorist attacks that have killed more than 10 people since the 9/11 attacks. Much of the Western military power has turned a blind eye towards these post-9/11 attacks because many of them have taken place off of U.S. or Western country soil. With the recent downing of the Russian airliner (killing all 224 passengers), coupled with the Paris terror attacks, ISIS has gained the full military attention of the French, Americans, and Russians. As a result, political willpower is gaining momentum to heighten military involvement.

Source: Wikipedia

Investor anxiety isn’t solely focused outside our borders. The never ending saga of when the Federal Reserve will initiate its first Federal Funds interest rate target increase could finally be coming to an end. According to the CME futures market, there currently is a 78% probability of a 0.25% interest rate increase on December 16th. As I have said many times before, interest rates are currently near generational lows, and the widely communicated position of Federal Reserve Chairwoman Yellen (i.e., shallow slope of future interest rate hike trajectory) means much of the initial rate increase pain has likely been anticipated already by market participants. After all, a shift in your credit card interest rate from 19.00% to 19.25% or an adjustment to your mortgage rate from 3.90% to 4.15% is unlikely to have a major effect on consumer spending. In fact, the initial rate hike may be considered a vote of confidence by Yellen to the sustainability of the current economic expansion.

Shopping Without My Rose Colored Glasses

Regardless of the state of the economic environment, proper investing should be instituted through an unemotional decision-making process, just as going shopping should be an unemotional endeavor. Price and value should be the key criteria used when buying a specific investment or holiday gift. Unfortunately for many, emotions such as greed, fear, impatience, and instant gratification overwhelm objective measurements such as price and value.

As I have noted on many occasions, over the long-run, money unemotionally moves to where it is treated best. From a long-term perspective, that has meant more capital has migrated to democratic and capitalistic countries with a strong rule of law. Closed, autocratic societies operating under corrupt regimes have been the big economic losers.

With all of that set aside, the last six years have created tremendous investment opportunities due to the extreme investor risk aversion created by the financial crisis – hence the more than tripling in U.S. stock prices since March 2009.

When comparing the yield (i.e., profit earned on an investment) between stocks and bonds, as shown in the chart below, you can see that stock investors are being treated significantly better than bond investors (6.1% vs. 4.0%). Not only are bond investors receiving a lower yield than stock investors, but bond investors also have no hope of achieving higher payouts in the future. Stocks, on the other hand, earn the opportunity of a double positive whammy. Not only are stocks currently receiving a higher yield, but stockholders could achieve a significantly higher yield in the future. For example, if S&P 500 earnings can grow at their historic rate of about 7%, then the current stock earnings yield of 6.1% would about double to 12.0% over the next decade at current prices. The inflated price and relative attractiveness of stocks looks that much better if you compare the 6.1% earnings yield to the paltry 2.2% 10-Year Treasury yield.

Source: Yardeni.com

This analysis doesn’t mean everyone should pile 100% of their portfolios into stocks, but it does show how expensively nervous investors are valuing bonds. Time horizon, risk tolerance, and diversification should always be pillars to a disciplined, systematic investment strategy, but as long as these disparities remain between the earnings yields on stocks and bonds, long-term investors should be able to shop for plenty of doorbuster discount bargain opportunities.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AMZN and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Inside the Brain of an Investing Genius

Those readers who have frequented my Investing Caffeine site are familiar with the numerous profiles on professional investors of both current and prior periods (See Profiles). Many of the individuals described have a tremendous track record of success, while others have a tremendous ability of making outrageous forecasts. I have covered both. Regardless, much can be learned from the successes and failures by mirroring the behavior of the greats – like modeling your golf swing after Tiger Woods (O.K., since Tiger is out of favor right now, let’s say Jordan Spieth). My investment swing borrows techniques and tips from many great investors, but Peter Lynch (ex-Fidelity fund manager), probably more than any icon, has had the most influence on my investing philosophy and career as any investor. His breadth of knowledge and versatility across styles has allowed him to compile a record that few, if any, could match – outside perhaps the great Warren Buffett.

Consider that Lynch’s Magellan fund averaged +29% per year from 1977 – 1990 (almost doubling the return of the S&P 500 index for that period). In 1977, the obscure Magellan Fund started with about $20 million, and by his retirement the fund grew to approximately $14 billion (700x’s larger). Cynics believed that Magellan was too big to adequately perform at $1, $2, $3, $5 and then $10 billion, but Lynch ultimately silenced the critics. Despite the fund’s gargantuan size, over the final five years of Lynch’s tenure, Magellan outperformed 99.5% of all other funds, according to Barron’s. How did Magellan investors fare in the period under Lynch’s watch? A $10,000 investment initiated when he took the helm would have grown to roughly $280,000 (+2,700%) by the day he retired. Not too shabby.

Background

Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968. Like the previously mentioned Warren Buffett, Peter Lynch shared his knowledge with the investing masses through his writings, including his two seminal books One Up on Wall Street and Beating the Street. Subsequently, Lynch authored Learn to Earn, a book targeted at younger, novice investors. Regardless, the ideas and lessons from his writings, including contributing author to Worth magazine, are still transferable to investors across a broad spectrum of skill levels, even today.

The Lessons of Lynch

Although Lynch has left me with enough financially rich content to write a full-blown textbook, I will limit the meat of this article to lessons and quotations coming directly from the horse’s mouth. Here is a selective list of gems Lynch has shared with investors over the years:

Buy within Your Comfort Zone: Lynch simply urges investors to “Buy what you know.” In similar fashion to Warren Buffett, who stuck to investing in stocks within his “circle of competence,” Lynch focused on investments he understood or on industries he felt he had an edge over others. Perhaps if investors would have heeded this advice, the leveraged, toxic derivative debacle occurring over previous years could have been avoided.

Do Your Homework: Building the conviction to ride through equity market volatility requires rigorous homework. Lynch adds, “A company does not tell you to buy it, there is always something to worry about. There are always respected investors that say you are wrong. You have to know the story better than they do, and have faith in what you know.”

Price Follows Earnings: Investing is often unnecessarily made complicated. Lynch fundamentally believes stock prices will follow the long-term trajectory of earnings growth. He makes the point that “People may bet on hourly wiggles of the market, but it’s the earnings that waggle the wiggle long term.” In a publicly attended group meeting, Michael Dell, CEO of Dell Inc. (DELL), asked Peter Lynch about the direction of Dell’s future stock price. Lynch’s answer: “If your earnings are higher in 5 years, your stock will be higher.” Maybe Dell’s price decline over the last five years can be attributed to its earnings decline over the same period? It’s no surprise that Hewlett-Packard’s dramatic stock price outperformance (relative to DELL) has something to do with the more than doubling of HP’s earnings over the same time frame.

Valuation & Price Declines: “People Concentrate too much on the P (Price), but the E (Earnings) really makes the difference.” In a nutshell, Lynch believes valuation metrics play an important role, but long-term earnings growth will have a larger impact on future stock price appreciation.

Two Key Stock Questions: 1) “Is the stock still attractively priced relative to earnings?” and 2) “What is happening in the company to make the earnings go up?” Improving fundamentals at an attractive price are key components to Lynch’s investing strategy.

Lynch on Buffett: Lynch was given an opportunity to write the foreword in Buffett’s biography, The Warren Buffett Way. Lynch did not believe in “pulling out flowers and watering the weeds,” or in other words, selling winners and buying losers. In highlighting this weed-flower concept, Lynch said this about Buffett: “He purchased over $1 billion of Coca-Cola in 1988 and 1989 after the stock had risen over fivefold the prior six years and over five-hundredfold the previous sixty years. He made four times his money in three years and plans to make a lot more the next five, ten, and twenty years with Coke.” Hammering home the idea that a few good stocks a decade can make an investment career, Lynch had this to say about Buffett: “Warren states that twelve investments decisions in his forty year career have made all the difference.”

You Don’t Need Perfect Batting Average: In order to significantly outperform the market, investors need not generate near perfect results. According to Lynch, “If you’re terrific in this business, you’re right six times out of 10 – I’ve had stocks go from $11 to 7 cents (American Intl Airways).” Here is one recipe Lynch shares with others on how to beat the market: “All you have to do really is find the best hundred stocks in the S&P 500 and find another few hundred outside the S&P 500 to beat the market.”

The Critical Element of Patience: With the explosion of information, expansion of the internet age, and the reduction of trading costs has come the itchy trading finger. This hasty investment principle runs contrary to Lynch’s core beliefs. Here’s what he had to say regarding the importance of a steady investment hand:

- “In my investing career, the best gains usually have come in the third or fourth year, not in the third or fourth week or the third or fourth month.”

- “Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

- “Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

- “The key to making money in stocks is not to get scared out of them.”

Bear Market Beliefs: “I’m always more depressed by an overpriced market in which many stocks are hitting new highs every day than by a beaten-down market in a recession,” says Lynch. The media responds in exactly the opposite manner – bear markets lead to an inundation of headlines driven by panic-based fear. Lynch shares a similar sentiment to Warren Buffett when it comes to the media holding a glass half full view in bear markets.

Market Worries: Is worrying about market concerns worth the stress? Not according to Lynch. His belief: “I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” Just this last March, Lynch used history to drive home his views: “We’ve had 11 recessions since World War II and we’ve had a perfect score — 11 recoveries. There are a lot of natural cushions in the economy now that weren’t there in the 1930s. They keep things from getting out of control. We have the Federal Deposit Insurance Corporation [which insures bank deposits]. We have social security. We have pensions. We have two-person, working families. We have unemployment payments. And we have a Federal Reserve with a brain.”

Thoughts on Cyclicals: Lynch divided his portfolio into several buckets, and cyclical stocks occupied one of the buckets. “Cyclicals are like blackjack: stay in the game too long and it’s bound to take all your profit,” Lynch emphasized.

Selling Discipline: The rationale behind Lynch’s selling discipline is straightforward – here are some of his thoughts on the subject:

- “When the fundamentals change, sell your mistakes.”

- “Write down why you own a stock and sell it if the reason isn’t true anymore.”

- “Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling.”

Distilling the genius of an investing legend like Peter Lynch down to a single article is not only a grueling challenge, but it also cannot bring complete justice to the vast accomplishments of this incredible investment legend. Nonetheless, his record should be meticulously studied in hopes of adding jewels of investment knowledge to the repertoires of all investors. If delving into the head of this investing mastermind can provide access to even a fraction of his vast knowledge pool, then we can all benefit by adding a slice of this greatness to our investment portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, including KO, but at time of publishing had no direct positions in DELL, HPQ or any other security mentioned. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Playing the Field with Your Investments

For some, casually dating can be fun and exciting. The same goes for trading and speculating – the freedom to make free- wheeling, non-committal purchases can be exhilarating. Unfortunately the costs (fiscally and emotionally) of short-term dating/investing often outweigh the benefits.

Fortunately, in the investment world, you can get to know an investment pretty well through fundamental research that is widely available (e.g., 10Ks, 10Qs, press releases, analyst days, quarterly conference calls, management interviews, trade rags, research reports). Unlike dating, researching stocks can be very cheap, and you do not need to worry about being rejected.

Dating is important early in adulthood because we make many mistakes choosing whom we date, but in the process we learn from our misjudgments and discover the important qualities we value in relationships. The same goes for stocks. Nothing beats experience, and in my long investment career, I can honestly say I’ve dated/traded a lot of pigs and gained valuable lessons that have improved my investing capabilities. Now, however, I don’t just casually date my investments – I factor in a rigorous, disciplined process that requires a serious commitment. I no longer enter positions lightly.

One of my investment heroes, Peter Lynch, appropriately stated, “In stocks as in romance, ease of divorce is not a sound basis for commitment. If you’ve chosen wisely to begin with, you won’t want a divorce.”

Charles Ellis shared these thoughts on relationships with mutual funds:

“If you invest in mutual funds and make mutual funds investment changes in less than 10 years…you’re really just ‘dating.’ Investing in mutual funds should be marital – for richer, for poorer, and so on; mutual fund decisions should be entered into soberly and advisedly and for the truly long term.”

No relationship comes without wild swings, and stocks are no different. If you want to survive the volatile ups and downs of a relationship (or stock ownership), you better do your homework before blindly jumping into bed. The consequences can be punishing.

Buy and Hold is Dead…Unless Stocks Go Up

If you are serious about your investments, I believe you must be mentally willing to commit to a relationship with your stock, not for a day, not for a week, or not for a month, but rather for years. Now, I know this is blasphemy in the age when “buy-and-hold” investing is considered dead, but I refute that basic premise whole-heartedly…with a few caveats.

Sure, buy-and-hold is a stupid strategy when stocks do nothing for a decade – like they have done in the 2000s, but buying and holding was an absolutely brilliant strategy in the 1980s and 1990s. Moreover, even in the miserable 2000s, there have been many buy-and-hold investments that have made owners a fortune (see Questioning Buy & Hold ). So, the moral of the story for me is “buy-and-hold” is good for stocks that go up in price, and bad for stocks that go flat or down in price. Wow, how deeply profound!

To measure my personal commitment to an investment prospect, a bachelorette investment I am courting must pass another test…a test from another one of my investment idols, Phil Fisher, called the three-year rule. This is what the late Mr. Fisher had to say about this topic:

“While I realized thoroughly that if I were to make the kinds of profits that are made possible by [my] process … it was vital that I have some sort of quantitative check… With this in mind, I established what I called my three-year rule.” Fisher adds, “I have repeated again and again to my clients that when I purchase something for them, not to judge the results in a matter of a month or a year, but allow me a three year period.”

Certainly, there will be situations where an investment thesis is wrong, valuation explodes, or there are superior investment opportunities that will trigger a sale before the three-year minimum expires. Nonetheless, I follow Fisher’s rule in principle in hopes of setting the bar high enough to only let the best ideas into both my client and personal portfolios.

As I have written in the past, there are always reasons of why you should not invest for the long-term and instead sell your position, such as: 1) new competition; 2) cost pressures; 3) slowing growth; 4) management change; 5) valuation; 6) change in industry regulation; 7) slowing economy; 8 ) loss of market share; 9) product obsolescence; 10) etc, etc, etc. You get the idea.

Don Hays summed it up best: “Long term is not a popular time-horizon for today’s hedge fund short-term mentality. Every wiggle is interpreted as a new secular trend.”

Peter Lynch shares similar sympathies when it comes to noise in the marketplace:

“Whatever method you use to pick stocks or stock mutual funds, your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

Every once in a while there is validity to some of the concerns, but more often than not, the scare campaigns are merely Chicken Little calling for the world to come to an end.

Patience is a Virtue

In the instant gratification society we live in, patience is difficult to come by, and for many people ignoring the constant chatter of fear is challenging. Pundits spend every waking hour trying to explain each blip in the market, but in the short-run, prices often move up or down irrespective of the daily headlines. Explaining this randomness, Peter Lynch said the following:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of a company and the success of its stock. It pays to be patient, and to own successful companies.”

Long-term investing, like long-term relationships, is not a new concept. Investment time horizons have been shortening for decades, so talking about the long-term is generally considered heresy. Rather than casually date a stock position, perhaps you should commit to a long-term relationship and divorce your field-playing habits. Now that sounds like a sweet kiss of success.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.