Posts tagged ‘inflation’

Bin Laden Killing Overshadows Royal Rally

Excerpt from No-Cost May Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Before the announcement of the killing of the most wanted terrorist in the world, Osama bin Laden, the royal wedding of Prince William Arthur Philip Louis and Catherine Middleton (Duke and Duchess of Cambridge) grabbed the hearts, headlines, and minds of people around the world. As we exited the month, a less conspicuous royal rally in the U.S. stock market has continued into May, with the S&P 500 index climbing +2.8% last month as the economic recovery gained firmer footing from the recession of 2008 and early 2009. As always, there is no shortage of issues to worry about as traders and speculators (investors not included) have an itchy sell-trigger finger, anxiously fretting over the possibility of losing gains accumulated over the last two years.

Here are some of the attention-grabbing issues that occurred last month:

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Powerful Profits: According to Thomson Reuters, first quarter profit growth as measured by S&P 500 companies is estimated at a very handsome +18% thus far. At this point, approximately 84% of companies are exceeding or meeting expectations by a margin of 7%, which is above the long-term average of a 2% surprise factor.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Debt Anchor Front & Center: Budget battles remain over record deficits and debt levels anchoring our economy, but clashes over the extension of our debt ceiling will occur first in the coming weeks. Skepticism and concern were so high on this issue of our fiscal situation that the Standard & Poor’s rating agency reduced its outlook on the sovereign debt rating of U.S. Treasury securities to “negative,” meaning there is a one-in-three chance our country’s debt rating could be reduced in the next two years. Democrats and Republicans have put forth various plans on the negotiating table that would cut the national debt by $4 – $6 trillion over the next 10-12 years, but a chasm still remains between both sides with regard to how these cuts will be best achieved.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Inflation Heating Up: The global economic recovery, fueled by loose global central bank monetary policies, has resulted in fanning of the inflation flames. Crude oil prices have jumped to $113 per barrel and gasoline has spiked to over $4 per gallon. Commodity prices have jumped up across the board, as measured by the CRB (Commodity Research Bureau) BLS Index, which measures the price movements of a basket of 22 different commodities. The CRB Index has risen over +28% from a year ago. Although the topic of inflation is dominating the airwaves, this problem is not only a domestic phenomenon. Inflation in emerging markets, like China and Brazil, has also expanded into a dangerous range of 6-7%, and many of these governments are doing their best to slow-down or reverse loose monetary policies from a few years ago.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Expansion Continues but Slows: Economic expansion continued in the first quarter, but slowed to a snail’s pace. The initial GDP (Gross Domestic Product) reading for Q1 slowed down to +1.8% growth. Brakes on government stimulus and spending subtracted from growth, and high fuel costs are pinching consumer spending.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Ben Holds the Course: One person who is not overly eager to reverse loose monetary policies is Federal Reserve Chairman, Ben Bernanke. The Chairman vowed to keep interest rates low for an “extended period,” and he committed the Federal Reserve to complete his $600 billion QE2 (Quantitative Easing) bond buying program through the end of June. If that wasn’t enough news, Bernanke held a historic, first-ever news conference. He fielded a broad range of questions and felt the first quarter GDP slowdown and inflation uptick would be transitory.

Skyrocketing Silver Prices: Silver surged ahead +28% in April, the largest monthly gain since April 1987, and reached a 30-year high in price before closing at around $49 per ounce at the end of the month. Speculators and investors have been piling into silver as evidenced by activity in the SLV (iShares Silver Trust) exchange traded fund, which on occasion has seen its daily April volume exceed that of the SPY (iShares SPDR S&P 500) exchange traded fund.

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Obama-Trump Birth Certificate Faceoff: Real estate magnate and TV personality Donald Trump broached the birther issue again, questioning whether President Barack Obama was indeed born in the United States. President Obama produced his full Hawaiian birth certificate in hopes of putting the question behind him. If somehow Trump can be selected as the Republican presidential candidate for 2012, he will certainly try to get President Obama “fired!”

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Charlie Sheen…Losing! The Charlie Sheen soap opera continues. Ever since Sheen has gotten kicked off the show Two and a Half Men, speculation has percolated as to whether someone would replace Sheen to act next to co-star John Cryer. Names traveling through the gossip circles include everyone from Woody Harrelson to Jeremy Piven to Rob Lowe. Time will tell whether the audience will laugh or cry, but regardless, Sheen will be laughing to the bank if he wins his $100 million lawsuit against Warner Brothers (TWX).

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain commodity and S&P 500 exchange traded funds, but at the time of publishing SCM had no direct position in SLV, SPY, TWX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Inflation and the Debt Default Paradox

With the federal government anchored down with over $14 trillion in debt and trillion dollar deficits as far as the eye can see, somehow people are shocked that Standard & Poor’s downgraded its outlook on U.S. government debt to “Negative” from “Stable.” This is about as surprising as learning that Fat Albert is overweight or that Charlie Sheen has a substance abuse problem.

Let’s use an example. Suppose I received a pay demotion and then I went on an irresponsible around-the-world spending rampage while racking up over $1,000,000.00 in credit card debt. Should I be surprised if my 850 FICO score would be reviewed for a possible downgrade, or if credit card lenders became slightly concerned about the possibility of collecting my debt? I guess I wouldn’t be flabbergasted by their anxiety.

Debt Default Paradox?

With the recent S&P rating adjustment, pundits over the airwaves (see CNBC video) make the case that the U.S. cannot default on its debt, because the U.S. is a sovereign nation that can indefinitely issue bonds in its own currency (i.e., print money likes it’s going out of style). There is some basis to this argument if you consider the last major developed country to default was the U.S. government in 1933 when it went off the gold standard.

On the other hand, non-sovereign nations issuing foreign currencies do not have the luxury of whipping out the printing presses to save the day. The Latin America debt defaults in the 1980s and Asian Financial crisis in the late 1990s are examples of foreign countries over-extending themselves with U.S. dollar-denominated debt, which subsequently led to collapsing currencies. The irresponsible fiscal policies eventually destroyed the debtors’ ability to issue bonds and ultimately repay their obligations (i.e., default).

Regardless of a country’s strength of currency or central bank, if reckless fiscal policies are instituted, governments will eventually be left to pick their own poison…default or hyperinflation. One can think of these options as a favorite dental procedure – a root canal or wisdom teeth pulled. Whether debtors get paid 50 cents on the dollar in the event of a default, or debtors receive 100 cents in hyper-inflated dollars (worth 50% less), the resulting pain feels the same – purchasing power has been dramatically reduced in either case (default or hyperinflation).

Of course, Ben Bernanke and the Federal Reserve Bank would like investors to believe a Goldilocks scenario is possible, which is the creation of enough liquidity to stimulate the economy while maintaining low interest rates and low inflation. At the end of the day, the inflation picture boils down to simple supply and demand for money. Fervent critics of the Fed and Bernanke would have you believe the money supply is exploding, and hyperinflation is just around the corner. It’s difficult to quarrel with the printing press arguments, given the size and scale of QE1 & QE2 (Quantitative Easing), but the fact of the matter is that money supply growth has not exploded because all the liquidity created and supplied into the banking system has been sitting idle in bank vaults – financial institutions simply are not lending. Eventually this phenomenon will change as the economy continues to recover; banks adequately build their capital ratios; the housing market sustainably recovers; and confidence regarding borrower creditworthiness improves.

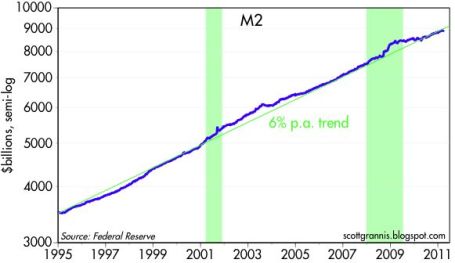

Scott Grannis at the California Beach Pundit makes the point that money supply as measured by M2 has shown a steady 6% increase since 1995, with no serious side-effects from QE1/QE2 yet:

In fact, Grannis states that money supply growth (+6%) has actually grown less than nominal GDP over the period (+6.7%). Money supply growth relative to GDP growth (money demand) in the end is what really matters. Take for instance an economy producing 10 widgets for $10 dollars, would have a CPI (Consumer Price Index) of $1 per widget and a money supply of $10. If the widget GDP increased by 10% to 11 widgets (10 widgets X 1.1) and the Federal Reserve increased money supply by 10% to $11, then the CPI index would remain constant at $1 per widget ($11/11 widgets). This is obviously grossly oversimplified, but it makes my point.

Gold Bugs Banking on Inflation or Collapse

Gold prices have been on a tear over the last 10 years and current fiscal and monetary policies have “gold bugs” frothing at the mouth. These irresponsible policies will no doubt have an impact on gold demand and gold prices, but many gold investors fail to acknowledge a gold supply response. Take for example Freeport-McMoRan Copper & Gold Inc. (FCX), which just reported stellar quarterly sales and earnings growth today (up 31% and 57%, respectively). FCX more than doubled their capital expenditures to more than $500 million in the quarter, and they are planning to double their exploration spending in fiscal 2011. Is Freeport alone in their supply expansion plans? No, and like any commodity with exploding prices, eventually higher prices get greedy capitalists to create enough supply to put a lid on price appreciation. For prior bubbles you can reference the recent housing collapse or older burstings such as the Tulip Mania of the 1600s. One of the richest billionaires on the planet, Warren Buffett, also has a few thoughts on the prospects of gold.

The recent Standard & Poor’s outlook downgrade on U.S. government debt has caught a lot of press headlines. Fears about a technical default may be overblown, but if fiscal constraint cannot be agreed upon in Congress, the alternative path to hyperinflation will feel just as painful.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in FCX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Your Portfolio’s Silent Killer

Shhh, if you listen closely enough, you may hear the sound of your portfolio disintegrating away due to the quiet killer…inflation. Inflation is especially worrisome with what we’ve seen happening with commodity prices and the drastic fiscal challenges our country faces. Quantitative Easing (read Flying to the Moon) has only added fuel to the inflation fear flames.

Whether you’re a conspiracy theorist who believes the government inflation data is cooked, or you are a Baby Boomer just looking to secure your retirement, it doesn’t take a genius to figure out that movies, pair of jeans, a tank of gas, concert tickets, or healthcare premiums are all going up in price (See also Bacon and Oreo Future).

Companies are currently churning out quarterly results in volume and seeing the impact from commodity prices, whether you are McDonald’s Corp. (MCD) facing rising beef prices or luxury handbag maker Coach Inc. (COH) dealing with escalating leather costs, margins are getting crimped. Investors, especially those on fixed income streams, are experiencing the same pain as these corporations, but the problem is much worse. Unlike a market share leading company that can pass on price increases onto its customers, an investor with piles of cash, and low yielding CDs (Certificates of Deposit), and bonds runs the risk of getting eaten alive. Baby Boomers are beginning to reach retirement age in mass volume. Life spans are extending, and this demographic pool of individuals will become ever-large consumers of costlier and costlier healthcare services. If investments are not prudently managed, Baby Boomers will see their nest eggs evaporate, and be forced to work as Wal-Mart (WMT) greeters into their 80s…not that there’s anything wrong with that.

Every day investors are bombarded with a hundred different scary headlines on why the economy will collapse or the world will end. Most of these sensationalist scare tactics distort the truth and overstate reality. What is understated is what Charles Ellis (see Winning the Loser’s Game) calls a “corrosive power”:

“Over the long run, inflation is the major problem for investors, not the attention-getting daily or cyclical changes in securities prices that most investors fret about. The corrosive power of inflation is truly daunting: At 3 percent inflation – which most people accept as ‘normal’ – the purchasing power of your money is cut in half in 24 years. At 5 percent inflation, the purchasing power of your money is cut in half in less than 15 years – and cut in half again in 15 years to just one-quarter.”

In order to bolster his case, Ellis cites the following period:

“From 1977 to 1982, the inflation-adjusted Dow Jones Industrial Average took a five-year loss of 63 percent…In the 15 years from the late 1960s to the early 1980s the unweighted stock market, adjusted for inflation, plunged by about 80 percent. As a result, the decade of the 1970s was actually worse for investors than the decade of the 1930s.”

Solutions – How to Beat Inflation

Although the gold bugs would have you believe it, we are not resigned to live in a world with worthless money, which only has a useful purpose as toilet paper. There are ways to protect your portfolio, if you are properly invested. Here are some strategies to consider:

- TIPS (Treasury Inflation Protection Securities): These government-guaranteed tools are a useful way to protect yourself against rising inflation (see Drowning TIPS).

- Equities (including real estate): Bond issuers do not generally call up there investors and say, “You are such a great investor, so we have decided to increase your interest payments.” However, many publicly traded stocks do exactly that. Wal-Mart Stores (WMT) is an example of such a company that has increased its dividend for 37 consecutive years. As alluded to earlier, stocks are unique in that they allow inflationary pressures placed on operating profits to be relieved somewhat by the ability to pass on price increases to customers.

- Commodities: Whether you are talking about petroleum products, precious metals (those with a commercial purpose), or agricultural goods, commodities in general act as a great inflationary hedge. Another reason that commodities broadly perform better in an inflationary environment is because the U.S. dollar can often depreciate, which commonly increases the value of commodities.

- Short Duration Bonds: Rising rates are usually tied to escalating inflation, therefore investors would be best served by reducing maturity length and increasing coupon.

There are other ways of battling the inflation problem, but number one is saving and investing across a broadly diversified portfolio. If you want to secure and grow your nest egg, you need to use the silent power of compounding (see Penny Saved is Billion Earned) to combat the silent killer of inflation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, WMT, TIP, equities, commodities, and short duration bonds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Another Year, Another Decade

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dealing Currency Drug to Export Addicts

With the first phase of the post-financial crisis global economic bounce largely behind us, growth is becoming scarcer and countries are becoming more desperate – especially in developed countries with challenged exports and high unemployment. The United States, like other expansion challenged countries, fits this bill and is doing everything in its power to stem the tide by blasting foreigners’ currency policies in hopes of stimulating exports.

Political Hot Potato

The global race to devalue currencies in many ways is like a drug addict doing whatever it can to gain a short-term high. Sadly, the euphoric short-term benefit form lower exchange rates will be fleeting. Regardless, Ben Bernanke, the Chairman of the Federal Reserve, has openly indicated his willingness to become the economy’s drug dealer and “provide additional accommodation” in the form of quantitative easing part two (QE2).

Unfortunately, there is no long-term free lunch in global economics. The consequences of manipulating (depressing) exchange rates can lead to short-term artificial export growth, but eventually results convert to unwanted inflation. China too is like a crack dealer selling cheap imports as a drug to addicted buyers all over the world – ourselves included. We all love the $2.99 t-shirts and $5.99 toys made in China that we purchase at Wal-Mart (WMT), but don’t consciously realize the indirect cost of these cheap goods – primarily the export of manufacturing jobs overseas.

Global Political Pressure Cooker

Congressional mid-term elections are a mere few weeks away, but a sluggish global economic recovery is creating a global political pressure cooker. While domestic politicians worry about whining voters screaming about unemployment and lack of job availability, politicians in China still worry about social unrest developing from a billion job-starved rural farmers and citizens. The Tiananmen Square protests of 1989 are still fresh in the minds of Chinese officials and the government is doing everything in its power to keep the restless natives content. In fact, Premier Wen Jiabao believes a free-floating U.S.-China currency exchange rate would “bring disaster to China and the world.”

While China continues to enjoy near double-digit percentage economic growth, other global players are not sitting idly. Like every country, others would also like to crank out exports and fill their factories with workers as well.

The latest high profile devaluation effort has come from Japan. The Japanese Prime Minister post has become a non-stop revolving door and their central bank has become desperate, like ours, by nudging its target interest rate to zero. In addition, the Japanese have been aggressively selling currency in the open market in hopes of lowering the value of the Yen. Japan hasn’t stopped there. The Bank of Japan recently announced a plan to pump the equivalent of approximately $60 billion into the economy by buying not only government bonds but also short-term debt and securitized loans from banks and corporations.

Europe is not sitting around sucking its thumb either. The ECB (European Central Bank) is scooping up some of the toxic bonds from its most debt-laden member countries. Stay tuned for future initiatives if European growth doesn’t progress as optimistically planned.

Dealing with Angry Parents

When it comes to the United States, the Obama administration campaigned on “change,” and the near 10% unemployment rate wasn’t the type of change many voters were hoping for. The Federal Reserve is supposed to be “independent,” but the institution does not live in a vacuum. The Fed in many ways is like a grown adult living away from home, but regrettably Bernanke and the Fed periodically get called by into Congress (the parents) to receive a verbal scolding for not following a policy loose enough to create jobs. Technically the Fed is supposed to be living on its own, able to maintain its independence, but sadly a constant barrage of political criticism has leaked into the Fed’s decision making process and Bernanke appears to be willing to entertain any extreme monetary measure regardless of the potential negative impact on long-term price stability.

Just over the last four months, as the dollar index has weakened over 10%, we have witnessed the CRB Index (commodities proxy) increase over 10% and crude oil increase about 10% too.

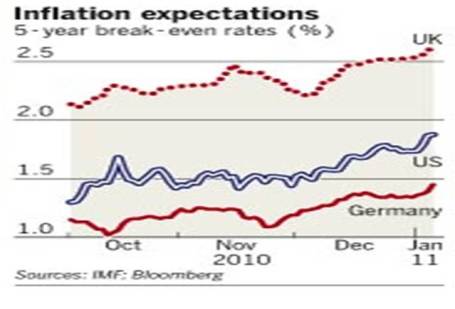

In the end, artificially manipulating currencies in hopes of raising economic activity may result in a short-term adrenaline boost in export orders, but lasting benefits will not be felt because printing money will not ultimately create jobs. Any successful devaluation in currency rates will eventually be offset by price changes (inflation). Finance ministers and central bankers from 187 countries all over the world are now meeting in Washington at the annual International Monetary Fund (IMF) meeting. We all want to witness a sustained, coordinated global economic recovery, but a never-ending, unanimous quest for devaluation nirvana will only lead to export addicts ruining the party for everyone.

See also Arbitrage Vigilantes

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Skiing Portfolios Down Bunny Slopes

Oh Nelly, take it easy…don’t get too crazy on that bunny slope. With fall officially kicking off and the crisp smell of leaves in the air, the new season also marks the beginning of the ski season. In many respects, investing is a lot like skiing. Unfortunately, many investors are financially skiing their investment portfolios down a bunny slope by stuffing their money in low yielding CDs, money market accounts, and Treasury securities. The bunny slope certainly feels safe and secure, but many investors are actually doing more long-term harm than good and could be potentially jeopardizing their retirements.

Let’s take a gander at the cautious returns offered up from the financial bunny slope products:

That CD earning 1.21% should cover a fraction of your medical insurance premium hike, or if you accumulate the interest from your money market account for a few years, perhaps it will cover the family seeing a new 3-D movie. If you also extend the maturity on that CD a little, maybe it can cover an order of chicken fingers at Applebees (APPB)?!

We all know, for much of the non-retiree population, the probability that entitlement programs like Social Security and Medicare will be wiped out or severely cut is very high. Not to mention, life expectancies for non-retirees are increasing dramatically – some life insurance actuarial tables are registering well above 100 years old. These trends indicate the criticalness of investing efficiently for a large swath of the population, especially non-retirees.

Let’s Face It, One Size Does Not Fit All

As I have pointed out in the past, when it comes to investing (or skiing), one size does not fit all (see article). Just as it does not make sense to have Bode Miller (32 year old Olympic gold medalist) ski down a beginner’s bunny slope, it also does not make sense to take a 75-year old grandpa helicopter skiing off a cornice. The same principles apply to investment portfolios. The risk one takes should be commensurate with an individual’s age, objectives, and constraints.

Often the average investor is unaware of the risks they are taking because of the counterintuitive nature of the financial market dangers. In the late 1990s, technology stocks felt safe (risk was high). In the mid-2000s, real estate felt like a sure bet (risk was high), and in 2010, Treasury bonds and gold are currently being touted as sure bets and safe havens (read Bubblicious Bonds and Shiny Metal Shopping). You guess how the next story ends?

Unquestionably, coasting down the bunny slopes with CDs, money market accounts, and Treasuries is prudent strategy if you are a retiree holding a massive nest egg able to meet all your expenses. However, if you are younger non-retiree and do not want to retire on mac & cheese or work at Wal-Mart as a greeter into your 80s, then I suggest you venture away from the bunny slope and select a more suitable intermediate path to financial success.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and WMT, but at the time of publishing SCM had no direct position in APPB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Siegel & Co. See “Bubblicious” Bonds

Siegel compares 1999 stock prices with 2010 bonds

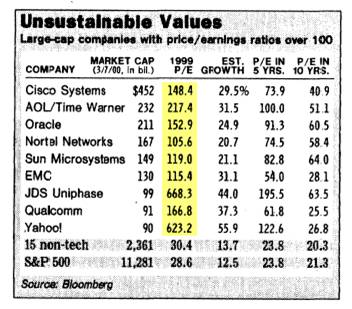

Unlike a lot of economists, Jeremy Siegel, Professor at the Wharton School of Business, is not bashful about making contrarian calls (see other Siegel article). Just days after the Nasdaq index peaked 10 years ago at a level above 5,000 (below 2,200 today), Siegel called the large capitalization technology market a “Sucker’s Bet” in a Wall Street Journal article dated March 14, 2000. Investors were smitten with large-cap technology stocks at the time, paying balloon-like P/E (Price-Earnings) ratios in excess of 100 times trailing earnings (see table above).

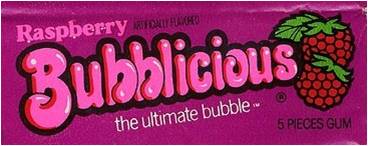

Bubblicious Boom

Today, Siegel has now switched his focus from overpriced tech-stock bubbles to “Bubblicious” bonds, which may burst at any moment. Bolstering his view of the current “Great American Bond Bubble” is the fact that average investors are wheelbarrowing money into bond funds. Siegel highlights recent Investment Company Institute data to make his point:

“From January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.”

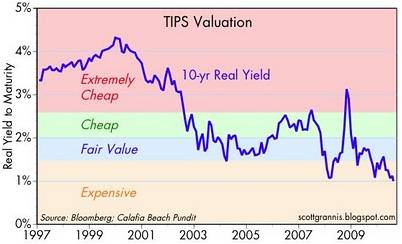

The professor goes on to make the stretch that some government bonds (i.e., 10-year Treasury Inflation-Protected Securities or TIPS) are priced so egregiously that the 1% TIPS yield (or 100 times the payout ratio) equates to the crazy tech stock valuations 10 years earlier. Conceptually the comparison of old stock and new bond bubbles may make some sense, but let’s not lose sight of the fact that tech stocks virtually had a 0% payout (no dividends). The risk of permanent investment loss is much lower with a bond as compared to a 100-plus multiple tech stock.

Making Rate History No Mystery

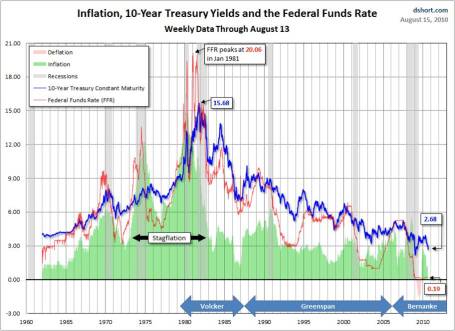

What makes Siegel so nervous about bonds? Well for one thing, take a look at what interest rates have done over the last 30 years, with the Federal Funds rate cresting over 20%+ in 1981 (View RED LINE & BLUE LINE or click to enlarge):

As I have commented before, there is only one real direction for interest rates to go, since we currently sit watching rates at a generational low. Rates have a minute amount of wiggle room, but Siegel rightfully understands there is very little wiggle room for rates to go lower. How bad could the pain be? Siegel outlines the following scenario:

“If over the next year, 10-year interest rates, which are now 2.8%, rise to 3.15%, bondholders will suffer a capital loss equal to the current yield. If rates rise to 4% as they did last spring, the capital loss will be more than three times the current yield.”

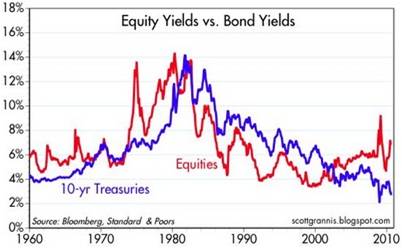

Siegel is not the only observer who sees relatively less value in bonds (especially government bonds) versus stocks. Scott Grannis, author of the Calafia Report artfully shows the comparisons of the 10-Year Treasury Note yield relative to the earnings yield on the S&P 500 index:

As you can see, rarely have there been periods over the last five decades where bonds were so poorly attractive relative to equities.

Grannis mirrors Siegel’s view on government bond prices through his chart on TIPS pricing:

Pricey Treasuries is not a new unearthed theme, however, Siegel and Grannis make compelling points to highlight bond risks. Certainly, the economy could soften further, and trying to time the bottom to a multi-decade bond bubble can be hazardous to your investing health. Having said that, effectively everyone should desire some exposure to fixed income securities, depending on their objectives and constraints (retirees obviously more). The key is managing duration and the risk of inflation in a prudent fashion. If you believe Siegel is correct about an impending bond bubble bursting, you may consider lightening your Treasury bond load. Otherwise, don’t be surprised if you do not collect on another “sucker’s bet.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including TIP and other fixed income ETFs), but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Securing Your Bacon and Oreo Future

Stuffing money under the mattress earning next to nothing (e.g., 1.3% on a on a 1-year CD or a whopping 1.59% on a 5-year Treasury Note) may feel secure and safe, but how protected is that mattress money, when you consider the inflation eating away at its purchasing power?

We’ve all been confronted by older friends and family members proudly claiming, “When I was your age, (“fill in XYZ product here”) cost me a nickel and today it costs $5,000!” Well guess what…you’re going to become that same curmudgeon, except 20 or 30 years from now, you’re going to replace the product that cost a “nickel” with a “$15 3-D movie,” “$200 pair of jeans” and “$15,000 family health plan.” Chances are these seemingly lofty priced products and services will look like screaming bargains in the years to come.

The inflation boogeyman has been relatively tame over the last three decades. Kudos goes to former Federal Reserve Chairman Paul Volcker, who tamed out-of-control double-digit inflation by increasing short-term interest rates to 20% and choking off the money supply. Despite, the Bernanke printing presses smoking from excess activity, money has been clogged up on the banks’ balance sheets. This phenomenon, coupled with the debt-induced excess capacity of our economy, has led to core inflation lingering around the low single-digit range. Some even believe we will follow in the foot-steps of Japanese deflation (see why we will not follow Japan’s Lost Decades).

The Essentials: Oreos and Bacon

Even if you believe movie, jeans, and healthcare won’t continue inflating at a rapid clip, I’m even more concerned about the critical essentials – for example, indispensable items like Oreos and bacon. Little did you probably know, but according to ProQuest’s Historic newspaper database, a package of Oreos has more than quadrupled in price over the last 30 years to over $4.00 per package – let’s just say I’m not looking forward to spending $16.00 a pop for these heavenly, synthetic, hockey-puck-like, creamy delights.

Beyond Oreos, another essential staple of my diet came under intense scrutiny during my analysis. I’ve perused many an uninspiring chart in my day, but I must admit I experienced a rush of adrenaline when I stumbled across a chart highlighting my favorite pork product. Unfortunately the chart delivered a disheartening message. For my fellow pork lovers, I was saddened to learn those greasy, charred slices of salty protein paradise (a.k.a. bacon strips), have about tripled in price over a similar timeframe as the Oreos. Let us pray we will not suffer the same outcome again.

It’s Not Getting Any Easier

Volatility aside, investing has become more challenging than ever. However, efficiently investing your nest egg has never been more critical. Why has efficiently managing your investments become so vital? First off, let’s take a look at the entitlement picture. Not so rosy. I suppose there are some retirees that will skate by enjoying their fully allocated Social Security check and Medicare services, but for the rest of us chumps, those luxurious future entitlements are quickly turning to a mirage.

What the financial crisis, rating agency conflicts, Madoff scandal, Lehman Brothers bankruptcy, AIG collapse, Goldman Sachs hearings, FinReg legislation, etc. taught us is the structural financial system is flawed. The system favors institutions and penalizes the investor with fees, commissions, transactions costs, fine print, and layers of conflicts of interests. All is not lost however. For most investors, the money stuffed under the mattress earning nothing needs to be resourcefully put to work at higher returns in order to offset rising prices. Putting together a diversified, low-cost, tax-efficient portfolio with an investment management firm that invests on a fee-only basis (thereby limiting conflicts) will put you on a path of financial success to cover the imperative but escalating living expenses, including of course, Oreos and bacon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in KFT, GS, Lehman Brothers, AIG (however own derivative tied to insurance subsidary), or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.