Posts tagged ‘Greece’

The European Dog Ate My Homework

I never thought my daily routine would be dominated by checking European markets before our domestic open, but these days it is appearing like the European tail is wagging the global dog. Tracking Spanish bond yields from the Tesoro Publico and the Italia Borsa index is currently having a larger bearing on my portfolio than U.S. fundamentals. When explaining short term performance to others, I feel a little like an elementary school student making an excuse that my dog ate my homework.

Although the multi-year European saga has gone on for years, this too shall pass. What’s more, despite the bailouts of Portugal, Ireland, and Greece in recent years, the resilient U.S. economy has recorded 11 consecutive quarters of GDP (Gross Domestic Product) growth and added more than 4 million jobs, albeit at a less than desirable pace.

Could it get worse? Certainly. Will it get worse before it gets better? Probably. Is worsening European fundamentals and a potential Greek eurozone exit already factored into current stock prices? Possibly. The truth of the matter is that nobody knows the answers to these questions with certainty. At this point, the probability of an unknown or unexpected event in a different geography is more likely to be the cause of our economic downfall than a worsening European crisis. As sage investor and strategist Don Hays aptly points out, “When everyone is concerned about a problem, that problem is solved.” That may be overstating the truth a bit, but I do believe the issues absent from current headlines are the matters we should be most concerned about.

The European financial crisis may drag on for a while longer, but nothing lasts forever. Years from now, worries about the PIIGS countries (Portugal, Ireland, Italy, Greece, Spain) will switch to others, like the BRICs (Brazil, Russia, India, China) or other worry geography du jour. The issues of greatest damage in 2008-2009, like Bear Stearns, Lehman Brothers, AIG, CDS (credit default swaps), and subprime mortgages, didn’t dominate the headlines for years like the European crisis stories of today. As compared to Europe’s problems, these prior pains felt like Band Aids being quickly ripped off.

Correlation Conundrum

Eventually European worries will be put on the backburner, but until some other boogeyman dominates the daily headlines, our financial markets will continue to correlate tightly with European security prices. How does one fight these tight correlations? For starters, the correlations will not stay tight forever. If an investor can survive through the valley of strong security association, then the benefits will eventually accrue.

Although the benefits from diversification may disappear in the short-run, they should not be fully forgotten. Bonds, cash, and precious metals (i.e., gold) proved to be great portfolio diversifiers in 2008 and early 2009. Commodities, inflation protection, floating rate bonds, real estate, and alternative investments, are a few asset classes that will help diversify portfolios. Risk is defined in many circles as volatility (i.e., standard deviation) and combining disparate asset classes can lower volatility. But risk, defined as the potential of experiencing permanent losses, can also be controlled by focusing on valuation. By in large, large cap dividend paying stocks have struggled for more than a decade, despite equity dividend yields for the S&P 500 exceeding 10-year Treasury yields (the first time in more than 50 years). Investing in large companies with strong balance sheets and attractive growth prospects is another strategy of lowering portfolio risk.

Politics & Winston Churchill

Some factors however are out of shareholders hands, such as politics. As we know from last year’s debt ceiling melee and credit downgrade debacle, getting things done in Washington is very challenging. If you think achieving consensus in one country is difficult, imagine what it’s like in herding 17 countries? That’s the facts of life we are dealing with in the eurozone right now.

Although I am optimistic something will eventually get done, I consider myself a frustrated optimist. I am frustrated because of the gridlock, but optimistic because these problems are not rocket science. Rather these challenges are concepts my first grade child could understand:

• Expenses are running higher than revenues. You must cut expenses, increase revenues, or a combination thereof.

• Adding debt can support growth, but can lead to inflation. Cutting debt can hinder growth, but leads to a more sustainable fiscal state of wellbeing.

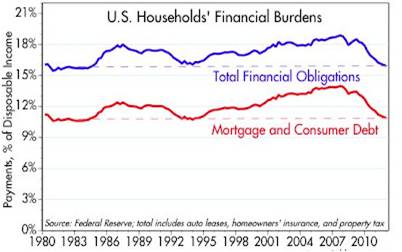

Relieving all the excess global leverage is a long, tortuous process. We saw firsthand here in the U.S. what happened to the U.S. real estate market and associated financial institutions when irresponsible debt consumption took place. Fortunately, corporations and consumers adjusted their all-you-can-eat debt buffet habits by going on a diet. As a matter of fact, corporations today are holding records amounts of cash and debt service loads for consumers has been reduced to levels not seen in decades (see chart below). Unlike governments, luckily CEOs and individuals do not need Congressional approval to adapt to a world of reality – they can simply adjust spending habits.

Governments, on the other hand, generally do need legislative approval to adjust spending habits. Regrettably, cutting the benefits of your constituents is not a real popular political strategy for accumulating votes or brownie points. If you don’t believe me, see what voters are doing to their leaders in Europe. Nicolas Sarkozy is the latest European leader to be booted from office due to austerity backlash and economic frustration. No less than nine European leaders have been cast aside since the financial crisis began.

The fate for U.S. politicians is less clear as we enter into a heated presidential election over the next six months. We do however know how the mid-term Congressional elections fared for the incumbents…not all sunshine and roses. Until elections are completed, we are resigned to the continued mind-numbing political gridlock, with no tangible resolutions to the trillion dollar deficits and gargantuan debt load. Obviously, most citizens would prefer a forward looking strategic plan from politicians (rather than a reactive one), but there are no signs that this will happen anytime soon…in either party.

Realistically though, tough decisions made by politicians only occur during crises, and if this slow-motion train wreck continues along this same path, then at least we have something to look forward to – forced resolution. We are seeing this firsthand in Greece. The “bond vigilantes” (see Plumbers & Cops) and responsible parents (i.e., Germany) have given Greece two options:

1.) Fix your financial problems and receive assistance; or

2.) Leave the EU (return to the Drachma currency) and figure your problems out yourself.

Panic has a way of forcing action, and we are approaching that “when push comes to shove” moment very quickly. I believe the Europeans are currently taking a note from our strategic playbook, which basically is the spaghetti approach – throw lots of things up on the wall and see what sticks. Or as Winston Churchill stated, “You can always count on Americans to do the right thing – after they’ve tried everything else.”

There is no question, the European sovereign debt issue is a complete mess, and there are no clear paths to a quick solution. Until voters force politicians into making tough unpopular decisions, or leaders come together with forward looking answers, the default position will be to keep kicking the fiscal can issues down the road. In the absence of political leadership, eventually the crisis will naturally force tough decisions to be made. Until then, I will go on explaining to others how the European dog ate my homework.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds (including commodities, inflation protection, floating rate bonds, real estate, dividend, and alternative investment ETFs), but at the time of publishing SCM had no direct position in AIG, JNJ, Bear Stearns, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Cash Security Blanket Turns Into Tourniquet

Article is an excerpt from Sidoxia Capital Management’s April 2012 newsletter. Subscribe on right side of page.

That warm safety blanket of cash that millions of Americans have clutched on to during the 2008-09 financial crisis; the 2010 “Flash Crash”; and the 2011 U.S. credit downgrade felt cozy during the bumpy ride we experienced over the last three years. Now with domestic stocks (S&P 500) up +12% in the first quarter of 2012, that same comfy blanket of CDs, money market, and checking accounts is switching into a painful tourniquet, cutting off the lucrative blood and oxygen supply to millions of Americans’ future retirement plans.

Earning next to nothing by stuffing your money under the mattress (0.7% average CD rate – Bankrate.com) isn’t going to make many financial dreams a reality. The truth of the matter is that due to inflation (running +2% to +3% per year), blanket holders are losing about -2% per year in the true value of their savings.

Your Choice: 3 Years or 107 years?

If you like to accumulate money, would you prefer doubling your money in 3 years or 107 years? Although the S&P 500 has more than doubled over the last three years, based on fund flows data and cash balances at the banks, apparently more individuals prefer waiting until the year 2119 (107 years from now) for their money to double – SEE CHART BELOW.

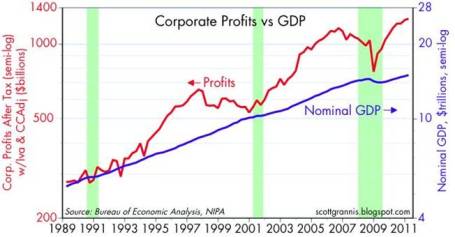

Obviously the massive underperformance of CDs cherry picks the time-period a bit, given the superb performance of stocks from 2009 – 2012 year-to-date. Over 1999-2012 stock performance hasn’t been as spectacular, but what we do know is that despite the lackluster performance of stocks over the last 12 years, corporate profits have about doubled in a similar timeframe, making equity prices that much more attractive relative to 1999.

With the economy and employment picture improving, some doomsday scenarios have temporarily been put on the backburner. As the recovery has gained some steam, many people are opening their bank statements with the painful realization, “I just made $31.49 on my checking maximizer account last year! Wow, how incredible…I can now go out and buy a half-tank of gas.” Never mind that healthcare premiums are exploding, food costs are skyrocketing, and that vacation you were planning is now out of reach. If you’re a mega-millionaire, perhaps you can make these stingy rates work for you, but for most of the other people, successful retirements will require more efficient use of their investment dollars. Or of course you can always work at Wal-Mart (WMT) as a greeter in your 80s.

Rationalizing with a Teen

Some people get it and some don’t. Trying to time the market, by getting in and out at the right times is a losing battle (see Getting Off the Market Timing Treadmill). Even the smartest professionals in the industry have little accuracy and cannot consistently predict the direction of the markets. Rationalizing the ups and downs of the financial markets is equivalent to rationalizing the actions of a teenager. Sometimes the outcomes are explainable, but most of the times they are not.

What an astute investor does know is that higher long-term returns come with higher volatility. So while the last four years have been a bumpy ride for investors, this is nothing new for an experienced investor who has studied the history of financial markets. There have been a dozen or so recessions since World War II, and we’ll have a dozen or so more over the next 50-60 years. Wars, banking crises, currency crises, and political turmoil have been a constant over history. Despite all these setbacks, the equity markets have climbed over +1,300% over the last 30 years or so. The smartest financial minds on the planet (e.g., the Ben Bernankes and Alan Greenspans of the world) haven’t been able to figure it out, so if they couldn’t do it, how is an average Joe supposed to be able to time the market? The answer is nobody can predict the direction of the market reliably.

As my clients and Investing Caffeine followers know, for those individuals with adequate savings and shorter time horizons, much of this conversation is irrelevant. However, based on our country’s low savings rate and the demographics of longer Baby Boomer life expectancies, most individuals can’t afford to stuff all their money under the mattress. As famous investor Sir John Templeton stated, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.” Earning 0.7% on your nest egg is difficult to call investing.

Ignoring the Experts

Why is the investing game so difficult? For starters, individuals are constantly bombarded by so-called experts through television, radio, and newspapers. Not only did Federal Reserve Chairmen Alan Greenspan and Ben Bernanke get the economy, financial markets, and housing markets wrong, the most powerful and smart financial institution CEOs were dead wrong as well. Look no further than Lehman Brothers (Dick Fuld), Citigroup Inc. (Chuck Prince), and American International Group (Martin Sullivan), which were believed to house some of the shrewdest executives – they too completely missed the financial crisis.

Rather than listening to shoddy predictions from pundits who have little to no investing experience, it makes more sense to listen to successful long-term investors who have survived multiple investment cycles and lived to tell the tale. Those people include the great fund manager Peter Lynch who said it is better to “assume the market is going nowhere and invest accordingly,” rather than try to time the market.

What You Hear

As the market has more than doubled over the last 37 months, here are some clouds of pessimism that these same shoddy economists, strategists, and analysts have described for investors:

* Europe and Greece’s impending fiscal domino collapse

* Excessive money printing at the Federal Reserve through quantitative easing and other programs

* Imminent government disintegration due to unresolved structural debts and deficits

* Elevated unemployment rates and pathetic job creation statistics

* Rigged high frequency trading and “Flash Crash”

* Credit downgrade and political turmoil in Washington

* Looming Chinese real estate bubble and subsequent hard economic landing

Unfortunately, many investors got sucked up in these ominous warnings and missed most, if not all, of the recent doubling in equity markets.

What You Don’t Hear

What you haven’t heard from the popular press are the following headlines:

* 10 consecutive quarters of GDP growth

* Record corporate profits and profit margins

* Equity valuations attractively priced below 50-year average (14.4 < 16.6 via Calafia Beach Pundit)

* Rising dividends with yields approaching 3%, if you consider recent bank announcements

* Record low interest rates and moderate inflation make earnings streams and dividends that much more valuable

* Four million new jobs created over the last three years

* S&P Smallcap near all-time highs (21 years); S&P Midcap index near all-time highs (20 years); NASDAQ is at 11-year highs; Dow Jones Industrials and S&P 500 near 4-year-highs.

* Record retail sales with a consumer that has reduced household debt

Given the massive upward run in the stock market over the last few years (and a complacent short-term VIX reading of 15), stocks are ripe for a breather. With that said, I would advise any blanket holders to not get too comfy with that money decaying away in a CD, money market, or savings account. Waiting too long may turn that security blanket into a tourniquet – forcing investors to amputate a portion of their future retirement savings.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in C, AIG, RATE, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Investors Sit on Fence and Watch New Highs

Article includes excerpts from Sidoxia Capital Management’s 3/1/2012 newsletter. Subscribe on right side of page.

We’ve seen some things jump during this 2012 Leap Year (mainly stock prices), but investors have not been jumping – rather they have been doing a lot of fence sitting. Despite the NASDAQ index hitting 11+ year highs (+14% in 2012 excl. dividends), and the S&P 500 index approaching 4-year highs, investors have been pulling cash out in droves from equities. Just last month, Scott Grannis at Calafia Beach Pundit highlighted that $355 billion in equity outflows has occurred since September 2008, including $155 billion since April 2011 and $6 billion siphoned out at the beginning of 2012.

Once again, listening to the vast majority of TV talking heads has decimated investor portfolios. However, ignoring the dreadful, horrific news over the last three years would have made an equity investor 100%+ (yes, that’s right…double). Somehow, the facts have escaped the psyches of millions of average Americans as the train is leaving the station. Certainly in 2008, a generational decline in equity markets was accompanied by horrific headlines. Those who were positioned too aggressively suffered about 15 months of severe pain, but those who capitulated with knee-jerk reactions after the collapse did incredibly more damage by selling near the bottom and locking in losses. Only now, after the Dow has exploded from 6,500 to 13,000 over the last three years have investors begun to ask whether now is the time to buy stocks.

Of course, making decisions by reacting to news headlines is a horrible way to manage one’s money and will only lead to a puddle of tears in the long-run. Psychological studies have shown that losses are 2.5x’s as painful as the pleasure experienced from gains. The wounds from the 2000 technology bubble and 2008-2009 financial crisis are still too fresh in investors’ minds, and until the scars heal, millions of investors will remain on the sidelines. As usual, average investors unfortunately get more excited after much of the gains have already been garnered.

Investing should be treated like an extended game of chess that requires long-term thinking. As in investing, there are many strategies that can be used in chess. Shadowing your opponent’s every move generally is not a winning strategy. Rather than defensively reacting to an opponent’s every move, proactively planning for the future is a healthier strategy. Don’t be a pawn, but instead create a long-term, low-cost investment plan that accounts for your current balance sheet, future goals, and risk tolerance in order to achieve your retirement checkmate. But before you can do that, you must first get that rump off the fence and put a plan into action.

Hot News Bites

How Do You Like Them Apples? Apple Inc. (AAPL) has become the most valuable company on the planet as it has surpassed a half-trillion dollars in market value at the end of February. Thanks to record sales of new iPhones, iPads, and Mac computers, Apple has managed to stuff away close to $100 billion in cash in its coffers. What’s next for Apple? Besides introducing new versions of existing products, Apple is expected to innovate its television platform later this year.

Greece Dips into Euro Purse Again: Euro-zone ministers approved a $172 billion rescue package for Greece to avoid default for the second time in less than two years. In addition to the Greek citizens, private bondholders are sharing in the pain. The deal calls for debt holders to write down their Greek debt by 74%; demands stark austerity measures (Debt/GDP ratio of 120.5% by 2020); and a continuous monitoring of Greece’s fiscal standing by a European task force.

Taxes-Schmaxes: There’s nothing more exciting in politics than the discussion of taxes. OK, maybe former Speaker Newt Gingrich’s moon colony proposal is a tad more interesting. Nonetheless, Congress voted to extend the payroll-tax cut through December, and both President Obama and presidential candidate Mitt Romney unveiled their new tax plans. Although Obama’s plan hopes to tax the rich, both politicians have plenty of tax-cuts embedded in their plans. In an election year, apparently debt and deficit amnesia have set in.

Investors “Like” Facebook: Although investors appear to be “Like”-ing Facebook in advance of its initial public offering (IPO), employees and owners seem to be even happier, considering the company is estimated to reach up to $100 billion in value once shares begin trading. I can’t wait to read CEO Mark Zuckerberg’s status update when he cashes in on a portion of his stake of $25 billion or so.

Gas Prices Empty Wallet: Improving global economic data is not the only reason behind escalating gasoline prices (currently averaging $3.73 per gallon for Regular). Iran reduced its sales of crude oil to Britain and France after those countries stopped importing Iranian oil, and Iran stated it has made progress on its nuclear-development program. Can’t we just all get along?!

Plan. Invest. Prosper.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, FB and AAPL, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dominoes, Deleveraging, and Justin Bieber

Despite significant 2011 estimated corporate profit growth (+17% S&P 500) and a sharp rebound in the markets since early October (+18% since the lows), investors remain scared of their own shadows. Even with trembling trillions in cash on the sidelines, the Dow Jones Industrial Average is up +5.0% for the year (+11% in 2010), and that excludes dividends. Not too shabby, if you think about the trillions melting away to inflation in CDs, savings accounts, and cash. With capital panicking into 10-year Treasuries, hovering near record lows of 2%, it should be no surprise to anyone that fears of a Greek domino toppling Italy, the eurozone, and the global economy have sapped confidence and retarded economic growth.

Deleveraging is a painful process, and U.S. consumers and corporations have experienced this first hand since the financial crisis of 2008 gained a full head of steam. Sure, housing has not recovered, and many domestic banks continue to chew threw a slew of foreclosures and underwater loan modifications. However, our European friends are now going through the same joyful process with their banks that we went through in 2008-2009. Certainly, when it comes to the government arena, the U.S. has only just begun to scratch the deleveraging surface. Fortunately, we will get a fresh update of how we’re doing in this department, come November 23rd, when the Congressional “Super Committee” will update us on $1.2 trillion+ in expected 10-year debt reductions.

Death by Dominoes?

Is now the time to stock your cave with a survival kit, gun, and gold? I’m going to go out on a limb and say we may see some more volatility surrounding the European PIIGS debt hangover (Portugal/Italy/Ireland/Greece/Spain) before normality returns, but Greece defaulting and/or exiting the euro does not mean the world is coming to an end. At the end of the day, despite legal ambiguity, the ECB (European Central Bank) will come to the rescue and steal a page from Ben Bernanke’s quantitative easing printing press playbook (see European Deadbeat Cousin).

Greece isn’t the first country to be attacked by bond vigilantes who push borrowing costs up or the first country to suffer an economic collapse. Memories are short, but it was not too long ago that a hedge fund on ice called Iceland experienced a massive economic collapse. It wasn’t pretty – Iceland’s three largest banks suffered $100 billion in losses (vs. a $13 billion GDP); Iceland’s stock market collapsed 95%; Iceland’s currency (krona) dropped 50% in a week. The country is already on the comeback trail. Currently, unemployment (@ 6.8%) in Iceland is significantly less than the U.S. (@ 9.0%), and Iceland’s economy is expanding +2.5%, with another +2.5% growth rate forecasted by the IMF (International Monetary Fund) in 2012.

Iceland used a formula of austerity and deleveraging, similar in some fashions to Ireland, which also has seen a dramatic -15% decrease in its sovereign debt borrowing costs (see chart below).

OK, sure, Iceland and Ireland are small potatoes (no pun intended), so how realistic is comparing these small countries’ problems to the massive $2.6 trillion in Italian sovereign debt that bearish investors expect to imminently implode? If these countries aren’t credibly large enough, then why not take a peek at Japan, which was the universe’s second largest economy in 1989. Since then, this South Pacific economic behemoth has experienced an unprecedented depression that has lasted longer than two decades, and seen the value of its stock market decline by -78% (from 38,916 to 8,514). Over that same timeframe, the U.S. economy has seen its economy grow from roughly $5.5 trillion to $15.2 trillion.

There’s no question in mind, if Greece exits the euro, financial markets will fall in the short-run, but if you believe the following…

1.) The world is NOT going to end.

2.) 2012 S&P profits are NOT declining to $65.

AND/OR

3.) Justin Bieber will NOT run and overtake Mitt Romney as the leading Republican candidate

…then I believe the financial markets are poised to move in a more constructive direction. Perhaps I am a bit too Pollyannaish, but as I decide if this is truly the case, I think I’ll go play a game of dominoes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Boo! Will History Offer a Bearish Trick or BullishTreat?

October is not only a scary month for trick-or-treaters during Halloween, but October is also a scary month for investors.

Boo! Scared yet? Well if not, need I remind you of the market crashes of 1929 and 1987 also occurred during this ghoulish month? With a wall of worry and concerns galore overwhelming myopic traders, it’s no surprise nervous memories become shortened in anxious times like these.

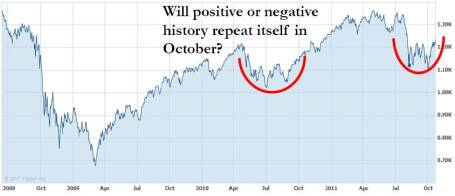

The financial crisis of 2008-2009 is seared into the minds of investors and every Greek debt negotiation creates fresh new Armageddon fears. But perhaps history will repeat itself in a shorter-term more positive way? Just last year, I wrote about the excessive pessimism (It’s All Greek to Me) in July 2010, when “de-risking” was the buzz word of the day and hedge funds were bailing in droves – right before the +30%+ QE2 (quantitative easing) melt-up. Despite a massive expansion in earnings growth over the last few years, the S&P 500 just touched 1074 a few weeks ago – putting the index at similar trading levels as in Fall 2009 (see chart below).

Will Europe crater the U.S. into an abyss, or will Bernanke need to pull a QE3 rabbit out of his hat? I’m not sure what’s going to happen, but I do know it’s better to follow the wisdom of Warren Buffett who says to “buy fear and sell greed.” If a 2% 10-Year Treasury, elevated VIX, and trillions in swollen cash reserves do not represent fear, then I may just need to pack my backs and head out to the Greek island of Santorini – that way I can at least enjoy my fear on a sunny beach.

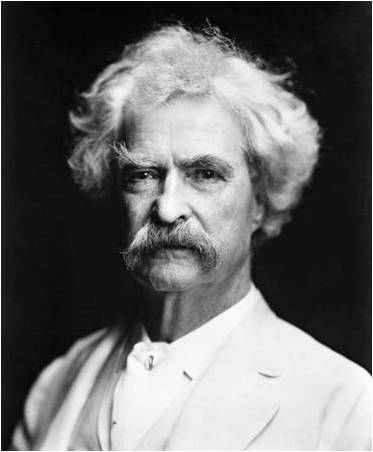

Regardless of the Q4 outcome, I thought my friend Mark Twain could provide some insight about history’s role in financial markets. Here is an Investing Caffeine flashback from the fall of 2009 (History Never Repeats Itself, but it Often Rhymes) which also questioned the extremely negative sentiment at the time (S&P 500: 1069):

As Mark Twain said, “History never repeats itself, but it often rhymes.” There are many bear markets with which to compare the current financial crisis we are working through. By studying the past we can understand the repeated mistakes of others (caused by fear and greed), and avoid making similar emotional errors.

Do you want an example? Here you go:

Today there are thoughtful, experienced, respected economists, bankers, investors and businessmen who can give you well-reasoned, logical, documented arguments why this bear market is different; why this time the economic problems are different; why this time things are going to get worse — and hence, why this is not a good time to invest in common stocks, even though they may appear low.”

Although the quote above seems appropriate for 2009, it actually is reflective of the bearish mood felt in most bear markets. We have been through wars, assassinations, banking crises, currency crises, terrorist attacks, mad-cow disease, swine flu, and yes, even recessions. And through it all, most have managed to survive in decent shape. Let’s take a deeper look.

1973-1974 Case Study:

For those of you familiar with this period, recall the prevailing circumstances:

- Exiting Vietnam War

- Undergoing a recession

- 9% unemployment

- Arab Oil Embargo

- Watergate: Presidential resignation

- Collapse of the Nifty Fifty stocks

- Rising inflation

Not too rosy a scenario, yet here’s what happened:

S&P 500 Price (12/1974): 69

S&P 500 Price (8/2009): 1,021

That is a whopping +1,380% increase, excluding dividends.

What Investors Should Do:

- Avoid Knee-Jerk Reactions to Media Reports: Whether it’s radio, television, newspapers, or now blogs, the headlines should not emotionally control your investment decisions. Historically, media venues are lousy at identifying changes in price direction. Reporters are excellent at telling you what is happening or what just happened – not what is going to happen.

- Save and Invest: Regardless of the market direction, entitlements like Medicare and social security are under stress, and life expectancies are increasing (despite the sad state of our healthcare system), therefore investing is even more important today than ever.

- Create a Systematic, Disciplined Investment Plan: I recommend a plan that takes advantage of passive, low-cost, tax-efficient investment strategies (e.g. exchange-traded and index funds) across a diversified portfolio. Rather than capitulating in response to market volatility, have a systematic process that can rebalance periodically to take advantage of these circumstances.

For DIY-ers (Do-It-Yourselfers), I suggest opening a low-cost discount brokerage account and research firms like Vanguard Group, iShares, or Select Sector SPDRs. If you choose to outsource to a professional advisor, I recommend interviewing several fee-only* advisers – focusing on experience, investment philosophy, and potential compensation conflicts of interest.

If you believe, like some economists, CEOs, and investors, we have suffered through the worst of the current “Great Recession” and you are sitting on the sidelines, then it might make sense to heed the following advice: “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished.” Dean Witter made those comments 77 years ago – a few weeks before the end of worst bear market in history. The market has bounced quite a bit since March of this year, but if history is on our side, there might be more room to go.

Portions of this article were originally published on September 16, 2009.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

*For disclosure purposes: Wade W. Slome, CFA, CFP is President & Founder of Sidoxia Capital Management, LLC, a fee-only investment adviser based in Newport Beach, California.

Mr. Market Bullying Investors

There’s been a bully pushing investor’s around and his name is “Mr. Market.” Volatility is Mr. Market’s partner in crime, and over the last 10 trading days Mr. M has used volatility to school equity investors to the tune of 1,600+ point swings, which has contributed to equity investors’ failing grade over the last few months. Who is Mr. Market? Charles Ellis, author of Winning the Loser’s Game (1998) described him best:

“Mr. Market is a mischievous but captivating fellow who persistently teases investors with gimmicks and tricks such as surprising earnings reports, startling dividend announcements, sudden surges of inflation, inspiring presidential announcements, grim reports of commodities prices, announcements of amazing new technologies, ugly bankruptcies, and even threats of war.”

How has Mr. Market been stealing investors’ lunch money? The process really hasn’t been that difficult for him, once you consider how many times investors have been heaved into the garbage can over the last decade, forced to deal with these messy events:

• 2001 technology bubble beating

• 2006 real estate collapse

• 2008 – 2009 financial crisis and recession

• 2010 “flash crash” and soft patch

• 2011 debt ceiling debate and credit rating downgrade

With this backdrop, investors are dropping like flies due to extreme bully fatigue. Over the last four months alone, approximately $75 billion in equities been liquidated, according to data from the Investment Company Institute – this is even more money withdrawn than the outflows occurring during the peak panic months after the Lehman Brothers collapse.

The Atomic Wedgie

Mr. Market understands the severity of these prior economic scars, which have been even more painful than atomic wedgies (reference Exhibit I above), so he opportunistically is taking advantage of fragile nerves. Introducing the following scary scenarios makes collecting lunch money from panicked investors much easier for Mr. Market. What is he using to frighten investors?

- A potential Greek sovereign debt default that will trigger a collapse of the Euro.

- Slowing growth in China due to slowing developed market economic activity.

- Possible double-dip recession in the U.S. coupled with an austerity driven downturn in Europe.

- Lack of political policy response to short and long-term economic problems in Washington and abroad.

- Impending deflation caused by decelerating global growth or likely inflation brought about by central banks’ easy monetary policies (i.e., printing money).

- End of the world.

Bully Victim Protection

Of course, not all of these events are likely to occur. As a matter of fact, there are some positive forming trends, besides just improving valuations, that provide protection to bully victims:

- Not only is the earnings yield (E/P – 12-month trailing EPS/share price) trouncing the yield on the 10-year Treasury note (~8% vs. ~2%, respectively), but the dividend yield on the S&P 500 index is also higher than the 10-year Treasury note yield (source: MarketWatch). Historically, this has been an excellent time to invest in equities with the S&P 500 index up an average of 20% in the ensuing 12 months.

- Jobs data may be poor, but it is improving relative to a few years ago as depicted here:

- Record low interest rates and mortgage rates provide a stimulative backdrop for businesses and consumers. Appetite for risk taking remains low, but as history teaches us, the pendulum of fear will eventually swing back towards greed.

As I say in my James Carville peace from earlier this year, It’s the Earnings Stupid, long term prices of stocks follow the path of earnings. Recent equity price market declines have factored in slowing in corporate profits. How severely the European debt crisis, and austerity have (and will) spread to the U.S. and emerging markets will become apparent in the coming weeks as companies give us a fresh look at the profit outlook. So far, we have gotten a mixed bag of data. Alpha Natural Resources (ANR) acknowledged slowing coal demand in Asia and FedEx Corp. (FDX) shave its fiscal year outlook by less than 2% due to international deceleration. Other bellwethers like Oracle Corp. (ORCL) and Nike Inc. (NKE) reported strong growth and outlooks. In the short-run Mr. Market is doing everything in his power to bully investors from their money, and lack of international policy response to mitigate the European financial crisis and contagion will only sap confidence and drag 2011-2012 earnings lower.

Punching Mr. Market

The warmth of negative real returns in cash, bonds, and CDs may feel pleasant and prudent, but for many investors the lasting effects of inflation erosion will inflict more pain than the alternatives. For retirees with adequate savings, these issues are less important and focus on equities should be deemphasized. For the majority of others, long-term investors need to reject the overwhelming sense of fear.

As I frequently remind others, I have no clue about the short-term direction of the market, and Greece could be the domino that causes the end of the world. But what I do know is that history teaches us the probabilities of higher long-term equity returns are only improving. Mr. Market is currently using some pretty effective scare tactics to bully investors. For those investors with a multi-year time horizon, who are willing to punch Mr. Market in the nose, the benefits are significant. The reward of better long-term returns is preferable to an atomic wedgie or a head-flush in the toilet received from Mr. Market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and FDX, but at the time of publishing SCM had no direct position in ANR, ORCL, NKE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Plumbers & Cops: Can the Debt Ceiling be Fixed?

The ceiling is leaking, but it’s unclear whether it will be repaired? Rather than fix the seeping fiscal problem, Democrats and Republicans have stared at the leaky ceiling and periodically applied debt ceiling patches every year or two by raising the limit. Nanosecond debt ceiling coverage has reached a nauseating level, but this issue has been escalating for many months. Last fall, politicians feared their long-term disregard of fiscally responsible policies could lead to a massive collapse in the financial ceiling protecting us, so the President called in the bipartisan plumbers of Alan Simpson & Erskine Bowles to fix the leak. The commission swiftly identified the problems and came up with a deep, thoughtful plan of action. Unfortunately, their recommendations were abruptly dismissed and Washington fell back into neglect mode, choosing instead to bicker like immature teenagers. The result: poisonous name calling and finger pointing that has placed Washington politicians one notch above Cuba’s Fidel Castro, Venezuela’s Hugo Chavez, and Iran’s Mahmoud Ahmadinejad on the list of the world’s most hated leaders. Strategist Ed Yardeni captured the disappointment of American voters when he mockingly states, “The clowns in Washington are making people cry rather than laugh.”

Although despair is in the air and the outlook is dour, our government can redeem itself with the simple passage of a debt ceiling increase, coupled with credible spending reduction legislation (and possibly “revenue enhancers” – you gotta love the tax euphimism).

The Elephant in the Room

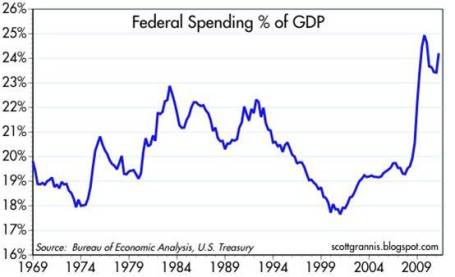

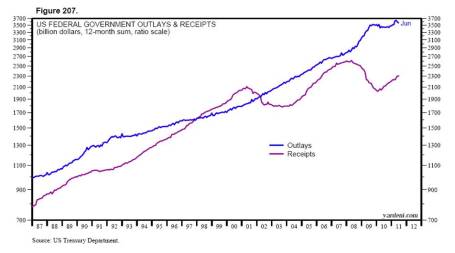

Our country’s spending problems is nothing new, but the 2008-2009 financial crisis merely amplified and highlighted the severity of the problem. The evidence is indisputable – we are spending beyond our means:

If the federal spending to GDP chart is not convincing enough, then review the following graph:

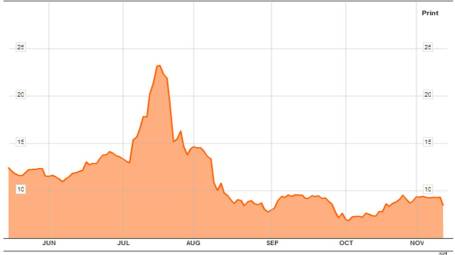

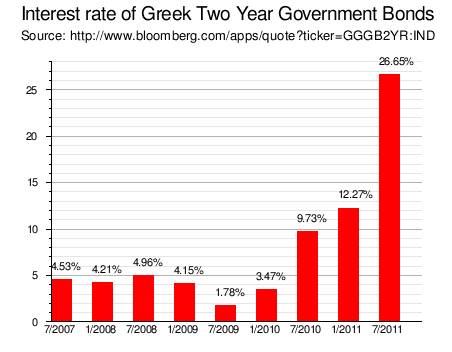

You don’t need to be a brain surgeon or rocket scientist to realize government expenditures are massively outpacing revenues (tax receipts). Expenditures need to be dramatically reduced, revenues increased, and/or a combination thereof. Applying for a new credit card with a limit to spend more isn’t going to work anymore – the lenders reviewing those upcoming credit applications will straightforwardly deny the applications or laugh at us as they gouge us with prohibitively high borrowing costs. The end result will be the evaporation of entitlement programs as we know them today (including Medicare and Social Security). For reference of exploding borrowing costs, please see Greek interest rate chart below. The mathematical equation for the Greek financial crisis (and potentially the U.S.) is amazingly straightforward…Loony Spending + Looney Politicians = Loony Interest Rates.

To illustrate my point further, imagine the government owning a home with a mortgage payment tied to a 2.5% interest rate (a tremendously low, average borrowing cost for the U.S. today). Now visualize the U.S. going bankrupt, which would then force foreign and domestic lenders to double or triple the rates charged on the mortgage payment (in order to compensate the lenders for heightened U.S. default risk). Global investors, including the Chinese, are pointing a gun at our head, and if a political blind eye on spending continues, our foreign brethren who have provided us with extremely generous low priced loans will not be bashful about pulling the high borrowing cost trigger. The ballooning mortgage payments resulting from a default would then break an already unsustainably crippling budget, and the government would therefore be placed in a position of painfully slashing spending. Too extreme a shift towards austerity could spin a presently wobbling economy into chaos. That’s precisely the situation we face under a no-action Congressional default (i.e., no fix by August 2nd or shortly thereafter). To date, the Chinese have collected their payments from us with a nervous smile, but if the U.S. can’t make some fiscally responsible choices, our Asian Pacific pals will be back soon with a baseball bat to collect.

The Cops to the Rescue

Any parent knows disciplining teenagers doesn’t always work out as planned. With fiscally irresponsible spending habits and debt load piling up to the ceiling, politicians are stealing the prospects of a brighter future from upcoming generations. The good news is that if the politicians do not listen to the parental voter cries for fiscal sanity, the capital market cops will enforce justice for the criminal negligence and financial thievery going on in Washington. Ed Yardeni calls these capital market enforcers the “bond vigilantes.” If you want proof of lackadaisical and stubborn politicians responding expeditiously to capital market cops, please hearken back to September 2008 when Congress caved into the $700 billion TARP legislation, right after the Dow Jones Industrial average plummeted 777 points in a single day.

Who exactly are these cops? These cops come in the shape of hedge funds, sovereign wealth funds, pension funds, endowments, mutual funds, and other institutional investors that shift their dollars to the geographies where their money is treated best. If there is a perceived, heightened risk of the United States defaulting on promised debt payments, then global investors will simply take their dollar-denominated investments, sell them, and then convert them into currencies/investments of more conscientious countries like Australia or Switzerland.

Assisting the capital market cops in disciplining the unruly teenagers are the credit rating agencies. S&P (Standard and Poor’s) and Moody’s (MCO) have been watching the slow-motion train wreck develop and they are threatening to downgrade the U.S.’ AAA credit rating. Republicans and Democrats may not speak the same language, but the common word in both of their vocabularies is “reelection,” which at some point will effect a reaction due to voter and investor anxiety.

Nobody wants to see our nation’s pipes burst from excessive debt and spending, and if the political plumbers can repair the very obvious and fixable fiscal problems, we can move on to more important challenges. It’s best we fix our problems by ourselves…before the cops arrive and arrest the culprits for gross negligence.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in MCO, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Soft Patch Creating Hard-Landing Nightmares

Boo! Was that a ghost, or was that just some soft patch talk scaring you during a nightmare? The economic data hasn’t been exactly rosy over the last month, and as a result, investors have gotten spooked and have chosen to chainsaw their equity positions. Since late April, nervous investors had already yanked more than $15 billion from U.S. equity mutual funds and shoved nearly $29 billion toward bond funds (Barron’s). Jittery emotions are evidenced by the recently released June Consumer Confidence numbers (Conference Board), which came in at a dismal 58.5 level – significantly above the low of 25.3 in 2009, but a mile away from the pre-crisis high of 111.9 in 2007.

Economic Monsters under the Bed

Why are investors having such scary dreams? Look no further than the latest terror-filled headlines du Jour referencing one (if not all) of the following issues:

• Inevitable economic collapse of Greece.

• End of QE2 (Quantitative Easing Part II) monetary stimulus program.

• Excessive state deficits, debt, and pension obligations.

• Housing market remains in shambles.

• Slowing in economic growth – lethargic +1.9% GDP growth in Q1.

• Accelerating inflation.

• Anemic auto sales in part caused by Japanese supply chain disruptions post the nuclear disaster.

Surely with all this horrible news, the equity markets must have suffered some severe bloodletting? Wait a second, my crack research team has just discovered the S&P 500 is up +5.0% this year and its sister index the Dow Jones Industrial Average is up +7.2%. How can bad news plus more bad news equal an up market?

OK, I know the sarcasm is oozing from the page, but the fact of the matter is investing based on economic headlines can be hazardous for your investment portfolio health. The flow of horrendous headlines was actually much worse over the last 24 months, yet equity markets have approximately doubled in price. On the flip-side, in 2007 there was an abundant amount of economic sunshine (excluding housing), right before the economy drove off a cliff.

Balanced Viewpoints

Being purely Pollyannaish and ignoring objective soft patch data is certainly not advisable, but with the financial crisis of 2008-2009 close behind us in the rear-view mirror, it has become apparent to me that fair and balanced analysis of the facts by TV, newspaper, radio, and blogging venues is noticeably absent.

Given the fact that the stock market is up in 2011 in the face of dreadful news, are investors just whistling as they walk past the graveyard? Or are there some positive countervailing trends hidden amidst all the gloom?

I could probably provide some credible contrarian views to the current pessimistically accepted outlook, but rather than recreating the wheel, why not choose a more efficient method and leave it to a trusted voice of Scott Grannis at the Calafia Beach Report, where he resourcefully notes the market positives:

“Corporate profits are very strong; the economy has created over 2 million private sector jobs since the recession low; swap spreads are very low; the implied volatility of equity options is only moderately elevated; the yield curve is very steep (thus ruling out any monetary policy threat to growth); commodity prices are very strong (thus ruling out any material slowdown in global demand); the US Congress is debating how much to cut spending, rather than how much to increase spending; oil prices are down one-third from their 2008 recession-provoking highs; exports are growing at strong double-digit rates; the number of people collecting unemployment insurance has dropped by 5 million since early 2010; federal revenues are growing at a 10% annual rate; households’ net worth has risen by over $9 trillion in the past two years; and the level of swap and credit spreads shows no signs of being artificially depressed (thus virtually ruling out excessive optimism or Fed-induced asset price distortions). When you put the latest concerns about the potential fallout from a Greek default (which is virtually assured and has been known and expected for months) against the backdrop of these positive and powerful fundamentals, the world doesn’t look like a very scary place.”

Wow, that doesn’t sound half bad, but rock throwing Greek vandals, nude politicians Tweeting pictures, and anti-terrorist war campaigns happen to sell more newspapers.

It’s the Earnings Stupid

Grannis’s view on corporate profits supports what I recently wrote in It’s the Earnings, Stupid. What really drives stock prices over the long-term is earnings and cash flows (with a good dash of interest rates). Given the sour stock market sentiment, little attention has been placed on the record growth in corporate profits – up +47% in 2010 on an S&P 500 operating basis and estimated +17% growth in 2011. Few people realize that corporate profits have more than doubled over the last decade (see chart below) in light of the feeble stock market performance. Despite the much improved current profit outlook, cynical bears question the validity of this year’s profit forecasts as we approach the beginning of Q2 earnings reporting season. However, if recent results from the likes of Nike Inc. (NKE), FedEx Corp (FDX), Oracle Corp. (ORCL), Caterpillar Inc. (CAT), and Bed Bath & Beyond Inc. (BBBY) are indicators of what’s to come from the rest of corporate America, then profit estimates may actually get adjusted upwards…not downwards?

There is plenty to worry about and there is never a shortage of scary headlines (see Back to the Future magazine covers), but reacting to news with impulsive emotional trades will produce fewer sweet dreams and more investment nightmares.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and FDX, but at the time of publishing SCM had no direct position in NKE, CAT, ORCL, BBY or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Tug-of-War as Recovery Matures

Excerpt from No-Cost June 2011 Sidoxia Monthly Newsletter (Subscribe on right-side of page)

With the Rapture behind us, we can now focus less on the end of the world and more on the economic tug of war. As we approach the midpoint of 2011, equity markets were down -1.4% last month (S&P 500 index) and are virtually flat since February – trading within a narrow band of approximately +/- 5% over that period. Investors are filtering through data as we speak, reconciling record corporate profits and margins with decelerating economic and employment trends.

Here are some of the issues investors are digesting:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

- International Expansion: A weaker dollar has made domestic goods and services more affordable to foreigners, resulting in stronger sales abroad. The expansion of middle classes in developing countries is leading to the broader purchasing power necessary to drive increasing American exports.

- Rising Productivity: Cheap labor, new equipment, and expanded technology adoption have resulted in annualized productivity increases of +2.9% and +1.6% in the 4th quarter and 1st quarter, respectively. Eventually, corporations will be forced to hire full-time employees in bulk, as bursting temporary worker staffs and stretched employee bases will hit output limitations.

- Deleveraging Helps Spending: As we enter the third year of the economic recovery, consumers, corporations, and financial institutions have become more responsible in curtailing their debt loads, which has led to more sustainable, albeit more moderate, spending levels. For instance, ever since mid-2008, when recessionary fundamentals worsened, consumer debt in the U.S. has fallen by more than $1 trillion.

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

From Bearded Monks to Greek Decline

Noted author Michael Lewis has sold millions of books and written on topics ranging from professional baseball to Wall Street and Iceland to Silicon Valley. Now, he has decided to tackle the gripping but nebulous Greek financial crisis through the eyes and bearded mouths of Greek monks in a recently released article from Vanity Fair.

At the heart of the story is a Christian monastery (Vatopaidi), located on a northeastern peninsula of Greece. This ten-century old sanctuary has helped expose the tenuous state of the Greek economy, which is estimated to be sitting on $1.2 trillion in debt (representing $.25 million per working Greek adult) – a massive number considering the relatively petite size of the country. Beyond interviewing the Vatopaidi monks, Lewis trolled through the country interviewing various politicians, businessmen, government officials, and natives in order to make sense of this Mediterranean mess.

The Scandal Genesis

Starting in 2008, news filtered out that Vatopaidi had somehow acquired a practically worthless lake and swapped it for 73 different government properties, including a 2004 Olympics center. The Vatopaidi monastery effectively created an estimated $1 billion+ commercial real estate portfolio from nothing, thanks to one of the key Vatopaidi monks negotiating a fishy, behind-the-door government exchange scheme. This scandal, among other issues, ultimately lead to the collapse of the prior Greek ruling party and sent Prime Minister Kostas Karamanlis packing his bags.

The Greek crisis did not happen overnight, but rather decades. A casual observer may mistake the caustic Greek media headlines as proof to blame Greece as the reason behind the global financial meltdown, Rather, the challenges faced by this island-based country are more symptomatic of the weak global credit standards and the undisciplined disregard for excessive debt levels. Even with an embarrassingly high debt/GDP ratio (Gross Domestic Product) of about 130%, Greece’s desperate financial situation is a relatively minor blemish in the whole global scheme of things. More specifically, the $300 billion or so in Greek GDP represents the equivalent of a pubescent pimple on the face of a $60 plus trillion global economy.

The Greek Concern

The Vatopaidi scandal is still being investigated, but how did this broader debt-induced, Greek fiscal catastrophe occur?

Lax tax collection, absence of legal enforcement, and simple corruption are a few of the contributing reasons. Lewis describes the situation as follows:

“Everyone is pretty sure everyone is cheating on his taxes, or bribing politicians, or taking bribes, or lying about the value of his real estate. And this total absence of faith in one another is self-reinforcing. The epidemic of lying and cheating and stealing makes any sort of civic life impossible; the collapse of civic life only encourages more lying, cheating, and stealing.”

A tax collector and real estate agent from the article had this to say:

“If the law was enforced, every doctor in Greece would be in jail.” AND

“Every single member of the Greek Parliament is lying to evade taxes.”

The Greek government also did an incredible job of distorting the reported economic data and swept reality under the rug:

“How in the hell is it possible for a member of the euro area to say the deficit was 3 percent of G.D.P. when it was really 15 percent?” a senior I.M.F. (International Monetary Fund) representative asked.

The Greek debacle was not an isolated incident. The significant dislocations occurring around the earth’s small and dark corners have directly impacted our lives here in the U.S. Take for example Iceland, the country that New York Times columnist Thomas Friedman called a converted “hedge fund with glaciers.” Not only did this historically tiny fishing island do dynamic damage to its southern neighbors in Europe, but damage from its collapsing banks extended all the way to busted condominium developments in Beverly Hills, California. Or consider Dubai and the multi-billion dollar debt restructuring at Nakheel Development that held the world breathless as people around the world watched in trepidation.

These examples, coupled with the Greek financial crisis highlight how widespread the collateral damage of cheap credit proliferated. The cost of money is still dangerously low, as governments around the globe attempt to stimulate demand, however the regulators and banking industry must remain vigilant in maintaining loan and capital deployment discipline. The hot debates over financial regulatory reform in the U.S., along with the recent Basel III banking requirement discussions are evidence of the need to restore balance and stability to the global financial playing field.

The global financial crisis has spooked billions of people around the world. Like a mysterious boogeyman, the crisis has turned cheap and easy credit into the public’s worst nightmare. The mysticism and general opacity surrounding the inner-workings of Wall Street and global financial markets attacks at investors’ inherent emotional vulnerabilities. Michael Lewis has once again helped turn what on the exterior seems extremely complex and confusing and boiled the essence of the problem down into terms the masses can digest and put into perspective.

Bearded monks loading up on government-swapped commercial real estate may have provided valuable lessons and insights into the global financial crisis, however now I can hardly wait for Michael Lewis’s next topic…perhaps balding nuns in South African gold mines?

Read the whole Vanity Fair article written by Michael Lewis

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.