Posts tagged ‘global trade’

Tariffs & Free Trade by Wade

Tariffs and trade have dominated the media headlines since the beginning of the year, creating a volatile rollercoaster ride in the financial markets and broader economy. What were screams of fear just last month turned into cheers of optimism after a trade deal between the U.S. and the U.K. was announced earlier this month.

This agreement—combined with hopes for future trade deals and the absence of runaway inflation or economic collapse—sparked a rally in stock prices. The minimum 10% baseline tariff in the U.K. agreement has fueled optimism that a simplified framework might extend to other international trade pacts. For the month, the S&P 500 surged by +6.2%, the Dow Jones Industrial Average climbed +3.9%, and the tech-heavy NASDAQ soared by +9.6%.

However, tariffs and trade haven’t faded into the background. In fact, just this week, a federal court ruled that the president’s tariff policies were illegal, citing misuse of emergency powers under the International Emergency Economic Powers Act (IEEPA) of 1977. Subsequently, the same court has granted the Trump administration a reprieve pending appeal—potentially escalating the issue to the Supreme Court. Even if the ruling stands, the president has alternative avenues to impose tariffs through other legal mechanisms.

So, what is all this fuss over tariffs and trade really about? I’ve previously written extensively on the topic (“Tariff Sheriff”), but some fundamental economic concepts still get lost in the tariff chaos noise.

It’s true that many countries engage in unfair trade practices against the U.S.—including subsidies, currency manipulation, non-tariff barriers, dumping, quotas, complex permitting, and value-added taxes (VAT). However, the powerful benefits of free trade are often underappreciated or poorly explained by the pundits.

Tariffs and Free Trade 101: China & France Experiment

To illustrate, let’s reference an example drawn from an op-ed by Princeton economist Burton Malkiel, author of the legendary finance book A Random Walk Down Wall Street.

Every country enjoys a comparative advantage in producing certain goods. For example, China historically benefits from low labor costs, making it a global manufacturing hub. Meanwhile, the U.S. leads in technological innovation, and countries like Brazil leverage vast land resources to dominate agricultural exports—such as being the world’s top coffee exporter. Let’s consider a simplified example using two countries: China and France, each with 100 labor hours available, and only able to produce T-shirts and wine.

China’s Output (see graphic above) – China’s comparative advantage in making more T-shirts than bottles of wine results in the following:

- 50 hours = 50 T-shirts

- 50 hours = 10 bottles of wine

France’s Output (see graphic above) – France’s comparative advantage in making more bottles of wine than T-shirts results in the following:

- 50 hours = 50 bottles of wine

- 50 hours = 20 T-shirts

Combined Total (China + France): 70 T-shirts + 60 bottles of wine = 130 total units of goods.

Example #2: Production Plan #2 (Each country specializes in their comparative advantage)

China’s Output (T-shirt specialization):

- 100 hours = 100 T-shirts

France’s Output (Wine specialization):

- 100 hours = 100 bottles of wine

Combined Total: 100 T-shirts + 100 bottles of wine = 200 total units of goods.

But here’s the challenge: the Chinese still want wine, and the French still want T-shirts. That’s where free trade comes in – see next example (graphic below).

Example #3: Production Plan #2 + Free Trade

Through free trade, each country can specialize in what they do best and then trade for other goods wanted or needed. If China trades 50 T-shirts for 50 bottles of wine with France, both countries end up with:

- China: 50 T-shirts + 50 bottles of wine

- France: 50 bottles of wine + 50 T-shirts

This plan produces 54% more total goods than the original production plan (200 vs. 130 – Example #1), with no increase in labor hours. China gets 300% more wine, and France gets 150% more T-shirts—a clear win-win.

Today’s Tariff Reality

In 2024, the U.S. trade deficit stood at $918 billion. President Trump’s aggressive tariff strategy aims to reduce this gap by incentivizing domestic manufacturing, increasing exports, and reducing imports. The challenge is that tariffs also raise prices for consumers and disrupt the benefits of free trade.

If the administration succeeds in establishing fairer rules for a level trading field, increasing government revenue, and narrowing the trade deficit, then history will likely view President Trump’s tariff policy favorably. But if tariffs lead to higher prices, inflation, and a weaker economy, the tariff policy may be judged as a costly misstep. The stock market, voters, and time will ultimately serve as the principal judges.

Looking ahead, two key dates are on the calendar:

- July 9 marks the end of the 90-day reciprocal tariff pause. Without new trade agreements, tariffs will spike on imports from many countries — raising costs for consumers.

- July 4 is not only Independence Day, but also the target date for Senate Republicans to pass the “One Big Beautiful Bill”, which packages several of President Trump’s top priorities: tax cuts, welfare reform, energy expansion, and border security. While the bill could stimulate growth, critics warn of its potential to balloon the national deficit.

Most Americans support the idea of fairer global trade. The question is whether aggressive tariffs across the globe are the right tool to achieve that goal — and whether trading partners will agree to new deals. Regardless of the outcome, this crash course in Tariffs & Free Trade 101 underscores the enduring value of specialization and free trade, even amid today’s turbulent tariff battles.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Trade War Bark: Hold Tight or Nasty Bite?

In recent weeks, President Trump has come out viciously barking about potential trade wars, not only with China, but also with other allies, including key trade collaborators in Europe, Canada, and Mexico. What does this all mean? Should you brace for a nasty financial bite in your portfolio, or should you remain calm and hold tight?

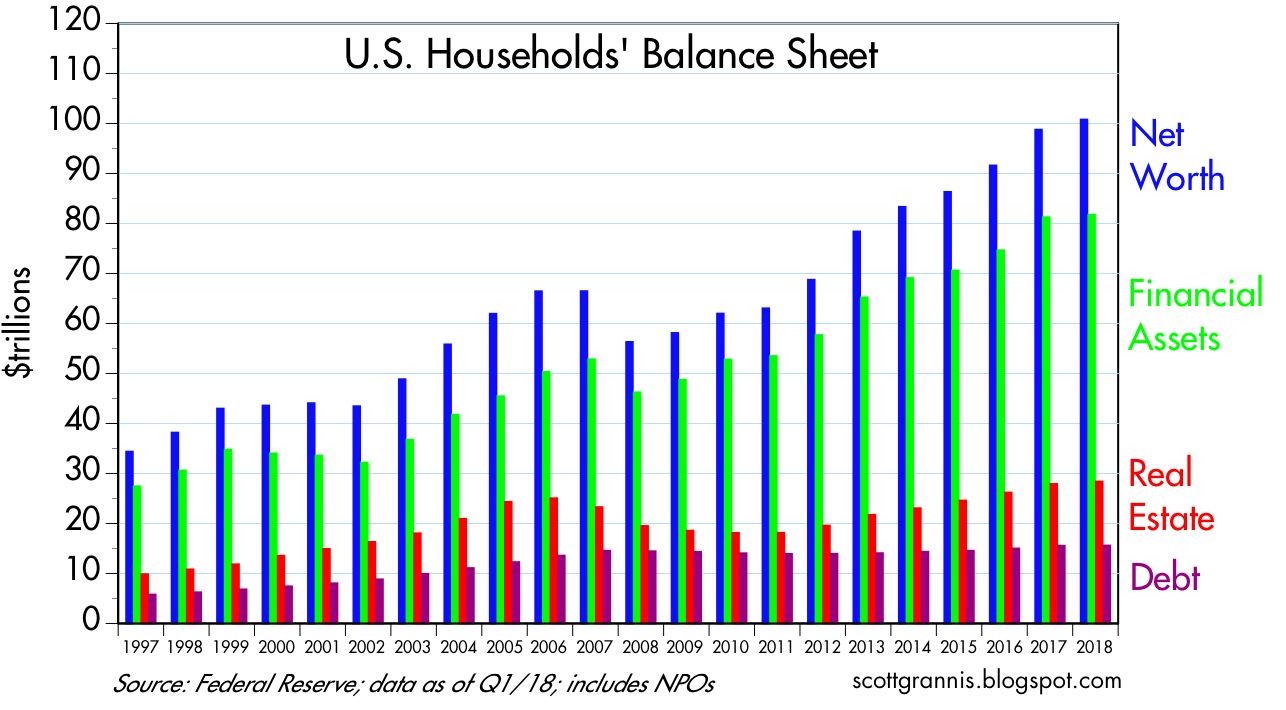

Let’s take a closer look. Recent talks of trade wars and tit-for-tat retaliations have produced mixed results for the stock market. For the month, the S&P 500 index advanced +0.5% (+1.7% year-to-date), while the Dow Jones Industrial Average modestly retreated -0.6% (-1.8% YTD). Despite trade war concerns and anxiety over a responsibly cautious Federal Reserve increasing interest rates, the economy remains strong. Not only is unemployment at an impressively low level of 3.8% (tying the lowest rate seen since 1969), but corporate profits are at record levels, thanks to a healthy economy and stimulative tax cuts. Consumers are feeling quite well regarding their financial situation too. For instance, household net worth has surpassed $100 trillion dollars, while debt ratios are declining (see chart below).

Source: Scott Grannis

Although trade is presently top-of-mind among many investors, a lot of the fiery rhetoric emanating from Washington should come as no surprise. The president heavily campaigned on the idea of reducing uniform unfair Chinese trade policies and leveling the trade playing field. It took about a year and a half before the president actually pulled out the tariff guns. The first $50 billion tariff salvo has been launched by the Trump administration against China, and an additional $200 billion in tariffs have been threatened. So far, Trump has enacted tariffs on imported steel, aluminum, solar panels, washing machines and other Chinese imports.

It’s important to understand, we are in the very early innings of tariff implementation and trade negotiations. Therefore, the scale and potential impact from tariffs and trade wars should be placed in the proper context relative to our $20 trillion U.S. economy (annual Gross Domestic Product) and the $16 trillion in annual global trade.

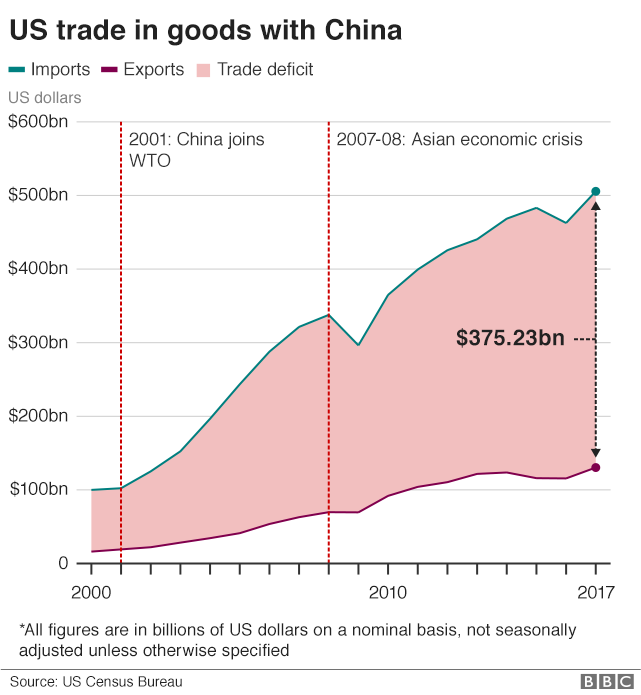

Stated differently, even if the president’s proposed $50 billion in Chinese tariffs quadruples in value to $200 billion, the impact on the overall economy will be minimal – less than 1% of the total. Even if you go further and consider our country’s $375 billion trade deficit with China for physical goods (see chart below), significant reductions in the Chinese trade deficit will still not dramatically change the trajectory of economic growth.

Source: BBC

The Tax Foundation adds support to the idea that current tariffs should have minimal influence:

“The tariffs enacted so far by the Trump administration would reduce long-run GDP by 0.06 percent ($15 billion) and wages by 0.04 percent and eliminate 48,585 full-time equivalent jobs.”

Of course, if the China trade skirmish explodes into an all-out global trade war into key regions like Europe, Mexico, Canada, and Japan, then all bets are off. Not only would inflationary pressures be a drag on the economy, but consumer and business confidence would dive and they would drastically cut back on spending and negatively pressure the economy.

Most investors, economists, and consumers recognize the significant benefits accrued from free trade in the form of lower-prices and a broadened selection. In the case of China, cheaper Chinese imports allow the American masses to buy bargain toys from Wal-Mart, big-screen televisions from Best Buy, and/or leading-edge iPhones from the Apple Store. Most reasonable people also understand these previously mentioned consumer benefits can be somewhat offset by the costs of intellectual property/trade secret theft and unfair business practices levied on current and future American businesses doing business in China.

Trump Playing Chicken

Right now, Trump is playing a game of chicken with our global trading partners, including our largest partner, China. If his threats of imposing stiffer tariffs and trade restrictions result in new and better bilateral trade agreements (see South Korean trade deal), then his tactics could prove beneficial. However, if the threat and imposition of new tariffs merely leads to retaliatory tariffs, higher prices (i.e., inflation), and no new deals, then this mutually destructive outcome will likely leave our economy worse off.

Critics of Trump’s tariff strategy point to the high profile announcement by Harley-Davidson to move manufacturing production from the United States to overseas plants. Harley made the decision because the tariffs are estimated to cost the company up to $100 million to move production overseas. As part of this strategy, Harley has also been forced to consider motorcycle price hikes of $2,200 each. On the other hand, proponents of Trump’s trade and economic policies (i.e., tariffs, reduced regulations, lower taxes) point to the recent announcement by Foxconn, China’s largest private employer. Foxconn works with technology companies like Apple, Amazon, and HP to help manufacture a wide array of products. Due to tax incentives, Foxconn is planning to build a $10 billion plant in Wisconsin that will create 13,000 – 15,000 high-paying jobs. Wherever you stand on the political or economic philosophy spectrum, ultimately Americans will vote for the candidates and policies that benefit their personal wallets/purses. So, if retaliatory measures by foreign countries introduces inflation and slowly grinds trade to a halt, voter backlash will likely result in politicians being voted out of office due to failed trade policies.

Source: Dr. Ed’s Blog

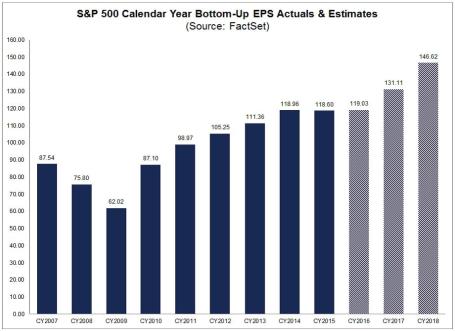

Time will tell whether the current trade policies and actions implemented by the current administration will lead to higher costs or greater benefits. Talk about China tariffs, NAFTA (North American Free Trade Agreement), TPP (Trans Pacific Partnership), and other reciprocal trade negotiations will persist, but these trading relationships are extremely complex and will take a long time to resolve. While I am explicitly against tariff policies in general, I am not an alarmist or doomsayer, at this point. Currently, the trade war bark is worse than the bite. If the situation worsens, the history of politics proves nothing is permanent. Circumstances and opinions are continually changing, which highlights why politics has a way of improving or changing policies through the power of the vote. While many news stories paint a picture of imminent, critical tariff pain, I believe it is way too early to come to that conclusion. The economy remains strong, corporate profits are at record levels (see chart above), interest rates remain low historically, and consumers overall are feeling better about their financial situation. It is by no means a certainty, but if improved trade agreements can be established with our key trading partners, fears of an undisciplined barking and biting trade dog could turn into a tame smooching puppy that loves trade.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2018). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in WMT, HOG, HPQ, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Double Dip Expansion?

Ever since the 2008-2009 financial crisis, every time the stock market has experienced a -5%, -10%, or -15% correction, industry pundits and media talking heads have repeatedly sounded the “Double Dip Recession” alarm bells. As you know, we have yet to experience a technical recession (two reported quarters of negative GDP growth), and stock prices have almost quadrupled from a 2009 low on the S&P 500 of 666 to 2,378 today (up approximately +257%).

Over the last nine years, so-called experts have been warning of an imminent stock market collapse from the likes of PIIGS (Portugal/Italy/Ireland/Greece/Spain), Cyprus, China, Fed interest rate hikes, Brexit, ISIS, U.S. elections, North Korea, French elections, and other fears. While there have been plenty of “Double Dip Recession” references, what you have not heard are calls for a “Double Dip Expansion.”

Is it possible that after the initial 2010-2014 economic expansionary rebound, and subsequent 2015-2016 earnings recession caused by sluggish global growth and a spike in the value of the U.S. dollar, we could possibly be in the midst of a “Double Dip Expansion?” (see earnings chart below)

Source: FactSet

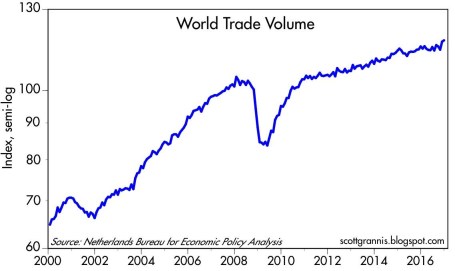

Whether you agree or disagree with the new political administration’s politics, the economy was already on the comeback trail before the November 2016 elections, and the momentum appears to be continuing. Not only has the pace of job growth been fairly consistent (+235,000 new jobs in February, 4.7% unemployment rate), but industrial production has been picking up globally, along with a key global trade index that accelerated to 4-5% growth in the back half of 2016 (see chart below).

Source: Calafia Beach Pundit

This continued, or improved, economic growth has arisen despite the lack of legislation from the new U.S. administration. Optimists hope for an improved healthcare system, income tax reform, foreign profit repatriation, and infrastructure spending as some of the initiatives to drive financial markets higher.

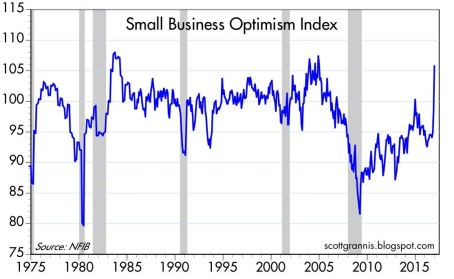

Pessimists, on the other hand, believe all these proposed initiatives will fail, and cause financial markets to fall into a tailspin. Regardless, at least for the period following the elections, investors and companies have perceived the pro-business rhetoric, executive orders, and regulatory relief proposals as positive developments. It’s widely understood that small businesses supply the largest portion of our nation’s jobs, and the upward spike in Small Business Optimism early in 2017 is a welcome sign (see chart below).

Source: Calafia Beach Pundit

Yes, it is true our new president could send out a rogue tweet; start a trade war due to a tariff slapped on a critical trading partner; or make a hawkish military remark that isolates our country from an ally. These events, along with other potential failed campaign promises, are all possibilities that could pause the trajectory of the current bull market. However, more importantly, as long as corporate profits, the mother’s milk of stock price appreciation, continue to march higher, then the stock market fun can continue. If that’s the case, there will likely be less talk of “Double Dip Recessions,” and more discussions of a “Double Dip Expansion.”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.