Posts tagged ‘global economy’

End of the World or Status Quo?

If you were the chief executive of a newspaper, television, or magazine company, what headline stories would you run to generate the most viewers and readers? Which subjects will you choose to make me impulsively grab a magazine in the grocery line, keep me glued to the television news, or suck me in to click-bait advertisements on the web? For example, what topics below would you select to grab the most attention?

· Hurricane or Sunshine?

· High Speed Car Chase or Cat Saved from Tree?

· Bloody Murder or Baby’s Birthday?

· Messy Divorce or Wedding Celebration?

· Impeachment or Bipartisan Legislation

· End of the World or Status Quo?

If you selected the first subject in each pair above, you would likely gain much more initial interest. In choosing a winning topic, the saying goes, “what bleeds, leads.” In other words, scary or controversial stories always grab more attention than feel-good or status quo narratives. And that is why the vast majority of media outlets are drawn to negativity, just as mosquitos are attracted to bug zappers. This phenomenon can be explained in part with the help of Nobel Prize winner Daniel Kahneman and his partner Amos Tversky, who conducted research showing the pain from losses is more than twice as painful as are the pleasures experienced from gains (see chart below).

The significant volatility seen in the stock market recently from the Russian war/invasion of Ukraine is further evidence of how this fear dynamic can create short-term panics.

Although the stock market as measured by the S&P 500 index has gone gangbusters over the last three years, almost doubling in value (2019: +29%, 2020: +16%, 2021: +27%), the S&P 500 has hit an air pocket during the first couple months of 2022 (-8%), including down -3% in February. The year started with turbulence as investors became fearful of a Federal Reserve that is entering the beginning stages of interest rate hikes while cutting stimulative bond purchases. And then last month, the Russian-Ukrainian incursion made investors even more skittish. Like always, these geopolitical events tend to be short-lived once investors realize the impact turns out to be less meaningful than initially feared. As you can see below, the worst economic impact is forecasted to be felt by Russia (consensus on 2/24/22 of approximately a -1.0% hit to economic growth), more than twice as bad as the -0.2% to -0.4% knock to growth for the U.S., Europe, and the world (see chart below). The Russian hit will likely be worse after accelerated sanctions.

As it relates to Ukraine, many Americans don’t even know where the country is located on a map. Ukraine accounts for about only 0.14% of total global GDP (i.e., a rounding error and less than 1% of total global economic activity). Russia, although larger than Ukraine, is still a relative small-fry and represents only about 3% of total global economic activity. If you live in Europe during the winter, you might be a little more concerned about Vladimir Putin’s recent activities because a lot of Europe’s energy (natural gas) is supplied by Russia through Ukraine. For example, Germany receives about half of its natural gas from Russia (see chart below).

Russia, on the other hand, is larger than Ukraine, but the red country is still a relative small-fry representing only about 3% of total global economic activity. When it comes to energy production however, Russia is more than a rounding error because the country accounts for about 11% of global energy production (#3 country globally behind the United States and Saudi Arabia). By taking all these factors into account, we can confidently state that Russia and Ukraine have a very low probability of solely pulling the global economy into recession.

If history repeats itself, this conflict will turn out to be another garden variety decline in the stock market and an opportunity to buy at a discount. It’s virtually impossible to predict a short-term bottom in stock prices has been reached, but over the long-run, stock investors have been handsomely rewarded for not panicking and staying invested (see chart below).

At the end of the day, the daily headlines will continually attempt to sell the negative story that the world is coming to an end. If you have the fortitude and discipline to ignore the irrelevant noise, the status quo of normal volatility can create more exciting opportunities and better returns for long-term investors.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 1, 2022). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Return to Rationality?

As the worst pandemic in more than a generation is winding down in the U.S., people are readjusting their personal lives and investing worlds as they transition from ridiculousness to rationality. After many months of non-stop lockdowns, social distancing, hand-sanitizers, mask-wearing, and vaccines, Americans feel like caged tigers ready to roam back into the wild. An incredible amount of pent-up demand is just now being unleashed not only by consumers, but also by businesses and the economy overall. This reality was also felt in the stock market as the Dow Jones Industrial Average powered ahead another 654 points last month (+1.9%) to a new record level (34,529) and the S&P 500 also closed at a new monthly high (+0.6% to 4,204). For the year, the bull market remains intact with the Dow gaining almost 4,000 points (+12.8%), while the S&P 500 has also registered a respectable +11.9% return.

The story was different last year. The economy and stock market temporarily fell off a cliff and came to a grinding halt in the first quarter of 2020. However, with broad distribution of the vaccines and antibodies gained by the previously infected, herd immunity has effectively been reached. As a result, the U.S. COVID-19 pandemic has essentially come to an end for now and stock prices have continued their upward surge since last March.

Insanity to Sanity?

With the help of the Federal Reserve keeping interest rates at near-0% levels, coupled with trillions of dollars in stimulus and proposed infrastructure spending, corporate profits have been racing ahead. All this free money has pushed speculation into areas such as cryptocurrencies (i.e., Bitcoin, Dogecoin, Ethereum), SPACs (Special Purpose Acquisition Companies), Reddit meme stocks (GameStop Corp, AMC Entertainment), and highly valued, money-losing companies (e.g., Spotify, Uber, Snowflake, Palantir Technologies, Lyft, Peloton, and others). The good news, at least in the short-term, is that some of these areas of insanity have gone from stratospheric levels to just nosebleed heights. Take for example, Cathie Wood’s ARK Innovation Fund (ARKK) that invests in pricey stocks averaging a 91x price-earnings ratio, which exceeds 4x’s the valuation of the average S&P 500 stock. The ARK exchange traded fund that touts investments in buzzword technologies like artificial intelligence, machine learning, and cryptocurrencies rocketed +149% last year in the middle of a pandemic, but is down -10.0% this year. The Grayscale Bitcoin Trust fund (GBTC) that skyrocketed +291% in 2020 has fallen -5.6% in 2021 and -48.1% from its peak. What’s more, after climbing by more than +50% in less than four months, the Defiance NextGen SPAC fund (SPAK) has declined by -28.9% from its apex just a few months ago in February. You can see the dramatic 2021 underperformance in these areas in the chart below.

Inflation Rearing its Ugly Head?

The economic resurgence, weaker value of the U.S. dollar, and rising stock prices have pushed up inflation in commodities such as corn, gasoline, lumber, automobiles, housing, and a whole host of other goods (see chart below). Whether this phenomenon is “transitory” in nature, as Federal Reserve Chairman Jerome Powell likes to describe this trend, or if this is the beginning of a longer phase of continued rising prices, the answer will be determined in the coming months. It’s clear the Federal Reserve has its hands full as it attempts to keep a lid on inflation and interest rates. The Fed’s success, or lack thereof, will have significant ramifications for all financial markets, and also have meaningful consequences for retirees looking to survive on fixed income budgets.

As we have worked our way through this pandemic, all Americans and investors look to change their routines from an environment of irrationality to rationality, and insanity to sanity. Although the bull market remains alive and well in the stock market, inflation, interest rates, and speculative areas like cryptocurrencies, SPACs, meme-stocks, and nosebleed-priced stocks remain areas of caution. Stick to a disciplined and diversified investment approach that incorporates valuation into the process or contact an experienced advisor like Sidoxia Capital Management to assist you through these volatile times.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME, AMC, SPOT, UBER, SNOW, PLTR, LYFT, PTON, GBTC, SPAK, ARKK or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Pedal to the Metal Leads to Record Rebound

Like a race car pushing the pedal to the metal, the stock market sped to its best quarterly stock market gains in decades. The +20% rebound in the 2nd quarter S&P 500 index was the best result achieved since 1998. Moreover, the Dow Jones Industrial Average saw its largest quarterly gain (+18%) since 1987, and the technology-heavy NASDAQ index (+31%) saw the most appreciation since 2001. While a snap-back after a shockingly dismal 1st quarter should come as no surprise to many investors, the pace of this rebound is unlikely to be sustainable at this trajectory, given the challenging economic backdrop and COVID public health crisis.

Racing Ahead Via Re-Opening

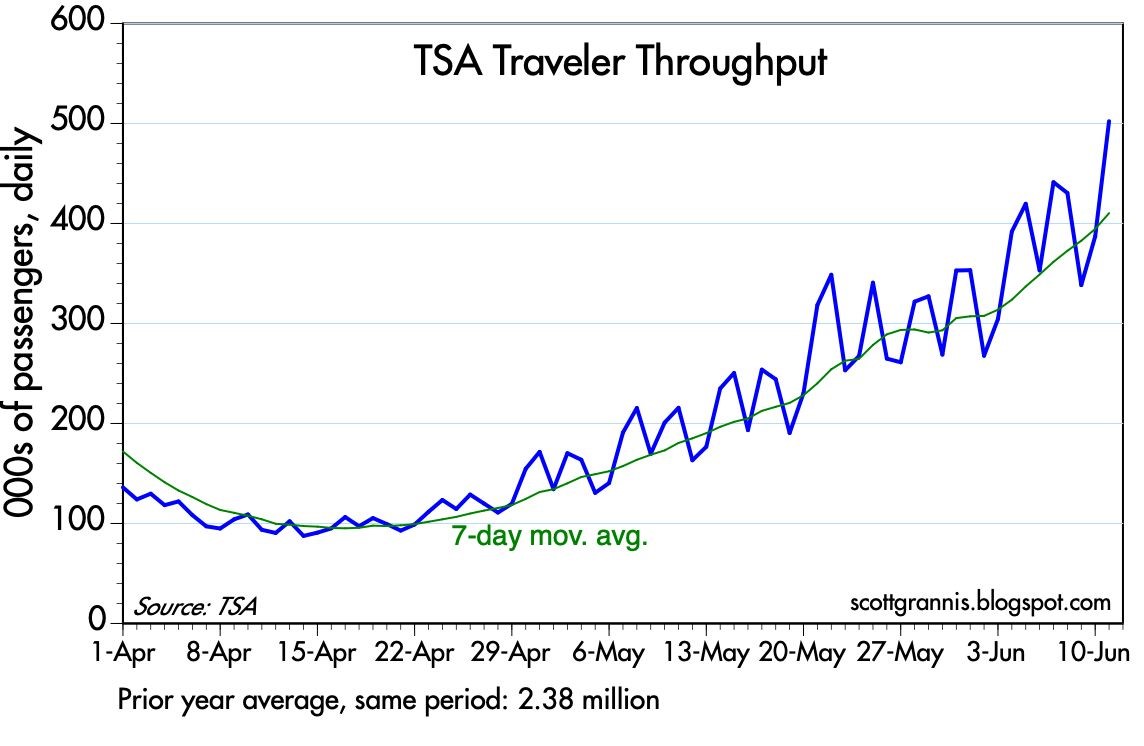

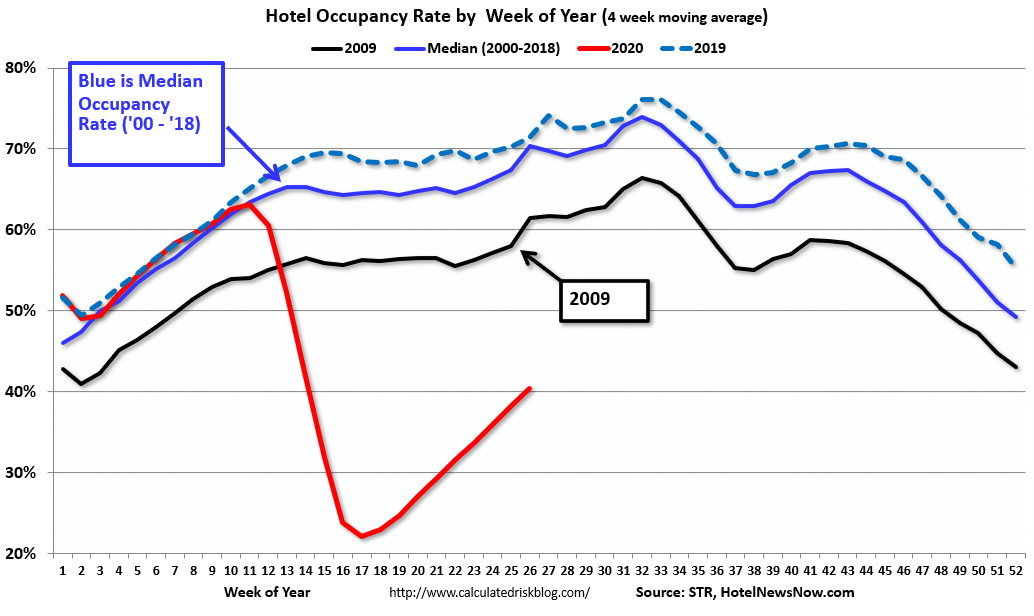

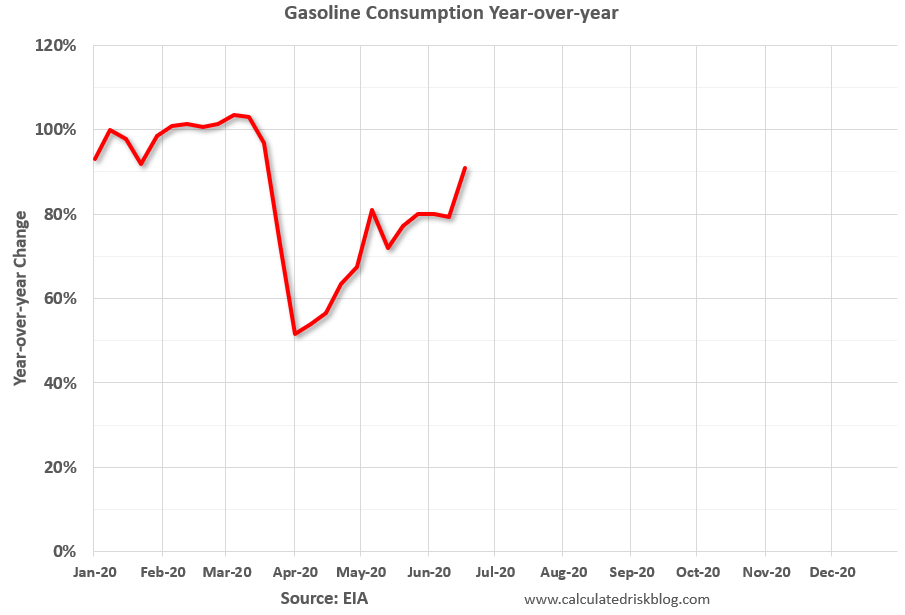

After experiencing six months of the coronavirus pandemic, the country has been re-opening across all 50 states at differing paces. We can see the benefits of a V-shaped recovery in various indicators, such as the following:

- Airline Traffic

- Hotel Occupancy

- Gasoline Consumption

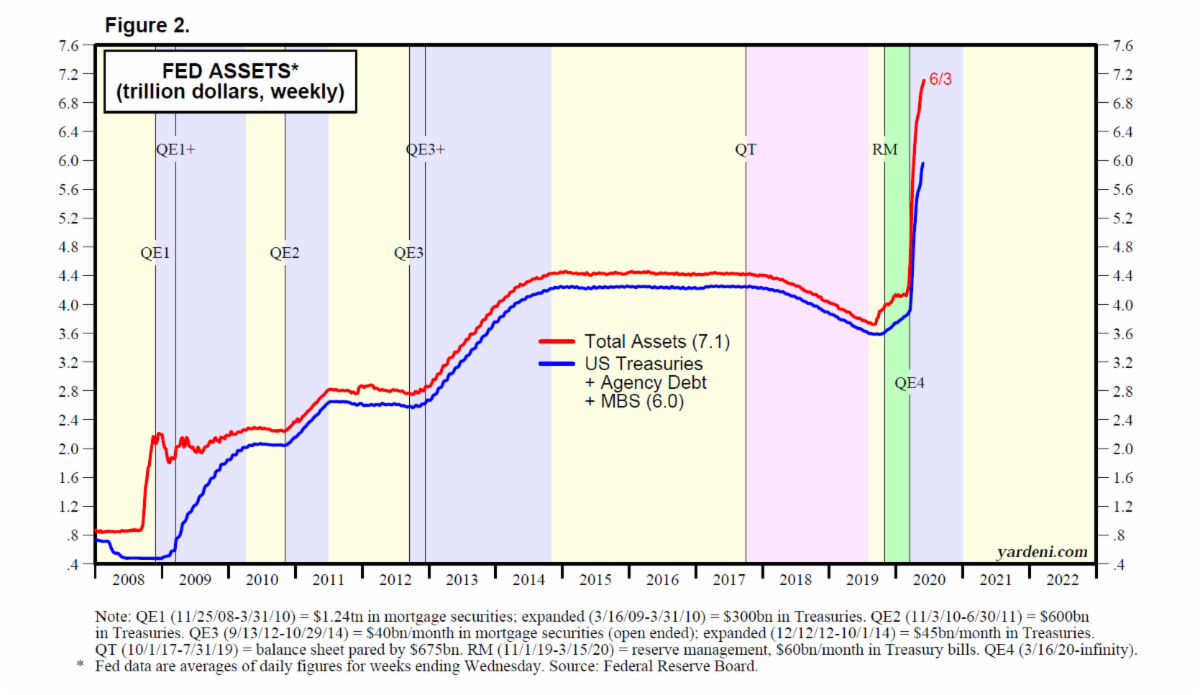

Thanks to unprecedented support from the Federal Reserve in the form of trillions of dollars in stimulative money printing that has been injected into the economy (see chart below), and trillions of government support (including 4.8 million PPP [Payroll Protection Program] loans totaling $519 billion), the economic benefits of the re-openings have been tangible. Not only did the economy unexpectedly add 2.5 million jobs last month, but economic growth is also projected to rebound in the back-half of 2020. More specifically, Treasury Secretary Steven Mnuchin recently testified in front of Congress that 3rd quarter economic growth (GDP – Gross Domestic Product) is currently projected at +17%, and 4th quarter at +9%.

The Stubborn Virus Remains

Many Americans feel liberated from the lifting of stay-at-home orders, but if the re-openings are not handled with proper precautions, the consequences can result in an economic equivalent of serious speeding tickets or jail time. We have experienced this phenomenon firsthand as a surge of new COVID-19 infections has spread predominately across the Southern and Western states, skewed towards younger Americans.

Now that the economic genie has been released out of the bottle, it’s going to be very difficult for state governors and city mayors to stuff the genie back in. Even if the new surge in COVID-19 cases continues, we are more likely to see required health guidelines instituted (e.g., mandatory mask wearing) or rollbacks in certain re-opening phases (e.g., closures of bars, restaurants, and other large gathering establishments). For instance, Disneyland (ticker: DIS) hit some speed bumps when the company just announced its re-opening originally scheduled for mid-July has been delayed indefinitely.

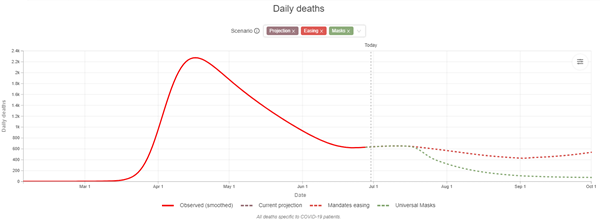

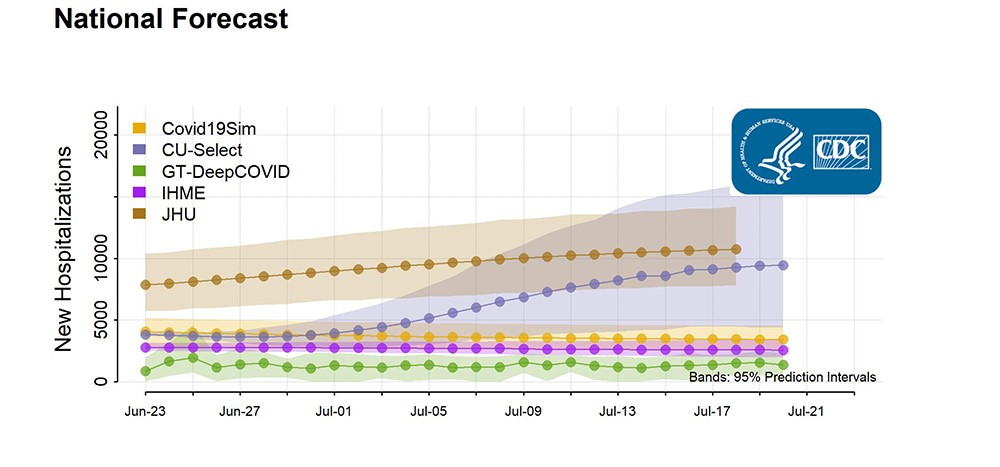

Although COVID infections have been on the rise, driven in part by complacent or irresponsible younger individuals not adhering to social distancing and mask-wearing recommendations, the healthcare treatment regimens have kept the level of deaths at a flat rate (see chart below) and national hospitalization rates at a relatively stable level (see chart below).

The Bridge to a Vaccine

Despite the recent rise in COVID-19 cases, investors have been focused more on the half-glass full developments relating to the pandemic. Approved therapeutics, such as remdesivir by Gilead Sciences Inc. (GILD) and dexamethasone, have proven effective in treating COVID. In addition, ventilator and PPE (Personal Protective Equipment) supplies have become plentiful; virus testing has risen dramatically (see also COVID Comeback); and contact tracing is slowly improving. If you layer in the more than 100 vaccines being developed, including expected Phase 3 trials this year by Pfizer Inc. (PFE), Moderna Inc. (MRNA), Astrazeneca PLC (AZN), Glaxosmithkline PLC (GSK), and Johnson & Johnson (JNJ), there is room for optimism. With all these developments, coupled with more stringent guidelines by governors/federal government/health agencies, and more responsible behavior by individuals (i.e., social distancing, personal hygiene, mask wearing), especially in hot spot regions, there is a credible bridge to managing the virus until a vaccine is approved.

The stock market has been racing ahead at an amazing pace in recent months (+41% since late-March), but with the COVID public health crisis starting to overheat the engine with rising COVID cases, investors should not be shocked to see the driver tap the economic brakes a little in the coming months. For long-term investors like my clients, Sidoxia Capital Management will continue to take advantage of opportunities, while pushing to safely avoid the risky potholes, during these highly volatile times. In periods like these, when your race car has created a large lead, it’s perfectly okay to reassess your circumstances and temporarily take your foot off the pedal before the next turn.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, MRNA, PFE, JNJ, AZN, GSK, and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

What the Heck & What Now?

The Covid-19 viral pandemic that hit our shores in early 2020 shut down the economy to a virtual halt, and unemployment has skyrocketed to an estimated 19%, as 30 million people have now filed for unemployment benefits over the last six weeks (see chart below). Shockingly, we have not seen joblessness levels this high since the Great Depression. All this destruction has investors asking themselves, “What the heck, and what now?

Forecasts for 2nd quarter economic activity (Gross Domestic Product) are estimating an unprecedented decline of -12% (see chart below) with some projections plummeting as low as -34%. Despite the dreadful freefall in the stock market during March, along with the pessimistic economic outlook, the major stock indexes came back with a vengeance during April. More specifically, the Dow Jones Industrial Average soared +2,428 points, or +11% for the month. The other major indexes, S&P 500 and NASDAQ, catapulted higher over the same period by +13% and +15%, respectively.

Certainly, there have been some industries hurt by Covid-19 more than others. At the top of the misery list are travel related industries such as airlines, cruise lines, and hotels. Retailers like Neiman Marcus, Pier 1, and JCPenney are filing for bankruptcy or on the verge of closing. Restaurants have also been pummeled (partially offset by the ability to offer pickup and delivery services), and entertainment industries such as sporting arenas, concert venues, movie theaters, and theme parks have all painfully come to a screeching halt as well. Let’s not forget energy and oil companies, which are battling for their survival life in an environment that has witnessed oil prices plunge from $61 per barrel at the beginning of the year to $19 per barrel today (with a brief period at negative -$37…yes negative!) – click here for an explanation and see the chart below.

What the Heck?!

With all this horrifying economic data financially crippling millions of businesses and families coupled with an epidemic that has resulted in a U.S. death count surpassing 60,000, how in the heck can the stock market be up approximately +34% from the epidemic lows experienced just five short weeks ago?

I was optimistic in my Investing Caffeine post last month, but here are some more specific explanations that have contributed to the recent significant rebound in the stock market.

- Virus Curve Flattening: The wave of Covid-19 started in China and crashed all over Europe before landing in the U.S. Fortunately, as you can see from the chart below (U.S. = red line), social distancing and stay-at-home orders have slowed the growth in coronavirus deaths.

- Fiscal Stimulus: The government fire trucks are coming to the rescue and looking to extinguish the Covid fire by spraying trillions of stimulus and aid dollars to individuals, businesses, and governments. Most recently, Congress passed a $484 billion bill in stimulus funding, including $320 billion in additional funding for the wildly popular Payroll Protection Program (PPP), which is designed to quickly get money in the hands of small businesses, so employers can retain employees rather than fire them. This half trillion program adds to the $2 trillion package Congress approved last month (see also Recovering from the Coma).

- Monetary Stimulus: The Federal Reserve has pulled out another monetary bazooka with the announcement of $2.3 trillion dollars in additional lending to small businesses . This action, coupled with the long menu of actions announced last month brings the total amount of stimulus dollars to well above $6 trillion (see also Recovering from the Coma for a list of Fed actions). You can see in the chart below how the Fed’s balance sheet has ballooned by approximately $3 trillion in recent months. The central bank is attempting to stimulate commerce by injecting dollars into the economy through financial asset purchases.

- Improving Healthcare System: Treatments for sick Covid patients has only gotten better, including new therapeutics like the drug remdesivir from Gilead Sciences Inc. (GILD). Dr. Anthony Fauci, the NIAID Director (National Institute of Allergy and Infectious Diseases) stated remdesivir “will be the standard of care.” With 76 vaccine candidates under development, there is also a strong probability researchers could discover a cure for Covid by 2021. With the help of the Defense Production Act (DPA), the government is also slowly relieving critical manufacturing bottlenecks in areas such as ventilators, PPE (Personal Protective Equipment) and Covid test kits. Making testing progress is crucial because this process is a vital component to reopening the economy (see chart below).

- Economy Reopening: After I have completed all of Netflix, participated in dozens of Zoom Happy Hours, and stocked up on a year’s supply of toilet paper, I have become a little stir crazy like many Americans who are itching to return to normalcy. The government is doing its part by attempting a three-phase reopening of the economy as you can see from the table below. You can’t fall off the floor, so a rebound is almost guaranteed as states slowly reopen in phases.

What Now?!

In the short run, it appears the worst is behind us. Why do I say that? Covid deaths are declining; Congress is spending trillions of dollars to support the economy; the Federal Reserve has effectively cut interest rates to 0% and provided trillions of dollars to provide the economy a backstop; our healthcare preparedness has improved; and global economies (including ours) are in the process of reopening. What’s not to like?!

However, it’s not all rainbows, flowers, and unicorns. We are in the middle of a severe recession with tens of millions unemployed. The Covid-19 epidemic has created a generation of germaphobes who will be hesitant to dive back into old routines. And until a vaccine is found, fears of a resurgence of the virus during the fall is a possibility, even if the masses and our healthcare system are much more prepared for that possibility.

As the world adjusts to a post-Covid 2.0 reality, I’m confident consumer spending will rebound, and pent-up demand will trigger a steady rise of economic demand. However, I am not whistling past the graveyard. I fully understand behavior and protocols will significantly change in a post-Covid 2.0 world, if not permanently, at least for a long period of time. Before the 9/11 terrorist attacks, nobody suspected air travelers would be required to remove shoes, take off belts, place laptops in bins, and carry tiny bottles of mouthwash and shampoo. Nevertheless, a much broader list of social distancing and safety codes of behaviors will be established, which could slow down the pace of the economic recovery.

Regardless of the recovery pace, over just a few short months, we have already placed our hands around the throat of the virus. There are bound to be future setbacks related to the pandemic. Physical and economic wounds will take time to heal. Turbulence will remain commonplace during these uncertain times, but volatility will create opportunities as the recovery continues to gain stronger footing. Although Covid-19 has produced significant damage, don’t let fear and panic infect your long-term investment future.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in GILD, Zoom, Netflix , and certain exchange traded funds (ETFS), but at the time of publishing had no direct position in Neiman Marcus, Pier 1, and JCPenney or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

A Tale of Two Years: Happy & Not-So-Happy

Happy New Year! If you look at the stock market, 2019 was indeed a happy one. The S&P 500 index rose +29% and the Dow Jones Industrial Average was up +22%. Spectacular, right? More specifically, for the S&P 500, 2019 was the best year since 2013, while the Dow had its finest 12-month period since 2017. Worth noting, although 2019 made investors very happy, 2018 stock returns were not-so-happy (S&P 500 dropped -6%).

Source: Investor’s Business Daily

As measured against almost any year, the 2019 results are unreasonably magnificent. This has many prognosticators worrying that these gains are unsustainable going into 2020, and many pundits are predicting death and destruction are awaiting investors just around the corner. However, if the 2019 achievements are combined with the lackluster results of 2018, then the two-year average return (2018-2019) of +10% looks more reasonable and sustainable. Moreover, if history is a guide, 2020 could very well be another up year. According to Barron’s, stocks have finished higher two-thirds of the time in years following a +25% or higher gain.

With the yield on the 10-Year Treasury Note declining from 2.7% to 1.9% in 2019, it should come as no surprise that bonds underwent a reversal of fortune as well. All else equal, both existing bond and stock prices generally benefit from declining interest rates. The U.S. Aggregate Bond Index climbed +5.5% in 2019, a very respectable outcome for this more conservative asset class, after the index experienced a modest decline in 2018.

Happy Highlights

What contributed to the stellar financial market results in 2019? There are numerous contributing factors, but here are a few explanations:

Source: Dr. Ed’s Blog

Source: Dr. Ed’s Blog

- Federal Reserve Cuts Interest Rates: After slamming on the brakes in 2018 by hiking interest rates four times, the central bank added stimulus to the economy by cutting interest rates three times in 2019 (see chart above).

- Phase I Trade Deal with China: Washington and Beijing reached an initial trade agreement that will reduce tariffs and force China to purchase larger volumes of U.S. farm products.

- Healthy Economy: 2019 economic growth (Gross Domestic Product) is estimated to come in around +2.3%, while the most recent unemployment rate of 3.5% remains near a 50-year low.

- Government Shutdown Averted: Congress approved $1.4 trillion in spending packages to avoid a government shutdown. The spending boosts both the military and domestic programs and the signed bills also get rid of key taxes to fund the Affordable Care Act and raises the U.S. tobacco buying age to 21.

- Brexit Delayed: The October 31, 2019 Brexit date was delayed, and now the U.K. is scheduled to leave the European Union on January 31, 2020. EU officials are signaling more time may be necessary to prevent a hard Brexit.

- Sluggish Global Growth Expected to Rise in 2020: Global growth rates are expected to increase in 2020 with little chance of recessions in major economies. The Financial Times writes, “The outlook from the models shows global growth rates rising next year, returning roughly to trend rates. Recession risks are deemed to be low, currently standing about 5 per cent for the US and 15 per cent for the eurozone.”

- Potential Bipartisan Infrastructure Spend: In addition to the $1.4 trillion in aforementioned spending, Nancy Pelosi, the Speaker of the Democratic-controlled House of Representatives, said she is willing to work with the Republicans and the White House on a stimulative infrastructure spending bill.

2018-2019 Lesson Learned

One of the lessons learned over the last two years is that listening to the self-proclaimed professionals, economists, strategists, and analysts on TV, or over the blogosphere, is dangerous and usually a waste of your time. For stock market participants, listening to experienced and long-term successful investors is a better strategy to follow.

Conventional wisdom at the beginning of 2018 was that a strong economy, coupled with the Tax Reform Act that dramatically reduced tax rates, would catapult corporate profits and the stock market higher. While many of the talking heads were correct about the trajectory of S&P 500 profits, which propelled upwards by an astonishing +24%, stock prices still sank -6% in 2018 (as mentioned earlier). If you fast forward to the start of 2019, after a -20% correction in stock prices at the end of 2018, conventional wisdom stated the economy was heading into a recession, therefore stock prices should decline further. Wrong!

As is typical, the forecasters turned out to be completely incorrect again. Although profit growth for 2019 was roughly flat (0%), stock prices, as previously referenced, unexpectedly skyrocketed. The moral of the story is profits are very important to the direction of future stock prices, but using profits alone as a timing mechanism to predict the direction of the stock market is nearly impossible.

So, there you have it, 2018 and 2019 were the tale of two years. Although 2018 was an unhappy year for investors in the stock market, 2019’s performance made investors happier than average. When you combine the two years, stock investors should be in a reasonably good mood heading into 2020 with the achievement of a +10% average annual return. While this multi-year result should keep you happy, listening to noisy pundits will make you and your investment portfolio unhappy over the long-run. Rather, if you are going to heed the advice of others, it’s better to pay attention to seasoned, successful investors…that will put a happy smile on your face.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Scared Silly While Stocks Enjoy Sugar High

China trade war, impeachment hearings, Brexit negotiations, changing Federal Reserve monetary policy, Turkish-Kurd battles in Syria, global slowdown fears, and worries over an inverted yield curve. Do these headlines feel like a conducive environment for stock market values to break out to new all-time, record highs? If you answered “no”, then you are not alone – investors have been scared silly despite stocks experiencing a sugar high.

For the month, the S&P 500 index climbed another +2.0% and set a new monthly-high record. The same can be said for the Dow Jones Industrial Average, which also set a new monthly record at 27,046, up +0.5% from the previous month. For the S&P 500, these monthly gains contributed to what’s become an impressive 2019 total appreciation of +21%. Normally, such heady gains would invoke broad-based optimism, however, the aforementioned spooky headlines have scared investors into a coffin as evidenced by the hundreds of billions of dollars that have poured out of stocks into risk-averse bonds. More specifically, ICI (Investment Company Institute) releases weekly asset flow figures, which show -$215 billion fleeing stock funds in 2018-2019 through the end of October, while over +$452 billion have flocked into the perceived safe haven of bonds. I emphasize the word “perceived” safe haven because many long duration (extended maturity) bonds can be extremely risky, if (when) interest rates rise materially and prices fall significantly.

Besides the data showing investors fleeing stocks and flocking to bonds, we have also witnessed the risk-averse saving behavior of individuals. When uncertainty rose in 2008 during the financial crisis, you can see how savings spiked (see chart below), even as the economy picked up steam. With the recent spate of negative headlines, you can see that savings have once again climbed and reached a record $1.3 trillion! All those consumer savings translate into dry powder spending dollars that can be circulated through the economy to extend the duration of this decade-long financial expansion.

Source: Dr. Ed’s Blog

If you look at the same phenomenon through a slightly different lens, you can see that the net worth of consumer households has increased by 60% to $113 trillion from the 2007 peak of about $70 trillion (see chart below). This net worth explosion compares to only a 10% increase in household debt over the same timeframe. In other words, consumer balance sheets have gotten much stronger, which will likely extend the current expansion or minimize the blow from the next eventual recession.

Source: Calafia Beach Pundit

If hard numbers are not good enough to convince you of investor skepticism, try taking a poll of your friends, family and/or co-workers at the office watercooler, cocktail party, or family gathering. Chances are a majority of the respondents will validate the current actions of investors, which scream nervousness and anxiety.

How does one reconcile the Armageddon headlines and ebullient stock prices? Long-time clients and followers of my blog know I sound like a broken record, but the factors underpinning the decade-long bull market bears repeating. What the stock market ultimately does care about are the level and direction of 1) corporate profits; 2) interest rates; 3) valuations; and 4) investor sentiment (see the Fool-Stool article). Sure, on any one day, stock prices may move up or down on any one prominent headline, but over the long run, the market cares very little about headlines. Our country and financial markets have survived handsomely through wars (military and trade), recessions, banking crises, currency crises, housing crises, geopolitical tensions, impeachments, assassinations, and even elections.

Case in point on a shorter period of time, Dr. Ed Yardeni, author of Dr. Ed’s Blog created list of 65 U.S. Stock Market Panic Attacks from 2009 – 2019 (see below). What have stock prices done over this period? From a low of 666 in 2009, the S&P 500 stock index has more than quadrupled to 3,030!

For the majority of this decade-long, rising bull market, the previously mentioned stool factors have created a tailwind for stock price appreciation (i.e., interest rates have moved lower, profits have moved higher, valuations have remained reasonable, and investors have stayed persistently nervous…a contrarian positive indicator). Investors may remain scared silly for a while, but as long as the four stock factors on balance remain largely constructive stock prices should continue experiencing a sugar high.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Are Stocks Cheap or Expensive? Weekly Rant and the Week in Review 4-7-19

The Weekly Grind podcast is designed to wake up your investment brain with a weekly overview of financial markets and other economic-related topics.

Episode 7

Weekly Market Review and This Week’s Rant: Are Stocks Cheap or Expensive?

Don’t miss out! Follow us on iTunes, Spotify, SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

SoundCloud: soundcloud.com/sidoxia

PodBean: sidoxia.podbean.com

Spotify: open.spotify.com

Podcast 3/24/19: Week in Review and Interview: Russ Murdock, CFA

The Weekly Grind podcast is designed to wake up your investment brain with weekly overviews of financial markets and other economic-related topics.

Episode 5

Market Review and Interview: Russ Murdock, CFA – Small Cap Value Manager and Founder of Seabreeze Capital Management

Don’t miss out! Follow us on iTunes, Spotify, SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

SoundCloud: soundcloud.com/sidoxia

PodBean: sidoxia.podbean.com

Spotify: open.spotify.com

Podcast 3/17/19: Week in Review and BREXIT

The Weekly Grind podcast is designed to wake up your investment brain with weekly overviews of financial markets and other economic-related topics.

Episode 4

Market Review, Stock Ideas, and The Weekly Rant: BREXIT

Don’t miss out! Follow us on iTunes, Spotify, SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

SoundCloud: soundcloud.com/sidoxia

PodBean: sidoxia.podbean.com

Spotify: open.spotify.com

Podcast 3/10/19: Week in Review and Market Forecasting

The Weekly Grind podcast is designed to wake up your investment brain with weekly overviews of financial markets and other economic-related topics.

Episode 3

Market Review, Stock Ideas, and The Weekly Rant: Market Forecasting

Don’t miss out! Follow us on iTunes, Spotify, SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

Spotify: open.spotify.com