Posts tagged ‘geopolitics’

Turn Off TV – Emperor Media Has No Clothes!

Famous Danish author Hans Christian Andersen told a renowned fairy tale of an emperor who was conned into believing he is wearing an invisible suit. The crowd was too embarrassed to acknowledge his nakedness, so they pretend to not notice – until a young boy shouted, “The emperor has no clothes!”

Much like the fairy tale, when it comes to pointing out the many shortcomings of the financial media, I have no problem yelling, “The Emperor Media has no clothes!”

Media Spreads Fear and Misinformation

Mark Twain famously stated, “If you don’t read the newspaper, you’re uninformed. If you read the newspaper, you’re misinformed.” That sentiment rings especially true amid today’s swirl of alarming headlines. Here’s a sampling of recent media-induced worries:

- Global trade war caused by tariffs

- Declining value of the U.S. dollar

- Rising interest rates due to foreign debt sales

- Doubts over the U.S. dollar’s global reserve currency status

- Recession anxiety

- Stagflation fears

- Concerns about Executive Branch overreach

- Threats to remove the Federal Reserve Chairman

Is the sky falling? Is now the time to sell stocks, as the media often implies? Or are these risks being overstated and distorted by media outlets that chase monetary gains?

Issues are More Gray Than Black or White

Journalists – most of whom have little investing experience – like to authoritatively paint economic issues in black-or-white terms. But most reasonable people understand that these matters are complex, and the truth lies somewhere in the gray. To claim the media offers a balanced view of both the positives and negatives of complicated financial topics would be disingenuous.

I have been investing for over 30 years, and while I’ve never faced a global rebalancing of trade impacting trillions in economic activity, I’ve lived through far more uncertain times. Not only have my investments survived those volatile periods, but they have also thrived – repeatedly hitting new record highs.

F.U.D. Sells!

Does the media want you to believe the accurate, long-term stock market prosperity story? Hardly. As the saying goes, “If it bleeds, it leads.” Fear, uncertainty, and doubt (F.U.D.) sell more ads, subscriptions, newspapers, and magazines. The more blood, sweat, and anxiety in the headlines, the more money the media makes from distressed readers.

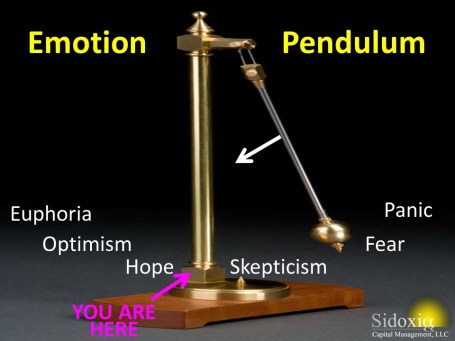

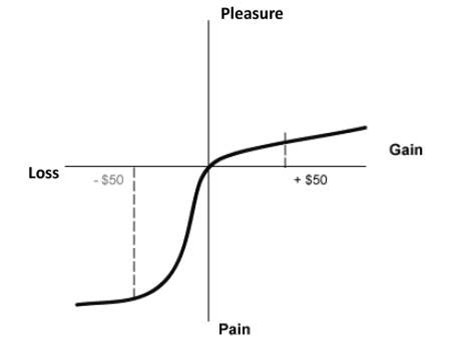

Behavioral finance pioneers, Nobel Prize winner Daniel Kahneman and Amos Tversky, showed that losses feel twice as painful as the pleasure of gains (see the Pleasure/Pain diagram below). Their Prospect Theory remains just as relevant today as when it was introduced in the late 1970s.

The greatest investor of all-time, Warren Buffett, once said, “Be fearful when others are greedy, and greedy when others are fearful.” Unfortunately, the media pushes the opposite mantra: “sell fear and buy greed.” When markets fall, they sell Armageddon. When markets soar, they sell nirvana. During periods of over-optimism, they also exploit FOMO (Fear of Missing Out) by feasting on investors’ emotional cycle of excitement.

Reassuring long-term investors that everything will be okay—or that dips are buying opportunities—doesn’t generate as much media profits and ad sales. Fear does.

History Doesn’t Repeat Itself, But It Often Rhymes

Too many investors suffer from short-term thinking and goldfish-like memory. But as Mark Twain wisely stated, “History doesn’t repeat itself, but It often rhymes.” And history has shown that listening to the media during times of extreme market volatility often leads to poor decisions.

Let’s take a look at some key examples where media-driven fear was more misleading than helpful over the decades:

The Nifty Fifty Collapse (1973-1974)

In the early 1970s, long before the “Magnificent 7” stocks came to the fore, we had the “Nifty Fifty” stocks. These large-cap blue chip stocks traded at lofty P/E (Price-Earnings) ratios and were seen as invincible before they came crashing down in 1973-1974. Suffice it to say, the media headlines were horrific during this period.

Here is some context for this period:

- The U.S. was exiting the Vietnam War

- Economy was undergoing a major recession

- Watergate scandal and presidential resignation

- 9% unemployment

- The Arab Oil Embargo

- Surging inflation

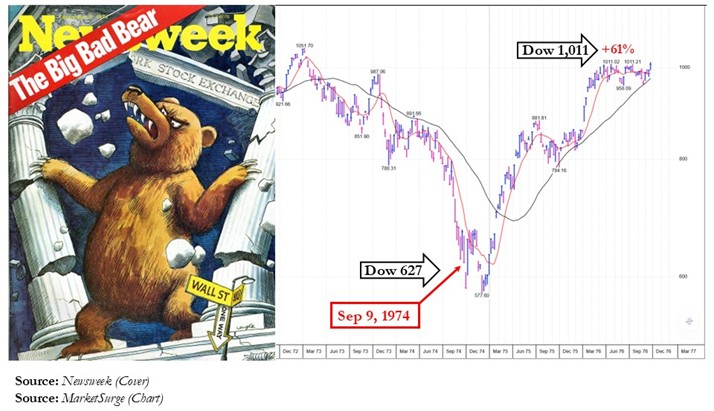

The media’s response? Doom and gloom. Here’s an example of this sentiment from the Newsweek cover, “The Big Bad Bear,” published on September 9, 1974.

For those who sold in fear, the results were disastrous. The Dow bottomed shortly after the magazine was released and the market rebounded +61% in less than two years. Panic was the wrong move.

“The Death of Equities” (1979)

Inflation plagued the 1970s, and just before one of the longest bull markets in history, BusinessWeek declared “The Death of Equities” on its now-infamous September 1979 cover. Once again, the media acted as a perfect contrarian indicator with the Dow quadrupling over the next decade.

Dot-Com Bubble: “The Hottest Market Ever” (2000)

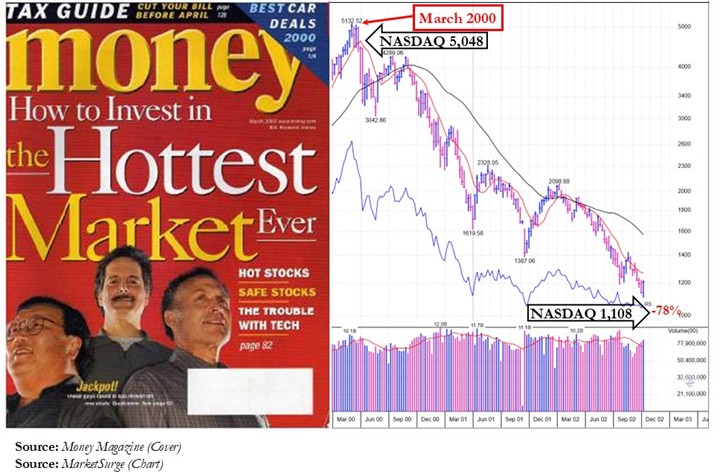

In March 2000, at the peak of the tech bubble, Money magazine ran a cover story: “How to Invest in the Hottest Market Ever.” Weeks later, the bubble burst. Suboptimal timing once again.

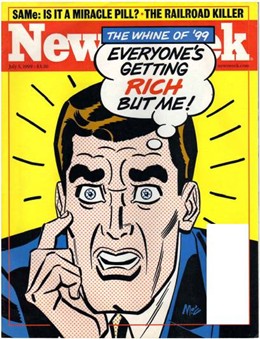

In that same timeframe, Newsweek captured the essence of FOMO with its July 5, 1999 cover: “Everyone Is Getting Rich but Me.” Right when risk was at its peak, most investors were blind to it and got sucked into the downdraft.

Source: NewsWeek

Financial Crisis – Depression 2.0 (2008)

In October 2008, the Time magazine cover encapsulated the zeitgeist of the period with a 1929 photo that included a line of desperate people waiting for food donations at a soup kitchen. Many feared a second Great Depression. Yet it was one of the best times in history to buy stocks with the Dow tripling over the next decade.

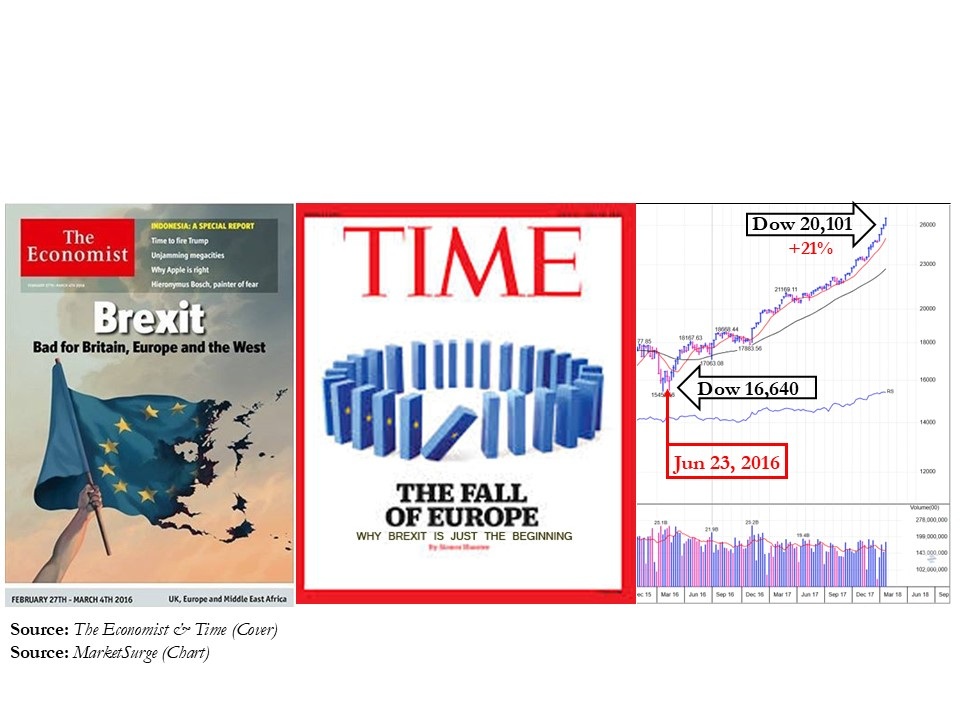

Brexit Panic (2016)

Media coverage around the U.K.’s Brexit vote to leave the EU (European Union) painted a picture of imminent recession and contagion. Instead, the media blitz surrounding Brexit turned out to be more molehill than mountain. Markets rebounded strongly and reached new highs in the subsequent months.

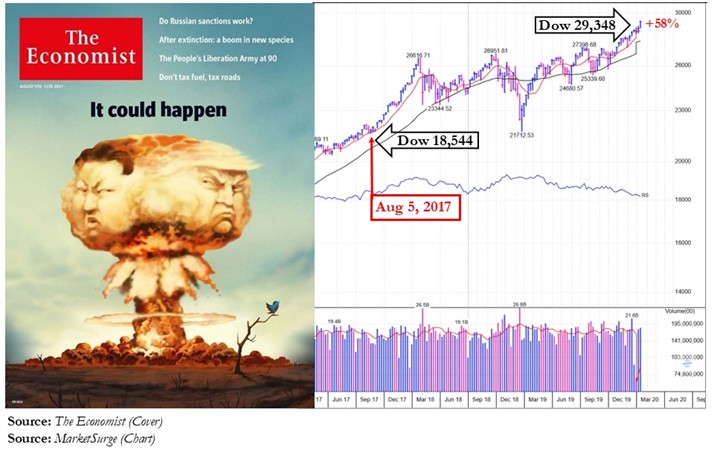

“Rocketman” and North Korea Missiles (2017)

Tensions flared in 2017 as North Korea tested missiles and President Trump threatened retaliation against dictator Kim Jong Un by bombing Pyongyang and “Rocket Man”. The media went into overdrive regarding the nuclear unease, but the market brushed it off and continued climbing +58% over the next few years.

COVID-19 Pandemic (2020)

With over 3 million deaths worldwide and a grinding halt to the global economy, markets initially fell roughly -35%. But as consumers stockpiled toilet paper, fast vaccine development and stimulus sparked a powerful rebound, with stocks finishing the year up +16%. Over the next two years, the Dow almost doubled.

Hostage to Our Lizard Brain

Why are we so susceptible to the sensationalist tendencies of the media? Evolution holds the answer. Humans’ DNA and brains are hard-wired to flee prey. The small almond-shaped tissue in our brain called the amygdala—or what author Seth Godin calls the “lizard brain”—evolved to respond instantly to danger. When headlines scream “crash” or “war,” our emotional brain overrides our logical one, which leads to poor long-term results. As Seth Godin explains, we’re wired to react, not reflect (Watch here). And the media knows it.

Headlines Change but the Long-Term Market Trend Doesn’t

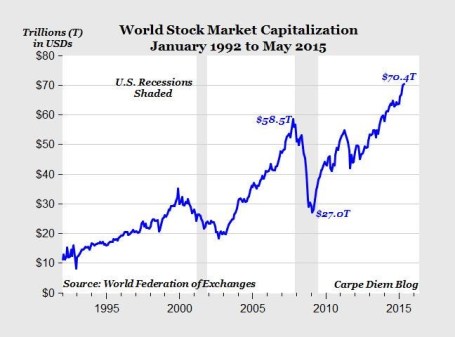

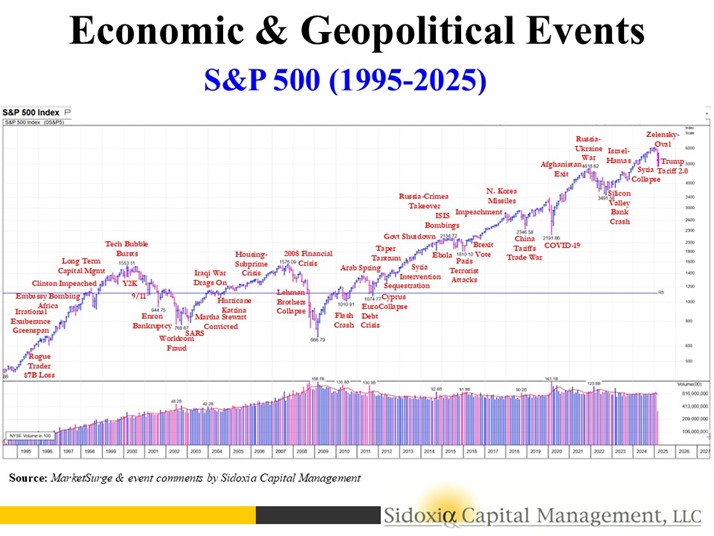

Despite a barrage of negative headlines, stocks have remained resilient over the long run. The market has overcome wars, assassinations, currency crises, banking failures, terrorist attacks, pandemics, natural disasters, impeachments, tax hikes, recessions, restrictive Fed policies, debt downgrades, inflation, and yes, even tariffs (see chart below). Since WWII, we’ve had 12 recessions—each followed by a full recovery to new record highs. In baseball terms, the economy has batted a perfect 1.000 (12-for-12) with recession recoveries.

How to Survive the Avalanche of Media Headlines

Here are five key strategies:

- Turn off the TV: Don’t obsess over headlines. Emotional reactions result in poor decisions.

Buying high (greed) and selling low (fear) is not a recipe for long-term investment success.

- Diversify Your Investments: A well-balanced portfolio across asset classes helps reduce panic.

- Invest According to Time Horizon: Are you young? Assuming more risk and higher exposure to the stock market is generally fine. Are you near retirement? Don’t jeopardize your retirement goals – de-risk accordingly.

- Ignore Talking Heads: Most pundits don’t invest and their credibility is compromised by monetary conflicts of interest. It’s much more beneficial to follow seasoned professionals with real track records through multiple bull and bear markets.

- Avoid the Herd: Continually following the herd into the most popular investments often leads to underperformance. The grass is greener, and the food sources are more plentiful, off the beaten path trampled by the herd. Contrarian thinking works even though it can feel scary.

In the age of constant connectivity, headlines and the 24/7 news cycle are addictive. But if you’re tired of being a pawn in the media’s game, I invite you to join my fight by acknowledging that the Emperor Media has no clothes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

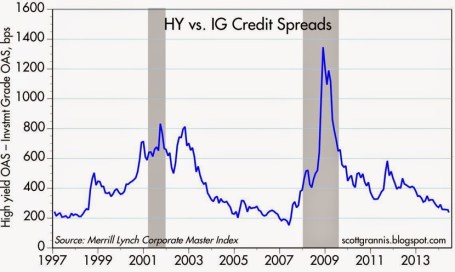

Extrapolation: Dangers of the Reckless Ruler

The game of investing would be rather simple if everything moved in a straight line and economic data points could be could be connected with a level ruler. Unfortunately, the real world doesn’t operate that way – data points are actually scattered continuously. In the short-run, inflation, GDP, exchange rates, interest rates, corporate earnings, profit margins, geopolitics, natural disasters, financial crises, and an infinite number of other factors are very difficult to predict with any accurate consistency. The true way to make money is to correctly identify long-term trends and then opportunistically take advantage of the chaos by using the power of mean reversion. Let me explain.

Take for example the just-released October employment figures, which on the surface showed a blowout creation of +271,000 new jobs during the month (unemployment rate decline to 5.0%) versus the Wall Street consensus forecast of +180,000 (flat unemployment rate of 5.1%). The rise in new workers was a marked acceleration from the +137,000 additions in September and the +136,000 in August. The better-than-expected jobs numbers, the highest monthly addition since late 2014, was paraded across television broadcasts and web headlines as a blowout number, which gives the Federal Reserve and Chairwoman Janet Yellen more ammunition to raise interest rates next month at the Federal Open Market Committee meeting. Investors are now factoring in roughly a 70% probability of a +0.25% interest rate hike next month compared to an approximately 30% chance of an increase a few weeks ago.

As is often the case, speculators, traders, and the media rely heavily on their trusty ruler to connect two data points to create a trend, and then subsequently extrapolate that trend out into infinity, whether the trend is moving upwards or downwards. I went back in time to explore the media’s infatuation with limitless extrapolation in my Back to the Future series (see Part I; Part II; and Part III). More recently, weakening data in China caused traders to extrapolate that weakness into perpetuity and pushed Chinese stocks down in August by more than -20% and U.S. stocks down more than -10%, over the same timeframe.

While most of the media coverage blew the recent jobs number out of proportion (see BOOM! Big Rebound in Job Creation), some shrewd investors understand mean reversion is one of the most powerful dynamics in economics and often overrides the limited utility of extrapolation. Case in point is blogger-extraordinaire Scott Grannis (Calafia Beach Pundit) who displayed this judgment when he handicapped the October jobs data a day before the statistics were released. Here’s what Grannis said:

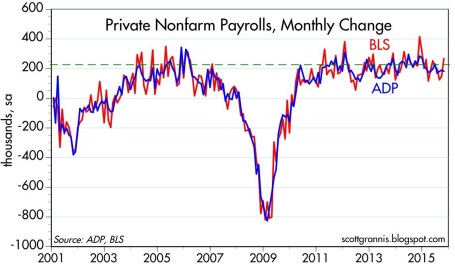

The BLS’s estimate of private sector employment tends to be more volatile than ADP’s, and both tend to track each other over time. That further suggests that the BLS jobs number—to be released early tomorrow—has a decent chance of beating expectations.

Now, Grannis may not have guaranteed a specific number, but comparing the volatile government BLS and private sector ADP jobs data (always released before BLS) only bolsters the supremacy of mean reversion. As you can see from the chart below, both sets of data have been highly correlated and the monthly statistics have reliably varied between a range of +100k to +300k job additions over the last six years. So, although the number came in higher than expected for October, the result is perfectly consistent with the “slowly-but-surely” growing U.S. economy.

While I spend much more time picking stocks than picking the direction of economic statistics, even I will agree there is a high probability the Fed moves interest rates next month. But even if Yellen acts in December, she has been very clear that this rate hike cycle will be slower than previous periods due to the weak pace of economic expansion. I agree with Grannis, who noted, “Higher rates would be a confirmation of growth, not a threat to growth.” Whatever happens next month, do yourself a favor and keep the urge of extrapolation at bay by keeping your pencil and ruler in your drawer.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.