Posts tagged ‘GDP’

Running with the Bulls

Guest Contributing Writer: Bruce Wimberly

No matter where you turn some “expert” is espousing his or her view on the direction of the market. The reality is none of them know. My advice to anyone is avoid the fallacy of experts. Those that purport to know, donʼt. It is a mere exercise in futility to justify charging higher fees. Letʼs be honest if anyone knew the future direction of asset prices they would be beyond rich (Iʼm talking John Paulson – Trade of the Century rich!). Nice job John who would have thought you could make that much money betting against mortgages.

As investors our best bet is to accept that fact that market timing is a losing strategy. Timing the market is similar to a coin flip. Pure and simple, the cost of getting it wrong wipes out the occasional gain of getting it right. Remember, every time you listen to the perma-bears and try to time the market, there is big time investment professional on the other side of that trade who is by definition taking the opposite view.

Good investors expand their timeframes. They do not get sucked into the news of the day. Let the perma-bears worry about Dubai, currency devaluation, or whatever else is todayʼs fear. Keep in mind there is always something to worry about. For long term investors the greatest fear is not being in the market. For example, if inflation were to average 3% and you are sitting in cash earning nothing your money will be cut in half by 2033. Grandmaʼs mattress is not an option for most people.

Now back to the question of bulls versus bears and the direction of the markets. Who is right? The simplest way to think about this comes from Oracle of Omaha himself, Warren Buffett. Buffett thinks of the market as a reflection of total market cap relative to US GNP (gross national product). After all, in the long run the market should approximate some measure of overall corporate profitability or in this case overall economic growth. If you accept Buffettʼs argument then the market is neither overly expensive or cheap. As of yesterday the total market index is at $11,296.2 billion which is about 79% of the last reported GDP. (I know the perma-bulls will find some reason to bash the reported GDP number). Nevertheless, this simple formula provides a good long term context on which to gage the relative attractiveness of the overall market. To put todayʼs number in context (79%) at the peak of the market bubble in 1999, the ratio of total market cap/GDP was 150% or almost double todayʼs reading. Yes, the market has made a major move from depressed levels earlier in the year but that is irrelevant. Donʼt anchor on that number or you will never get off the sidelines.

My advice is simple, ignore the perma-bears and avoid market timing like the plague for it is a suckers bet (see also article on passive vs. active investing). If the market does pull back (and it will at some point) this is great news for the long term investor. Anytime you can buy a stock on sale – this is a good thing! So enjoy the Christmas holidays, donʼt believe the hyped up bears and as always:

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and equity securities in client and personal portfolios at the time of publishing, but had no direct position in BRKA/B. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Getting Debt Binge Under Control

Given the endless daily reminders about our federal government’s insatiable appetite for debt, the inevitable collapse of the dollar, and the potential for civil unrest, the average citizen might be surprised to find out the overall debt situation has actually improved. While our federal debt has been exploding (see also Investing Caffeine D-E-B-T article), households and businesses have been tightening their belts and cutting down on the debt binge of recent years. In fact, the overall debt for the U.S. grew at the slowest rate in a decade according to The Business Insider.

As you can see from the nitty-gritty in the Federal Reserve chart below, total Nonfinancial Debt grew at +2.8% in the 3rd quarter of 2009 (comprised of -2.6% Household Debt; -2.6% Business Debt; +5.1% State & Local Government Debt; and +20.6% Federal Debt).

What does this all mean? Not surprisingly, we are seeing the same trends in the debt figures that we are seeing in the components of our GDP (Gross Domestic Product). We learned from our Economics 101 class that the equation for GDP = C + I + G + (NX), which explains the components of economic growth.

- C = Consumer spending (or private consumption)

- I = Investment (or business spending)

- G = Government spending

- NX = Net exports (or exports – imports)

Consumer spending has been the biggest driver of growth before the financial crisis (fueled in part by the contribution of debt growth), accounting for more than 2/3 of our GDP. Now, with the consumer retrenching dramatically – spending less and saving more – we are seeing government spending (i.e., stimulus) pick up the slack.

These same dynamics are playing out in the total debt figures. Since the consumer is retrenching, they are saving more and paying down debt. Business owner debt has been chopped too, either by choice or because the banks simply are not lending. Here again, the government is picking up the slack by ramping up the debt growth.

Encouragingly, all is not lost. Economic principles, like the laws of physics, eventually take hold. Fortunately consumers and businesses have gone on a crash diet from debt – and the banks haven’t accommodated the pleading cash-starved either. Now legislators in our nation’s capital must do their part in dealing with the weighty spending. The overall debt progress is heartening, but Uncle Sam still needs to get off the Ho-Hos and Twinkies and start shedding some of that binge-related debt.

Read Full Business Insider Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and equity securities in client and personal portfolios at the time of publishing. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Indicators Like Kissing Your Sister

The economy is on the mend, but we are obviously not out of the woods. Leverage and asset inflation through the housing bubble were major causes of the financial crisis of 2008-09. Now some of the major indicators are turning upwards with GDP expected to rise around +3% in Q3 this year and we are seeing housing units up, housing prices up, and housing inventories down (charts below). Although some of these numbers may create some warm and fuzzy sensations, abnormally high unemployment rates, massive budget deficits, and stuttering consumer confidence make this rebound feel more like kissing your sister.

There are, however, other signs of economic strength. For example, credit appears to be healing as well. Moodys predicts global speculative debt default rates will peak in Q4 this year at 12.5% – lower than the 18% Moodys predicted earlier this year in January. The CEO Confidence Board index, which typically leads profit growth by two quarters, jumped to a five year high in the 3rd quarter. The recovery is not limited to our domestic economy either – the International Monetary Fund (IMF) recently raised its global growth forecasts in 2010 from +2.5% to +3.1%.

How sustainable is the recovery? Bears like Nouriel Roubini still think we are likely heading into a double-dip recession, perhaps by mid-2010, once the temporary home purchase credits expire and the stimulus funds run out. A collapse in the dollar due to exploding debt and rising deficits is feared to cause a spiraling in debt costs – another factor that could cause a relapse into recession. Unemployment remains at an abnormally 26 year high at 9.8% (September) and any self-maintaining recovery will require an improvement from this deteriorating trend. Before consumers freely open their wallets and purses, consumer confidence could use a boost in light of the recent -10% month-to-month drop in October.

Fewer people are debating the existence of “green shoots,” however now the discussion is turning to sustainability. Time will tell whether those feelings of harmless sibling cheek pecks will lead to the discovery of a new long-lasting romantic relationship with a non-family member.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Tortuous Path to Productivity

There is a silver lining to the deep, tortuous job cuts in this severe recession and it is called “productivity.” Those fortunate enough to retain their jobs are forced to become more productive. In layman’s terms, productivity simply is output divided by hours worked.

Unemployment dropped to 9.4% in July, thanks in part to a decline in the job losses to -247,000 from a peak in January of -741,000 job losses. During this period of job-loss cratering, we managed to sustain a decline of a mere -1% in Q2 Gross Domestic Product (GDP). How could we lose more than 6 million jobs since the beginning of 2008 and still be on a path to recovery? A large contributor is our friend, productivity, which came in at a whopping +6.4% in Q2 – the highest in six years.

Productivity increased in part because of a slashing of work-hours by employers. Employees that have maintained employment are therefore forced to produce more output (goods and services) per unit hour of employment. In this severe recession that we are pulling out of, the American worker is being stretched like a rubber band. At some point, the “Law of Diminishing Returns” kicks in and employers are forced to hire new employees to meet demand levels, or the rubber band will snap.

The prime ways of increasing productivity are raising the amount of capital per worker (capital intensity) and also elevating the workers’ average level of skill, education, and training (labor quality).

Not only are the surviving U.S. workers toiling harder, they are not getting pay increases large enough to offset inflation. For example, Q2 hourly compensation increased +0.2%, but after accounting for inflation, real hourly compensation was actually down -1.1%.

As the MarketWatch article points out:

The early stages of recovery are typically the best for productivity: Output is rising, but cost-cutting plans are still being implemented… Productivity gains are the key to higher living standards, higher wages, increased profits and low inflation… Productivity averaged about 2.7% annually from 1948 to 1970, then slowed to 1.6% from 1971 to 1995. Since then, productivity has grown about 2.5% annually. In 2008, productivity increased 1.8%.

Productivity allows the U.S. to produce more goods and services with fewer workers. For instance, the MarketWatch article also highlights the U.S. is producing 20% more output relative to a decade ago, yet employment has not changed at all over that time period.

We are certainly not out of the woods when it comes to the recession, and for those lucky enough to maintain employment, they are being asked (forced) to work more for less pay. These productivity improvements feel like torture to the survivors, however this pain will eventually lead to economic gain.

Wade W. Slome, CFA, CFP

Plan. Invest. Prosper.

California the Golden State Turning Brown

California is facing a significant cash crunch as the state attempts the narrowing of its $24 billion budget deficit. The crisis will come to a head now that the fiscal year, June 2009, budget deadline has passed. Without a budget resolution and in order to fill the budget gap, the California government will need to start issuing billions of government IOUs to contractors and vendors, local agencies handling health programs, as well as some receiving state aid.

California is facing a significant cash crunch as the state attempts the narrowing of its $24 billion budget deficit. The crisis will come to a head now that the fiscal year, June 2009, budget deadline has passed. Without a budget resolution and in order to fill the budget gap, the California government will need to start issuing billions of government IOUs to contractors and vendors, local agencies handling health programs, as well as some receiving state aid.

Moodys rates the Golden State as the lowest rated state of all 50 at A2. The average rating for all states is AA2 and only two other states besides California are rated below AA. At the beginning of 2009 the state bought some breathing room by delaying cash tax refunds, but that cushion has rapidly deteriorated as the economy and employment outlook have deteriorated. Making things worse for the state, relative to other states, is the state constitutional inflexibility requiring voter approval for deficit borrowing.

Time will tell if Governor Schwarzenegger can gather the votes necessary to prevent bond defaults. President Obama and other states are watching closely as the actions (or inactions) will have a ripple through effect for everyone. At 13% of the nation’s GDP, California’s economy impacts the overall country in a significant manner.

Let’s hope the state maintains its “golden” status and does not get burnt.

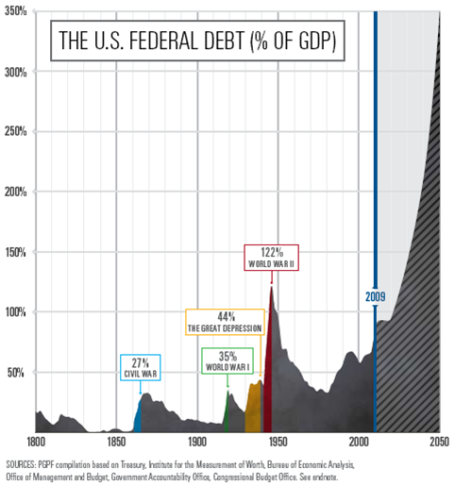

Debt: The New Four-Letter Word

D-E-B-T, our country’s new four-letter word, used to be a fun toy the masses played and danced with to buy all kinds of goods and services. Debt was creatively utilized for all types of things, including, our super-sized McMansions purchased with Option ARM (Adjustable Rate Mortgage) Countrywide loans; our 0% financing car binges (thanks to now-bankrupt Chrysler and General Motors); and our no-payment-for-two-years, big screen plasma TVs (financed at now-bankrupt Circuit City). Eventually consumers, corporations, and governments realized excessive debt creates all kinds of lingering problems – especially in recessionary periods. We are by no means out of the woods yet, but consumers are now spending less than they are taking in, as evidenced by a positive and rising savings rate. This slowdown in spending is bad for short-term demand, but eventually these savings will be recycled into our economy leading to productive and innovative value creating jobs that will jumpstart the economy back on a path to sustainable growth.

Click Here For Excellent Article from the Peterson Foundation

In our hot-cold society, where the pendulum of greed and fear swing dramatically from one side to the next, we are also observing an unhealthy level of risk aversion by financial institutions. This excessive caution is unfortunately choking off the health of legitimate businesses that need capital/debt in order to survive. As we continue to see a pickup in the leading indicators for an economic recovery, banks should loosen up the credit purse strings to provide capital for profitable, growing businesses – even if there are hiccups along the way.

National Debt “Blob” Must Be Slowed

In the famous 1958 sci-fi horror film, “The Blob”, a gelatinous, ever-growing creature from outer space threatens to take over the town of Downingtown, Pennsylvania by methodically engulfing everything in its path. Steve McQueen eventually learns that freezing the Blob will halt its progression. In our country, entitlements, in the form of Medicare and Social Security, serve as our 21st century Blob. As the chart above shows, entitlements have expanded dramatically over the last 40 years and stand to expand faster, as the 76 million Baby Boomers reach retirement and demand more Social Security and Medicare benefits. Clearly the current path we are travelling on is not sustainable, and beyond breakthroughs in technology, the only way we can suitably address this problem is by cutting benefits or raising taxes. We only dug ourselves in a deeper financial hole with the enactment of Medicare Part D (prescription drug benefits for Medicare participants). I must admit I have great difficulty in understanding how we are going to expand health care coverage for the vast majority of Americans in the face of exploding deficits and debt burdens. I eagerly await specifics.

With an enlarging national debt burden and widening deficits, the U.S. is only becoming more reliant on foreign investors to finance our shortcomings. This trend too cannot last forever (see chart below). At some point, foreigners will either balk by not providing us the financing, or demanding prohibitively high interest rates on any funding we request – thereby negatively escalating our already high interest payment streams to bondholders.

Regardless of your political view, the problem pretty simply boils down to elementary school math. The government either needs to cut expenses or raise revenue (taxes or growth initiatives). Politically, the stimulative spending path is easier to rationalize, but as we see in California, eventually the game ends and tough cuts are forced to be made.

Regardless of your political view, the problem pretty simply boils down to elementary school math. The government either needs to cut expenses or raise revenue (taxes or growth initiatives). Politically, the stimulative spending path is easier to rationalize, but as we see in California, eventually the game ends and tough cuts are forced to be made.

Let’s hope the painful lessons learned from this financial crisis will steer us back on path to more responsible borrowing – a point where D-E-B-T is no longer considered a dirty four-letter word.