Posts tagged ‘GDP’

2012 Party Train Missed Thanks to F.U.D.

Article is an excerpt from previously released Sidoxia Capital Management’s complementary January 2, 2013 newsletter. Subscribe on right side of page.

There was plenty of fear, uncertainty, and doubt (F.U.D.) in 2012, and the gridlock in Washington has been a contributing factor to investors’ angst. As the saying goes, the stock market climbs a “wall of worry” and that was certainly the case this year with the S&P 500 index rising +13.4% (over +15% including dividends), and the Nasdaq index soaring +15.9% before dividends. Short-term investors had ample worries to fret about throughout the year, including a European financial collapse, the presidential elections, fiscal cliff negotiations, and a Mayan doomsday (see this hilarious clip). Despite these fears dominating the daily airwaves and newspaper headlines, long-term investors holding an adequate equity asset allocation jumped on the non-stop 2012 party train.

While Americans were served a full plate of concerns this year, global investors benefited from European Central Bank intervention by Mario Draghi who promised to do “whatever it takes” to save the euro currency (the European dominated EAFE index rose +13.6% in 2012). Growth here in the U.S. slowed as cautious consumers and businesses horded cash, but a rebound in the domestic housing market provided support to the sluggish economic expansion (3rd quarter GDP growth was revised higher to +3.1% vs. 2011).

Now that the presidential elections are over and we achieved a partial fiscal cliff deal, the amount of F.U.D. going into 2013 will diminish, which should provide a tailwind to economic growth and the financial markets. The impending debt ceiling and deficit reduction talks may slow the train down, but if a sufficient resolution can be accomplished, the economic party train can continue chugging along.

Attention: Grab Your Ear Muffs

Economists and strategists will continue to sound smart and be completely wrong about their 2013 predictions (see Strategist Predictions & MacGyver), but that won’t stop average investors from neglecting their long-term investment plans. Investors have commonly overindulged in certain narrow asset classes like overpriced bonds and gold, which both underperformed equities in 2012. Diversification may sound like an overused finance cliché, but the principle is paramount if you are serious about reducing risk, beating inflation, and smoothing out incessant volatility.

2013 New Year’s Resolution: Avoid Personal Fiscal Cliff

With the New Year upon us, just because politicians have financial problems, it doesn’t mean you have to be fiscally irresponsible too. There is no better time than now to make a financial New Year’s resolution to avoid your own personal fiscal cliff. If you are too heavily parked in cash or over-exposed to low-yielding bonds subject to significant interest rate risk, then now is the time to re-evaluate your investment plan.

There is always something to worry about (see also Uncertainty: Love It?), but in order to prevent working into your 80s, a long-term investment plan needs to be implemented, regardless of economic headlines or market volatility. In other words, investors need to replace their short-term microscope for their long-term telescope. By committing to a disciplined fiscal New Year’s resolution, you can earn a ticket on the 2013 party train!

Monthly News Tidbits

The presidential elections dominated the news cycle in November, but there were a whole host of other tidbits occurring over the last thirty-one days. Here are some of the main storylines:

Congress Approves Mini Fiscal Cliff Deal: After months of debate, Congress painfully and reluctantly agreed upon an estimated $600 billion mini fiscal cliff deal that represents the largest tax increase in two decades. Contrary to a $4 trillion “Grand Bargain” deal, this bill amounts to a more modest reduction in the deficit over 10 years. The Senate passed the bill by a margin of 89-8 and the House of Representatives by a spread of 257-167. The fact that any deal got done is somewhat surprising since the gridlock has been especially rampant in the House. As proof of this assertion, one need only point to the chamber’s meager voting activity record – the House has passed the fewest bills in 60 years during its recent term.

Fiscal Cliff Bill Details: Despite the Senate’s convincing voting margin, large numbers of Congressional Democrats and Republicans were unhappy with the bill’s details. The President made good on his campaign promises by securing revenue-raising taxes from wealthy Americans. More specifically, the law contains provisions including a 39.6% rate on earners above $400,000; a 20% capital gains rate increase from 15%; new exemption/deduction limits; an estate tax increase to 40% from 35%; and a measure to help prevent near-term milk price spikes. There are plenty more details, but I will spare your eyeballs and brain from the painful minutiae. If you haven’t had enough partisan politics, no need to worry, you have the debt ceiling debate to look forward to in a few months.

Quantitative Easing Redux (QE4): Federal Reserve Chairman Ben Bernanke helped orchestrate additional monetary policy stimulus via a fourth round of quantitative easing (a.k.a., QE4). As part of this plan, the Fed will vastly expand its $2.8 trillion balance sheet in 2013 with additional monthly purchases of $45 billion of long-term Treasuries. By executing this invigorating QE4 bond buying program, the Fed pledges to keep interest rates in the cellar until the unemployment rate falls below 6.5% or inflation rises above 2.5%.

Same-Sex Marriage: The Supreme Court tackled a long-debated social issue and declared it would rule on the legality of a law denying benefits to same-sex couples in 2013.

New Female President: Additional hormones were added to the gender-skewed global pool of testosterone-filled leaders as South Korea elected its first female president, Park Geun-hye.

Global Bank Fined: Another greedy financial institution got caught with its hand in the cookie jar. UBS agreed to cough up a $1.5 billion penalty to the U.S., U.K., and Swiss authorities as part of an agreement to resolve its involvement in the manipulation of the London Interbank Offered Rate (LIBOR) – see also Wall Street Meets Greed Street.

Sandy Hook Distressing Disaster: The gun control debate was reignited when 20-year-old Adam Lanza gunned down 20 children and 7 adults (including his mother) at a Connecticut elementary school – Sandy Hook Elementary. Besides the examination of an assault weapons ban, the government needs to revisit the inadequate awareness and resources devoted to the serious issue of mental illness.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) including fixed income ETFs, but at the time of publishing SCM had no direct position in EFA, UBS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Lily Pad Jumping & Term Paper Cramming

Article is an excerpt from previously released Sidoxia Capital Management’s complementary December 3, 2012 newsletter. Subscribe on right side of page.

Over the last year, investors’ concerns have jumped around like a frog moving from one lily pad to the next. From the debt ceiling debate to the European financial crisis, and then from the presidential election to now the “fiscal cliff.” With the election behind us (Obama winning 332 electoral votes vs 206 for Romney; and Obama 50.8% of the popular vote vs 47.5% for Romney), the frog’s bulging eyes are squarely focused on the fiscal cliff. For the uninformed frogs that have been swimming underwater, the fiscal cliff is the roughly $600 billion in automatic tax hikes and spending cuts that are scheduled to be triggered by the end of this year, if Congress cannot come to some type of agreement (for more fiscal cliff information see videos here). The mathematical consequences are clear: Congress + No Deal = Recession.

While political brinksmanship and theater are nothing new, the explosive amount of data is something new. In our mobile world of 6 billion cell phones (more than the number of toothbrushes on our planet) and trillions of text messages sent annually, nobody can escape the avalanche of global data. Google (GOOG), Facebook (FB), Twitter, and millions of blogs (including this one) didn’t exist 15 years ago, therefore fiscal boogeymen like obscure Greek debt negotiations and Chinese PMI figures wouldn’t have scared pre-internet generations underneath their beds like today’s investors. The fact of the matter is our country has triumphed over plenty of significant issues (many of them scarier than today’s headlines), including wars, assassinations, currency crises, banking crises, double digit inflation, SARS, mad cow disease, flash crashes, Ponzi schemes, and a whole lot more.

Although today’s jumpy investors may worry about the lily pads of a double-dip recession in the US, a financial meltdown in Europe, and/or a hard landing in China, fiscal frogs will undoubtedly be worried about different lily pads (concerns) twelve months from now. This may not be an insightful observation for day traders, but for the other 99% of investors, taking a longer term view of the daily news cycle may prove beneficial.

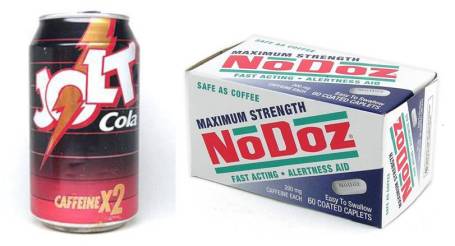

Fiscal Cliff Term Paper Due on Friday December 21st

As a college student, chugging Jolt Cola, in combination with a couple dosages of NoDoz, was part of the routine procrastination process the day before a term paper was due. Apparently Congress has also earned a PhD in procrastination, judging by the last minute conclusion of the debt ceiling negotiations last summer. There are only a few more weeks until politicians break for the Christmas holiday break, therefore I am setting an Investing Caffeine mandated fiscal cliff due date of December 21st. Could Congress turn in its term paper early? Anything is possible, but unfortunately turning in the assignment early is highly unlikely, especially when politically bashing your opponent is perceived as a better re-election tactic compared to bipartisan negotiation.

A higher probability scenario involves Americans stuck listening to Nancy Pelosi, Harry Reid, John Boehner, and Mitch McConnell on a daily basis as these politicians finger-point and call the other side obstructionists. While I’m not alone in believing a deal will ultimately get done before Christmas, how credible and substantive the announcement will be depends on whether the politicians seriously face entitlement and tax reforms. Regardless, any deal announced by Investing Caffeine’s December 21st due date will likely be received well by the market, as long as a framework for entitlement and tax reform is laid out for 2013.

Frog News Bites

Source: Photobucket

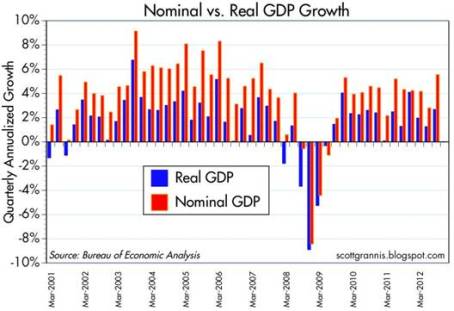

GDP Revised Higher: Despite all the gloom and uncertainties, the barometer of the economy’s health (i.e., Real Gross Domestic Product), was revised higher to 2.7% growth for the third quarter (from 2.0%). Nominal growth, a related measurement that includes inflation, reached a five-year high of 5.55%. In the wake of Superstorm Sandy, which caused upwards of $50 billion in damage, fourth quarter GDP numbers are likely to be artificially depressed. The silver lining, however, is first quarter 2013 figures may get an economic boost from reconstruction efforts.

Source: Calafia Beach Pundit

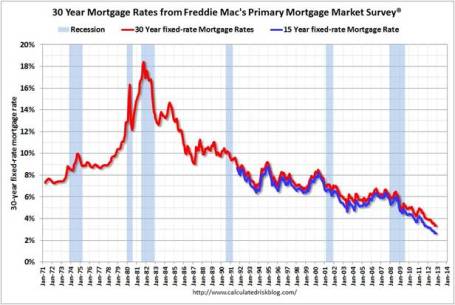

Housing Recovery Continues: Buoyed by record low interest rates (30-yr fixed mortgages < 3.5%), housing sales and prices continue on an upward trajectory. New home sales came in at 368,000 in October, below expectations, but sales are still up around +20% from 2011 (Calculated Risk).

Source: Calculated Risk

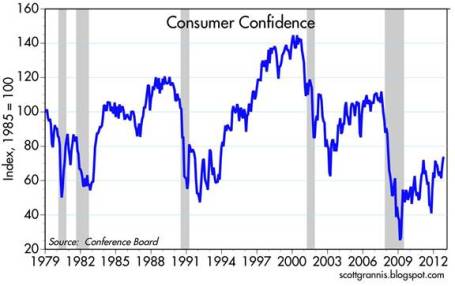

Confidence Still Low but Climbing: The recently reported consumer confidence figures reached the highest level in more than four years, but as Scott Grannis highlights, this is nothing to write home about. These current confidence levels match where we were during the 1990-91 and 1980-82 recessions.

Source: Calafia Beach Pundit

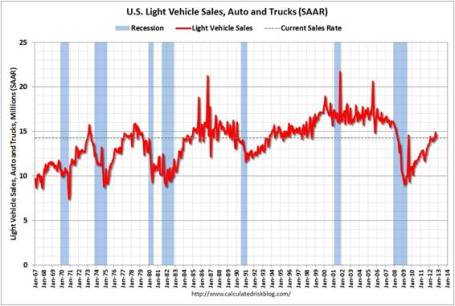

Car Sales Picking Up: Fiscal cliff discussions haven’t discouraged consumers from buying cars. As you can see from the chart below, car and truck sales reached 14.3 million annualized units in October. November sales are expected to rise about +13% on a year-over-year basis, reaching approximately 15.3 million units.

Source: Calculated Risk

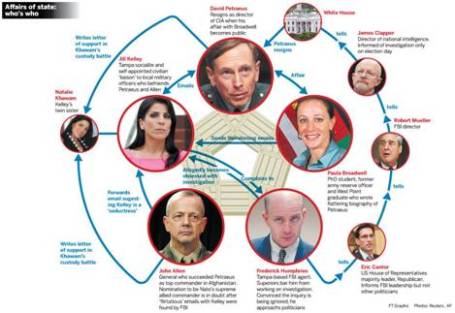

CIA Chief Fired in Sex Scandal: If you didn’t get enough of the Lindsay Lohan bar brawl dirt in New York, never fear, there was plenty of salacious details emanating from Washington DC this month. A complicated web of Florida socialites, a biographer, email chains, and a bare-chested FBI agent led to the firing of CIA director David Petraeus.

Source: The Financial Times

Death to Twinkies: After lining stomachs with golden cream-filled cakes for more than 80+ years, Hostess Brands was forced to halt production of Twinkies, Ding Dongs, and Ho Hos. Negotiations with union bakers crumbled, which led to Hostess Brands’ Chapter 7 bankruptcy and liquidation proceedings. My financial brain understands, but my sweet tooth is still grieving (see also Twinkie Investing).

Source: Photobucket

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in FB, Twitter or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Digesting the Anchovy Pizza Market

Article is an excerpt from previously released Sidoxia Capital Management’s complementary July 2012 newsletter. Subscribe on right side of page.

I love pizza, and most fellow connoisseurs have difficulty refusing a hot, fresh slice of heaven too. Pizza is so universally appreciated that people consider pizza like ice cream – it’s good even when it’s bad (I agree). However, even the biggest, diehard pizza-lover will sheepishly admit their fondness for the flat and circular cheesy delight changes when you integrate anchovies into the mix. Not many people enjoy salty, slimy, marine creatures layered onto their doughy mozzarella and marinara pizza paradise.

With all the turmoil and uncertainty going on in the global financial markets, prudently investing in a widely diversified portfolio, including a broad range of equity securities, is viewed as palatable as participating in an all-you-can-eat anchovy pizza contest. Why are investors’ appetites so salty now? Hmmm, let me think. Oh yes, here are a few things that come to mind:

- Presidential Election Uncertainty

- European Financial Crisis

- Impending Fiscal Cliff (tax cut expirations, automatic spending cuts, termination of stimulus, etc.)

- Unsustainable Fiscal Debt & Deficits

- Slowing Subpar Domestic Economic Growth

- Partisan Politics and Gridlock in Washington

- High Unemployment

- Fears of a Hard Economic Landing in China

Doesn’t sound too appealing, does it? So, what are most investors doing in this unclear market? Rather than feasting on a pungent pie of anchovies, investors are flocking to the perceived safety of low yielding asset classes, no matter the price. In other words, the short-term warmth and comfort of CDs, money market, checking, and fixed income assets are being gobbled up like nicotine-laced pepperoni pizzas selling for $29.95/each + tax. The anchovy alternative, like stocks, is much more attractively priced now. After accounting for dividends, earnings, and cash flows, the anchovy/stock option is currently offering a 2-for-1 special with breadsticks and a salad…quite the bargain!

Nonetheless, the plain and expensive pepperoni/bond option remains the choice du jour and there are no immediate signs of a pepperoni hangover just quite yet. However, this risk aversion addiction cannot last forever. The bond gorging buffet has gone on relatively unabated for the last three decades, as you can see from the chart below. In spite of this, the bond binging game is quickly approaching a mathematical terminal end-game, as interest rates cannot logically go below zero.

Since my firm (Sidoxia Capital Management) is based in Newport Beach, next to PIMCO’s global headquarters, we get to follow the progression of the bond binging game firsthand. I’ve personally learned that if I manage close to $2 trillion in assets under management, I too can construct a 23-story Taj Mahal-esque headquarters that overlooks the Pacific Ocean from a stones-throw away.

Beyond glorified headquarters, there is evidence of other low-risk appetite examples. Here are some reinforcing pictures:

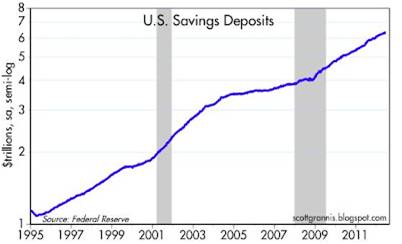

The Bond Binge

Cash Hoarding

Source (Calafia Beach Pundit): Stuffing money under the mattress has accelerated in recent years as fear, uncertainty, and doubt have reigned supreme.

The Anchovy Special

Even though anchovy pizza, or a broadly diversified portfolio across asset class, size, geography, and style may not sound appealing, there are plenty of reasons to fight the urges of caving to fear and skepticism. Here are a few:

1) Growth Rolls On: Despite the aforementioned challenges occurring domestically and abroad, growth has continued unabated for 11 consecutive quarters, albeit at a rate less than desired. We are not immune to global recessionary forces, but regardless of European forces, the U.S. has been resilient in its expansion.

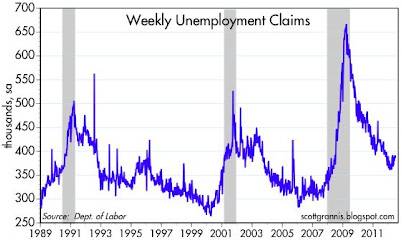

2) Jobs and Housing on the Upswing: Unemployment remains high, but our country has experienced 27 consecutive months of private creation, leading to more than 4 million new jobs being added to our workforce. As you can see from the clear longer-term downward trend in unemployment claims, we are moving in the right direction.

3) Eurozone Slowly Healing its Wounds: The Greek political and fiscal soap opera is grabbing all the headlines, but quietly in the background there are signs that the eurozone is slowly healing the wounds of the financial crisis. If you look at the 2-year borrowing costs of Europe’s troubled countries (ex-Greece), there is an unambiguous and beneficial decline. There is no doubt that Spain and Italy play a larger role than Portugal and Ireland, but at least some seeds of change have been planted for optimism.

4) Record Corporate Profits: Investors are not the only people reading uncertain newspaper headlines and watching CNBC business television. CEOs are reading the same gloomy sensationalistic stories, and as a result, corporations have been cautious about dipping their short arms into their deep pockets. Significant expense reductions and a reluctance to hire have led to record profits and cash hoards. As evidenced by the chart below, profits continue to rise, and these earnings are being applied to shareholder friendly uses like dividends, share buybacks, and accretive acquisitions.

5) Attractive Valuations (Pricing): We have already explored the lofty prices surrounding bonds and $30 pepperoni pizzas, but counter-intuitively, stock prices are trading at a discount to historical norms, despite record low interest rates. All else equal, an investor should pay higher prices for stocks when interest rates are at a record low (and vice versa), but currently we are seeing the opposite dynamic occur.

Even though the financial markets may look, smell, and taste like an anchovy pizza, the price, value, and return benefits may outweigh the fishy odor. And guess what…anchovies are versatile. If you don’t like them on your pizza, you can always take them off and put them on your Caesar salad or use them for bait the next time you go fishing. The gloom-filled headlines haven’t been spectacular, but if they were, the return opportunities would be drastically reduced. Therefore you are much better off by following investor legend Warren Buffett’s advice, which is to “buy fear and sell greed.”

Investing has never been more difficult with record low interest rates, and it has also never been more important. Excluding a small minority of late retirees and wealthy individuals, efficiently investing your retirement dollars has become even more critical. The safety nets of Social Security and Medicare are likely to be crippled, which will require better and more prudent investing by individuals. Inflation relating to food, energy, healthcare, gasoline, and entertainment is dramatically eroding peoples’ nest eggs.

Digesting a pepperoni pizza may sound like the most popular and best option given the gloomy headlines and uncertain outlook, but if you do not want financial heartburn you may consider alternative choices. Like the healthier and less loved anchovy pizza, a more attractively valued strategy based on a broadly diversified portfolio across asset class, size, geography, and style may be the best financial choice to satiate your long-term financial goals.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Rates Dance their Way to a Floor

The globe is awash in debt, deficits are exploding, and the Euro is about to collapse…right? Well, then why in the heck are six countries out of the G-7 seeing their 10-year sovereign debt trade at 2.5% or lower on a consistent downward long-term trajectory? What’s more, three of the six countries witnessing their rates plummet are from Europe, despite pundits continually calling for the demise of the eurozone.

Here is a snapshot of 10-year sovereign debt yields for the majority of the G-7 countries over the last few decades:

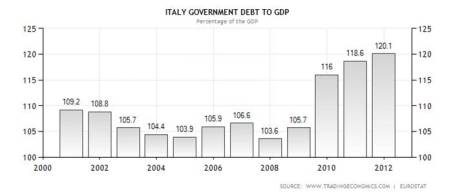

The sole G-7 member missing from the bond yield charts above? Italy. Although Italy’s deficits are not massive (Italy actually has a smaller deficit than U.S. as % of GDP: 3.9% in 2011), its Debt/GDP ratio has been large and rising (see chart below):

As the globe has plodded through the financial crisis of 2008-2009, investors have flocked to the perceived stability of these larger developed countries’ bonds, even if they are merely better homes in a bad neighborhood right now. PIMCO likes to call these popular sovereign bonds, “cleaner dirty shirts.” Buying sovereign debt from these less dirty shirt countries, without sensitivity to price or yield, has been a lucrative trade that has worked consistently for quite some time. Now, however, with sovereign bond yields rapidly approaching 0%, it becomes mathematically impossible to fall lower than the bottom rate floor that developed countries are standing on.

Bond bears have been wrong about the timing of the inevitable bond price reversal, myself included, but the bulls are skating on thinner and thinner ice as rates continue moving lower. The bears may prolong their bragging rights if interest rates continue downward, or persist at these lower levels for extended periods of time. Eventually the “buy the dips” mentality dies, as we so poignantly experienced in 2000 when the technology dips turned into outright collapse.

The Flies in the Bond Binging Ointment

As long as equities remain in a trading range, the “risk-off” bond binging arguments will continue holding water. If corporate earnings remain elevated and stock buybacks carry on, the pain of deflating real returns will eventually become too unbearable for investors. As the insidious rising prices of energy, healthcare, food, leisure, and general costs keep eating away everyone’s purchasing power, even the skeptics will become more impatient with the paltry returns they are currently earning. Earning negative real returns in Treasuries, CDs, money market accounts, and other conservative investments, is not going to help millions of Americans meet their future financial goals. Due to the laundry list of global economic concerns, large swaths of investors are still running and hiding, but this is not a sustainable strategy longer term. The danger from these so-called “safe,” low-yielding asset classes is actually riskier than the perceived risk, in my view.

With that said, I’ve consistently held there are a subset of investors, including a significant number of my Sidoxia Capital Management clients, who are in the later stage of retirement and have a rational need for capital preservation and income generating assets (albeit low yielding). For this investor segment, portfolio construction is not executed due to an opportunistic urge of chasing potential outsized rates of return, but more-so out of necessity. Shorter time horizons eliminate the prudence of additional equity exposure because of the extra associated volatility. Unfortunately, many of the 76 million Baby Boomers will statistically live another 20 – 30 years based on actuarial life expectations and under-save, so the risks of being too conservative can dramatically outweigh the risks of increasing equity exposure. This is all stated in the context of stocks paying a higher yield than long-term Treasuries – the first time in a generation.

Short-term risks and uncertainties remain high, with Greek election outcomes unknown; a U.S. Presidential election in flux; and an impending domestic fiscal cliff that needs to be addressed. But with interest rates accelerating towards 0% and investors’ fright-filled buying of pricey, low-yielding asset classes, many of these risks are already factored into current valuations. As it turns out, the pain of panic can be more detrimental than being stuck in over-priced assets, driven by rates dancing near an absolute floor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Fear & Greed Occupy Wall Street in October

Excerpt from Free November Sidoxia Monthly Newsletter (Subscribe on right-side of page)

Fear and frustration dominated investor psyches during August and September as backlash from political gridlock in the U.S. and worries of European contagion dominated action in volatile investment portfolios. Elevated 9.1% unemployment and a sluggish recovery in the U.S. also led populist Occupy Wall Street protesters to flood our nation’s streets, blaming the bankers and the wealthy as the cause for personal misfortunes and the widening gap between rich and poor. However, in the face of the palpable pessimism, economic Halloween treats and greedy corporate profits scared away bearish naysayers like invisible ghosts during the month of October.

While many investors stayed home for Halloween in the supposed comfort of their inflation-losing savings accounts and bonds, those investors choosing to brave the chilling elements in the frightening equity markets were handsomely rewarded. Stockholders tasted the sweet pleasure of a +11% October return in the S&P 500 index, the largest monthly advance in 20 years.

Of course, as I always advise, investors should not load themselves to the gills in stocks just to chase performance. Rather, investors should construct a diversified portfolio designed to meet one’s objectives, constraints, risk tolerance, and liquidity needs. Within that context, a portfolio should also periodically rebalance by selling pricey investments (i.e., Treasuries) and redeploy those proceeds into unloved investments (i.e., equities).

Glass Half Full

There is never a shortage of reasons to be fearful and a one-month rally in equities is not reason enough to blindly pile on risk, but there are plenty of reasons to counter the endless pessimism pornography peddled by media outlets on a continuous basis. Here are some of the “half-full” reasons:

- Euro Plan in Place: After months of conflicting headlines, European leaders reached an agreement to increase the European Union’s bailout fund to one trillion euros ($1.4 trillion) and negotiated a -50% debt reduction deal with Greek bondholders. In addition, European officials agreed on a plan to increase bank reserves by 106 billion euros to support potential bank losses due to European debt defaults. This plan is not a silver bullet, but it is a start.

- Bulging Corporate Profits: With the majority of S&P 500 companies now having reported their actual third quarter results, profit growth is estimated to exceed +16% for the three month period ending in September. Expectations for fourth quarter earnings are currently forecasted to top a respectable +11% growth rate (Data from Thomson Reuters).

- Tortoise-Like Growth Continues: Even though it’s Halloween, the double-dip recession boogeyman is still hiding. U.S. economic growth actually accelerated its growth to +2.5% in the third quarter on a year-over-year basis, up from +1.3% last quarter. The growth in Gross Domestic Product (GDP) was primarily driven by consumer and business spending.

- Jobs Still on the Rise: The unemployment rate remains stubbornly high, but offsetting the ongoing decline in government jobs has been a 19 consecutive month spurt in private job creation activity, resulting in +2.6 million jobs being added to the economy over the period. This doesn’t make up for the 8 million+ jobs lost during the 2008-2009 recession, but the economy is moving in the right direction.

- Consumers Opening Wallet: Consumers can be like cockroaches in that they are difficult to kill off when it comes to spending. Consumers whipped out their wallets in September as retail sales advanced at a brisk +7.9% pace (+7.8% excluding auto sales).

- Dividends on the Rise: While nervous Nellies park money in money losing cash and Treasuries (on an inflation-adjusted basis), corporations flush with cash are increasing dividends at a rapid clip. According to Standard & Poor’s rating agency, dividend increases rose over +17% during the third quarter of 2011. As of October 25th, the indicated dividend for the S&P stood at a decent +2.20% rate.

I am fully aware that equity investors are not out of the woods yet, as the European debt crisis has not been resolved, and the structural deficit/debt issues we face in the U.S. still have a long way to go before becoming disentangled. As a matter of fact, fear is building as we approach the looming deficit reduction Super Committee resolution (or lack thereof) later this month – I can hardly wait. If a $1.5 trillion bipartisan debt reduction agreement can’t be reached, some bored Occupy Wall Street protesters can shift priorities and take a tour bus to Washington D.C. to demonstrate. Regardless of the potential grand European or Washington debt plans that may or may not transpire, observers can rest assured fear and greed are two emotions that will remain alive and well when it comes to Wall Street and “Main Street” portfolios.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Magical Growth through Manufacturing Decline

In a data driven world, we can never get enough numbers. The market magicians and the media machines have no problem overhyping or overselling the importance of each pending data-point. With a quick economic sleight of hand, the industry pundits have converted the average investor into a frothing Pavlovian dog, begging for another market shaking statistic. One of the supposed earth-rattling data points is the monthly ISM Manufacturing Index figure, but the release of the ISM number alone isn’t enough for the audience. The real fun comes in determining whether the monthly number registers above or below a schizophrenic 50 level – a number above 50 indicates the manufacturing economy is generally expanding (August came in at 50.6).

The trick can often be surprising, but more surprising to me is the importance placed on this relatively small, disappearing segment of our economy. With the manufacturing sector now accounting for just 11-13% of GDP (see also Manufacturing – Losing Out?), shouldn’t we be focusing more on the “Services” sector of the economy, which accounts for roughly 75% of our country’s output, up from 62% in 1971 (source: Earthtrends). I believe economist Mark Perry at Carpe Diem captured this phenomenon best in his post from earlier this year (Decline of Manufacturing – The World is Much Better Off ):

The fact of the matter is that manufacturing has been declining as a percentage of GDP over the decades just as the broader economy has seen massive growth. While manufacturing got chopped in half, as a percentage of GDP, from 1970 to 2011 we have seen GDP balloon from about $1 trillion to $15 trillion. If manufacturing declined by another 50% of GDP, I’d do cartwheels to see another 15x increase in economic expansion. I acknowledge the existence of certain synergies between product development and product manufacturing, but these benefits must be weighed against higher domestic costs that could make sales potentially unviable.

The fact of the matter is that manufacturing has been declining as a percentage of GDP over the decades just as the broader economy has seen massive growth. While manufacturing got chopped in half, as a percentage of GDP, from 1970 to 2011 we have seen GDP balloon from about $1 trillion to $15 trillion. If manufacturing declined by another 50% of GDP, I’d do cartwheels to see another 15x increase in economic expansion. I acknowledge the existence of certain synergies between product development and product manufacturing, but these benefits must be weighed against higher domestic costs that could make sales potentially unviable.

Déjà Vu All Over Again

This isn’t the first time in our country’s history that we’ve experienced explosive economic growth as legacy segments of the economy decline in relative importance. Consider the share of jobs agriculture controlled in the early 1800s – a whopping 90% of jobs were tied to farms (see chart below). Today, that percentage is less than 2% in the wake of the U.S. becoming the 20th Century global superpower. History has taught us that technology can be a bitch on employment, as robots, machinery, processes, and chemistry replace the demand for human labor. As Perry points out, there is no doubt that “tractors, electricity, combines, the cotton gin, automatic milking machinery, computers, GPS, hybrid seeds, irrigation systems, herbicides, pesticides” replaced millions of farming jobs, but guess what…American ingenuity ruled the day. As it turns out, those economic resources freed up by technology and productivity were redeployed into new, expanding, job-fertile areas of the economy like, “manufacturing, health care, education, business, retail, computers, transportation, etc.”

More Apples or More GMs?

The farming lobby still cries for its inefficient, growth-muffling subsidies today, but many unproductive, unionized domestic manufacturing industries are also screaming for government assistance because cheap foreign labor and new technologies are stealing manufacturing jobs by the boatloads. So at the core, the real question is do we want government and investments supporting more companies like Apple Inc. (AAPL) or more companies like General Motors Company (GM)?

As you may know, by flipping over an iPhone, any observer can clearly notice the product is “designed by Apple in California – assembled in China.” It is clear that Apple and its customers value brains over manufacturing brawn. At $371 billion and the most valuable publicly traded stock in the universe, Apple is dominating the electronics world, all the while hiring employees by the thousands. These facts beg the question of whether Apple should revamp their manufacturing supply-chain back to the U.S. to save more domestic jobs? Of course the result of a manufacturing strategy shift to a higher cost region would make Apple less competitive, force them to charge consumers higher prices for Apple products, and open the door for competitors to freely steal market share? Would this strategy create more incremental jobs, or fewer jobs? I think I’ll side with the Steve Jobs philosophy of business, which says “more profitable businesses must fill more job openings.”

If this Apple case study isn’t illustrative enough for you, maybe you should take a look at companies like GM. The U.S. automobile industry has historically been notoriously mismanaged, thanks to a horrific manufacturing cost structure, anchored by unsustainable pension and healthcare costs. Should investors be surprised that an uncompetitive, bloated cost structure leaves companies like GM less money to invest in new products and innovation? This irrational cost management contributed to decades of market share losses to foreigners. If I’m the job creation czar in the U.S., I think I’ll choose the Apple path to job creation over GM’s route.

Global Competitiveness = Jobs

With a 9.1% unemployment rate and the recent introduction of the American Jobs Act, there has been plenty of emphasis and focus on job creation. At the end of the day, what will create durable, long-term job creation is innovative, competitively priced products and services that can be sold domestically and abroad. How do we achieve this goal? We need an education system that can teach and train a workforce sufficiently to meet the discerning tastes of a global marketplace. Government, on the other hand, needs to support (not direct) the private sector by investing in strategic areas to help global competitiveness (i.e., education, energy independence, basic research, infrastructure, entrepreneurial capital for business formation, etc.), while facilitating a business environment that incentivizes growth.

Regardless of the policy mixtures, the common denominator needs to be focused on improving global competitiveness. Excessive focus on a declining manufacturing sector and the monthly ISM data will only distract decision makers from the core issues. If the economic magician’s sleight of hand diverts investor attention for too long, we may see more jobs disappear.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, and AAPL, but at the time of publishing SCM had no direct position in GM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page

Soft Patch Creating Hard-Landing Nightmares

Boo! Was that a ghost, or was that just some soft patch talk scaring you during a nightmare? The economic data hasn’t been exactly rosy over the last month, and as a result, investors have gotten spooked and have chosen to chainsaw their equity positions. Since late April, nervous investors had already yanked more than $15 billion from U.S. equity mutual funds and shoved nearly $29 billion toward bond funds (Barron’s). Jittery emotions are evidenced by the recently released June Consumer Confidence numbers (Conference Board), which came in at a dismal 58.5 level – significantly above the low of 25.3 in 2009, but a mile away from the pre-crisis high of 111.9 in 2007.

Economic Monsters under the Bed

Why are investors having such scary dreams? Look no further than the latest terror-filled headlines du Jour referencing one (if not all) of the following issues:

• Inevitable economic collapse of Greece.

• End of QE2 (Quantitative Easing Part II) monetary stimulus program.

• Excessive state deficits, debt, and pension obligations.

• Housing market remains in shambles.

• Slowing in economic growth – lethargic +1.9% GDP growth in Q1.

• Accelerating inflation.

• Anemic auto sales in part caused by Japanese supply chain disruptions post the nuclear disaster.

Surely with all this horrible news, the equity markets must have suffered some severe bloodletting? Wait a second, my crack research team has just discovered the S&P 500 is up +5.0% this year and its sister index the Dow Jones Industrial Average is up +7.2%. How can bad news plus more bad news equal an up market?

OK, I know the sarcasm is oozing from the page, but the fact of the matter is investing based on economic headlines can be hazardous for your investment portfolio health. The flow of horrendous headlines was actually much worse over the last 24 months, yet equity markets have approximately doubled in price. On the flip-side, in 2007 there was an abundant amount of economic sunshine (excluding housing), right before the economy drove off a cliff.

Balanced Viewpoints

Being purely Pollyannaish and ignoring objective soft patch data is certainly not advisable, but with the financial crisis of 2008-2009 close behind us in the rear-view mirror, it has become apparent to me that fair and balanced analysis of the facts by TV, newspaper, radio, and blogging venues is noticeably absent.

Given the fact that the stock market is up in 2011 in the face of dreadful news, are investors just whistling as they walk past the graveyard? Or are there some positive countervailing trends hidden amidst all the gloom?

I could probably provide some credible contrarian views to the current pessimistically accepted outlook, but rather than recreating the wheel, why not choose a more efficient method and leave it to a trusted voice of Scott Grannis at the Calafia Beach Report, where he resourcefully notes the market positives:

“Corporate profits are very strong; the economy has created over 2 million private sector jobs since the recession low; swap spreads are very low; the implied volatility of equity options is only moderately elevated; the yield curve is very steep (thus ruling out any monetary policy threat to growth); commodity prices are very strong (thus ruling out any material slowdown in global demand); the US Congress is debating how much to cut spending, rather than how much to increase spending; oil prices are down one-third from their 2008 recession-provoking highs; exports are growing at strong double-digit rates; the number of people collecting unemployment insurance has dropped by 5 million since early 2010; federal revenues are growing at a 10% annual rate; households’ net worth has risen by over $9 trillion in the past two years; and the level of swap and credit spreads shows no signs of being artificially depressed (thus virtually ruling out excessive optimism or Fed-induced asset price distortions). When you put the latest concerns about the potential fallout from a Greek default (which is virtually assured and has been known and expected for months) against the backdrop of these positive and powerful fundamentals, the world doesn’t look like a very scary place.”

Wow, that doesn’t sound half bad, but rock throwing Greek vandals, nude politicians Tweeting pictures, and anti-terrorist war campaigns happen to sell more newspapers.

It’s the Earnings Stupid

Grannis’s view on corporate profits supports what I recently wrote in It’s the Earnings, Stupid. What really drives stock prices over the long-term is earnings and cash flows (with a good dash of interest rates). Given the sour stock market sentiment, little attention has been placed on the record growth in corporate profits – up +47% in 2010 on an S&P 500 operating basis and estimated +17% growth in 2011. Few people realize that corporate profits have more than doubled over the last decade (see chart below) in light of the feeble stock market performance. Despite the much improved current profit outlook, cynical bears question the validity of this year’s profit forecasts as we approach the beginning of Q2 earnings reporting season. However, if recent results from the likes of Nike Inc. (NKE), FedEx Corp (FDX), Oracle Corp. (ORCL), Caterpillar Inc. (CAT), and Bed Bath & Beyond Inc. (BBBY) are indicators of what’s to come from the rest of corporate America, then profit estimates may actually get adjusted upwards…not downwards?

There is plenty to worry about and there is never a shortage of scary headlines (see Back to the Future magazine covers), but reacting to news with impulsive emotional trades will produce fewer sweet dreams and more investment nightmares.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Performance data from Morningstar.com. Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and FDX, but at the time of publishing SCM had no direct position in NKE, CAT, ORCL, BBY or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Economic Tug-of-War as Recovery Matures

Excerpt from No-Cost June 2011 Sidoxia Monthly Newsletter (Subscribe on right-side of page)

With the Rapture behind us, we can now focus less on the end of the world and more on the economic tug of war. As we approach the midpoint of 2011, equity markets were down -1.4% last month (S&P 500 index) and are virtually flat since February – trading within a narrow band of approximately +/- 5% over that period. Investors are filtering through data as we speak, reconciling record corporate profits and margins with decelerating economic and employment trends.

Here are some of the issues investors are digesting:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

Profits Continue Chugging Along: There are many crosscurrents swirling around the economy, but corporations are sitting on fat profits and growing cash piles owing success to several factors:

- International Expansion: A weaker dollar has made domestic goods and services more affordable to foreigners, resulting in stronger sales abroad. The expansion of middle classes in developing countries is leading to the broader purchasing power necessary to drive increasing American exports.

- Rising Productivity: Cheap labor, new equipment, and expanded technology adoption have resulted in annualized productivity increases of +2.9% and +1.6% in the 4th quarter and 1st quarter, respectively. Eventually, corporations will be forced to hire full-time employees in bulk, as bursting temporary worker staffs and stretched employee bases will hit output limitations.

- Deleveraging Helps Spending: As we enter the third year of the economic recovery, consumers, corporations, and financial institutions have become more responsible in curtailing their debt loads, which has led to more sustainable, albeit more moderate, spending levels. For instance, ever since mid-2008, when recessionary fundamentals worsened, consumer debt in the U.S. has fallen by more than $1 trillion.

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Fed Running on Empty: The QE2 (Quantitative Easing Part II) government security purchase program, designed to stimulate the economy by driving interest rates lower, is concluding at the end of this month. If the economy continues to stagnate, there’s a possibility that the tank may need to be re-filled with some QE3? Maintaining the 30-year fixed rate mortgage currently around 4.25%, and the 10-year Treasury note yielding around 3.05% will be a challenge after the program expires. Time will tell…

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Slogging Through Mud: Although corporate profits are expanding smartly, economic momentum, as measured by real Gross Domestic Product (GDP) growth, is struggling like a vehicle spinning its wheels in mud. Annualized first quarter GDP growth registered in at a meager +1.8% as the economy weans itself off of fiscal stimulus and adjusts to more normalized spending levels. An elevated 9% unemployment rate and continued weak housing market is also putting a lid on consumer spending. Offsetting the negative impacts of the stimulative spending declines have been the increasing tax receipts achieved as a consequence of seven consecutive quarters of GDP growth.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Mixed Bag – Euro Confusion: Germany reported eye-popping first quarter GDP growth of +5.2%, the steepest year-over-year rise since reunification in 1990, yet lingering fiscal concerns surrounding the likes of Greece, Portugal, and Italy have intensified. Fitch, for example, recently cut its rating on Greece’s long-term sovereign debt three notches, from BB+ to B+ plus, and placed the country on “rating watch negative” status. These fears have pushed up two-year Greek bond yields to over 26%. Regarding the other countries mentioned, Standard & Poor’s, another credit rating agency, cut Italy’s A+ rating, while the European Union and International Monetary Fund agreed on a $116 billion bailout program for Portugal.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

It’s the Earnings, Stupid

Political strategist James Carville famously stated, “It’s the economy stupid,” during the 1992 presidential campaign. Despite a historic record approval rating of 90 by President George H.W. Bush after the 1991 Gulf War victory, Bush Sr. still managed to lose the election to President Bill Clinton because of a weak economy. President Barack Obama would serve himself well to pay attention to history if he wants to enter the “two-termer” club. Pundits are placing their bets on Obama due to his large campaign war chest, a post-Osama bin Laden extinguishment approval bump, and a cloudy Republican candidate weather forecast. If however, the unemployment rate remains elevated and the current administration ignores the spending/debt crisis, then the President’s re-election hopes may just come crashing down.

Price Follows Earnings

The similarly vital relationship between the economy and politics applies to the relationship of earnings and the equity markets too. Instead of the key phrase, “It’s the economy stupid,” in the stock market, “It’s all about the earnings stupid” is the crucial guideline. The balance sheet may play a role as well, but at the end of the day, the longer-term trend in stock prices eventually follows earnings and cash flows (i.e., investors will pay a higher price for a growing stream of earnings and a lower price for a declining or stagnant stream of earnings). Ultimately, even value investors pay more attention to earnings in the cases where losses are deteriorating or hemorrhaging (e.g. a Blockbuster or Enron). Another main factor in stock price valuations is interest rates. Investors will pay more for a given stream of earnings in a low interest rate environment relative to a high interest rate environment. Investors lived through this in the early 1980s when stocks traded at puny 7-8x P/E ratios due to double-digit inflation and a Federal Funds rate that peaked near 20%.

Bears Come Out of Hibernation

Today, earnings portray a different picture relative to the early eighties. Not only are S&P 500 operating earnings growing at a healthy estimated rate of +17% in 2011, but the 10-year Treasury note is also trading at a near-record low yield of 3.06%. In spite of these massively positive earnings and cash flow dynamics occurring over the last few years, the recent -3% pullback in the S&P 500 index from a month ago has awoken some hibernating bears from their caves. Certainly a slowing or pause in the overall economic indicators has something to do with the newfound somber mood (i.e., meager Q1 real GDP growth of +1.8% and rising unemployment claims). Contributing to the bears’ grumpy moods is the economic debt hangover we are recovering from. However, a large portion of the fundamental economic expansion experienced by corporate America has not been fueled by the overwhelming debt still being burned off throughout the financial sector and eventually our federal and state governments. Companies have become leaner and meaner – not only paying down debt, but also increasing dividends, buying back stock, and doing more acquisitions. The corporate debt-free muscle is further evidenced by the $100 billion in cash held by the likes of IBM, Microsoft Corp. (MSFT), and Google Inc. (GOOG) – and still growing.

At a 13.5x P/E multiple of 2011 earnings, perhaps the stock market is pricing in an earnings slowdown? But as of last week, about 70% of the S&P 500 companies reporting Q1 earnings have exceeded expectations. If this trend continues, perhaps we will see James Carville on CNBC rightfully shouting the maxim, “It’s the earnings, stupid!”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and GOOG, but at the time of publishing SCM had no direct position in IBM, MSFT, Blockbuster, Enron, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Listening for Dinner Bell or Penalty Whistle?

Excerpt from my monthly newsletter (sign-up on the right of page)…

Investors are eagerly waiting on the sidelines wondering whether to listen for a dinner bell signaling the time to sink their teeth into traditional equity investments, or respond to a penalty whistle by nervously maintaining money in depleted, inflation-losing CDs. A large swath of investors are still scarred from the losses experienced from the 2008-2009 financial crisis and are trying to rationalize the recent +80% move in equity markets (S&P 500 index) over the last 18 months. Eating saltine crackers and drinking water in CDs and money market accounts yielding < 1% feels OK when the world is collapsing around you, but eventually people realize retirement goals are tough to achieve with the money stuffed under the mattress.

Here are some recent bells and whistles we are listening to:

Mid-Term Elections: Regardless of your politics, Republicans are forecasted to regain control of the House of Representatives, while expectations for a narrow Democrat Senate majority remains the consensus. Currently, Democrat Jerry Brown is a handful of points in the lead over Meg Whitman for the California governor’s race. Another issue voters are closely monitoring is the likelihood of Bush tax-cut extensions.

Printing Press Part II: The Federal Reserve has strongly hinted of another round at the printing press in an effort to stimulate the economy by keeping interest rates low (e.g., record low 30-year fixed mortgage rates around 4.2%). The Fed accomplishes this so-called Quantitative Easing (or QE2) by purchasing Treasuries and mortgage backed securities – pumping more dollars into the financial system to expand credit and loans. In addition, QE2 is structured to stimulate the meager 0.8% core inflation experienced over the last 12 months (Bloomberg) to a Goldilocks level – not too hot and not too cold. QE2 asset purchase estimates are all over the map, but estimates generally stand at the low end of the original $200 billion to $2 trillion range.

Growth Continues: Although companies are sitting on record piles of cash ($1.8 trillion for all non-financial companies), chief executive officers continue to have short arms with their deep pockets when it comes to spending on new hires. Persistent growth for five consecutive quarters (2% GDP expansion in Q2), coupled with tight cost controls, is resulting in 46% estimated growth in 2010 corporate profits as measured by the average of S&P 500 companies. For the time being, “double dip” worries have been put on hold for this jobless recovery.

Unemployment Hypochondria: As I wrote in an earlier Investing Caffeine article (READ HERE), there is an almost obsessive focus on the unemployment rate, which although moving in the right direction, remains at a stubbornly high 9.6% rate nationally. Fresh new employment data will be released this Friday.

Foreclosure-gate: As foreclosures have increased and the decline in the housing market has matured, investors have grown more impatient with collections from mortgage backed securities originators. Banks and other mortgage lenders could face more than $100 billion in losses (CNBC) in mortgage “putbacks” related to improper packaging and terms disclosed to investors. Lawyers are salivating at the opportunity of litigating the thousands of potential cases across the country.

Create Your Own Blueprint – Block Noise

In reality, there is no dinner bell or penalty whistle when it comes to investing. Sure, we hear dinner bells and whistles every day on TV from strategists and economists, but in this sordid, cacophony of daily noise, the long line-up of soothsayers are constantly switching back and forth between optimistic bells and pessimistic whistles. The consistent onslaught of this indiscernible noise serves no constructive purpose for the average investor. I strongly believe the correct plan of attack is to create a customized investment plan that meets your long-term objectives, constraints, and risk tolerance. By creating a diversified portfolio of low-cost tax-efficient products and strategies, I believe investors will be more securely positioned for a more comfortable and less stressful retirement.

I have my own opinions on the economic environment, which I detail in excruciating detail through my InvestingCaffeine.com writings. These macro-economic opinions are stimulating but have little to no bearing on the construction of my investment portfolios. More important is focusing on the investment areas with the best fundamental prospects, while balancing risk and return for each client.

Despite what I just said, if you are still determined to know my opinions on the market direction, then follow me to the dinner table; I just heard the dinner bell ring.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.