Posts tagged ‘GDP’

Have Peripheral Colds Caused a U.S. Recession Flu?

At the trough of the recent correction, which was underscored by a brief but sharp -1,100 point drop in the Dow Jones Industrial Average, the Dow had temporarily corrected by -16.2% from its peak in May, earlier this year. Whether we retest or break below the 15,370 level again is debatable, but with the Dow almost reaching “bear market” (-20%) territory, it begs the question of whether the U.S. has caught a recessionary flu from the ill international markets’ colds?

Certainly, several factors have investors concerned about a potential recession, including the following: slowing growth and financial market instability in China; contraction of -0.4% in Japan’s Q2 GDP growth; and turmoil in emerging markets like Russia and Brazil. With stock prices down more than double digits, it appears investors factored in a significant chance of a recession occurring. Although the Tech Bubble of 2000 and generational Great Recession of 2008-2009 were no ordinary recessions, your more garden variety recessions like the 1980 and 1990 recessions resulted in peak to trough declines in the Dow Jones Industrial Average of -20.5% and -22.5%, respectively.

In other words, with the Dow recently down -16.2% in three months, investors were awfully close to factoring in a full blown U.S. recession. Should this be the case? In answering this question, one must certainly understand the stock market is a predicting or discounting mechanism. However, if we pull out our economic thermometers, right now there are no definitive indicators sending us to the recessionary doctor’s office. Here are a number of the indicators to review.

Yield Curve Indicator

For starters, let’s take a look at the yield curve. Traditionally, in a normally expanding economy, we would normally expect inflationary expectations and a term premium for holding longer maturity bonds to equate to a positively shaped yield curve (e.g., shorter term 2-Year Treasuries with interest rates lower than 30-Year Treasuries). Interestingly, historically an inverted yield curve (shorter term interest rates are higher than longer term rates) has been an excellent leading indicator and warning signal for unhealthy stock market conditions forthcoming.

As you can see in the charts below, before the two preceding recessions, in the years 2000 and 2007, we experienced an inverted yield curve that served as a tremendous warning signal in advance of significant downdrafts in stock prices. If you fast forward to today, the slope of the yield curve is fairly steeply sloped – nowhere close to inverted. When the yield curve flattens meaningfully, I will become much more cautious.

The Oil Price Indicator

There is substantial interest and focus on the recessionary conditions in the energy sector, and more specifically the high yield (junk bond) issuers that could suffer. It is true that high yield energy credit spreads have widened, but typically this sector’s pain has been the economy’s gain, and vice versa. The chart below shows that the gray shaded recessionary time periods have classically been preceded by spikes upward in oil prices. As you know, we currently are experiencing the opposite trend. Over the last 12 months, WTI oil prices have been chopped by more than half to $45 per barrel. This is effectively a massive tax for consumers, which should help support the economy.

Other Macro Statistics

Toward the top of any recession-causing, fear factor list right now is China. Slowing economic growth and an unstable Shanghai stock market has investors nervously biting their nails. Although China is the 2nd largest global economy behind the U.S., China still only accounts for about 15% of overall global economic activity, and U.S. exports to the region only account for about 0.7% of our GDP, according to veteran Value investor Bill Nygren. If on top of the China concern you layer a fairly strong U.S. labor market, an improving housing market (albeit slowly), and a recently revised higher GDP statistics, you could probably agree the economic dashboard is not signaling bright red flashing lights.

There is never a shortage of concerns to worry about, including most recently the slowing growth and stock market turbulence in China. While volatility may be implying sickness and international markets may be reaching for the Kleenex box, the yield curve, oil prices, and other macroeconomic indicators are signaling the outlook for U.S. stock remains relatively healthy.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

U.S. Takes Breather in Windy Economic Race

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (May 1, 2015). Subscribe on the right side of the page for the complete text.

Looking back, in the race for financial dominance, the U.S. economy sprinted out to a relatively quick recovery from the 2008-2009 financial crisis injury compared to its other global competitors. The ultra-loose monetary policies implemented by the Federal Reserve (i.e., zero percent Fed Funds rate, quantitative easing – QE, Operation Twist, etc.) and the associated weakening in the value of the U.S. dollar served as tailwinds for growth. The low interest rate byproduct created cheaper borrowing costs for consumers and businesses alike for things like mortgages, refinancings, stock buybacks, and infrastructure investments. The cheaper U.S. dollar also helped domestically based, multinational companies sell their goods abroad at more attractive prices.

However, those positive dynamics have now changed. With the end of stimulative bond buying (QE) and threats of imminent interest rate hikes coming from the Federal Reserve and its Chairwoman Janet Yellen, the tailwinds for the U.S. economy have now transitioned into headwinds. The measly +0.2% growth recently reported in the 1st quarter – Gross Domestic Product (GDP) results are evidence of an economy currently sucking wind (see chart below).

As it relates to the stock market, the Dow Jones crept up +0.4% for the month of April to 17,841, and is essentially flat for all of 2015. Small Cap stocks in the Russell 2000® Index (companies with an average value of $2 billion – IWM), pulled a muscle in April as shown by the index’s -2.6% tumble. A slight increase in the yield of the 10-Year Treasury to 2.05% caused bond prices to contract a modest -0.5% for the month.

Beyond a strengthening dollar and threats of rising interest rates, debilitating port strikes on the West Coast and abnormally cold weather especially back east also contributed to weak trade data and sub par economic performance. Although a drop in oil and gasoline prices should ultimately be stimulative for broader consumer and industrial activity, the immediate negative impacts of job losses and declining drilling in the energy sector added to the drag on 1st quarter GDP results.

The good news is that many of the previously mentioned negative factors are temporary in nature and should self-correct themselves as we enter the 2nd quarter. One positive aspect to our country’s strong currency is cheaper imports. So, as the U.S. recovers from its temporary currency cramps, foreigners will continue pumping out cheap exports to Americans for purchase. If this import phenomenon lasts, these lower priced goods, coupled with discounted oil prices, should keep a lid on broader inflation. The benefit of lower inflation means the Federal Reserve is more likely to postpone slamming the brakes on the economy with interest rate hikes. The decision of when to lift interest rates will ultimately be data-dependent. Due to the lousy 1st quarter numbers, it will probably take some time for economic momentum to reemerge, and therefore the Fed is unlikely to raise interest rates until September, at the earliest.

The great thing about financial markets and economics is many of these swirling monetary winds eventually self-correct themselves. And during April, we saw these self-correcting mechanisms up close and in person. For example, from March 2014 to March 2015 the U.S. dollar appreciated in value by about +25% versus the euro currency (FXE). However, from the peak exchange rate seen this March, the value of the U.S. dollar declined by about -7%. The same self-correcting principle applies to the oil market. From the highs reached in mid-2014 at about $108 per barrel, crude oil prices plunged by about -60% to a low of $42 per barrel in March. Since then, oil prices have recovered significantly by spiking over +40% to about $60 per barrel today.

Competitors Narrow the Gap with the U.S.

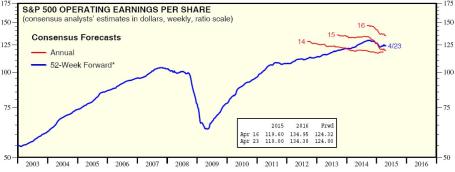

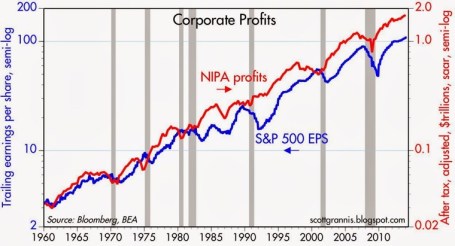

As I’ve written many times in the past, one of the ultimate arbiters of stock price performance is the long-term direction of corporate profits. And as you can see from the chart above, profits have hit a bump in the road after a fairly uninterrupted progression over the last six years. The decline is nowhere near the collapse of 2008-2009, but given the rise in stock prices, investors should be prepared for the bears and skeptics to become more vocal.

And while the U.S. has struggled a bit, European and Asian shares have advanced significantly. To that point, Asian equities (FXI) spiked an impressive +16% in April (see chart below) and European stocks jumped a respectable +4% (VGK) over the same timeframe.

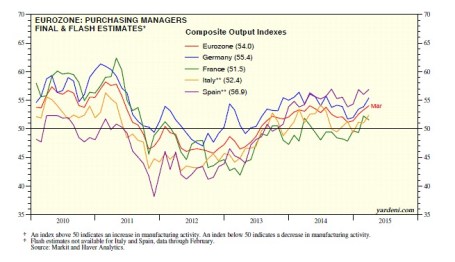

Bolstering the advance in China’s shares has been the Chinese central bank’s move to cut the amount of cash that banks must hold as reserves (“reserve requirements”). The action by the central bank is designed to spur bank lending and combat slowing growth in the world’s second largest economy. The Europeans are not sitting idly on their hands either. European central bankers have taken a cheat sheet page from the U.S. playbook and have introduced their own form of trillion dollar+ quantitative easing (see Draghi Provides Beer Goggles) in hopes of jump starting the European economy. Given the moves, how is the European business activity picture looking? Well, based on the Eurozone Purchasing Managers’ Index (PMI), you can see from the chart below that the region is finally growing (readings > 50 indicate expansion).

The economic winds in the global race for growth have been swirling in all directions, and due to temporary headwinds, the dominating lead of the U.S. has narrowed. Fortunately for long-term investors, they understand investing is a marathon and not a sprint. Holding a globally balanced and diversified portfolio will help you maintain the stamina required for these volatile and windy economic times.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), FXI, VGK, and a short position in FXE, but at the time of publishing, SCM had no direct position in IWM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Treadmill Market – Jogging in Place

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (April 1, 2014). Subscribe on the right side of the page for the complete text.

After the stock market raced ahead to about a +30% gain last year, it became clear this meteoric trend was not sustainable into perpetuity. Correct investing should be treated more like a marathon than a sprint. After dashing ahead by more than +100% over the last handful of years, 2014 stock prices took a breather by spending the first quarter jogging in place. Like a runner on the treadmill, year-to-date returns equated to a -0.7% for the Dow Jones Industrial Average index, and +1.3% for the S&P index. Digesting the large gains from previous years, despite making no discernable forward progress this quarter, is a healthy exercise that builds long-term portfolio endurance. As far as I’m concerned, nothing in life worthwhile comes easy, and the first three months of the year have demonstrated this principle.

As I’ve written in the past (see Series of Unfortunate Events), there is never a shortage of issues to worry about. The first few months of 2014 have been no exception. Vladimir Putin’s strong armed military backed takeover of Crimea, coupled with the Federal Reserve’s unwinding $30 billion of the $85 billion of its “Quantitative Easing” bond buying program (i.e. tapering) have contributed to investors’ nervousness. When the “Fairy Godmother of the Bull Market,” Federal Reserve Chair Janet Yellen, hinted at potentially raising interest rates in about 12 months, the mood soured further.

The unseasonably cold winter back east (a.k.a., Polar Vortex) has caused some additional jitters due to the dampening effects on economic conditions. More specifically, economic growth as measured by GDP (Gross Domestic Product) is expected to come in around a meager +2.0% rate during the first quarter of 2014, before picking up later in the year.

And if that isn’t enough, best-selling author Michael Lewis, whose books include Money Ball, The Blind Side, and Liar’s Poker, just came out on national television and sparked a debate with his controversial statement that the “stock market is rigged.” (read and listen more here)

Runners High

But as always, not everything is gloom and doom. Offsetting the temporary price fatigue, resilient record corporate profits have supported the surprising market stamina. Like a runner’s high, corporations are feeling elated about historically elevated profit margins. As you can see from the chart below, the reason it’s prudent for most to have some U.S. equity exposure is due to the clear, upward multi-decade trend of U.S. corporate earnings.

While the skeptics wait for these game-ending dynamics to take root, core economic fundamentals in areas like these remain strong:I didn’t invent the idea of profits impacting the stock market, but the concept is simple: stock prices generally follow earnings over long periods of time (see It’s the Earnings, Stupid). In other words, as profits accelerate, so do stock prices – and the opposite holds true (decelerating earnings leads to price declines). This direct relationship normally holds over the long-run as long as the following conditions are not in place: 1) valuations are stretched; 2) a recession is imminent; and/or 3) interest rates are spiking. Fortunately for long-term investors, there is no compelling evidence of these factors currently in place.

Employment Adrenaline

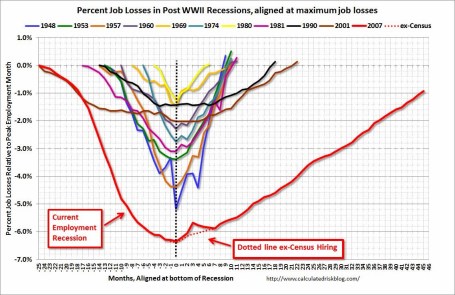

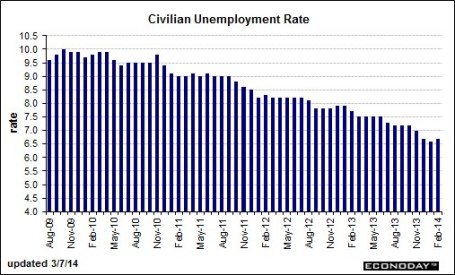

The employment outlook received a boost of adrenaline last month. Despite the slight upward nudge in the unemployment rate to 6.7%, total nonfarm payroll jobs increased by +175,000 in February versus a +129,000 gain in January and an +84,000 gain in December. Not only was last month’s increase better than expectations, but the net figures calculated over the previous two months were also revised higher by +25,000 jobs. As you can see below, the improvement since 2009 has been fairly steady, but as the current rate flirts with the Fed’s 6.5% target, Chair Yellen has decided to remove the quantitative objective. The rising number of discouraged workers (i.e., voluntarily opt-out of job searching) and part-timers has distorted the numbers, rendering arbitrary numeric targets less useful.

Source: Barron’s Online

Housing Holding Strong

In the face of the severe winter weather, the feisty housing market remains near multi-year highs as shown in the 5-month moving average housing start figure below. With the spring selling season upon us, we should be able to better gauge the impact of cold weather and higher mortgage rates on the housing market.

Source: Barron’s Online

Even though stock market investors found themselves jogging in place during the first quarter of the year, long-term investors are building up endurance as corporate profits and the economy continue to consistently grow in the background. Successful investors must realize stock prices cannot sustainably sprint for long periods of time without eventually hitting a wall and collapsing. Those who recognize investing as a marathon sport, rather than a mad dash, will be able to jump off the treadmill and ultimately reach their financial finish line.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Can Good News be Good News?

There has been a lot of hyper-taper sensitivity of late, ever since Fed Chairman Ben Bernanke broached the subject of reducing the monthly $85 billion bond buying stimulus program during the spring. With a better than expected ADP jobs report on Wednesday and a weekly jobless claims figure on Thursday, everyone (myself) included was nervously bracing for hot November jobs number on Friday. Why fret about potentially good economic numbers? Firstly, as a money manager my primary job is to fret, and secondarily, stronger than forecasted job additions in November would likely feed the fear monster with inflation and taper alarm, thus resulting in a triple digit Dow decline and a 20 basis point spike in 10-year Treasury rates. Right?

Well, the triple digit Dow move indeed came to fruition…but in the wrong direction. Rather than cratering, the Dow exploded higher by +200 points above 16,000 once again. Any worry of a potential bond market thrashing fizzled out to a flattish whimper in the 10-year Treasury yield (to approximately 2.86%). You certainly should not extrapolate one data point or one day of trading as a guaranteed indicator of future price directions. But, in the coming weeks and months, if the economic recovery gains steam I will be paying attention to how the market reacts to an inevitable Fed tapering and likely rise in interest rates.

The Expectations Game

Interpreting the correlation between the tone of news and stock direction is a challenging endeavor for most (see Circular Conversations & Tweet), but stock prices going up on bad news has not a been a new phenomenon. Many will argue the economy has been limp and the news flow extremely weak since stock prices bottomed in early 2009 (i.e., Europe, Iran, Syria, deficits, debt downgrade, unemployment, government shutdown, sequestration, taxes, etc.), yet actual stock prices have chugged higher, nearly tripling in value. There is one word that reconciles the counterintuitive link between ugly news and handsome gains…EXPECTATIONS. When expectations in 2009 were rapidly shifting towards a Great Depression and/or Armageddon scenario, it didn’t take much to move stock prices higher. In fact, sluggish growth coupled with historically low interest rates were enough to catapult equity indices upwards – even after factoring in a dysfunctional, ineffectual political backdrop.

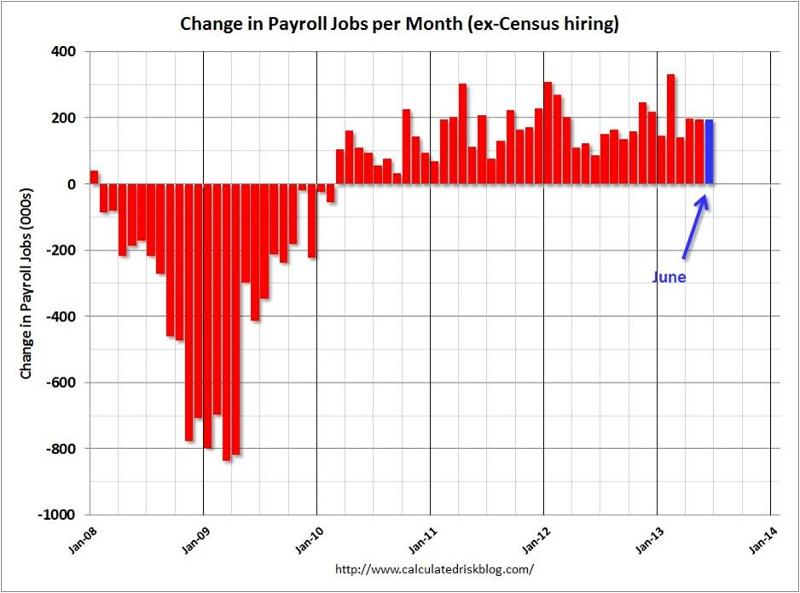

From a longer term economic cycle perspective, this recovery, as measured by job creation, has been the slowest since World War II (see Calculated Risk chart below). However, if you consider other major garden variety historical global banking crises, our crisis is not much different (see Oregon economic study).

While it’s true that stock prices can go up on bad news (and go down on good news), it is also possible for prices to go up on good news. Friday’s trading action after the jobs report is the proof of concept. As I’ve stated before, with the meteoric rise in stock prices, it’s my view the low hanging profitable fruit has been plucked, but there is still plenty of fruit on the trees (see Missing the Pre-Party). I am not the only person who shares this view.

Recently, legendary investor Warren Buffett had this to say about stocks (Source: Louis Navellier):

“I don’t have concerns about this market.” Buffet said stocks are “in a zone of reasonableness. Five years ago,” Buffett said, “I wrote an article for The New York Times that said they were very cheap. And every now and then, you can see that that they’re very overpriced or very underpriced.” Today, “they’re definitely not way overpriced. They’re definitely not underpriced.” “If you live long enough,” Buffett said, “you’ll see a lot higher prices. I don’t know what stocks will do next week or next month or next year, but five or 10 years from now, they are very likely to be higher.”

However, up cycles eventually run their course. As stocks continue to go up on good news, ultimately they begin to go down on good news. Expectations in time tend to get too lofty, and the market begins to anticipate a downturn. Stock prices are continually incorporating information that reflects the direction of future earnings and cash flow prospects. Looking into the rearview mirror at historical results may have some value, but gazing through the windshield and anticipating what’s around the corner is more important.

Rather than getting caught up with the daily mental somersault exercises of interpreting what the tone of news headlines means to the stock market (see Sentiment Pendulum), it’s better to take a longer-term cyclical sentiment gauge. As you can see from the chart below, waiting for the bad news to end can mean missing half of the upward cycle. And the same principle applies to good news.

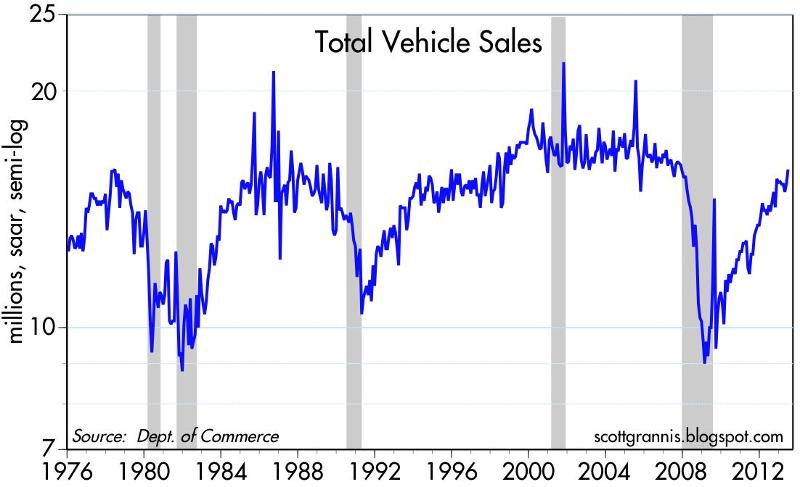

Bad news can be good news for stock prices, and good news can be bad for stock prices. With the spate of recent positive results (i.e., accelerating purchasing manager data, robust auto sales, improving GDP, better job growth, and more new-home sales), perhaps good news will be good news for stock prices?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

To Taper or Not to Taper…That is the Question?

It’s not Hamlet who is providing theatrical intrigue in the financial markets, but rather Federal Reserve Chairman Ben Bernanke. Watching Bernanke decide whether to taper or not to taper the $85 billion in monthly bond purchases (quantitative easing) is similar to viewing an emotionally volatile Shakespearean drama. The audience of investors is sitting at the edge of their seats waiting to see if incoming Fed Chief will be plagued with guilt like Lady Macbeth for her complicit money printing ways or will she score a heroic and triumphant victory for her hawkish stance on quantitative easing (QE). No need to purchase tickets at a theater box office near you, the performance is coming live to your living room as Yellen’s upcoming Senate confirmation hearings will be televised this upcoming week.

Bad News = Good News; Good News = Bad News?

In deciding whether to slowly kill QE, the Fed has been stricken with the usual stream of never-ending economic data (see current data from Barry Ritholtz). Most recently, investors have followed the script that says bad news is good news for stocks and good news is bad news. So-called pundits, strategists, and economists generally believe sluggish economic data will lead the Fed to further romance QE for a longer period, while robust data will force a poisonous death to QE via tapering.

Good News

Despite the recent, tragically-perceived government shutdown, here is the week’s positive news that may contribute to an accelerated QE stimulus tapering:

- Strong Jobs: The latest monthly employment report showed +204,000 jobs added in October, almost +100,000 more additions than economists expected. August and September job additions were also revised higher.

- GDP Surprise: 3rd quarter GDP registered in at +2.8% vs. expectations of 2%.

- IPO Dough: Twitter Inc (TWTR) achieved a lofty $25,000,000,000 initial public offering (IPO) value on its first day of trading.

- ECB Cuts Rates: The European Central Bank (ECB) lowered its key benchmark refinancing rate to a record low 0.25% level.

- Service Sector Surge: ISM non-manufacturing PMI data for October came in at 55.4 vs. 54.0 estimate.

Bad News

Here is the other side of the coin, which could assist in the delay of tapering:

- Mortgage Apps Decline: Last week the MBA mortgage application index fell -7%.

- Jobless # Revised Higher: Last week’s Initial jobless Claims were revised higher by 5,000 to 345,000.

- Investors Too Happy: The spread between Bulls & Bears is highest since April 2011 as measured by Investors Intelligence

Much Ado About Nothing

With the recent surge in the October jobs numbers, the tapering plot has thickened. But rather than a tragic death to the stock market, the inevitable taper and eventual tightening of the Fed Funds rate will likely be “Much Ado About Nothing.” How can that be?

As I have written in an article earlier this year (see 1994 Bond Repeat), the modest increase in 2013 yields (up +1.35% approximately) from the July 2012 lows pales in comparison to the +2.5% multi-period hike in the 1994 Federal Funds rate by then Fed Chairman Alan Greenspan. What’s more, inflation was a much greater risk in 1994 with GDP exceeding 4.0% and unemployment reaching a hot 5.5% level.

Given an overheated economy and job market in 1994, coupled with a hawkish Fed aggressively raising rates, the impact of these factors must have been disastrous for the stock market…right? WRONG. The S&P 500 actually finished the year essentially flat (~-1.5%) after experiencing some volatility earlier in the year, then subsequently stocks went on a tear to more than triple in value over the next five years.

To taper or not to taper may be the media question du jour, however the Fed’s ultimate decision regarding QE will most likely resemble a heroic Shakespearean finale or Much Ado About Nothing. Panicked portfolios may be in love with cash like Romeo & Juliet were with each other, but overreaction by investors to future tapering and rate hikes may result in poisonous or tragic returns.

Referenced article: 1994 Bond Repeat or 2013 Stock Defeat?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in TWTR, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page. Some Shakespeare references were sourced from Kevin D. Weaver.

The Teflon Market

At the pace of all this head-scratching going on, our population is likely to turn completely bald. One thing is for certain, nothing has scratched this Teflon stock market. If you want to have fun with a friend, family member or co-worker, just ask them how they feel about politics and then ask them how stocks have done this year? You’re bound to get some entertaining responses. Despite a Congress that has a lower favorability rating than cockroaches, lice, root canals, and colonoscopies , the S&P 500 index is up a whopping +22% and the NASDAQ index + 30% this year, both records. The USA Today ran with the Teflon theme and had this to say:

“This year alone the stock market has survived the recent brush with a U.S. debt default. It has also survived a government shutdown. Tax hikes. Government spending cuts. The threat of war. Terror at the Boston Marathon. A spike in interest rates. Plunging Apple shares. Stock exchange glitches. Fears of a less-friendly Federal Reserve. And a narrow escape from going over the “fiscal cliff.” Nothing bad seems to stick.”

The reason nothing is sticking to this Teflon market is because the market is more sensitive to reality rather than perception. Here are some come current discrepancies between these two states:

Perception: The economy is on the verge of a recession. Reality: The economy has grown GDP for 15 of the last 16 quarters. The private sector has added about 7.5 million jobs and the unemployment rate has been cut by about three percentage points.

Perception: Corporations are struggling. Reality: Corporations are actually posting record profits; increasing dividends significantly; buying back stock; and registering record profit margins.

Perception: The Federal Reserve controls the economy. Reality: Federal Reserve Chairman Ben Bernanke has little to no influence on decisions made by companies like Google Inc (GOOG), Facebook Inc (FB), McDonald’s Corp (MCD), Tesla Motors Inc (TSLA), and Target Corporation (TGT) (see also The Greatest Thing Since Sliced Bread). Interest rates are actually higher than when QE1 (quantitative easing) was first implemented, yet growth persists.

These types of mental mistakes occur outside the realm of financial markets as well. For example, most people fail to correctly answer the question, “Which animal is responsible for the greatest number of human deaths in the U.S.?”

A.) Alligator; B.) Bear; C.) Deer; D.) Shark; and E.) Snake

The ANSWER: C) Deer.

Deer colliding into cars trigger seven times more deaths than alligators, bears, sharks, and snakes combined, according to Jason Zweig at the Wall Street Journal (see also Alligators & Airplane Crashes). Other mental disconnects include the belief that planes are more dangerous than cars. In fact, people are 65 times more likely to get killed in your own car versus a plane. Also, misconceptions exist that guns are more dangerous than smoking, or that tornadoes are more dangerous than asthma – both beliefs wrong.

Party Not Over Yet

Long-time followers and readers of Investing Caffeine know that I’ve been an active participant in this bull market that started in 2009, evidenced by my critical views of Armageddonists like Peter Schiff, John Mauldin, Nouriel Roubini, Meredith Whitney, and other doom & gloomers.

I fully recognize there’s no honor in being Pollyannaish or a perma-bull just for the sake of it. However, it’s also very clear that excessive fear exercised by many investors proved very painful as S&P 500 level 666 has exploded to 1,744. The extreme panic that reached a pinnacle in 2009 has now morphed into an insidious skepticism (see Sentiment Pendulum ). Investor emotions continually swing from fear to greed, and with the political shenanigans going on in Washington DC, the skeptical pendulum has a long way before reaching euphoric levels. Or stated differently, the pre-party is over (see my article from earlier this year, Those Who Missed the Pre-Party), but the DJ is still playing and the cops aren’t here to break up the party yet.

I agree that we’ve had a Teflon market for a handful of years. There have been a few minimal scratches and a few hand burns along the way, but for the most part, those investors who have stayed invested and ignored the endless manufactured crisis headlines have been rewarded handsomely. Investing in stocks will always cause some heartburn, but if you don’t want your long-term retirement to get grilled, seared, pan-fried, or flambéed, then you want to make sure you still have some stocks in your Teflon pan.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), AAPL and GOOG, but at the time of publishing, SCM had no direct position in FB, TGT, TSLA, MCD, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Take Me Out to the Stock Game

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (October 1, 2013). Subscribe on the right side of the page for the complete text.

The Major League Baseball playoffs are just about to start, and the struggling U.S. economy is also trying to score some more wins to make the postseason as well. In 2008 and early 2009, the stock market looked more like The Bad News Bears with the S&P 500 index losing -58% of its value from the peak to the trough. The overleveraged (debt-laden) financial system, banged by a speculative housing bubble, swung the global economy into recession and put a large part of the economic team onto the disabled list.

Since the lows of 2009, S&P 500 stocks have skyrocketed +152%, including an +18% gain in 2013, and a +3% jump in September alone. With that incredible track record, one might expect a euphoric wave of investors pouring into the stock market stadium, ready to open their wallets at the financial market concession stand. Au contraire. Despite the dramatic winning streak, investors remain complacent skeptics, analyzing and critiquing every political, economic, and financial market movement and gyration.

Unfortunately, as stock prices have scored massive gains, many market followers have been too busy eating peanuts and drinking beer, rather than focusing on the positive economic statistics in the scorebook, such as these:

15/16 Quarters of Positive GDP Growth:

|

| Source: Crossing Wall Street |

Precipitous Drop in Unemployment Claims: The lowest level since 2007 (7.5 million private sector jobs added since employment trough).

|

| Source: Bespoke |

All-Time Record Corporate Profits:

|

| Source: Ed Yardeni |

Financially Healthier Consumer – Lower Debt & Higher Net Worth:

|

| Source: Scott Grannis |

Improving Housing Market:

|

| Source: Scott Grannis |

While you can see a lot of financial momentum is propelling Team USA, there are plenty of observers concerned more about potential slumps and injuries emanating from a lineup of uncertainties. Currently, the fair-weather fans who are sitting in the bleachers are more interested in the uncertainty surrounding a government shutdown, debt ceiling negotiations, Syrian unrest, Iranian nuclear discussions, Obamacare defunding, and an imminent tapering of the Federal Reserve’s QE bond purchasing program (see Perception vs. Reality). The fearful skepticism of the fans has manifested itself in the form of a mountain of cash ($7 trillion), which is rapidly eroding to inflation and damaging millions of retirees’ long-term goals (see chart below). The fans sitting in the bleachers are less likely to buy long-term season tickets until some of these issues are settled.

|

| Source: Scott Grannis – $3 trillion added since crisis. |

The aforementioned list of worries are but a few of the concerns that have investors biting their nails. While there certainly is a possibility the market could be thrown a curve ball by one of these issues, veteran all-star investors understand there are ALWAYS uncertainties, and when the current list of concerns eventually gets resolved or forgotten, you can bet there will be plenty of new knuckle-balls and screw-balls (i.e., new list of worries) to fret over in the coming weeks, months, and years (see Back to the Future I, II,& III). Ultimately, the vast majority of concerns fade away.

Yoooouuuuuu’rrrreee Out!

The politicians in Washington are a lot like umpires, but what our country really needs are umpires who can change and improve the rules, especially the silly, antiquated ones (see also Strangest Baseball Rules). The problem is that bad rules (not good ones) often get put in place so the umpires/politicians can keep their jobs at the expense of the country’s best interest.

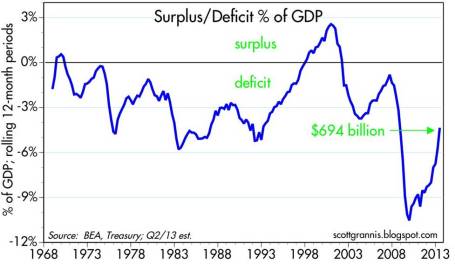

When umpires (politicians) cannot agree on how to improve the rules, gridlock actually is the next best outcome (see Who Said Gridlock is Bad?). The fact of the matter is that deficits and debt/GDP ratios have declined dramatically in recent years due in part to bitter political feuds (see chart below). When responsible spending is put into action, good things happen and a stronger economic foundation can be established to cushion future crises.

|

| Source: Scott Grannis |

There is plenty of room for improvement, but the statistics speak for themselves, which help explain why patient fans/investors have been handsomely rewarded with a homerun over the last four years. October historically has been a volatile month for the stock market, and the looming government shutdown and $16.7 trillion debt ceiling negotiations may contribute to some short-term strike-outs. However, if history proves to be a guide, stocks on average rise +4.26% during the last three months of the year (source: Bespoke), meaning the game may just not be over yet. With plenty of innings remaining for stocks to continue their upward trajectory, I still have ample time to grab my hot dog and malt during the 7th inning stretch.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in TSLA, PBI, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is the information to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Who Said Gridlock is Bad?

Living in Southern California is extraordinary, but just like anything else, there are always tradeoffs, including traffic. Living in the United States is extraordinary too, but one of the detrimental tradeoffs is political gridlock…or is it? I am just as frustrated as anybody else that the knucklehead politicians in Washington can’t get their act together (especially on bipartisan issues such as taxes/immigration/deficits, etc.), but as it turns out, gridlock has created a significant financial silver lining.

Let’s take a look at some of the positive impacts of gridlock:

1) Federal Spending as % of GDP Declines

The demands of both Tax-and-Spend Democrats and Tea-Partier Republicans fell on deaf ears thanks to gridlock. The U.S. didn’t institute the depth of austerity that the far-right wanted, and Congress didn’t implement the additional fiscal stimulus the far-left desired. The result has been a slow but steady recovery, which has brought spending closer to historical averages.

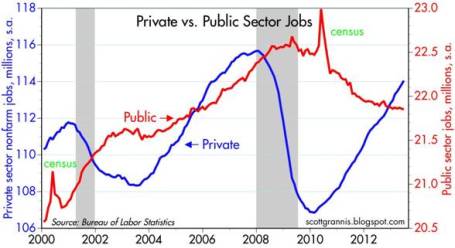

2) Private vs. Public Sector

The implementation of more responsible (or less irresponsible) government spending has freed up resources and allowed the private sector to slowly add jobs. The next wave of sequestration spending cuts may unleash some more pain on the public sector and delay overall economic recovery further, but just like dieting, we will feel much better once we have shed more debt and spending – at least as a percentage of GDP.

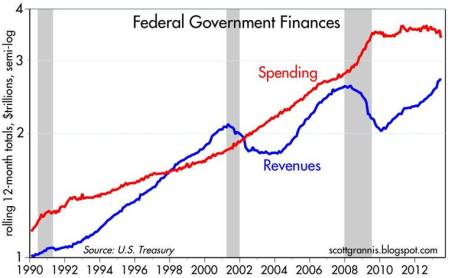

3) Deficit Reduced Significantly

The chart above is closely tied to point #1 (government spending), but as you can see, revenues have climbed significantly since 2010. I would argue plain economic cyclicality has more impact on the volatility of revenues. Blaming the current administration on the collapse or crediting them for the rebound is probably overstated. Comprehensive tax reform would likely have a lot more impact on the slope of revenues relative to the recent tax policy changes.

The same picture can be seen from a different angle, as shown above (Deficit as % of GDP). While the absolute dollar amounts are staggeringly high, as a percentage of GDP, the percentage has been chopped by more than half since the peak of the crisis.

Everyone would like to see politicians solve all of our problems, but as we have experienced, deep philosophical differences can lead to political gridlock. When it comes to our nation’s finances, gridlock may not be optimal, but you can also see that a stalemate is not always the worst outcome either. As politicians continue to scream at each other with purple faces, I will monitor the developments from my car radio while in California gridlocked traffic…sunroof open of course.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Markets Soar and Investors Snore

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (August 1, 2013). Subscribe on the right side of the page for the complete text.

If you haven’t been paying close attention, or perhaps if you were taking a long nap, you may not have noticed that the stock market was up an astounding +5% in July (+78% if compounded annualized), pushing the S&P 500 index up +18% for the year to near all-time record highs. Wait a second…how can that be when that bald and grey-bearded man at the Federal Reserve has hinted at bond purchase “tapering” (see also Fed Fatigue)? What’s more, I thought the moronic politicians were clueless about our debt and deficit-laden economy, jobless recovery, imploding eurozone, Chinese real estate bubble, and impending explosion of inflation – all of which are expected to sink our grandchildren’s grandchildren into a standard of living not seen since the Great Depression. Okay, well a dash of hyperbole and sarcasm never hurt anybody.

This incessant stream of doom-and-gloom pouring over our TVs, newspapers, and internet devices has numbed Americans’ psyches. To prove my point, the next time you are talking to somebody at the water cooler, church, soccer game, or happy hour, gauge how excited your co-worker, friend, or acquaintance gets when you bring up the subject of the stock market. If my suspicions are correct, they are more likely to yawn or pass out from boredom than to scream in excitement or do cartwheels.

You don’t believe me? Reality dictates the wounds from the 2008-2009 financial crisis are still healing. Panic and fear may have disappeared, but skepticism remains in full gear, even though stocks have more than doubled in price in recent years. Here is some data to support my case there are more stock detractors than defenders:

Record Savings Deposits

|

| Source: Calafia Beach Pundit |

Although there are no signs of an impending recession, defensive cash hoarded in savings deposits has almost increased by $3 trillion since the end of the financial crisis.

Blah Consumer Confidence

|

| Source: Calafia Beach Pundit |

As you can see from the chart above, Consumer Confidence has bounced around quite a bit over the last 30+ years, but there is no sign that consumer sentiment has turned euphoric.

15-Year Low Stock Market Participation

|

|

Source: Gallup Poll

|

There has been a trickling of funds into stocks in 2013, yet participation in the stock market is at a 15-year low. Investors remain nervous.

Lack of Equity Fund Buying

|

| Source: ICI & Calafia Beach Pundit |

After a short lived tax-driven purchase spike in January, the buying trend quickly turned negative in the ensuing months. Modest inflows resumed into equity funds during the first few weeks of July (source: ICI), but the meager stock fund investments represent < 95% of 2012 positive bond flows ($15 billion < $304 billion, respectively). Moreover, these modest stock inflows pale in comparison to the hundreds of billions in investor withdrawals since 2008. See also Fund Flows Paradox – Investing Caffeine.

Decline in CNBC Viewership

In spite of the stock market more than doubling in value from the lows of 2009, CNBC viewer ratings are the weakest in about 20 years (source: Value Walk). Stock investing apparently isn’t very exciting when prices go up.

The Hater’s Index:

And if that is not enough, you can take a field trip to the hater’s comment section of my most recent written Seeking Alpha article, The Most Hated Bull Market Ever. Apparently the stock market more than doubling creates some hostile feelings.

JOLLY & JOVIAL MEMO

Keeping the previous objective and subjective data points in mind, it’s clear to me the doom-and-gloom memo has been adequately distributed to the masses. Less clear, however, is the dissemination success of the jolly-and-jovial memo. I think Ron Bailey, an author and science journalist at Reason.com (VIDEO), said it best, “News is always bad news. Good news is simply not news…that is our [human] bias.” If you turn on your local TV news, I think you may agree with Ron. Nevertheless, there are actually plenty of happier news items to report, so here are some positive bullet points to my economic and stock market memo:

16th Consecutive Positive GDP Quarter*

|

| Source: Quartz.com |

The broadest measure of economic activity, GDP (Gross Domestic Product), was reported yesterday and came in better than expected in Q2 (+1.7%) for the 16th straight positive reported quarter (*Q1-2011 was just revised to fractionally negative). Obviously, the economists and dooms-dayers who repeatedly called for a double-dip recession were wrong.

40 Consecutive Months & 7 Million Jobs

Source: Calculated Risk

The economic recovery has been painfully slow, but nevertheless, the U.S. has experienced 40 consecutive months of private sector job additions, representing +7.2 million jobs created. With about -9 million jobs lost during the most recent recession, there is still plenty of room for improvement. We will find out if the positive job creation streak will continue this Friday when the July total non-farm payroll report is released.

Housing on the Mend

|

| Source: Calafia Beach Pundit |

New home sales are up significantly from the lows; housing starts have risen about 40% over the last two years; and Case Shiller home prices rose by +12.2% in the latest reported numbers. The housing market foundation is firming.

Auto Sales Rebound

|

| Source: Calafia Beach Pundit |

Auto sales remain on a tear, reaching an annualized level of 15.9 million vehicles, the highest since November 2007, and up +12% from June 2012. Car sales have almost reached pre-recessionary levels.

Record Corporate Profits

|

| Source: Dr. Ed’s Blog |

Optimistic forecasts have been ratcheted down, nonetheless corporate profits continue to grind to all-time record highs. As you can see, operating earnings have more than doubled since 2003. Given reasonable historical valuations in stocks, as measured by the P/E (Price Earnings) ratio, persistent profit growth should augur well for stock prices.

Bad Banks Bounce Back

Europe on the Comeback Trail

|

| Source: Calafia Beach Pundit |

There are signs of improvement in the Eurozone after years of recession. Talks of a European Armageddon have recently abated, in part because of Markit manufacturing manager purchasing statistics that are signaling expansion for the first time in two years.

Overall, corporations are achieving record profits and sitting on mountains of cash. The economy is continuing on a broad, steady recovery, however investors remain skeptical. Domestic stocks are at historic levels, but buying stocks solely because they are going up is never the right reason to invest. Alternatively, bunkering away excessive cash in useless, inflation depreciating assets is not the best strategy either. If nervousness and/or anxiety are driving your investment strategy, then perhaps now is the time to create a long-term plan to secure your financial future. However, if your goal is to soak up the endless doom-and-gloom and watch your money melt away to inflation, then perhaps you are better off just taking another nap.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Risk of “Double-Rip” on the Rise

Okay, you heard it here first. I’m officially anointing my first new 2013 economic term of the year: “Double-Rip!” No, the biggest risk of 2013 is not a “double-dip” (the risk of the economy falling back into recession), but instead, the larger risk is of a double-rip – a sustained expansion of GDP after multiple quarters of recovery. I know, this sounds like heresy, given we’ve had to listen to perma-bears like Nouriel Roubini, Peter Schiff, John Mauldin, Mohamed El-Erian, Bill Gross, et al shovel their consistently wrong pessimism for the last 14 quarters. However, those readers who have followed me for the last four years of this bull market know where I’ve stood relative to these unwavering doomsday-ers. Rather than endlessly rehash the erroneous gospel spewed by this cautious clan, you can decide for yourself how accurate they’ve been by reviewing the links below and named links above:

Roubini calling for double-dip in 2012

Roubini calling for double-dip in 2011

Roubini calling for double-dip in 2010

Roubini calling for double-dip in 2009

If we switch from past to present, Bill Gross has already dug himself into a deep hole just two weeks into the year by tweeting equity markets will return less than 5% in 2013. Hmmm, I wonder if he’d predict the same thing now that the market is up about +4.5% during the first 18 days of the year?

Why Double-Rip Over Double-Dip?

How can stocks rip if economic growth is so sluggish? If forced to equate our private sector to a car, opinions would vary widely. We could probably agree the U.S. economy is no Ferrari. Faster growing countries like China, which recently reported 4th quarter growth of +7.9% (up from +7.4% in 3rd quarter), have lapped us complacent, right-lane driving Americans in recent years. But speed alone should not be investors’ only key objective. If speed was the number one priority, the only places investors would be placing their money would be in countries like Rwanda, Turkmenistan, and Libya (see Business Insider article). However, freedom, rule of law, and entrepreneurial spirit are other important investment factors to be considered. The U.S. market is more like a Toyota Camry – not very flashy, but it will reliably get you from point A to point B in an efficient and safe manner.

Beyond lackluster economic growth, corporate profit growth has slowed remarkably. In fact, with about 10% of the S&P 500 index companies reporting 4th quarter earnings thus far, earnings growth is expected to rise a measly 2.5% from a year ago (from a previous estimate of 3.0% growth). With this being the case, how can stock prices go up? Shrewd investors understand the stock market is a discounting mechanism of future fundamentals, and therefore stocks will move in advance of future growth. It makes sense that before a turn in the economy, the brakes will often be activated before accelerating into another fast moving straight-away.

In addition, valuation acts like shock absorbers. With generational low interest rates and a below-average forward 12-month P/E (Price-Earnings) ratio of 13x’s, this stock market car can absorb a significant amount of fundamental challenges. The oft quoted message that “In the short run, the market is a voting machine but in the long run it is a weighing machine,” from value icon Benjamin Graham holds as true today as it did a century ago. The recent market advance may be attributed to the voters, but long-term movements are ultimately tied to the sustainable scales of sales, earnings, and cash flows.

If that’s the case, how can someone be optimistic in the face of the slowing growth challenges of this year? What 2013 will not have is the drag of election uncertainty, the fiscal cliff, Superstorm Sandy, and an end-of-the-world Mayan calendar concern. This is setting the stage for improved fundamentals as we progress deeper into the year. Certainly there will be other puts and takes, but the absence of these factors should provide some wind under the economy’s sails.

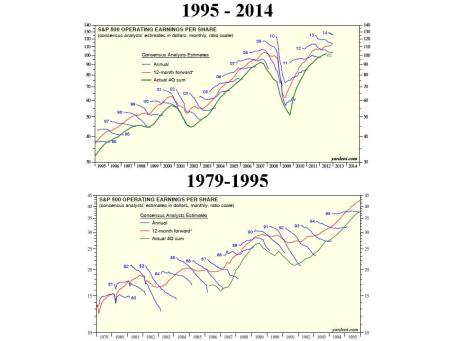

What’s more, history shows us that indeed stock prices can go up quite dramatically (more than +325% during the 1990s) when consensus earnings forecasts continually get trimmed. We have seen this same dynamic since mid-2012 – earnings forecasts have come down and stock prices have gone up. Strategist Ed Yardeni captures this point beautifully in a recent post on his Dr. Ed’s Blog (see charts below).

What Will Make Me Bearish?

Am I a perma-bull, incessantly wearing rose-colored glasses that I refuse to take off? I’ll let you come to your own conclusion. When I see a combination of the following, I will become bearish:

#1. I see the trillions of dollars parked in near-0% cash start coming outside to play.

#2. See Pimco’s Bill Gross and Mohammed El-Erian on CNBC fewer than 10 times per week.

#3. See money flow stop flooding into sub-3% bonds (Scott Grannis) and actually reverse.

#4. Observe a sustained reversal in hemorrhaging of equity investments (Scott Grannis).

#5. Yield curve flattens dramatically or inverts.

#6. Nouriel and his bear buds become bullish and call for a “triple-rip” turn in the equity markets.

#7. Smarter, more-experienced investors than I, á la Warren Buffett, become more cautious. I arrogantly believe that will occur in conjunction with some of the previously listed items.

Despite my firm beliefs, it is evident the bears won’t go down without a fight. If you are getting tired of drinking the double-dip Kool-Aid, then perhaps it’s time to expand your bullish horizons. If not, just wait 12 months after a market rally, and buy yourself a fresh copy of the Merriam-Webster dictionary. There you can locate and learn about a new definition…double-rip!

Read Also: Double-Dip Guesses are “Probably Wrong”

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in Fiat, Toyota, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.