Posts tagged ‘GDP’

Animal Spirits to Animal Hibernation

Investor mood or sentiment can change rather quickly. Immediately after the 2024 presidential elections, positive animal spirits catapulted the stock market higher due to hopes of stimulating tax cuts and deregulation legislation. However, those warm and fuzzy feelings soured last month, as investor focus shifted to on-again, off-again tariff talks, and stagflation concerns, which have converted animal spirits into gloomy feelings of hibernation.

As a result, the advancing bull market took a breather and transformed into a weary bear during March. For the month, the S&P 500 (-5.8%), NASDAQ (-8.2%), and the Dow Jones Industrial Average (-4.2%) all fell significantly in the wake of tariffs, inflation, and recession worries.

Lovely Liberation Day or Tariff Trouble?

Since the President took office in January, he has announced, reversed, and implemented tariffs across a wide range of countries and sectors, including China, Canada, Mexico, the EU, Colombia, Venezuela, steel, aluminum, oil, automobiles, digital services taxes, and more.

The day of reckoning begins on April 2nd, designated Liberation Day by the president. This is when the president and the White House officially announce global reciprocal tariffs on foreign countries in an attempt to reverse the nation’s large trade deficit (see chart below) and bring manufacturing back to the United States. For example, if Germany subsidizes BMW cars sold in the U.S. while simultaneously placing tariffs (i.e., additional taxes) on American Ford Explorers sold in Germany, the president wants to impose equivalent reciprocal tariffs on those same BMWs sold in the U.S. in an effort to level the trading playing field. On the surface, a $131 billion trade deficit sounds very significant, but when compared to a $30 trillion economy (Gross Domestic Product – GDP), this negative trade balance represents less than 0.5% of GDP – effectively a rounding error. I have previously written how tariffs represent more of a molehill than a mountain (see Tariff Sheriff), in part because consumer spending and services make up the vast majority of our country’s economic activity, whereas trade and manufacturing are relatively smaller segments.

Source: Trading Economics

Driving home the point that tariffs are more bark than bite, Senior White House trade and manufacturing counselor Peter Navarro recently stated the 2025 tariffs could add $700 billion annually to U.S. revenues, including $100 billion from the recently announced 25% auto tariffs. Many economists believe this collection estimate is too optimistic. However, even if this target is achievable, $700 billion only represents a measly 2% of overall GDP.

Tariffs = Recession or Stagflation?

With the recent stock market downdraft and growing concerns related to tariffs, some economists and pundits are raising the probability of a recession and the possibility of inflation accompanying an economic downturn (i.e., stagflation).

Economic data should clear some of the fog. Fresh employment numbers will be released this Friday, which should shine some light on the health of the economy. Irrespective of this month’s results, the most recent 4.1% unemployment rate (see chart below), though slightly higher over the last two years, does not strongly indicate a recession.

Source: Trading Economics

Other “hard” data, such as GDP, also suggest a slowing economy rather than a recession. For instance, a recent survey of 14 economists estimates the economy is growing at a paltry +0.3% rate in Q1 – 2025 versus +2.3% in Q4 – 2024. Data is continually changing, but if a looming recession were imminent, corporate earnings would likely be trending downward, not upwards, as evident in the chart below.

Source: Yardeni Research

Tariff Inflation Has Yet to Arrive

There is no doubt tariffs function as a tax hike on consumers because U.S. companies that pay the tariffs on imported goods are eventually forced to raise prices to maintain profit margins or limit margin degradation.

Nonetheless, inflation did not spike under President Trump’s first term. Even if the president’s new policies result in more aggressive tariff actions this go-around, inflation will likely remain in check due to the point mentioned earlier – imported goods represent a small percentage of overall consumer and business purchases.

Tariff implementation is just beginning, so only time will tell how pervasive inflation will become. However, what we do know now is that inflation has declined dramatically over the last couple of years and has not yet spiked (see Consumer Price Index chart below).

Source: Calafia Beach Pundit

Where Could I Be Wrong?

I have explained how some of the lagging “hard” data does not signal recession or stagflation, but what could I be missing? For starters, some of the leading “soft” data (e.g., surveys) indicate various cracks in the economic foundation are forming. Take the recent Consumer Confidence data (see chart below), which has weakened dramatically from pre-COVID and even post-COVID levels.

Source: Trading Economics

It’s not just consumers who are feeling uneasy about the economic environment; businesses are as well. Another soft data point flashing red is the NFIB Small Business Uncertainty index, which recently reported its second-highest reading in 48 years (see chart below). Even if my argument that tariffs are too small to materially impact the economy holds, if the psychological effects of tariff uncertainty paralyzes consumer and business economic activity to a standstill, then tariffs could indeed become a substantial factor.

Source: National Federation of Independent Business (NFIB)

What Comes Next After Liberation Day?

Liberation Day is unlikely to trigger an immediate and sustained V-shaped recovery in the stock market because international trading partners will be forced to announce retaliatory tariffs in response to President Trump’s reciprocal tariffs, potentially leading to additional reactionary tariffs by the U.S.

Additionally, the reciprocal tariffs announced on April 2nd will likely serve as a starting point for subsequent negotiations with trading partners. Without a comprehensive resolution, investor sentiment will likely remain somewhat unresolved and unsettled. Regardless of your views on the size and impact of tariffs, Liberation Day will at least bring some clarity and reduce the uncertainty surrounding the current murky and chaotic environment.

The multi-year bull market continued its charge after the presidential election, but investor sentiment has weakened the bull run due to tariff uncertainty. In response, the excited bull has temporarily turned into a sleepy bear. Depending on how these tariff events unfold, we will soon find out whether Liberation Day will awaken the bear to hunt for bulls or send it into deep hibernation.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in F or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Par for the Course

Stocks have been in a multi-year bull market, but just as investors cannot earn positive returns every month, golfers also cannot achieve a hole-in-one or birdie on every hole, either. A challenging performance is exactly what happened last month when stocks recorded a bogey on the scorecard.

More specifically, this is how far out-of-bounds the major indexes were last month:

- S&P 500: -1.4%

- Dow Jones Industrial Average -1.6%

- NASDAQ: -4.0%

Technology stocks and the Magnificent 7 stocks felt the largest brunt of the force last month as tariffs and the impact of Chinese AI (Artificial Intelligence) competition gave investors heartburn as they digested the information (see New Year, New AI ERA & New Tariff Sheriff).

Tariffs – More Molehill Than Mountain

As mentioned, a large part of last month’s volatility can be explained by the policy uncertainty surrounding the impending tariffs on China, Canada, and Mexico. Despite the absence of new tariffs being implemented, in an attempt to lock in cheaper imported goods, U.S. corporations and consumers have been stockpiling foreign goods before prices move higher due to tariffs. The 25% proposed tariffs on Canadian and Mexican goods are set to be applied as soon as March 4th. A flat 25% tariff on imported steel and aluminum products is expected to begin on March 12th – these particular tariffs are expected to have a disproportionately negative impact on the automotive industry.

Regarding other proposed reciprocal trade agreements, the White House’s analysis on tariffs for all other countries (beyond China, Canada, and Mexico) is expected to arrive on the president’s desk on April 2nd.

All these proposed changes are having an immediate economic impact whether intended or not. Not only are consumers buying more overseas products now, as they brace for higher prices, but businesses are also shifting supply chains to countries outside of China, Canada, and Mexico, in hopes of finding temporary tariff loopholes.

The bottom-line is our country’s imports have been spiking up recently, especially in the first quarter. Imports by definition subtract from America’s economic activity, so if businesses and consumers are rationally stockpiling foreign goods before prices go up from tariffs, investors should not be surprised that GDP (Gross Domestic Product) growth is set to go negative in the first quarter (-1.5%), according to the Federal Reserve Bank of Atlanta.

This short-term spike in foreign product purchases should be temporary until the tariffs are officially put in place. Subsequently, demand for relatively cheaper U.S. goods should rise because foreign goods will be pricier. In other words, buyers may begin purchasing more American-made t-shirts on Amazon because those shirts could be cheaper than the Chinese-made t-shirts after the additional tariffs commence on China.

How large are these overall tariffs? When it comes to Mexico and Canada, the size of these countries’ imports is estimated at $918 billion (see the 2023 import breakdown below for the two countries). On the surface, this sounds like a very large number, and it is. However, if you consider the size of the U.S. GDP ($29.4 trillion), these tariffs will mathematically have less than a 1% impact on the direction of our country’s economic activity.

However, if demand for American products goes up after the tariffs begin, as mentioned above, then it is perfectly logical to expect the drag from imports can be diminished or possibly completely reversed, if consumers decide to buy more American goods.

Source: Visual Capitalist

Also worth noting, as I documented last month in my Investing Caffeine blog, imports only account for 13.9% of our country’s economic activity (see New Tariff Sheriff). So, while tariffs make for great scary headlines, the reality of the numbers paints a different picture. Overall, the uncertainty surrounding the discussion of tariffs is having a much larger economic impact than the actual tariffs themselves. In other words, what we are discussing is more molehill than mountain. We saw this same movie before during the administration’s first-term when tariffs did not crater the economy into recession or create disproportionately high inflation.

War at the White House

A geopolitical soap opera played out on global television last Friday during a meeting between Ukraine’s President Volodymyr Zelensky and President Trump in the Oval Office. The meeting was designed to be a celebratory signing of a minerals deal in which the U.S. would gain access to strategically important Ukrainian rare earth metals in exchange for continued U.S. aid and military support. A signed deal would increase the probability of a peace deal between Russia and Ukraine dramatically. What actually happened was a war of words at the White House, which resulted in Zelensky getting kicked out of the White House with no signed deal.

Both sides have economic and strategic incentives to reengage in peace and mineral deal negotiations, but if the U.S.-Ukraine relationship totally crumbles, Europe and the other NATO (North Atlantic Treaty Organization) countries will need to pick up the slack in their military and economic aid to Ukraine. Regardless, increased European support is required to stave off a broader incursion by Russia and Vladimir Putin into a wider portion of Europe.

Tariffs, the Russia-Ukraine war, and AI issues may have heightened investor anxiety last month, but long-term investors understand that annual -5% and -10% corrections in the equity markets are considered par for the course. In fact, over the last 12 months, the S&P 500 index has declined -5% five times, and -10% one time, yet the stock market is still up +16% on a trailing 12-month basis (see chart below).

Source: Trading Economics

Financial markets end up in the rough plenty of the time, which often results in performance scorecard bogeys. However, long-term investors and Sidoxia Capital Management clients have won more often than not because the benefits of American capitalism have created many more birdies and pars over time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (March 3, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in META, NVDA, certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BABA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

New Year, New AI Era & New Tariff Sheriff

The first month of 2025 started with a bang when newly-inaugurated President Donald Trump announced a groundbreaking AI (artificial intelligence) program led by business titan thought leaders called Stargate, which promises to spend a half trillion dollars on AI data center infrastructure projects and create hundreds of thousands of jobs. Just one week later, a wet blanket was placed on the Stargate euphoria when a Chinese AI upstart announced a technological breakthrough. Stocks moved lower on the last day of the month when Trump added insult to injury by confirming 25% Mexican/Canadian tariffs and 10% additional Chinese tariffs would be implemented immediately.

Regardless, positive economic and corporate data coupled with other pro-business fiscal policies (e.g., deregulation and lower proposed taxes) allowed the financial markets to finish the month with respectable gains. More specifically, the S&P 500 surged higher by +2.7%; the NASDAQ +1.6%; and the Dow Jones Industrial Average +4.7%.

DeepSeek = Deep AI Trouble?

Ever since OpenAI launched its ChatGPT language model (LLM) at the end of 2022, the global AI gold rush began. Just as the United States appeared to be dominating the AI race to global superiority, a bombshell was recently released, when a new Chinese AI upstart, DeepSeek, released a white paper claiming the company’s R1 large language model (LLM) rivaled competitors’ LLMs like OpenAI’s ChatGPT, Meta’s Llama (META), Anthropic’s Claude, and Alibaba’s Qwen (BABA) for a small fraction of the price spent by DeepSeek’s American rivals. The “DeepSeek Freak” caused a chain reaction of selling across a wide swath of companies (including NVIDIA Corp – NVDA) that have benefitted from hundreds of billions in AI infrastructure spending. The fear that Chinese AI competition may leapfrog U.S. companies, and potentially dramatically reduce AI-related capital expenditures caused the NASDAQ to almost fall -2% last week, and AI juggernaut NVIDIA shed more than a half trillion dollars in the company’s market value in a single day. Overall, U.S. stocks lost more than a trillion dollars in value on the day of the DeepSeek Freak unveiling.

Although investors were initially panicked by the DeepSeek revelations, not all of the Chinese claims have been substantiated. In fact, a just-released report by SemiAnalysis, a semiconductor research and consulting firm, states that DeepSeek’s costs for its R1 LLM likely exceed $500 million, much higher than the $6 million training costs stated in DeepSeek’s initial pronouncement.

Source: NBC News

New Tariff Sheriff in Town

While many investors were hoping for a delay in the implementation of President Trump’s tariffs on Mexico, Canada, and China, Trump decided to move full steam ahead with a February 1st start date. In 2023, Mexico was the U.S.’s largest trade partner and Canada was the second largest. These Mexican and Canadian tariffs are very broad based and impact many different industries, including autos, agricultural products, and crude oil. You can see the extent of the impact in the graphic below graphic below.

Source: VisualCapitalist.com

But what does this mean for the economy? In short, it will mean higher prices for U.S. consumers and businesses. The Tax Foundation, an 85-year-old, non-partisan, tax policy non-profit attempted to quantify some of the potential impacts from the proposed tariffs. The bottom-line findings from the Tax Foundation were that tariffs would “shrink economic output by -0.4% and increase taxes by $1.2 trillion between 2025 and 2034 on a conventional basis, amounting to an average tax increase of more than $830 per US household in 2025.” Please, also see table below (Scenario 2).

Source: Tax Foundation

In addition to American consumers having to pay higher taxes and prices for tariffed import products, there will be an estimated -344,000 jobs lost and there could be unintended consequences from retaliatory tariffs imposed on U.S. exports (i.e., our goods shipped internationally will be priced uncompetitively). In fact, Canada and Mexico just jointly announced tit-for-tat tariffs on U.S. goods and services, which will hurt these U.S. sales abroad.

With all of that said, the bark of the 25% tariffs on Mexico and Canada, along with the 10% in additional tariffs on China could be worse than the actual bite. Especially, if Trump uses these tariffs successfully as a negotiating tool and provides foreign countries with significant exemptions.

It’s also important to keep the size of these tariffs in context. Imports of foreign good and services only represented 13.9% of the Unted States’ Gross Domestic Product in 2023. Of that small percentage of imports, Mexico, Canada, and China only represent a fraction of that. It’s true that imports subtract from our country’s economic activity, but even if tariffs on foreign goods lead to the consumption of more American manufactured products, those benefits will be somewhat offset by higher inflated prices that will pinch consumer wallets. The new year marks an exciting new era of AI and global trade, but with that comes many new threats and opportunities. Throughout our 17-year history at Sidoxia Capital Management, we have successfully navigated these pivot points, and we are excited about effectively managing through this current transitional period.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 3, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in META, NVDA, certain exchange traded funds (ETFs), but at the time of publishing had no direct position in BABA or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

No Market Misgiving on This Thanksgiving

We’ll see if there is any gravy left for investors during the last month of the year, but so far 2024 has been a satiating feast that has stuffed investors. There has been a cornucopia of items to be thankful for, including the Federal Reserve, which is expected to provide some dessert this month in the form of its third interest rate cut this year.

Investors certainly can also be grateful for the performance of the stock market, which has had a phenomenal year thus far (see chart below):

• S&P 500: +26.5%

• Dow Jones Industrial Average:+19.2%

• NASDAQ: +28.0%

On a two-year basis, the S&P 500 results look even tastier: +57.1%

Why is there such a large appetite for stocks? For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Regardless of whether your candidate won or lost the election, investors can agree there is less uncertainty with an uncontested election, which is welcomed by all. In addition, the two Fed rate cuts that started in September have also buoyed enthusiasm.

What is less clear are the effects of President-elect Donald Trump’s tariff policy threats, which if enacted run the risk of increasing inflation, stifling global trade, and jeopardizing future Fed rate cuts. Combined, these negative side effects have the potential of significantly dampening economic growth. On the other hand, if the tariffs are only used as a negotiating tool with our larger trading partners (including China, Mexico, Canada, and Europe), the tariff discussion will likely have more bark than bite. Time will tell.

Dissecting Stock Performance & Valuations

A lot of pundits are pointing to an overheated market, but on a 3-year basis, returns are looking more normalized (+8.2% per year) because of the -20% hit on stocks during 2022. As you may recall, much of the 2022 decline was caused by the Fed slamming on the economic breaks with its fastest rate-hiking cycle in four decades (raising rates from 0.0% to 5.5%).

Objectively, stock values, as measured by the Price-Earnings (P/E) ratio of the S&P 500, are at elevated levels – registering in at approximately 22-times next year’s forecasted profits. As you can see from the chart below, the stock market is priced at levels not seen since 2001 and valuations are roughly double what they were at the lows of the 2008 Financial Crisis.

Source: Yardeni.com

A major reason for escalated valuations has been the concentration of performance in the largest seven companies, or the so-called Magnificent 7 stocks, which include, Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla. In fact, the index concentration is the highest it has been in more than a half century – even higher than at the peak of the 2000 Tech Bubble when Cisco Systems, Microsoft, GE, Intel, and Exxon Mobil were the five largest companies by market capitalization (see chart below).

The good news is the other 493 companies in the S&P 500 (I call them the “Absentee 493”) are priced much more reasonably. This bifurcated dynamic between the largest seven companies versus everything else, highlights the plethora of opportunities available to be harvested in Value stocks, Small-cap stocks, and Mid-cap stocks.

As is evident in the chart below, the S&P 500 index (red-line), which is skewed by the Magnificent 7, is about 30% more expensive than Small-cap and Mid-cap stocks, which are hovering near historically attractive valuation levels.

Source: Yardeni.com

Value stocks (blue-line) in the market look equally attractive (about 30% cheaper than the S&P 500), as can be seen in the chart below.

Source: Yardeni.com

As always, the future is uncertain, and risks abound for next year. But 2024 has been a blockbuster year and there has been plenty to be thankful for, especially the performance of the U.S. stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, MSFT, GOOGL, META, TSLA, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CSCO, GE, XOM, INTC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Past Elections Status Quo Means No Need for Woe

Scarier than Halloween, the current presidential election is causing people on both sides of the political aisle to be frightened by the idea of their candidate potentially losing. Uncertainty is generally petrifying to investors, resulting in downward pressure on stock prices, but with less than a week until election day, the stock market is providing more treats than tricks. Sweetness has come in the form of a stock market up +20% in 2024 (up 8 out of 10 months this year), and only off -3% from its record high reached a few weeks ago. For the month, investors experienced modest declines as they braced for the election results. The S&P 500 dropped -1.0%, the Dow Jones Industrial Average -1.3%, and NASDAQ -0.5%.

Regardless of whether the red team or blue team wins the presidential election, the good news is history reminds us the end result has little effect on the long-term results of the stock market. As you can see from the chart below, over the last century, stock prices have gone up under both Republican and Democrat presidents. As Mark Twain famously stated, “History doesn’t repeat itself, but it often rhymes.” If that’s the case, past elections teach us, there is no need to fear the status quo of a Republican or Democrat president.

Source: Yardeni Research (Yardeni.com)

More recently, over the last 26 years, the stock market has been up significantly under each president, regardless of political party. Here are the results of the S&P 500 under the last three presidents:

- President Barack Obama(November 4, 2008 – November 8, 2016 – Democrat): +137%

- President Donald Trump(November 8, 2016 – November 3, 2020 – Republican): +51%

- President Joe Biden (November 3, 2020 – Present – Democrat): +63%

No matter who wins the White House, they will be inheriting a relatively strong economy. Consider the following tailwinds benefitting the new president:

- Strong Economy: The broadest measurement of economic activity, Gross Domestic Product (GDP), registered a healthy +2.8% growth rate for Q3

- Resilient Jobs Market: The just-reported unemployment rate of 4.1% today is representative of a strong but slowing job market. The unemployment rate has climbed modestly since troughing in 2023, but unemployment is still relatively low compared to historic levels much higher.

- Declining Inflation: As I pointed out last month (see Rate Cut Adrenaline) inflation has been on a fairly consistent downward trajectory over the last two years, which has allowed the Federal Reserve to cut interest rates by 0.50% in September. Moreover, based on the current economic environment, the Fed has signaled more stimulative interest rate cuts are likely ahead – economic strategists and pundits are predicting another 0.25% cut at the next Federal Reserve meeting that occurs over the two days following the elections.

- Record Corporate Profits (see chart below): The United States economy is the envy of the world, and the reason why is evident by the 65-year chart below showing record corporate profits and GDP. If you were an entrepreneur, where would you choose to start your company? China? Japan? UK? Russia? There’s plenty of room for improvements in our country’s policies, but there’s a reason the U.S. dominates in creating the largest and most profitable multi-trillion companies in the world.

Source: Calafia Beach Pundit

One area for improvement in the U.S. revolves around our fiscal debt and deficits. Our government simply spends too much money and doesn’t collect enough (tax receipts) to cover those expenses (see chart below). Another lesson to learn from our government’s excessive spending over the last four decades is that the glut of expenditures can’t be blamed on any one political party – the slope of spending is consistently up and to the right for all serving politicians.

Source: Calafia Beach Pundit

As I have mentioned in the past, stocks do not perpetually move up forever. However, regardless of the election outcome, we know from history that up-markets (bull markets) occur about 85% of the time, if we look at the last 100 years (see chart below). Analysis by Dimensional Fund Advisors shows that from 1926 – 2023, bull markets have lasted 994 months versus much shorter bear markets of 177 months.

Source: Dimensional Fund Advisors

It is very possible that stock prices may take a breather or correct under various election outcomes, but if we follow the historic status quo, there will be no long-term reason for woe.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

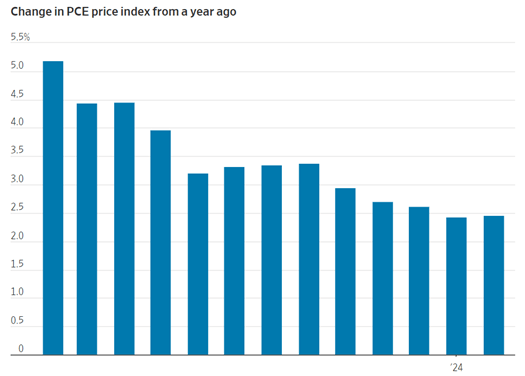

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bad News is Good News?

Remember that global pandemic back in 2020 called COVID-19 that killed over 350,000 people in the U.S.? That same year, the unemployment rate reached a sky-high level of 14.9% (vs. 3.9% most recently) and the economy went into recession with GDP (Gross Domestic Product) declining by -2.2%. With the whole population locked in their homes and 9.4 million businesses closed, this debacle doesn’t sound like a real great environment for the stock market. What did the stock market actually do in 2020? The S&P 500 surged +16.3% (see chart below). Bad economic news turned out to be good news for stocks.

On the flip side, during 2022, the economy was firing on all cylinders. GDP was advancing at a reasonable +1.9% growth rate, and the unemployment rate stood at a near generationally low rate of 3.6%. What did the stock market do? It fell -19%. This time around, good economic news meant bad news for stock prices, primarily because the Federal Reserve was slamming the brakes on the economy by increasing the Federal Funds interest rate target.

These examples are powerful reminders that the direction of economic trends does not necessarily move in tandem with the direction of the stock market. Just this last month, investors experienced this same phenomenon when GDP growth figures were revised lower from +1.6% to +1.3%, and pending home sales dropped by -7.7% to the lowest level in four years during the pandemic. What did the stock market do last month? The S&P climbed +4.8% and the NASDAQ soared +6.9%. Once again, bad news has equaled good news due to higher hopes for Fed interest rate cuts.

For the year, the S&P has already appreciated a very respectable +10.6%. This stellar performance has come despite heated election concerns, persistent wars overseas, nervousness over the Federal Reserve’s monetary policy, and wild volatility in the cryptocurrency markets.

Fighting against these headwinds has been the tsunami of corporate investing dollars piling into the Artificial Intelligence (AI) spending tidal wave. I have been writing about this trend for a while (see AI World) and NVIDIA Corp (NVDA) confirmed this trend a couple weeks ago, when the AI juggernaut reported its fiscal first quarter financial results. Not only did NVIDIA more than triple its revenue above $26 billion for the three-month period compared to last year, but the company also increased its net profit by more than seven-fold to almost $15 billion for the quarter, in addition to announcing a 10-for-1 stock split (see chart below).

What these examples teach you is that it is a fruitless effort for investors to try to time the market based on economic news headlines. Yet, every day you turn on the television or comb through the avalanche of news headlines through various media outlets, there is always some Armageddon story about an impending market crash, or some other speculative, get-rich-quick scheme. As Warren Buffett states, “Investing is like dieting. Easy to understand, but difficult to execute.”

In other words, there is no simple solution to investing. It requires patience, discipline, and financial emotional wherewithal to allow the power of long-term compounding to grow your retirement nest egg. Short-term news cycle headlines shouldn’t drive portfolio decision-making, but rather your personal objectives, goals, and risk tolerance. These items are not static, and can change over time, therefore it’s important to revisit your asset allocation periodically as financial circumstances and life events change your objectives.

Of course, improving economic news can also lead to rising stock prices, just as deteriorating economic news can result in declining prices. Regardless, attempting to time the market is a fool’s errand. Rather than trying to maneuver in and out of the stocks, long-term investors should focus more intently on the four key factors that drive the direction of the stock market: corporate profits, interest rates, valuations, and investor sentiment (see also Don’t Be a Fool, Follow the Stool). If you understand the stock market doesn’t logically follow the daily headlines, and instead you follow the key fundament factors driving equity markets, then your investment portfolio should be blessed with plenty of good news.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 3, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA,, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Dow Knocking on the Door of 40,000

The stock market rang the doorbell of the New Year with a bang during the 1st quarter. The S&P 500 index built on last year’s +24% gain with another +10% advance during the first three months of the year. And as a result of these increases, the Dow Jones Industrial Average index is knocking on the door of the 40,000 milestone – more specifically, the Dow closed the month at 39,807 (see chart below). To put his into context, when I was born more than 50 years ago, the Dow was valued at less than 1,000 – not a bad run. This is proof positive of what Einstein called the 8th Wonder of the World, “compounding”. At Sidoxia Capital Management, we view investing as a marathon, not a sprint. You cannot realize the benefits of compounding without having a long-term time horizon. The sooner you start saving and the more you save, the faster and larger your retirement nest egg will grow.

If you are one of the people who thinks the stock market is too high, then you should definitely ignore Warren Buffett, arguably the greatest investor of all-time. Buffett predicted the Dow will reach an astronomical level of one million (1,000,000) within the next 100 years. I’m not sure I will still be around to witness this momentous achievement, however, if history repeats itself, this targeted timeframe could prove conservative.

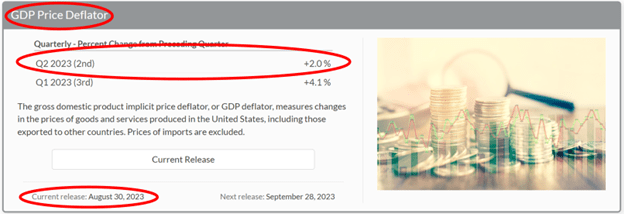

Despite the magnitude and duration of this bull market, there is still a lot of angst and anxiety over the upcoming election. Nevertheless, investors are choosing instead to focus on the strong fundamentals of the economy. Just this last week, we saw the broadest measurement of economic activity, GDP (Gross Domestic Product), get revised higher to +3.4% growth during the 4th quarter of 2023 (see chart below). On the jobs front, the unemployment picture remains healthy (3.9%), near a generational low.

Source: Trading Economics and Bureau of Economic Analysis

And when it comes to the all-important inflation data, the Federal Reserve’s preferred inflation measure, Core PCE index (Core Personal Consumption Expenditures), was also just released in-line with economists’ projections at 2.5% (see chart below), very near the Fed’s long-term 2.0% inflation target and well below the Core PCE’s recent peak near 6%.

Source: The Wall Street Journal and Commerce Department

This resilient economic data, when combined with the declining inflation figures, has resulted in the Federal Reserve sticking with its plan of cutting its Federal Funds interest rate target three times this year. If inflation reverses course or remains stubbornly high, then there is a higher likelihood that interest rate cuts will be delayed. On the flip side, if economic data slows significantly or the country goes into a recession, then the probability of sooner and/or more Fed interest-rate cuts will increase.

In other news, here are some of the other major financial headlines this month:

- Francis Scott Key Baltimore Bridge Collapse: Six people died when a large container ship crashed into the Francis Scott Key bridge in the Port of Baltimore. An estimated 50 million tons of goods valued at $80 billion flows through this port, making this one of the top 10 ports in the country. The auto and coal industry supply chains will be disproportionately affected, but the good news is much of these goods will be diverted to other larger ports (e.g., Port of New York and Port of New Jersey).

- DJT Debut: A lot of hype surrounded the trading debut of Trump Media & Technology Group, which began trading last week under the initials of our country’s former president, Donald J. Trump (Ticker: DJT). Despite only posting a few million in revenue and -$50 million in losses during the first nine months of 2023, the stock skyrocketed +65% in its first week of trading and attained a $9 billion valuation. Time will tell if Trump’s Truth Social media platform will gain traction and justify the stock’s price, or rather suffer the declining fate of other meme stocks like GameStop Corp. (GME) or AMC Entertainment Holdings (AMC).

- SBF Sentenced to 25 Years: The former CEO of cryptocurrency exchange company FTX, Sam Bankman-Fried (SBF), was sentenced to 25 years in prison due to his conviction on seven counts of fraud and what is believed to be $8 billion in stolen client funds. SBF didn’t help his own cause by perjuring himself, tampering with witnesses, and showing a lack of remorse, according to the judge.

We are only 25% of the way through the year, but the Dow is knocking on the 40,000-milestone door. The way things look now, investors are wiping their feet on the welcome doormat and ready to walk right in.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), and notes including AMC 2026, but at the time of publishing had no direct position in DJT, GME, AMC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

From Hard Landing to Soft Landing to No Landing?

I haven’t received my pilot’s license yet, but in trying to figure out whether the economy is heading for a hard landing, soft landing, or no landing, I’m planning to enroll in flight school soon! With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected. As you can see in the chart below, economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter.

How have investors been interpreting this confusing array of landing scenarios? The stock market has stabilized and risen since last October (S&P +13.7%) but has also hit a temporary air pocket last month (-2.6%). Similarly, the Dow Jones Industrial Average has rebounded +13.9% since October, but pulled back further in February (-4.2%). As mentioned earlier, investors are having difficulty reading all the economic dials, instruments, and controls in the cockpit because there is no consensus on interest rates, inflation, economic growth, corporate earnings growth, and employment.

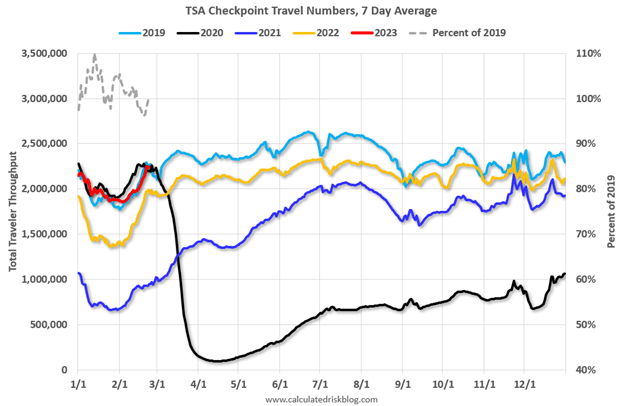

At the one end of the spectrum, you have a consumer who remains employed and willing to spend his/her savings accumulated during the pandemic. Case in point, air travel has hit pre-pandemic levels of 2019, despite business travelers staying at home conducting business on Zoom (see red line on chart below).

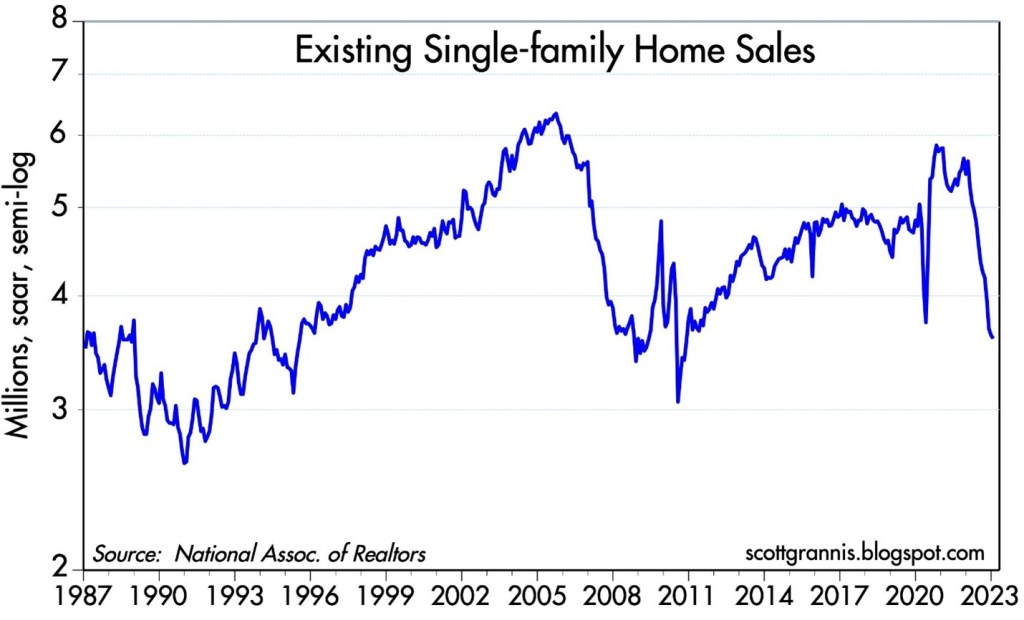

At the other end of the spectrum, we are witnessing the crippling effects that 7% mortgage rates can have on the $4 trillion real estate industry. As you can see from the chart below, sales of existing homes have plummeted at the fastest rate since the beginning of the 2008 Financial Crisis.

With all of that said, there is a consensus building that inflation is steadily coming down. Even the very skeptical and hawkish Federal Reserve Chairman, Jerome Powell, acknowledged that the “disinflationary process has begun.” We can see that in this inflation expectation chart below (green line), which measures the average anticipated inflation over the next five years by comparing the difference in yields between the five-year Treasury Notes and the five-year TIPS (Treasury Inflation Protection Securities).

Although, currently, there are many financial crosswinds swirling, the good news is that in the near-term, the economy has been maintaining its elevation and there is no imminent sign of a hard landing. We certainly could face the potential of turbulence and changing weather conditions, but that is always the case when you invest in the financial markets. If, however, inflation continues to move in the same direction, and growth continues to surprise on the upside, there may be no landing at all. Under this scenario of maintaining a comfortable altitude, I guess I can put my pilot training on hold.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Mar. 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.