Posts tagged ‘forecasting’

The Art of Weather Forecasting and Investing

I’ve lived across the country and traveled around the world and have experienced everything from triple-digit desert heat to sub-zero wind chill. The financial markets experience the same variability over time.

Forecasting the weather is a lot like forecasting the stock market. In the short-run, volatility in patterns can be very difficult to predict, but if efforts are energized into analyzing long-term factors, trends can be identified.

For example, I live here in Southern California, and although weather is fairly homogenous, the variability can be significant on a day-to-day basis. I’m much more likely to be accurate in estimating the long-term climate than the forecast seven days from now. I’m not trying to rub salt in the wounds of those people freezing in Antarctica or the upper-Midwest, but forecasting a climate of 72 degrees, sunny, and blue skies is a good fall-back scenario if you are a television weatherman in Southern California.

Charles Ellis, author of the Winning the Loser’s Game – “WTLG” (see Investing Caffeine article #1 and article #2), highlights the weather analogy more convincingly:

“Weather is about the short run; climate is about the long run – and that makes all the difference. In choosing a climate in which to build a home, we would not be deflected by last week’s weather. Similarly, in choosing a long-term investment program, we don’t want to be deflected by temporary market conditions.”

Ellis adds:

“Like the weather, the average long-term experience in investing is never surprising, but the short-term experience is constantly surprising.”

In the financial markets the weather predicting principle applies to long-term economic forecasts as well. Predicting annual GDP growth can often be more accurate than the expected change in Dow Jones Industrial Index points tomorrow or the next day.

Economic Weathermen

As I outlined in Professional Guesses Probably Wrong, economists and strategists use several means of making their guesses.

- One method is to simply not make forecasts at all, but rather use some big words and current news to explain what currently is happening in the economy and financial markets.

- A second approach used by prognosticators is to constantly change forecasts. Consider a person making a weather forecast every minute…his/her forecast would be very accurate, but it would be changing constantly and not provide much more value than what an ordinary person could gather by looking out their own window.

- Thirdly, some use the “spaghetti approach” – throw enough scenarios out there against the wall and something is bound to stick – regardless of accuracy.

- Lastly, the “extend and pretend” method is often implemented. Forecasters make big bold economic predictions that garner lots of attention, but when the expectations don’t come true, the original forecast is either forgotten by investors or the original forecast just becomes extended further into the future.

Coin Flipping

If the weather analogy doesn’t work for you, how about a coin-flipping analogy? The short-term randomness surrounding the consecutive number of heads and tails may make no sense in the short-run, but will mean revert to an average over time. In other words, it is possible for someone to flip 10 consecutive “tails,” but in the long-run, the number of times a coin will land on “tails” will come close to averaging half of all coin tosses. The same dynamic is observed in the investment world. Often, short-term spikes or declines are short lived and return toward a mean average. IN WTLG, Ellis provides some more color on the topic:

“The manager whose favorable investment performance in the recent past appears to be ‘proving’ that he or she is a better manager is often – not always, but all too often – about to produce below-average results…A large part of the apparently superior performance was not due to superior skill that will continue to produce superior results but was instead due to that particular manager’s sector of the market temporarily enjoying above-average rates of return – or luck.”

Regardless of your interests in weather forecasting or coin-flipping, when it comes to investing you will be better served by following the long-term climate trends and probabilities. Otherwise, the performance outlook for your investment portfolio may be cloudy with a chance of thunderstorms.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Why it’s NOT Different This Time

“Those who don’t know history are destined to repeat it.”

– Edmund Burke – British Statesman and Philosopher (1729-1797)

I wasn’t a history major in college, but I’ve learned two things by studying history books: 1) The unchanging psyche of human nature leads history consistently to repeats itself; and 2) There is never a shortage of goofballs willing to make zany predictions.

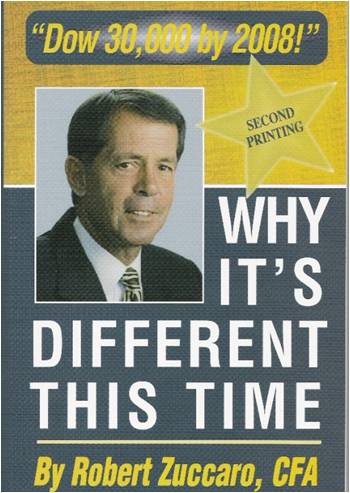

Robert Zuccaro is no exception to lesson number two, as evidenced by his 2001 book, Why it’s Different this Time…Dow 30,000 by 2008! Sticking one’s neck out is never too difficult when you have a multi-decade trend behind your back – I guess Dow “14,000” just didn’t sound sexy enough back then. Unfortunately the herd reacting to these bold, extreme predictions eventually realize (usually post-mortem) that they are quickly approaching a tail-end of a cycle. The cab driver, hair dresser, and mechanic realized the dangers of following the “New Economy” cheerleaders in 1999 when everyone was piling into dot-com stocks (see Bubblicious technology table ).

Dow 1,000 Here We Come!

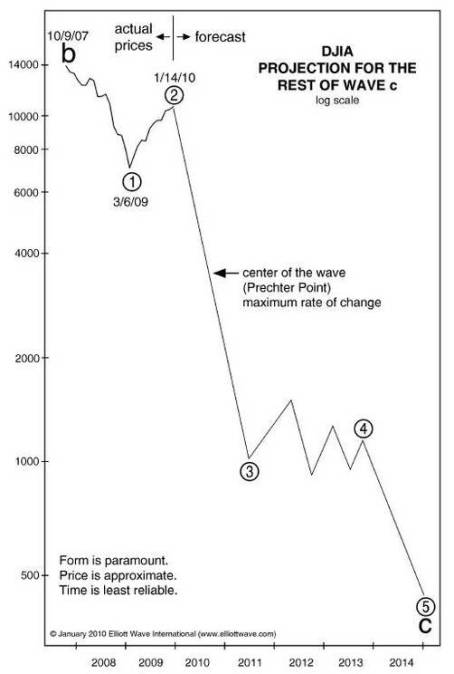

Today, the Zuccaros of the world have been washed to the curb, and new “Armageddon” extremists have sprouted up to the surface, like perma-bear Peter Schiff and his call for Dow 2,000 or his $5,000 per ounce gold estimate. More recently, Robert Prechter has one-upped Schiff by forecasting Dow 1,000 with the assistance of the not-so ironclad Elliott Wave Theory philosophy (see Technical Analysis: Astrology or Lob Wedge). If you’re in the Prechter camp, either crawl back into your bunker or start digging that dream cave you always wanted.

“Hey, Look Here at My Crazy Forecast!”

Publicity doesn’t necessarily rain praise on those parroting the consensus view (although the warmth of job security is appreciated), but rather the extreme outliers love to bask in the glow of media attention. The extremists consistently repeat “why it’s different this time.” What is different is the set of circumstances, but what history shows us over and over again is the emotions of fear and greed feeding the bubbles of excess are exactly the same. Whether you’re talking about the Tulip-Mania of the 1630s, the Nifty Fifty stocks of 1973-1974, the technology Four Horsemen of the mid-1990s, or the Icelandic Banks of 2008, what we learn from the lessons of history is that human nature will never change and fear and greed will continue creating and bursting future bubbles.

People playing the game long enough understand, “It’s NOT different this time.” Not only have we endured repeated wars, recessions, banking crises, currency crises, but we have also survived every exotic animal disease known to man, including Mad Cow, Swine Flu, Bird Flu, West Nile, etc.

Robert Zuccaro and Robert Prechter may get an “A” for their attention grabbing forecasts, but thus far the grade earned on accuracy is closer to an “F.” More specifically, Zuccaro’s prediction never came close to 30,000 by the end of 2008 (only off by about 21,000 points), and guess what, Bob Prechter has a long way to go before reaching his Dow 1,000 target. So here is my proposition: Why don’t we just split the difference between Zuccaro’s 2008 and Prechter’s 2016 forecasts and take the average? If it turns out they are equally bad forecasters, then Dow 15,500 by 2012 should be no problem ([30,000 + 1,000] ÷ 2)!

Regardless of the ultimate outcome of this market (double-dip or sustained recovery), what I do know is there will continue to be wacky outlandish forecasters rationalizing why a trend will go on for infinity and why “this time is different.” In reality these attention mongers will always be around ensuring this time (or next time) will never be different…just the same fear and greed as always.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Professional Double-Dip Guesses are “Probably” Wrong

As you may have noticed from previous articles, I take a significant grain (or pound) of salt when listening to economists and strategists like Peter Schiff, Nouriel Roubini, Meredith Whitney, John Mauldin, et.al. Typically, these financial astrologists weave together convincing, elaborate, grand guesses that extrapolate every short-term, fleeting economic data point into an imposing (or magnificent) long-term secular trend.

With all this talk of “double-dip” recession, I cannot help but notice the latest verbal tool implemented by every Tom, Dick, and Harry economist when discussing this topic… the word “probability”. Rather than honestly saying I have no clue on what the economy will do, many strategists place a squishy numerical “probability” around the possibility of a “double-dip” recession consistent with the news du jour. Over recent weeks, unstable U.S. economic data have been coming in softer than expectations. So, guess what? Economists have become more pessimistic about the economy and raised the “probability” of a double dip recession. Thanks Mr. Professor “Obvious!” I’m going to go out on a limb, and say the probability of a double-dip recession will likely go down if economic data improves. Geez…thanks.

Here is a partial list of double-dip “probabilities” spouted out by some well-known and relatively unknown economists:

- Robert Shiller (Professor at Yale University): “The probability of that kind of double-dip is more than 50 percent.”

- Bill Gross (Founder/Managing Director at PIMCO): The New York Times described Gross’s double-dip radar with the following, “He put the probability of a recession — and of an accompanying bout of deflation — at 25 to 35 percent.”

- Mohamed El-Erian (CEO of PIMCO): “If you wonder how meaningful 25 per cent is, ask yourself the following question: if I offered you that I drive you back to work, but there’s a one in four chance that I get into a big accident, would you come with me?”

- David Rosenberg (Chief Economist at Gluskin Chef): In a recent newsletter, Rosenberg has raised the odds of a double-dip recession from 45 per cent a month ago to 67 per cent currently.

- Nouriel Roubini (Professor at New York University): “As early as August 2009 I expressed concern in a Financial Times op-ed about the risk of a double-dip recession, even if my benchmark scenario characterizes the risk of a W as still a low probability event (20% probability) as opposed to a 60% probability for a U-shaped recovery.”

- Robert Reich (Former Secretary of Labor): According to Martin Fridson, Global Credit Strategist at BNP Paribas, Robert Reich has assigned a 50% probability of a double dip, even if Reich believes we are actually in one “Long Dipper.”

- Graeme Leach (Chief Economist at the Institute of Directors): “I would give a 40 per cent probability to what I call ‘one L of a recovery’, in other words a fairly weak flattish cycle over the next 12 months. A double-dip recession would get a 40 per cent probability as well.”

- Ed McKelvey (Sr. U.S. Economist at Goldman Sachs): “We think the probability is unusually high — between 25 percent and 30 percent — but we do not see double dip as the base case.”

- Avery Shenfeld (Chief Economist at CIBC): “The probability estimate is likely more consistent with a slowdown rather than a true double-dip recession but, given the uncertainties, fiscal tightening ahead and the potential for a slow economy to be vulnerable to shocks, we will keep an eye on our new indicator nevertheless.” This guy can’t even be pinned down for a number!

- National Institute for Economic and Social Research (NIESR) : “The probability of seeing a contraction of output in 2011 as compared to 2010 has risen from 14 per cent to 19 per cent.”

- New York Fed Treasury Spread Model (see chart below): Professor Mark J. Perry notes, “For July 2010, the recession probability is only 0.06% and by a year from now in June of next year the recession probability is only slightly higher, at only 0.3137% (less than 1/3 of 1%).”

Listening to these economic armchair quarterbacks predict the direction of the financial markets is as painful as watching Jim Gray’s agonizing hour-long interview of Lebron James’s NBA contract decision (see also Lebron: Buy, Sell, or Hold?). Just what I want to hear – a journalist that probably has never dribbled a ball in his life, inquiring about cutting edge questions like whether Lebron is still biting his nails? Most of these economists are no better than Jim Gray. In many instances these professionals don’t invest in accordance with their recommendations and their probability estimates are about as reliable as an estimate of the volatility index (see chart below) or a prediction about Lindsay Lohan’s legal system status.

I can virtually guarantee you at least one of the previously mentioned economists will be correct on their forecasts. That isn’t much of an achievement, if you consider all the strategists’ guesses effectively cover every and any economic scenario possible. If enough guesses are thrown out there, one is bound to stick. And if they’re wrong, no problem, the economists can simply blame randomness of the lower probability event as the cause of the miscue.

Unlike Wayne Gretzky, who said, “I skate to where the puck is going to be, not where it has been,” economists skate right next to the puck. Because the economic data is constantly changing, this strategy allows every forecaster to constantly change their outlook in lock-step with the current conditions. This phenomenon is like me looking at the dark clouds outside my morning window and predicting a higher probability of rain, or conversely, like me looking at the blue skies outside and predicting a higher chance of sunshine.

Using this “probability” framework is a convenient B.S. means of saving face if a directional guess is wrong. By continually adjusting probability scenarios with the always transforming economic data, the strategist can persistently waffle with the market sentiment vicissitudes.

What would be very refreshing to see is a strategist on CNBC who declares he was dead wrong on his prediction, but acknowledges the world is inherently uncertain and confesses that nobody can predict the market with certainty. Instead, the rent-o-strategists consistently change their predictions in such a manner that it is difficult to measure their accuracy – especially when there is rarely hard numbers to hold these professional guessers accountable for.

Economists and strategists may be well-intentioned people, just as is the schizophrenic trading advice of Jim Cramer of CNBC’s Mad Money, but the “probability” of them being right over relevant investing time horizons is best left to an experienced long-term investor that understands the pitfalls of professional guessing.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, NYT or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Forecasting Recipe: Trend Analysis & Sustainability

Forecasting financial performance of a company requires a fairly simple recipe: one part trend analysis and one part determining sustainability. On the surface, forecasting sounds pretty easy. While discovering certain financial trends can be straightforward, the ability to ascertain the durability of a trend can become endlessly complex.

Before you become Nostradamus and spreadsheet your way to the Wall Street Hall of Fame, an accurate forecaster must first build a firm understanding of a company and the underlying industry. Unfortunately for the predictor, not all companies and industries are created equally. Evaluating the profit dynamics of Cheesecake Factory Inc. (CAKE), an upscale casual chain of restaurants, is quite different from deciphering the financials of 3SBio (SSRX), a Chinese biotech company focused on recombinant products. Regardless of the thorniness of the company or industry, before you can truly look out into the future, the investor should learn the language of the company. For example, learning the importance of “comparable store sales” and “sales per square foot” for CAKE may be just as important as learning about the “Phase III FDA trial endpoint” and “pipeline” for SSRX.

Because you could spend a lifetime following just one company – for instance General Electric Co. (GE) or Microsoft Corp. (MSFT) – and never make an investment, you would probably be better served by applying a framework that allows you to research and analyze multiple industries and companies. There are various tools, whether you consider Harvard professor Michael Porter’s Five Forces or SWOT analysis (Strengths Weaknesses Opportunities Threats), and each provides a template or process to use when tearing apart specific companies and industries.

Nuts & Bolts of Forecasting

Before you can identify a trend, you first need to gather the data. For all companies I examine, I first compile a quarterly and annual income statement, balance sheet, and cash flow statement – those that have followed me know the extreme importance I place on the cash flows of a business. In general a good start is to create common size financial statements for the income statement and balance sheet. Basically, this exercise creates an income statement and balance sheet in percentage terms – usually expressed as a percentage of net sales (income statement) and as a percentage of total assets (balance sheet). Earnings forecasts are often used as a logical starting point for driving the shape of future results across the financials, but further insight can be gleaned by comparing year-over-year (this year vs. last) and sequential (this quarter vs. last quarter) growth rates for key figures.

These common statements will then serve as the foundation of identifying the trends, and force the forecaster to seek answers to random questions like these?

- Why is depreciation expense going down even though the company is expanding retail stores?

- Gross margins increased for seven consecutive quarters for a total of 250 basis points (2.5%), however in the recent quarter margins declined by 175 basis points…why?

- Long-term debt increased by $200 million in the current quarter, but if the company just issued $325 million in equity last quarter, then why do they need new capital?

Many of these types of questions may have logical explanations, but by getting answers the analyst will be in a position to better understand the business issues affecting financial performance and to better forecast future economic values.

Forecasting Your Way to Wrongness

A lot can go wrong with forecasting, principally in the assumptions used for the forecast. As the character Felix Unger from the Odd Couple stated, “You should never “assume.” You see, when you “assume,” you make an “ass”… out of “you”… and “me.”” Often assumptions do not consider the inclusion of important economic shocks or unexpected factors, such as recessions, currency fluctuations, management turnover, lawsuits, accounting changes, new products, restructurings, acquisitions, divestitures, flash crashes, Greek debt downgrades, regulatory reform…yada…yada…yada (you get the idea). To get a better sense for a range of outcomes, sensitivity analysis can be employed to determine a “base case” outcome in conjunction with a rosier “upside case” and more conservative “downside case.” Worth noting is the impact debt levels can have on the variance of outcomes – I think Bear Stearns and Lehman Brothers would concur with this point.

Pinpointing variable financial figures is quite difficult. Different companies and industries inherently have more or less predictable attributes. Predicting when the sun will rise and set is quite a bit more predictable than predicting what Intel Corp’s (INTC) gross margins will be on a quarterly basis. As mentioned earlier, layering on debt can increase the volatility of earnings forecasts as well.

Forecasting is essential in the investment world, but even if you were the best forecaster in the world, investors cannot disregard the importance of valuation skills. The art of valuation is just as important, if not more important than being right on your financial scenarios.

All in all, the recipe of forecasting sounds simple if you look at the basic ingredients of trend and sustainability analysis. However, before the ultimate forecast comes out of the oven, this straightforward recipe requires a lot of preparation, whether it is slicing and dicing cash flow figures, whipping up some margin trends, or measuring up sales growth. Any way you cut it, systematically following a recipe of trend and sustainability analysis is a non-negotiable requirement if you want to heat up superior financial results.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GE, MSFT, CAKE, SSRX, INTC, JPM/Bear Stearns, Lehman Brothers, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

John Mauldin: The Man Who Cries Wolf

We have all heard about the famous Aesop fable about The Boy Who Cried Wolf. In that story, a little boy amuses himself by tricking others into falsely believing a wolf is attacking his flock of sheep. After running to the boy’s rescue multiple times, the villagers became desensitized to the boy’s cries for help. The boy’s pleas ultimately get completely ignored by the villagers despite an eventual real wolf attack that kills the boy’s flock of sheep.

Mauldin: The Man Who Cries Bear

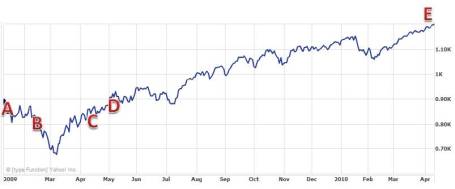

John Mauldin, former print shop professional and current perma-bear investment strategist, unfortunately seems to have taken a page from Aesop’s book by consistently crying for a market collapse. After spending many years wrongly forecasting a bear market, his dependable pessimism eventually paid dividends in 2008. Unfortunately for him, rather than reverse his downbeat outlook, he stepped on the pessimism pedal just as the equity markets have exploded upwards more than +80% from the March lows of last year. Mauldin is widely followed in part to his thoughtful pieces and intriguing contributing writers, but as some behavioral finance students have recognized, being bearish or cautious on the markets always sounds smarter than being bullish. I’m not so sure how smart Mauldin will sound if he’s wrong on the direction of the next 80% move?

The Challenged Predictor

I find it interesting that a man who freely admits to his challenged prediction capabilities continues to make bold assertive forecasts. Mauldin freely confesses in his writings about his inability to manage money and make correct market forecasts, but that hasn’t slowed down the pessimism express. Just two years ago as the financial crisis was unfolding, Mauldin admits to his poor fortune telling skills with regards to his annual forecast report each January:

“ I was wrong (as usual) about the stock markets.”

Here’s Mauldin explaining why he decided to switch from investing real money to the simulated version of investment strategy and economic analysis:

“I wanted to begin to manage money on my own… I found out as much about myself as I did about market timing. What I found out was that I did not have the emotional personality (the stomach?) to directly time the markets with someone else’s money… I simply worried too much over each move of the tape.”

Apparently timing the market is not so simple? Readers of Investing Caffeine understand my feelings about market timing (read Market Timing Treadmill piece) – it’s a waste of time. Market followers are much better off listening to investors who have successfully navigated a wide variety of market cycles (see Investing Caffeine Profiles), rather than strategists who are constantly changing positions like a flag in the wind. I wonder why you never hear Warren Buffett ever make a market prediction or throw out a price target on the Dow Jones or S&P 500 indexes? Maybe buying good businesses or investments at good prices, and owning them for longer than a nanosecond is a strategy that can actually work? Sure seems to work for him over the last few years.

When You’re Wrong

Typically a strategist utilizes two approaches when they are wrong:

1) Convert to Current Consensus: Most strategists change their opinion to match the current consensus thinking. Or as Mauldin described last year, “I expect that this year will bring a few surprises that will cause me to change my opinions yet again. When the facts change, I will try and change with them.” The only problem is…the facts change every day (see also Nouriel Roubini).

2) Push Prediction Out: The other technique is to ignore the forecasting mistake and merely push out the timing (see also Peter Schiff). A simple example would be of Mr. Mauldin extending his recession prediction made last April, “We are going to pay for that with a likely dip back into a recession in 2010,” to his current view made a few weeks ago, “I put the odds of a double-dip recession in 2011 at better than 50-50.”

More Mauldin Mistake Magic

Well maybe I’m just being overly critical, or distorting the facts? Let’s take a look at some excerpts from Mauldin’s writings:

A. January 10, 2009 (S&P @ 890):

Prediction: “I now think we will be in recession through at least 2009 before we begin a recovery….We could see a tradable rally in the next few months, but at the very least test the lows this summer, if not set new lows….It takes a lot of buying to make a bull market. It only takes an absence of buying to make a bear market.”

Outcome: S&P 500 today at 1,179, up +32%. Oops, maybe the timing of his recovery forecast was a little off?

B. February 14, 2009 (S&P @ 827):

Prediction/Advice: “Let me reiterate my continued warning: this is not a market you want to buy and hold from today’s level. This is just far too precarious an economic and earnings environment.”

Outcome: S&P 500 up +45%. You pay a cherry price for certainty and consensus.

C. April 10, 2009 (S&P @ 856):

Prediction: “All in all, the next few years are going to be a very difficult environment for corporate earnings. To think we are headed back to the halcyon years of 2004-06 is not very realistic. And if you expect a major bull market to develop in this climate, you are not paying attention.” On the economy he adds, “We are going to pay for that with a likely dip back into a recession in 2010.”

Outcome: S&P 500 up +38%, with the economy currently in recovery. Interestingly, his comments on corporate earnings in February 2009 referenced an estimate of $55 in S&P 2010. Now that we are 14 months closer to the end of 2010, not only is the consensus estimate much firmer, but the 2010 S&P estimate presently stands at approximately $75 today, about +36% higher than Mauldin was anticipating last year.

D. May 2, 2009 (S&P @ 878):

Prediction: “This rally has all the earmarks of a major short squeeze. ..When the short squeeze is over, the buying will stop and the market will drop. Remember, it takes buying and lot of it to move a market up but only a lack of buying to create a bear market.”

Outcome: S&P 500 up +36%.

Now that we have entered a new year and experienced an +80% move in the market, certainly Mauldin must feel a little more comfortable about the current environment? Apparently not.

E. April 2, 2010 (S&P @ 1178):

Prediction: “ I think it is very possible we’ll see another lost decade for stocks in the US. If we do have a recession next year, the world markets are likely to fall in sympathy with ours.”

Outcome: ????

Previous Mauldin Gems

Here are few more gloomy gems from Mauldin’s bearish toolbox of yester-year:

2005: “The market is a sideways to down market, with the risk to the downside as we get toward the end of the year and a possible recession on the horizon in 2006. And not to put too fine a point on it, I still think we are in a long term secular bear market.” Reality: S&P 500 up +5% for the year and up a few more years after that.

2006: “This year I think the market actually ends the year down, and by at least 10% or more during the year. Reality: S&P 500 up +14% (excluding dividends).

2007: Mauldin’s rhetoric was tamed in light of poor predictions, so rhetoric switches to a “Goldilocks recession” and a mere -10-20% range correction. He goes on to dismiss a deep bear market, “In future letters we will look at why a deep (the 40% plus that is typical in recession) stock market bear is not as likely.” Reality: S&P 500 up +5%. Looks like the writing on the wall for 2008 turned out a bit worse than he expected.

2008: Sticking to soft landing outlook Mauldin states, “I think this will be a mild recession … I don’t think we are looking at anything close to the bear market of 2000-2001.” Uggh. Ultimately, the bear market turned out to be the worst market since 1973-1974 – his prediction was just off by a few decades. Reality: S&P 500 down -37%.

Lessons Learned from Market Strategists

I certainly don’t mean to demonize John Mauldin because his writings are indeed very thoughtful, interesting and include provocative financial topics. But put in the wrong hands, his opinions (and dozens of other strategists’ views) can be extremely dangerous for the average investor trying to follow the ever-changing judgments of so-called expert strategists. To Mauldin’s credit, his writings are archived publicly for everyone to sift through – unfortunately the media and many average investors have short memories and do not take the time to hold strategists accountable for their false predictions. Although, Iike Warren Buffett, I do not make market timing predictions or forecast short-term market trends, I see no problem in strategists making bold or inaccurate forecasts, as long as they are held responsible. Every investor makes mistakes, unfortunately, strategist predictions are usually not readily available for analysis, unlike tangible investment manager performance numbers. When forecasting lightning strikes and extreme bets win, every newspaper, radio show, and media outlet has no problem of placing these soothsayers on a pedestal. Thanks to the law of large numbers and the constantly shifting markets, there will always be a few outliers making correct calls on bold predictions. Who knows, maybe Mauldin will be the next CNBC guru du jour in the future for predicting another lost decade of equity market performance (see Lost Decade article)?

Regardless of your views on the market, the next time you hear a financial strategist make a bold forecast, like John Mauldin crying wolf, I urge you to not go running with the motivation to alter your investment portfolio. I suppose the time to become frightened and drive the REAL wolf (bear market) away will occur when consistently pessimistic strategists like Mauldin turn more optimistic. Until then, tread lightly when it comes to acting on financial market forecasts and stick to listening to long-term, successful investors that have invested their own money through all types of market cycles.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.