Source: Photobucket

“The reports of my death are greatly exaggerated.”

-Mark Twain (after a relative’s illness was attributed to Twain)

The same can be said for the exaggerated death of the U.S. economy and stock market. Naysayers have been pounding a consistent stream of fatal economic theories for years as a positive set of broader metrics disassembled those arguments. Debt downgrades, debt defaults, and a domino of European country collapses were supposed to set our financial markets spiraling downwards out of control. That didn’t happen.

A large contributing component to our oversized debt burden was the massive federal, state, and local deficits. Consider the federal fiscal deficit that reached -$1.5 trillion during the 2008-09 Financial Crisis.

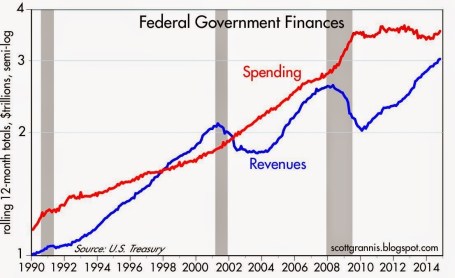

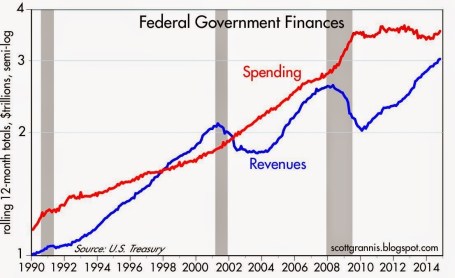

Many of the doom-and-gloomer pundits expected a deficit in the uber-trillion dollar range to last for as far as the eye could see, but perception didn’t turn out to be reality. Scott Grannis at Calafia Beach Pundit always does a superb job of summarizing this government related data (see chart below):

Source: Calafia Beach Pundit

All too often people confuse a secular trend vs. a cyclical move. The collapse in tax revenues during the 2008-2009 timeframe was not the result of some permanent shift in tax policy, but rather a function of a cyclical downturn, much like we have seen in prior recessions.

Extrapolating a short-term trend into a long-term trend is a common investor mistake (see Extrapolation Dangers). While the mean reversion in tax revenues came as a surprise to some, it was no bombshell for me. When the country axes 9 million private jobs and then both companies and consumers rein in spending due to depression fears, a subsequent reduction in tax receipts should not be a shock to market observers. On the flip side, it should then be no revelation that tax revenues will rise when 9 million+ jobs return and confidence rebounds.

We have talked about the shape of tax revenues/receipts, but what about the shape of spending? With all the gridlock occurring in Washington, Americans are fed up with the government’s inability to get anything done, which is evident by the near-record low approval rating of Congress. But as I have written before, not all the effects of gridlock are bad (see Who Said Gridlock is Bad?). What Grannis’s chart above shows is that gridlock has beneficially resulted in about five years of flat spending. Despite the spending stinginess, the slow and steady economic recovery has continued virtually unabated since 2009.

Looked at from a slightly different lens, you can see the deficit reached its worst point in 2009 at about -$1.5 trillion (-10% of GDP) – see chart below. Today, the deficit has almost been cut by 2/3rds to a level of -$0.5 billion (-2.8% of GDP). As you can see, the current deficit/GDP percentage is consistent with the average deficit levels experienced over the last 50 years.

Source: Calafia Beach Pundit

Regardless of your political persuasion, investors are best served by not placing too much focus on what’s going on in Washington D.C. Equal blame and credit can be dispersed across Congress (Democrats & Republicans), the President, and the Federal Reserve. Exaggerating the death of the U.S. economy and stock market may sell more newspapers and advertising, but the resilience of capitalism and innovative spirit of American entrepreneurship has not and will not die.

www.Sidoxia.com

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions in certain exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

November 15, 2014 at 10:48 pm

Source: Photobucket

Between Felix Baumgartner flying through space at the speed of sound and the masses flapping their arms Gangnam style, we all still managed to survive the Mayan apocalyptic end to the world. Investing Caffeine also survived and managed to grow it’s viewership by about +50% from last year.

Thank you to all the readers who inspire me to spew out my random but impassioned thoughts on a somewhat regular basis. Investing Caffeine and Sidoxia Capital Management wish you a healthy, happy, and prosperous New Year in 2013!

Here are some of the most popular Investing Caffeine postings over the year:

1) The Fund Flows Paradox

Explaining how billions of dollars in stock selling can lead to doubling in stock prices.

2) Uncertainty: Love It or Hate It?

Source: Photobucket

Good investors love ambiguity.

3) USA Inc.: Buy, Hold or Sell?

What would you do if our country was a stock?

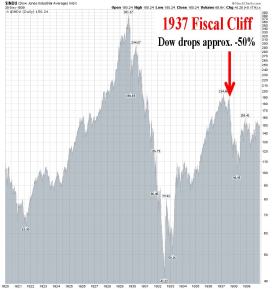

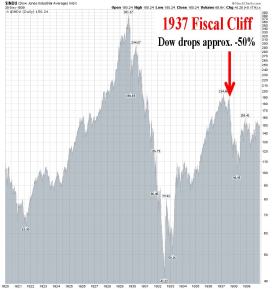

4) Fiscal Cliff: Will a 1937 Repeat = 2013 Dead Meat?

Source: StockCharts.com

Determining whether history will repeat itself after the presidential elections.

5) Robotic Chain Saw Replaces Paul Bunyan

How robots are changing the face of the global job market.

6) Floating Hedge Fund on Ice Thawing Out

Lessons learned from Iceland four years after Lehman Brothers.

7) Sidoxia’s Investor Hall of Fame

Continue reading at IC & perhaps you too can become a member?!

8) Broken Record Repeats Itself

It appears that the cycle from previous years is happening again.

9) The European Dog Ate My Homework

Explaining the tight correlation of European & U.S. markets, and what to do about it.

10) Cash Security Blanket Turns into Tourniquet

Stock market returns are beginning to make change perceptions about holding cash.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

www.Sidoxia.com

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct positions in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

December 30, 2012 at 2:02 pm