Posts tagged ‘Financial Markets’

Consumer Confidence Flies as Stock Market Hits New Highs

As the economy starts reopening from a global pandemic that is improving, consumers and businesses are beginning to see a light at the end of the tunnel. The surge in the recently reported Consumer Confidence figures to a new one-year high (see chart below) is evidence the recovery is well on its way. A stock market reaching new record highs is further evidence of the reopening recovery. More specifically, the Dow Jones Industrial Average catapulted 2,094 points higher (+6.2%) for the month to 32,981 and the S&P 500 index soared +4.2%. A rise in interest rate yields on the 10-Year Treasury Note to 1.7% from 1.4% last month placed pressure on technology growth stocks, which led to a more modest gain of +0.4% in the tech-heavy NASDAQ index during March.

Comeback from COVID

With a combination of 150 million vaccine doses administered and 30 million cumulative COVID cases, the U.S. population has creeped closer toward herd immunity protection against the virus and pushed down hospitalizations dramatically (see chart below).

Also contributing to investor optimism have been the rising values of investments and real estate assets thanks to an improving economy and COVID case count. As you can see from the chart below, the net worth of American households has more than doubled from the 2008-2009 financial crisis to approximately $130 trillion dollars, which in turn has allowed consumers to responsibly control and manage their personal debt. Unfortunately, the U.S. government hasn’t been as successful in keeping debt levels in check.

Spending and Paying for Infrastructure Growth

Besides focusing on positive COVID trends, investors have also centered their attention on the passage of a $1.9 trillion stimulus bill last month and a new proposed $2.3 trillion infrastructure bill that President Biden unveiled details on yesterday. At the heart of the multi-trillion dollar spending are the following components (see also graphic below):

- $621 billion modernize transportation infrastructure

- $400 billion to assist the aging and disabled

- $300 billion to boost the manufacturing industry

- $213 billion to build and retrofit affordable housing

- $100 billion to expand broadband access

With over $28 trillion in government debt, how will all this spending be funded? According to The Fiscal Times, there are four main tax categories to help in the funding:

Corporate Taxes: Raising the corporate tax rate to 28% from 21% is expected to raise $730 billion over 10 years

Foreign Corporate Subsidiary Tax: A new global minimum tax on foreign subsidiaries of American corporations is estimated to raise $550 billion

Capital Gains Tax on Wealthy: Increasing income tax rates on capital gains for wealthy individuals is forecasted to raise $370 billion

Income Tax on Wealthy: Lifting the top individual tax rate back to 39.6% for households earning more than $400,000 per year is seen to bring in $110 billion

Besides the economy being supported by government spending, growth and appreciation in the housing market are contributing to GDP growth. The recently released housing data shows housing prices accelerating significantly above the peak levels last seen before the last financial crisis (see chart below).

Although the economy appears to be on solid footing and stock prices have marched higher to new record levels, there are still plenty of potential factors that could derail the current bull market advance. For starters, increased debt and deficit spending could lead to rising inflation and higher interest rates, which could potentially choke off economic growth. Bad things can always happen when large financial institutions take on too much leverage (i.e., debt) and speculate too much (see also Long-Term Capital Management: When Genius Failed). The lesson from the latest, crazy blow-up (Archegos Capital Management) reminds us of how individual financial companies can cause billions in losses and cause ripple-through effects to the whole financial system. And if that’s not enough to worry about, you have rampant speculation in SPACs (Special Purpose Acquisition Companies), Reddit meme stocks (e.g., GameStop Corp. – GME), cryptocurrencies, and NFTs (Non-Fungible Tokens).

Successful investing requires a mixture of art and science – not everything is clear and you can always find reasons to be concerned. At Sidoxia Capital Management, we continue to find attractive opportunities as we strive to navigate through areas of excess speculation. At the end of the day, we remain disciplined in following our fundamental strategy and process that integrates the four key legs of our financial stool: corporate profits, interest rates, valuations, and sentiment (see also Don’t Be a Fool, Follow the Stool). As long as the balance of these factors still signal strength, we will remain confident in our outlook just like consumers and investors are currently.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Movie Deja Vu – Coronavirus

I have seen this movie before. I love the stock market, but I do actually have other outside interests, including seeing movies. What better indoor winter activity than watching movies?! The Hollywood excitement continues this Sunday for the 92nd Academy Awards. My popcorn consumption has been generous this year as I have seen seven of the nine Best Picture nominated films with the exception of Jojo Rabbit and Little Women.

With a lifetime of movie watching under my belt, there is no shortage of redundant movie themes, whether it’s happy endings in romantic comedies, triumphant patriotism in war flicks, or gory blood spatters in horror films. Just as repetitive as these story lines have been in films, the redundant theme of pandemic health panics continues to plague investors every time a new contagious disease is announced. The newest debut is coronavirus. While coronavirus is playing on the big screen, the presidential impeachment trial, and January 31st Brexit deadline have been sideshows. Stay tuned for that breaking news!

Doctor Wade’s Diagnosis

Although I have not added M.D. to my list of professional credentials (CFA, CFP), Dr. Wade has enough medical experience to identify historical patterns. Most recently, the media covering the Wuhan coronavirus originating in the central Chinese province of Hubei (see map below) has unnecessarily terrorized the global masses with F.U.D. (Fear, Uncertainty, Doubt). While we likely know the ending of this health scare movie (i.e., humanity survives and life goes on), the timing, and scope remain uncertain.

2020: Sickness After Healthy Start

After an healthy start to the 2020 stock market show (S&P 500 index zoomed +3.3% higher), investors viewing the coronavirus plot unfold subsequently were sickened with an S&P decline of -3.4% to finish the month slightly down from year-end (-0.2% from December 31st to January 31st). The Dow Jones Industrial Average was hit slightly worse, down 282 points for the month to 28,256, or -1.0%.

How do we know this infectious coronavirus disease scare shall too pass? Well, over the last few decades, there have been many more lethal diseases that have been put to bed. Here’s a list of some of these high profile, safely-controlled infectious diseases:

- Severe Acute Respiratory Syndrome (SARS)

- Middle East Respiratory Syndrome (MERS)

- Ebola

- Zika Virus

- Bird Flu

- Swine Flu

- H1N1 Virus

- Mad Cow

- Hoof-and-Mouth

A chart comparing the severity and timing of some of the major viruses can be seen below.

While the human impact has been tragic, coronavirus has also struck a blow to the global economy. The pandemic prequel that mostly closely matches coronavirus is SARS, which also originated in China during 2003 in the province of Guandong. Most notable to me is the fatality rate for coronavirus of just 2.2% versus 9.6% for SARS. While coronavirus is less deadly than SARS, coronavirus is objectively more contagious than SARS and could have an incubation period of 14 days (significantly longer than SARS, which could increase the rate of infections). In fact, there were more confirmed cases of coronavirus in one month than all the reported cases of SARS identified over a span of nine months. Even so, as the chart shows, coronavirus deaths remain the lowest.

Economic Impact

The damaging economic impact of the coronavirus pandemic continues to escalate rapidly on a daily basis as governments, global health agencies, corporations, and individuals respond. Even though coronavirus appears to be much less lethal than SARS, we can scale current economic estimates based on the relative costs incurred during SARS. Some reports show the 2003 SARS situation costing the global economy $40 – $60 billion and 2.8 milllion Chinese jobs, while the potential hit in lost global growth from coronavirus could total $160 billion, according to Warwick McKibbin, a Australian National University economics professor.

The Chinese government fully realizes the amount of financial destruction caused by the SARS outbreak, and therefore is not sitting idly as it relates to the coronavirus. Back during SARS, the government did not institute quarantine measures nor publish the SARS’ genome (necessary to test and track virus) until four months had passed. After the first coronavirus patient was diagnosed around December 1st (two months ago) and the spread of the virus accelerated, the Chinese local governments expanded mandatory factory shutdowns for the Lunar New Year from January 31st to February 9th. What’s more, Wuhan, a city of 11 million residents at the epicenter of the illness, recently closed the area’s outgoing airport and railway stations and suspended all public transport. Chinese government officials have since extended the travel ban to 16 neighboring cities with a combined population of more than 50 million people, including Huanggang, a city next to Wuhan with 7.5 million people, essentially placing those cities on lock down.

Private companies are taking action as well. Companies such as Disney, Tesla, Amazon, Google, Apple, McDonalds, Starbucks, and more than a dozen airlines, cruise lines, casinos, and other global companies with significant footprints in China are suspending operations, temporarily shutting factories and instituting travel restrictions.

No Need to Panic Yet

Before you quarantine yourself in your basement, and take full-body showers in hand sanitizer, let’s take a look at some of those annoying things called facts:

- There have been zero (0) coronavirus deaths in the United States, and eight diagnosed cases (at time of press).

- There have been approximately 10,000 Americans killed by the flu since October 2019.

Apparently casual American observers are unable to filter out the true signals being lost in the avalanche of blood-curdling, panicked virus headlines. Tufts Medical Center infectious disease specialist Dr. Shira Doron highlighted this message when she stated the following, “The likelihood of an American being killed by the flu compared to being killed by the coronavirus is probably approaching infinity.” Of the limited number of coronavirus deaths thus far, one study of 41 Wuhan coronavirus death cases showed the median age is around 75 years old. For most people (i.e., those who are not elderly or young children), I guess the moral of this story is to turn the TV off, go get your flu shot, and fall asleep with few worries.

There may be some more coronavirus pain and suffering ahead until this tragic human and economic pandemic comes under control. During the SARS outbreak (November 2002 – July 2003), peak-to-trough stock prices temporarily fell by -16% before marching upwards to new record highs. However, if this movie finishes like so many other similar infectious diseases, the coronavirus fever should break soon enough, and investors will be satisfied with new opportunities and another happy ending to the story.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 3, 2020). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFS) and DIS, TSLA, AMZN, GOOGL, AAPL, and MCD, but at the time of publishing had no direct position in SBUX or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Missing the Financial Forest for the Political Trees

In the never-ending, 24/7, polarizing political news cycle, headlines of Ukraine phone calls, China trade negotiations, impeachment hearings, presidential elections, Federal Reserve monetary policy, and other Washington based stories have traders and news junkies glued to their phones, Twitter feeds, news accounts, blog subscriptions, and Facebook stories. However, through the incessant, deafening noise, many investors are missing the overall financial forest as they get lost in the irrelevant D.C. details.

Meanwhile, as many investors fall prey to the mesmerizing, but inconsequential headlines, financial markets have not fallen asleep or gotten distracted. The S&P 500 stock market index rose another +1.7% last month, and for the year, the index has registered a +18.7% return. As we enter the volatile fourth quarter, many stock market participants remain shell-shocked from last year’s roughly -20% temporary collapse, even though the S&P 500 subsequently rallied +29% from the 2018 trough to the 2019 peak.

Why are many people missing the financial forest? A big key to the significant rally in 2019 stock prices can be attributed to two words…interest rates. Unlike last year’s fourth quarter, when the Federal Reserve was increasing interest rates (i.e., tapping the economic brakes), this year the Fed is cutting rates (i.e., hitting the economic accelerator). Interest rates are a key leg to Sidoxia’s financial four-legged stool (see Don’t Be a Fool, Follow the Stool). Interest rates are at or near generational lows, depending where on the geographic map you reside. For example, interest rates on 10-year German government bonds are -0.55%. Yes, it’s true. If you were to invest $10,000 in a negative yielding -0.55% German bond for 10-years starting in 2019, if you held the bond until maturity (2029), the investor would get back less than the original $10,000 invested. In other words, many bond investors are choosing to pay bond issuers for the privilege of giving the issuers money for the unpalatable right of receiving less money in the future.

The unprecedented negative-yielding bond market is reaching epic proportions, having eclipsed $17 trillion globally (see chart below). This gargantuan and growing dollar figure of negative-yielding bonds defies common sense and feels very reminiscent of the panic buying of technology stocks in the late 1990s.

Source: Bloomberg

At Sidoxia Capital Management, we are implementing proprietary fixed income strategies to navigate this negative interest rate environment. However, the plummeting interest rates and skyrocketing bond prices only make our bond investing job tougher. On the other hand, declining rates, all else equal, also make my stock-picking job easier. Nevertheless, many market participants have gotten lost in the financial trees. More specifically, investors are losing sight of the key tenet that money goes where it is treated best (go where yields are highest and valuations lowest). With many bonds yielding low or negative interest rates, bond investors are being treated like criminals forced to serve jail time and pay large fines because future returns will become much tougher to accrue. In my Investing Caffeine blog, I have been writing about how the stock market’s earnings yield (current approximating +5.5%) and the S&P dividend yield of about +1.9% are handily outstripping the +1.7% yield on the 10-Year Treasury Note (see Going Shopping: Chicken vs. Beef ).

Unless our economy falls into a prolonged recession, interest rates spike substantially higher, or stock prices catapult appreciably, then any decline in stock prices will likely be temporary. Fortunately, the economy appears to be chugging along, albeit at a slower rate. For instance, 3rd quarter GDP (Gross Domestic Product) estimates are hovering around +2.0%.

Low Rates Aid Housing Market

Thanks to low interest rates, the housing markets remain strong. As you can see from the chart below, new home sales continue to ratchet higher over the last eight years, and lower mortgage rates are only helping this cause.

Source: Calafia Beach Pundit

The same tailwind of lower interest rates can be seen below with rising home prices.

Source: Calculated Risk

Consumer Flexes Muscles

At 3.7%, the unemployment rate remains low and the number of workers collecting unemployment is near multi-decade lows (see chart below).

Source: Calafia Beach Pundit

It should come as no surprise that the more employed workers there are collecting paychecks, the more consumer confidence will rise (see chart below). As you can see, consumer confidence is near multi-decade record highs.

Source: Calafia Beach Pundit

Although politics continue to dominate headlines and grab attention, many investors are missing the financial forest because the political noise is distracting the irrefutable, positive effect that low interest rates is contributing to the positive direction of the stock market and the economy. Do your best to not miss the forest – you don’t want your portfolio to suffer by you getting lost in the trees.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Are Stocks Cheap or Expensive? Weekly Rant and the Week in Review 4-7-19

The Weekly Grind podcast is designed to wake up your investment brain with a weekly overview of financial markets and other economic-related topics.

Episode 7

Weekly Market Review and This Week’s Rant: Are Stocks Cheap or Expensive?

Don’t miss out! Follow us on iTunes, Spotify, SoundCloud or PodBean to get a new episode each week. Or follow our InvestingCaffeine.com blog and watch for new podcast updates each week.

SoundCloud: soundcloud.com/sidoxia

PodBean: sidoxia.podbean.com

Spotify: open.spotify.com

Markets Fly as Media Noise Goes By

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2017). Subscribe on the right side of the page for the complete text.

That loud pitched noise is not a frightening scream from Halloween, but rather what you are likely hearing is the deafening noise coming from Washington D.C or cries from concerned Americans watching senseless acts of terrorism. Thanks to the explosion of real-time social media and smart phones, coupled with the divisive politics and depressing headlines blasted across all media outlets, it is almost impossible to ignore the daily avalanche of informational irrelevance.

As I have been writing for some time, the good news for long-term investors is the financial markets continue to plug their ears and ignore poisonous politics and the spread of F.U.D. (Fear, Uncertainty & Doubt). There is a financial benefit to turning off the TV and disregarding political rants over your Facebook feed. Regardless of your political views, President Trump’s approval ratings have objectively been going down, but that really doesn’t matter…the stock market keeps going up (see chart below).

Source: Bespoke

While politicians on both sides scream at each other, investment portfolios have been screaming higher. Stock prices are more focused on the items that really matter, which include corporate profits, interest rates, valuations (price levels), and sentiment (i.e., determining whether investors are too optimistic or too pessimistic). The proof is in the pudding. Stock prices continue to set new records, as witnessed by the 7th consecutive monthly high registered by the Dow Jones Industrial Average to a level of 23,377. For the month, these results translate into an astonishing +4.3% gain. For the year, this outcome equates to an even more impressive +18.3% return. This definitely beats the near-0% rate earned on your checking account and cash stuffed under the mattress.

On the surface, 2017 has been quite remarkable, but over the last decade, stock market returns have proved to be even more extraordinary. Bolstering my contention that politics rarely matter to your long-term pocketbook, one can simply observe history. We are now approaching the 10-year anniversary of the 2008-2009 Financial Crisis – arguably the worst recession experienced in a generation. Over the last decade, despite political power in Washington bouncing around like a hot potato, stock performance has skyrocketed. From early 2009, when the Dow briefly touched a low of 6,470, the index has almost quadrupled above the 23,000 threshold (see chart below).

Source: Barchart.com

To place this spectacular period into better context, one should look at the political control dynamics across Congress and the White House over the same time frame (see the right side of the chart below). Whether you can decipher the chart or not, anyone can recognize that the colors consistently change from red (Republican) to blue (Democrat), and then from blue to red.

More specifically, since the end of 2007, the Democrats have controlled the Senate for approximately 80% of the time; the Republicans have controlled the House of Representatives for 60% of the time; and the Oval Office has switched between three different presidents (two Republicans and one Democrat). And if that is not enough diversity for you, we have also had two Federal Reserve Chairs (Ben Bernanke and Janet Yellen) who controlled the world’s most powerful monetary system, and a Congressional mid-term election taking place in twelve short months. There are two morals to this story: 1) No matter how sad or excited you are about your candidate/political party, you can bank on the control eventually changing; and 2) One person alone cannot save the economy, nor can that same person singlehandedly crater the economy.

Source: Wikipedia

Waterfall of Worries

If you simply read the newspapers and watched the news on TV all day, you would be shocked to learn about the magnificent magnitude of this equity bull market. Reaching these new highs has not been a walk in the park for most investors. There certainly has been no shortage of issues to worry about, including the following:

- Special Counsel Indictments: After the abrupt firing of former FBI Director James Comey by President Donald Trump, Deputy Attorney General Rod Rosenstein established a special counsel in May and appointed ex-FBI official and attorney Robert Mueller to investigate potential Russian meddling into the 2016 presidential elections. Just this week, Mueller indicted Paul Manafort, the former Trump campaign chairman, and Manafort’s business partner and Trump campaign volunteer, Rick Gates. The special counsel also announced the guilty plea of George Papadopoulos, a former foreign policy adviser for the Trump campaign who admitted lying to the FBI regarding interactions between Russian officials and the Trump campaign.

- Terrorist Attacks: Senseless murders of eight people in New York by a 29-year-old man from Uzbekistan, and 59 people shot dead by a 64-year-old shooter from a Las Vegas casino have created a chilling blanket of concern over American psyches.

- New Money Chief? The term of current Federal Reserve Chair, Janet Yellen, ends this February. President Trump has fueled speculation he will announce the appointment of a new Fed chief as early as this week. Although the president has recently praised Yellen, a registered Democrat, many pundits believe Trump wants to select Jerome Powell, a Republican, who currently sits on the Federal Board of Governors.

- North Korea Rocket Launches: So far in 2017, North Korea has launched 22 missiles and tested a hydrogen bomb, while simultaneously threatening to fire missiles over the US territory of Guam and conduct an atmospheric nuclear test. Saber rattling has diminished somewhat in recent weeks since the last North Korean missile launch took place on September 15th. Nevertheless, tensions could rise at any moment, if missile launches resume.

Although media headlines are often depressing, F.U.D. will never go away – it’s only the list of worries that change over time. As noted earlier, the entrepreneurial DNA of the financial markets is focused on more important economic factors like the economy, rather than politics or terrorism. One barometer of economic health can be gauged by the chart below – Consumer Confidence is at the highest level since 2000.

Source: Bespoke

This trend is important because consumers make up approximately 70% of our nation’s economic output. Therefore, it should come as no surprise that Americans are feeling considerably better due to the following factors:

- Strong Job Market: The 4.2% unemployment rate is at the lowest level in 16 years.

- Strong Economy: Despite the dampening effect of the hurricanes, the economy is poised to register its best six-month performance of at least 3% growth in three years.

- Strong Housing Market: Just-released data shows an acceleration in national home price appreciation by +6.1% compared to a year ago.

- Low Interest Rates: Inflation has been low, credit has been cheap, and the Federal Reserve has been cautious in raising interest rates. These low rates have improved the affordability of credit, which has been stimulative for the economy.

Tax Reform Could be the Norm

The icing on the stock market cake has been the optimism surrounding the potential passage of tax reform, likely in the shape of corporate & personal tax cuts, foreign profit repatriation, and tax simplification. The process has been slow, but by passing a budget, the Republican-led Congress was able to pave the way for substantive new tax reform, something not seen since the Ronald Reagan administration, some 30-years ago. Everybody loves paying lower taxes, but victory cannot be claimed yet. Democrats and some fiscally conservative Republicans are not interested in exploding our country’s already-large deficits and debt levels. In order to achieve responsible tax legislation, Congress is looking to remove certain tax loopholes and is negotiating precious tax breaks such as mortgage interest deductibility, state/local tax deductibility, 401(k) tax incentives, and corporate interest expense deductibility, among many other possible iterations. Although corporate tax discussions have been heated, the chart below demonstrates individual income tax legislation is much more important for tax reform legislation because the government collects a much larger share of taxes from individuals vs. corporations.

Source: Calafia Beach Pundit

In spite of all the deafening political noise heard over social media and traditional media, it’s important to block out all the F.U.D. and concentrate on how to achieve your long-term financial goals. If you don’t have the time, energy, or emotional fortitude to follow a disciplined financial plan, I urge you to find an experienced investment advisor who is also a fiduciary. If you need assistance finding one, I am confident Sidoxia Capital Management can help you with this endeavor.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and FB, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

More Treats, Less Tricks

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 2, 2015). Subscribe on the right side of the page for the complete text.

Have you finished licking the last of your Halloween chocolate-covered fingers and scheduled your next cavity-filled dental appointment? After a few challenging months, the normally spooky month of October produced an abundance of sweet treats rather than scary tricks for stock market investors. In fact, the S&P 500 index finished the month with a whopping +8.3% burst, making October the tastiest performing month since late 2010. This came in stark contrast to the indigestion experienced with the -8.7% decline over the previous two months.

What’s behind all these sweet gains? For starters, fears of a Chinese economic sugar-high ending in a crash have abated for now. With that said, “Little Red Riding Hood” is not out of the woods quite yet. Like a surprising goblin or ghost popping out to scare you at a Halloween haunted house, China could still rear its ugly head in the future due to its prominent stature as the second largest global economy. We have been forced to deal with similar on-again-off-again concerns associated with Greece.

The good news is the Chinese government and central bank are not sitting on their hands. In addition to interest rate cuts and corruption crackdowns, Chinese government officials have even recently halted its decades-long one-child policy. China’s new two-child policy is designed to spur flagging economic growth and also reverse the country’s aging demographic profile.

Also contributing to the stock market’s sugary October advances is an increasing comfort level with the Federal Reserve’s eventual interest rate increase. Just last week, the central bank released the statement from its October Federal Open Market Committee meetings stating it will determine whether it will be “appropriate” to increase interest rates at its next meetings, which take place on December 15th and 16th. Interest rate financial markets are now baking in a roughly 50% probability of a Fed interest rate hike next month. Initially, the October Fed statement was perceived negatively by investors due to fears that higher rates could potentially choke off economic growth. Within a 30 minute period after the announcement, stock prices reversed course and surged higher. Investors interpreted the Fed signal of a possible interest rate hike as an upbeat display of confidence in a strengthening economy.

As I have reiterated on numerous occasions (see also Fed Fatigue), a +0.25% increase in the Federal Funds rate from essentially a level of 0% is almost irrelevant in my eyes – just like adjusting the Jacuzzi temperature from 102 degrees down to 101 degrees is hardly noticeable. More practically speaking, an increase from 14.00% to 14.25% on a credit card interest rate will not deter consumers from spending, just like a 3.90% mortgage rising to 4.15% will not break the bank for homebuyers. On the other hand, if interest rates were to spike materially higher by 3.00% – 4.00% over a very short period of time, this move would have a much more disruptive impact, and would be cause for concern. Fortunately for equity investors, this scenario is rather unlikely in the short-run due to virtually no sign of inflation at either the consumer or worker level. Actually, if you read the Fed’s most recent statement, Fed Chairwoman Janet Yellen indicated the central bank intends to maintain interest rates below “normal” levels for “some time” even if the economy keeps chugging along at a healthy clip.

If you think my interest rate perspective is the equivalent of me whistling past the graveyard, history proves to be a pretty good guide of what normally happens after the Fed increases interest rates. Bolstering my argument is data observed over the last seven Federal Reserve interest rate hike cycles from 1983 – 2006 (see table below). As the statistics show, stock prices increased an impressive +20.9% on average over Fed interest rate “Tightening Cycles.” It is entirely conceivable that the announcement of a December interest rate hike could increase short-term volatility. We saw this rate hike fear phenomenon a few months ago, and also a few years ago in 2013 (see also Will Rising Rates Murder Market?) when Federal Reserve Chairman Ben Bernanke threatened an end to quantitative easing (a.k.a., “Taper Tantrum”), but eventually people figured out the world was not going to end and stock prices ultimately moved higher.

Besides increased comfort with Fed interest rate policies, another positive contributing factor to the financial market rebound was the latest Congressional approval of a two-year budget deal that prevents the government from defaulting on its debt. Not only does the deal suspend the $18.1 trillion debt limit through March 2017 (see chart below), but the legislation also lowers the chance of a government shutdown in December. Rather than creating a contentious battle for the fresh, incoming Speaker of the House (Paul Ryan), the approved budget deal will allow the new Speaker to start with a clean slate with which he can use to negotiate across a spectrum of political issues.

Source: Wall Street Journal

Remain Calm – Not Frightened

Humans, including all investors, are emotional beings, but the best investors separate fear from greed and are masters at making unemotional, objective decisions. Just as everything wasn’t a scary disaster when stocks declined during August and September, so too, the subsequent rise in October doesn’t mean everything is a bed of roses.

Every three months, thousands of companies share their financial report cards with investors, and so far with more than 65% of the S&P 500 companies reporting their results this period, corporate America is not making the honor roll. Collapsing commodity prices, including oil, along with the rapid appreciation in the value of the U.S. dollar (i.e., causing declines in relatively expensive U.S. exports), third quarter profit growth has declined -1%. If you exclude the energy sector from the equation, corporations are still not making the “Dean’s List,” however the report cards look a lot more respectable through this lens with profits rising +6% during the third quarter. A sluggish third quarter GDP (Gross Domestic Product) growth report of +1.5% is further evidence the economy has plenty of room to improve the country’s financial GPA.

Historically speaking, October has been a scary period, if you consider the 1929 and 1987 stock market crashes occurred during this Halloween month. Now that investors have survived this frightening period, we will see if the “Santa Claus Rally” will arrive early this season. Stock market treats have been sweet in recent weeks, but investors cannot lose sight of the long-term. With interest rates near generational lows, investors need to make sure they are efficiently investing their investment funds in a low-cost, tax-efficient, diversified manner, subject to personal time horizons and risk tolerances. Over the long-run, meeting these objectives will create a lot more treats than tricks.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Ceasefires & Investor Quagmires

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (March 1, 2015). Subscribe on the right side of the page for the complete text.

Considering the following current event headlines, who would have guessed the stock market is trading near record, all-time highs and the NASDAQ index breaking 5,000 for the first time since the year 2000?

- Russia Lies Over Ukraine Ceasefire

- ISIS Beheadings and Jihadi John

- Strong Dollar, Weak Global Economy

- Fed’s Yellen: Rate Rise & Inflation

- Iranian Negotiations & Nuclear Weapons

- Grexit: The Likelihood of Greece’s Exit from the Euro

- The Chinese Bubble Pops

- Ebola and the Fear Epidemic

After reading all these depressing stories, I feel more like taking a Prozac pill than I do venturing into the investing world. Unfortunately, in the media world, the overarching motto driving the selection of published stories is, “If it bleeds, it leads!” Plainly and simply, bad news sells. The media outlets prey on our human behavioral shortcomings. Specifically, people feel the pain from losses at a rate more than double the feelings of pleasure (see Controlling the Lizard Brain and chart below).

This phenomenon leaves Americans and the overall investing public choking on the daily doom and gloom headlines. Investor skepticism caused by the 2008-2009 financial crisis is evidenced by historically low stock ownership statistics and stagnant equity purchase flow data. Talk of another stock bubble has been introduced again now that the NASDAQ is approaching 5,000 again, but we are not seeing signs of this phenomenon in the IPO market (Initial Public Offering) – see chart below. IPOs are on the rise, but the number of filings is more than -50% below the peak of 845 IPOs seen in the late 1990s when former Federal Reserve Chairman Alan Greenspan made his famous “irrational exuberance” speech (see also Irrational Exuberance Deja Vu and chart below).

Uggh! 0.08% Really?

Compounding the never-ending pessimism problem is the near-0% interest rate environment. Times are long gone when you could earn 18% on a certificate of deposit (see chart below). Today, you can earn 0.08% on a minimum $10,000 investment in a Bank of America (BAC) Certificate of Deposit (CD). Invest at that rate for more than a decade and you will have almost accumulated a $100 (~1%) – probably enough for a single family meal…without tip. To put these paltry interest rates into perspective, the U.S. stock market as measured by the S&P 500 index was up a whopping +5.5% last month and the Dow Jones Industrials climbed +5.6% (+968 points to 18,133). Granted, last month’s S&P 500 percentage increase was the largest advance since 2011, but if I wanted to earn an equivalent +5.5% return by investing in that Bank of America CD, it would take me to age 100 years old before I earned that much!

Globally, the interest rate picture doesn’t look much prettier. In fact, the negative interest rate bonds offered in Switzerland and other neighboring countries, including France and Germany, have left investors in these bonds with guaranteed losses, if held to maturity (see also Draghi Beer Goggles).

Money Seeking Preferred Treatment

Investors and followers of mine have heard me repeatedly declare that “money goes where it is treated best.” When many investments are offering 0% (or negative yields), it comes as no surprise to me that dividend paying stocks have handily outperformed the overall bond market in recent years. Hard to blame someone investing in certain stocks offering between 2-6% in dividends when the alternative is offered at or near 0%.

While at Sidoxia we are still finding plenty of opportunities in the equity markets, I want to extend the reminder that not everyone can (or should) increase their equity allocation because of personal time horizon and risk tolerance constraints. Regardless, the current, restricting global financial markets are highlighting the scarcity of investment alternatives available.

As we will continue to be bombarded with more cease fires, quagmires and other bleeding headlines, investors will be better served by ignoring the irrelevant headlines and instead create a long-term financial plan with an asset allocation designed to meeting their personal goals. By following this strategy, you can let the dooms-dayers bleed while you succeed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) and BAC, but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Time for Your Retirement Physical

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (October 1, 2014). Subscribe on the right side of the page for the complete text.

As a middle-aged man, I’ve learned the importance of getting my annual physical to improve my longevity. The same principle applies to the longevity of your retirement account. With the fourth quarter of the calendar year officially underway, there is no better time to probe your investment portfolio and prescribe some recommendations relating to your financial goals.

A physical is especially relevant given all the hypertension raising events transpiring in the financial markets during the third quarter. Although the large cap biased indexes (Dow Jones Industrials and S&P 500) were up modestly for the quarter (+1.3% and +0.6%, respectively), the small and mid-cap stock indexes underperformed significantly (-8.0% [IWM] and -4.2% [SPMIX], respectively). What’s more, all the daunting geopolitical headlines and uncertain macroeconomic data catapulted the Volatility Index (VIX – aka, “Fear Gauge”) higher by a whopping +40.0% over the same period.

- What caused all the recent heartburn? Pick your choice and/or combine the following:

- ISIS in Iraq

- Bombings in Syria

- End of Quantitative Easing (QE) – Impending Interest Rate Hikes

- Mid-Term Elections

- Hong Kong Protests

- Tax Inversions

- Security Hacks

- Rising U.S. Dollar

- PIMCO’s Bill Gross Departure

(See Hot News Bites in Newsletter for more details)

As I’ve pointed out on numerous occasions, there is never a shortage of issues to worry about (see Series of Unfortunate Events), and contrary to what you see on TV, not everything is destruction and despair. In fact, as I’ve discussed before, corporate profits are at record levels (see Retail Profits chart below), companies are sitting on trillions of dollars in cash, the employment picture is improving (albeit slowly), and companies are finally beginning to spend (see Capital Spending chart below):

Retail Profits

Source: Dr. Ed’s Blog

Capital Spending

Source: Calafia Beach Pundit

Even during prosperous times, you can’t escape the dooms-dayers because too much of a good thing can also be bad (i.e., inflation). Rather than getting caught up in the day-to-day headlines, like many of us investment nerds, it is better to focus on your long-term financial goals, diversification, and objective financial metrics. Even us professionals become challenged by sifting through the never-ending avalanche of news headlines. It’s better to stick with a disciplined, systematic approach that functions as shock absorbers for all the inevitable potholes and speed bumps. Investment guru Peter Lynch said it best, “Assume the market is going nowhere and invest accordingly.” Everyone’s situation and risk tolerance is different and changing, which is why it’s important to give your financial plan a recurring physical.

Vacation or Retirement?

Keeping up with the Joneses in our instant gratification society can be a taxing endeavor, but ultimately investors must decide between 1) Spend now, save later; or 2) Save now, spend later. Most people prefer the more enjoyable option (#1), however these individuals also want to retire at a young age. Often, these competing goals are in conflict. Unless, you are Oprah or Bill Gates (or have rich relatives), chances are you must get into the practice of saving, if you want a sizeable nest egg…before age 85. The problem is Americans typically spend more time planning their vacation than they do planning for retirement. Talking about finances with an advisor, spouse, or partner can feel about as comfortable as walking into a cold doctor’s office while naked under a thin gown. Vulnerability may be an undesirable emotion, but often it is a necessity to reach a desired goal.

Ignorance is Not Bliss – Avoid Procrastination

Many people believe “ignorance is bliss” when it comes to healthcare and finance, which we all know is the worst possible strategy. Normally, individuals have multiple IRA, 401(k), 529, savings, joint, trust, checking and other accounts scattered around with no rhyme or reason. As with healthcare, reviewing finances most often takes place whenever there is a serious problem or need, which is usually at a point when it’s too late. Unfortunately, procrastination typically wins out over proactiveness. Just because you may feel good, or just because you are contributing to your employer’s 401(k), doesn’t mean you shouldn’t get an annual physical for your health and finances. I’m the perfect example. While I feel great on the outside, ignoring my high cholesterol lab results would be a bad idea.

And even for the DIY-ers (Do-It-Yourself-ers), rebalancing your portfolio is critical. In the last fifteen years, overexposure to technology, real estate, financials, and emerging markets at the wrong times had the potential of creating financial ruin. Like a boat, your investment portfolio needs to remain balanced in conjunction with your goals and risk tolerance, or your savings might tip over and sink.

Financial markets go up and down, but your long-term financial well-being does not have to become hostage to the daily vicissitudes. With the fourth quarter now upon us, take control of your financial future and schedule your retirement physical.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in IWM, SPMIX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Goldilocks Meets the Fragile 5 and the 3 Bears

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 3, 2014). Subscribe on the right side of the page for the complete text.

The porridge for stock market investors was hot in 2013, with the S&P 500 index skyrocketing +30%, while the porridge for bond investors was too cold, losing -4% last year (AGG). Like Goldilocks, investors are waiting to get more aggressive with their investment portfolios once everything feels “just right.” Dragging one’s feet too long is not the right strategy. Counterintuitively, and as I pointed out in “Here Comes the Dumb Money,” the investing masses have been very bashful in committing large sums of money out of cash/bonds into stocks, despite the Herculean returns experienced in the stock market over the last five years.

Once the party begins to get crowded is the period you should plan your exit. As experienced investors know, when the porridge, chair, and bed feel just right, is usually around the time the unhappy bears arrive. The same principle applies to the investing. In the late 1990s (i.e., technology bubble) and in the mid-2000s (i.e., housing bubble) everyone binged on tech stocks and McMansions with the help of loose credit. Well, we all know how those stories ended…the bears eventually arrived and left a bunch of carnage after tearing apart investors.

Fragile 5 Bed Too Hard

After enjoying some nice porridge at a perfect temperature in 2013, Goldilocks and investors are now searching for a comfortable bed. The recent volatility in the emerging markets has caused some lost sleep for investors. At the center of this sleeplessness are the financially stressed countries of Argentina and the so-called “Fragile Five” (Brazil, India, Indonesia, Turkey and South Africa) – still not sure why they don’t combine to call the “Sick Six” (see chart below).

|

| Source: Financial Times |

Why are these countries faced with the dilemma of watching their currencies plummet in value? One cannot overly generalize for each country, but these dysfunctional countries share a combination of factors, including excessive external debt (loans denominated in U.S. dollars), large current account deficits (trade deficits), and small or shrinking foreign currency reserves. This explanation may sound like a bunch of economic mumbo-jumbo, but at a basic level, all this means is these deadbeat countries are having difficulty paying their lenders and trading partners back with weaker currencies and depleted foreign currency reserves.

Many pundits, TV commentators, and bloggers like to paint a simplistic picture of the current situation by solely blaming the Federal Reserve’s tapering (reduction) of monetary stimulus as the main reason for the recent emerging markets sell-off. It’s true that yield chasing investors hunted for higher returns in in emerging market bonds, since U.S. interest rates have bounced around near record lows. But the fact of the matter is that many of these debt-laden countries were already financially irresponsible basket cases. What’s more, these emerging market currencies were dropping in value even before the Federal Reserve implemented their stimulative zero interest rate and quantitative easing policies. Slowing growth in China and other developed countries has made the situation more abysmal because weaker commodity prices negatively impact the core economic engines of these countries.

Argentina’s Adversity

In reviewing the struggles of some emerging markets, let’s take a closer look at Argentina, which has seen its currency (peso) decline for years due to imprudent and inflationary actions taken by their government and central bank. More specifically, Argentina tried to maintain a synchronized peg of their peso with the U.S. dollar by manipulating its foreign currency rate (i.e., Argentina propped up their currency by selling U.S. dollars and buying Argentinean pesos). That worked for a little while, but now that their foreign currency reserves are down -45% from their 2011 peak (Source: Scott Grannis), Argentina can no longer realistically and sustainably purchase pesos. Investors and hedge funds have figured this out and as a result put a bulls-eye on the South American country’s currency by selling aggressively.

Furthermore, Argentina’s central bank has made a bad situation worse by launching the money printing presses. Artificially printing additional money may help in paying off excessive debts, but the consequence of this policy is a rampant case of inflation, which now appears to be running at a crippling 25-30% annual pace. Since the beginning of last year, pesos in the black market are worth about -50% less relative to the U.S. dollar. This is a scary developing trend, but Argentina is no stranger to currency problems. In fact, during 2002 the value of the Argentina peso declined by -75% almost overnight compared to the dollar.

Each country has unique nuances regarding their specific financial currency pickles, but at the core, each of these countries share a mixture of these debt, deficit, and currency reserve problems. As I have stated numerous times in the past, money ultimately moves to the place(s) it is treated best, and right now that includes the United States. In the short-run, this state of affairs has strengthened the value of the U.S. dollar and increased the appetite for U.S. Treasury bonds, thereby pushing up our bond prices and lowering our longer-term interest rates.

Their Cold is Our Warm

Overall, besides the benefits of lower U.S. interest rates, weaker foreign currencies lead to a stronger dollar, and a stronger U.S. currency means greater purchasing power for Americans. A stronger dollar may not support our exports of goods and services (i.e., exports become more expensive) to our trading partners, however a healthy dollar also means individuals can buy imported goods at cheaper prices. In other words, a strong dollar should help control inflation on imported goods like oil, gasoline, food, cars, technology, etc.

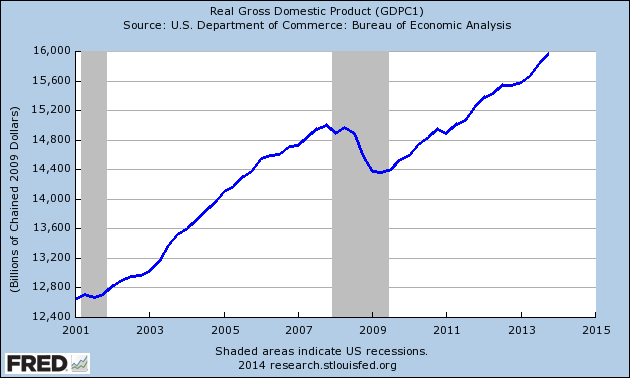

While emerging markets have cooled off fairly quickly, the temperature of our economic porridge in the U.S. has been quite nice. Most recently, the broadest barometer of economic growth (Real GDP) showed a healthy +3.2% acceleration in the 4th quarter to a record of approximately $16 trillion (see chart below).

|

| Source: Crossing Wall Street |

Moreover, corporate profits continue to come in at decent, record-setting levels and employment trends remain healthy as well. Although job numbers have been volatile in recent weeks and discouraged workers have shrunk the overall labor pool, nevertheless the unemployment rate hit a respectable 6.7% level last month and the positive initial jobless claims trend remains at a healthy level (see chart below).

Skeptics of the economy and stock market assert the Fed’s continued retrenchment from quantitative easing will only exacerbate the recent volatility experienced in emerging market currencies and ultimately lead to a crash. If history is any guide, the growl from this emerging market bear may be worse than the bite. The last broad-based, major currency crisis occurred in Asia during 1997-1998, yet the S&P 500 was up +31% in 1997 and +27% in 1998. If history serves as a guide, the past may prove to be a profitable prologue. So rather than running and screaming in panic from the three bears, investors still have some time to enjoy the nice warm porridge and take a nap. The Goldilocks economy and stock market won’t last forever though, so once the masses are dying to jump in the comfy investment bed, then that will be the time to run for the hills and leave the latecomers to deal with the bears.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in AGG, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Reality More Fascinating than Fiction

Make-believe is fun, but reality is often more fascinating than fiction. The same can be said for the books I read. Actually, all the books reviewed at Investing Caffeine have been non-fiction. My movie-viewing preferences happen to be quite similar – comedies and dramas are terrific, but I’m also a documentary fanatic. As a matter of fact, I have rented or watched more than 125 documentaries (and mockumentary, This is Spinal Tap) over the last six years.

There have been a slew of non-fiction books written about the recent global financial crisis, including the ones I reviewed: Too Big to Fail, The Greatest Trade Ever, and The Big Short. When it comes to videos, I have seen several TV-based documentaries covering various aspects of the global meltdown, but the Inside Job did an exceptionally good job of providing a global perspective of the financial collapse. The film was produced, written, and directed by Charles Ferguson (you can call him “doctor” thanks to the Ph.D he earned at MIT) and also narrated by Academy Award winner Matt Damon. The Inside Job provided a comprehensive worldly view by filming on location in the United States, Iceland, England, France, Singapore, and China. Not only did Ferguson break down the complex facets of the crisis into easily digestible pieces for the audience, but he also features prominent journalists, politicians, and academics who describe the complicated global events from a birds-eye view. Hedge fund manager George Soros, former Federal Reserve Chairman Paul Volcker, former New York Governor Eliot Spitzer, and economist Nouriel Roubini, are a small subset of the heavy-hitters interviewed in the movie.

A wide range of causes and effects were explored – everything from derivatives, lack of regulation, excessive banker compensation, and the pervasive conflicts of interest throughout the financial system. Bankers and politicians shoulder much of the blame for the global crisis, and Ferguson does not go out of his way to present their side of the story. Ferguson does a fairly decent job of keeping his direct personal political views out of the film, but based on his undergraduate Berkeley degree and his non-stop Goldman Sachs (GS) bashing, I think someone could profitably prevail in wagering on which side of the political fence Ferguson resides.

Although I give Inside Job a “thumbs-up,” I wasn’t the only person who liked the movie. The Inside Job in fact won numerous awards, including the 2010 Academy Award for Best Documentary, Best Documentary from the New York Film Critics Circle, and the Best Documentary Screenplay from the Writers Guild.

Slome’s Oscar Nominees

As I mentioned previously, I am somewhat fanatical when it comes to documentaries, although I have yet to see Justin Bieber’s Never Say Never. Besides the Inside Job, here is a varied list of must-see documentaries. There may be a conflict of personal tastes on a few of these, but I will provide you a hand-written apology for anybody that falls asleep to more than one of my top 15:

1) Murderball

5) Hoop Dreams

6) Lewis and Clark: The Journey (Ken Burns)

8) Enron: The Smartest Guys in the Room

10) Paradise Lost

11) The Endurance

14) The Devil Came on Horseback

15) Emmanuel’s Gift

I’m obviously biased about the quality of my recommended documentaries, but you can even the score by sharing some of your favorite documentaries in the comment section below or by emailing me directly. I will be greatly indebted for any suggestions offered. Regardless, whether watching a truth-revealing thought-piece like the Inside Job or A Crude awakening, or an inspirational story like Murderball or Touching the Void, I’m convinced that these reality based stories are much more fascinating than the vast majority of recycled fiction continually shoveled out by Hollywood. For those adventurous movie-watchers, check out a documentary or two – who knows…there may be an inner-documentary fanatic in you too?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in GS, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.