Posts tagged ‘finance’

As We Give Thanks, AI and Mag 7 Take Cash to the Bank

Market volatility resurfaced last month as speculation intensified over whether an AI bubble may be forming—and potentially bursting. Yet despite the jitters, equity markets remain solidly positive for the year (S&P 500 +16.5%, NASDAQ +21.0%, Dow +12.2%) – see S&P 500 chart below. A significant portion of the gains have been powered in large part by ongoing strength in the Magnificent 7. Standouts such as NVIDIA (+31.8%) and Alphabet (+68.1%) have been instrumental in carrying the broader indices higher.

Even with these sizable year-to-date gains, memories of the 2000 Tech Bubble and 2008 Financial Crisis resurfaced and prompted investors to temporarily tap the brakes. Mid-month, the NASDAQ retreated roughly -9% from its October peak. After a month-end bounce, the S&P 500 finished essentially flat (+0.1%), the NASDAQ slipped -1.5%, and the Dow eked out a +0.3% increase.

OpenAI and the $1.4 Trillion Question

At the center of the AI controversy sits OpenAI, parent of the three-year-old technology toddler, ChatGPT (Generative Pre-trained Transformer), which now boasts more than 800 million global users (see chart below). The company reportedly runs at a $20 billion annual revenue pace, yet faces difficult questions about how it intends to fund its staggering $1.4 trillion AI infrastructure commitments.

Those concerns came to a head when tech investor Brad Gerstner pressed CEO Sam Altman on his podcast last month. Instead of answering how OpenAI plans to underwrite such an enormous buildout, Altman childishly shot back defensively:

“If you want to sell your shares, I’ll find you a buyer.” (See clip here — or full interview here)

Source: Digital Information World

OpenAI is a key player, but just one component in the vast—and rapidly expanding—web of global AI infrastructure. Gartner, a global research and advisory firm, forecasts $2 trillion of AI investment in 2026, while NVIDIA CEO Jensen Huang recently said:

“Over the next five years, we’re going to scale into… effectively a $3 to $4 trillion AI infrastructure opportunity.”

These provocative “Is this a bubble?” questions make for great headlines, but to truly evaluate AI sustainability, it’s wise to follow the classic Watergate guidance from of All the President’s Men character, Deep Throat (FBI Associate Director, Mark Felt), who tells journalist Bob Woodward to “follow the money,” if he wants to get to the bottom of the Watergate scandal.

The same principle applies to investors who follow the money – the picture looks very different from past bubbles.

Forget Pets.com—Today’s AI Buildout Is Being Funded by Cash-Rich Titans

Unlike the flimsy, profitless internet startups of the late 1990s—companies that raised billions based on “eyeballs” and cocktail-napkin business plans—the current AI buildout is being financed largely by profitable cash-generating giants.

Yes, some firms like Oracle (ORCL) are leaning on debt financing for data-center expansion. But the overwhelming majority of AI capex is being funded by customers and by the cash flow of the Magnificent 7, a group with the financial firepower to sustain multi-year spending without relying heavily on capital markets.

This dynamic alone separates today’s environment from classic bubble conditions.

Do the Magnificent 7 Really Deserve a $22 Trillion Valuation?

The Mag 7 represent only 1% of S&P 500 constituents yet account for a massive 35% of the index’s market value. That concentration understandably raises eyebrows, evoking historical parallels to the “Nifty Fifty” of the 1970s or the “Four Horsemen” of the 1990s.

But headline concentration can be misleading—because the fundamentals tell a very different story. Here are some of the major disparities:

1.) Mag 7 Share of Profits Matches Their Share of Market Value: The Mag 7 collectively contribute $22 trillion of the S&P 500’s $58 trillion total value (below). Said differently, the market values and weightings of the Mag 7 equate to about $22 trillion and 37% of the S&P 500, respectively:

· Nvidia Corp: $4.3T & 7.0%

· Apple Inc.: $4.1 T & 6.7%

· Alphabet Inc.: $3.9 T & 6.3%

· Microsoft Corp.: $3.7 T & 5.9%

· Amazon.com Inc.: $2.5 T & 4.0%

· Meta Platforms Inc.: $1.6T & 2.6%

· Tesla Inc.: $1.4T & 2.3%

· TOTAL: $22T / 37%

Source: Slickcharts

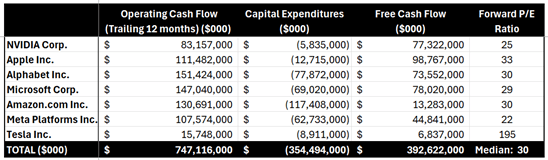

Conveniently (and importantly), the Mag 7’s roughly $747 billion in annual cash flow (see table below) is a good proxy for their profit contribution to the $2 trillion in S&P profits.

Source: SEC Filings & MarketSurge

The $747 billion in Mag 7 cash flows divided by the $2 trillion in S&P 500 coincidentally also equates to 37% ($747B/$2T).

These calculations of the Mag 7 are not bubble math—these calculation comparisons are rational math. Arguments could be made that Mag 7 market values are actually undervalued (not in bubble territory) and should appreciate to a higher percentage of the S&P 500 weightings because these 7 stocks are growing sales and profits faster than compared to the other “absentee” 493 stocks in the index.

2.) Mag 7 are Swimming in Cash: That $747 billion in annual cash flow is on track to hit a jaw-dropping $1 trillion, giving these firms ample capital to fund AI buildouts without substantially accessing the equity or credit markets. The ability to self-fund a multi-trillion-dollar infrastructure expansion is the opposite of bubble behavior.

3.) Valuations Are Elevated—but Far from Bubble Territory: During the 2000 Tech Bubble, many leading tech names traded at 100x+ earnings (See also: Rational or Irrational Exuberance. Today, the Mag 7 trade at a median forward P/E around 30x. Expensive? Historically, yes, versus long-term averages, but nowhere near historical extremes. Relative to growth, profitability, and cash flow, valuations are far more grounded today than during prior manias.

The bottom line is there is plenty to be thankful for and bubble fears are overstated. Despite pockets of AI froth, the underlying economic engine powering AI adoption is real, profitable, and well-capitalized. When investors follow the money, they discover:

· The Mag 7 generate over one-third of S&P 500 profits

· They generate and hold hundreds of billions in cash

· They largely fund their own AI capital expenditures

· Valuations remain far below bubble-era extremes

Investors have a lot to be thankful for. And while volatility will likely continue, the ingredients for a classic, catastrophic AI bubble are noticeably absent. For disciplined, long-term investing strategies like those employed at Sidoxia Capital Management, this environment still offers abundant opportunity—without the need to fear a pricked AI balloon anytime soon.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Dec. 1, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in ORCL or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Rational or Irrational Exuberance?

The government may be shut down, but the stock market hasn’t noticed. In fact, stocks just capped another record-breaking month. The S&P 500 gained +2.3%, the NASDAQ climbed +4.7%, and the Dow rose +2.5%.

Millions of Americans are feeling the downside of the shutdown—from disrupted travel to stalled services and furloughed workers. Historically, such uncertainty rattles Wall Street. This time? Investors seem more captivated by the transformative promise of artificial intelligence (AI).

So, the key question today: Is this AI-driven exuberance rational—or irrational?

Exuberance Then vs. Exuberance Now

Having invested for more than 35 years, I’ve seen periods of euphoria and fear. I vividly remember December 1996 when Fed Chair Alan Greenspan famously questioned whether markets were becoming “irrationally exuberant.” Back then, the NASDAQ sat near 1,300. Over the next three years it soared past 5,100 (almost quadrupling), only to crash nearly 80% by 2002.

But here’s the twist: it’s true, we did experience a “tech bubble burst”, but where is the NASDAQ index value today? Amazingly, the index stands at 23,000 (see chart below) – an 18x increase above the 1996 level when Greenspan gave his irrational exuberance speech! So, in hindsight, the sound we heard during 2000 was not the tech bubble bursting but rather an internet Big Bang! The internet wasn’t a speculative fad—it was the foundation of a global transformation.

So, what about AI?

Source: Macrotrends LLC

Internet Cycle vs. AI Supercycle

The internet era lifted the number of online users from zero to five billion—over 60% of the planet (see chart below). The AI wave kicked off publicly in November 2022 with ChatGPT’s release. In under three years, the NASDAQ has more than doubled. That pace isn’t sustainable forever, of course. Bubbles form, emotions swing, and markets correct. But dismissing AI as a fad ignores its unmistakable—and accelerating—impact.

Source: BOND – Mary Meeker

With the rapid appreciation in the stock market, it’s important for investors to identify and understand the warning signs of potential bubble bursting or market crash. In fact, I continue to do my part by studying past crashes. My shipment of Andrew Ross Sorkin’s book, 1929: Inside the Greatest Crash in Wall Street History just arrived and all these lessons remind us that not all booms are bubbles, and not all crashes end innovation.

Not All Bubbles are Created Equal

Major market drawdowns are part of a long-term investor’s journey:

- 1929: Great Crash

- 1973-74: Nifty-Fifty

- 1987: Black Monday

- 2000: Dot-com bust

- 2008: Financial crisis

- 2020: COVID crash

Many pundits today are now asking is this AI surge the next bubble? Valuations, as measured by P/E ratios (Price/Earnings), suggest a very different setup than in 2000.

Back then, many tech leaders traded at 100x+ earnings. Today’s Magnificent Seven tech leaders are elevated, but nowhere near dot-com extremes:

- NVIDIA Corporation (NVDA): 57x

- Apple Inc. (AAPL): 36x

- Microsoft Corp. (MSFT): 36x

- Alphabet Inc. (GOOG): 32x

- Amazon.com, Inc. (AMZN): 31x

- Meta Platforms, Inc. (META): 23x

*Source: MarketSurge – only Tesla, Inc. (TSLA) has a P/E higher than 100x.

For the S&P 500 overall, the index has a forward P/E of 22.8x (Yardeni Research), significantly lower than 2000 levels and nowhere near bubble territory.

Source: Wall Street Journal – March 14, 2000

Life After the Internet and Life After AI Introduction

Think back 25 years:

- Renting movies at Blockbuster before Netflix went digital

- Driving to the bank for deposits

- Buying stamps to mail checks before Venmo or Zelle

Today, those activities feel prehistoric. AI is set to reshape daily life on an even faster timeline — from medicine and logistics to entertainment and marketing.

I’m discovering “AI epiphanies” weekly.

- With a few prompts, I created a beautiful Mother’s Day poem and became a poet hero despite never writing poetry before.

- When I recently needed to write an obituary for my mother, AI helped structure and refine it in minutes instead of taking me hours.

- Just last month I needed to hunt down lobster bisque for a shrimp pasta recipe I wanted to make. It turned into a time-wasting scavenger hunt. Thankfully, AI found it in stock, even when multiple apps insisted it wasn’t available. Needless to say, the recipe was incredibly delicious, and my stomach thanked ChatGPT.

And when it comes to investing? Evaluating biotech companies used to take weeks. Now, detailed research can be synthesized in days without sacrificing rigor. AI isn’t replacing insight — it’s amplifying output.

Not All AI Stories Are “Unicorns and Rainbows”

AI boosts productivity. Higher productivity means some companies need fewer people. Amazon recently announced 14,000 layoffs despite reporting amazing financial results. Microsoft and Meta have also announced thousands of employee layoffs even as profits rise.

This isn’t doom and gloom — it’s innovation cycles in action. Technology displaces tasks before ultimately creating new industries and roles.

So… Rational or Irrational?

Although there has been much debate regarding whether we are in an AI bubble, from my perspective, we are in the very early innings of a long AI revolutionary game. There are definitely pockets of frothiness that expose investors to undue risk, but if you can follow a disciplined, diversified, valuation-sensitive investment strategy, like we implement at Sidoxia Capital Management, I feel that the current exuberance is more rational than irrational.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (Nov. 3, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, MSFT, GOOGL, AMZN, META, TSLA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investing in Pigs and Kidneys: Building a $100 Billion Empire and Revolutionizing Organ Transplants

How does one create a $100 billion empire while pioneering an endless supply of transplantable organs that could save millions of lives? The first step is launching a multi-billion-dollar satellite company (SiriusXM – SIRI). The next step? Founding a biotechnology company with nothing more than a high school-level biology education — all in a desperate attempt to save the life of your seven-year-old daughter from a rare heart disease that claims lives within three to five years.

This is the extraordinary path of Martine Rothblatt, CEO and visionary of United Therapeutics Corp. (UTHR), who began this journey 35 years ago.

Transforming Industries: From SiriusXM to Organ Transplants

Few individuals have singlehandedly transformed entire industries. One name that comes to mind is Steve Jobs – who revolutionized consumer electronics and laid the foundation for Apple Inc.’s (AAPL) meteoric rise to a multi-trillion dollar company before he passed away. While Rothblatt and United Therapeutics may not yet be household names, she is undeniably reshaping the healthcare industry and steering it toward a future of unprecedented, life-extending medical advancements.

How can these ambitious, world-changing goals be achieved? A whole aisle of books could be written about Rothblatt’s impressive lifetime accomplishments, but the unique investment opportunity for investors cannot be fully understood without appreciating the person that created United Therapeutics 29 years ago in 1996.

Rothblatt has accomplished more than most humans could in multiple lifetimes – here is a partial sampling of her achievements:

- Earned a Bachelor of Arts, a Juris Doctor (JD), and Master of Business Administration (MBA) degrees from the University of California, Los Angeles (UCLA).

- Finished her PhD at The London School of Medicine (Barts)

- Practiced law at the Covington & Burling law firm representing the television broadcasting industry before the Federal Communications Commission (FCC).

- Hired by NASA to seek approval from the FCC for NASA systems used to track and relay satellite data.

- Created the multi-billion-dollar satellite radio company SiriusXM in 1990 with the inspiration of physicist Gerard O’Neill, the same Princeton professor who motivated Amazon CEO, Jeff Bezos to create Blue Origin.

- Invented the Terasem Movement, an organization with the mission of human life extension that uses cognitive and artificial intelligence software. Terasem’s technology has created a lifelike robot (BINA48), which is modeled after her spouse, Bina Rothblatt.

- Pioneered EV (electric) helicopter transportation through the company’s Unither Bioelectronics division with the purpose of cutting energy consumption and speeding up organ delivery times.

The United Therapeutics Story

In 1996, while leading SiriusXM, Rothblatt faced every parent’s worst nightmare. Doctors diagnosed her seven-year-old daughter, Jenesis, with Pulmonary Arterial Hypertension (PAH) — a rare, devastating disease with no known cure. Determined to save her daughter, Rothblatt initially funded research grants totaling over a million dollars to a narrow group of five doctors studying the disease. When the scientists failed to find a cure, she took matters into her own hands.

With no formal medical background, she quit SiriusXM, immersed herself in biology, and founded United Therapeutics. Against all odds, armed with her mantra that “persistence leads to omnipotence,” Rothblatt’s relentless pursuit paid off when she discovered a cure. Today, decades later, Jenesis is 42 years old and thriving as a high-profile manager at United Therapeutics.

Addressing the Organ Shortage Crisis

United Therapeutics’ advancements in PAH treatment have allowed patients like Jenesis to live long, productive lives. However, many eventually require organ transplants – the company is already assisting hundreds of patients with lifesaving human lung transplants. Despite some progress, the current organ shortage crisis is staggering:

- Over 100,000 people are on the national transplant waiting list.

- More than 92,000 of them need a kidney due to kidney failure or End-Stage Renal Disease (ESRD).

To address the organ shortage, United Therapeutics recently made history last month when the FDA approved the first-ever clinical trial for its UKidney xenotransplantation procedure for kidney failure patients.

The severity of the organ shortage problem is clear-cut if you examine the numbers. In addition to the 92,000 patients on the kidney transplant waitlist mentioned above, there are approximately 500,000 additional ESRD dialysis patients not on the national transplant list. Roughly 10% of these ESRD patients die each year due to dialysis-related complications.

If you combine the wait list population with the dialysis patient population you get to a total of around 600,000 people total. Regrettably, the vast majority of these patients do not receive an organ. In fact, only 27,759 kidney transplants were performed in the U.S. last year. In other words, despite the enormous demand for transplantable organs, less than 5% of the addressable market have actually benefited from a new kidney.

The Future of Organ Transplants: Profitable Pig Potential

How can this massive undersupply of transplants be fixed? One word…pigs. With a very scarce supply of human donors, pigs may hold the key to solving the organ shortage. United Therapeutics has pioneered genetically engineered pig organs (xenotransplantation) by modifying 10 key genes to prevent immune system rejection. As part of the xenotransplantation trial, United Therapeutics has built multiple DPF (designated pathogen free) facilities that house the pigs carrying the gene-modified kidneys.

All of this may sound like science fiction, but the dream of xenotransplantation has already become reality. Just last November, a genetically engineered pig kidney was transplanted into a patient (Towana Looney) under a compassionate use basis granted by the FDA. With its new clinical trial now underway, United Therapeutics is planning to transplant up to 50 patients with modified pig kidneys in the coming months.

And UKidney is just the beginning. United Therapeutics has a deep organ transplant pipeline that extends beyond kidneys into livers, hearts, and lungs (see graphic below). The company is also working on the “holy grail” of transplants – 3D printed organs using the cells of organ recipients to build the tissue structure, which dramatically reduces or eliminates the risk of organ rejection.

If UKidney is successful, United Therapeutics and Martine Rothblatt will be one step closer to realizing the company’s vision of manufacturing an endless supply of transplantable organs.

Source: United Therapeutics

Investment Opportunity of a Lifetime?

Nothing in life is certain, and there are risks to making any investment, but betting against Martine Rothblatt over the years has been a major losing proposition. From an investment standpoint, the core PAH drug business is trading at an immense discount, and investors are essentially valuing the organ transplant business at $0.

Despite its groundbreaking advancements and tremendous profit growth, United Therapeutics has huge stock price appreciation potential. Here’s why:

Stock is Dirt Cheap: At $317 per share, the stock currently trades at roughly a 50% discount to the trailing S&P 500 Price-Earnings ratio (PE) – 13x P/E vs. 26x index P/E. In other words, the shares should be trading north of $600 (double the price), if United Therapeutics was afforded an “average” company P/E multiple. But United Therapeutics clearly is not an average company.

Over the last two years, the company has grown revenues +48% from $1.9 billion to $2.9 billion and seen earnings explode +64% higher from $15.00 per share to $24.64. The stock becomes even cheaper on a forward P/E multiple (11x P/E) if the company can meet 2025 Wall Street expectations of 15% growth in its EPS to $28.23. Its superior products, execution, and competitive moats should afford the company a significant premium, not a drastic discount. Short-term investors are missing the boat by ignoring the gargantuan market potential for the company.

Is it possible for a $15 billion company to reach a $100 billion market value? This is not difficult to imagine if the company can bring its innovative and revolutionary pipeline products to market and take its current revenue base of almost $3 billion to $16 billion (see graphic below). The company certainly will not reach $16 billion in revenues tomorrow, but if you applied an average market multiple to those projections, and the company were able to maintain its current profit margin profile, a $3,000 per share stock price would be well within reason, equating to a market value well above $100 billion.

Source: United Therapeutics

Many Irons (Catalysts) in the Fire: United Therapeutics is no one-trick pony. Besides the company’s organ transplant plans, and their core commercial PAH and PH-ILD franchise, which includes, Remodulin, Orenitram, and Adcirca, United Therapeutics has many more irons in the fire that can be catalysts for stock price appreciation over the next 12 – 24 months (see graphic below).

Here is a more detailed description of the drivers:

- New Markets for Core Drugs: Any biotech or pharmaceutical company is in the business of searching for new markets to sell its products. United Therapeutics has found that in both the IPF (Idiopathic Pulmonary Fibrosis) and PPF (Progressive Pulmonary Fibrosis) markets, which are two different forms of chronic lung disease that are characterized by the gradual scarring and thickening of the lung tissue, which is called fibrosis. These patients can be administered with modified formulations of its existing Tyvaso molecule. The revenue potential is huge if the efficacy data comes in as planned because the pools of patients suffering from these horrible, progressive lung diseases could more than double the size of the present addressable market. Data from the company’s TETON 1 (IPF), TETON 2 (IPF), and TETON PPF studies will be released over the next few years, starting as early as next quarter.

- Improved Drug Formulation: United Therapeutics is also waiting for groundbreaking data from a drug called Ralinepag, the first once-per-day prostacyclin pill that is an improvement over its existing drugs of Remodulin, Tyvaso, and Orenitram. The company is releasing the Ralinepag data from its ADVANCE OUTCOMES study next year, and if the data proves to be positive, this could represent another multi-billion dollar opportunity for the company and investors.

- Other Near-Term Catalysts: Although perhaps representing a less meaningful potential from a long-term revenue standpoint, the company’s Centralized Lung Evaluation System (CLES) program is awaiting an FDA decision this year – CLES is designed to expand the supply of donor lungs. Last, but not least, data from United Therapeutics’ microliverELAP study represents another sizeable revenue opportunity for liver transplants.

Source: United Therapeutics

Fly in the Ointment: Failing Capital Allocation Grade

United Therapeutics deserves an A+ grade for developing the critical, world-class therapeutics that serve the PAH and PH-ILD market and the massive potential pipeline in xenotransplantation and alternative organ platforms. However, the company receives a failing grade for the implementation of its capital allocation strategy. United Therapeutics holds an excessively bloated cash surplus on its balance sheet, which has exploded higher from $1.0 billion in 2015 to $4.7 billion in 2024.

Sadly, the problem is only getting worse, as the company is on pace to add more than $1 billion more to the cash balance this year, and in subsequent years. This is woefully inefficient and becoming an alarmingly growing percentage (approximately 30% currently) of the company’s market value. To put this issue into perspective, investors should consider the company has enough cash on its balance sheet to effectively fund two decades of capital expenditure requirements. Profitable companies in United Therapeutics’ hand-selected proxy peer group hold a much more responsible amount of cash, representing about 4% of their market values.

If you had $100k of annual spending requirements, would you negligently place $2 million dollars in a low-single-digit yielding checking account or multi-year CD at your bank, when you could responsibly earn a 10% or higher return by paying down credit card debt? This is what United Therapeutics is doing. The company is essentially burning shareholder money by letting cash sit idly on its balance sheet earning a pittance when it could be earning significantly more. Why invest in government Treasuries when you could invest in your own company, compounding at rates greater than 10%?

The solution is clear. Implement a meaningful share repurchase program that is immediately EPS-accretive with the company’s bloated mountain of cash and bring down to responsible levels that are consistent with profitable growth peers. And rather than limiting your share repurchase to a one-time accelerated stock repurchase (ASR) program, expand the buyback to be more open ended on top of immediate purchases. This strategy provides the company with the flexibility to opportunistically purchase shares at a discount when the share price is depressed – like now, when shares are down -24% over the last five months.

Unfortunately, my message appears to be falling on deaf ears. I was hoping to gain clarity through communications with the company along with a letter sent to management and the board of directors. In my letter, I attempted to remind management of the importance of upholding its rigorous corporate governance standards and exercise its fiduciary duty when it comes to the company’s allocation strategy. However, regrettably, up to this point, there has been no indication to the market or me that there is any urgency to take advantage of the massively discounted United Therapeutics share price that exists today.

READ RECENT LETTER SENT TO MANAGEMENT & BOARD OF DIRECTORS BY CLICKING HERE

Investors Should Not Miss the Forest for the Trees

Although the company receives a failing capital allocation grade from my perspective, investors should not miss the forest from the trees. United Therapeutics’ share price is currently trading at a gigantic discount, yet it boasts unparalleled profitability and a groundbreaking organ transplant pipeline.

This lack of appreciation for the shares is surprising given how wildly profitable the company is and its tremendous long-term track record of success. But the company is not sitting on its hands – United Therapeutics has ambitious plans to expand its current annual revenue base by more than five-fold from $3 billion to $16 billion due to full cupboard of pipeline products.

With Martine Rothblatt at the helm—a visionary with a track record rivaling Steve Jobs—the company is poised to revolutionize healthcare. The world is a better place due to Martine Rothblatt, and your portfolio will be a better place with an investment in United Therapeutics.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in UTHR, AAPL, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in SIRI or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Time in the Market Beats Timing the Market

It was another great year in the stock market. But predicting the timing of a bear or bull market is more challenging. Fortunately for investors, the stock market is up a lot more of the time than it is down. More specifically, over the last century, the stock market has been up 73% of the time for one-year periods and 94% of the time for 10-year periods (see graphic below and Time is What Matters). That’s why investors’ time in the market beats the fools’ errand strategy of trying to time the market. The long-term, consistent upward trend in stock prices makes investing in the stock market akin to sailing around the world with a persistent tailwind for the whole trip.

Source: Capital Group and S&P 500 Index

Many people believe investing in the stock market is gambling, but 73% and 94% odds for stock market gains seem a lot better than the probabilities of making money in Las Vegas. I explored this concept further in one of my recent articles (see Elections Status Quo). Even with those favorable, lopsided odds, recessions do occur, albeit infrequently. As you can see from the chart below, since World War II, we have experienced a dozen recessions averaging 10 months in duration. And guess what? Successful post-recession recoveries have equaled 100% (12 for 12). Despite the short-lived bear markets, stock prices have appreciated more than 30x-fold since the end of World War II.

Source: Yardeni.com

2024 Predictions

There were plenty of pundits and talking heads who falsely predicted a recession in 2024, but the odds certainly worked in investors’ favor. For 2024, the S&P 500 index gained +23%, and this comes on the heels of a banner 2023, which was up +24%. Experiencing back-to-back +20%-years is a rare occurrence, which hasn’t occurred since the late-1990s. As we look into 2025, achieving three consecutive positive years in the stock market is not unprecedented, but as I mentioned earlier, predicting the timing of a down market can be tricky.

Case in point, predicting the outcome of stock returns, even with perfect information can be very daunting. What would have been your prediction of the 2024 stock market return, if I told you the following events were to occur this year (in no particular order)?

- Two assassination attempts on a presidential candidate

- An ongoing bloody war between Russia and Ukraine that reaches one million deaths

- Brutal Israeli-Hamas war in Gaza moves into its second year

- Nationwide Palestinian protests across college campuses

- Israeli-Hezbollah war commences in Lebanon

- Rebels in Syria topple the Assad regime

- A hotly contested presidential election triggering fears of a civil war

- A Baltimore bridge collapses killing six people and costing the overall economy upwards of $10 billion

- After crypto exchange goes bankrupt, CEO is sentenced to 25 years in prison for fraud

Most intelligently honest people would not have predicted a +23% return, but that is exactly what happened. As part of this extended bull market, some major stock market milestones were achieved: 1.) the Dow Jones Industrial average eclipsed 40,000; 2.) the main benchmark S&P 500 index surpassed 6,000; and 3.) the NASDAQ index temporarily triumphed the 20,000 level. The market took a breather in December (the Dow -5.3% and S&P -2.5%), so we have momentarily pulled back from some of these key levels.

What Next in 2025?

As I alluded to earlier, pulling off a three-peat in 2025 with a third consecutive year of gains may be a difficult feat, but not impossible. There remains some room for optimism. First of all, we have an accommodative Federal Reserve that has cut interest rates three times in 2024 (see chart below) from a target of 5.5% to 4.5% (see red line). Currently, expectations are set for the Fed to make another two interest rate cuts in 2025. All else equal, this should provide some mild stimulus for both borrowers and investors in 2025.

Source: Yardeni.com

Next, we have a new pro-business administration entering the White House that has promised lower taxes and less regulation, which should aid business profits. Tariff policies remain a wildcard, but if used judiciously for negotiation purposes, perhaps there could be more bark than bite from the rhetoric. Time will tell.

The 2024 chapter has closed, and we have started the 2025 chapter. Regardless of the outcome this year, history teaches us the time in the market is much more important than timing the market. This philosophy has served Sidoxia Capital Management and its clients well over the long-run.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (January 2, 2025). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Investors Scared Silly While Stocks Enjoy Sugar High

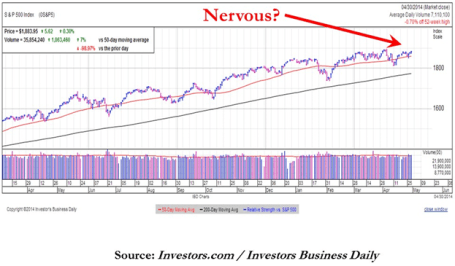

China trade war, impeachment hearings, Brexit negotiations, changing Federal Reserve monetary policy, Turkish-Kurd battles in Syria, global slowdown fears, and worries over an inverted yield curve. Do these headlines feel like a conducive environment for stock market values to break out to new all-time, record highs? If you answered “no”, then you are not alone – investors have been scared silly despite stocks experiencing a sugar high.

For the month, the S&P 500 index climbed another +2.0% and set a new monthly-high record. The same can be said for the Dow Jones Industrial Average, which also set a new monthly record at 27,046, up +0.5% from the previous month. For the S&P 500, these monthly gains contributed to what’s become an impressive 2019 total appreciation of +21%. Normally, such heady gains would invoke broad-based optimism, however, the aforementioned spooky headlines have scared investors into a coffin as evidenced by the hundreds of billions of dollars that have poured out of stocks into risk-averse bonds. More specifically, ICI (Investment Company Institute) releases weekly asset flow figures, which show -$215 billion fleeing stock funds in 2018-2019 through the end of October, while over +$452 billion have flocked into the perceived safe haven of bonds. I emphasize the word “perceived” safe haven because many long duration (extended maturity) bonds can be extremely risky, if (when) interest rates rise materially and prices fall significantly.

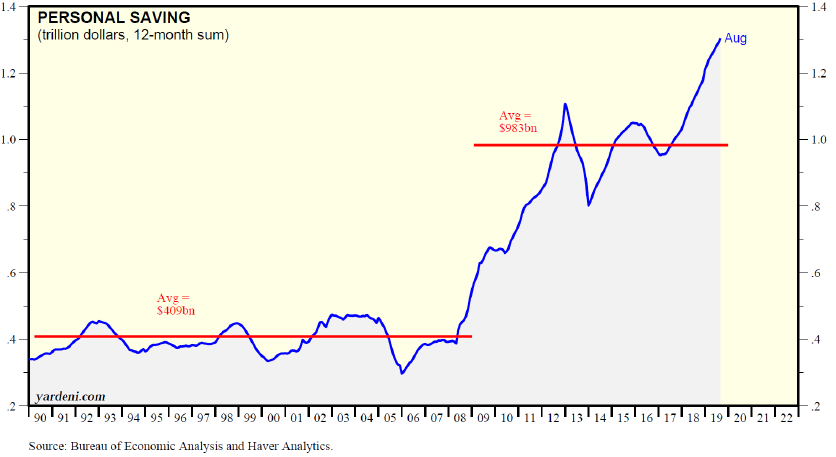

Besides the data showing investors fleeing stocks and flocking to bonds, we have also witnessed the risk-averse saving behavior of individuals. When uncertainty rose in 2008 during the financial crisis, you can see how savings spiked (see chart below), even as the economy picked up steam. With the recent spate of negative headlines, you can see that savings have once again climbed and reached a record $1.3 trillion! All those consumer savings translate into dry powder spending dollars that can be circulated through the economy to extend the duration of this decade-long financial expansion.

Source: Dr. Ed’s Blog

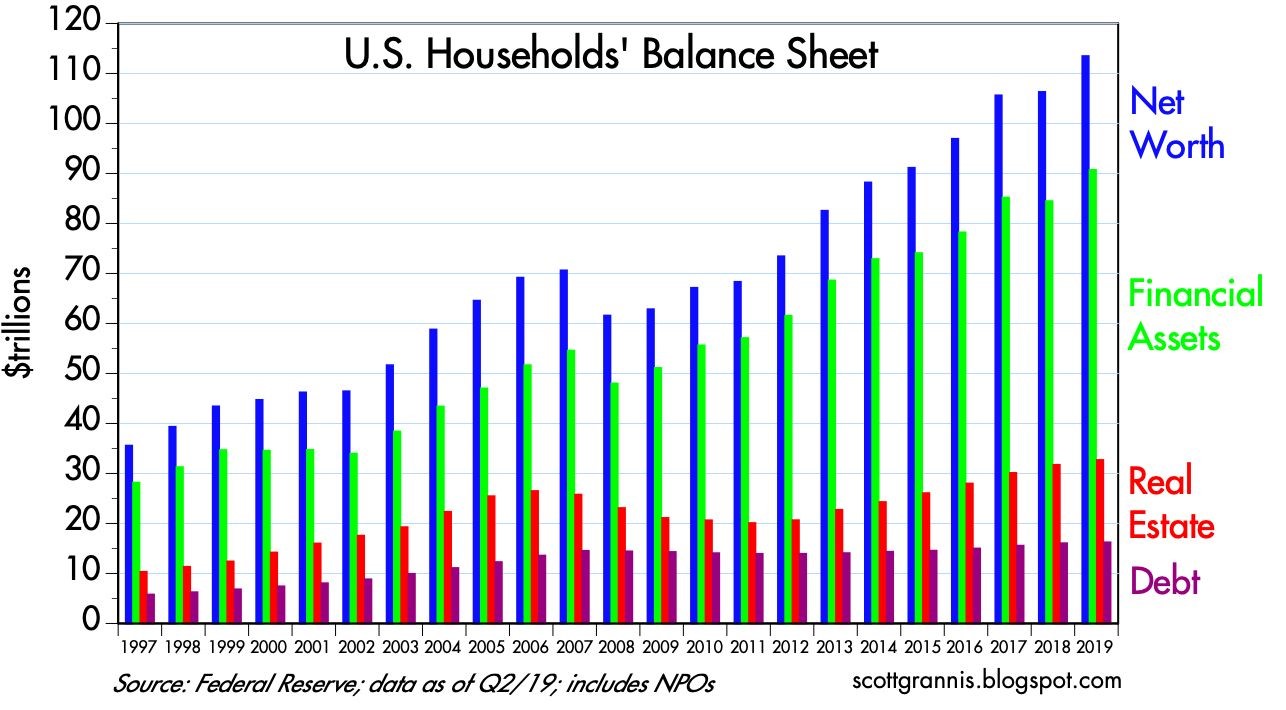

If you look at the same phenomenon through a slightly different lens, you can see that the net worth of consumer households has increased by 60% to $113 trillion from the 2007 peak of about $70 trillion (see chart below). This net worth explosion compares to only a 10% increase in household debt over the same timeframe. In other words, consumer balance sheets have gotten much stronger, which will likely extend the current expansion or minimize the blow from the next eventual recession.

Source: Calafia Beach Pundit

If hard numbers are not good enough to convince you of investor skepticism, try taking a poll of your friends, family and/or co-workers at the office watercooler, cocktail party, or family gathering. Chances are a majority of the respondents will validate the current actions of investors, which scream nervousness and anxiety.

How does one reconcile the Armageddon headlines and ebullient stock prices? Long-time clients and followers of my blog know I sound like a broken record, but the factors underpinning the decade-long bull market bears repeating. What the stock market ultimately does care about are the level and direction of 1) corporate profits; 2) interest rates; 3) valuations; and 4) investor sentiment (see the Fool-Stool article). Sure, on any one day, stock prices may move up or down on any one prominent headline, but over the long run, the market cares very little about headlines. Our country and financial markets have survived handsomely through wars (military and trade), recessions, banking crises, currency crises, housing crises, geopolitical tensions, impeachments, assassinations, and even elections.

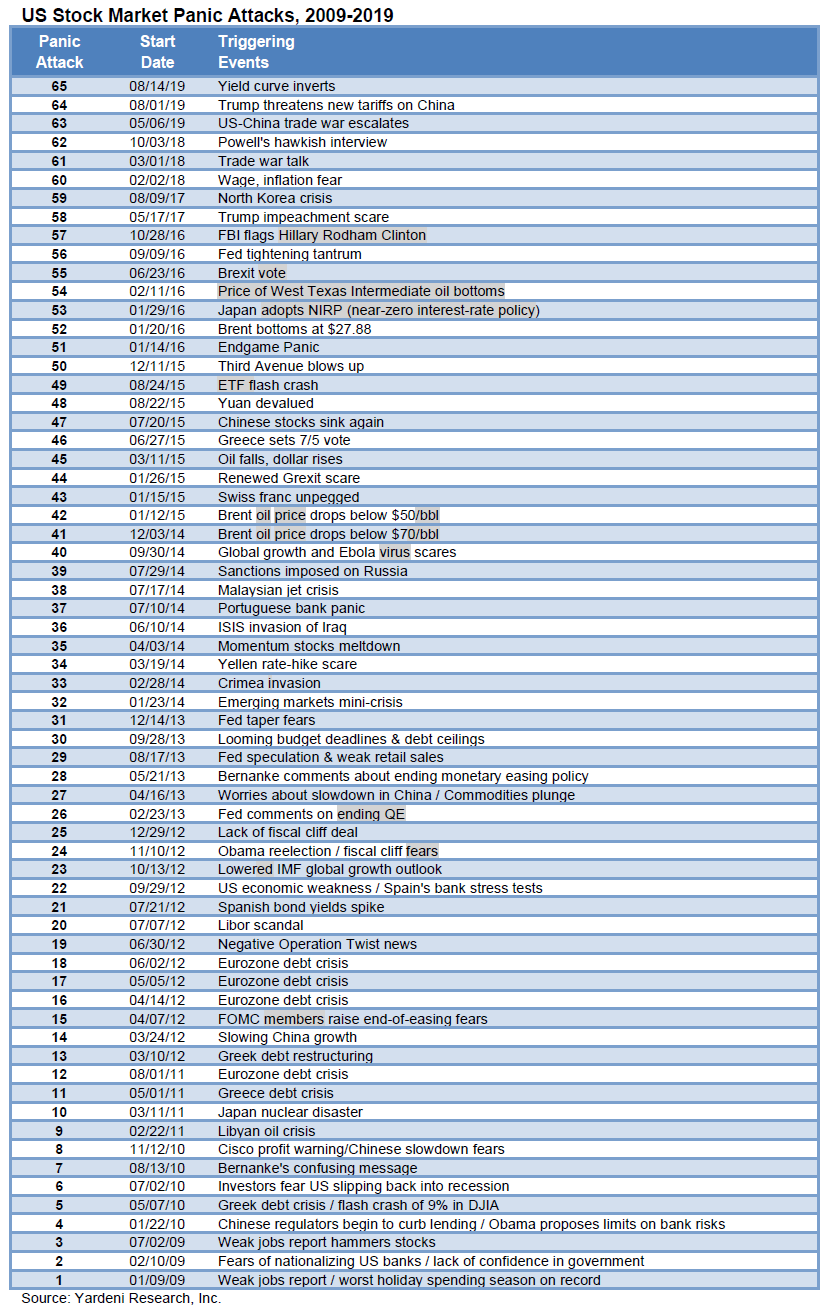

Case in point on a shorter period of time, Dr. Ed Yardeni, author of Dr. Ed’s Blog created list of 65 U.S. Stock Market Panic Attacks from 2009 – 2019 (see below). What have stock prices done over this period? From a low of 666 in 2009, the S&P 500 stock index has more than quadrupled to 3,030!

For the majority of this decade-long, rising bull market, the previously mentioned stool factors have created a tailwind for stock price appreciation (i.e., interest rates have moved lower, profits have moved higher, valuations have remained reasonable, and investors have stayed persistently nervous…a contrarian positive indicator). Investors may remain scared silly for a while, but as long as the four stock factors on balance remain largely constructive stock prices should continue experiencing a sugar high.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2019). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Don’t Be a Fool, Follow the Stool

It’s the holiday season and with another year coming to an end, it’s also time for a wide range of religious celebrations to take place. Investing is a lot like religion too. Just like there are a countless number of religions, there are also a countless number of investing styles, whether you are talking about Value investing, Growth, Quantitative, Technical, Momentum, Merger-Arbitrage, GARP (Growth At a Reasonable Price), or a multitude of other derivative types. But regardless of the style followed, most professional managers believe their style is the sole answer to lead followers to financial nirvana. While I may not share the same view (I believe there are many ways to skin the stock market cat), each investing discipline (or religion) will have its own unique core tenets that drive expectations for future returns (outcomes).

As it relates to my firm, Sidoxia Capital Management, our investment process is premised on four key tenets. Much like the four legs of a stool, the following principles provide the foundation for our beliefs and outlook on the mid-to-long-term direction of the stock market:

- Profits

- Interest Rates

- Sentiment

- Valuations

Why are these the key components that drive stock market returns? Let’s dig a little deeper to clarify the importance of these factors:

Profits: Over the long-run there is a very significant correlation between stock prices and profits (see also It’s the Earnings, Stupid). I’m not the only one preaching this religious belief, investment legends Peter Lynch and William O’Neil think the same. In answer to a question by Dell Computer’s CEO Michael Dell about its stock price, Lynch famously responded , “If your earnings are higher in five years, your stock will be higher.” The same idea works with the overall stock market. As I recently wrote (see Why Buy at Record Highs? Ask the Fat Turkey), with corporate profits at all-time record highs, it should come as no surprise that stock prices are near all-time record highs. Regardless of the absolute level of profits, it’s also very important to have a feel for whether earnings are accelerating or decelerating, because investors will pay a different price based on this dynamic.

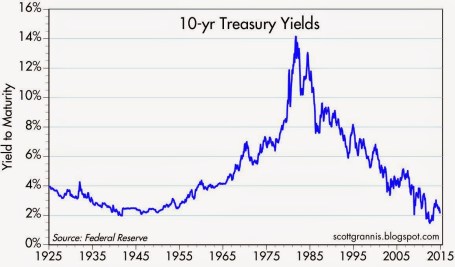

Interest Rates: When embarrassingly low CD interest rates of 0.08% are being offered on $10,000 deposits at Bank of America, do you think stocks look more or less attractive? It’s obviously a rhetorical question, because I can earn 20x more just by collecting the dividends from the S&P 500 index. Now in 1980 when the Federal Funds rate was set at 20.0% and investors could earn 16.0% on CDs, guess what? Stocks were logging their lowest valuation levels in decades (approximately 8x P/E ratio vs 17x today). The interest rate chart from Scott Grannis below highlights the near generational low interest rates we are currently experiencing.

Source: Calafia Beach Pundit

Sentiment: As I wrote in my Sentiment Indicators: Reading the Tea Leaves article, there are plenty of sentiment indicators (e.g., AAII Surveys, VIX Fear Gauge, Breadth Indicators, NYSE Bulls %, Put-Call Ratio, Volume), which traditionally are good contrarian indicators for the future direction of stock prices. When sentiment is too bullish (optimistic), it is often a good time to sell or trim, and when sentiment is too bearish (pessimistic), it is often good to buy. With that said, in addition to many of these short-term sentiment indicators, I realize that actions speak louder than words, therefore I like to also see the flows of funds into and out of stocks/bonds to gauge sentiment (see also Market Champagne Sits on Ice).

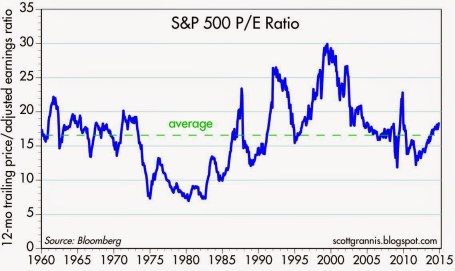

Valuations: As Fred Hickey, the lead editor of the High Tech Strategist noted, “Valuations do matter in the stock market, just as good pitching matters in baseball.” The most often quoted valuation metric is the Price/Earnings multiple or PE ratio. In other words, this ratio compares the price you would pay for an annual stream of profits. This can be tricky to determine because there are virtually an infinite number of factors that can impact the numerator and denominator. Currently P/E valuations are near historical averages (see below) – not nearly as cheap as 1980 and not nearly as expensive as 2000. If I only had one metric to choose, this would be a good place to start because the previous three legs of the stool feed into valuation calculations. In addition to P/E, at Sidoxia one of our other favorite metrics is Free-Cash-Flow Yield (annual cash generation after all expenses and expenditures divided by a company’s value). Earnings can be manipulated much easier than cold hard cash in our view.

Source: Calafia Beach Pundit

Nobody, myself and Warren Buffett included, can consistently predict what the stock market will do in the short-run. Buffett freely admits it. However, investing is a game of probabilities, and if you use the four tenets of profits, interest rates, sentiment, and valuations to drive your long-term investing decisions, your chances for future financial success will increase dramatically. This framework is just as relevant today as it is when studying the 1929 Crash, the 1989 Japan Bubble, or the 2008-2009 Financial Crisis. If your goal is to not become an investing fool, I highly encourage you to follow the legs of the Sidoxia stool.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own a range of positions, including BAC and certain exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Stock Talk: The Value of Media in Finance

I recently caught up with 50-year investment veteran Bill Kort to answer his questions regarding the media’s impact on the financial industry. After working for Kidder Peabody, A.G. Edwards, Wachovia, and Wells Fargo, Bill called it quits and decided to retire. Besides enjoying retirement with his wife, children, and grandchildren, Bill now also devotes considerable time to his blog Kort Sessions (www.KortSessions.com).

In a recent interview published on his Kort Sessions blog (KS), here’s what we discussed:

KS: Today, when you recommend a client take on, or increase equity exposure, what are the most common push-backs that you get? Have these changed in the past few years? If so, could you explain.

Wade Slome: “Given the events that have transpired over the last 15 years, I expect to receive a healthy dosage of pushback. Many investors have naturally been scarred from the 2008-2009 Financial Crisis, so convincing certain people that the 100-year flood will not occur every 100 days can be challenging. Regardless of the skepticism I receive, I feel it’s my duty to provide the best possible advice I can to existing clients and prospective clients. I can lead a horse to water, but I believe it’s not my job to force clients into a single investment option. At Sidoxia, we customize investment plans that meet clients’ risk tolerances, time horizons, and overall objectives.

With regard to sentiment changes in recent years, it is true that the tripling in equity market values since early 2009 has changed investor moods. Risk appetites have definitely increased. Nevertheless, cynicism is still rampant. Surveys done by Gallup show that stock ownership is near 15-year lows and despite stocks at or near record highs, ICI fund flow data shows money fleeing U.S. stock funds in 2014. With generational low interest rates, I see many long-term investors being too imprudently conservative. However, on the other hand, my responsibility is to also prevent other clients from taking on too much risk, especially if they have shorter investment time horizons or have limited funds in retirement.”

KS: When you speak with clients today, what are prominent worries do they have about their investments: The general level of the market, valuation, the economic backdrop, U.S. political issues or geopolitical concerns (all of the above)? Could you rank or tell me which concerns seem to be paramount.

Wade Slome: “In this 24-hour news cycle society we live in, an avalanche of real-time data gets crammed down our throats daily through our smartphones and Twitter-Facebook pages. As a result, the overwhelming barrage of news gets disseminated instantaneously, which in turn spreads fear like wildfire by word of mouth. In this type of environment it comes as no surprise to me that the general public is on edge. Every molehill is made into a mountain by media outlets for a simple reason…fear sells! Before the internet 20 years ago, virtually no one could find the location of Cyprus, Syria, Ukraine, or Gaza on a map – now we have Google and Wikipedia to show us or the Twitter feed scrolling at the bottom of our television sets reminds us. As far as concerns go, it’s tough to rank which ones are paramount. One day it’s the elections or Iran, and then the other day it’s the stock market crashing or the Ebola virus. Eventually the emotional pendulum will swing from fear and pessimism to optimism and euphoria, it always does. Like a lot of different professions, one of best strengths to have as an investment manager is the experience in knowing what noise to filter out and the ability to identify the relevant factors that drive outperformance.”

KS: Could you share the short-form responses that you might give to your clients when addressing the aforementioned issues.

Wade Slome: “The best advice I can give investors is to ignore the headlines. This principle is just as true today as it was a century or two ago. Mark Twain famously said, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.” This is obviously presented a little tongue-in-cheek, but the main point being is headlines should not drive your investment decisions. It’s perfectly fine to be informed about the economy and politics, but people must realize the stock market often moves independently and in contrarian directions to prevailing media stories. Rather than emotionally react to news flow, it is much more important to create an objective, long-term investment plan that takes advantage of market noise, hype, and volatility.”

KS: Finally, this is a little bit of a leading question that I hope you might run with. Do you find any useful purpose being served by the financial, general or political media that might aid an individual’s investment process?

Wade Slome: “In my view of the financial markets, there are a few underlying principles that drive stock prices over the long-term, and they include such basic factors as earnings, valuations, interest rates, and market psychology. What I would objectively try to argue is that the financial, general, or political media have little to no impact on the first three factors and only modest influence on the last one (market psychology). Part of the reason I have been so constructive on the markets on my Investing Caffeine blog over the last five years is because all these factors have generally pointed in the right direction. I will become nervous when earnings decline, valuations get stretched, interest rates spike, and/or psychology turns euphoric. Right now, I don’t think we are seeing any of that occurring.

With that said, I do believe there are exceptions to the rule that the “media is evil.” If you have the time, interest, and patience to stagger through the endless desert of financial media, you can find a few rare flowers. Although I do consume mass amounts of media, 99% of it ends up in the trash or ignored. I do my best to reserve my media consumption to those successful investors who have lived through multiple market cycles and have a winning track record to back it up. It is possible to find sage investment bloggers; Warren Buffett interviews on CNBC; or newspaper interviews of thriving venture capitalists, if you properly dine on a healthy media diet. Unfortunately there is a lot of junk food financial content out in media land. What should generally be avoided at all costs are rants from economists, journalists, analysts, commentators, and talking heads. No matter how eloquent or articulate they may sound, the vast majority of the people you see on television have not invested a professional dime in their careers, so all you are getting from them are worthless, vacillating opinions. I choose to stick to commentary from the tried and true investment veterans.”

Bill, thanks again for the thoughtful interview questions, and continued success with your Kort Sessions blog!

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own GOOG/GOOGL, and a range of positions in certain exchange traded fund positions, but at the time of publishing SCM had no direct position in TWTR, FB, WFC, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Buy in May and Tap Dance Away

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (May 1, 2014). Subscribe on the right side of the page for the complete text.

The proverbial Wall Street adage that urges investors to “Sell in May, and go away” in order to avoid a seasonally volatile period from May to October has driven speculative trading strategies for generations. The basic premise behind the plan revolves around the idea that people have better things to do during the spring and summer months, so they sell stocks. Once the weather cools off, the thought process reverses as investors renew their interest in stocks during November. If investing was as easy as selling stocks on May 1 st and then buying them back on November 1st, then we could all caravan in yachts to our private islands while drinking from umbrella-filled coconut drinks. Regrettably, successful investing is not that simple and following naïve strategies like these generally don’t work over the long-run.

Even if you believe in market timing and seasonal investing (see Getting Off the Market Timing Treadmill ), the prohibitive transaction costs and tax implications often strip away any potential statistical advantage.

Unfortunately for the bears, who often react to this type of voodoo investing, betting against the stock market from May – October during the last two years has been a money-losing strategy. Rather than going away, investors have been better served to “Buy in May, and tap dance away.” More specifically, the S&P 500 index has increased in each of the last two years, including a +10% surge during the May-October period last year.

Nervous? Why Invest Now?

With the weak recent economic GDP figures and stock prices off by less than 1% from their all-time record highs, why in the world would investors consider investing now? Well, for starters, one must ask themselves, “What options do I have for my savings…cash?” Cash has been and will continue to be a poor place to hoard funds, especially when interest rates are near historic lows and inflation is eating away the value of your nest-egg like a hungry sumo wrestler. Anyone who has completed their income taxes last month knows how pathetic bank rates have been, and if you have pumped gas recently, you can appreciate the gnawing impact of escalating gasoline prices.

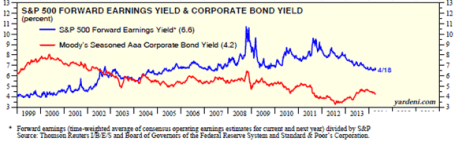

While there are selective opportunities to garner attractive yields in the bond market, as exploited in Sidoxia Fusion strategies, strategist and economist Dr. Ed Yardeni points out that equities have approximately +50% higher yields than corporate bonds. As you can see from the chart below, stocks (blue line) are yielding profits of about +6.6% vs +4.2% for corporate bonds (red line). In other words, for every $100 invested in stocks, companies are earning $6.60 in profits on average, which are then either paid out to investors as growing dividends and/or reinvested back into their companies for future growth.

Source: Dr. Ed’s Blog

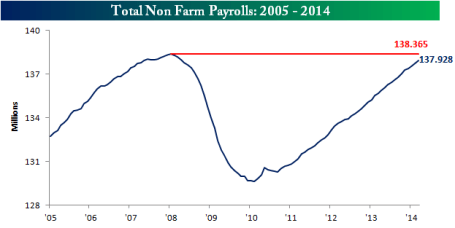

Hefty profit streams have resulted in healthy corporate balance sheets, which have served as ammunition for the improving jobs picture. At best, the economic recovery has moved from a snail’s pace to a tortoise’s pace, but nevertheless, the unemployment rate has returned to a more respectable 6.7% rate. The mended economy has virtually recovered all of the approximately 9 million private jobs lost during the financial crisis (see chart below) and expectations for Friday’s jobs report is for another +220,000 jobs added during the month of April.

Source: Bespoke

Wondrous Wing Woman

Investing can be scary for some individuals, but having an accommodative Fed Chair like Janet Yellen on your side makes the challenge more manageable. As I’ve pointed out in the past (with the help of Scott Grannis), the Fed’s stimulative ‘Quantitative Easing’ program counter intuitively raised interest rates during its implementation. What’s more, Yellen’s spearheading of the unprecedented $40 billion bond buying reduction program (a.k.a., ‘Taper’) has unexpectedly led to declining interest rates in recent months. If all goes well, Yellen will have completed the $85 billion monthly tapering by the end of this year, assuming the economy continues to expand.

In the meantime, investors and the broader financial markets have begun to digest the unwinding of the largest, most unprecedented monetary intervention in financial history. How can we tell this is the case? CEO confidence has improved to the point that $1 trillion of deals have been announced this year, including offers by Pfizer Inc. – PFE ($100 billion), Facebook Inc. – FB ($19 billion), and Comcast Corp. – CMCSA ($45 billion).

Source: Entrepreneur

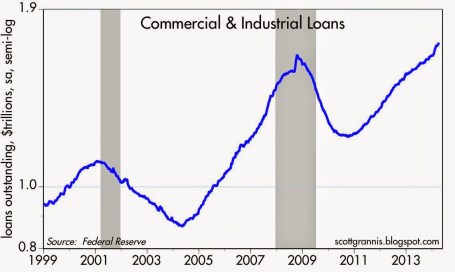

Banks are feeling more confident too, and this is evident by the acceleration seen in bank loans. After the financial crisis, gun-shy bank CEOs fortified their balance sheets, but with five years of economic expansion under their belts, the banks are beginning to loosen their loan purse strings further (see chart below).

The coast is never completely clear. As always, there are plenty of things to worry about. If it’s not Ukraine, it can be slowing growth in China, mid-term elections in the fall, and/or rising tensions in the Middle East. However, for the vast majority of investors, relying on calendar adages (i.e., selling in May) is a complete waste of time. You will be much better off investing in attractively priced, long-term opportunities, and then tap dance your way to financial prosperity.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in PFE, CMCSA, and certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in FB or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The EPS House of Cards: Tricks of the Trade

As we enter the quarterly ritual of the tsunami of earnings reports, investors will be combing through the financial reports. Due to the flood of information, and increasingly shorter and shorter investment time horizons, much of investors’ focus will center on a few quarterly report metrics – primarily earnings per share (EPS), revenues, and forecasts/guidance (if provided).

Many lessons have been learned from the financial crisis over the last few years, and one of the major ones is to do your homework thoroughly. Relying on a AAA ratings from Moody’s (MCO) and S&P (when ratings should have been more appropriately graded D or F) or blindly following a “Buy” rating from a conflicted investment banking firm just does not make sense.

FINANCIAL SECTOR COLLAPSE

Given the severity of the losses, investors need to be more demanding and comprehensive in their earnings analysis. In many instances the reported earnings numbers resemble a deceptive house of cards on a weak foundation, merely overlooked by distracted investors. Case in point is the Financial sector, which before the financial collapse saw distorted multi-year growth, propelled by phantom earnings due to artificial asset inflation and excessive leverage. One need look no further than the weighting of Financial stocks, which ballooned from 5% of the total S&P 500 Index market capitalization in 1980 to a peak of 23% in 2007. Once the credit and real estate bubble burst, the sector subsequently imploded to around 9% of the index value around the March 2009 lows. Let’s be honest, and ask ourselves how much faith can we put in the Financial sector earnings figures that moved from +$22.79 in 2007 to a loss of -$21.24 in 2008? Since that time regulation and reform has put the sector on a more solid footing. Luckily, the opacity and black box nature of many of these Financials largely kept me out of the 2009 sector implosion.

WHAT TO WATCH FOR

But the Financial sector is not the only fuzzy areas of accounting manipulation. Thanks to our friends at the FASB (Financial Accounting Standards Board), company management teams have discretion in how they apply different GAAP (Generally Accepted Accounting Principles) rules. Saj Karsan, a contributing writer at Morningstar.com, also writes about the “Fallacy of Earnings Per Share.”

“EPS can fluctuate wildly from year to year. Writedowns, abnormal business conditions, asset sale gains/losses and other unusual factors find their way into EPS quite often. Investors are urged to average EPS over a business cycle, as stressed in Security Analysis Chapter 37, in order to get a true picture of a company’s earnings power.”

These gray areas of interpretation can lead to a range of distorted EPS outcomes. Here are a few ways companies can manipulate their EPS:

Distorted Expenses: If a $10 million manufacturing plant is expected to last 10 years, then the depreciation expense should be $1 million per year. If for some reason the Chief Financial Officer (CFO) suddenly decided the building would last 40 years rather than 10 years, then the expense would only be $250,000 per year. Voila, an instant $750,000 annual gain was created out of thin air due to management’s change in estimates.

Magical Revenues: Some companies have been known to do what’s called “stuffing the channel.” Or in other words, companies sometimes will ship product to a distributor or customer even if there is no immediate demand for that product. This practice can potentially increase the revenue of the reporting company, while providing the customer with more inventory on-hand. The major problem with the strategy is cash collection, which can be pushed way off in the future or become uncollectible.

Accounting Shifts: Under certain circumstances, specific expenses can be converted to an asset on the balance sheet, leading to inflated EPS numbers. A common example of this phenomenon occurs in the software industry, where software engineering expenses on the income statement get converted to capitalized software assets on the balance sheet. Again, like other schemes, this practice delays the negative expense effects on reported earnings.

Artificial Income: Not only did many of the trouble banks make imprudent loans to borrowers that were unlikely to repay, but the loans were made based on assumptions that asset prices would go up indefinitely and credit costs would remain freakishly low. Based on the overly optimistic repayment and loss assumptions, banks recognized massive amounts of gains which propelled even more imprudent loans. Needless to say, investors are now more tightly questioning these assumptions. That said, recent relaxation of mark-to-market accounting makes it even more difficult to estimate the true values of assets on the bank’s balance sheets.

Like dieting, there are no easy solutions. Tearing through the financial statements is tough work and requires a lot of diligence. My process of identifying winning stocks is heavily cash flow based (see my article on cash flow investing) analysis, which although lumpier and more volatile than basic EPS analysis, provides a deeper understanding of a company’s value-creating capabilities and true cash generation powers.

As earnings season kicks into full gear, do yourself a favor and not only take a more critical” eye towards company earnings, but follow the cash to a firmer conviction in your stock picks. Otherwise, those shaky EPS numbers may lead to a tumbling house of cards.

Read Saj Karsan’s Full Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management has no direct position in MCO or MHP at the time this article was originally posted. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.