Posts tagged ‘Federal Reserve’

No Market Misgiving on This Thanksgiving

We’ll see if there is any gravy left for investors during the last month of the year, but so far 2024 has been a satiating feast that has stuffed investors. There has been a cornucopia of items to be thankful for, including the Federal Reserve, which is expected to provide some dessert this month in the form of its third interest rate cut this year.

Investors certainly can also be grateful for the performance of the stock market, which has had a phenomenal year thus far (see chart below):

• S&P 500: +26.5%

• Dow Jones Industrial Average:+19.2%

• NASDAQ: +28.0%

On a two-year basis, the S&P 500 results look even tastier: +57.1%

Why is there such a large appetite for stocks? For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Regardless of whether your candidate won or lost the election, investors can agree there is less uncertainty with an uncontested election, which is welcomed by all. In addition, the two Fed rate cuts that started in September have also buoyed enthusiasm.

What is less clear are the effects of President-elect Donald Trump’s tariff policy threats, which if enacted run the risk of increasing inflation, stifling global trade, and jeopardizing future Fed rate cuts. Combined, these negative side effects have the potential of significantly dampening economic growth. On the other hand, if the tariffs are only used as a negotiating tool with our larger trading partners (including China, Mexico, Canada, and Europe), the tariff discussion will likely have more bark than bite. Time will tell.

Dissecting Stock Performance & Valuations

A lot of pundits are pointing to an overheated market, but on a 3-year basis, returns are looking more normalized (+8.2% per year) because of the -20% hit on stocks during 2022. As you may recall, much of the 2022 decline was caused by the Fed slamming on the economic breaks with its fastest rate-hiking cycle in four decades (raising rates from 0.0% to 5.5%).

Objectively, stock values, as measured by the Price-Earnings (P/E) ratio of the S&P 500, are at elevated levels – registering in at approximately 22-times next year’s forecasted profits. As you can see from the chart below, the stock market is priced at levels not seen since 2001 and valuations are roughly double what they were at the lows of the 2008 Financial Crisis.

Source: Yardeni.com

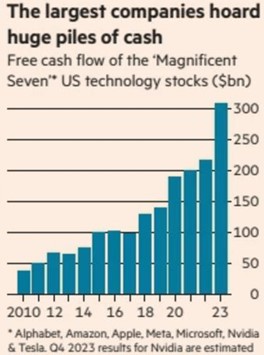

A major reason for escalated valuations has been the concentration of performance in the largest seven companies, or the so-called Magnificent 7 stocks, which include, Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla. In fact, the index concentration is the highest it has been in more than a half century – even higher than at the peak of the 2000 Tech Bubble when Cisco Systems, Microsoft, GE, Intel, and Exxon Mobil were the five largest companies by market capitalization (see chart below).

The good news is the other 493 companies in the S&P 500 (I call them the “Absentee 493”) are priced much more reasonably. This bifurcated dynamic between the largest seven companies versus everything else, highlights the plethora of opportunities available to be harvested in Value stocks, Small-cap stocks, and Mid-cap stocks.

As is evident in the chart below, the S&P 500 index (red-line), which is skewed by the Magnificent 7, is about 30% more expensive than Small-cap and Mid-cap stocks, which are hovering near historically attractive valuation levels.

Source: Yardeni.com

Value stocks (blue-line) in the market look equally attractive (about 30% cheaper than the S&P 500), as can be seen in the chart below.

Source: Yardeni.com

As always, the future is uncertain, and risks abound for next year. But 2024 has been a blockbuster year and there has been plenty to be thankful for, especially the performance of the U.S. stock market.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, AMZN, MSFT, GOOGL, META, TSLA, NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CSCO, GE, XOM, INTC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Past Elections Status Quo Means No Need for Woe

Scarier than Halloween, the current presidential election is causing people on both sides of the political aisle to be frightened by the idea of their candidate potentially losing. Uncertainty is generally petrifying to investors, resulting in downward pressure on stock prices, but with less than a week until election day, the stock market is providing more treats than tricks. Sweetness has come in the form of a stock market up +20% in 2024 (up 8 out of 10 months this year), and only off -3% from its record high reached a few weeks ago. For the month, investors experienced modest declines as they braced for the election results. The S&P 500 dropped -1.0%, the Dow Jones Industrial Average -1.3%, and NASDAQ -0.5%.

Regardless of whether the red team or blue team wins the presidential election, the good news is history reminds us the end result has little effect on the long-term results of the stock market. As you can see from the chart below, over the last century, stock prices have gone up under both Republican and Democrat presidents. As Mark Twain famously stated, “History doesn’t repeat itself, but it often rhymes.” If that’s the case, past elections teach us, there is no need to fear the status quo of a Republican or Democrat president.

Source: Yardeni Research (Yardeni.com)

More recently, over the last 26 years, the stock market has been up significantly under each president, regardless of political party. Here are the results of the S&P 500 under the last three presidents:

- President Barack Obama(November 4, 2008 – November 8, 2016 – Democrat): +137%

- President Donald Trump(November 8, 2016 – November 3, 2020 – Republican): +51%

- President Joe Biden (November 3, 2020 – Present – Democrat): +63%

No matter who wins the White House, they will be inheriting a relatively strong economy. Consider the following tailwinds benefitting the new president:

- Strong Economy: The broadest measurement of economic activity, Gross Domestic Product (GDP), registered a healthy +2.8% growth rate for Q3

- Resilient Jobs Market: The just-reported unemployment rate of 4.1% today is representative of a strong but slowing job market. The unemployment rate has climbed modestly since troughing in 2023, but unemployment is still relatively low compared to historic levels much higher.

- Declining Inflation: As I pointed out last month (see Rate Cut Adrenaline) inflation has been on a fairly consistent downward trajectory over the last two years, which has allowed the Federal Reserve to cut interest rates by 0.50% in September. Moreover, based on the current economic environment, the Fed has signaled more stimulative interest rate cuts are likely ahead – economic strategists and pundits are predicting another 0.25% cut at the next Federal Reserve meeting that occurs over the two days following the elections.

- Record Corporate Profits (see chart below): The United States economy is the envy of the world, and the reason why is evident by the 65-year chart below showing record corporate profits and GDP. If you were an entrepreneur, where would you choose to start your company? China? Japan? UK? Russia? There’s plenty of room for improvements in our country’s policies, but there’s a reason the U.S. dominates in creating the largest and most profitable multi-trillion companies in the world.

Source: Calafia Beach Pundit

One area for improvement in the U.S. revolves around our fiscal debt and deficits. Our government simply spends too much money and doesn’t collect enough (tax receipts) to cover those expenses (see chart below). Another lesson to learn from our government’s excessive spending over the last four decades is that the glut of expenditures can’t be blamed on any one political party – the slope of spending is consistently up and to the right for all serving politicians.

Source: Calafia Beach Pundit

As I have mentioned in the past, stocks do not perpetually move up forever. However, regardless of the election outcome, we know from history that up-markets (bull markets) occur about 85% of the time, if we look at the last 100 years (see chart below). Analysis by Dimensional Fund Advisors shows that from 1926 – 2023, bull markets have lasted 994 months versus much shorter bear markets of 177 months.

Source: Dimensional Fund Advisors

It is very possible that stock prices may take a breather or correct under various election outcomes, but if we follow the historic status quo, there will be no long-term reason for woe.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (November 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Fed Injects Rate Cut Adrenaline

There were a lot of injections, of the COVID vaccine variety, four years ago, but now the Federal Reserve is injecting some financial adrenaline through stimulative interest rate cuts. Expectations are for seven more -0.25% cuts over the next 12 months, but this cycle started two weeks ago when the FOMC (Federal Open Market Committee) initiated a larger -0.50% reduction in the benchmark federal funds rate target (see chart below). For now, investors have enjoyed the boost of adrenaline, which should help lower consumer interest rates on things like home mortgages, credit cards, and car loans.

Source: Yardeni.com

For the month, the S&P 500 climbed +2.0%, the Dow Jones Industrial +1.9%, and the NASDAQ index +2.7%. The monthly gains are adding to a 2024 that is shaping up to be a potentially banner year. With one quarter left in the year, the S&P has catapulted +21% higher, the Dow Jones Industrial Average +12%, and the NASDAQ index +21% for the first nine months.

Economy Strong, So Why Cut Now?

Before the Fed’s last action a couple weeks ago, the last Fed rate cut occurred in 2020 (a -1.50% cut) in the midst of a global pandemic with the aim of boosting financial activity while the brick-and-mortar economy had effectively been shut down. But compared to today, the economy is performing much better. Second quarter GDP growth came in at +3.0% with 3rd quarter GDP growth forecasts coming in at +3.1%.

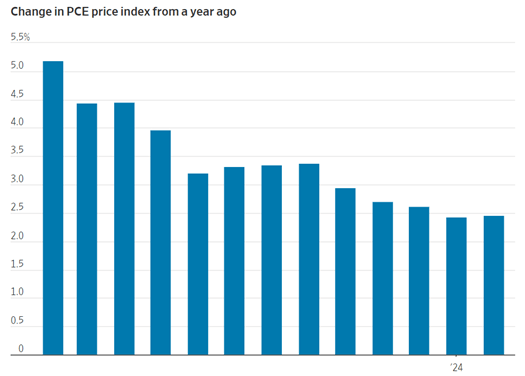

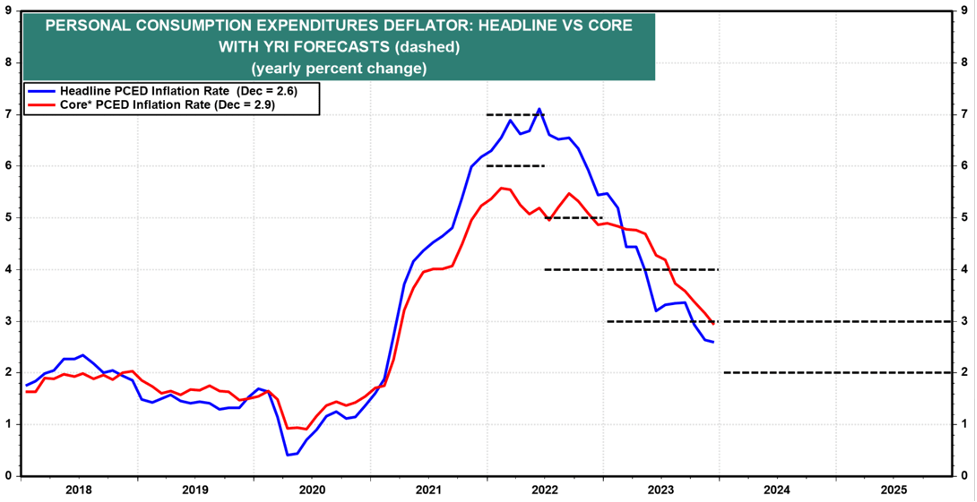

So, if things look so great, why would the Fed be cutting rates to stimulate the economy now? In short, inflation has been coming down (see chart below) from a peak of 9.1% a couple years ago to 2.5% last month (near the Fed’s long-term 2.0% target). And although the current unemployment rate is low at 4.2%, it has nevertheless weakened and climbed substantially from a 3.4% level last year).

Source: Trading Economics

China Chugs Higher

While the U.S. economy has been leading developed countries during the post-COVID recovery period, China’s financial system has been struggling due to a collapsing real estate market and deteriorating consumer spending. As a result, the Chinese stock market has been drastically underperforming other foreign markets, until Beijing just recently announced a number of stimulus initiatives last week in hopes of buoying economic growth closer to its 5% target.

Here are some of the Chinese government measures:

- China plans to issue 2 trillion yuan in special sovereign bonds

- China’s central bank cut its reserve requirement ratio by 50 basis points

- Fiscal policies to focus on increasing consumer subsidies and controlling government debt

- Shanghai, Shenzhen plan to lift key home purchase restrictions

Investors cheered the announcements by binge-buying Chinese stocks, as you can see from the CSI 300 China index, which rocketed +21% higher last month – the largest monthly gain since 2008.

AI Revolution Continues

While economic headwinds and tailwinds continue to swirl, the AI (Artificial Intelligence) revolution has persisted in the background. While some traders have solely focused on AI juggernaut NVIDIA Corp. (NVDA), which has steamrolled its way into becoming a three trillion-dollar valued company, there are other tech titan companies like Oracle Corp. (ORCL), which are also riding the AI wave. Just last month, Oracle’s billionaire founder, Larry Ellison, stated, “We have 162 data centers now. I expect we will have 1,000 or 2,000 or more data centers…around the world.” Each large-scaled data center can cost in the hundreds of millions or multi-billion-dollar range. With hundreds of billions (if not trillions) of dollars to be spent on the multi-year AI infrastructure buildout, as you can imagine, there is a large, diverse ecosystem of other companies that stand to benefit. At Sidoxia Capital Management (www.Sidoxia.com), we have identified a wide swath of AI investments that have benefited our investors and stand to do so in the future.

Flies in the Ointment

By simply judging the performance of the U.S. stock market, one might think there is nothing for investors to worry about. But as is always the case, there still remain some flies in the ointment. With a tight, hotly-contested presidential election just one month away, coupled with escalated wars in the Mideast and Ukraine, future volatility or a correction in the stock market should come as no surprise to anyone, especially in light of the rich gains already registered this year. Another concern is the risk of rising inflation, which could rear its ugly head again if the Federal Reserve misjudges its rate-cutting program and overheats the economy.

Normally, interest rate cuts are reserved by the Fed for periods when the economy is headed towards a recession or there are major systemic disruptions in the financial system, which affect market liquidity and/or bank lending. That’s not the case today. Thanks to declining inflation and a robust but weakening job market, the Fed has been equipped to provide investors with a healthy injection of adrenaline through an early round of interest rate cuts, which has contributed to the powerful stock market gains. So far, the adrenaline is doing its job.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (October 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including AMZN, MSFT, META, GOOGL, NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

The Great Rotation

There are many styles of investing, and many ways to make money in the stock market. Just like the styles of men’s ties or women’s dresses come in and out of fashion, so too do the styles of investing. Some stick around for a long time, while other fads flop in short order, leading consumers to rotate into new fashions. I’m still waiting for my Bermuda shorts and pleated pants to come back in style. At this year’s Olympics, the broad array of styles has been on full display.

Growth & Tech in Style

The stock market has been on a one-way freight train riding on the coattails of large capitalization growth stocks, primarily technology stocks, especially those associated with technology and artificial intelligence (AI). You can see the dominance of the Growth style over Value in the 30-year chart below.

Source: Yardeni.com

When the blue line is sloping upwards, that means Growth stocks are outperforming Value stocks, and when sloping downwards, Value stocks are outperforming Growth Stocks. For most of the 1990s, Growth was dominant, and ever since the aftermath of the 2008 Financial Crisis, Growth stocks have once again overshadowed Value stocks a majority of the time (2022 being a short-lived reprieve for Value stocks).

This mega-Growth trend reversed last month (at least temporarily), and investors decided to rotate out of large winners into the previously shunned areas of the market, including Small Cap and Value stocks. You can see in the chart below that Small Caps (S&P 600) have underperformed Large Caps (S&P 500) over the last six years.

Source: Yardeni.com

Is this rotation sustainable? At this point, I’d say it’s too early to tell, but during periods like these, when Wall Street darlings like NVIDIA Corp (NVDA) suffer a large hit (e.g., down -17% for NVDA since the June peak), diversification benefits are pushed to the forefront. The lesson of the year 2000 technology bubble bursting taught a generation of investors that getting overly concentrated in a single sector of technology stocks can be seriously dangerous to your wealth and financial well-being. By selecting a diversity of eggs in your basket, like Value and Small Cap stocks, you can protect your nest egg when there are substantial rotations like we experienced last month. Diversification is a core tenet of our investment philosophy at Sidoxia.

In order to place the recent rotation in perspective, let’s look at how a range of indexes performed last month. The Dow Jones Industrial Average increased a hefty +4.4%, while the S&P 500 finished up modestly +1.1%. As investors rotated out of technology (-3.3% – Technology Select Sector SPDR Fund / XLK), a good chunk of those sales rotated into small cap stocks (+10.3% – iShares Russell 2000 ETF / IWM) and value stocks (+5.1% – iShares Russell 1000 Value ETF / IWD).

Despite concerns over global geopolitics, political election madness, and a slowing economy, investors are more focused on the positive prospect of future interest rate cuts by the Federal Reserve, starting in September with a probability exceeding 90% (see chart below).

Source: CME Group

Some investors got caught up in the dizzying rotation last month, but timing these rotations is nearly impossible and one month does not make a long-term trend. Rather than getting caught up in a fool’s errand, make sure your investment portfolio is diversified and built to withstand volatile rotations.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on the IC Contact page.

Economic & Inflation Information Create Market Jubilation

Ever since the Federal Reserve went on a crusade to increase interest rates and slow the progression of inflation at the beginning of 2022, investors have been cheering for a Goldilocks-type of economic “soft landing.” Last month, this narrative remained intact.

The S&P 500 index surged +3.5% for the month, the technology-heavy NASDAQ rocketed +6.0% (fueled by NVIDIA and other AI-related companies), and the Dow Jones Industrial Average a more modest +1.1% move thanks to the contribution of older economy stocks.

Despite the looming presidential election this November and the recent debate, the stock market has continued on a +56% bull market tear since the October 2023-low, eight months ago (see chart below). The not-too-hot, not-too-cold economic data have provided comfort to investors. For example, growth in Gross Domestic Product (GDP), the broadest measurement of economic activity, was positive (+1.4%) during the first quarter and it is expected to modestly accelerate in the second quarter (+2.2%), as forecasted by the Federal Reserve Bank of Atlanta.

In addition, the job and inflation stories are staying consistent with the “soft landing” plot line, as well. The unemployment rate has been creeping higher, but currently remains near multi-decade lows at 4.0%. Inflation also continued its downward trend as evidenced by last week’s Core PCE inflation data (the Federal Reserve’s favorite inflation gauge), which came in at +2.6%, the lowest level since March of 2021 (see chart below).

Gasoline and food costs are significant inputs to the overall declining inflation dynamics. The two largest crops in the United States are corn and soybeans, and with those prices down significantly year-over-year (see chart below), it should come as no surprise that consumers are finally seeing some relief in skyrocketing food prices. Declining gasoline prices have also chipped-in to the improving inflation outlook.

With all these economic statistics harmoniously aligning with a “soft landing” scenario, investors are currently comfortable in forecasting one interest rate cut over the next six months, and three and a half interest rate cuts over the next 12 months (see chart below).

Source: Yardeni Research

But a bull market cannot survive on interest rate cut expectations alone. Over the long-run, stock prices generally follow the direction of corporate profits, and as the chart below indicates (red line), fortunately, the path of profits has been rising after a period of stagnation last year.

Source: Yardeni Research

The last eight months have been an exhilarating ride in the overall stock market, which has been propelled by the multi-trillion dollar technology companies participating in the A.I. (Artificial Intelligence) buildout revolution (i.e., NVIDIA, Microsoft, Alphabet-Google, Apple, Meta Platforms, Amazon, et.al.). However, neither trees nor stock markets can grow, uninterrupted, to the sky forever. The recent environment has been jubilant for investors, but party participants cannot go on forever without experiencing a hangover. The best advice is to celebrate responsibly, while managing the risk of your investment portfolio, because eventually the cops will arrive and the party will come to an end.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA, MSFT, GOOGL, AAPL, META, and AMZN but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Bad News is Good News?

Remember that global pandemic back in 2020 called COVID-19 that killed over 350,000 people in the U.S.? That same year, the unemployment rate reached a sky-high level of 14.9% (vs. 3.9% most recently) and the economy went into recession with GDP (Gross Domestic Product) declining by -2.2%. With the whole population locked in their homes and 9.4 million businesses closed, this debacle doesn’t sound like a real great environment for the stock market. What did the stock market actually do in 2020? The S&P 500 surged +16.3% (see chart below). Bad economic news turned out to be good news for stocks.

On the flip side, during 2022, the economy was firing on all cylinders. GDP was advancing at a reasonable +1.9% growth rate, and the unemployment rate stood at a near generationally low rate of 3.6%. What did the stock market do? It fell -19%. This time around, good economic news meant bad news for stock prices, primarily because the Federal Reserve was slamming the brakes on the economy by increasing the Federal Funds interest rate target.

These examples are powerful reminders that the direction of economic trends does not necessarily move in tandem with the direction of the stock market. Just this last month, investors experienced this same phenomenon when GDP growth figures were revised lower from +1.6% to +1.3%, and pending home sales dropped by -7.7% to the lowest level in four years during the pandemic. What did the stock market do last month? The S&P climbed +4.8% and the NASDAQ soared +6.9%. Once again, bad news has equaled good news due to higher hopes for Fed interest rate cuts.

For the year, the S&P has already appreciated a very respectable +10.6%. This stellar performance has come despite heated election concerns, persistent wars overseas, nervousness over the Federal Reserve’s monetary policy, and wild volatility in the cryptocurrency markets.

Fighting against these headwinds has been the tsunami of corporate investing dollars piling into the Artificial Intelligence (AI) spending tidal wave. I have been writing about this trend for a while (see AI World) and NVIDIA Corp (NVDA) confirmed this trend a couple weeks ago, when the AI juggernaut reported its fiscal first quarter financial results. Not only did NVIDIA more than triple its revenue above $26 billion for the three-month period compared to last year, but the company also increased its net profit by more than seven-fold to almost $15 billion for the quarter, in addition to announcing a 10-for-1 stock split (see chart below).

What these examples teach you is that it is a fruitless effort for investors to try to time the market based on economic news headlines. Yet, every day you turn on the television or comb through the avalanche of news headlines through various media outlets, there is always some Armageddon story about an impending market crash, or some other speculative, get-rich-quick scheme. As Warren Buffett states, “Investing is like dieting. Easy to understand, but difficult to execute.”

In other words, there is no simple solution to investing. It requires patience, discipline, and financial emotional wherewithal to allow the power of long-term compounding to grow your retirement nest egg. Short-term news cycle headlines shouldn’t drive portfolio decision-making, but rather your personal objectives, goals, and risk tolerance. These items are not static, and can change over time, therefore it’s important to revisit your asset allocation periodically as financial circumstances and life events change your objectives.

Of course, improving economic news can also lead to rising stock prices, just as deteriorating economic news can result in declining prices. Regardless, attempting to time the market is a fool’s errand. Rather than trying to maneuver in and out of the stocks, long-term investors should focus more intently on the four key factors that drive the direction of the stock market: corporate profits, interest rates, valuations, and investor sentiment (see also Don’t Be a Fool, Follow the Stool). If you understand the stock market doesn’t logically follow the daily headlines, and instead you follow the key fundament factors driving equity markets, then your investment portfolio should be blessed with plenty of good news.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (June 3, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), including NVDA,, but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Dow Knocking on the Door of 40,000

The stock market rang the doorbell of the New Year with a bang during the 1st quarter. The S&P 500 index built on last year’s +24% gain with another +10% advance during the first three months of the year. And as a result of these increases, the Dow Jones Industrial Average index is knocking on the door of the 40,000 milestone – more specifically, the Dow closed the month at 39,807 (see chart below). To put his into context, when I was born more than 50 years ago, the Dow was valued at less than 1,000 – not a bad run. This is proof positive of what Einstein called the 8th Wonder of the World, “compounding”. At Sidoxia Capital Management, we view investing as a marathon, not a sprint. You cannot realize the benefits of compounding without having a long-term time horizon. The sooner you start saving and the more you save, the faster and larger your retirement nest egg will grow.

If you are one of the people who thinks the stock market is too high, then you should definitely ignore Warren Buffett, arguably the greatest investor of all-time. Buffett predicted the Dow will reach an astronomical level of one million (1,000,000) within the next 100 years. I’m not sure I will still be around to witness this momentous achievement, however, if history repeats itself, this targeted timeframe could prove conservative.

Despite the magnitude and duration of this bull market, there is still a lot of angst and anxiety over the upcoming election. Nevertheless, investors are choosing instead to focus on the strong fundamentals of the economy. Just this last week, we saw the broadest measurement of economic activity, GDP (Gross Domestic Product), get revised higher to +3.4% growth during the 4th quarter of 2023 (see chart below). On the jobs front, the unemployment picture remains healthy (3.9%), near a generational low.

Source: Trading Economics and Bureau of Economic Analysis

And when it comes to the all-important inflation data, the Federal Reserve’s preferred inflation measure, Core PCE index (Core Personal Consumption Expenditures), was also just released in-line with economists’ projections at 2.5% (see chart below), very near the Fed’s long-term 2.0% inflation target and well below the Core PCE’s recent peak near 6%.

Source: The Wall Street Journal and Commerce Department

This resilient economic data, when combined with the declining inflation figures, has resulted in the Federal Reserve sticking with its plan of cutting its Federal Funds interest rate target three times this year. If inflation reverses course or remains stubbornly high, then there is a higher likelihood that interest rate cuts will be delayed. On the flip side, if economic data slows significantly or the country goes into a recession, then the probability of sooner and/or more Fed interest-rate cuts will increase.

In other news, here are some of the other major financial headlines this month:

- Francis Scott Key Baltimore Bridge Collapse: Six people died when a large container ship crashed into the Francis Scott Key bridge in the Port of Baltimore. An estimated 50 million tons of goods valued at $80 billion flows through this port, making this one of the top 10 ports in the country. The auto and coal industry supply chains will be disproportionately affected, but the good news is much of these goods will be diverted to other larger ports (e.g., Port of New York and Port of New Jersey).

- DJT Debut: A lot of hype surrounded the trading debut of Trump Media & Technology Group, which began trading last week under the initials of our country’s former president, Donald J. Trump (Ticker: DJT). Despite only posting a few million in revenue and -$50 million in losses during the first nine months of 2023, the stock skyrocketed +65% in its first week of trading and attained a $9 billion valuation. Time will tell if Trump’s Truth Social media platform will gain traction and justify the stock’s price, or rather suffer the declining fate of other meme stocks like GameStop Corp. (GME) or AMC Entertainment Holdings (AMC).

- SBF Sentenced to 25 Years: The former CEO of cryptocurrency exchange company FTX, Sam Bankman-Fried (SBF), was sentenced to 25 years in prison due to his conviction on seven counts of fraud and what is believed to be $8 billion in stolen client funds. SBF didn’t help his own cause by perjuring himself, tampering with witnesses, and showing a lack of remorse, according to the judge.

We are only 25% of the way through the year, but the Dow is knocking on the 40,000-milestone door. The way things look now, investors are wiping their feet on the welcome doormat and ready to walk right in.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (April 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks , certain exchange traded funds (ETFs), and notes including AMC 2026, but at the time of publishing had no direct position in DJT, GME, AMC or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Quickly Out of the Gate

The race into 2024 has begun, and the U.S. market is off to a quick start. The S&P 500 jumped out of the gates by +1.6%, and the technology and AI (Artificial Intelligence) – heavy NASDAQ index raced out by +1.2%. The bull market rally broadened out at the end of 2023, but 2024 returned to the leaders of last year’s pack, the Magnificent 7 (see also Mission Accomplished). Out front, in the lead of the Mag 7, is Nvidia with a +24% gain in January.

Inflation dropping (see chart below), the Federal Reserve signaling a decline in interest rates, low unemployment (3.7%), and healthy economic growth (+3.3% Q4 – GDP) have all contributed to the continuing bull market run.

Source: Yardeni.com

Consumer spending is the number one driver of economic growth, and consumers remain relatively confident about future prospects as seen in the recently released Conference Board Consumer Confidence numbers released this week (see chart below).

Source: Conference Board

But the race isn’t over yet, and there are always plenty of issues to worry about. The world is an uncertain place. Here are some of the concerns du jour:

– Red Sea conflict led by the Yemen-based, rebel group, Houthis

– Gaza war between Israel and Hamas

– Anxiety over November presidential election

– Ukraine – Russia war

Money Goes Where It is Treated Best

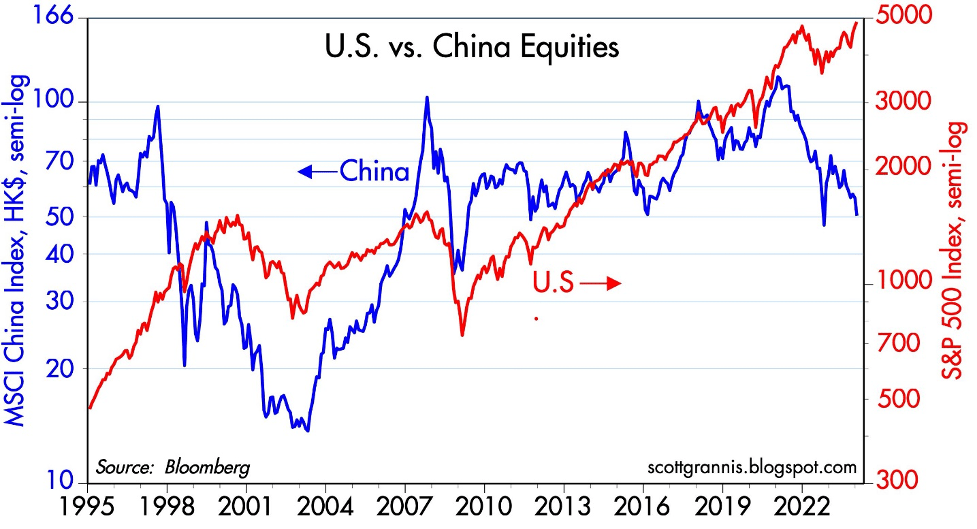

There are plenty of domestic concerns regarding government debt, deficit levels, and political frustrations on both sides of the partisan aisle remain elevated. When it comes to the financial markets, money continues to go where it is treated best. Sure, we have no shortage of problems or challenges, but where else are you going to put your life savings? China? Europe? Russia? Japan?

Well, as you can see in the chart below, anti-democratic, anti-American business, and confrontational military policies instituted by China have not benefitted investors – the U.S. stock market (S&P 500) has trounced the Chinese stock market (MSCI) over the last 30 years.

Source: Calafia Beach Pundit

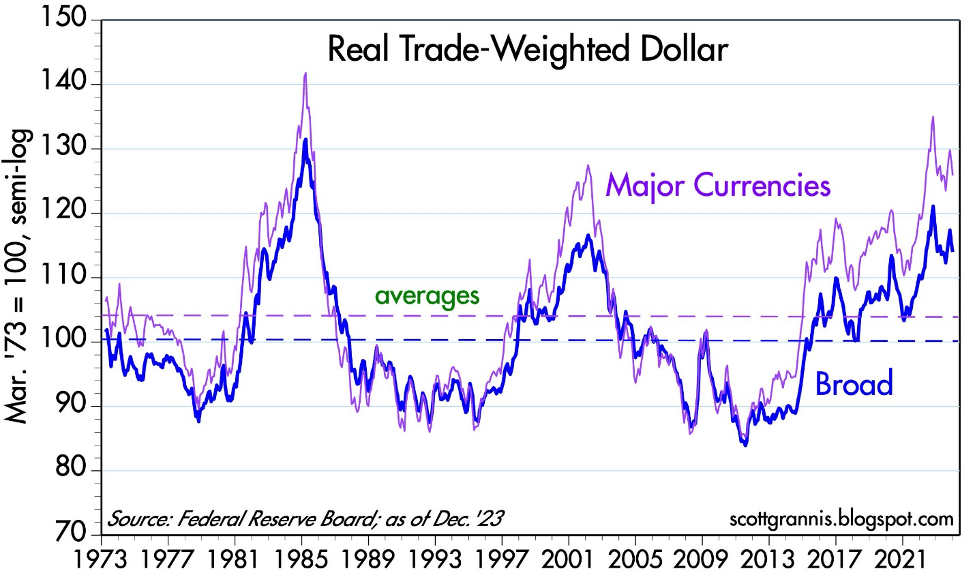

For years, market critics and pessimists have been screaming doom-and-gloom as it relates to the United States. The story goes, the U.S. is falling apart, government spending and debt levels are out of control, politicians are corrupt, and we’re going into recession, thanks in part to higher interest rates and inflation. Well, if that’s the case, then why has the value of the U.S. dollar increased over the last 10 years (see chart below)? And why is the stock market at all-time record-highs?

Source: Calafia Beach Pundit

Global investors are discerning in which countries they invest their hard-earned money. Global capital will flow to those countries with a rule of law, financial transparency, prudent tax policy, lower inflation, higher profit growth, lower interest rates, sensible fiscal and monetary policies, among other pragmatic business practices. There’s a reason they call it the “American Dream” and not the “Chinese Dream.” Our capitalist economy is far from perfect, but finding another country with a better overall investing environment is nearly impossible. There’s a reason why venture capitalists, private equity managers, sovereign wealth funds, hedge funds, and foreign institutions are investing trillions of their dollars in the United States. Money goes where it is treated best!

As money sloshes around the world, the 2024 investing race has a long way before it’s over, but at least the stock market has quickly gotten out of the gate and built a small lead.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2024). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.