Posts tagged ‘fed’

Spitzer the Pot Calling the Fed Kettle Black

Eliot Spitzer, whose job as the former Attorney General of New York was to convict criminals, was forced to quit himself as Governor for his illegal solicitation of prostitutes that he funded with secretive ATM withdrawals of government funds. Now, Mr. Spitzer is getting on his soapbox and telling others the Federal Reserve has been committing a Ponzi Scheme.

There are a lot of conspiracy theories floating around regarding the Fed’s motives and questions relating to the benefits of those receiving government bailout funds. Dylan Ratigan’s interview of Mr. Spitzer on MSNBC feeds into these conspiracy views. I can buy into conflicts of interests and the need for more transparency arguments, but let’s be realistic, this is not the DaVinci Code, this is the slow, bureaucratic Federal Government. Even if you buy into this skeptical belief, the Fed isn’t exactly a “black box.” The Fed proactively provides the minutes from its private meetings and systematically releases a full accounting of the Fed’s balance sheet (assets).

Mr. Spitzer and other critics point to the egregious benefits handed down to the banks and financial institutions through the bailouts and monetary system actions. Well, wasn’t that the idea? I thought our banking system (and the global banking system) was on the verge of collapse and we were trying to save the world from impending disaster? So, I think most people get the fact that our financial institutions needed a lifeline to prevent worse outcomes from occurring.

Should the Fed have carte blanche on all financial system decisions? Certainly not, but extreme situations like this generational financial crisis we are slogging through now, requires extreme measures.

Accountability I believe is even more important than the micro-managing transparency details Ron Paul (Republican/Libertarian Congressman from Texas) and others are asking for. If indeed it is the Fed’s job to remain an independent body, then maybe it’s not Congress’ job to question every word and minor decision. However, when it comes to these massive bailouts (AIG, Fannie Mae, Freddie Mac, etc.), additional details and accountability should be provided and seems fair. What we don’t need are more regulatory bodies and committees creating more inefficiencies in an already tangled system of regulatory fiefdoms.

Before Mr. Spitzer starts pointing his finger at the black Fed-kettle, perhaps he should get his illegal decision making pot in order first?

Read Full Daniel Tencer Spitzer-Ponzi Scheme Article

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

Government Looks to Strengthen Regulatory Web

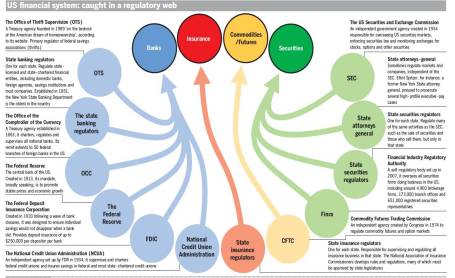

As the chart from the Financial Times shows (BELOW), our messy regulatory cobweb system needs to be straightened out, so it can efficiently function. Not only to encourage risk taking and capitalism, but to also deter and punish those that take advantage of the U.S. system and its citizens. The President and Treasury Secretary Timothy Geithner will address the inefficient, entangled set of regulatory issues surrounding the intertwined agencies in our financial regulatory system. With a mix of federal, regional, and state- driven oversight, the current structure leaves potential gaps for rule-breakers to slide through.

As the FT article explains (http://is.gd/13YuS), a “council of regulators,” comprised of the agency heads, will be formed along with another consumer-related agency designed to protect areas such as home mortgages and credit cards. Will new unproductive layers be added to merely bog down risk-taking and innovation (i.e., Sarbanes-Oxley legislation), or will substantive reform occur, thereby allowing businesses to innovate and grow. The proof will be in the pudding when Geithner reveals the details of his plan.

What should regulatory reform include?

1) Consolidation: You can call me crazy, but simply looking at the layers of agencies cries for consolidation. Do we really need six different sets of regulators overseeing the banks?

2) Transparency/Capital Requirement Changes: When it comes to derivatives, heightened transparency and capital requirements feel like moves in the right direction. We have perfectly functioning options and futures markets that integrate margin and capital requirements for the various constituencies; I do not see why Credit Default Swaps should be any different. For more customized, exotic over-the-counter products, you could avoid much of the AIG debacle by increasing the capital requirements of the counterparties. I believe these aims without stifling innovation.

3) FDIC of Mega-Institutions: FDIC insurance has succeeded in managing the failures of retail depository institutions, so I see no reason why the same model for mega financial institutions. Certainly, managing the collapse of a global money center bank would be more convoluted; however a system to handle an orderly failure would limit the fallout effect we experienced with the folding of Lehman and crumbling of Bear Stearns.

Although many lawmakers will hunt for a silver bullet, we all know that in this complex global economy a path for reform will involve more evolution rather than revolution. Most controversial will be the consumer protection agency, as details still remain sparse. In my a healthy regulatory system boils down to more simplified structures with tighter oversight, mixed in with proper incentives and harsher punishments for criminals. We’ll know soon enough whether the government can weave a solution tight enough to capture the Bernie Madoffs and Allen Stanfords of the world without sacrificing our position as the global financial capitol of the world.