Posts tagged ‘eurozone’

2011: Beating Batter into Flat Pancake

As it turns out, 2011 can be characterized as the year of the pancake…the flat pancake. While the Dow Jones Industrial Average (Dow) rose about 6% this year (its third consecutive annual gain), the S&P 500 ended the year flat at 1257.6 (-0.003%), the smallest yearly move in more than four decades. Along the way in 2011, there was plenty of violent beating and whipping of the lumpy pancake batter before the flat cake was cooked for the year. With respect to the financial markets, the 2011 lumps came in the form of various unsavory events:

* Never-Ending Eurozone Financial Saga: After Ireland and Portugal sought bailouts, Greece added its negligent financial storyline to the financial soap opera. Whether European government leaders can manage out-of-control deficits and debt loads will determine if Greece and other peripheral countries will topple larger countries like Italy and Spain.

* Credit Rating Downgrade: Standard & Poor’s, the highest profile credit rating agency, downgraded the U.S.’s long-term debt rating to AA+ from AAA due to high debt levels and Congressional legislators inability to hammer out a deficit-reduction plan during the debt ceiling negotiations.

* Japanese Earthquake and Tsunami: Japan and the global economy were rocked by a magnitude 9.0 earthquake and tsunami on March 11, 2011, which resulted in 15,844 people dead and 3,451 people missing. The ripple effects are still being felt through large industries like the automobile and electronics industries.

* Arab Spring Protests: Protesters throughout the Middle East and North Africa provided additional uncertainty to the global political map as demonstrators demanded regime change and more political freedoms. In the long-run, removing oppressive leaders like Hosni Mubarak (Egypt’s leader for 30 years), Muammar Gadaffi (Libya’s leader for 42 years), and Zine al-Abidine Ben Ali (Tunisia’s president for 23 years) should be beneficial for global stability, but in the short-run, how the new leadership vacuum will be filled remains ambiguous.

* Occupy Movement Voices Disapproval: The Occupy Wall Street movement began on September 17, 2011 in Liberty Square in Manhattan’s Financial District, and spread to over 100 cities in the U.S. There has not been a cohesive articulated agenda, but a common thread underlying all the Occupy movements is a sense that 99% of the population is being treated unfairly due to a flawed corrupt system controlled by Wall Street that is feeding the richest 1%.

All these lumps experienced in 2011 were not settling to investors’ stomachs. As a result individuals continued the trend of piling into bonds, in hopes of soothing their investment tummies. Long-term Treasury prices spiked upwards in 2011 (+29% as measured by TLT Treasury ETF) and soaring 10-year Treasury note prices pushed yields (1.87%) below yields on S&P 500 equities (2.1%). Despite a more than 3,400 point increase in the Dow (+39%) since the end of 2008, investors have still poured $774 billion into bonds versus $33 billion yanked from equities, according to EPFR Global. Over-weighting bonds makes sense for some, including retirees on fixed budgets, but many investors should brace for an inevitable reversal in bond prices. Eventually, the sweet taste of safety achieved from bond appreciation will turn to heartburn, once interest rates reverse their 30 year trend of declines.

Syrupy Factors Help Sweeten Pancakes

Although the aforementioned factors lead to historically high volatility and flat flavors in 2011, there are also some countering sweet reasons that make equities look more palatable for 2012. Here are some of the factors:

* Record Corporate Profits: Even with the constant barrage of fear, uncertainty, and doubt distributed via the media channels, corporations posted record profits in 2011, with an estimated increase of +16% over last year (and another forecasted +10% rise in 2012 – Source: S&P).

* Historic Levels of Cash: Record profits mean record cash, and all those riches have been piling up on non-financial corporate balance sheets at historic levels. At the beginning of Q4 the figure stood at $2.12 trillion. Companies have generally been stingy, but as the recovery progresses, they have increasingly been spending on technology, equipment, international expansion, and even the beginnings of hiring.

* Interest Rates at 60 Year Lows: Interest rates are at record lows and home affordability has never been better with 30-year fixed rate mortgages hovering below 4%. Housing may not come screaming back, but the foundation for a recovery is being laid.

* Improving Economic Variables: Whether you’re looking at broader economic activity (Gross Domestic Product up for nine consecutive quarters); employment growth (declining unemployment rate and 21 consecutive months of private job creation), or consumer spending (consumer confidence approaching multi-year highs), all major signs are currently pointing to an improving outlook.

* Near Record Exports: While the U.S. dollar has made some recent gains against foreign currencies because of the financial crisis in Europe, the relative value of the dollar remains historically low versus the major global currencies. The longer-term depreciation of the dollar has buoyed exports of U.S. goods to near record levels despite the global uncertainty.

* Unprecedented Central Bank Support Globally: Ben Bernanke and the U.S. Federal Reserve is committed to keeping exceptionally low levels of lending interest rates at least through mid-2013, while also implementing “Operation Twist” and potential further quantitative easing (QE3). Translation: Ben Bernanke is going to do everything in his power to keep interest rates low in order to stimulate economic growth. The European Central Bank (ECB) has pulled out its lending fire trucks too, with an unparalleled three-year lending program to extinguish liquidity fires in the European banking sector.

* Improving Mergers & Acquisitions Environment: We may not be back to the 2006 buyout “hay-days,” but U.S. mergers and acquisitions activity increased +24% in 2011. What’s more, high profile potential IPOs like an estimated $100 billion Facebook offering may help kick-start the new equity issuance market in 2012.

* Tasty Fat Dividends: Rarely have S&P 500 dividend yields (currently 2.1%) outpaced the interest rates earned on 10-year Treasury note yields, but now happens to be one of those times. Typically S&P 500 stock dividends have averaged about 40% of the yield on 10-year Treasury notes, and now it is 112%. In Q3 of 2011, dividend increases rose +17% and expectations are for nearly a +11% increase in 2012, said Howard Silverblatt, senior index analyst at S&P.

Any way you cut it (or beat the batter), 2011 was a volatile year. And despite all the fear, uncertainty, and doubt, profits continue to grow and sovereign nations are being forced to deal with their fiscal problems. Unforeseen risks always exist, but if Europe can contain its financial crisis and the U.S. recovery can continue into this new election year, then opportunities in the 2012 attractively priced equity markets should sweeten the flat equity pancake we ate in 2011.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, including a short position in TLT, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

U.S. – Best House in Bad Global Neighborhood

Article below represents a portion of free December 1, 2011 Sidoxia monthly newsletter (Subscribe on right-side of page)

There is no shortage of issues to worry about in our troubled global neighborhood, but then again, anybody older than 25 years old knows the world is always an uncertain place. Whether we are talking about wars (Vietnam, Cold War, Iraq); presidential calamities (Kennedy assassination, Nixon resignation/impeachment proceedings); international turmoil (dissolution of Soviet Union, 9/11 attacks, Arab Spring); investment bubbles (technology, real estate); or financial crises (S&L crisis, Long Term Capital, Lehman Brothers bankruptcy), investors always have a large menu of concerns from which they can order.

Despite the doom and gloom dominating the media airwaves, and the lackluster performance of equities experienced over the last decade, the Dow Jones Industrial Average and the S&P 500 index are both up more than 20-fold since the 1970s (those gains also exclude the positive impact of dividends).

Times Have Changed

Just a few decades ago, nobody would have talked or cared about small economies like Iceland, Dubai, and Greece. Today, technology has accelerated the forces of globalization, resulting in information travelling thousands of miles at the click of a mouse, often creating scary financial mountains out of meaningless molehills. As a result of these trends, news of Italian bond auctions, which normally would be glossed over on the evening news, instantaneously clogs our smart phones, computers, radios, and televisions. The implications of all these developments mean investing has become much more difficult, just as its importance has never been more crucial.

How has investing become more critical? For starters, interest rates are near 60-year lows and Treasury bond prices are at record highs, while inflation (food, energy, healthcare, leisure, etc.) is shrinking the value of people’s savings. Next, entitlement and pension reliability are decreasing by the minute – fiscal imbalances and unrealistic promises have contributed to a less certain retirement outlook. Layer on hyper-manic volatility of daily, multi-hundred point swings in the Dow Jones Industrial index and a less experienced investor quickly realizes investing can become an overwhelming game. Case in point is the VIX volatility index (a.k.a., the “Fear Gauge”), which has registered a whopping +57% increase in 2011.

December to Remember?

After an explosive +23% return in the S&P 500 index for 2009 (excluding dividends) and another +13% return in 2010, equity investors have taken a breather thus far in 2011 – the Dow Jones Industrial Average is up modestly (+4%) and the S&P 500 index is down fractionally (-1%). We still have the month of December to log, but in the short-run the European tail has definitely been wagging the rest of the global dog.

Although the United States knows a thing or two about lack of political leadership and coordination, herding the 17 eurozone countries to resolve the European debt financial crisis has proved even more challenging. As you can see below in the performance figures of the major global equity markets, the U.S. remains the best house in a bad neighborhood:

Our fiscal house undeniably needs some work (i.e., unsustainable deficits and bloated debt), but record corporate profits, record levels of cash, voracious consumer spending, improving employment data, and attractive valuations are all contributing to a domestic house that makes opportunities in our backyard look a lot more appealing to investors than prospects elsewhere in the global neighborhood.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and VGK, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Dominoes, Deleveraging, and Justin Bieber

Despite significant 2011 estimated corporate profit growth (+17% S&P 500) and a sharp rebound in the markets since early October (+18% since the lows), investors remain scared of their own shadows. Even with trembling trillions in cash on the sidelines, the Dow Jones Industrial Average is up +5.0% for the year (+11% in 2010), and that excludes dividends. Not too shabby, if you think about the trillions melting away to inflation in CDs, savings accounts, and cash. With capital panicking into 10-year Treasuries, hovering near record lows of 2%, it should be no surprise to anyone that fears of a Greek domino toppling Italy, the eurozone, and the global economy have sapped confidence and retarded economic growth.

Deleveraging is a painful process, and U.S. consumers and corporations have experienced this first hand since the financial crisis of 2008 gained a full head of steam. Sure, housing has not recovered, and many domestic banks continue to chew threw a slew of foreclosures and underwater loan modifications. However, our European friends are now going through the same joyful process with their banks that we went through in 2008-2009. Certainly, when it comes to the government arena, the U.S. has only just begun to scratch the deleveraging surface. Fortunately, we will get a fresh update of how we’re doing in this department, come November 23rd, when the Congressional “Super Committee” will update us on $1.2 trillion+ in expected 10-year debt reductions.

Death by Dominoes?

Is now the time to stock your cave with a survival kit, gun, and gold? I’m going to go out on a limb and say we may see some more volatility surrounding the European PIIGS debt hangover (Portugal/Italy/Ireland/Greece/Spain) before normality returns, but Greece defaulting and/or exiting the euro does not mean the world is coming to an end. At the end of the day, despite legal ambiguity, the ECB (European Central Bank) will come to the rescue and steal a page from Ben Bernanke’s quantitative easing printing press playbook (see European Deadbeat Cousin).

Greece isn’t the first country to be attacked by bond vigilantes who push borrowing costs up or the first country to suffer an economic collapse. Memories are short, but it was not too long ago that a hedge fund on ice called Iceland experienced a massive economic collapse. It wasn’t pretty – Iceland’s three largest banks suffered $100 billion in losses (vs. a $13 billion GDP); Iceland’s stock market collapsed 95%; Iceland’s currency (krona) dropped 50% in a week. The country is already on the comeback trail. Currently, unemployment (@ 6.8%) in Iceland is significantly less than the U.S. (@ 9.0%), and Iceland’s economy is expanding +2.5%, with another +2.5% growth rate forecasted by the IMF (International Monetary Fund) in 2012.

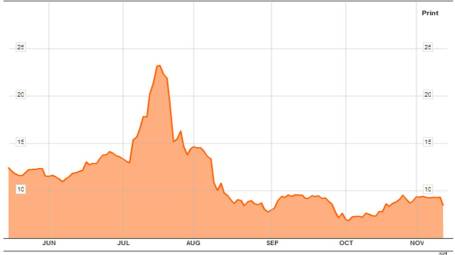

Iceland used a formula of austerity and deleveraging, similar in some fashions to Ireland, which also has seen a dramatic -15% decrease in its sovereign debt borrowing costs (see chart below).

OK, sure, Iceland and Ireland are small potatoes (no pun intended), so how realistic is comparing these small countries’ problems to the massive $2.6 trillion in Italian sovereign debt that bearish investors expect to imminently implode? If these countries aren’t credibly large enough, then why not take a peek at Japan, which was the universe’s second largest economy in 1989. Since then, this South Pacific economic behemoth has experienced an unprecedented depression that has lasted longer than two decades, and seen the value of its stock market decline by -78% (from 38,916 to 8,514). Over that same timeframe, the U.S. economy has seen its economy grow from roughly $5.5 trillion to $15.2 trillion.

There’s no question in mind, if Greece exits the euro, financial markets will fall in the short-run, but if you believe the following…

1.) The world is NOT going to end.

2.) 2012 S&P profits are NOT declining to $65.

AND/OR

3.) Justin Bieber will NOT run and overtake Mitt Romney as the leading Republican candidate

…then I believe the financial markets are poised to move in a more constructive direction. Perhaps I am a bit too Pollyannaish, but as I decide if this is truly the case, I think I’ll go play a game of dominoes.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.