Posts tagged ‘equities’

The Curious Case of Gen Y and Benjamin Button

If a current Gen Y-er aged backwards like Benjamin Button, he would feel right at home when it comes to investing, because acute conservatism and risk aversion have struck older and younger generations alike. The Curious Case of Benjamin Button is a story that follows the critical peaks and valleys of a boy born in his eighties, who immediately begins to reverse the aging process. Investors of all ages have suffered their peaks and valleys over the last decade, and these experiences have impacted investing attitudes and perceptions heavily during the prime earning years. For retirees, it’s virtually impossible for extreme events like the Great Depression, World War II, Vietnam, Kennedy’s assassination, and Nixon’s impeachment to NOT have had an influence on individuals’ investing behavior.

Investing Consequences on Younger Investors

If a younger Mr. Button were still alive today, there is no doubt the disheartening events experienced in his 80s would only become reinforced by the bleak occurrences in 2008-2009. His reverse aging would not only have allowed him to witness the collapse of Lehman Brothers, but also behold the demise and bailout of other gargantuan financial institutions. Today, if Benjamin wasn’t busy watching the MTV Video Music Awards, he would most likely be diligently managing his bullet-proof portfolio of cash, CDs (Certificates of Deposit), Treasury bills, and maybe some tax-free municipals if he was feeling a little spunky.

The cautious stance of youthful savers was confirmed in a recent study conducted by Merrill Lynch Global Wealth Management. The report demonstrates how the recent financial crisis has had a severe dampening impact on the risk appetites of 18-34 year old “Millennials.” So dramatic an effect was the recession, the nervous conservatism experienced by the 30-somethings was only rivaled by fear from 65 year olds. In fact, the 56% of young investors, who were more cautious today than a year ago, was the highest percentage registered by any age group.

Here’s what Christopher Geczy adjunct associate professor of finance at University of Pennsylvania’s Wharton School had to say about younger Millennials:

“We’re coming off a series of financial crises that hit this young generation at points in their lives where external events shape strong opinions…Many of them have witnessed a decline in the wealth of their families and seen their parents delay retirement or even return to the workforce.”

Beyond witnessing the challenges faced by their parents, the Millennials are encountering their own obstacles – such as joblessness. For those workers under age 35, the unemployment rate in August stood at more than 13% – significantly higher than the 9.6% national rate.

Note to Youths: Stocks for the Long Haul

In the typical life cycle of investing, investors flaunt a higher risk tolerance in their younger years and exhibit more risk aversion as they approach or enter retirement. Historically, this makes perfect sense because workers earlier in their careers have plenty of time to ride out the fluctuations associated with owning equities. Jeremy Siegel, professor at the Wharton University Professor, says stocks significantly outperform bonds by 6% per year over longer timeframes (see Siegel Digs in Heels).

For Gen Y-ers the larger risk is being too conservative, not too aggressive. Barry Nalebuff, a strategy professor at Yale’s School of Management agrees:

“The biggest risk for this generation is that they’ll live too long. With medical breakthroughs, the reality is that many of them will live beyond 100…The only way they have enough assets to last them is to invest in stocks. If they don’t, a lot of people will have to keep working way past when they want to because they won’t have enough money saved up.”

Even for those downbeat on the domestic equity markets – rightfully so with no price gains achieved over the last decade – younger investors should not lose sight of the tremendous equity opportunities available internationally (see the Blowing the Perfect Investment Game).

For many people, reverse aging may be fun for a while, but for Benjamin Button, living through the Great Depression and multiple wars as an adult would likely dampen the mood and increase risk aversion dramatically. Millennials have persevered through difficult times too. Generation Y has survived two recessionary bubbles caused by excessive technology spending and consumer credit binging, both over a short timeframe. Becoming too conservative for these investors will feel comfortable in the short-run if uncertainty continues to prevail. But investing now with adequate, diversified equity exposure is the prudent course of action. Even a wrinkly Benjamin Button could agree, wisely investing in some equities during your earlier career sure beats working as a Wal-Mart (WMT) greeter into your 80s.

Read the full Money-CNN and Newsweek articles on the subject

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and WMT, but at the time of publishing SCM had no direct position in BAC/Merrill, Lehman, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Equities Up, But Investors Queasy

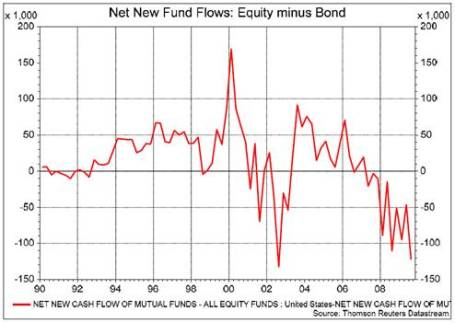

The market may have recovered partially from its illness over the last two years, but investors are still queasy when it comes to equities. The market is up by more than +60% since the March 2009 lows despite the unemployment rate continuing to tick higher, reaching 10.2% in October. Even though equity markets have rebounded, recovering investors have flocked to the drug store with their prescriptions for bonds. Mark Dodson, CFA, from Hays Advisory published a telling chart that highlights the extreme aversion savers have shown towards stocks.

Dodson adds:

“Net new fund mutual fund flows favor bonds over stocks dramatically, so much so that flows are on the cusp of breaking into record territory, with the previous record occurring back in the doldrums of the 2002 bear market. Given nothing but the chart (above), we would never in a million years guess that the stock market has rallied 50-60% off the March lows. It looks more like what you would see right in the throes of a nasty stock market decline.”

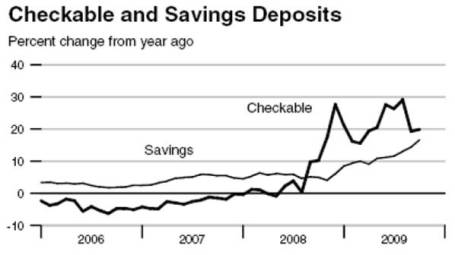

Checking and savings data from the Federal Reserve Bank of Saint Louis further corroborates the mood of the general public as the nausea of the last two years has yet to wear off. The mountains of cash on the sidelines have the potential of fueling further gains under the right conditions (see also Dry Powder Piled High story).

As Dodson notes in the Hays Advisory note, not everything is doom and gloom when it comes to stocks. For one, insider purchases according to the Emergent Financial Gambill Ratio is the highest since the recent bear market came to a halt. This trend is important, because as Peter Lynch emphasizes, “There are many reasons insiders sell shares but only one reason they buy, they feel the price is going up.”

What’s more, the yield curve is the steepest it has been in the last 25 years. This opposing signal should provide comfort to those blue investors that cried through inverted yield curves (T-Bill yields higher than 10-Year Notes) that preceded the recessions of 2000 and 2008.

Equity investors are still feeling ill, but time will tell if a dose of bond selling and a prescription for “cash-into-stocks” will make the queasy patient feel better?

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.